Kraft Heinz Company Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kraft Heinz Company Bundle

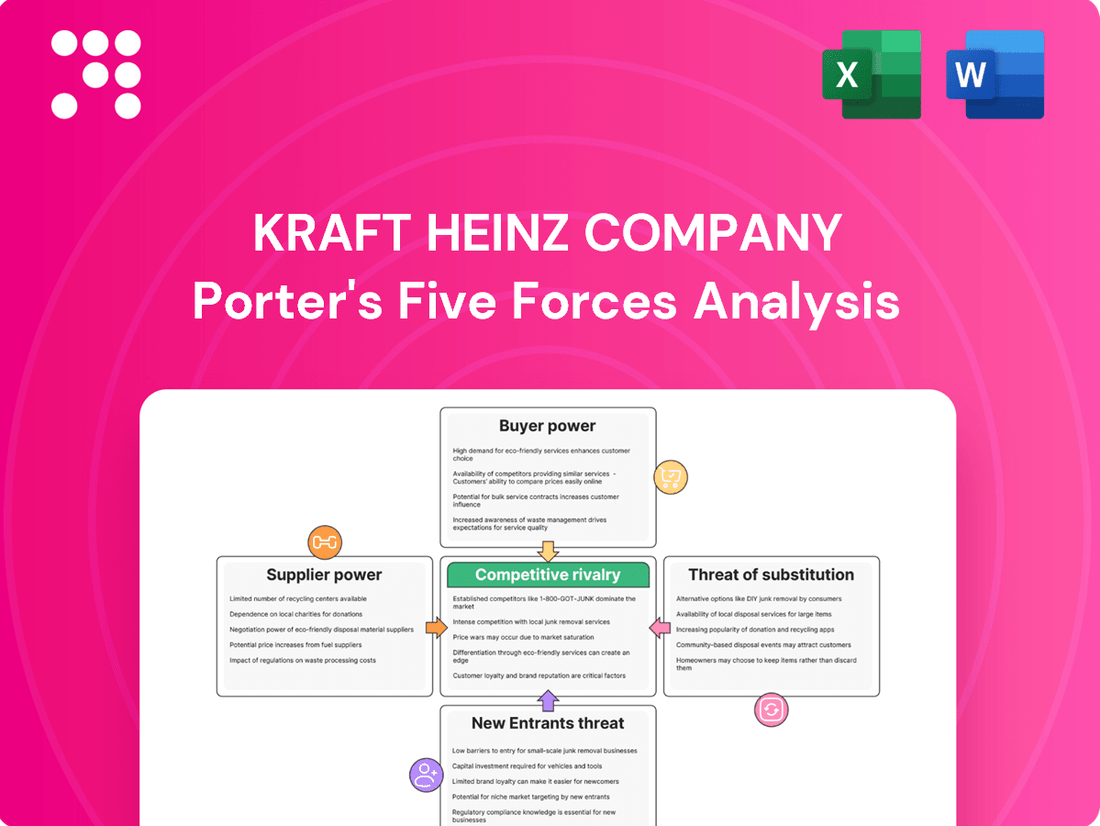

Kraft Heinz faces significant competitive rivalry due to the mature nature of the food and beverage industry, with numerous established players vying for market share. The bargaining power of buyers, primarily large retailers, also exerts considerable pressure on pricing and product innovation. Understanding these dynamics is crucial for navigating the complex landscape.

The complete report reveals the real forces shaping Kraft Heinz Company’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of Kraft Heinz's suppliers is significantly shaped by the concentration within its key raw material markets. For essential inputs such as dairy, meat, grains, and packaging, a situation where only a few major suppliers control the supply chain can give those suppliers considerable leverage. This concentration means Kraft Heinz may face higher costs for these critical ingredients if dominant suppliers decide to increase prices.

For example, in 2024, the global dairy market, a significant input for Kraft Heinz's cheese and other products, experienced price volatility driven by factors like herd sizes and feed costs. If a small number of large dairy cooperatives or processors were to gain even more market share, their ability to dictate terms to Kraft Heinz would likely increase, impacting the company's cost of goods sold.

The availability of substitute inputs for Kraft Heinz plays a crucial role in its bargaining power against suppliers. If Kraft Heinz can easily switch between multiple suppliers for key ingredients or if alternative raw materials are readily available, the power of any single supplier is significantly reduced. For instance, in 2024, Kraft Heinz's diverse product portfolio, ranging from ketchup to Oscar Mayer meats, means it sources a wide array of commodities. The ability to source, say, tomatoes from different regions or utilize various types of packaging materials limits the leverage of any one tomato farmer or packaging provider.

