Kraft Heinz Company Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kraft Heinz Company Bundle

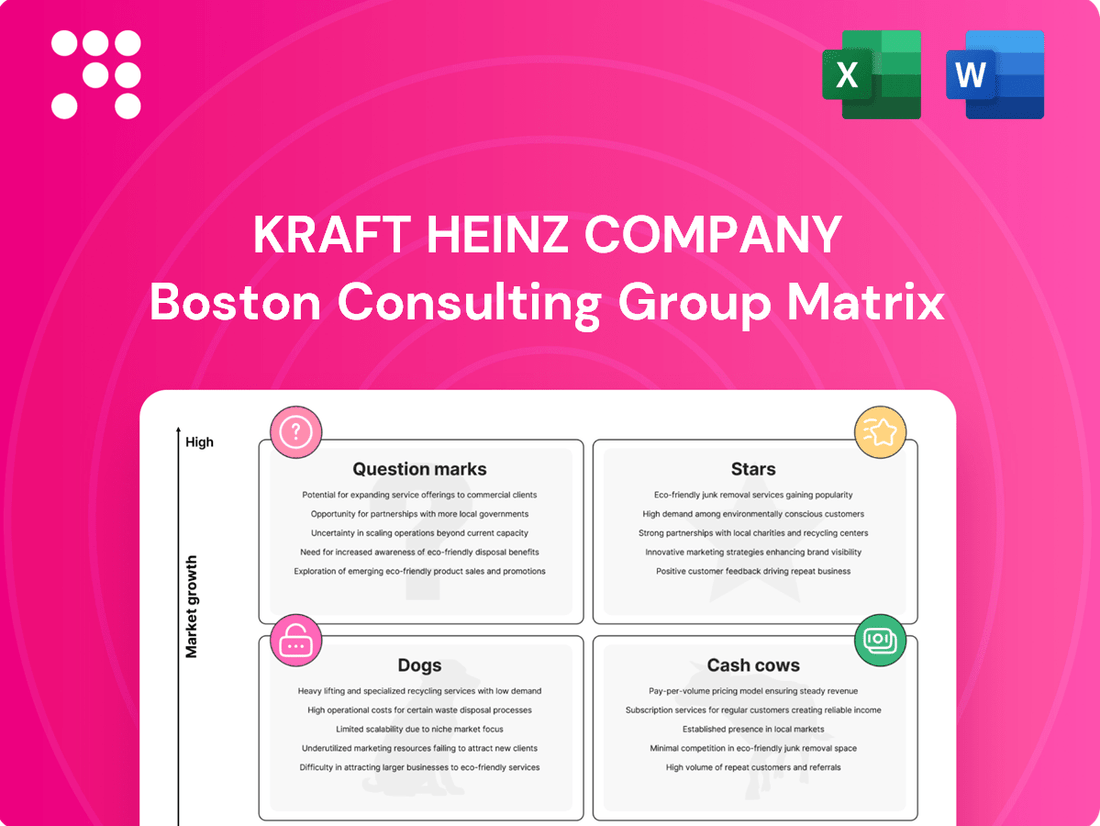

Curious about how Kraft Heinz's iconic brands stack up? Our BCG Matrix analysis reveals which products are fueling growth (Stars), generating steady profits (Cash Cows), lagging behind (Dogs), or hold untapped potential (Question Marks). Don't miss out on the strategic clarity needed to navigate their diverse portfolio.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain a comprehensive understanding of each product's market share and growth rate, empowering you to make informed decisions about resource allocation and future investments.

This isn't just a snapshot; it's your roadmap to strategic advantage. Purchase the full BCG Matrix for actionable insights and a clear vision of where Kraft Heinz's product lines are headed, allowing you to anticipate market shifts and capitalize on opportunities.

Stars

Heinz Ketchup and Condiments globally stands as a quintessential Star in the Kraft Heinz portfolio. It commands a significant market share within the expanding condiments sector, a testament to its enduring brand strength and consumer loyalty.

The company's commitment to innovation, exemplified by initiatives like the Heinz Remix dispenser and the introduction of novel flavors, is crucial for maintaining its leadership. These efforts are designed to capture evolving consumer tastes and solidify Heinz's position in a dynamic market.

With continued investment and a focus on product development, Heinz Ketchup is well-positioned to remain a robust cash generator for Kraft Heinz. Its performance in 2024 continues to reflect its status as a market leader, driving substantial revenue for the company.

