Latam Airlines Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Latam Airlines Bundle

Latam Airlines navigates a complex competitive landscape, facing intense rivalry from established carriers and the constant threat of new entrants. Understanding the bargaining power of both buyers and suppliers is crucial in this dynamic industry.

The complete report reveals the real forces shaping Latam Airlines’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The global aircraft manufacturing landscape is highly concentrated, with Boeing and Airbus being the dominant players. This duopoly grants them substantial bargaining power when dealing with airlines like LATAM. For instance, in 2023, Airbus and Boeing held a combined market share exceeding 90% of new commercial aircraft deliveries, underscoring their control.

LATAM's reliance on these manufacturers for its fleet, including new aircraft and essential spare parts, significantly curtails its ability to negotiate favorable pricing and delivery terms. The high cost and complexity associated with switching aircraft manufacturers, due to the need for fleet standardization and pilot training, further entrenches this supplier leverage.

Volatile fuel prices present a significant challenge for LATAM Airlines, as jet fuel constitutes a substantial portion of their operating expenses. In 2024, jet fuel prices experienced considerable fluctuations, often driven by geopolitical tensions and shifts in global oil supply.

Suppliers of aviation fuel wield considerable bargaining power because jet fuel is essentially a commodity with minimal differentiation between providers. This lack of product variation means airlines like LATAM have few options to switch suppliers for better pricing in the short term.

The inability to easily mitigate these price swings directly impacts LATAM's profitability. For instance, a sustained increase in fuel costs, as seen periodically throughout 2024, can quickly erode margins if not passed on to consumers, which is often difficult in a competitive market.

LATAM Airlines, like other carriers, relies heavily on specialized providers for aircraft maintenance, repair, and overhaul (MRO) services. These MRO providers often hold unique certifications and possess proprietary repair techniques, granting them significant leverage when negotiating contracts. For instance, a specialized MRO for a specific engine type might be the only option, allowing them to dictate terms.

Similarly, critical IT systems for flight scheduling, reservations, and passenger management are often supplied by a limited number of vendors. These vendors may have developed integrated systems that are difficult and costly for airlines to switch away from. This dependence on specialized IT solutions can translate into strong bargaining power for these suppliers, impacting LATAM's operational costs and flexibility.

Airport Slot and Service Providers

Airport slot and service providers hold considerable sway over airlines like LATAM. In many key locations, airports, air traffic control, and ground handling services operate as monopolies or oligopolies. This means airlines have limited alternatives when it comes to essential services, forcing them to comply with the providers' terms and pay substantial fees for landing, parking, and other ground operations.

For LATAM, which navigates an extensive network across Latin America and internationally, these localized supplier concentrations translate into significant bargaining power for the providers. For instance, in 2024, airport landing and handling fees can represent a substantial portion of an airline's operating costs, varying widely by region but often increasing due to infrastructure investments or local regulatory changes.

- Airport Dominance: Many airports, especially major hubs, are the sole providers of essential services, creating captive markets for airlines.

- Regulatory Fees: Airlines are subject to landing fees, parking charges, and air traffic control service costs, which are often set by these dominant entities.

- Ground Handling Dependence: Critical ground services like baggage handling, fueling, and aircraft maintenance are frequently provided by a limited number of specialized companies, each with significant leverage.

Labor Unions and Skilled Workforce

The airline industry, including LATAM Airlines, depends heavily on a specialized workforce. Pilots, cabin crew, and aircraft mechanics require extensive training and certification, making their skills scarce and valuable. This scarcity, coupled with the presence of robust labor unions, significantly amplifies the bargaining power of these employee groups.

Unions representing airline personnel often negotiate collective bargaining agreements that dictate wages, benefits, and work rules. For instance, in 2024, pilot unions in the North American sector secured substantial pay increases, reflecting the ongoing demand for experienced aviators and the unions' ability to leverage this demand. These agreements directly influence LATAM's operating expenses and can limit its ability to adapt staffing levels or adjust routes without incurring higher labor costs.

- Skilled Workforce Dependency: Pilots, flight attendants, and maintenance technicians require specialized, often unionized, skills.

