Latam Airlines Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Latam Airlines Bundle

Latam Airlines' strategic positioning is a complex puzzle, with some routes likely acting as Stars and others as Dogs. Understanding which segments are generating cash and which are draining resources is crucial for future growth.

Dive deeper into Latam Airlines' BCG Matrix and gain a clear view of where its key routes and services stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

LATAM Airlines is aggressively expanding its domestic presence in Brazil, anticipating a robust 6% to 8% growth in its Brazilian operations for 2025. This strategic move involves introducing new flight routes, signaling a high-growth market environment.

The airline already commands a substantial 38% market share in Brazil's domestic aviation sector as of Q1 2025, underscoring its dominant position. This strong foothold in a rapidly expanding market firmly places its Brazilian domestic operations in the Star category.

LATAM's international presence, especially to North America and Europe, is set for substantial growth. The airline anticipates a 7% to 9% capacity increase across its international operations in 2025. This expansion is evident in routes such as Santiago to Los Angeles and Miami, which have seen more frequent flights, alongside the introduction of entirely new routes, underscoring a strategic push into these key markets.

The strategic partnership with Delta Air Lines has been a major catalyst, injecting a 75% capacity boost. This collaboration unlocks access to over 300 destinations, significantly enhancing LATAM's competitive standing on popular international travel corridors.

LATAM Cargo Operations is a clear Star in the BCG Matrix for LATAM Airlines. The division experienced a substantial 12.2% rise in adjusted cargo revenue during 2024, and continued this momentum with a 9.8% increase in cargo revenues in the first quarter of 2025.

This impressive growth is fueled by a 70% expansion in cargo capacity since 2019, achieved by growing its dedicated freighter fleet to 21 aircraft. This strategic expansion directly addresses the surging demand from e-commerce and the broader regional logistics landscape, solidifying its position as a high-growth, high-yield segment.

As the largest cargo airline group in Latin America, LATAM Cargo benefits from significant market share and operational scale. These factors, combined with its robust financial performance and strategic fleet expansion, firmly place it in the Star category, indicating strong future potential.

Fleet Modernization with NEO and Dreamliner Aircraft

LATAM's strategic investment in modern aircraft, specifically the Airbus NEO family and Boeing 787 Dreamliner, clearly positions these as Stars in its fleet. The airline is set to receive 22 A320neo family aircraft in 2025, a significant expansion of its fuel-efficient fleet.

These new aircraft offer substantial operational advantages, boasting a 20-25% reduction in fuel consumption. This efficiency not only lowers operating costs but also aligns with LATAM's commitment to sustainability.

The ongoing fleet renewal is impressive: 100% of its narrow-body fleet has been retrofitted, and 57% of its wide-body fleet has been upgraded. This continuous modernization ensures LATAM maintains a competitive edge through cost efficiency and environmental responsibility.

- Fleet Modernization: LATAM's commitment to a younger, more efficient fleet is a key driver of its Star status.

- Fuel Efficiency Gains: The 20-25% fuel savings from NEO and Dreamliner aircraft directly translate to improved profitability.

- Delivery Schedule: The 22 A320neo family aircraft deliveries in 2025 underscore continued investment and growth potential.

- Fleet Upgrade Percentage: 100% narrow-body and 57% wide-body fleet upgrades highlight a proactive approach to fleet management.

Digital Transformation and Customer Experience Enhancements

LATAM Airlines' commitment to digital transformation is a key driver for enhancing customer experience. Investments in technologies like biometrics and self-service kiosks streamline the travel process, while improved in-flight connectivity keeps passengers engaged.

This strategic focus on digital innovation is yielding tangible results. A partnership with Globant has already led to a significant 14% increase in ancillary revenue per passenger and a 30% surge in digital sales, underscoring the high growth potential and market impact of these initiatives.

Furthermore, LATAM is actively expanding its digital offerings to boost customer satisfaction and loyalty. For instance, the airline has achieved 100% free Wi-Fi coverage on its narrow-body fleet in Brazil and extended this service to 75% of its other subsidiaries, directly addressing a key passenger need in today's connected world.

- Digital Transformation Initiatives: Biometrics, self-service options, and enhanced in-flight connectivity are improving customer experience and operational efficiency.

