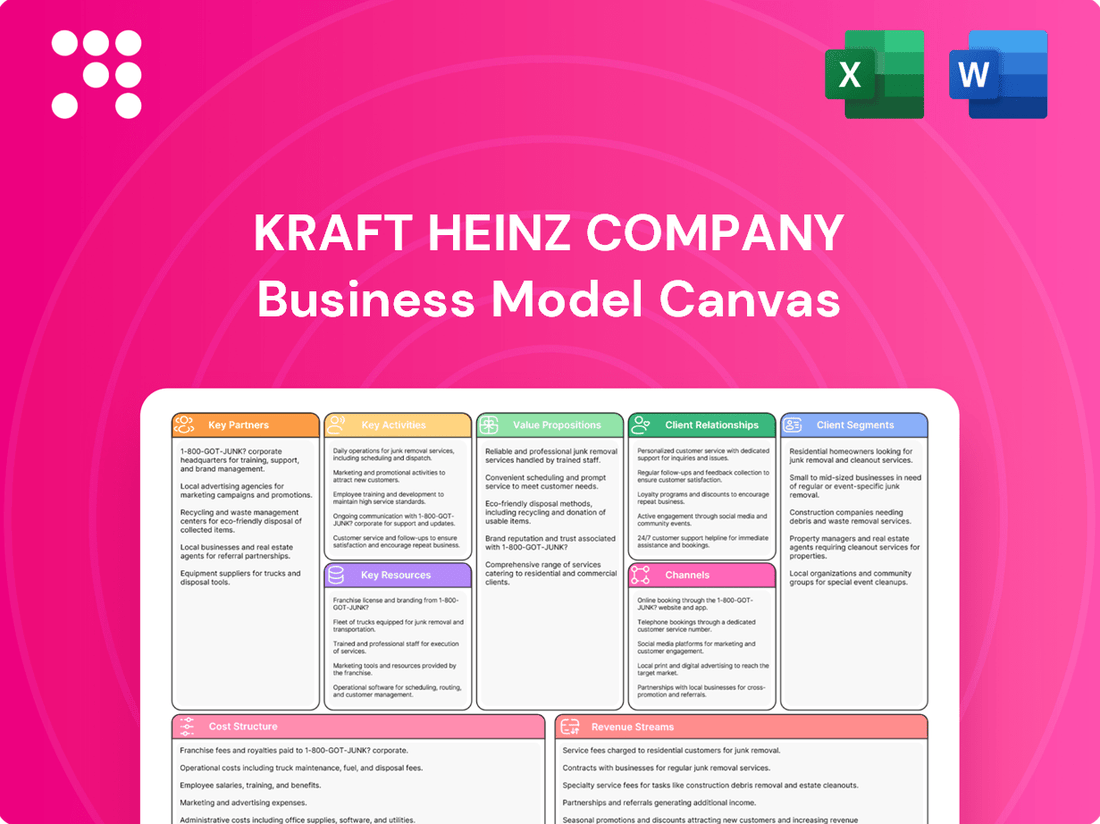

Kraft Heinz Company Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kraft Heinz Company Bundle

Explore the strategic framework behind Kraft Heinz Company's enduring market presence. This Business Model Canvas breaks down how they connect with diverse customer segments, leverage key partnerships, and deliver iconic products. Understand their revenue streams and cost structure to grasp their operational efficiency.

Ready to dissect Kraft Heinz Company's winning formula? Our comprehensive Business Model Canvas lays bare their value propositions, channels, and customer relationships. Gain actionable insights into their core activities and resources that fuel their global success. Download the full canvas to unlock a strategic roadmap.

Partnerships

Kraft Heinz maintains vital connections with major retailers like grocery chains, supermarkets, hypermarkets, and convenience stores worldwide. These collaborations are essential for securing prominent shelf placement, executing marketing campaigns, and ensuring smooth operations within their extensive supply chain.

In 2024, Kraft Heinz's top five North American customers were responsible for roughly 46% of its segment net sales. Notably, Walmart Inc. alone contributed approximately 21% of the company's total net sales for that year, highlighting the significant impact of these retail partnerships.

Kraft Heinz relies on a strong network of suppliers for key ingredients like dairy, meat, produce, and packaging. These partnerships are crucial for maintaining consistent product quality and ensuring the smooth operation of their extensive manufacturing processes.

In 2023, the company continued to emphasize efficiency in its procurement strategies, including supplier relationships, to combat rising input costs. This focus is essential for mitigating inflationary pressures that have impacted the food industry, aiming to maintain cost-effectiveness across their product lines.

The resilience of Kraft Heinz's supply chain is heavily dependent on these supplier relationships, especially in navigating ongoing global supply chain disruptions. By working closely with suppliers, the company seeks to guarantee a steady flow of materials, thereby safeguarding production and availability for consumers.

Kraft Heinz is significantly investing in its Away From Home (AFH) segment, forging partnerships with a wide array of businesses including restaurants, hotels, and large venues like stadiums. This strategic focus aims to capture growth opportunities beyond traditional retail channels.

A prime example of this commitment is the global collaboration with the World Association of Chefs Societies (Worldchefs). This partnership is designed to foster culinary innovation and bolster Kraft Heinz's presence within the foodservice industry, driving mutual growth and brand visibility.

Technology and Innovation Collaborators

Kraft Heinz actively partners with technology and innovation collaborators to boost its product development, streamline its supply chain, and refine its digital marketing efforts. These collaborations are crucial for staying competitive in a rapidly evolving food industry.