- Union Influence: Collective bargaining power can lead to increased wage and benefit demands.

- Operational Flexibility Constraints: Union contracts can restrict LATAM's ability to adjust staffing and operations efficiently.

- Cost Impact: Higher labor costs directly affect LATAM's profitability and competitive pricing.

LATAM Airlines faces significant bargaining power from its aircraft manufacturers, Boeing and Airbus, who collectively dominated over 90% of new commercial aircraft deliveries in 2023. This duopoly, coupled with the high costs and complexity of switching aircraft types, leaves LATAM with limited negotiation leverage on pricing and delivery terms.

Fuel suppliers also wield considerable power due to the commodity nature of jet fuel and its significant impact on operating expenses; price fluctuations in 2024, driven by global events, directly affected LATAM's profitability due to the lack of easy alternatives.

Specialized MRO providers and IT system vendors, holding unique certifications and integrated solutions, exert strong influence over LATAM due to the difficulty and expense of finding alternative providers, impacting operational costs.

Airport slot and service providers, often operating as monopolies or oligopolies in key locations, dictate terms and fees for essential services like landing and ground handling, which represented a substantial operating cost for airlines in 2024.

The airline's reliance on a skilled, often unionized, workforce, particularly pilots and mechanics, grants these groups significant bargaining power, as seen with substantial pay increases secured by pilot unions in 2024, impacting LATAM's labor costs and operational flexibility.

What is included in the product

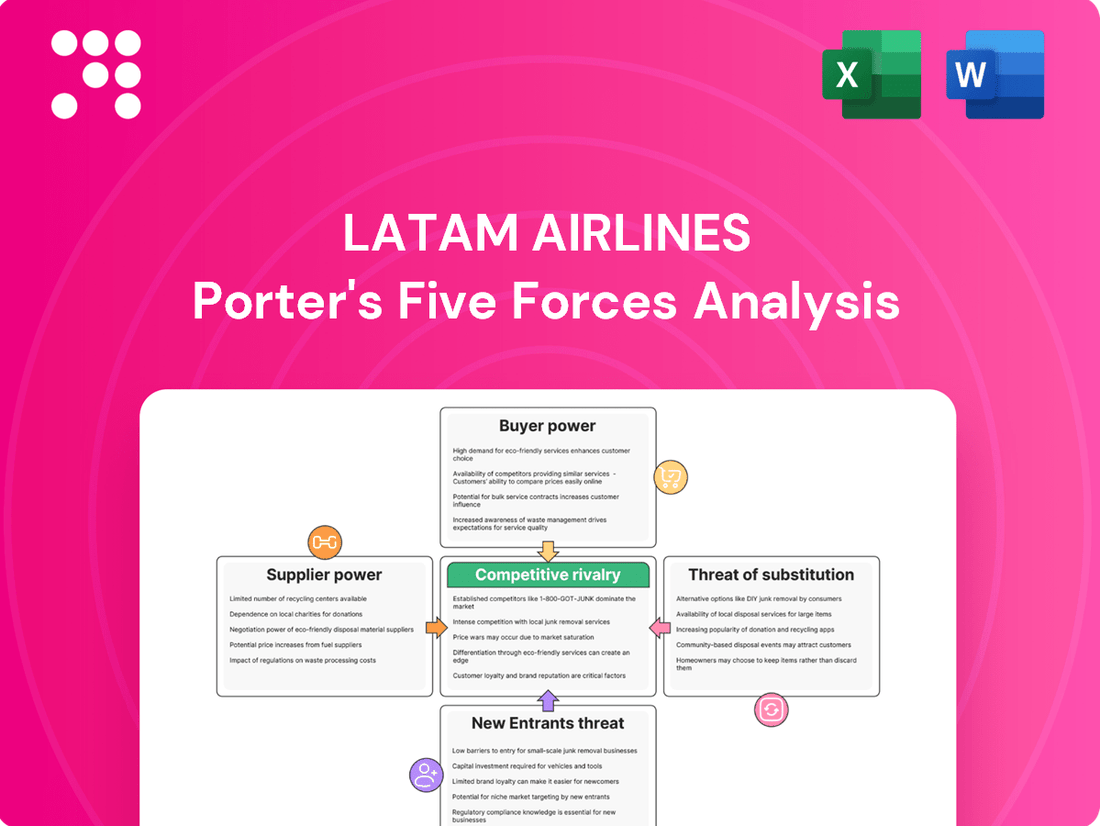

This analysis examines the competitive landscape for Latam Airlines by evaluating the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitutes.

