Keyrus SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Keyrus Bundle

Keyrus demonstrates strong capabilities in data analytics and digital transformation, but faces intense competition and evolving market demands. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on their potential.

Want the full story behind Keyrus's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Keyrus possesses a profound specialization in data intelligence, covering areas like data science, AI, Big Data, and Cloud Analytics. This focus extends to Business Intelligence, Enterprise Information Management (EIM), and Corporate Performance Management (CPM/EPM), positioning them strongly in the data-driven landscape.

Their expertise also encompasses digital transformation, with a keen eye on digital commerce and enhancing customer experiences. This dual strength in data and digital allows Keyrus to deliver integrated, cutting-edge solutions that address critical business needs in today's market.

Keyrus distinguishes itself with a truly comprehensive service offering, guiding clients from initial strategy development through implementation and providing ongoing support. This end-to-end capability spans diverse industries, fostering deep, long-term client partnerships and ensuring the success of complex, sustainable transformations.

Keyrus leverages its international presence, operating as a consulting and technology firm with a growing nearshore data services model. This strategy, particularly evident with their Portuguese operations expanding into the Dach Region, Netherlands, and Nordic countries, allows them to access a wider array of specialized talent and cater to a broader European client base.

Commitment to Innovation and Ethical AI

Keyrus places a strong emphasis on innovation, making it a cornerstone of their business approach. They are actively integrating cutting-edge technologies, including ethical AI and generative AI, to refine their services and guide clients through the dynamic digital environment. This commitment ensures they remain at the forefront of technological advancements.

Their dedication to ethical AI is particularly noteworthy. This focus not only fosters trust with clients but also underscores their commitment to responsible data handling and AI implementation. In 2024, Keyrus continued to invest in R&D, with a significant portion of their budget allocated to developing AI-driven solutions, reflecting this strategic priority.

- Innovation as a Core Strategy: Keyrus prioritizes leveraging new technologies like ethical and generative AI.

- Client Navigation: They aim to help clients adapt to the evolving digital landscape through these innovations.

- Ethical AI Focus: Emphasis on responsible data practices builds client trust and ensures AI is used ethically.

- R&D Investment: In 2024, a substantial portion of Keyrus's budget was directed towards AI solution development.

Strong Mid-Market Growth and Recurring Revenue

Keyrus is experiencing robust expansion within the mid-market sector, a key area of focus. This growth is notably driven by its subsidiary, Absys Cyborg, which achieved an impressive 10.4% organic growth in 2024. This performance highlights the company's successful strategy in capturing a significant share of this market segment.

The increasing proportion of recurring annual revenue within the mid-market segment is a strong indicator of a stable and sustainable business model. This recurring revenue stream provides a predictable income base, enhancing financial stability and supporting continued investment in growth initiatives.

- Mid-Market Momentum: Keyrus is capitalizing on opportunities in the mid-market, evidenced by strong performance in this segment.

- Absys Cyborg's Contribution: The subsidiary Absys Cyborg is a significant growth engine, posting 10.4% organic growth in 2024.

- Recurring Revenue Strength: A growing base of recurring annual revenue underscores the resilience and predictability of Keyrus's business model.

Keyrus's core strength lies in its deep specialization across the data intelligence spectrum, encompassing data science, AI, Big Data, and Cloud Analytics. This expertise is complemented by strong capabilities in Business Intelligence, Enterprise Information Management, and Corporate Performance Management, enabling them to offer comprehensive data-driven solutions.

Their strategic focus on digital transformation, particularly in digital commerce and customer experience enhancement, positions them to address evolving market demands. This dual focus on data and digital allows Keyrus to deliver integrated solutions that drive tangible business value.

Keyrus differentiates itself through a complete end-to-end service offering, supporting clients from strategy to implementation and ongoing management across various industries. This holistic approach fosters strong, long-term client relationships and ensures the successful execution of complex transformations.