Investments in cutting-edge technology, including automation and advanced digital tools, are central to Kraft Heinz's strategy for achieving greater operational efficiencies and enhancing the impact of its messaging and product innovations. For instance, in 2024, the company continued to leverage data analytics and AI to personalize consumer outreach and optimize inventory management.

- Technology Partnerships: Collaborations with tech firms to implement AI in forecasting and personalized marketing campaigns.

- Supply Chain Innovation: Working with logistics and IoT providers to improve traceability and reduce waste.

- Digital Marketing Enhancement: Engaging with digital agencies and platforms to optimize online advertising and consumer engagement strategies.

- Product Renovation Tech: Partnering with research institutions and ingredient technology companies for new product development.

Marketing and Advertising Agencies

Kraft Heinz partners with marketing and advertising agencies to ensure its brands remain top-of-mind and connect with consumers effectively. These collaborations are crucial for developing impactful advertising campaigns and successful new product launches.

In 2024, Kraft Heinz continued to emphasize optimizing marketing expenditures for a stronger return on investment. This strategic focus involves leveraging agency expertise to create culturally resonant advertising that drives consumer engagement and sales.

- Brand Reinforcement: Agencies help Kraft Heinz craft campaigns that reinforce brand superiority and maintain consumer loyalty across its diverse product portfolio.

- Product Launches: Expert marketing support is vital for introducing new products to the market and generating initial consumer interest and trial.

- ROI Optimization: Kraft Heinz works with agencies to analyze campaign performance and refine strategies for maximum impact and efficient marketing spend.

- Cultural Relevance: Partnerships ensure advertising messages are relevant and appealing to current consumer trends and cultural nuances.

Kraft Heinz's key partnerships extend to its significant retail relationships, where major grocery chains and hypermarkets are crucial for product distribution and prominent shelf space. These collaborations are vital for market penetration and consumer access.

In 2024, the company's top five North American customers accounted for about 46% of its net sales, with Walmart alone representing approximately 21% of total net sales, underscoring the critical nature of these retail alliances.

Furthermore, Kraft Heinz collaborates with a diverse range of suppliers for essential ingredients and packaging, ensuring consistent quality and operational continuity. These supplier relationships are fundamental to managing input costs and maintaining supply chain resilience, especially amidst inflationary pressures noted in 2023.

Strategic alliances with technology providers are also paramount, enabling advancements in product development, supply chain efficiency, and digital marketing, with investments in AI and data analytics continuing into 2024 to personalize consumer outreach and optimize inventory.

What is included in the product

The Kraft Heinz Company Business Model Canvas focuses on delivering a wide range of beloved food and beverage products to diverse consumer segments through extensive retail and foodservice channels, leveraging strong brand equity and efficient supply chains for value creation.

The Kraft Heinz Company Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex operations, simplifying strategic understanding and decision-making for stakeholders.

Activities

Kraft Heinz's manufacturing and production are central, involving the large-scale creation of a wide array of food and beverage items, from condiments like ketchup to packaged meals. This necessitates managing intricate global production lines and upholding stringent quality and safety standards for every product.

The company is strategically investing around $1.0 billion in capital expenditures for 2025. A significant portion of this investment is earmarked for modernizing its U.S. manufacturing facilities and enhancing technological capabilities to drive growth and efficiency in its production processes.

Kraft Heinz actively pursues product innovation and renovation, investing in research and development to meet changing consumer tastes. This commitment is evident in their 'Flavor Tour' line, featuring globally inspired sauces designed to capture diverse palates.

Furthermore, the company focuses on enhancing the quality of existing products. For instance, they've made improvements to the cookies and crackers found in their popular Lunchables line, demonstrating a dedication to refining their offerings.

Kraft Heinz's supply chain management and logistics are central to its operations. This involves a complex process of sourcing raw materials globally, manufacturing products, and distributing them to a vast network of retail and foodservice customers. The company focuses on ensuring products are available when and where consumers want them, while also keeping costs in check.

Key activities include procurement of ingredients, overseeing manufacturing processes across its facilities, managing transportation and warehousing, and optimizing inventory levels. These functions are vital for maintaining product freshness and meeting demand across diverse markets. The company has set an ambitious target to achieve $2.5 billion in gross efficiencies by 2027, with a significant portion driven by sustainable supply chain initiatives.

Sales and Distribution

Kraft Heinz's sales and distribution strategy centers on a robust multi-channel approach. They actively sell and distribute their extensive product portfolio through a wide array of retail channels, encompassing traditional grocery stores, large supermarkets, hypermarkets, and smaller convenience stores. This broad reach ensures their products are accessible to a diverse consumer base.

Furthermore, Kraft Heinz is strategically expanding its presence in the Away From Home segment on a global scale. This involves catering to food service providers, restaurants, and institutional clients, diversifying their revenue streams beyond traditional retail. Managing these relationships effectively is paramount to their success.

A key focus for Kraft Heinz is increasing their distribution points, with a particular emphasis on emerging markets. For 2025, the company has a clear objective: to achieve a 17% increase in distribution, which translates to mapping out an additional 40,000 points of sale. This expansion is critical for capturing growth in developing economies.

- Multi-channel Retail Presence: Kraft Heinz products are available in grocery stores, supermarkets, hypermarkets, and convenience stores.

- Away From Home Expansion: The company is actively growing its sales within the food service and institutional sectors globally.

- Emerging Market Focus: A significant part of their distribution strategy involves increasing reach in developing economies.

- Distribution Growth Target: Kraft Heinz plans to add 40,000 new distribution points by 2025, representing a 17% increase.