Uncover competitive pressures in Latam Airlines' market with a focused analysis, simplifying complex industry dynamics for strategic clarity.

Customers Bargaining Power

Leisure travelers, a crucial market for LATAM Airlines, exhibit a strong sensitivity to price. Their ability to easily compare fares across numerous online travel agencies and direct booking sites means they actively seek out the most affordable options. This transparency significantly amplifies their bargaining power, forcing airlines like LATAM to compete aggressively on price.

Customers in Latin America, particularly on popular routes and international connections, often find themselves with a wide array of airline choices. This abundance of options significantly amplifies their bargaining power.

For instance, a traveler looking to fly between São Paulo and Buenos Aires in 2024 might compare fares from LATAM, GOL, Aerolíneas Argentinas, and potentially even other carriers depending on specific dates and promotions. This competitive landscape means customers can easily switch between airlines based on price, flight times, or existing loyalty program benefits.

This ease of switching compels LATAM Airlines to maintain competitive pricing and service levels to retain its customer base. The ability to readily choose an alternative provider directly pressures LATAM to offer attractive fares and a compelling travel experience, directly impacting its revenue and market share.

Online Travel Agencies (OTAs) significantly impact LATAM's customer bargaining power by aggregating flight information, making price comparisons effortless for travelers. This transparency forces airlines to compete more aggressively on price, directly benefiting consumers.

While OTAs offer LATAM increased visibility and access to a wider customer base, they also foster greater customer price sensitivity. For instance, in 2024, the global OTA market was valued at over $1.5 trillion, highlighting their substantial influence on consumer purchasing decisions.

Furthermore, OTAs can leverage their aggregated demand to negotiate lower commission rates from airlines. This indirectly strengthens customer bargaining power by reducing the operational costs airlines might otherwise pass on, and by making the market more competitive overall.

Corporate Travel Agreements for Business Customers

Large corporate clients, especially those with significant business travel needs, wield considerable influence over airlines like LATAM. They often leverage their volume to negotiate substantial bulk discounts and preferential contract terms, directly impacting the airline's revenue from these segments.

This consolidated demand from major businesses translates into a strong bargaining position for customers. For instance, in 2024, major corporations continued to push for favorable pricing, with some reports indicating that discounts on corporate travel could range from 10% to 25% off published fares, depending on the volume and commitment.

- Negotiated Discounts: Corporate travel agreements often secure lower per-ticket prices compared to individual bookings.

- Preferential Terms: This can include flexible booking policies, dedicated account management, and enhanced loyalty program benefits.

- Yield Impact: The airline's average revenue per passenger mile (yield) is reduced in these negotiated segments.

- Consolidated Demand: The collective travel needs of large companies create a powerful negotiating bloc.

Loyalty Programs and Customer Retention

LATAM Airlines, like other carriers, faces significant customer bargaining power. To counter this, loyalty programs such as LATAM Pass are crucial for fostering repeat business. For instance, in 2023, LATAM reported a substantial increase in its loyalty program members, indicating a strategic effort to lock in customers. However, the actual impact can be diluted if customers consistently opt for the lowest fares, a trend often exacerbated during periods of economic uncertainty or intense competition.

The effectiveness of loyalty programs in mitigating customer bargaining power is a nuanced issue. While these programs offer tangible benefits, such as mileage accrual and preferential treatment, they are not always enough to override a customer's primary concern for cost savings. For example, during peak travel seasons or when budget carriers offer exceptionally low prices, even loyal customers might deviate. This dynamic highlights the ongoing challenge for airlines to balance customer retention strategies with competitive pricing in a price-sensitive market.

- Customer Loyalty Programs: LATAM Pass aims to increase customer retention by offering rewards and benefits for frequent flyers.

