Keyrus Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Keyrus Bundle

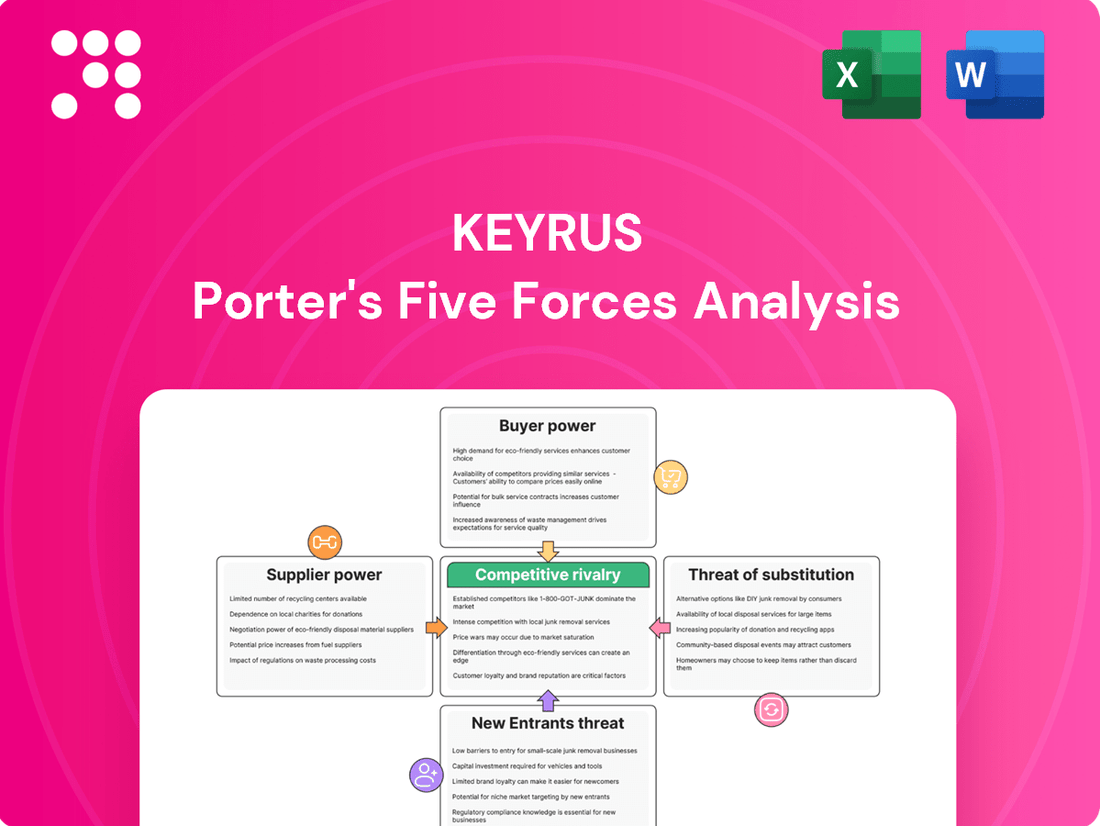

Keyrus operates within an industry shaped by the bargaining power of buyers and suppliers, the threat of new entrants, and the intensity of rivalry. Understanding these forces is crucial for strategic positioning.

The complete report reveals the real forces shaping Keyrus’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Keyrus, a firm deeply embedded in data and digital consulting, finds its operational strength tied to professionals with expertise in data science, AI, and digital transformation. The availability of these specialized skills directly impacts the company's ability to deliver on client projects.

The market for these highly sought-after professionals is often tight. For instance, in 2024, the demand for AI specialists continued to outpace supply, with some reports indicating a shortage of over 2 million AI professionals globally. This scarcity significantly amplifies the bargaining power of these individuals.

When specialized talent is scarce, these professionals can command higher salaries and more favorable working conditions. This translates into increased recruitment and retention expenses for Keyrus, as the company must compete to attract and keep its most valuable assets.

Keyrus's reliance on technology and software vendors, like Tableau Software, can shift bargaining power towards these suppliers. If Keyrus depends on specialized, proprietary software or critical cloud infrastructure, and the cost or complexity of switching is substantial, these vendors gain leverage. For instance, in 2023, the global cloud computing market, a critical area for many software vendors, was valued at over $600 billion, highlighting the scale of these providers.