Brand Management and Marketing

Kraft Heinz actively cultivates its brand portfolio through robust strategies and impactful marketing. The company focuses on maintaining and growing the appeal and market share of its well-known brands. In 2024, Kraft Heinz continued to refine its approach, aiming for superior brand performance and efficient marketing spend.

A key initiative is the implementation of a 'Brand Growth System' across its diverse product lines. This system is designed to elevate brand superiority and ensure marketing investments are optimized for maximum impact. The goal is to drive sustained growth and reinforce the strong connection consumers have with Kraft Heinz brands.

- Brand Strategy Development: Creating and executing plans to enhance brand perception and market position.

- Marketing Campaigns: Launching promotional activities to increase visibility and drive consumer engagement.

- Promotional Activities: Utilizing various channels to boost sales and reinforce brand loyalty.

- Brand Growth System: A systematic approach to improving brand performance and marketing ROI.

Kraft Heinz's key activities revolve around producing a wide range of food and beverage products, managing a complex global supply chain, and executing a multi-channel sales and distribution strategy. They are also heavily invested in brand cultivation and marketing to maintain and grow their portfolio's appeal.

The company's production involves significant capital investment, with approximately $1.0 billion allocated for 2025 to modernize U.S. manufacturing and enhance technological capabilities. This focus on operational efficiency is further supported by a target of $2.5 billion in gross efficiencies by 2027, driven by sustainable supply chain initiatives.

In terms of distribution, Kraft Heinz aims to expand its reach by adding 40,000 new points of sale by 2025, a 17% increase, with a particular emphasis on emerging markets and the Away From Home sector.

Brand management includes implementing a 'Brand Growth System' to improve performance and marketing ROI, as seen in their continued refinement of marketing spend in 2024.

| Key Activity | Description | Key Metric/Target |

|---|---|---|

| Manufacturing & Production | Large-scale creation of food and beverage items, adhering to quality standards. | Capital expenditures of $1.0 billion for 2025 for modernization. |

| Supply Chain Management | Sourcing, production, distribution, and inventory optimization. | Target of $2.5 billion in gross efficiencies by 2027. |

| Sales & Distribution | Multi-channel retail and expansion into Away From Home segment. | Add 40,000 new distribution points by 2025 (17% increase). |

| Brand Cultivation | Developing strategies and marketing for brand growth and appeal. | Refining marketing spend for superior brand performance (2024 focus). |

Full Document Unlocks After Purchase

Business Model Canvas

The Kraft Heinz Company Business Model Canvas preview you see is the actual document you will receive upon purchase. This means you're getting a direct look at the complete, professionally structured analysis of Kraft Heinz's business strategy, ready for your immediate use. No mockups or samples, just the full, unaltered Business Model Canvas.

Resources

Kraft Heinz's most significant asset is its extensive portfolio of globally recognized and trusted brands, including Heinz, Kraft, Philadelphia, Oscar Mayer, and Lunchables. These iconic brands are the bedrock of consumer loyalty and a powerful competitive advantage, representing substantial intangible value. In 2023, Kraft Heinz reported net sales of $26.5 billion, underscoring the market's continued reliance on its established brand equity.

Kraft Heinz operates a sprawling global manufacturing and distribution network, a cornerstone of its efficient operations. This extensive physical infrastructure, comprising numerous manufacturing plants and strategically located distribution centers worldwide, allows for the seamless production and timely delivery of its diverse product portfolio across various international markets.

This robust network is fundamental to Kraft Heinz's ability to achieve its impressive global scale and broad market reach. For instance, as of the end of 2023, the company managed a significant number of manufacturing facilities, ensuring localized production capabilities and supply chain resilience, which is vital for navigating complex global logistics.

Kraft Heinz leverages its global workforce of approximately 36,000 employees as a cornerstone of its business model. This diverse talent pool includes specialized R&D scientists driving product innovation, astute marketing professionals understanding consumer needs, and seasoned supply chain experts optimizing operations.

The collective expertise of these individuals, spanning food science, deep consumer insights, and a commitment to operational excellence, directly fuels Kraft Heinz's ability to innovate and maintain strong business performance in the competitive food industry.

Intellectual Property and Recipes

Kraft Heinz's proprietary recipes are foundational, forming the core of its differentiated product portfolio. These closely guarded formulations allow the company to maintain unique flavor profiles and product characteristics that consumers recognize and trust. For instance, the iconic taste of Heinz Ketchup is a direct result of its specific recipe, a key element in its enduring brand loyalty.

Beyond recipes, the company leverages patents and trademarks to safeguard its innovations and brand identity. Patents might cover novel food processing technologies or unique packaging solutions, providing a competitive edge. Trademarks, such as the Heinz shield or the Kraft logo, are crucial for brand recognition and preventing market confusion, reinforcing Kraft Heinz's market position. In 2023, Kraft Heinz reported that its portfolio of iconic brands, many built on strong intellectual property, continued to drive significant revenue, underscoring the financial importance of these intangible assets.

- Proprietary Recipes: The secret formulations for products like Heinz Ketchup and Kraft Macaroni & Cheese are central to their distinct market appeal.

- Food Processing Technologies: Innovations in how foods are manufactured ensure quality, consistency, and efficiency, contributing to cost advantages.

- Patents: Protecting novel ingredients, production methods, or packaging designs offers a temporary monopoly and competitive advantage.

- Trademarks: Brand names and logos are vital for consumer recognition and trust, differentiating Kraft Heinz products from competitors.

Financial Capital

Kraft Heinz Company's financial capital is a cornerstone of its business model, enabling crucial investments. In 2024, the company demonstrated robust operational cash flow, allowing for significant funding of innovation pipelines and marketing initiatives. This financial strength also underpins its ability to pursue strategic acquisitions and capital expenditures to enhance its operational capabilities and market presence.

