Keyrus Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Keyrus Bundle

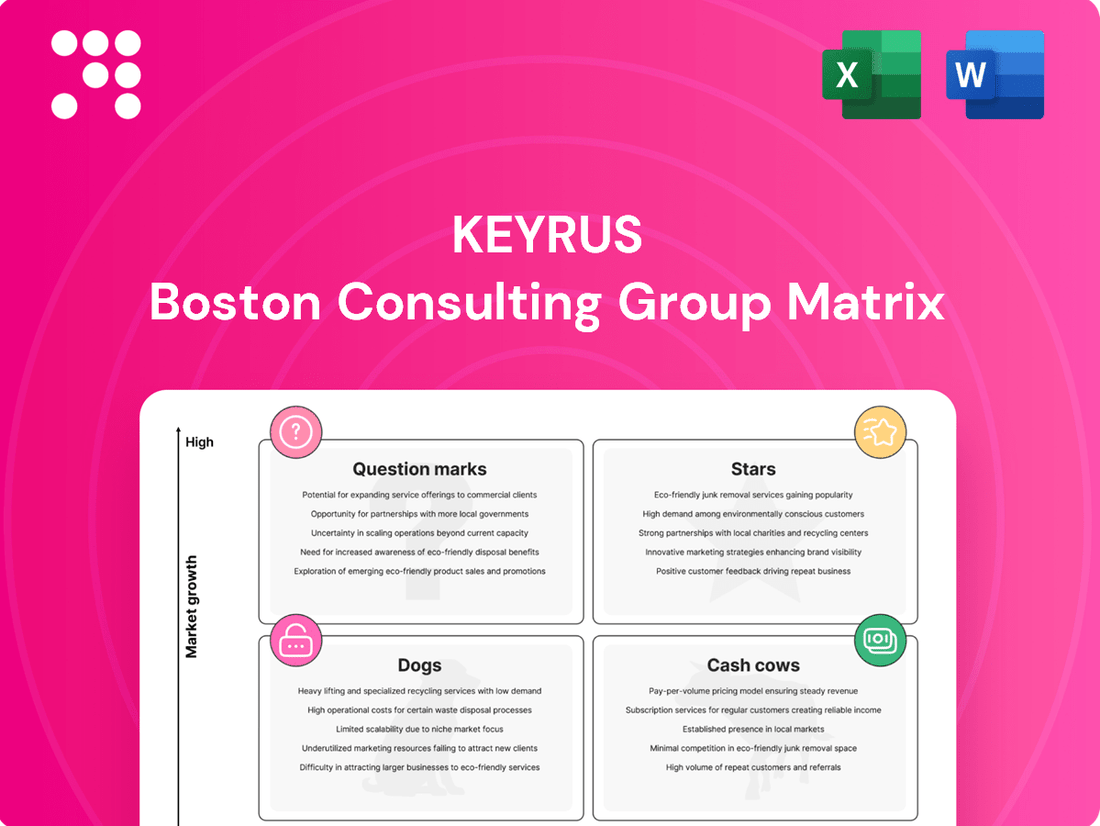

Unlock the strategic potential of this company's product portfolio with our Keyrus BCG Matrix analysis. Understand whether products are Stars, Cash Cows, Dogs, or Question Marks, and identify opportunities for growth and resource allocation.

This preview offers a glimpse into the power of the full BCG Matrix. Purchase the complete report for in-depth quadrant breakdowns, actionable insights, and a clear roadmap to optimizing your product strategy and maximizing profitability.

Stars

Keyrus is making significant strides in AI and advanced data analytics, a sector poised for substantial expansion. The AI in Data Science market, for instance, is expected to witness a compound annual growth rate of 30.1% between 2024 and 2033, highlighting the immense opportunity.

As of 2024, Keyrus is strategically positioned as a key player offering AI-related services across Europe. This focus leverages their deep-rooted data expertise to secure a considerable share in this rapidly evolving market.

This strategic emphasis on AI and advanced analytics directly addresses global trends. These include the growing demand for ethical AI practices, the push for data democratization, and the increasing integration of AI into core business strategies, making it a vital engine for Keyrus's future growth.