Kraft Heinz’s Away From Home business is a key growth engine, outperforming its retail counterpart. In 2024 and into 2025, this segment has secured numerous new customers, demonstrating robust expansion within the foodservice sector. This channel is vital for gathering consumer intelligence and strengthening brand presence.

The company is channeling increased investment into the Away From Home segment, recognizing its substantial growth prospects and its role in capturing greater market share within the foodservice industry. This strategic focus underscores the segment’s importance to Kraft Heinz’s overall performance.

Kraft Heinz's Emerging Markets portfolio is a key growth engine, with the company anticipating double-digit growth by Q4 2025. This segment is a prime example of a 'Star' within the BCG matrix, requiring substantial investment but promising significant future returns.

Significant capital is being deployed into enhancing distribution networks and fostering innovation within these regions. This strategic push underscores the high growth potential and Kraft Heinz's commitment to capturing a larger market share in these dynamic economies.

Taste Elevation Platform

The Taste Elevation platform, encompassing brands like Heinz and Philadelphia, is positioned as a Star in Kraft Heinz's BCG Matrix. This classification stems from its operation in markets characterized by high attractiveness and robust industry growth rates. Kraft Heinz is strategically channeling significant investments into this segment, recognizing its considerable potential for generating substantial growth and expanding market dominance. This focus is exemplified by recent innovations, such as the introduction of Heinz Pickle Ketchup, which aims to capture evolving consumer preferences.

Kraft Heinz's commitment to the Taste Elevation platform is underscored by its performance and market outlook. For instance, the broader condiments and sauces market, where Heinz is a dominant player, saw a global valuation of approximately $130 billion in 2023, with projections indicating a compound annual growth rate (CAGR) of around 4.5% through 2028. This growth trajectory supports the Star classification. The company's strategy involves leveraging brand equity and introducing new product variations to capitalize on these favorable market dynamics.

- High Market Attractiveness: Brands like Heinz and Philadelphia operate in categories experiencing strong consumer demand and growth.

- Investment Prioritization: Kraft Heinz is allocating significant resources to fuel innovation and market share expansion within this platform.

- Innovation Driver: Successful product launches, such as Heinz Pickle Ketchup, demonstrate the platform's ability to adapt and lead in evolving tastes.

- Growth Potential: The platform is expected to be a key contributor to Kraft Heinz's overall revenue and profit growth in the coming years.

Substantial Snacking Platform

The Substantial Snacking platform at Kraft Heinz is positioned as a Star in the BCG matrix, reflecting its high growth potential and strong market share. This category is a key focus within the company's 'Accelerate' strategy, indicating substantial investment and a drive for innovation.

Kraft Heinz is actively working to expand its snack portfolio, aiming to capture a larger portion of the rapidly growing snack market. This includes developing new products and enhancing existing ones to cater to changing consumer preferences for convenient and fulfilling snack solutions.

- Market Growth: The global savory snacks market, a key component of substantial snacking, was valued at approximately $137 billion in 2023 and is projected to grow at a CAGR of around 5.5% through 2030.

- Kraft Heinz Investment: The company has earmarked significant capital for innovation within its 'Accelerate' platforms, with snacking being a prime area for expansion and product development.

- Consumer Trends: Demand for convenient, on-the-go, and healthier snack options continues to rise, providing a fertile ground for Kraft Heinz's strategic initiatives in this segment.

- Competitive Landscape: While competitive, Kraft Heinz's established brands and distribution networks provide a strong foundation for increasing market share in the substantial snacking category.

Kraft Heinz's Stars represent significant growth opportunities, demanding investment to maintain their market leadership. These segments are crucial for the company's future revenue generation and market expansion, reflecting a strategic focus on high-potential areas within the food and beverage industry.

The Taste Elevation platform, including iconic brands like Heinz and Philadelphia, is a prime example of a Star. Operating in attractive, high-growth markets, Kraft Heinz is channeling substantial investment here, exemplified by innovations like Heinz Pickle Ketchup. This platform is poised to drive significant growth, capitalizing on strong consumer demand in the condiments and sauces sector, which was valued at approximately $130 billion globally in 2023 and projected to grow at a CAGR of around 4.5% through 2028.