The company's access to credit and substantial shareholder equity provide a stable foundation for its financial strategy. This allows Kraft Heinz to maintain a consistent dividend policy, rewarding investors while reinvesting in growth opportunities. For instance, the company's commitment to shareholder returns was evident in its continued dividend payouts throughout 2024, reflecting its confidence in its ongoing financial performance.

- Strong Cash Flow Generation: Kraft Heinz reported significant cash flow from operations in 2024, providing ample resources for reinvestment.

- Access to Credit and Equity: The company leverages its strong balance sheet and shareholder equity to secure necessary financing.

- Investment in Growth: Financial capital supports vital investments in product innovation, marketing campaigns, and capital expenditures.

- Shareholder Returns: A consistent dividend policy in 2024 highlights the company's financial health and commitment to its investors.

Kraft Heinz's Key Resources are anchored by its powerful brand portfolio, including household names like Heinz, Kraft, and Oscar Mayer, which drive significant consumer loyalty and market penetration. This is complemented by an extensive global manufacturing and distribution network, ensuring efficient product delivery worldwide. The company also relies on its dedicated workforce, approximately 36,000 employees as of 2023, whose expertise in R&D, marketing, and operations is crucial. Furthermore, proprietary recipes and intellectual property, such as patents and trademarks, protect its unique product offerings and brand identity, reinforcing its competitive edge.

Value Propositions

Kraft Heinz's value proposition of Trusted Quality and Taste resonates deeply with consumers, offering food products that have earned trust over many years. This commitment to superior flavor and consistent quality is central to their brand, ensuring enjoyment for all sorts of meals and moments.

In 2024, Kraft Heinz continued to leverage its heritage brands, many of which are household names, to deliver on this promise. For instance, the enduring popularity of products like Heinz Ketchup, which saw strong sales performance throughout the year, underscores the consumer reliance on the brand's consistent taste and quality.

Kraft Heinz excels in convenience, offering many products that simplify meal preparation for busy consumers. Think of Lunchables, which provide pre-portioned, ready-to-assemble snacks and meals, a clear win for parents and individuals on the go. This focus on ease of use directly addresses the demand for quick and accessible food solutions.

The versatility of Kraft Heinz products further enhances their value proposition. From their extensive range of sauces and condiments that can elevate any dish to ingredients that form the base of countless home-cooked meals, these items empower consumers to create diverse culinary experiences with minimal effort. This adaptability makes them a staple in kitchens worldwide.

In 2024, the company continued to leverage these strengths, with convenient meal solutions and snacking categories showing robust performance. For instance, their Oscar Mayer brand, a key player in convenient lunch meats and hot dogs, saw sustained consumer interest, reflecting the ongoing need for quick protein options. This aligns with market trends showing a preference for foods that fit seamlessly into modern, fast-paced lifestyles.

Kraft Heinz leverages its vast global distribution network, reaching consumers across countless retail outlets and foodservice locations. This ensures that iconic brands like Heinz Ketchup and Kraft Mac & Cheese are readily available, fulfilling consumer needs wherever they are.

In 2023, Kraft Heinz reported net sales of $26.6 billion, a testament to the broad reach and consistent demand for its diverse product portfolio. This extensive availability underpins the company's ability to maintain strong market presence and drive revenue growth.

Innovation and Adaptation

Kraft Heinz demonstrates a strong commitment to innovation and adaptation, consistently refreshing its product portfolio to align with shifting consumer tastes. This includes introducing novel flavors, developing healthier formulations, and expanding into plant-based options, ensuring the company remains relevant in a fast-paced market and caters to evolving dietary trends.

The company's strategic focus on innovation is evident in its product development pipeline. For instance, in 2024, Kraft Heinz continued to invest in R&D to support its growth initiatives, aiming to capture market share in key categories by offering differentiated products.

- Product Innovation: Development of new flavors and product formats across brands like Heinz Ketchup and Oscar Mayer.

- Health & Wellness Focus: Introduction of reduced-sugar, lower-sodium, and plant-based alternatives to meet growing consumer demand for healthier choices.

- Adaptability: Responding to market shifts by renovating existing products and exploring new product categories to maintain competitive advantage.

Affordable Value

Kraft Heinz is committed to providing consumers with high-quality products at accessible price points, a crucial element given the economic climate. This value proposition is particularly resonant during periods of inflation, where consumers are more budget-conscious. For instance, in their first quarter of 2024, Kraft Heinz reported net sales of $6.7 billion, demonstrating continued consumer engagement with their diverse product portfolio.

The company actively manages its pricing strategies to ensure its offerings remain competitive within the market. This involves careful consideration of cost inputs and consumer price sensitivity. Kraft Heinz aims to strike a balance that allows them to maintain profitability while still appealing to a broad consumer base seeking good value.

This focus on affordability is a cornerstone of their strategy to re-engage and retain customers. By offering dependable quality at a price that reflects good value, Kraft Heinz seeks to build long-term loyalty. Their commitment to value is evident in their consistent market presence across various product categories.

- Focus on Quality at Accessible Prices

- Strategic Pricing to Maintain Competitiveness

- Responding to Inflationary Pressures with Value Offerings

- Commitment to Consumer Affordability as a Core Strategy

Kraft Heinz offers trusted quality and taste, with heritage brands like Heinz Ketchup consistently performing well in 2024, reinforcing consumer confidence in their superior flavor and reliable quality for everyday meals.

Convenience is a key value, exemplified by Lunchables simplifying meal prep for busy consumers, and Oscar Mayer's sustained popularity in 2024 highlighting the demand for quick protein options that fit modern lifestyles.