- Partnership Impact: The collaboration with Globant has boosted ancillary revenue per passenger by 14% and digital sales by 30%.

- Wi-Fi Expansion: Free Wi-Fi is now available on 100% of LATAM's narrow-body fleet in Brazil and 75% across other subsidiaries.

- Customer Loyalty: These digital enhancements aim to strengthen brand loyalty in an increasingly digital travel market.

LATAM's Brazilian domestic operations are a clear Star, with anticipated 6-8% growth in 2025 and a dominant 38% market share as of Q1 2025.

LATAM Cargo is also a Star, evidenced by a 9.8% revenue increase in Q1 2025 and a 70% capacity expansion since 2019, now operating 21 freighters.

The airline's fleet modernization, including 22 A320neo deliveries in 2025 and significant fuel efficiency gains, solidifies its modern aircraft as Stars.

Digital transformation initiatives, such as a 30% surge in digital sales driven by partnerships, position these efforts as Stars for enhancing customer experience and revenue.

| Business Unit | BCG Category | Key Performance Indicators |

| Brazilian Domestic Operations | Star | 6-8% projected growth (2025), 38% market share (Q1 2025) |

| LATAM Cargo | Star | 9.8% revenue growth (Q1 2025), 21 freighters, 70% capacity expansion |

| Fleet Modernization (NEO/Dreamliner) | Star | 22 A320neo deliveries (2025), 20-25% fuel savings |

| Digital Transformation | Star | 30% digital sales increase, 14% ancillary revenue growth |

What is included in the product

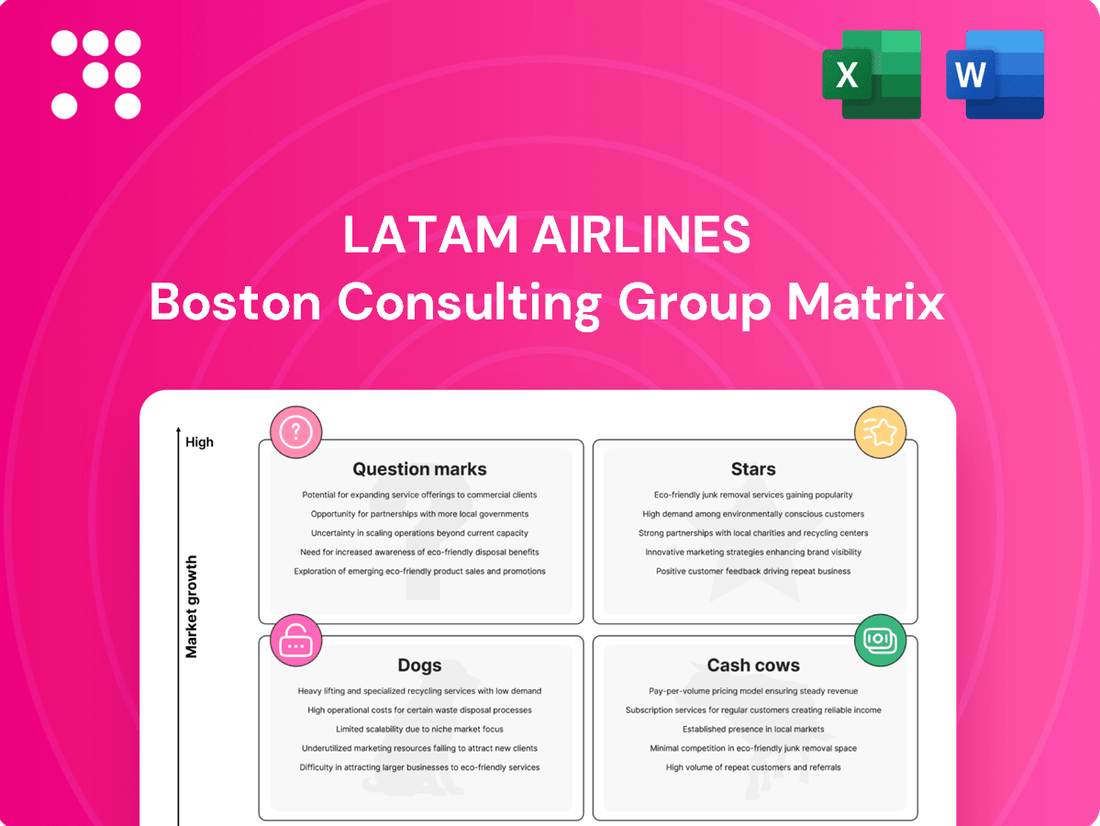

This Latam Airlines BCG Matrix overview highlights strategic insights for its business units, indicating which to invest in, hold, or divest.