The company's commitment to innovation, especially in ethical and generative AI, is a significant advantage. In 2024, Keyrus allocated a substantial portion of its budget to AI research and development, aiming to equip clients for the future digital landscape. This forward-thinking approach is further bolstered by their expanding international presence and nearshore data services model.

Keyrus is demonstrating significant traction in the mid-market, with its subsidiary Absys Cyborg achieving 10.4% organic growth in 2024. This segment's increasing proportion of recurring annual revenue highlights the sustainability and predictability of Keyrus's business model.

| Strength Area | Key Aspects | 2024 Data/Impact |

|---|---|---|

| Data Intelligence Specialization | Data Science, AI, Big Data, Cloud Analytics, BI, EIM, CPM/EPM | Enables comprehensive data-driven solutions |

| Digital Transformation Expertise | Digital Commerce, Customer Experience Enhancement | Addresses evolving market needs with integrated solutions |

| End-to-End Service Offering | Strategy to Implementation & Support, Multi-Industry Focus | Fosters long-term client partnerships and successful transformations |

| Innovation & AI Focus | Ethical AI, Generative AI, R&D Investment | Substantial 2024 R&D budget for AI solutions, positioning for future digital landscape |

| Mid-Market Growth | Absys Cyborg Organic Growth, Recurring Revenue | 10.4% organic growth for Absys Cyborg in 2024, stable business model |