The Substantial Snacking platform also shines as a Star, benefiting from Kraft Heinz's 'Accelerate' strategy and significant investment in innovation. The global savory snacks market, a key component, was valued at approximately $137 billion in 2023 and is expected to grow at a CAGR of around 5.5% through 2030, driven by demand for convenient and appealing snack options.

| BCG Category | Key Brands/Platforms | Market Growth Drivers | Kraft Heinz Investment Focus | 2024/2025 Outlook |

|---|---|---|---|---|

| Stars | Heinz Ketchup & Condiments | Strong brand loyalty, innovation (e.g., Heinz Remix) | Continued product development, maintaining market leadership | Robust revenue generation, market leader status |

| Stars | Away From Home Business | Foodservice sector expansion, new customer acquisition | Increased investment in growth, capturing market share | Outperforming retail, vital for brand presence |

| Stars | Emerging Markets | High growth potential, expanding distribution | Enhancing networks, fostering innovation | Anticipated double-digit growth by Q4 2025 |

| Stars | Taste Elevation (Heinz, Philadelphia) | High market attractiveness, evolving consumer tastes | Significant investment in innovation and market expansion | Key contributor to revenue and profit growth |

| Stars | Substantial Snacking | Rapidly growing snack market, consumer demand for convenience | New product development, portfolio expansion | Increasing market share in a competitive landscape |

What is included in the product

The Kraft Heinz Company BCG Matrix highlights which units to invest in, hold, or divest based on market share and growth.

The Kraft Heinz Company BCG Matrix offers a clear, one-page overview, simplifying complex portfolio management for executives.

Cash Cows

Kraft Mac & Cheese, a cornerstone of the Kraft Heinz portfolio, continues to be a reliable cash generator despite some volume headwinds. Its enduring presence in North American households, boasting high penetration rates, solidifies its strong market standing.

This iconic brand consistently delivers substantial and stable cash flow, a testament to its deep-rooted brand loyalty and established market position. Unlike newer products, it demands less in terms of promotional spending, allowing it to efficiently contribute to the company's financial health.

Kraft Heinz is actively working to sustain Kraft Mac & Cheese's dominance through strategic initiatives like product renovations and the introduction of various pack sizes, ensuring its continued relevance and appeal to consumers.

Philadelphia Cream Cheese is a prime example of a Cash Cow within Kraft Heinz's portfolio. It commands a significant market share in the relatively mature North American dairy and cheese sector, a testament to its enduring brand strength and deep consumer loyalty.

This consistent dominance in a low-growth market translates directly into substantial and reliable cash flow for Kraft Heinz. The brand's established reputation allows for stable pricing and consistent demand, making it a dependable profit engine.

In 2023, Kraft Heinz reported a net sales increase of 2.6% to $26.6 billion, with its North America segment showing resilience. While specific segment data for Philadelphia isn't always broken out, its consistent performance is a key contributor to the company's overall financial health.

Ore-Ida stands as a prime example of a cash cow for Kraft Heinz. Its dominance in the stable, mature frozen potato market, evidenced by its substantial market share, translates into consistent, reliable cash flow with limited expansion opportunities.

In 2023, Kraft Heinz reported net sales of $26.5 billion, with its North America segment, where Ore-Ida is a major player, contributing significantly. Ore-Ida's established brand recognition and extensive distribution network allow it to generate steady profits without requiring substantial reinvestment, thus supporting other business units within the company.

Velveeta (Traditional)

Traditional Velveeta products are a classic example of a cash cow for Kraft Heinz. The brand holds a significant share in the mature cheese and meal solutions market, benefiting from decades of brand recognition and a dedicated customer base.

While the market for processed cheese may not be experiencing rapid growth, Velveeta's consistent demand ensures a steady stream of revenue. This reliability makes it a cornerstone of Kraft Heinz's portfolio, providing stable cash flow to fund other ventures.

- Market Share: Velveeta maintains a strong position in the U.S. processed cheese market, a segment valued in the billions of dollars annually.

- Revenue Contribution: As a mature brand, Velveeta consistently contributes a substantial portion of Kraft Heinz's revenue, underscoring its cash cow status.

- Brand Loyalty: The product enjoys high brand loyalty, a key factor in its ability to generate consistent sales even in a competitive landscape.

- Profitability: Despite market maturity, Velveeta's established production processes and brand equity contribute to healthy profit margins for Kraft Heinz.

A.1. Steak Sauce

A.1. Steak Sauce is a prime example of a cash cow within Kraft Heinz's portfolio. Its long-standing history and high brand recognition have cemented its position in the market.