Conversely, for highly specialized ingredients or unique packaging solutions, Kraft Heinz might face higher switching costs. This could involve significant investment in new equipment, retooling production lines, or extensive product reformulation. In such scenarios, suppliers of these specialized inputs would possess greater bargaining power, as Kraft Heinz would be less inclined to switch, even if prices increase. For example, a proprietary spice blend or a unique, patented food preservation technology could give its supplier considerable leverage.

Kraft Heinz's significant purchasing volume can reduce supplier bargaining power. For instance, in 2023, Kraft Heinz's net sales reached $26.6 billion, indicating substantial procurement from its suppliers. This scale encourages suppliers to offer competitive pricing and favorable terms to secure continued business, thereby mitigating their leverage.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into food production, thus becoming direct competitors to Kraft Heinz, is a factor that could increase their bargaining power. While this is less likely for suppliers of basic commodities, specialized ingredient providers might consider such a move, compelling Kraft Heinz to nurture strong supplier relationships and offer competitive pricing to mitigate this risk.

For a company like Kraft Heinz, which operates on a massive scale, the threat of forward integration by its suppliers is generally considered low. This is primarily due to the significant capital investment and established distribution networks required to compete effectively in the food manufacturing sector.

- Low Likelihood for Kraft Heinz: Large-scale food manufacturing requires substantial capital and established distribution, making direct competition from suppliers unlikely.

- Specialized Ingredient Providers: A potential, albeit limited, threat exists from specialized ingredient suppliers who might consider forward integration.

- Relationship Management: Kraft Heinz must maintain robust supplier relationships and competitive pricing to counter any potential increase in supplier bargaining power.

Impact of Commodity Price Volatility

The inherent volatility of global commodity markets, driven by factors like weather and geopolitical events, empowers suppliers to adjust prices rapidly. For Kraft Heinz, this means navigating fluctuations, often through long-term contracts or hedging strategies, to mitigate the impact of sudden price increases dictated by market conditions and supplier responses.

For instance, in 2024, the price of key commodities like wheat and dairy experienced significant swings due to adverse weather patterns in major producing regions. This volatility directly impacts Kraft Heinz's cost of goods sold, as seen in their financial reports where fluctuations in input costs are a recurring theme.

- Commodity Price Fluctuations: Suppliers can leverage market volatility to increase prices, directly affecting Kraft Heinz's raw material expenses.

- Supply Chain Disruptions: Events like port congestion or labor shortages can further empower suppliers by limiting available supply, giving them more pricing leverage.

- Mitigation Strategies: Kraft Heinz employs long-term contracts and hedging to lock in prices and reduce exposure to sudden commodity price spikes.

Kraft Heinz's supplier bargaining power is moderate, influenced by its significant purchasing volume which typically grants it leverage. However, reliance on a few concentrated suppliers for certain key ingredients or specialized packaging can shift power to those suppliers. The company's scale, with 2023 net sales of $26.6 billion, provides a strong negotiating position, encouraging suppliers to offer competitive terms to secure consistent business.

| Factor | Impact on Kraft Heinz | Example (2024 Data) |

| Supplier Concentration | Can increase supplier power if few dominate key inputs (e.g., dairy). | Dairy market volatility due to herd sizes and feed costs affects Kraft Heinz's cheese production costs. |

| Availability of Substitutes | Reduces supplier power if Kraft Heinz can easily switch inputs or sources. | Diverse sourcing for tomatoes and packaging materials limits individual supplier leverage. |

| Purchasing Volume | Lowers supplier power due to Kraft Heinz's significant demand. | $26.6 billion in 2023 net sales incentivizes suppliers to offer competitive pricing. |

| Switching Costs | Increases supplier power for specialized inputs with high costs to change. | Proprietary spice blends or unique packaging technologies give suppliers more leverage. |

What is included in the product

This analysis of Kraft Heinz Company reveals intense rivalry from established brands and private labels, moderate buyer power due to product differentiation, and significant barriers to entry for new competitors.

Easily identify and mitigate competitive threats by visualizing Kraft Heinz's supplier power and buyer bargaining on a single, intuitive dashboard.