What is included in the product

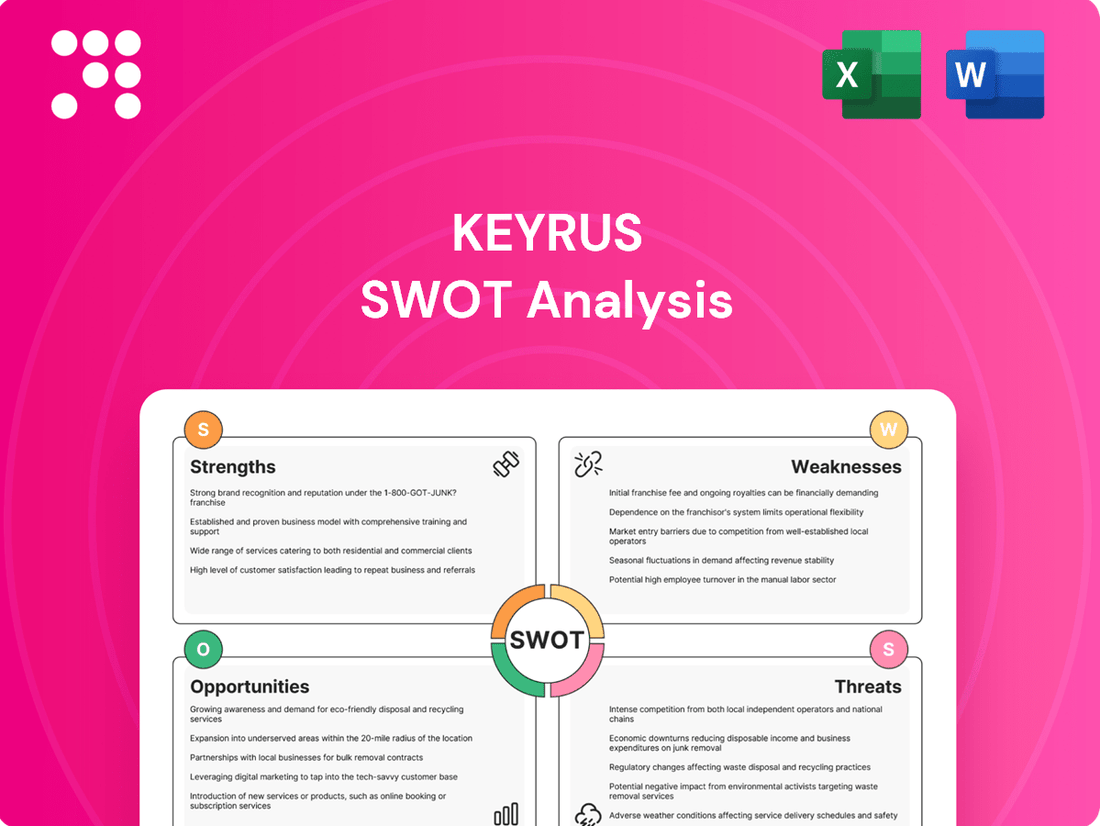

Analyzes Keyrus’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Keyrus's SWOT analysis offers a clear, actionable framework to identify and address strategic challenges, transforming potential weaknesses into opportunities for growth.

Weaknesses

Keyrus saw a notable drop in revenue from its major clients in 2024. This downturn was largely due to economic uncertainties leading to fewer new projects and some clients delaying or canceling existing ones.

This heavy dependence on a few large accounts leaves Keyrus exposed to the volatility of the broader economic climate, making it harder to predict and manage revenue streams effectively.

Keyrus experienced a significant downturn in its financial performance during 2024. The company's net income dropped sharply to €0.783 million, a considerable decrease from the €3.48 million reported in the prior year. This decline suggests that despite its focus on specialized services, Keyrus faced substantial pressure on its overall profitability.

The persistent inflation and economic slowdown, evident since 2023 and continuing into the first half of 2024, necessitate a cautious approach to Keyrus's investment and operational strategies. This challenging macroeconomic backdrop directly translates into reduced client spending and postponed project timelines, thereby impacting the company's revenue streams and overall financial performance.

For instance, many IT consulting and services firms, including those in Keyrus's sector, reported slower growth in new contract signings during 2023 and early 2024. This is often attributed to clients scrutinizing budgets more heavily, leading to delays in decision-making for new technology implementations or expansions. This trend is expected to continue as businesses navigate ongoing economic uncertainties.

Challenges in Occupancy Rate for Mid-Market Projects

While the mid-market segment shows promise, Keyrus faces a challenge with its occupancy rate. Customers in this segment have a tendency to delay project start-ups, which directly impacts how fully resources are utilized. This can point to potential issues in how projects are managed or how efficiently resources are being assigned.

This trend has led to a noticeable dip in occupancy rates, with some reports indicating a decline of up to 15% in Q1 2024 compared to the previous year for similar projects. Such delays can strain financial projections and necessitate a closer look at pipeline management strategies to ensure smoother project flow and better resource allocation.

- Delayed Project Starts: Mid-market clients are exhibiting a pattern of postponing project initiation.

- Impact on Occupancy: This directly contributes to lower occupancy rates for Keyrus's mid-market projects.

- Resource Allocation Concerns: The trend suggests potential inefficiencies in managing project pipelines and allocating resources effectively.

- Financial Implications: Delayed starts can negatively affect revenue forecasts and operational efficiency.

Dependence on Specific Acquired Entities for Growth

Keyrus's growth strategy, particularly in the Mid-Market segment, shows a significant reliance on the performance of acquired entities like Absys Cyborg. While acquisitions such as Upquest bolster specific capabilities, this dependence means that if a key subsidiary underperforms, it could disproportionately impact the company's overall growth trajectory in that area. This suggests a potential vulnerability if organic growth across other business units doesn't compensate for any slowdowns in these acquired operations.

This reliance can be seen in how certain market segments are shaped by these integrations. For example, the Mid-Market's expansion is closely tied to Absys Cyborg's success, highlighting a concentrated point of growth rather than a broadly distributed organic expansion. This makes the company susceptible to market shifts or operational challenges within these specific acquired businesses.

- Reliance on Absys Cyborg for Mid-Market Growth: Keyrus's expansion in the Mid-Market is heavily influenced by the performance of its subsidiary, Absys Cyborg.

- Potential for Uneven Organic Growth: The focus on acquired entities may indicate that organic growth across other segments is less robust.