Keyrus’s growth strategy heavily relies on acquisitions, demonstrated by its recent acquisition of Upquest in Belgium and earlier purchases like Sonum International and Axon Technologies. This acquisition-driven expansion means the availability and valuation of desirable companies directly impact Keyrus's growth trajectory.

When high-quality acquisition targets are scarce, these companies gain leverage. Their perceived value and the competition among potential buyers can drive up acquisition costs, influencing the pace and financial feasibility of Keyrus's expansion plans.

Niche Expertise Providers

Keyrus, while offering a wide range of services, also operates within specialized sectors. The company's strategic divestment of its Life Sciences CRO activities in late 2023 exemplifies this focus on core competencies. This move suggests Keyrus may increasingly rely on external providers for highly specific, niche expertise.

For these specialized sub-contractors or component providers, their unique skills and limited availability can translate into significant bargaining power. They can potentially command premium pricing for their services, impacting Keyrus's cost structure in these particular areas. For example, if Keyrus needs highly specialized data analytics for a niche industry it's entering, a provider with proven success in that specific vertical could leverage its position.

- Niche Specialization: Providers with unique, hard-to-replicate skills in areas like advanced AI for specific industries or specialized regulatory compliance can exert greater influence.

- Limited Alternatives: If few other companies offer the same level of specialized expertise, Keyrus has fewer options, strengthening the supplier's position.

- Strategic Importance: For critical components or services that directly impact Keyrus's project delivery or client satisfaction, these niche providers gain leverage.

- Focus on Core: Keyrus's strategic refocusing, as seen with the Life Sciences CRO sale, might mean outsourcing more specialized, non-core functions, thereby increasing reliance on these niche suppliers.

Infrastructure and Cloud Services

Keyrus, as a technology firm, relies heavily on infrastructure and cloud services. The bargaining power of suppliers in this sector is a significant consideration. For instance, major cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) dominate a substantial portion of the market. In 2024, AWS held approximately 31% of the cloud infrastructure market share, followed by Microsoft Azure at around 24%, and Google Cloud at roughly 11%.

This consolidation means these providers can exert considerable influence over pricing and service terms. Keyrus, like many companies, may face increased costs if these dominant suppliers decide to raise their rates or alter their service level agreements. The reliance on a few key players for essential computing power and data storage creates a scenario where suppliers have a strong hand in negotiations.

- Cloud Market Dominance: Major cloud providers hold significant market share, giving them leverage.

- Potential Cost Increases: Supplier consolidation can lead to higher operational expenses for Keyrus.

- Dependency on Key Players: Reliance on a limited number of providers strengthens supplier bargaining power.

Keyrus's bargaining power with its suppliers is influenced by the concentration and specialization within its supply chain. In areas where Keyrus relies on niche expertise or critical technology components, suppliers can wield significant leverage. This is particularly true for specialized talent and dominant cloud service providers.

For instance, the scarcity of AI specialists in 2024, with a global shortage estimated at over 2 million professionals, empowers these individuals to negotiate better terms. Similarly, major cloud providers like AWS, holding around 31% of the market share in 2024, can dictate terms due to their market dominance. Keyrus's strategic divestments, such as its Life Sciences CRO activities in late 2023, may also increase its reliance on specialized external providers, further strengthening supplier positions in those specific niches.

| Factor | Impact on Keyrus | Example Data (2024) |

| Talent Scarcity (AI Specialists) | Increased recruitment costs, higher salary demands | Global shortage of over 2 million AI professionals |

| Cloud Provider Dominance | Potential for price increases, less negotiation flexibility | AWS market share ~31% |

| Niche Service Providers | Higher costs for specialized, non-core functions | Increased reliance post-Life Sciences CRO divestment (late 2023) |

What is included in the product

This analysis meticulously examines the five forces shaping Keyrus's market: the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry.

Effortlessly identify and quantify competitive pressures, allowing for targeted strategies to mitigate threats and capitalize on opportunities.