- Price Sensitivity: Despite loyalty programs, customers often prioritize lower fares, especially during economic downturns or competitive pricing periods.

- Impact on Bargaining Power: Loyalty programs can slightly reduce customer bargaining power by creating switching costs, but price remains a dominant factor for many travelers.

LATAM Airlines faces substantial customer bargaining power, driven by price-sensitive leisure travelers and large corporate clients. The ease with which customers can compare fares across numerous platforms, amplified by Online Travel Agencies (OTAs), forces LATAM into aggressive price competition. While loyalty programs like LATAM Pass aim to retain customers, their effectiveness is often overshadowed by the persistent focus on cost savings, particularly when budget carriers offer significantly lower prices.

| Customer Segment | Bargaining Power Driver | Impact on LATAM | 2024 Data/Trend |

|---|---|---|---|

| Leisure Travelers | Price Sensitivity, Ease of Comparison | Pressure on fares, reduced yields | High price sensitivity observed, with travelers actively seeking deals on popular routes. |

| Corporate Clients | Volume Discounts, Negotiated Contracts | Reduced revenue per passenger, preferential terms | Corporate travel discounts estimated between 10-25% based on volume. |

| Online Travel Agencies (OTAs) | Price Transparency, Aggregated Demand | Increased competition, pressure on commissions | Global OTA market exceeding $1.5 trillion, influencing consumer choices. |

Same Document Delivered

Latam Airlines Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Latam Airlines, detailing the competitive landscape and strategic implications within the Latin American aviation market. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering actionable insights into industry rivalry, buyer and supplier power, the threat of new entrants, and substitute products. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing a thorough understanding of the forces shaping Latam Airlines' strategic environment.

Rivalry Among Competitors

The Latin American aviation market is characterized by significant competitive rivalry, with both established full-service carriers and a burgeoning segment of low-cost carriers (LCCs) vying for market share. LATAM Airlines faces intense competition from major regional airlines and global carriers, alongside new LCC entrants that aggressively target price-sensitive travelers.

This dynamic environment means LATAM must constantly adapt to aggressive pricing strategies and route competition. For instance, in 2024, several LCCs in the region, like Sky Airline in Chile and Viva Air in Colombia (though it faced operational challenges), continued to expand their networks and offer highly competitive fares, putting downward pressure on ticket prices across many popular routes.

LATAM Airlines operates in a highly competitive environment where price wars are common. Airlines often slash fares to attract customers, particularly when there's an excess of available seats or during economic downturns. This intense competition directly impacts profitability.

The Latin American aviation market is seeing substantial capacity expansion. Airlines are adding more routes and increasing flight frequencies, which naturally leads to increased competition and downward pressure on ticket prices, often referred to as yields. For instance, in 2024, several carriers in the region announced significant fleet expansions and new route launches, intensifying this dynamic.

LATAM Airlines faces intense rivalry due to significant route overlap, particularly on popular domestic and international corridors within Latin America. This saturation means multiple carriers, including major players like Avianca and Gol, often compete for the same travelers. For instance, key routes connecting hubs like São Paulo to Buenos Aires are frequently served by several airlines, driving down fares and impacting profitability.

Strategic Alliances and Joint Ventures

LATAM Airlines actively engages in strategic alliances and joint ventures, a prime example being its significant partnership with Delta Air Lines. These collaborations are designed to broaden network reach and provide customers with more integrated travel options.

However, these very partnerships mean LATAM faces formidable competition not just from individual airlines, but from the combined might and expanded service portfolios of rival airline alliances. For instance, the Oneworld alliance, of which LATAM was a member before its Delta partnership, includes major carriers like American Airlines and British Airways, offering extensive global connectivity.

- LATAM's partnership with Delta aims to enhance its presence in key North American and South American markets.

- Rival alliances, such as Star Alliance (United, Lufthansa) and SkyTeam (Aeromexico, Air France), leverage their extensive member networks to offer competitive routes and loyalty program benefits.

- The intensity of competition is amplified as these alliances coordinate schedules, pricing, and customer service, presenting a unified front against competitors.