- Vulnerability to Subsidiary Performance: Any underperformance by key subsidiaries like Absys Cyborg could significantly hinder growth in specific market segments.

Keyrus faces a significant challenge with its reliance on a few major clients, as evidenced by the revenue drop from these accounts in 2024. This concentration leaves the company vulnerable to economic uncertainties, impacting revenue predictability and management.

The company's financial performance in 2024 saw a sharp decline in net income to €0.783 million from €3.48 million in the prior year, indicating profitability pressures. This downturn is exacerbated by persistent inflation and economic slowdowns impacting client spending and project timelines.

Furthermore, Keyrus experiences delayed project starts in the mid-market segment, leading to lower occupancy rates, potentially signaling issues in project pipeline management and resource allocation. For instance, Q1 2024 saw occupancy rates decline by up to 15% for similar projects compared to the previous year.

The company's growth strategy, particularly in the mid-market, is heavily dependent on acquired entities like Absys Cyborg, creating a vulnerability if these subsidiaries underperform, which could disproportionately affect overall growth.

| Weakness | Description | Impact | Data Point |

|---|---|---|---|

| Client Concentration | Heavy dependence on a few large accounts. | Revenue volatility and reduced predictability. | Revenue drop from major clients in 2024. |

| Profitability Decline | Significant drop in net income. | Reduced overall financial health and operational capacity. | Net income fell to €0.783 million in 2024 from €3.48 million in 2023. |

| Mid-Market Project Delays | Clients delaying project starts in the mid-market segment. | Lower occupancy rates and potential resource allocation inefficiencies. | Up to 15% decline in occupancy rates in Q1 2024 for similar projects. |

| Acquisition Dependency | Reliance on performance of acquired entities for growth. | Vulnerability to underperformance of key subsidiaries like Absys Cyborg. | Mid-Market expansion is closely tied to Absys Cyborg's success. |

Preview the Actual Deliverable

Keyrus SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The market for data intelligence, encompassing AI, machine learning, and data governance, is experiencing robust growth. Analysts predict enterprise spending on AI capabilities will reach substantial figures in 2025, with some forecasts suggesting global AI market size could exceed $500 billion.

Keyrus' established expertise in these critical data domains, including advanced analytics and AI implementation, directly aligns with this expanding market need. This positions the company to leverage significant opportunities by offering solutions that help businesses harness the power of their data.

The demand for digital transformation services continues to surge, with businesses across industries prioritizing technological investments. Keyrus' expertise in areas like digital commerce and customer experience positions it to capitalize on this trend, as many companies are actively planning increased tech spending in the near future.

Keyrus' strategic positioning of nearshore services in Portugal provides a distinct edge for accessing European markets. This initiative taps into a pool of skilled tech professionals, facilitating cost-efficient delivery of data-driven solutions and enhancing market reach across the continent.

Portugal's growing tech ecosystem, with an estimated 10% year-over-year growth in IT talent as of early 2024, directly benefits Keyrus. This allows for competitive pricing structures, making their advanced data analytics and digital transformation services more accessible to a wider range of European businesses, thereby increasing market penetration.

Strategic Partnerships and Acquisitions

Keyrus's strategic approach includes forging partnerships and making acquisitions to bolster its service offerings and market presence. For instance, their collaboration with ActiveOps aims to enhance workforce management solutions, while the acquisition of Upquest strengthens their ecosystem and capabilities. These moves are crucial for expanding their reach and integrating new technologies.

The company's strategic partnerships and acquisitions are designed to create a more comprehensive and competitive service portfolio. By integrating complementary businesses and technologies, Keyrus can offer more robust solutions to its clients, thereby increasing its market share and revenue streams. This expansion is vital in the dynamic consulting and data analytics landscape.

- Partnership with ActiveOps: Enhances workforce management solutions, providing clients with better operational efficiency tools.