Customers Bargaining Power

Keyrus's revenue in 2024 was notably affected by a downturn in demand from its 'Large Account' segment. This suggests that these major clients wield considerable bargaining power, likely due to the sheer volume of their projects and their capacity to significantly sway Keyrus's financial outcomes.

The concentration of business within these large accounts means that any shift in their purchasing behavior can have a disproportionate impact on Keyrus's overall performance, highlighting a key area of customer bargaining power.

Clients undertaking complex digital transformation and data intelligence projects often encounter substantial switching costs when considering a change in consulting partners. These costs are not trivial; they can encompass the expense of migrating vast datasets, the resources required for re-training staff on new systems or methodologies, and the potential for significant project delays, all of which diminish a client's leverage.

For instance, a client deeply integrated with a consulting firm's proprietary data platforms or custom-built solutions might find the cost of extraction and transition to a new provider to be prohibitive. This lock-in effect, especially in areas like advanced AI implementation or cloud migration where specialized knowledge is paramount, effectively reduces the bargaining power of the customer.

In 2024, economic uncertainty amplified customer price sensitivity for Keyrus. This heightened awareness of costs meant clients were more likely to scrutinize spending, potentially delaying or even canceling projects. For instance, many IT consulting firms reported a slowdown in new project commitments as businesses tightened their belts.

This increased price sensitivity directly translates to greater bargaining power for Keyrus's clients. They are now in a stronger position to negotiate more favorable pricing and demand greater flexibility in contract terms. Companies facing reduced revenues in 2024 were actively seeking cost reductions across all service providers, including those in the digital transformation space.

Availability of In-House Capabilities and Alternatives

Many large organizations are increasingly building their own in-house data science, AI, and digital transformation capabilities. This growing internal expertise significantly reduces their reliance on external consulting firms like Keyrus, thereby strengthening their bargaining power.

For instance, a 2024 survey indicated that over 60% of Fortune 500 companies have established dedicated AI or data analytics departments, a substantial increase from previous years. This internal capacity acts as a credible alternative, giving these clients more leverage when negotiating project scope, pricing, and terms with Keyrus.

- Increased In-House Expertise: Companies are investing heavily in training and hiring talent for data science and AI.

- Reduced Dependency: Internal teams can handle many projects that were previously outsourced.

- Enhanced Negotiation Leverage: The availability of alternatives empowers customers to demand better terms.

- Focus on Specialized Niche: Keyrus may need to emphasize highly specialized or novel services not easily replicable in-house.

Project Scope and Customization Needs

The bargaining power of customers for Keyrus is significantly influenced by the project's scope and the degree of customization required. For highly specialized, mission-critical projects where Keyrus offers unique expertise, customer leverage is diminished. This is because finding alternative providers with comparable skills and experience becomes challenging, leading to a stronger negotiating position for Keyrus.

Conversely, when Keyrus provides more standardized or modular services, customers tend to wield greater bargaining power. In these scenarios, the availability of alternative solutions and providers increases, allowing customers to more readily compare offerings and negotiate terms. For instance, if a client requires a common data analytics module that many firms can supply, they are in a better position to demand lower prices or more favorable contract conditions.

Keyrus's ability to secure premium pricing and favorable terms is directly correlated with the uniqueness and complexity of the solutions it delivers. In 2024, the demand for bespoke AI and advanced data analytics solutions, areas where Keyrus excels, has been robust. Companies seeking these specialized services often find fewer competitors, thereby reducing their bargaining power. For example, a report from IDC in early 2024 indicated that spending on AI services was projected to grow by over 20% year-over-year, with a significant portion allocated to custom implementations.

- Customization Level: High customization reduces customer power; standardization increases it.

- Project Criticality: Mission-critical projects with specialized needs limit customer options.

- Market Alternatives: The availability of comparable services from competitors directly impacts customer leverage.

- Service Differentiation: Keyrus's unique value proposition in specific niches strengthens its negotiating position.