A clear Latam Airlines BCG Matrix visualizes each business unit's position, simplifying complex portfolio analysis for strategic decision-making.

Cash Cows

Established domestic routes within Chile, Peru, Colombia, and Ecuador are considered LATAM Airlines' Cash Cows. These markets are mature, and LATAM holds a significant share, ensuring consistent, strong cash flows with less need for aggressive promotional spending.

While precise 2024-2025 market share figures for each specific route aren't publicly detailed, LATAM's overall strong presence in South America indicates these domestic segments are stable and highly profitable pillars of their business.

International hub-to-hub connections, like the Lima-Santiago route, are LATAM Airlines' cash cows. This route alone was the busiest in Latin America in January 2025, showcasing the robust and consistent demand these established corridors generate.

These routes, connecting major South American cities to North America and Europe, are characterized by high passenger volumes and mature demand. They represent LATAM's stable revenue generators, requiring less investment for growth and delivering strong, predictable financial returns.

The LATAM Pass frequent flyer program, boasting 49 million members in 2024, stands as a prime example of a Cash Cow for LATAM Airlines. As the largest program in Latin America, it consistently generates substantial ancillary revenue through loyalty initiatives, strategic partnerships, and direct member engagement.

This established loyalty base offers a stable and predictable income stream, crucial for a mature market segment. The program's strength lies in its ability to foster customer retention and reinforce brand loyalty without necessitating significant new market growth investments.

Maintenance, Repair & Overhaul (MRO) Operations

LATAM Airlines' Maintenance, Repair & Overhaul (MRO) operations, particularly its facility in São Carlos, Brazil, are positioned as a Cash Cow within its BCG Matrix. This segment benefits from a mature market and essential service demand, generating consistent revenue streams.

A significant $7 million investment is being directed towards a new specialized Boeing 787 Dreamliner maintenance facility at the São Carlos center, slated for completion by September 2025. This investment is designed to bolster internal capabilities.

The strategic move to enhance its MRO capabilities is expected to reduce reliance on external providers, thereby cutting outsourcing costs. Furthermore, it opens avenues for generating additional revenue by offering third-party maintenance services.

The primary goal of this investment is to boost operational efficiency and increase internal cash flow, directly supporting LATAM's growing fleet requirements and solidifying its Cash Cow status.

- LATAM's MRO center in São Carlos, Brazil, is a key Cash Cow.

- A $7 million investment is funding a new Boeing 787 Dreamliner maintenance facility by September 2025.

- This enhances internal capabilities, reduces outsourcing costs, and creates potential for third-party revenue.

- The investment aims to improve efficiency and increase internal cash flow for fleet support.

Established Corporate Travel Segments

LATAM Airlines' established corporate travel segments are a significant Cash Cow. These segments consistently generate high-value revenue, benefiting from business travelers' preference for reliability and extensive network access. LATAM, as the largest airline group in Latin America, leverages its strong competitive advantage in these areas.

The predictable demand from business travelers ensures high load factors and stable profitability for these established routes. While growth might not be exponential, the consistent revenue streams are crucial for funding other strategic initiatives within the airline group.

- Stable Revenue: Corporate travel provides a predictable and substantial revenue base.

- High Load Factors: Business demand typically leads to consistently full flights.

- Network Advantage: LATAM's extensive network appeals to corporate clients needing connectivity.

- Profitability: These mature segments offer reliable profit margins.

The LATAM Pass frequent flyer program, with 49 million members in 2024, is a prime example of a Cash Cow. It generates substantial ancillary revenue through loyalty initiatives and partnerships, offering a stable income stream and reinforcing brand loyalty without requiring significant new investment.

LATAM's Maintenance, Repair & Overhaul (MRO) operations, particularly in São Carlos, Brazil, are also considered a Cash Cow. A $7 million investment by September 2025 will enhance its Boeing 787 Dreamliner maintenance capabilities, aiming to reduce outsourcing costs and potentially generate third-party revenue.