Customers Bargaining Power

Kraft Heinz faces significant bargaining power from its customers, particularly large retail chains. These powerful buyers, such as Walmart and Kroger, account for a substantial portion of Kraft Heinz's sales. For instance, in 2023, Kraft Heinz reported that its top four customers represented approximately 21% of its net sales, highlighting the concentration of its customer base and the leverage these retailers hold.

The concentration of retail channels means that major supermarkets and hypermarkets have considerable sway over product placement and pricing. Their control over prime shelf space and their ability to influence consumer purchasing decisions allows them to negotiate favorable terms, including lower prices and extensive promotional support, directly impacting Kraft Heinz's profit margins.

Individual consumers face minimal hurdles when deciding between food and beverage options. With a vast array of choices from competing brands and store-brand alternatives, switching is often as simple as picking a different item off the shelf. This ease of substitution means Kraft Heinz must constantly vie for consumer attention by offering competitive pricing and aligning with evolving tastes and health consciousness.

The increasing availability and quality of private label brands significantly boost customer bargaining power. Retailers, armed with their own brands, can negotiate more aggressively with Kraft Heinz, potentially reducing shelf space for Kraft Heinz products if price or other terms aren't met. This dynamic pressures Kraft Heinz to continually demonstrate the value of its brands through innovation and marketing to justify any price premium.

Consumer Price Sensitivity

Consumer price sensitivity is a significant factor for Kraft Heinz, particularly in the food and beverage sector where many products are considered everyday staples. This means shoppers are often looking for the best deals, which can put pressure on the company's pricing strategies.

High price sensitivity among consumers translates directly into increased bargaining power for retailers. These intermediaries understand that shelf placement and competitive pricing are critical to attracting customers. Consequently, they can push Kraft Heinz for lower wholesale prices, knowing that if Kraft Heinz doesn't comply, consumers might easily switch to a competitor's product.

For instance, in 2024, the inflation rate for food at home remained a concern for many households, reinforcing consumer focus on price. Kraft Heinz needs to carefully manage its costs and pricing to ensure its products remain attractive to consumers while still maintaining healthy profit margins. This delicate balance is essential for retaining market share in a competitive landscape.

- High Price Sensitivity: Consumers frequently compare prices for staple food items, making them sensitive to even small price increases.

- Retailer Leverage: Retailers use consumer price sensitivity to negotiate lower wholesale prices from Kraft Heinz.

- Market Share Defense: Kraft Heinz must balance affordability for consumers with the need to cover production costs and generate profit.

- Inflationary Pressures: Persistent inflation in 2024 meant consumers were even more attuned to pricing, amplifying this bargaining power dynamic.

Information Availability and Transparency

Kraft Heinz customers today have unprecedented access to information. Digital platforms allow consumers to easily compare prices, nutritional content, and ingredients across numerous brands, including Kraft Heinz products. This readily available data significantly boosts their ability to negotiate and demand better value.

This increased transparency means consumers are less likely to rely solely on brand loyalty or traditional advertising. They can quickly research alternatives, putting pressure on Kraft Heinz to offer competitive pricing and clearly articulate the unique benefits of its offerings. For instance, in 2024, online reviews and detailed product comparisons on retailer websites became a primary driver for purchasing decisions for a significant portion of grocery shoppers.

- Information Access: Consumers can easily find product details, nutritional facts, and pricing for Kraft Heinz items and competitors online.

- Price Sensitivity: Enhanced transparency empowers customers to seek out the best deals, increasing price sensitivity.

- Reduced Brand Loyalty: Easy access to alternatives can diminish reliance on brand reputation alone, forcing Kraft Heinz to focus on tangible value.

- Competitive Pressure: Kraft Heinz must continuously demonstrate value and communicate product advantages to maintain its customer base in this informed market.

Kraft Heinz contends with substantial customer bargaining power, particularly from large retail chains that command significant sales volume. These major buyers, such as Walmart and Kroger, can leverage their market share to negotiate favorable terms, impacting Kraft Heinz's pricing and profit margins. The company's reliance on these key accounts, with its top four customers representing approximately 21% of net sales in 2023, underscores the leverage these entities possess.

| Customer Type | Impact on Kraft Heinz | Key Negotiating Factors | Example Data (2023) |

|---|---|---|---|

| Large Retail Chains | High Bargaining Power | Volume Purchases, Shelf Space Control, Private Label Competition | Top 4 Customers = 21% of Net Sales |

| Individual Consumers | Moderate Bargaining Power | Price Sensitivity, Availability of Substitutes, Information Access | Inflation concerns in 2024 amplified price sensitivity |

Full Version Awaits

Kraft Heinz Company Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details how Kraft Heinz navigates intense rivalry from established food giants and private label brands, highlighting the significant threat of substitutes like fresh produce and home-cooked meals. Furthermore, the analysis explores the moderate bargaining power of buyers, influenced by retail concentration, and the substantial bargaining power of suppliers, particularly for key ingredients. Finally, it assesses the low threat of new entrants due to high capital requirements and established brand loyalty.