Keyrus's Mid-Market Digital Transformation segment is a shining star in its growth strategy. In 2024, this segment saw an impressive 10.4% expansion, largely fueled by the strong performance of its subsidiary, Absys Cyborg. This area is where Keyrus truly excels, guiding smaller and medium-sized businesses through their digital journeys and helping them adopt recurring revenue models.

The company is doubling down on this success, with significant investments planned, especially in France. The goal is to cement Keyrus's position as a leader in helping these businesses navigate their digital transformation needs, a critical area for continued growth and market share.

Enterprise Performance Management (EPM) stands as a robust growth area for Keyrus. In 2024, its EPM activities experienced a notable expansion of 25.8%. This surge is largely attributed to Keyrus's strong global partnership with Anaplan, a leader in connected planning solutions.

Keyrus's expertise in EPM focuses on delivering integrated financial and operational planning, a critical need for businesses seeking enhanced efficiency and strategic coherence. The demand for these solutions remains high as companies navigate increasingly complex business environments.

The consistent growth and strategic alliances within the EPM sector highlight Keyrus's competitive edge. This performance underscores the company's ability to adapt and thrive in the dynamic field of business planning and financial management.

Cybersecurity Solutions

Keyrus's strategic acquisition of a minority stake in Axon Technologies in February 2024 signals a significant push into the burgeoning cybersecurity market. This move positions Keyrus to bolster its data security offerings and tap into high-potential regions such as Saudi Arabia, a market projected for substantial digital transformation and increased cybersecurity spending.

The integration of Axon Technologies' specialized knowledge in data, cloud, and application security directly addresses the escalating global need for comprehensive digital protection. Cybersecurity is no longer a niche concern; it's a fundamental requirement for businesses worldwide. By February 2024, global cybersecurity spending was on an upward trajectory, with many analysts predicting continued double-digit growth throughout the year, driven by increasingly sophisticated cyber threats.

- Strategic Expansion: Keyrus's investment in Axon Technologies in February 2024 is a clear indicator of its ambition to become a major global cybersecurity provider.

- Market Opportunity: The cybersecurity sector is experiencing rapid growth, with projected global spending reaching hundreds of billions of dollars annually, making it a highly attractive area for investment.

- Enhanced Capabilities: By integrating Axon Technologies' expertise, Keyrus can offer more robust data, cloud, and application security solutions, meeting critical market demands.

- Geographic Reach: The expansion into markets like Saudi Arabia, which is heavily investing in its digital infrastructure, presents significant revenue growth opportunities for Keyrus.

Data Nearshore Services Expansion

Keyrus is strategically expanding its data nearshore services, extending its reach from Portugal into the DACH Region, Netherlands, and the Nordic Countries. This move capitalizes on Portugal's robust technological talent pool and competitive cost structures to deliver advanced data analytics and digital transformation solutions. The company's prior success in markets such as the UK, France, and Belgium provides a strong foundation for capturing market share in these new European territories.

This expansion is driven by the increasing demand for specialized data services across Europe. For instance, the European data analytics market was valued at approximately $23.2 billion in 2023 and is projected to grow significantly. Keyrus's expansion into these new regions aligns with this growth trajectory, aiming to leverage Portugal's nearshoring advantages.

- Market Penetration: Targeting DACH, Netherlands, and Nordic countries, regions with substantial digital transformation initiatives underway.

- Talent Leverage: Utilizing Portugal's skilled IT workforce, which boasts a high number of tech graduates annually, to offer cost-effective solutions.

- Service Offering: Providing comprehensive data analytics, AI, and digital transformation services, mirroring successful models in existing European markets.

- Competitive Advantage: Differentiating through a blend of quality, cost-efficiency, and specialized data expertise, aiming to capture significant market share.

Stars represent the highest potential growth areas within Keyrus's portfolio, demanding significant investment to maintain their leading positions and capitalize on market opportunities. These segments are characterized by rapid expansion and strong competitive advantages.

Keyrus's AI and advanced data analytics services are a prime example of a Star. The AI in Data Science market is projected to grow at a 30.1% CAGR from 2024 to 2033, indicating substantial future potential. Furthermore, the company's Mid-Market Digital Transformation segment, which saw 10.4% growth in 2024, is also a Star, demonstrating strong performance and strategic importance.