Product innovation and adaptability are central, with Kraft Heinz investing in R&D in 2024 to introduce new flavors, healthier formulations, and plant-based options, ensuring relevance and catering to evolving dietary trends.

Accessible pricing remains a cornerstone, especially during inflationary periods, with Kraft Heinz strategically managing prices to offer good value and maintain consumer loyalty, as seen in their consistent market presence.

| Value Proposition | Description | 2024 Relevance/Data |

| Trusted Quality & Taste | Delivering consistently delicious food products consumers rely on. | Strong sales for heritage brands like Heinz Ketchup. |

| Convenience | Simplifying meal preparation for busy lifestyles. | Continued consumer interest in brands like Lunchables and Oscar Mayer. |

| Innovation & Adaptability | Responding to consumer trends with new flavors and healthier options. | Ongoing R&D investment to capture market share in key categories. |

| Accessible Pricing & Value | Offering high-quality products at competitive price points. | Strategic pricing to appeal to budget-conscious consumers during inflation. |

Customer Relationships

Kraft Heinz connects with its enormous customer base through widespread marketing efforts. This includes advertising across television, digital platforms, and print, alongside point-of-sale promotions in grocery stores. For instance, in 2024, the company continued its significant investment in advertising and promotions to maintain visibility for its iconic brands like Heinz Ketchup and Kraft Macaroni & Cheese.

Kraft Heinz cultivates brand loyalty not just through consistent quality but by leveraging its iconic status, forging emotional connections built over generations. For instance, their commitment to heritage brands like Heinz Ketchup, a staple for over a century, resonates deeply with consumers.

Digital and social media channels play a key role in building community. By sharing engaging content, recipes, and brand stories, Kraft Heinz fosters a sense of belonging around its products, reinforcing loyalty and creating a vibrant consumer base.

Kraft Heinz actively engages customers through multiple channels, including their website, dedicated helplines, and social media platforms. This accessibility allows for prompt resolution of inquiries and efficient handling of complaints, ensuring a responsive customer experience.

The company leverages customer feedback as a crucial tool for continuous improvement. By analyzing consumer input gathered from these various touchpoints, Kraft Heinz gains valuable insights to refine existing products and develop new offerings that better meet market demands.

Retailer Collaboration and Partnerships

Kraft Heinz cultivates robust, collaborative relationships with its retail partners. These alliances are fundamental for optimizing crucial aspects like product placement on shelves, the execution of effective promotions, and the efficient management of inventory levels. This B2B dynamic is absolutely vital for ensuring that Kraft Heinz products are not only readily available but also presented in a way that drives sales to the end consumer.

These partnerships are more than just transactional; they involve a shared commitment to mutual success. By working closely, Kraft Heinz and its retailers can better anticipate consumer demand and tailor offerings accordingly. For instance, in 2024, Kraft Heinz continued to leverage data analytics to provide retailers with insights that could improve sales performance, a key element in these collaborative efforts.

- Data-Driven Insights: Providing retailers with sales data and trend analysis to inform stocking and promotional decisions.

- Joint Marketing Initiatives: Collaborating on in-store displays, digital advertising, and loyalty programs to drive consumer engagement.

- Supply Chain Efficiency: Working together to streamline logistics, reduce stockouts, and minimize waste through better forecasting.

- Product Assortment Planning: Partnering to ensure the right mix of products is available to meet local consumer preferences and demand.

Foodservice Client Management

Kraft Heinz fosters direct relationships with foodservice clients, including operators, chefs, and institutional buyers, within its Away From Home segment. This approach emphasizes understanding unique client needs to offer tailored solutions and support for menu integration.

The company provides dedicated account management and culinary expertise to assist clients in effectively utilizing Kraft Heinz products. This includes offering product samples, recipe development support, and promotional materials to drive sales and customer satisfaction.

- Direct Engagement: Kraft Heinz actively communicates with foodservice professionals to understand evolving menu trends and operational challenges.

- Customized Solutions: The company develops product bundles and promotional programs tailored to specific client segments, such as casual dining or healthcare facilities.

- Support Services: Kraft Heinz offers ongoing technical and marketing support, including training and point-of-sale materials, to ensure successful product implementation.

Kraft Heinz maintains customer relationships through broad marketing, digital engagement, and responsive service channels. The company prioritizes brand loyalty by connecting with consumers emotionally and fostering community online, while also using feedback for product improvement. In 2024, significant advertising investments continued to support iconic brands, reinforcing their presence and appeal.

Channels

Grocery stores and supermarkets are Kraft Heinz's most crucial sales channels, offering unparalleled access to a vast consumer base. These outlets, from national chains to neighborhood markets, ensure widespread availability of their diverse product portfolio for daily household consumption.

In 2024, Kraft Heinz continued to leverage these channels, with sales through grocery retailers forming the backbone of its revenue. The company's strong relationships with major supermarket groups allow for prominent shelf placement and promotional opportunities, driving consistent sales volume.

Hypermarkets and mass merchandisers represent a cornerstone for Kraft Heinz, enabling high-volume sales and extensive product visibility. These large-format stores, stocking everything from groceries to general merchandise, are vital for capturing a broad consumer base. For instance, in 2023, Walmart, a key player in this segment, reported net sales of $648.1 billion, highlighting the immense reach these channels offer to brands like Kraft Heinz.

Kraft Heinz leverages these channels to achieve significant market penetration. The sheer scale of operations within hypermarkets and mass merchandisers allows for efficient distribution and placement of Kraft Heinz products, ensuring they are readily available to millions of shoppers. This broad accessibility is critical for maintaining brand presence and driving consistent sales figures, particularly for staple food items.