Rivalry Among Competitors

The food and beverage sector is fiercely competitive, featuring a vast array of established global corporations, specialized regional players, and innovative niche brands. Kraft Heinz contends with titans like PepsiCo, Nestlé, Unilever, and General Mills, all actively pursuing market share across overlapping product segments. This crowded marketplace demands constant product development and robust marketing efforts to stand out.

Many sectors within the packaged food and beverage industry, including those Kraft Heinz operates in, are mature. This maturity means slower growth rates, typically in the low single digits. For instance, the U.S. packaged food market saw growth around 1-2% in recent years leading up to 2024, intensifying the battle for existing market share.

This slow industry growth naturally fuels competitive rivalry. Companies like Kraft Heinz must work harder to gain or maintain their position, often leading to price competition and increased promotional activities. In 2023, for example, major food manufacturers continued to invest heavily in advertising and promotions to capture consumer attention in a crowded marketplace.

The fight for market share in these mature segments can manifest as aggressive pricing strategies and increased marketing spend. Kraft Heinz, like its peers, faces pressure to differentiate its products and maintain brand loyalty through innovation and targeted campaigns, especially as consumer preferences evolve.

The food manufacturing sector, including companies like Kraft Heinz, is characterized by substantial fixed costs. These include investments in large-scale production plants, sophisticated machinery, and the establishment of wide-reaching distribution channels. For instance, building and maintaining a modern food processing facility can run into hundreds of millions of dollars.

These considerable fixed costs, combined with significant investments in brand building and the need for specialized equipment, erect high exit barriers. This means that exiting the industry is financially punitive, forcing companies to remain operational even when facing slim profit margins. This situation intensifies competition as existing players strive to utilize their capacity efficiently.

In 2023, Kraft Heinz reported selling, general, and administrative expenses of approximately $5.2 billion, a significant portion of which reflects ongoing operational and marketing costs inherent in the industry. The need to spread these fixed costs over a larger volume of sales compels companies to focus on operational efficiency and market share defense.

Product Homogeneity and Brand Differentiation

Kraft Heinz faces intense competition where many of its core products, like ketchup and canned soups, are seen as quite similar by consumers. This product homogeneity means that standing out often comes down to strong branding and effective marketing rather than unique product features alone. For instance, in 2024, the global condiments market, where Kraft Heinz is a major player, continued to see aggressive promotional activities from both established brands and private labels.

Competitors frequently introduce products with minor variations, forcing Kraft Heinz to invest heavily in advertising and brand building to maintain customer loyalty. This reliance on brand perception is crucial, especially as consumers can easily switch between similar offerings. The company’s strategy to counter this includes significant R&D for product innovation, aiming to create distinct value propositions that move beyond simple price comparisons.

- Product Similarity: Many Kraft Heinz staples, like pasta sauces and processed cheese, are easily replicated by rivals, intensifying rivalry.

- Brand as Differentiator: Kraft Heinz leverages iconic brands such as Heinz Ketchup and Kraft Mac & Cheese to create perceived uniqueness.

- Marketing Spend: The company must maintain substantial marketing budgets to reinforce brand messaging against competitors' similar offerings.

- Innovation Imperative: Developing novel products or unique selling points is essential to avoid pure price competition in 2024 and beyond.

Aggressive Marketing and Innovation Drives

The food and beverage industry, where Kraft Heinz operates, is characterized by fierce competition. This intense rivalry necessitates substantial spending on marketing and advertising to stand out. For instance, Kraft Heinz's 2023 advertising and sales promotion expenses were approximately $1.1 billion, reflecting the ongoing battle for consumer mindshare.

Continuous product innovation is another critical aspect driven by this aggressive rivalry. Companies are constantly developing new products, reformulating existing ones to meet evolving consumer preferences (like health-conscious options), and improving packaging. This innovation arms them to capture new market segments and prevent rivals from gaining an advantage.