Established domestic routes within Chile, Peru, Colombia, and Ecuador, along with key international hub-to-hub connections like Lima-Santiago, represent LATAM's cash cows. These mature markets boast significant market share and consistent, strong cash flows, requiring minimal promotional spending for stable returns.

Corporate travel segments are another significant Cash Cow, consistently generating high-value revenue due to business travelers' preference for reliability and LATAM's extensive network. These segments ensure high load factors and stable profitability.

| Segment | Description | Key Financial Indicator | 2024/2025 Relevance |

|---|---|---|---|

| LATAM Pass | Frequent flyer program | 49 million members (2024) | Ancillary revenue generation, customer retention |

| MRO Operations (São Carlos) | Aircraft maintenance and repair | $7 million investment by Sep 2025 | Cost reduction, potential third-party revenue |

| Domestic Routes | Established routes in Chile, Peru, Colombia, Ecuador | High market share, mature demand | Consistent, strong cash flows |

| International Hub-to-Hub | Key connections like Lima-Santiago | Busiest in Latin America (Jan 2025) | Robust and consistent demand, stable revenue |

| Corporate Travel | Business traveler segments | High load factors, predictable demand | Stable profitability, funding for initiatives |

What You See Is What You Get

Latam Airlines BCG Matrix

The Latam Airlines BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, will be delivered to you without any watermarks or demo content, ready for immediate professional use.

Dogs

LATAM Airlines' underperforming regional niche routes represent a classic 'Dog' in the BCG Matrix. These are routes with low market share and low growth, often struggling with passenger demand. For example, in early 2024, some of LATAM's less-trafficked domestic routes within countries like Brazil or Chile might fit this description, potentially showing load factors below the airline's overall average of around 80%.

These routes tend to consume valuable resources, including aircraft utilization and crew hours, without contributing substantially to profitability. They might barely break even or even operate at a loss, impacting the airline's overall financial performance. The challenge lies in balancing the need for network connectivity with the economic reality of these low-demand segments.

While these routes could be maintained for strategic reasons, such as serving smaller communities or offering feeder traffic to more profitable hubs, their continued underperformance warrants close scrutiny. LATAM may need to consider options like reducing flight frequencies, reallocating aircraft to more lucrative routes, or even divesting from these niche markets if they consistently drag down overall efficiency.

While LATAM Airlines is focused on fleet modernization, older, less fuel-efficient aircraft, if still in operation, would likely fall into the Dogs category. These planes typically have higher operating expenses due to increased fuel consumption and maintenance needs compared to newer models. For instance, a Boeing 767, which some airlines still operate, can consume significantly more fuel per seat mile than a modern Boeing 787 Dreamliner.

These older aircraft would represent a challenge for LATAM's profitability, especially in a market where fuel prices can fluctuate significantly. Their continued use on routes that don't generate high demand or passenger volume would further exacerbate their status as low-profit contributors. In 2024, fuel costs remained a major factor in airline profitability, making inefficient aircraft a direct drag on the bottom line.

Certain less competitive cargo routes within LATAM Airlines' network might be classified as Dogs. These are typically routes experiencing low demand or facing significant competition, resulting in a small market share and minimal revenue contribution. For instance, if a specific route only carried a few hundred tons of cargo in 2024 and faced strong competition from multiple carriers, it would likely fit this description.

Legacy IT Systems and Infrastructure

Legacy IT systems and outdated infrastructure within LATAM Airlines represent a significant drag, falling into the 'Dog' category of the BCG Matrix. These systems, often remnants of pre-digital transformation eras, are costly to maintain and offer little in terms of scalability or operational agility. For instance, as of 2024, LATAM continued to invest in maintaining older booking and operational platforms that, while functional, do not support the advanced analytics or real-time data integration needed to compete effectively in the modern airline industry.

These legacy systems incur substantial ongoing operational expenditures. For example, it's estimated that maintaining outdated IT infrastructure can cost up to four times more than managing modern cloud-based solutions. This financial burden diverts resources that could otherwise be allocated to growth initiatives or customer experience enhancements.

- High Maintenance Costs: Legacy systems often require specialized, expensive support and spare parts, driving up operational expenses.

- Limited Scalability: These systems struggle to adapt to fluctuating demand or new business requirements, hindering growth.