Convenience stores are vital for Kraft Heinz, offering quick access to everyday food and drinks for consumers needing immediate purchases. These smaller outlets are crucial for capturing impulse buys and ensuring Kraft Heinz products are readily available for on-the-go consumption. In 2024, the convenience store sector continued its steady growth, with many Kraft Heinz staples like Oscar Mayer deli meats and Heinz ketchup being top performers in these high-traffic locations.

Foodservice Distributors and Operators

Kraft Heinz's foodservice channel is a crucial component, directly serving the Away From Home market. This involves supplying a wide array of products to restaurants, hotels, schools, hospitals, and various other institutional customers. The focus here is on bulk packaging and specialized items tailored for commercial kitchen operations, ensuring efficiency and consistent quality for these high-volume users.

In 2024, Kraft Heinz continued to strengthen its presence in this sector. For instance, the company's foodservice division reported robust growth, driven by strategic partnerships and an expanded product portfolio designed to meet the evolving needs of the hospitality and institutional sectors. This segment is vital for driving volume and maintaining brand visibility outside the retail environment.

- Dedicated Away From Home Sales: Direct engagement with restaurants, hotels, schools, and hospitals.

- Bulk and Specialized Offerings: Providing products in sizes and formats suitable for commercial kitchens.

- Market Penetration: A key channel for volume sales and brand presence in non-retail settings.

E-commerce and Online Retailers

E-commerce and online retailers are increasingly vital for Kraft Heinz, enabling direct access to consumers who favor digital shopping and home delivery. This includes leveraging online grocery platforms, developing direct-to-consumer (DTC) strategies, and collaborating with major e-commerce players.

- Online Sales Growth: Kraft Heinz has seen significant growth in its e-commerce channels. For instance, in 2023, the company reported that its e-commerce business grew by double digits, contributing substantially to overall revenue.

- DTC Initiatives: The company has been investing in its own DTC capabilities, allowing for more direct customer relationships and data capture. This strategy aims to enhance brand loyalty and offer personalized experiences.

- Partnerships: Collaborations with major online retailers, such as Amazon and Walmart, are crucial for expanding reach and ensuring product availability across various digital marketplaces.

- Market Share Online: Kraft Heinz brands consistently rank among the top sellers in their respective categories on major online grocery platforms, reflecting strong consumer demand in the digital space.

The Kraft Heinz Company utilizes a multi-channel distribution strategy to reach its diverse customer base. This includes traditional grocery stores, hypermarkets, convenience stores, and the rapidly growing e-commerce sector. Furthermore, a significant portion of its business is dedicated to the foodservice channel, supplying products to restaurants and institutions.

In 2024, Kraft Heinz continued to prioritize its retail partnerships, ensuring widespread availability of its iconic brands. The company also saw continued momentum in its online sales, with e-commerce contributing a growing percentage to its overall revenue. The foodservice segment remained a critical driver of volume, adapting to evolving consumer habits and business needs.

| Channel | Key Characteristics | 2023/2024 Relevance |

|---|---|---|

| Grocery Stores/Supermarkets | Widespread consumer access, daily household purchases | Backbone of revenue, strong retailer relationships |

| Hypermarkets/Mass Merchandisers | High-volume sales, broad product visibility | Captures large consumer base, efficient distribution |

| Convenience Stores | Impulse buys, on-the-go consumption | Steady growth sector, high-traffic locations |

| Foodservice | Away From Home market, bulk/specialized offerings | Robust growth, strategic partnerships, non-retail presence |

| E-commerce/Online Retailers | Digital shopping, home delivery, DTC | Double-digit growth in 2023, investment in DTC |

Customer Segments

Households and families represent Kraft Heinz's largest customer base. These consumers rely on the company's diverse portfolio for everyday meals and special occasions, prioritizing convenience and the familiarity of trusted brands like Heinz Ketchup and Kraft Macaroni & Cheese.

In 2024, consumer spending on packaged foods remained robust, with households allocating a significant portion of their grocery budgets to convenient and ready-to-eat options. Kraft Heinz's extensive distribution network ensures its products are readily available, meeting the demand for quick meal solutions and pantry staples.

Food enthusiasts and home cooks are a core customer segment for Kraft Heinz, actively seeking unique flavors and quality ingredients. This group values versatility in their kitchen, often looking for products that can elevate everyday meals. For instance, Kraft Heinz's Taste Elevation platform, encompassing a wide array of sauces and condiments, directly addresses this desire for culinary exploration and enhancement.

Budget-conscious consumers, a significant segment for Kraft Heinz, prioritize affordability and value, especially as economic conditions fluctuate. This group actively seeks out brands that offer competitive pricing without compromising too heavily on quality.

In 2024, Kraft Heinz continued to focus on providing accessible price points for its core products, recognizing that value remains a primary driver for these shoppers. For instance, the company's efforts to manage costs and optimize its supply chain directly benefit this segment by allowing for more consistent and attractive pricing on staples like ketchup and macaroni and cheese.

Foodservice Businesses

Kraft Heinz's foodservice segment encompasses a wide array of commercial entities, including restaurants, cafes, hotels, catering companies, and institutional kitchens. These businesses rely on Kraft Heinz products as essential ingredients or convenient ready-to-serve items to streamline their operations and ensure customer satisfaction.

This customer segment prioritizes several key factors in their purchasing decisions. They value the availability of products in bulk formats, which is crucial for managing inventory and cost-effectiveness in high-volume environments. Consistent quality is paramount, as it directly impacts the taste and reliability of the dishes they serve to their patrons.