Promotional activities, including discounts, coupons, and loyalty programs, are a constant battleground. Kraft Heinz, like its peers, frequently utilizes these tactics to drive sales and encourage trial of its products. In 2024, the company continued to emphasize promotional strategies to support its brand portfolio.

- Aggressive Marketing Spend: Kraft Heinz invested around $1.1 billion in advertising and sales promotion in 2023, highlighting the intense competitive pressure.

- Product Innovation Focus: The company continually innovates with new flavors, healthier options, and sustainable packaging to maintain market relevance.

- Promotional Activities: Discounts, coupons, and loyalty programs are key competitive tools used to drive sales and consumer engagement.

- Market Share Defense: Continuous efforts in marketing and innovation are crucial for Kraft Heinz to defend its market share against numerous competitors.

Competitive rivalry within the food and beverage sector is intense, with Kraft Heinz facing numerous global and regional players. The market's maturity, with growth rates around 1-2% in recent years leading up to 2024, fuels this rivalry, leading to aggressive pricing and increased promotional activities. Kraft Heinz's 2023 advertising and sales promotion expenses were approximately $1.1 billion, underscoring the significant investment required to maintain brand presence and market share in this crowded landscape.

| Key Competitors | 2023 Revenue (Approx. USD Billions) | Key Product Overlaps |

| PepsiCo | $91.5 | Snacks, Beverages, Convenient Meals |

| Nestlé | $104.3 (CHF 93 Billion) | Coffee, Dairy, Confectionery, Pet Care |

| Unilever | $71.5 (EUR 65 Billion) | Food, Beverages, Home Care, Personal Care |

| General Mills | $19.4 | Cereals, Snacks, Baking Mixes, Dairy |

SSubstitutes Threaten

The growing presence of private label and store brands presents a substantial threat of substitution for Kraft Heinz. These retailer-backed products are increasingly matching the quality of national brands while offering them at a more attractive price point. For instance, in 2024, private label sales in the U.S. grocery sector continued their upward trajectory, capturing a larger share of consumer spending, forcing Kraft Heinz to continually reinforce the perceived value and distinctiveness of its own offerings to maintain market position and justify its pricing strategy.

The increasing consumer demand for fresh, natural, and minimally processed foods poses a significant threat to Kraft Heinz's traditional packaged and processed product portfolio. Health-conscious individuals are increasingly choosing whole foods like fruits, vegetables, and preparing meals from scratch, which directly competes with many of the company's core offerings.

This shift means that consumers are actively seeking alternatives to the convenience of packaged goods, opting for perceived healthier choices. For example, the global market for fresh produce continues to see robust growth, with projections indicating sustained expansion throughout 2024 and beyond, directly impacting the market share available for processed food manufacturers.

The availability of home-cooked alternatives presents a significant threat to Kraft Heinz. Consumers can easily prepare meals and condiments from scratch, directly substituting many of Kraft Heinz's convenience-focused offerings. This trend is amplified by economic pressures and a growing consumer preference for healthier, personalized food options, which often favors home preparation over packaged goods.

Emergence of Niche and Specialty Food Brands

The rise of niche and specialty food brands presents a significant threat of substitutes for Kraft Heinz. These agile companies, often operating online, cater to specific consumer demands like plant-based diets, organic ingredients, or unique global flavors. For instance, the plant-based food market experienced substantial growth, with retail sales reaching an estimated $8 billion in the US by the end of 2023, demonstrating a clear consumer shift away from traditional animal-based products, many of which are core to Kraft Heinz's portfolio.

These specialized brands can quickly gain traction by offering differentiated products that appeal to consumers seeking alternatives to Kraft Heinz's mass-market offerings. This fragmentation means that Kraft Heinz must continuously monitor evolving consumer preferences and adapt its product development to remain competitive. The ability of these smaller brands to innovate rapidly and target specific consumer segments effectively erodes the market share of larger, more established players.

- Niche Market Growth: Specialty food segments, such as gluten-free or keto, are growing at rates significantly higher than the overall food industry.

- Direct-to-Consumer (DTC) Impact: Many niche brands leverage DTC models, bypassing traditional retail channels and building direct relationships with consumers, weakening traditional brand loyalty.

- Consumer Demand for Authenticity: Consumers are increasingly seeking transparency in sourcing and production, areas where smaller, focused brands often excel.