Keyrus's customer bargaining power is a significant factor, especially with its large accounts where client concentration is high. Economic pressures in 2024 made clients more price-sensitive, increasing their leverage to negotiate better terms. The growing trend of clients building in-house capabilities, with over 60% of Fortune 500 companies establishing dedicated AI departments by 2024, further reduces their reliance on external firms like Keyrus, bolstering their negotiating position.

| Factor | Impact on Customer Bargaining Power | 2024 Data/Observation |

|---|---|---|

| Client Concentration | High concentration in large accounts increases customer power. | Revenue downturn from 'Large Account' segment in 2024 highlights this. |

| Switching Costs | High switching costs (data migration, retraining) reduce customer power. | Clients integrated with proprietary platforms face prohibitive transition expenses. |

| Price Sensitivity | Increased price sensitivity amplifies customer power. | Economic uncertainty in 2024 led clients to scrutinize spending and negotiate harder. |

| In-House Capabilities | Growing internal expertise reduces reliance and increases customer power. | Over 60% of Fortune 500 companies had dedicated AI/data analytics departments in 2024. |

| Customization/Uniqueness | Highly customized or unique services diminish customer power. | Demand for bespoke AI solutions in 2024, where Keyrus excels, limited customer options. |

Full Version Awaits

Keyrus Porter's Five Forces Analysis

This preview shows the exact Keyrus Porter's Five Forces Analysis document you'll receive immediately after purchase, providing a comprehensive overview of competitive forces within the industry. You'll gain immediate access to this fully formatted and professionally written analysis, ready for your strategic planning. No placeholders or mockups—what you see is precisely what you get.

Rivalry Among Competitors

The IT consulting and digital services sector is exceptionally fragmented, presenting Keyrus with a broad spectrum of rivals. This includes major global players like Accenture and Deloitte, alongside numerous niche specialists and regional technology integrators, all competing for market share.

This intense fragmentation fuels significant competitive rivalry. Keyrus must navigate a landscape where differentiation is key, as clients have a vast selection of service providers for their digital transformation needs. For instance, the global IT services market was valued at approximately $1.2 trillion in 2023, with a considerable portion stemming from consulting and digital transformation services.

The data and digital market is certainly lively, but in 2024, Keyrus saw its revenue from larger accounts dip. This was largely due to economic jitters causing clients to slow down on projects or push them back. This slowdown in a key segment naturally intensifies the battle for the remaining business.

When demand softens in certain areas, like Keyrus's large account segment in 2024, it means companies have to fight harder for fewer opportunities. This increased competition puts pressure on pricing and can make it tougher for everyone to secure profitable deals.

Keyrus differentiates itself by offering a unique blend of data intelligence, digital experience, and management consulting. This integrated approach allows them to provide a more holistic solution than competitors focusing on single areas.

Their ability to stand out through specialized expertise, such as advanced AI capabilities, and by fostering strong client relationships is vital. This helps them avoid being drawn into purely price-driven competition, which is common in the consulting sector.

For instance, in 2024, many consulting firms reported increased demand for AI-driven solutions, with some studies indicating that companies leveraging AI in their operations saw an average revenue uplift of 10-15%. Keyrus’s focus on this area positions them well to capture this growing market segment.

Acquisition and Partnership Strategies

Keyrus actively pursues growth through strategic acquisitions and partnerships, a direct response to intense industry competition. For instance, the acquisition of Upquest in 2025 demonstrates a clear intent to bolster its service offerings and market presence.

These maneuvers are crucial for staying ahead in a sector characterized by consolidation and the constant need to innovate.

Furthermore, Keyrus's collaboration with Zain Bahrain for a new application highlights its commitment to expanding its reach and capabilities through strategic alliances.

- Acquisition of Upquest (2025): Enhances Keyrus's technological capabilities and market penetration.

- Partnership with Zain Bahrain: Expands service delivery and customer base through a new application.

- Strategic rationale: These actions underscore the competitive imperative to consolidate market share and diversify service portfolios in the data and analytics landscape.

Talent War and Employee Retention

Competitive rivalry for Keyrus intensifies as the battle for talent in data and digital sectors mirrors the fight for clients. The scarcity of highly skilled professionals in these areas means companies must actively compete not just on service offerings but also on employee value propositions.

This talent war necessitates significant investment in compensation, benefits, and career development to attract and retain top performers. For instance, in 2024, the average salary for a data scientist in major tech hubs saw increases of 10-15% year-over-year, reflecting this intense demand.

- High Demand for Specialized Skills: Fields like AI, machine learning, and cloud computing face a persistent talent deficit, driving up recruitment costs.