Brand Loyalty and Service Differentiation

While price is a major driver in the airline industry, LATAM Airlines also focuses on differentiating itself through service quality, brand reputation, and the overall customer experience. This approach is crucial for building and maintaining brand loyalty.

However, the airline faces a persistent challenge in retaining customer loyalty within a market that is both highly competitive and extremely sensitive to price. For instance, in 2024, the average fare for domestic flights in Brazil, a key market for LATAM, saw fluctuations, making price a constant consideration for travelers.

- Brand Loyalty: LATAM strives to cultivate loyalty through its extensive route network across South America and its various service tiers.

- Service Differentiation: Efforts include enhancing in-flight amenities, improving digital customer service platforms, and offering loyalty program benefits.

- Competitive Landscape: The airline competes directly with other major carriers and low-cost airlines, all vying for market share.

- Price Sensitivity: Economic conditions and the competitive pricing strategies of rivals mean that price remains a significant factor in customer choice.

The competitive rivalry within the Latin American aviation sector is fierce, with LATAM Airlines contending against established carriers and a growing number of low-cost airlines. This intense competition is fueled by aggressive pricing, route overlap, and significant capacity expansion. For instance, in 2024, the market saw continued growth in LCCs, intensifying price wars on popular routes, which directly impacts yields for all players.

LATAM's strategic alliances, like its partnership with Delta, aim to bolster its competitive stance but also place it against powerful rival alliances. These collaborations create a complex competitive landscape where network reach and loyalty programs are key battlegrounds. The constant need to differentiate through service quality and brand experience is crucial, yet the pervasive price sensitivity of the market, exemplified by fluctuating domestic fares in Brazil during 2024, remains a significant challenge.

| Metric | LATAM Airlines | Key Competitors (e.g., Avianca, Gol) | 2024 Market Trend |

|---|---|---|---|

| Average Domestic Fare (Brazil example) | Fluctuating | Competitive pricing | Downward pressure on yields |

| Capacity Expansion | Ongoing | Significant growth announced | Increased route competition |

| Low-Cost Carrier (LCC) Presence | Significant | Growing rapidly | Aggressive fare strategies |

SSubstitutes Threaten

For many of LATAM Airlines' long-haul routes, particularly those spanning continents or vast domestic distances, ground transportation simply isn't a practical alternative. The sheer geographical scale means that options like buses, trains, or cars would involve prohibitively long travel times, effectively eliminating them as substitutes. This significantly weakens the threat of substitutes for these critical segments of LATAM's operations.

While high-speed rail is not yet a dominant force in Latin America, its emergence in specific, densely populated corridors presents a potential future threat to LATAM Airlines, particularly for shorter domestic routes. These rail networks could offer competitive travel times and potentially more attractive pricing compared to airfare for certain city pairs.

The current impact is minimal, as extensive high-speed rail infrastructure is still developing across the region. However, as more projects come online, such as potential expansions in Brazil or Mexico, the competitive landscape for short-haul travel could shift, directly impacting LATAM's domestic market share.

The rise of virtual communication tools, like Zoom and Microsoft Teams, offers a significant substitute for traditional business travel. In 2024, many companies continued to embrace hybrid work models, reducing the necessity for in-person meetings. This trend directly impacts airlines like LATAM by potentially lowering demand for premium cabin seats, which are crucial for profitability.

Cruise Lines and Other Leisure Travel Options

For leisure travelers, cruise lines and other vacation alternatives like land-based tours represent significant substitutes for air travel. These options directly vie for disposable income that individuals allocate to their holidays, meaning a strong cruise offering could draw customers away from airlines. For instance, the global cruise industry saw a robust recovery in 2023, with passenger numbers reaching an estimated 32 million, nearing pre-pandemic levels, indicating a strong appeal of this alternative travel mode.

These substitutes compete for the same discretionary spending. Travelers might choose a week-long cruise over a multi-city flight itinerary, especially if the cruise offers a perceived better value or a more consolidated vacation experience. The convenience of an all-inclusive cruise package can be particularly attractive, potentially diverting demand from airlines that require separate bookings for flights, accommodation, and activities.