- Operational Inefficiencies: Outdated technology can lead to slower processing times, increased error rates, and manual workarounds, impacting overall efficiency.

- Reduced Competitive Advantage: The inability to leverage modern digital tools and data analytics puts LATAM at a disadvantage compared to more agile competitors.

Non-Strategic or Underutilized Assets

Non-strategic or underutilized assets, such as specific airport slots in less desirable locations or ground support equipment that is not efficiently deployed across the network, could be classified as Dogs within LATAM Airlines' BCG Matrix.

These assets might incur holding costs without contributing effectively to the airline's core operations or strategic growth. For instance, if LATAM Airlines held unused slots at a smaller regional airport that saw minimal passenger traffic, these slots would represent a Dog. In 2024, airlines globally faced pressure to optimize asset utilization due to rising operational costs, making the identification and divestiture of such underperforming assets crucial.

- Airport Slots: Underutilized slots at secondary airports with low demand.

- Ground Support Equipment: Idle or inefficiently deployed machinery across the network.

- Holding Costs: Expenses associated with maintaining assets that do not generate significant revenue.

- Divestiture Potential: Opportunities to sell or reallocate these assets to improve capital efficiency.

LATAM Airlines' "Dogs" category encompasses underperforming assets and routes that exhibit low market share and low growth. These segments often require significant investment but yield minimal returns, potentially impacting overall profitability. Identifying and strategically managing these "Dogs" is crucial for optimizing resource allocation and enhancing financial performance.

Examples of these "Dogs" can include specific niche regional routes with consistently low passenger demand, older, less fuel-efficient aircraft, and legacy IT systems that are costly to maintain. In 2024, the airline industry faced continued pressure on operating costs, making the efficient management of such assets even more critical. For instance, a route with a load factor significantly below the airline's average of around 80% would likely be classified as a Dog.

The strategic approach to these "Dogs" often involves careful consideration of options such as reducing frequencies, reallocating resources to more promising areas, or even divesting from the underperforming segment. The goal is to improve the airline's overall efficiency and competitive standing by focusing on higher-potential business areas.

| BCG Category | LATAM Airlines Examples | Key Characteristics | Strategic Considerations |

|---|---|---|---|

| Dogs | Underperforming regional routes | Low market share, low growth, low passenger demand | Reduce frequency, reallocate aircraft, divest |

| Dogs | Older, less fuel-efficient aircraft (e.g., older Boeing 767s) | High operating costs (fuel, maintenance), lower efficiency | Phased retirement, reallocation to less demanding routes |

| Dogs | Legacy IT systems and outdated infrastructure | High maintenance costs, limited scalability, operational inefficiencies | Modernization, cloud migration, phased replacement |

| Dogs | Non-strategic or underutilized assets (e.g., unused airport slots) | Incur holding costs, low revenue generation | Divestiture, reallocation, optimization of utilization |

Question Marks

New international routes to emerging markets, such as LATAM's recent expansion to destinations like Bariloche, Argentina, from Guarulhos, Brazil, represent strategic plays for future growth. These routes often fall into the 'Question Marks' category in a BCG matrix due to their high growth potential but low initial market share for LATAM. For instance, LATAM Airlines Group reported operating 1,300 weekly flights to 144 destinations in 2023, with ongoing evaluations for new routes.

LATAM's expansion into new or underserved domestic destinations, like the São Paulo/Guarulhos-Rio Branco and São Paulo/Congonhas-Joinville routes in Brazil, positions them as potential Stars or Question Marks within the BCG framework. These routes, while tapping into a growing Brazilian domestic market, initially represent low market share ventures.

These new routes require significant investment in marketing and consistent service to build passenger volume and achieve profitability. For instance, in 2024, the Brazilian domestic air travel market saw a notable increase in passenger numbers, with LATAM aiming to capture a share of this growth in these less-served corridors.

The success hinges on rapid market adoption and establishing a strong competitive position against existing or potential rivals. LATAM's strategy here is to nurture these routes, much like a Question Mark, with the aim of them becoming Stars if they gain traction and market share.

LATAM's introduction of premium business class suites and planned onboard Wi-Fi on wide-body aircraft, backed by a $60 million investment starting in 2026, positions these offerings as potential stars in the BCG matrix. These are substantial, high-cost initiatives aimed at a lucrative, expanding market segment.