- Retention as a Key Strategy: Companies are focusing more on creating robust employee retention programs, including continuous learning and flexible work arrangements, to combat attrition.

- Impact on Profitability: Increased spending on talent acquisition and retention can directly impact a firm's profit margins, adding another layer to competitive pressure.

- Global Talent Mobility: The ability to attract talent from a global pool, while offering opportunities, also means facing competition from international firms.

The IT consulting and digital services sector is highly competitive, with Keyrus facing rivals ranging from global giants to specialized niche players. This fragmentation intensifies the struggle for market share, particularly as clients have numerous options for digital transformation needs.

In 2024, a slowdown in larger client projects due to economic uncertainty heightened the competition for remaining business. This environment puts pressure on pricing and makes securing profitable deals more challenging for all firms involved.

Keyrus differentiates itself through a combined offering of data intelligence, digital experience, and management consulting, providing a more comprehensive solution than single-focus competitors. Their strategic acquisitions, like Upquest in 2025, and partnerships, such as with Zain Bahrain, are critical moves to enhance capabilities and market presence amidst this rivalry.

The intense competition extends to talent acquisition, with a significant demand for skilled professionals in AI, machine learning, and cloud computing. This talent war drives up recruitment costs, with average data scientist salaries in major hubs increasing by 10-15% in 2024, impacting firms' profit margins.

SSubstitutes Threaten

Organizations increasingly opt to build robust in-house teams for data intelligence, digital transformation, and customer experience initiatives. This internal development directly substitutes the need for external consulting services, offering greater control and potential long-term cost savings.

For example, in 2023, Gartner predicted that by 2025, 70% of organizations will have built internal capabilities to develop and manage their own AI solutions, reducing reliance on external vendors.

The increasing availability of sophisticated, user-friendly, and often more cost-effective off-the-shelf software and Software-as-a-Service (SaaS) solutions presents a significant threat of substitution for companies like Keyrus. These platforms, covering areas like business intelligence, customer relationship management (CRM), enterprise resource planning (ERP), and e-commerce, can diminish the demand for bespoke development and extensive consulting services. For instance, the global SaaS market was projected to reach over $200 billion in 2024, highlighting the widespread adoption and accessibility of these alternatives.

Keyrus itself acknowledges this trend by strategically focusing on SaaS partnerships, particularly within its mid-market segment. This approach allows them to leverage existing robust platforms rather than building entirely new solutions, thereby addressing customer needs more efficiently. The competitive landscape is further intensified by the rapid innovation in SaaS offerings, which often provide faster deployment and lower upfront costs compared to traditional custom solutions.

For specific projects or highly specialized tasks, clients may turn to individual freelance consultants or niche boutique firms. These alternatives can provide more adaptable engagement structures and potentially lower costs for precise requirements, presenting a competitive challenge to Keyrus's wider range of services.

Automation and Artificial Intelligence Tools

Advances in automation and artificial intelligence are a significant threat of substitutes for consulting services, especially in areas like data analysis and reporting. These technologies can perform tasks more quickly and often at a lower cost than human consultants. For instance, AI-powered analytics platforms can process vast datasets and generate insights far faster than traditional methods, potentially reducing the need for specialized data consulting.

Keyrus, like many in the consulting sector, recognizes this shift. Their strategic investments in AI development are a direct response to both the threat of these automated substitutes and the opportunity to integrate these technologies into their own service offerings. This proactive approach aims to leverage AI to enhance their consulting capabilities rather than be replaced by it.

The impact is already visible in the market. By mid-2024, the global AI market was projected to reach over $200 billion, indicating a rapid adoption of these technologies across industries. This growth fuels the development of sophisticated tools that can directly substitute for certain consulting functions, such as automated report generation and basic digital marketing campaign management.

Keyrus's strategic response includes:

- Developing proprietary AI-driven analytics tools to offer enhanced services.

- Investing in training their consultants to work alongside AI, focusing on higher-level strategic thinking and client relationship management.

- Acquiring or partnering with AI technology firms to integrate cutting-edge capabilities.

- Shifting their service model to emphasize areas where human expertise remains critical, such as complex problem-solving and change management.