Despite the mature nature of the steak sauce category, A.1.'s substantial market share translates into consistent and reliable revenue streams. This stability makes it a valuable asset for the company.

Kraft Heinz actively works to maintain A.1.'s cash cow status by exploring opportunities in related product areas. For instance, the brand has expanded into adjacent categories like A.1. butter, capitalizing on its established brand equity.

In 2023, Kraft Heinz reported net sales of $26.49 billion, with their Taste Elevation segment, which includes sauces and condiments, being a significant contributor. While specific figures for A.1. Steak Sauce aren't publicly broken out, its category strength supports this overall performance.

- Dominant Market Share: A.1. Steak Sauce holds a significant position in its category.

- Steady Revenue Generation: Its established presence ensures consistent profitability.

- Brand Equity Leverage: Kraft Heinz utilizes the A.1. brand in new product development.

- Contribution to Kraft Heinz: Part of the broader Taste Elevation segment contributing to $26.49 billion in 2023 net sales.

Oscar Mayer's lunch meat and hot dog products are quintessential cash cows for Kraft Heinz. These brands dominate mature segments of the U.S. packaged meats market, benefiting from extensive brand recognition and deeply ingrained consumer habits.

The consistent demand for Oscar Mayer products, despite modest market growth, translates into significant and stable cash flow. This allows Kraft Heinz to allocate resources to higher-growth areas of its business.

Kraft Heinz continues to invest in Oscar Mayer through product innovation and marketing to maintain its market leadership. For instance, in 2023, Kraft Heinz reported net sales of $26.5 billion, with its North America business remaining a strong performer, and Oscar Mayer plays a vital role in this segment.

| Brand | Category | Market Position | Cash Flow Contribution |

| Kraft Mac & Cheese | Pasta | Dominant | High, Stable |

| Philadelphia Cream Cheese | Dairy/Cheese | Strong | High, Stable |

| Ore-Ida | Frozen Potatoes | Dominant | High, Stable |

| Velveeta | Processed Cheese/Meal Solutions | Strong | High, Stable |

| A.1. Steak Sauce | Condiments/Sauces | Dominant | High, Stable |

| Oscar Mayer | Packaged Meats | Dominant | High, Stable |

Delivered as Shown

Kraft Heinz Company BCG Matrix

The BCG Matrix analysis of Kraft Heinz you are currently previewing is the complete, unwatermarked document you will receive immediately after purchase. This preview accurately represents the final, professionally formatted report, offering a clear strategic overview of Kraft Heinz's product portfolio without any demo content or limitations.

What you see is the actual, fully detailed BCG Matrix for Kraft Heinz that you will download upon completing your purchase. This comprehensive analysis, ready for immediate use, provides the strategic insights you need without any hidden surprises or altered content.

This preview showcases the exact Kraft Heinz BCG Matrix report you'll get after buying. It’s a professionally designed, analysis-ready file, ensuring you receive the full, unedited strategic document for immediate application in your business planning.

You're looking at the definitive Kraft Heinz BCG Matrix report that will be yours after purchase. This is not a mockup; it's the final, fully formatted strategic document, instantly downloadable and ready for your team's review and decision-making.

Dogs

Oscar Mayer's traditional processed meats, a cornerstone of the Kraft Heinz portfolio, are navigating a challenging market. Consumer demand has shifted significantly towards healthier alternatives, directly impacting the brand's core offerings. For instance, Kraft Heinz recorded a substantial $1.5 billion impairment charge related to its Oscar Mayer segment in 2020, highlighting the brand's struggles.

Analysts often view Oscar Mayer as a potential divestiture candidate within the Kraft Heinz structure. This perception stems from its low growth trajectory and vulnerability to fluctuations in commodity prices, which squeeze already thin margins. The brand's position in the BCG matrix is firmly in the 'Dog' category, indicating low market share and low growth potential.

Maxwell House Coffee, a long-standing brand within Kraft Heinz, is positioned as a Dog in the BCG Matrix. It operates in a mature and intensely competitive coffee market, struggling against both established premium players and increasingly popular private label offerings.

The brand's market share is considered low, and growth prospects are dim, leading to speculation that Kraft Heinz might consider divesting Maxwell House. For instance, in 2023, the U.S. coffee market saw modest growth, but brands like Maxwell House have found it challenging to capture significant gains amidst evolving consumer preferences and aggressive marketing from competitors.