The Enterprise Performance Management (EPM) sector, with a 25.8% expansion in 2024, is another key Star for Keyrus, driven by its partnership with Anaplan. These segments are critical for Keyrus's overall growth strategy, requiring continued focus and investment to solidify market leadership.

| Business Segment | 2024 Growth | Key Drivers | BCG Category |

|---|---|---|---|

| AI & Advanced Data Analytics | High (Market CAGR 30.1% 2024-2033) | Global demand for AI integration, data democratization | Star |

| Mid-Market Digital Transformation | 10.4% | Subsidiary performance (Absys Cyborg), recurring revenue models | Star |

| Enterprise Performance Management (EPM) | 25.8% | Anaplan partnership, need for integrated planning | Star |

| Cybersecurity (via Axon Technologies) | High Potential (Global spending increasing) | Escalating cyber threats, digital transformation initiatives | Star |

What is included in the product

The Keyrus BCG Matrix provides strategic guidance by categorizing business units into Stars, Cash Cows, Question Marks, and Dogs, highlighting investment priorities.

Keyrus BCG Matrix: Clear visualization of business unit performance to identify areas needing strategic intervention and resource allocation.

Cash Cows

Keyrus, a dedicated data specialist since 1996, has built a robust presence in traditional data intelligence and business intelligence. These established services, though not in a high-growth phase, are likely significant cash generators for the company. Their maturity means consistent demand and recurring revenue from a loyal client base, requiring minimal new investment to maintain.

Despite a 8.7% contraction in the Large Accounts segment during 2024, this area remains a substantial revenue driver for Keyrus, functioning as a significant cash cow. These clients, often large and established entities, typically operate under long-term agreements, providing a bedrock of stable income even amidst economic headwinds.

Keyrus's core digital transformation implementation services, particularly in digital commerce and customer experience, are strong candidates for cash cows. These offerings are mature but remain critical for businesses seeking to modernize their operations and engage customers effectively.

The consistent demand for implementation, integration, and ongoing support in these established areas provides a stable revenue stream. Keyrus's deep expertise and existing client relationships in digital commerce, for instance, allow for efficient project delivery and recurring revenue opportunities, contributing to predictable profitability.

With a solid track record and established methodologies, Keyrus can leverage its existing infrastructure and talent to serve these mature markets. This reduces the need for significant new investment, allowing these services to generate consistent profits with a lower risk profile, a hallmark of cash cow business units.

Managed Services & Support Contracts

Managed Services & Support Contracts are a significant contributor to Keyrus's financial stability, acting as a reliable source of recurring revenue. The company's Mid-Market activities, in particular, demonstrate this strength, with recurring annual revenue making up 59.0% of their total revenue in 2024. This consistent income stream is crucial for funding growth and innovation.

These long-term engagements offer predictable cash flows and typically involve lower customer acquisition costs compared to one-off projects. This stability is built upon existing client relationships and the ongoing need for operational support, creating a solid foundation for Keyrus's business model.

The predictable nature of these contracts allows Keyrus to allocate resources effectively to other areas of the business, such as developing new services or expanding into new markets. This financial predictability is a hallmark of a strong Cash Cow.

- Recurring Revenue: 59.0% of Mid-Market revenue in 2024 was recurring annual revenue.

- Predictable Cash Flow: Long-term support contracts ensure consistent income.

- Lower Acquisition Costs: Leverages established client relationships.

- Funding Growth: Provides a stable base to finance strategic initiatives.

Established Geographic Operations (e.g., France)

Keyrus is strategically reinforcing its foothold in France, with a particular emphasis on capturing a larger share of the mid-market. This move is underpinned by their robust recurring revenue streams and strategic alliances with SaaS providers.

The French operations are a prime example of a cash cow within Keyrus's portfolio. Given France's status as a mature market where Keyrus already boasts a significant presence, the strategy centers on preserving and enhancing current market share. This approach is designed to ensure a consistent and reliable generation of cash flow.

- France: Mature Market Focus Keyrus aims to solidify its position in France, targeting the mid-market segment.

- Recurring Revenue & SaaS Partnerships This strategy leverages stable income from existing clients and collaborations with software-as-a-service companies.

- Cash Cow Designation The French operations are classified as a cash cow due to their established presence and consistent cash generation.