Foodservice and Restaurant Consumption

The threat of substitutes for Kraft Heinz's packaged goods is significant, primarily stemming from the foodservice sector. When consumers opt to eat out at restaurants, cafes, or other dining establishments, they are bypassing the purchase of items like Kraft mayonnaise or Heinz ketchup for home use. This shift directly impacts Kraft Heinz's retail sales volume.

For instance, during economic upturns, consumers often have more disposable income, leading them to dine out more frequently. In 2024, the global foodservice market was projected to reach over $3.5 trillion, indicating a substantial portion of consumer food spending directed away from home grocery purchases. This trend can intensify the substitution threat, as convenience and experience outside the home become more appealing than preparing meals domestically.

- Foodservice as a Substitute: Dining out directly replaces home consumption of packaged goods.

- Economic Impact: Economic upturns can boost foodservice spending, increasing substitution.

- Lifestyle Shifts: Growing preference for convenience and away-from-home meals elevates this threat.

- Market Size: The global foodservice market's vast size highlights the scale of potential substitution.

The threat of substitutes for Kraft Heinz is multifaceted, encompassing private labels, healthier alternatives, home cooking, niche brands, and the foodservice sector. Private label brands continue to gain market share by offering comparable quality at lower prices, a trend that persisted in 2024. Simultaneously, consumer preferences are shifting towards fresh, minimally processed foods, directly challenging Kraft Heinz's core packaged goods portfolio. The foodservice industry also represents a significant substitute, as consumers increasingly opt for dining out over home preparation.

| Threat Category | Description | 2024 Impact/Data Point |

| Private Labels | Retailer-backed brands offering value and quality | Continued upward trajectory in U.S. grocery market share |

| Healthier Alternatives | Fresh, natural, minimally processed foods | Robust growth in the global fresh produce market |

| Home Cooking | DIY meal and condiment preparation | Economic pressures and preference for personalized meals |

| Niche & Specialty Brands | Targeted offerings (e.g., plant-based, organic) | Plant-based market estimated at $8 billion in the US (end of 2023) |

| Foodservice Sector | Dining out vs. home consumption | Global foodservice market projected over $3.5 trillion |

Entrants Threaten

The threat of new entrants into the packaged food sector, where Kraft Heinz operates, is significantly dampened by the sheer scale of investment needed. Building modern, large-scale manufacturing plants, establishing robust and efficient supply chains, and creating widespread distribution networks demand billions of dollars. For instance, setting up a single, highly automated production facility can easily cost hundreds of millions, if not over a billion, depending on its capacity and technological sophistication.

This immense capital requirement acts as a substantial barrier. A new competitor would need to not only match the production capacity of giants like Kraft Heinz but also invest heavily in marketing, branding, and securing shelf space in retail environments. Without this level of financial backing, any new entrant would struggle to achieve the economies of scale necessary to compete on price and availability, making it incredibly difficult to gain market share.

Kraft Heinz benefits from deeply ingrained consumer trust, a result of decades of providing familiar products. This strong brand loyalty means new competitors face an uphill battle to even get noticed, let alone win over customers who are already happy with their go-to brands.

Consider that in 2024, the global food and beverage industry saw significant marketing investment, with major players like Kraft Heinz continuing to allocate substantial resources to maintain and enhance their brand presence. This ongoing investment makes it incredibly costly for newcomers to build comparable brand recognition and capture market share.

The sheer recognition of Kraft Heinz brands acts as a formidable barrier. Consumers often choose products they know and trust, making it difficult for unproven brands to break through the established preference, requiring immense marketing spend and time to even approach the same level of familiarity.

Gaining access to prime shelf space in major grocery stores, supermarkets, and hypermarkets presents a significant hurdle for new entrants. Kraft Heinz, with its established presence, benefits from long-standing relationships and distribution agreements that are difficult for newcomers to replicate.

New companies often find it challenging to secure the necessary visibility and widespread availability for their products. In 2024, the consumer packaged goods sector continues to see intense competition for retail placement, with established brands like Kraft Heinz holding a considerable advantage in securing prime locations.

Economies of Scale in Production and Procurement

Kraft Heinz leverages its immense size to achieve substantial economies of scale in both manufacturing and sourcing ingredients. This scale translates directly into lower per-unit production costs and superior bargaining power with suppliers, enabling them to secure favorable pricing on raw materials. For example, in 2023, Kraft Heinz reported net sales of $26.5 billion, underscoring the vastness of its operational footprint.