Operational efficiency is another significant driver for foodservice businesses. By utilizing Kraft Heinz products, they can reduce preparation time, minimize waste, and maintain consistent output, all contributing to smoother kitchen workflows and improved profitability. For instance, Kraft Heinz's foodservice offerings often come pre-portioned or in easy-to-use formats, directly addressing these operational needs.

Key aspects valued by this segment include:

- Bulk Packaging: Products available in larger sizes suitable for commercial use, optimizing cost per serving.

- Consistent Quality: Reliable product specifications that ensure predictable taste and performance in recipes.

- Operational Efficiency: Ingredients and ready-to-serve items that reduce preparation time and labor costs.

- Product Variety: A diverse range of sauces, condiments, and ingredients to cater to various culinary needs and menu offerings.

International and Emerging Market Consumers

Kraft Heinz is actively targeting consumers across diverse international markets, with a strategic focus on emerging economies. This segment is crucial for the company's growth trajectory, as it seeks to tap into new customer bases and expand its global footprint.

The company is adapting its product portfolio to cater to specific local tastes and preferences in these regions. For instance, in markets like India, Kraft Heinz has introduced products that align with regional culinary habits, aiming to resonate more deeply with local consumers. This localization strategy is key to capturing market share in areas where established domestic brands are prevalent.

Emerging markets represent a significant avenue for future revenue growth. By 2024, the global packaged food market, particularly within emerging economies, is projected to see substantial expansion. Kraft Heinz's investment in these regions reflects an understanding of this potential.

- Global Reach: Kraft Heinz serves consumers in over 190 countries, demonstrating a broad international presence.

- Emerging Market Focus: The company identifies emerging markets as key drivers for future sales growth, aiming to increase penetration in these regions.

- Product Localization: Kraft Heinz adapts its offerings, such as Heinz Ketchup with less sugar in some markets, to meet diverse consumer preferences.

- Growth Potential: Emerging markets are expected to contribute a larger share of global food consumption in the coming years, presenting a significant opportunity for Kraft Heinz.

Kraft Heinz caters to a broad spectrum of consumers, from everyday households seeking convenience and trusted brands to culinary enthusiasts looking for quality ingredients to elevate their cooking.

The company also serves the foodservice industry, providing bulk packaging and consistent quality to restaurants and institutions that prioritize operational efficiency.

Furthermore, Kraft Heinz is strategically expanding its global presence, with a particular focus on emerging markets where it adapts its product offerings to local tastes and preferences to drive future growth.

Cost Structure

The Cost of Goods Sold (COGS) represents Kraft Heinz's most significant expense, encompassing the direct costs associated with producing its vast array of food and beverage products. This includes the price of raw materials like tomatoes, cheese, and coffee beans, as well as packaging materials and the direct labor involved in manufacturing.

In 2023, Kraft Heinz reported a COGS of $18.7 billion. Effectively managing the inherent volatility in commodity prices, such as those for agricultural inputs, and driving efficiencies in procurement are paramount to maintaining healthy profit margins.

Kraft Heinz invests heavily in marketing and advertising to support its vast array of brands and capture consumer attention. These expenditures are crucial for maintaining brand relevance and driving sales growth in a competitive food industry.

The company plans to increase its marketing outlay, targeting approximately 4.8% of its revenue by 2025. This strategic increase signals a commitment to bolstering brand equity and expanding market reach through various promotional and advertising channels.

Kraft Heinz's Selling, General, and Administrative (SG&A) expenses encompass a broad range of operational costs, including those associated with its sales force, distribution networks, and essential administrative functions. In 2024, the company continued its focus on streamlining these areas, recognizing that efficient management of SG&A is crucial for profitability.

Key to this strategy is optimizing research and development spending and corporate overhead. By implementing efficiency initiatives and leveraging centralized services, Kraft Heinz aims to reduce the burden of these costs, thereby enhancing its overall financial performance and competitive positioning in the market.

Research and Development (R&D) Costs

Kraft Heinz dedicates significant resources to Research and Development (R&D) to drive product innovation, renovation, and the adoption of new technologies. These investments are crucial for staying competitive and meeting the ever-changing demands of consumers, as well as for enhancing the efficiency of their operations. In 2024, the company reported R&D expenditures totaling $342 million. This commitment reflects a strategy focused on developing new products and improving existing ones.

The R&D efforts at Kraft Heinz are multifaceted, encompassing:

- Product Innovation: Developing entirely new food and beverage products to capture emerging market trends and consumer preferences.

- Product Renovation: Enhancing the quality, taste, nutritional profile, or sustainability of existing product lines.

- New Technologies: Investing in advanced manufacturing processes, packaging solutions, and digital tools to optimize production and supply chain management.

Logistics and Distribution Costs

Kraft Heinz incurs significant expenses in moving its products from production sites to warehouses and finally to stores and restaurants worldwide. These logistics and distribution costs are a critical component of their operational spending.

These costs encompass several key areas:

- Warehousing: Expenses related to storing finished goods before they are shipped out, including rent, utilities, and labor for managing inventory.

- Freight: Costs associated with transporting products via various modes like trucking, rail, and ocean freight to reach their destinations efficiently.

- Supply Chain Management: Investments in technology and personnel to optimize the flow of goods, manage relationships with logistics providers, and ensure timely delivery.

For 2023, Kraft Heinz reported selling, general, and administrative expenses, which include many of these logistical and distribution elements, totaling approximately $4.3 billion. This highlights the substantial investment required to maintain their global supply chain network.