- Optimization Over Expansion The primary goal is to optimize existing market share rather than pursuing aggressive growth, ensuring steady financial returns.

Keyrus's established digital transformation services, particularly in digital commerce and customer experience, represent strong cash cows. These mature offerings, while not experiencing rapid growth, are essential for businesses and generate consistent revenue. Their consistent demand, coupled with Keyrus's expertise, allows for efficient project delivery and predictable profitability with minimal new investment.

Managed Services & Support Contracts, especially within the Mid-Market, are significant cash cows, contributing 59.0% of their total revenue in 2024 as recurring annual revenue. These long-term engagements provide stable, predictable cash flows with lower customer acquisition costs, funding strategic initiatives and ensuring financial stability.

The French operations, particularly the mid-market segment, are also classified as cash cows. Keyrus's focus here is on preserving and enhancing market share in a mature market, ensuring consistent cash generation through established presence and SaaS partnerships, rather than aggressive expansion.

| Service Area | BGC Matrix Category | Key Financial Indicator (2024) | Rationale |

|---|---|---|---|

| Digital Transformation (Commerce & CX) | Cash Cow | Mature, consistent demand | Critical for businesses, generates steady revenue with low investment needs. |

| Managed Services & Support (Mid-Market) | Cash Cow | 59.0% recurring annual revenue | Long-term contracts provide predictable cash flow and lower acquisition costs. |

| French Operations (Mid-Market Focus) | Cash Cow | Established presence, SaaS partnerships | Focus on market share preservation in a mature market for consistent cash generation. |

What You’re Viewing Is Included

Keyrus BCG Matrix

The preview you see is the identical, fully polished Keyrus BCG Matrix document you will receive upon purchase. This ensures you get exactly what you need for strategic decision-making, with no hidden surprises or alterations. The comprehensive analysis and professional formatting are present in this preview and will be in the final downloadable file, ready for immediate application in your business planning.

Dogs

Keyrus's decision to divest its Life Sciences CRO business unit to the Astek Group in June 2025 firmly places this segment within the 'Dog' quadrant of the BCG Matrix. This classification signifies a business with low market share and limited growth potential, indicating it was not a strategic priority for Keyrus moving forward.

The sale of this unit, which represented a segment struggling to gain traction, underscores Keyrus's strategic pivot. In 2024, the CRO market faced increasing competition and regulatory pressures, making it challenging for smaller players to achieve significant growth without substantial investment, a burden Keyrus likely sought to avoid.

Underperforming Legacy IT Services represent areas where Keyrus may still offer services that have become commoditized or outdated. These might include older software maintenance or support for systems that are no longer in high demand. In 2024, many IT firms are divesting or significantly reducing their focus on such services to streamline operations.

These services typically generate low profit margins and consume valuable resources that could be better invested in more innovative and profitable ventures. For instance, a legacy system’s maintenance contract might yield only a 5% profit margin compared to a cloud migration project potentially offering 20% or more. This strategic reallocation is crucial for maintaining competitive advantage.

Non-strategic niche consulting practices, often characterized by their specialized focus and limited market penetration, represent areas within Keyrus that may not be delivering substantial growth. These segments, if they haven't achieved critical mass or demonstrated a clear path to scalability, could be candidates for divestment or restructuring.

For instance, a niche practice in a rapidly evolving technology area where Keyrus has not established a dominant position, or a service offering in a declining industry, would fall into this category. In 2024, Keyrus, like many consulting firms, would be scrutinizing its portfolio for underperforming units that consume resources without generating commensurate returns, potentially impacting overall profitability.

Inefficient or Stalled Internal Projects

Inefficient or stalled internal projects, often found in the 'Dog' quadrant of the Keyrus BCG Matrix, represent initiatives that have consumed substantial resources without delivering meaningful returns or market traction. These can include R&D efforts that haven't translated into viable products or internal process improvements that failed to achieve expected efficiencies.

For instance, in 2024, many companies reported that a significant portion of their innovation budgets were allocated to projects that ultimately did not launch or gain market share. A survey of Fortune 500 companies indicated that up to 40% of internal development projects were either cancelled or significantly underperformed against initial projections, tying up valuable capital.

- Resource Drain: These projects tie up capital and human resources that could be better deployed in more promising ventures.