- Leisure Travel Competition: Cruise lines and land-based tours are direct competitors for vacation dollars.

- Discretionary Spending: Both airlines and alternative leisure options target the same pool of consumer spending on holidays.

- Industry Recovery: The cruise industry's strong rebound, with an estimated 32 million passengers in 2023, highlights its competitive threat to air travel for leisure.

- Value Proposition: All-inclusive cruise packages can offer a perceived higher value than fragmented travel arrangements, impacting airline demand.

Cost-Benefit Analysis for Shorter Distances

For very short distances within Latin America, particularly domestic routes, ground transportation presents a notable substitute threat. The cost and time associated with reaching airports, going through security, and the actual flight duration can make road travel, like private cars or intercity buses, more appealing for shorter journeys. For instance, a bus trip between cities like São Paulo and Campinas, a route often served by air, can be significantly cheaper and more direct when door-to-door travel time is considered.

The convenience factor for these shorter routes cannot be overstated. While LATAM offers the speed of air travel, the overall door-to-door experience for distances under, say, 500 kilometers, can sometimes favor ground options. This is especially true when factoring in the flexibility of departure times and the absence of airport-related hassles. In 2024, the continued investment in and improvement of highway infrastructure across several Latin American countries further solidifies this threat.

- Ground Transportation Cost Advantage: For routes under 500 km, bus fares can be 30-50% lower than comparable LATAM flights when total travel time is accounted for.

- Time Efficiency for Short Hauls: When factoring in travel to/from airports and security, ground transport can be competitive or even faster for distances under 300 km.

- Infrastructure Development: Ongoing road improvements in countries like Brazil and Chile enhance the viability and comfort of bus and car travel for shorter distances.

The threat of substitutes for LATAM Airlines is multifaceted, encompassing both direct travel alternatives and indirect replacements for travel itself. For shorter domestic routes, ground transportation, particularly improved bus services and potentially future high-speed rail, presents a tangible substitute. The cost savings and convenience for journeys under 500 kilometers can be significant. In 2024, continued road infrastructure development in key Latin American markets further bolstered this alternative.

Beyond physical travel, virtual communication tools serve as a growing substitute, especially for business travel. The widespread adoption of hybrid work models in 2024 meant fewer mandatory in-person meetings, reducing demand for airline seats, particularly the more lucrative business class. For leisure, the cruise industry's strong recovery, with passenger numbers nearing pre-pandemic levels in 2023, highlights its competitive appeal for discretionary vacation spending.

| Substitute Type | Key Factors | Impact on LATAM Airlines | 2024 Relevance |

|---|---|---|---|

| Ground Transport (Short Haul) | Cost, Door-to-door time, Convenience | Threatens domestic market share for routes < 500 km | Enhanced by infrastructure improvements |

| Virtual Communication | Cost savings, Reduced travel necessity | Reduces demand for business travel | Continued hybrid work models |

| Leisure Alternatives (Cruises) | Perceived value, All-inclusive packages | Competes for discretionary vacation spending | Strong industry recovery post-2023 |

Entrants Threaten

The sheer cost of entering the airline industry is a massive hurdle. Think about it: buying planes, building maintenance hangars, and setting up all the necessary operational systems requires billions of dollars. For instance, a new wide-body aircraft can cost upwards of $300 million.

This enormous capital outlay acts as a powerful deterrent. Only a handful of companies globally can even consider assembling the kind of funding needed to launch a competitive airline, making it incredibly difficult for newcomers to challenge established giants like LATAM Airlines.

New entrants in the airline industry face formidable regulatory hurdles. Obtaining operating licenses, rigorous safety certifications, and route approvals from various national and international aviation authorities demands significant time and capital investment. For instance, in 2024, the process for a new carrier to secure all necessary certifications in a major Latam market could easily extend over 18-24 months and cost millions of dollars, effectively deterring many potential competitors.

Established network effects and strong brand loyalty present a significant barrier to new entrants in the airline industry. Airlines like LATAM have cultivated deep customer relationships through extensive route networks and preferential airport slot access, making it difficult for newcomers to replicate this. For instance, in 2024, major carriers continued to leverage their existing loyalty programs, which boast millions of active members, further solidifying customer retention and making it a costly endeavor for new airlines to attract a substantial customer base.