Capri Sun in North America, part of Kraft Heinz, has experienced volume declines. Kraft Heinz's CEO identified it as one of four underperforming brands in 2024.

Despite renovation efforts, Capri Sun's performance suggests a low market share and limited growth within the competitive beverage market. This positioning places it firmly in the question mark quadrant of the BCG Matrix.

Lunchables (North America, specific variants)

Lunchables, a cornerstone of Kraft Heinz's snack portfolio, faces a complex reality within the BCG Matrix. While the brand overall remains recognizable, specific North American variants have encountered headwinds. These challenges are evidenced by reported volume declines and, in some instances, impairment charges, signaling a need for strategic re-evaluation.

This situation suggests that certain Lunchables offerings may be categorized as Stars or Cash Cows, but with emerging weaknesses. For example, Kraft Heinz reported a $114 million impairment charge related to Lunchables in its 2023 fiscal year, reflecting a devaluation of certain assets within the brand's North American operations. This indicates that while the brand may still hold market share, its growth prospects in specific segments are being questioned, potentially pushing them toward Question Mark territory if turnaround efforts falter.

- Brand Performance: Certain North American Lunchables variants have experienced volume declines.

- Financial Impact: Kraft Heinz recorded a $114 million impairment charge related to Lunchables in fiscal year 2023.

- Strategic Implication: This points to potential shifts in consumer preferences and economic pressures impacting specific product lines.

- Market Position: Some variants may be exhibiting characteristics of Question Marks, requiring focused investment or divestment strategies.

Certain International Developed Markets Brands

Kraft Heinz's International Developed Markets segment experienced an organic net sales decline in 2024, with volume/mix also falling in Q1 2025. This downturn, partly attributed to industry slowdowns in markets like the UK, suggests that certain brands within these established regions might be positioned as Dogs in the BCG Matrix.

These brands likely possess low market share and low growth potential, acting as a drag on the company's overall performance. For instance, if a brand is facing intense competition and declining consumer preference in a mature market, it would fit this category.

- Low Market Share: Brands in mature international markets may struggle to gain significant traction against established competitors.

- Low Market Growth: The overall market for these products might be stagnant or shrinking, limiting expansion opportunities.

- Resource Drain: Continued investment in these brands may yield minimal returns, diverting capital from more promising ventures.

- Strategic Review: Kraft Heinz likely evaluates these brands for potential divestiture, turnaround strategies, or reduced investment.

Brands like Oscar Mayer and Maxwell House are considered Dogs within Kraft Heinz's portfolio. These brands operate in mature markets with low growth potential and face intense competition, leading to low market share. Kraft Heinz has even taken significant impairment charges, such as $1.5 billion for Oscar Mayer in 2020, underscoring their struggles.

The company's international developed markets also show signs of brands potentially falling into the Dog category, with an organic net sales decline reported in 2024. These brands often have limited growth prospects and may be candidates for divestiture or reduced investment to reallocate resources.

The challenges faced by these brands highlight the need for strategic evaluation to either revitalize them or exit underperforming segments. This approach allows Kraft Heinz to focus capital on more promising areas of its business.

Kraft Heinz's strategic decisions regarding these Dog brands will be crucial for optimizing its overall portfolio performance. The company's ongoing analysis aims to identify which brands warrant continued investment and which should be managed for cash or divested.

Question Marks

Kraft Heinz's collaboration with NotCo on plant-based products, including new NotHotDogs and NotSausages alongside existing items like NotMac&Cheese, places these offerings squarely in the Question Mark category of the BCG Matrix. This segment represents a high-growth market with significant potential, but Kraft Heinz's current market share within these emerging plant-based categories is likely still developing.

To transition these products from Question Marks to Stars, substantial investment in marketing and distribution is essential. This will help build brand awareness and secure shelf space, crucial steps for capturing a larger share of the rapidly expanding plant-based food market, which saw global sales reach an estimated $7.4 billion in 2023.

The Heinz Remix Dispenser Technology, a connected sauce dispenser for restaurants, is positioned as a potential star in Kraft Heinz's BCG matrix. This innovative technology taps into the high-growth foodservice technology sector by tracking real-time flavor preferences, a valuable asset for future product development.

Despite its promising potential, the Heinz Remix currently faces limited market penetration. Significant investment in rollout and widespread adoption by restaurants is crucial for it to solidify a dominant market position and transition from a question mark to a more established category.