- Opportunity Cost: The time and money spent on stalled projects represent opportunities lost for more profitable investments.

- Re-evaluation Necessity: Companies must regularly assess these projects for potential pivots or outright discontinuation to optimize resource allocation.

Client Segments with Persistent Project Postponements

Client segments, especially within large account portfolios, that repeatedly defer or halt projects due to economic instability pose a significant hurdle. These relationships, despite their size, experience reduced occupancy rates and diminished profitability from delayed project initiations, rendering them less efficient.

These postponements can transform potentially valuable client relationships into liabilities if not proactively managed or renegotiated. For instance, a consulting firm might see its utilization rate drop if several large, previously committed projects are put on hold. In 2024, many professional services firms reported increased project pipeline volatility, with some indicating that up to 15% of scheduled projects experienced delays of over six months, directly impacting revenue forecasts.

- Large Account Delays: Clients in the large account category are particularly prone to project postponements driven by economic uncertainty.

- Impact on Occupancy: Recurring project delays directly reduce the billable hours and occupancy rates of key personnel.

- Profitability Erosion: The inability to commence and complete projects on schedule negatively affects a firm's profitability and cash flow.

- Relationship Efficiency: Persistent postponements make these client relationships less efficient and potentially unprofitable without strategic intervention.

The 'Dog' quadrant in the BCG Matrix represents business units or products that have low market share and low growth prospects. These are typically underperforming assets that consume resources without generating significant returns.

Keyrus's divestment of its Life Sciences CRO business in June 2025 exemplifies a 'Dog' as it had low market share and limited growth potential in a competitive 2024 CRO market. Similarly, legacy IT services and non-strategic niche consulting practices often fall into this category due to commoditization and lack of scalability.

Internal projects that stall or fail to gain traction, along with large client accounts experiencing persistent project deferrals due to economic volatility, also characterize 'Dogs'. These segments drain resources and represent opportunity costs, necessitating careful evaluation and potential divestment or restructuring to optimize overall portfolio performance.

| BCG Quadrant | Characteristics | Keyrus Examples (as of mid-2025) | Market Context (2024) | Strategic Implication |

|---|---|---|---|---|

| Dogs | Low Market Share, Low Growth | Life Sciences CRO (divested June 2025), Legacy IT Services, Stalled Internal Projects | Competitive CRO market, commoditized IT services, project deferrals due to economic instability | Divest, harvest, or restructure to reallocate resources |

| Niche Consulting Practices with limited penetration | Rapidly evolving tech areas, declining industries | |||

| Large client accounts with repeated project postponements | Increased project pipeline volatility, up to 15% of scheduled projects delayed >6 months |

Question Marks

Emerging Generative AI (Gen AI) offerings from Keyrus are currently positioned as Question Marks within the BCG matrix. The Gen AI market itself is experiencing explosive growth, with projections indicating a significant expansion in the coming years. For instance, the global Gen AI market was valued at approximately $15 billion in 2023 and is expected to surge to over $100 billion by 2025, demonstrating its high-growth nature.

Keyrus's strategic focus on ethical AI development aligns with market demand for responsible innovation. However, in this relatively new and rapidly evolving sector, Keyrus's current market share is likely modest. Establishing a strong foothold requires substantial investment in research and development, attracting specialized AI talent, and actively developing the market for these advanced services.

These investments are crucial for transforming these nascent offerings into future market leaders, or Stars, within Keyrus's portfolio. The company's commitment to innovation in Gen AI, despite the current low market share, signals a proactive approach to capturing future market opportunities in this transformative technology landscape.

Keyrus's acquisition of a majority stake in Upquest in July 2025 positions the latter as a Question Mark within the Keyrus BCG Matrix. This move is designed to bolster Keyrus's business and technology transformation services across Belgium and Europe.

While the strategic intent is clear, Upquest's future performance hinges on its successful integration and its capacity to carve out significant market share in the highly competitive transformation landscape. This requires considerable investment and focused effort to unlock its full potential.

Keyrus's strategic investment in Axon Technologies, marking its entry into Saudi Arabia's cybersecurity sector, positions this venture as a Question Mark within the BCG framework. This move into a new geographic market, while promising, carries inherent uncertainties regarding market penetration and profitability.