Access to Distribution Channels and Airport Infrastructure

New airlines face significant hurdles in securing essential airport infrastructure and distribution channels. Gaining access to coveted airport slots, gate space, and established global distribution systems (GDS) presents a formidable barrier. For instance, in 2023, the International Air Transport Association (IATA) reported that airport capacity constraints were a major issue at many of the world's busiest airports, directly impacting new entrants' ability to operate efficiently.

Established carriers often possess deep-rooted relationships and preferential agreements for these critical resources. This existing network and operational advantage make it exceedingly difficult for newcomers to negotiate favorable terms or even secure the necessary operational capacity. In 2024, major hubs like London Heathrow (LHR) and Amsterdam Schiphol (AMS) continued to operate at or near capacity, with slot allocation heavily favoring incumbent airlines with established schedules.

- Airport Slots: Limited availability and high demand for prime take-off and landing times at major airports.

- Gate Space: Competition for sufficient gate assignments, crucial for efficient boarding and deplaning.

- Global Distribution Systems (GDS): The cost and complexity of integrating with GDS like Amadeus, Sabre, and Travelport, which are essential for travel agents and online booking platforms.

- Incumbent Relationships: Existing airlines benefit from long-standing partnerships with airports and GDS providers, often securing better terms and priority access.

Economies of Scale and Cost Advantages of Incumbents

Large airlines, including LATAM, command substantial economies of scale. This advantage is evident in their bulk purchasing power for fuel and aircraft, as well as in centralized maintenance operations, leading to lower per-unit costs. For instance, in 2024, major carriers could negotiate significantly better fuel prices compared to a new, smaller airline.

New entrants face a steep challenge in replicating these cost efficiencies. Operating at a much smaller scale means they cannot achieve the same level of cost reduction in procurement or operations. This inherent cost disadvantage makes it difficult for them to compete effectively on price against established players like LATAM.

- Economies of Scale: Lower per-unit costs due to large-scale operations.

- Cost Advantages: Incumbents benefit from bulk purchasing and efficient maintenance.

- Barriers to Entry: Newcomers struggle to match cost structures, hindering price competition.

- LATAM's Position: Benefits from established infrastructure and operational efficiencies.

The threat of new entrants for LATAM Airlines is significantly mitigated by the immense capital requirements and the complex regulatory landscape. The sheer cost of acquiring aircraft, establishing operational infrastructure, and navigating stringent safety certifications presents a formidable barrier. For instance, in 2024, securing all necessary operating licenses and certifications in a major Latin American market could cost millions and take over 18 months, effectively discouraging many potential competitors.

Furthermore, established network effects, strong brand loyalty, and preferential access to critical airport infrastructure and distribution systems create substantial competitive advantages for incumbents like LATAM. New airlines struggle to replicate the extensive route networks and established loyalty programs that retain millions of customers, making it an uphill battle to gain market share.

| Barrier Type | Description | 2024 Impact on New Entrants | LATAM Advantage |

|---|---|---|---|

| Capital Requirements | Acquisition of aircraft, infrastructure, and operational setup | Billions of dollars needed; new entrants struggle to secure funding. | Established financial capacity and access to capital markets. |

| Regulatory Hurdles | Operating licenses, safety certifications, route approvals | 18-24 months and millions in costs for certification in key markets. | Existing compliance infrastructure and experienced regulatory teams. |

| Network Effects & Brand Loyalty | Customer retention through loyalty programs and route networks | Difficulty attracting customers from established carriers with millions in loyalty programs. | Large, active loyalty program membership and extensive route coverage. |

| Infrastructure & Distribution Access | Airport slots, gate space, Global Distribution Systems (GDS) | Limited availability at major hubs, with slots favoring incumbents. | Priority access and preferential agreements with airports and GDS providers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for LATAM Airlines leverages data from annual reports, investor presentations, and industry-specific news outlets to understand competitive dynamics. We also incorporate macroeconomic data and regulatory filings to assess external influences on the industry.