New companies entering the food and beverage market face a significant hurdle in matching Kraft Heinz's cost efficiencies. Their smaller production volumes mean higher per-unit costs, and they lack the purchasing clout to negotiate similar discounts from suppliers. This cost disadvantage makes it challenging for new entrants to compete on price, a critical factor in the consumer packaged goods sector.

- Production Cost Advantage: Kraft Heinz's large-scale factories and optimized supply chains lead to lower manufacturing costs per unit compared to smaller competitors.

- Procurement Power: The company's substantial order volumes allow it to negotiate better prices for raw materials, further reducing its cost base.

- Barriers to Entry: New entrants struggle to achieve similar economies of scale, creating a significant cost barrier that deters market entry.

- Competitive Pricing: Lower production costs enable Kraft Heinz to offer competitive pricing, making it difficult for new entrants to gain market share on price alone.

Stringent Regulatory Requirements and Food Safety Standards

The food and beverage sector faces rigorous regulations covering everything from food safety and accurate labeling to manufacturing processes and quality assurance. New companies entering this market must contend with a complex landscape of compliance, certifications, and inspections, which can significantly increase both the time and financial investment required to launch. For instance, in 2024, compliance costs for new food manufacturers can easily run into tens of thousands of dollars, depending on the specific product category and target markets.

Kraft Heinz, having already established a robust compliance framework and extensive experience in meeting these demanding standards, possesses a distinct advantage. New entrants, conversely, must invest heavily in building this infrastructure and expertise from scratch, a substantial barrier to entry. This includes obtaining certifications like HACCP or SQF, which are critical for market access and consumer trust.

- High Capital Investment: New entrants face significant upfront costs for regulatory compliance, including certifications and quality control systems.

- Established Infrastructure Advantage: Kraft Heinz benefits from existing, proven compliance systems, reducing operational risks for the company.

- Time-to-Market Delays: Navigating complex regulatory approvals can delay a new company's ability to bring products to market, impacting revenue generation.

- Brand Reputation Risk: Failure to meet stringent standards can lead to product recalls and severe damage to a new brand's reputation.

The threat of new entrants for Kraft Heinz is generally low due to substantial barriers. The massive capital required for manufacturing, distribution, and marketing makes it difficult for newcomers to compete with established giants. For example, building a single, modern food production facility can cost hundreds of millions of dollars, a figure that deters many potential competitors.

Kraft Heinz also benefits from strong brand loyalty and recognition, built over decades. In 2024, the company continued to invest heavily in marketing, making it incredibly expensive for new brands to gain consumer attention and trust. Securing prime shelf space in retail environments is another significant hurdle, as established players like Kraft Heinz have long-standing relationships with grocers.

Economies of scale provide Kraft Heinz with a significant cost advantage. Their vast production volumes lead to lower per-unit costs and greater bargaining power with suppliers, something new entrants struggle to match. In 2023, Kraft Heinz reported net sales of $26.5 billion, highlighting the scale of their operations and procurement power.

Rigorous food safety and labeling regulations also act as a barrier. New entrants must invest heavily in compliance, certifications, and quality control systems, which can be costly and time-consuming. Failure to meet these standards can result in product recalls and reputational damage, further discouraging new market participants.

| Barrier Type | Description | Impact on New Entrants | Kraft Heinz Advantage | Example Data (2024) |

| Capital Requirements | High cost of setting up manufacturing, distribution, and marketing. | Deters entry due to upfront investment needs. | Established infrastructure and scale reduce per-unit costs. | New plant setup can exceed $100 million. |

| Brand Loyalty & Recognition | Consumer trust in established brands. | Difficult for new brands to gain traction and market share. | Decades of consistent product quality and marketing. | Significant marketing budgets allocated by CPG giants. |

| Economies of Scale | Lower per-unit costs due to large-scale production and purchasing. | New entrants face higher production costs and price disadvantages. | Vast procurement power and optimized supply chains. | Net sales of $26.5 billion in 2023 indicate significant scale. |

| Regulatory Compliance | Strict food safety, labeling, and manufacturing standards. | Increased time and cost for new companies to meet requirements. | Existing robust compliance frameworks and expertise. | Compliance costs can reach tens of thousands for new food businesses. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Kraft Heinz is built upon a foundation of robust data, including the company's annual reports and SEC filings, alongside industry-specific market research from firms like IBISWorld and Statista.