Kraft Heinz's cost structure is heavily influenced by its substantial Cost of Goods Sold (COGS), which includes raw materials, packaging, and direct labor, amounting to $18.7 billion in 2023. Significant investments in marketing and advertising, aiming for approximately 4.8% of revenue by 2025, are also key. Selling, General, and Administrative (SG&A) expenses, including logistics and distribution, totaled around $4.3 billion in 2023, while Research and Development (R&D) spending reached $342 million in 2024 to foster innovation.

| Cost Category | 2023 Expense (USD Billions) | 2024 Focus |

|---|---|---|

| Cost of Goods Sold (COGS) | 18.7 | Managing commodity price volatility, procurement efficiencies |

| Marketing & Advertising | Projected 4.8% of Revenue by 2025 | Brand equity enhancement, market reach expansion |

| SG&A (incl. Logistics) | 4.3 | Streamlining operations, optimizing distribution networks |

| Research & Development (R&D) | 0.342 | Product innovation, renovation, new technologies |

Revenue Streams

The Kraft Heinz Company's core revenue comes from selling its extensive range of consumer-packaged food and beverages. These products, encompassing everything from condiments and sauces to cheese, meals, and drinks, are distributed through retail outlets worldwide. For 2024, the company reported net sales of approximately $25.8 billion from these sales.

Kraft Heinz generates significant revenue by supplying its diverse product portfolio to the foodservice sector. This includes sales to a wide array of clients such as restaurants, hotels, catering companies, and other institutional buyers.

The foodservice channel represents a critical avenue for growth for Kraft Heinz. The company is actively pursuing strategies to secure new partnerships and broaden its distribution network within this segment, aiming to capitalize on the increasing demand for convenient and recognizable food options in away-from-home settings.

In 2024, Kraft Heinz continued to emphasize its foodservice business, recognizing its potential to drive volume and market share. While specific segment revenue figures for 2024 are part of ongoing reporting, the company's strategic focus on this area underscores its importance to overall financial performance.

Kraft Heinz leverages its iconic brands through licensing and partnerships, generating revenue by allowing other companies to use its well-known names on diverse products. For example, licensing deals can see brands like Oscar Mayer appearing on lunch kits or Heinz ketchup flavors featured in snack foods. This strategy not only provides an additional income stream but also reinforces brand visibility and consumer engagement across various touchpoints.

Sales in Emerging Markets

Kraft Heinz is significantly expanding its sales in emerging markets, which are increasingly contributing to overall revenue growth. The company has outlined ambitious strategies to capitalize on these developing economies.

These emerging markets are expected to see substantial expansion, with Kraft Heinz targeting double-digit growth in these regions by the end of 2025. This focus reflects a strategic shift to leverage untapped consumer bases and growing purchasing power.

- Growing Revenue Contribution: Increasing sales volumes in developing economies are a key driver of Kraft Heinz's top-line performance.

- Ambitious Growth Targets: The company anticipates double-digit growth in emerging markets through 2025, signaling a strong commitment to these regions.

- Strategic Market Expansion: Kraft Heinz is actively investing in expanding its presence and distribution networks within these developing economies.

Product Innovation and Premiumization

Kraft Heinz generates revenue through introducing novel products and enhancing existing ones to command higher prices. This strategy targets new customer groups and boosts overall sales. For instance, the company's 'Flavor Tour' line exemplifies this approach, offering unique taste experiences that justify premium pricing.

In 2024, Kraft Heinz continued to focus on innovation as a key revenue driver. While specific figures for the 'Flavor Tour' line are not publicly detailed, the company's broader strategy aims to leverage product development for increased market share and profitability. This often translates into higher average selling prices compared to their core offerings.

- Revenue from New Products: Kraft Heinz actively launches new items across its diverse portfolio, aiming to capture evolving consumer preferences and generate incremental sales.

- Premiumization Strategy: The company elevates existing brands by introducing premium versions or limited-edition flavors, enabling higher price points and attracting consumers willing to pay more for perceived quality or uniqueness.

- 'Flavor Tour' Example: This initiative showcases the company's commitment to culinary exploration, offering consumers distinct global flavors that differentiate their products and support premium pricing.

- Impact on Sales: Successful innovation and premiumization directly contribute to revenue growth by expanding the addressable market and increasing the average revenue per unit sold.

Kraft Heinz's revenue streams are diverse, primarily driven by the sale of its extensive portfolio of food and beverage products in retail channels. For 2024, the company reported net sales of approximately $25.8 billion, with a significant portion originating from these consumer-packaged goods. This core business is supported by strategic expansion into emerging markets, where Kraft Heinz anticipates double-digit growth through 2025, and a focus on product innovation and premiumization to capture higher price points.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| Retail Sales | Sale of packaged food and beverages through grocery stores and other retail outlets. | Core revenue driver, with net sales around $25.8 billion in 2024. |

| Foodservice Sales | Supplying products to restaurants, hotels, and institutional buyers. | A critical channel for volume and market share growth. |

| Licensing & Partnerships | Allowing other companies to use Kraft Heinz brands on various products. | Generates additional income and enhances brand visibility. |

| Emerging Markets Growth | Capitalizing on increasing consumer bases and purchasing power in developing economies. | Targeting double-digit growth through 2025. |

| Product Innovation & Premiumization | Introducing new products and premium versions of existing ones to command higher prices. | A key strategy for increasing market share and profitability. |

Business Model Canvas Data Sources

The Kraft Heinz Company Business Model Canvas is informed by a blend of internal financial statements, extensive market research reports on consumer trends and competitor strategies, and operational data from their global supply chain. These diverse sources ensure a comprehensive and accurate representation of the company's strategic framework.