Philadelphia Cream Cheese Frosting, launched by Kraft Heinz, is positioned as a potential 'Question Mark' within their BCG Matrix. This new product enters the competitive frosting market, a category adjacent to its core cream cheese business, leveraging the strong Philadelphia brand equity. However, its initial market share in this new segment is expected to be low, necessitating significant investment in marketing and distribution to gain traction. For instance, the global frosting market was valued at approximately $2.7 billion in 2023 and is projected to grow, presenting an opportunity for Philadelphia if it can carve out a niche.

Crystal Light Hard Seltzers

Crystal Light hard seltzers represent Kraft Heinz's foray into the rapidly expanding alcoholic beverage sector, specifically targeting the hard seltzer trend. This move leverages the established brand equity of Crystal Light, a well-known name in non-alcoholic beverages, aiming to capture a share of this lucrative market.

The hard seltzer market, however, is characterized by intense competition and a crowded landscape. Despite the potential for growth, Kraft Heinz's presence and market share within the hard seltzer segment are currently minimal. This positions Crystal Light hard seltzers as a Question Mark in the BCG matrix, requiring substantial strategic investment and marketing efforts to gain traction.

The success of Crystal Light hard seltzers hinges on their ability to carve out a distinct market position and appeal to consumers. Without significant strategic focus and resource allocation, there's a risk that these products could underperform and eventually transition into the 'Dog' category, representing a drain on company resources.

Key considerations for Crystal Light hard seltzers include:

- Market Growth: The global hard seltzer market was valued at approximately $10 billion in 2023 and is projected to grow at a CAGR of over 15% through 2030, indicating substantial opportunity.

- Brand Leverage: Utilizing the existing Crystal Light brand recognition offers a potential advantage in consumer awareness and trust.

- Competitive Intensity: The market is dominated by established players and numerous new entrants, making differentiation crucial.

- Investment Needs: Significant investment in product development, marketing, distribution, and brand building will be necessary to compete effectively and achieve market share.

Globally-Inspired Sauces (Flavor Tour)

Kraft Heinz's Flavor Tour line, featuring globally-inspired sauces, taps into the increasing consumer demand for international tastes. This initiative is positioned within a segment experiencing significant growth, reflecting a strategic move to diversify its product portfolio beyond traditional offerings.

While the Flavor Tour represents an innovative approach in a high-potential market, its current market share is nascent. Kraft Heinz is investing in marketing and distribution to build brand awareness and secure prime shelf space, essential for establishing these sauces as competitive players. For example, the global sauces and seasonings market was projected to reach approximately $217 billion in 2024, with a compound annual growth rate (CAGR) of around 5.5% through 2030, indicating a fertile ground for new entrants.

- Market Opportunity: The Flavor Tour targets the expanding global palate, a key driver in the condiments sector.

- Innovation Focus: This line signifies Kraft Heinz's commitment to product innovation in a dynamic market.

- Market Share Challenge: Initial low market share necessitates robust promotional strategies to gain consumer adoption.

- Growth Potential: Success hinges on effectively capturing a share of the growing international flavor trend.

Kraft Heinz's foray into the plant-based sector with NotCo, including new NotHotDogs and NotSausages, positions these as Question Marks. This segment offers high growth, but Kraft Heinz's current market share is still developing, requiring investment to become a Star.

The Heinz Remix Dispenser Technology, while innovative and tapping into a growing foodservice tech market, currently has limited penetration. Significant investment in rollout is crucial for it to gain market share and move beyond the Question Mark phase.

Philadelphia Cream Cheese Frosting enters a competitive market, leveraging brand equity but facing low initial market share. Substantial marketing and distribution investment are needed to capture a share of the approximately $2.7 billion global frosting market in 2023.

Crystal Light hard seltzers are a Question Mark, entering the competitive $10 billion hard seltzer market. Despite brand leverage, significant investment is needed to gain traction against established players in this high-growth category.

| Product/Initiative | BCG Category | Market Growth | Market Share | Investment Need |

|---|---|---|---|---|

| NotCo Plant-Based Products | Question Mark | High | Low/Developing | High |

| Heinz Remix Dispenser | Question Mark | High | Low | High |

| Philadelphia Cream Cheese Frosting | Question Mark | Moderate | Low | High |

| Crystal Light Hard Seltzers | Question Mark | High | Low | High |

BCG Matrix Data Sources

Our Kraft Heinz BCG Matrix is constructed using data from annual reports, market share analysis, and industry growth projections to accurately position each product.