The broader Middle East and Africa (MEA) region, where Keyrus has demonstrated robust performance with a 13.8% growth in its MEA zone during 2024, highlights the potential of this expansion. However, replicating this success in Saudi Arabia necessitates significant capital allocation and meticulous strategic planning to navigate local market dynamics and competitive landscapes.

Advanced Cloud Solutions & Sovereign Cloud

Keyrus's commitment to advanced cloud solutions, particularly sovereign cloud, positions it within the Question Mark quadrant of the BCG Matrix. This segment of the cloud market is experiencing robust growth, driven by escalating data privacy regulations and heightened security demands. For instance, the global sovereign cloud market was projected to reach approximately $12.5 billion in 2024, with a compound annual growth rate (CAGR) expected to exceed 15% through 2028, according to industry analysts.

While the market potential is substantial, Keyrus's current market share in these niche and rapidly evolving cloud areas may still be in its nascent stages. Achieving leadership necessitates considerable investment in developing specialized expertise, forging strategic alliances, and cultivating client trust and adoption. This investment is crucial for transforming these promising ventures into strong market contenders.

- High Growth Market: The global cloud market continues its upward trajectory, with specialized segments like sovereign cloud seeing accelerated adoption.

- Regulatory Tailwinds: Increasing data localization and sovereignty requirements worldwide are creating significant demand for sovereign cloud offerings.

- Investment Required: Building expertise, partnerships, and client traction in advanced and sovereign cloud solutions demands substantial upfront investment.

- Potential for Market Leadership: Successful navigation of these challenges could position Keyrus for significant market share gains in a high-growth sector.

Digital Ecosystem and Super App Development

Keyrus's strategic focus on the rise of digital ecosystems and super app development places these ventures firmly in the 'Question Marks' category of the BCG matrix. These are areas of significant potential growth and innovation, reflecting a forward-looking approach to market trends. For instance, the global super app market was valued at approximately USD 55 billion in 2023 and is projected to reach over USD 200 billion by 2030, showcasing the immense opportunity.

Developing and implementing these intricate, interconnected platforms requires substantial investment in research and development, alongside crucial strategic partnerships. Keyrus's market share in this nascent yet rapidly expanding sector is likely still in its early stages. Companies entering this space often face high upfront costs and a long road to profitability, necessitating careful management of resources and a clear vision for long-term viability.

- High Growth Potential: Digital ecosystems and super apps tap into a growing consumer demand for integrated digital experiences.

- Emerging Market Share: Keyrus's involvement in these complex developments positions them as an emerging player, with market share yet to be fully established.

- Significant R&D Investment: Success in this domain necessitates considerable investment in technology, talent, and strategic alliances.

- Long-Term Viability Focus: Proving profitability and long-term success in these innovative spaces requires sustained effort and strategic execution.

Keyrus's ventures into emerging areas like Generative AI, sovereign cloud, digital ecosystems, and super app development are classified as Question Marks in the BCG matrix. These represent high-growth potential markets where Keyrus has a relatively low market share, requiring significant investment to gain traction and achieve market leadership.

The strategic acquisitions of Upquest and Axon Technologies also fall into the Question Mark category. These moves are aimed at expanding Keyrus's service offerings and geographic reach, but their future success depends heavily on integration, market penetration, and competitive positioning.

While these Question Marks demand substantial investment and strategic focus, they are critical for Keyrus's long-term growth and ability to capitalize on evolving technological trends and market demands.

| Keyrus Venture | Market Growth | Current Market Share | Investment Need | Strategic Outlook |

| Generative AI | Very High (>$100B by 2025) | Low | High (R&D, Talent) | Potential Star |

| Sovereign Cloud | High (>15% CAGR projected) | Low | High (Expertise, Partnerships) | Potential Star |

| Digital Ecosystems/Super Apps | Very High (>$200B by 2030) | Low | High (R&D, Partnerships) | Potential Star |

| Upquest (Acquisition) | High (Business Transformation) | Low | High (Integration, Market Penetration) | Potential Star |

| Axon Technologies (Entry) | High (Cybersecurity in MEA) | Low | High (Capital, Planning) | Potential Star |

BCG Matrix Data Sources

Our BCG Matrix is powered by a blend of internal financial data, comprehensive market research reports, and expert industry analysis to provide a robust strategic overview.