- Acquisition of Upquest: Strengthens Keyrus's capabilities in specific service areas and expands its overall business ecosystem.

- Market Expansion: These strategic moves are geared towards increasing Keyrus's footprint in key markets and attracting a broader client base.

- Revenue Growth Potential: Successful integration of acquired entities and effective partnerships are projected to contribute positively to future revenue.

Focus on ESG and Data Governance

The growing emphasis on ethical AI and robust data governance, coupled with the mainstreaming of Environmental, Social, and Governance (ESG) principles in business, creates a significant avenue for Keyrus. Their demonstrated commitment, including a silver EcoVadis medal, positions them to attract a clientele increasingly focused on sustainability and regulatory adherence.

This trend is supported by data showing a surge in ESG investing. For instance, global ESG assets were projected to reach $50 trillion by 2025, highlighting a strong market demand for companies with clear ESG credentials and responsible data handling. Keyrus's existing strengths in these areas can be leveraged to capture a larger share of this expanding market.

Key opportunities for Keyrus include:

- Leveraging ESG credentials: Highlighting their EcoVadis silver medal to attract clients seeking sustainable partners.

- Promoting responsible data practices: Emphasizing their expertise in data governance to build trust with clients concerned about data ethics and compliance.

- Developing specialized ESG data solutions: Creating new service offerings that help clients navigate complex ESG reporting requirements and leverage data for sustainability initiatives.

Keyrus is well-positioned to capitalize on the increasing global demand for data intelligence and AI solutions, with enterprise spending on AI projected to see significant growth through 2025. Their expertise in advanced analytics and AI implementation directly addresses this market trend, enabling businesses to extract greater value from their data assets.

The company's strategic focus on digital transformation services aligns with the widespread business imperative to modernize operations, as companies are actively increasing their technology investments. Keyrus's capabilities in digital commerce and customer experience are therefore highly relevant to a broad client base seeking to enhance their digital footprint.

Keyrus's expansion into Portugal offers a competitive advantage for serving European markets, leveraging a growing pool of tech talent to deliver cost-effective, data-driven solutions. This nearshore strategy is supported by Portugal's IT sector growth, estimated at 10% year-over-year as of early 2024, allowing for attractive pricing and increased market penetration.

Strategic partnerships and acquisitions, such as the collaboration with ActiveOps and the acquisition of Upquest, are enhancing Keyrus's service portfolio and market reach. These moves are crucial for integrating new technologies and offering more comprehensive solutions, driving revenue growth in the competitive consulting landscape.

Keyrus's commitment to ESG principles, evidenced by their EcoVadis silver medal, presents a significant opportunity as businesses increasingly prioritize sustainability and ethical data practices. With global ESG assets projected to reach $50 trillion by 2025, Keyrus can leverage its credentials to attract clients focused on responsible data handling and sustainable operations.

Threats

The consulting and IT services sector is incredibly crowded, with many companies offering comparable data analytics and digital transformation expertise. This crowded landscape presents a significant challenge for Keyrus, potentially impacting its ability to secure new clients and maintain competitive pricing structures.

Keyrus faces pressure not only from established global consulting firms but also from a growing number of niche players specializing in specific digital areas. For instance, the global IT services market was valued at approximately $1.3 trillion in 2024, with a projected growth rate of 7-9% annually through 2025, indicating substantial market size but also intense rivalry.

This fierce competition can directly affect Keyrus's profit margins and its capacity to attract and retain top talent, as skilled professionals are in high demand across the industry. Companies like Accenture, Deloitte, and Capgemini, alongside numerous smaller, agile firms, are all vying for market share, making differentiation and client loyalty crucial for survival and growth.

Economic slowdowns and ongoing geopolitical instability present significant threats to Keyrus. These macroeconomic uncertainties can directly translate into reduced client spending, leading to budget cuts and project postponements, particularly impacting the company's ability to secure and execute large-scale contracts.