The success of these premium features, which include features like sliding doors for suites, hinges on LATAM's ability to carve out a distinct advantage in the premium travel market. The airline needs to attract enough high-spending passengers to validate the considerable investment, making their future performance a key indicator for their strategic placement.

Sustainability-Linked Initiatives and Biofuel Investments

LATAM Airlines' commitment to sustainability, aiming for net-zero emissions by 2050, positions its investments in sustainable aviation fuels (SAF) as a Question Mark in the BCG matrix. These forward-thinking initiatives, such as exploring SAF production and sourcing, are crucial for long-term viability and brand image.

The airline's significant investments in SAF, a sector with high upfront costs and unproven large-scale economic viability, create uncertainty regarding immediate financial returns. For instance, in 2023, the aviation industry's SAF usage remained below 1% of total fuel consumption, highlighting the nascent stage of this market.

- Net-Zero Target: LATAM aims for net-zero emissions by 2050, a bold sustainability goal.

- SAF Investments: Significant capital is being directed towards sustainable aviation fuels.

- Market Uncertainty: The financial returns on SAF are currently unclear due to high costs and nascent technology.

- Industry Context: SAF adoption in 2023 was less than 1% of global aviation fuel, underscoring the challenges.

Exploration of Advanced Technologies (e.g., AI for Operations)

LATAM's exploration of advanced technologies, such as AI for ground operations and VR for crew training, positions these initiatives as Question Marks in the BCG matrix. These are areas with high growth potential, aiming to significantly boost efficiency and customer experience.

While these technologies promise revolutionary changes, their ultimate impact and the feasibility of scaling them across LATAM's extensive operations are still under evaluation. For instance, in 2024, airlines globally are investing heavily in AI for predictive maintenance and route optimization, with some reporting efficiency gains of up to 15%.

- AI for Ground Operations: Focuses on real-time monitoring, predictive analytics for equipment maintenance, and optimizing aircraft turnaround times.

- Virtual Reality for Cabin Crew Training: Enhances safety procedures, customer service scenarios, and emergency response training in a simulated environment.

- Investment and Scalability: Significant R&D is required, with the potential for high returns if successfully integrated and scaled, mirroring industry trends where early adopters of AI in aviation are seeing competitive advantages.

- Market Uncertainty: The long-term market share and profitability of these specific technological applications within the airline industry are not yet fully established, making them classic Question Mark candidates.

LATAM's new international routes to emerging markets, like their expansion to Bariloche, Argentina, are classic Question Marks. These ventures have high growth potential but currently represent a low market share for LATAM. The airline's strategy involves nurturing these routes with substantial marketing and service investments, aiming for them to evolve into Stars if they gain significant traction and market share.

LATAM's investments in sustainable aviation fuels (SAF) are also categorized as Question Marks. While crucial for their net-zero 2050 goal, SAF faces high upfront costs and unproven large-scale economic viability. In 2023, SAF usage in aviation was less than 1%, highlighting the market's nascent stage and the uncertainty surrounding immediate financial returns.

Similarly, the adoption of advanced technologies like AI for ground operations and VR for crew training are Question Marks. These innovations offer high growth potential and efficiency gains, as seen with global airlines reporting up to 15% efficiency improvements with AI in 2024. However, their scalability and long-term market impact within LATAM's operations are still being evaluated.

| Initiative | BCG Category | Rationale | Key Data Point |

| New International Routes (e.g., Bariloche) | Question Mark | High growth potential, low initial market share; requires significant investment to build volume. | LATAM operated 1,300 weekly flights to 144 destinations in 2023. |

| Sustainable Aviation Fuels (SAF) | Question Mark | High investment, uncertain economic viability, crucial for long-term sustainability goals. | SAF usage in aviation was <1% of total fuel consumption in 2023. |

| AI & VR Technologies | Question Mark | High growth potential, aims to boost efficiency; scalability and long-term impact are under evaluation. | Airlines using AI reported efficiency gains up to 15% in 2024. |

BCG Matrix Data Sources

Our Latam Airlines BCG Matrix leverages a blend of internal financial disclosures, industry growth forecasts, and competitor performance data. This ensures a comprehensive view of market share and industry attractiveness.