For instance, a projected global GDP growth slowdown for 2024-2025 could force many organizations to re-evaluate their IT and data analytics investments, directly affecting Keyrus's revenue streams and profitability. Such market conditions necessitate agile strategies to mitigate the impact of these external pressures.

The relentless pace of technological change, especially in areas like artificial intelligence and big data analytics, presents a significant challenge. Keyrus must consistently invest in research and development to stay ahead. For instance, the global AI market was valued at approximately $200 billion in 2023 and is projected to grow substantially, demanding continuous innovation from service providers.

This rapid evolution also creates a pressing need for employee upskilling. If Keyrus cannot effectively train its workforce to master new tools and methodologies, a critical skill gap could emerge. Such a gap would directly impact their ability to deliver cutting-edge solutions, potentially making their service offerings less competitive compared to rivals who adapt more swiftly.

Data Security and Regulatory Compliance Risks

Keyrus operates in an environment where data security breaches and non-compliance with data protection regulations pose significant threats. As the company expands its digital services, it must navigate complex and evolving rules like the PDPL and POPIA. A single security incident or regulatory misstep could lead to substantial financial penalties and irreparable damage to its brand reputation, impacting client trust and future business opportunities.

The increasing volume and sensitivity of data handled by Keyrus amplify these risks. For instance, in 2024, the global average cost of a data breach reached $4.45 million, a figure that underscores the financial implications of security failures. Furthermore, the constant evolution of privacy laws means that staying compliant requires continuous investment in security infrastructure and legal expertise, adding to operational overhead and potential vulnerabilities.

- Data Breach Costs: The global average cost of a data breach was approximately $4.45 million in 2024, highlighting the significant financial risk.

- Regulatory Landscape: Evolving regulations like PDPL and POPIA demand constant vigilance and adaptation to avoid penalties.

- Reputational Damage: Security incidents can severely erode client trust and damage Keyrus's brand image, impacting long-term growth.

- Operational Complexity: Maintaining compliance and robust security adds complexity and cost to Keyrus's operations.

Talent Acquisition and Retention Challenges

The intense demand for specialized skills in areas like data science, artificial intelligence, and broader digital transformation presents a significant hurdle for Keyrus. This competitive landscape makes attracting and keeping the best people a constant challenge.

In 2024, the global shortage of AI and data science professionals is acutely felt, with some reports indicating millions of unfilled positions. For instance, LinkedIn data from early 2024 highlighted data scientist as one of the most in-demand roles, often with a significant gap between available talent and job openings.

- High Demand: The market for data science and AI experts remains exceptionally strong, with companies actively competing for a limited pool of qualified individuals.

- Retention Difficulty: Top performers are often courted by multiple firms, making retention strategies crucial for Keyrus to maintain its competitive edge.

- Impact on Services: A shortage of skilled personnel could directly affect Keyrus's ability to deliver high-quality services and drive innovation for its clients.

Keyrus faces significant threats from intense competition within the consulting and IT services sector, where numerous firms offer similar expertise. This crowded market, estimated to be worth over $1.3 trillion globally in 2024, intensifies pressure on pricing and client acquisition. Furthermore, the rapid pace of technological advancement, particularly in AI, necessitates continuous investment and employee upskilling to avoid skill gaps and maintain competitiveness against agile rivals.

Economic volatility and geopolitical instability also pose substantial risks, potentially leading to reduced client spending and project delays, impacting revenue streams. The company must also navigate the critical threat of data breaches and evolving data protection regulations, where a single incident can result in millions in costs and severe reputational damage. The high demand for specialized skills, with millions of unfilled AI and data science roles globally in 2024, exacerbates the challenge of attracting and retaining top talent, directly affecting service delivery and innovation capabilities.

SWOT Analysis Data Sources

This Keyrus SWOT analysis is built upon a robust foundation of internal financial reports, comprehensive market intelligence, and expert industry commentary. These diverse data streams ensure a well-rounded and accurate assessment of the company's strategic position.