Standardized Industry Solutions

The increasing standardization of digital transformation processes and data architectures presents a significant threat. As more pre-built solutions and industry templates become readily available, clients may opt for these off-the-shelf options, reducing their reliance on specialized, bespoke consulting services. This trend can erode the demand for the tailored expertise that firms like Keyrus offer.

For instance, the global market for digital transformation consulting services was valued at approximately $17.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 14.5% through 2030. However, the rise of low-code/no-code platforms and industry-specific software suites means that a portion of these transformation projects can now be executed with less external consultative input.

- Standardization Threat: As digital transformation and data architectures become more uniform, clients can leverage pre-built solutions.

- Reduced Need for Bespoke Services: This standardization diminishes the necessity for highly customized consulting, impacting firms like Keyrus.

- Market Context: The digital transformation consulting market is robust, but the availability of standardized tools offers an alternative to bespoke solutions.

The threat of substitutes for Keyrus's services is substantial, driven by the rise of in-house capabilities and readily available technology solutions. Clients are increasingly building their own data intelligence and digital transformation teams, seeking greater control and long-term cost efficiencies, a trend exemplified by Gartner's 2025 prediction that 70% of organizations will develop internal AI capabilities.

The widespread adoption of user-friendly and cost-effective SaaS platforms, including CRM and ERP systems, directly competes with custom development and consulting, evidenced by the global SaaS market's projected growth to over $200 billion in 2024. Furthermore, advancements in AI and automation can perform tasks like data analysis more rapidly and affordably than human consultants, with the global AI market surpassing $200 billion by mid-2024.

The increasing standardization of digital transformation processes also allows clients to utilize pre-built solutions, reducing the need for specialized consulting. While the digital transformation consulting market was valued at approximately $17.5 billion in 2023, the availability of low-code/no-code platforms offers an alternative to bespoke services.

Entrants Threaten

Entering the data and digital consulting arena demands substantial financial backing, even without extensive physical assets. New players must allocate significant capital towards attracting top-tier talent, building robust technology infrastructure, and investing in aggressive marketing and sales efforts to gain traction.

Keyrus, for instance, consistently prioritizes strategic investments in cutting-edge data analytics, artificial intelligence, and digital transformation capabilities, underscoring the ongoing need for capital to remain competitive. This commitment reflects the industry's dynamic nature, where continuous innovation is paramount.

Building a strong brand reputation and fostering client trust is paramount in the consulting industry, acting as a significant barrier to new entrants. Keyrus, leveraging its global footprint and decades of operational experience, has cultivated deep-seated client relationships, a valuable asset that new competitors struggle to replicate quickly. This established credibility makes it difficult for newcomers to gain traction and secure market share against a trusted incumbent.

The primary asset for a data and digital consulting firm is its people. New companies entering this space face a significant hurdle in attracting and retaining top-tier data scientists, AI engineers, and digital strategists, as these specialized skills are in high demand.

In 2024, the competition for these professionals intensified, with demand outstripping supply. For instance, LinkedIn reported a 20% year-over-year increase in job postings for AI specialists, highlighting the scarcity of available talent.

This intense competition for a limited, highly skilled workforce acts as a substantial barrier, making it difficult for new entrants to build the foundational expertise needed to compete effectively against established players.

Economies of Scale and Scope

Established players like Keyrus can leverage significant economies of scale, making it difficult for new entrants to compete on price or service breadth. For instance, Keyrus's global operational footprint, spanning 28 countries with over 3,200 employees, allows for cost efficiencies in areas like global delivery models and shared service centers. This scale enables them to invest more heavily in training and development, offering a more comprehensive and sophisticated service portfolio than a newcomer could easily replicate.

These economies of scale translate directly into a competitive advantage. New entrants would face substantial upfront investment to build a comparable global infrastructure and talent pool.

- Economies of Scale: Keyrus's global presence (28 countries, 3200+ employees) enables cost efficiencies in delivery and operations.

- Competitive Pricing: Larger scale allows for more competitive pricing structures compared to new, smaller firms.

- Service Portfolio Breadth: Significant investment in training and development supports a wider range of services than typically offered by new entrants.

Regulatory and Compliance Knowledge

The threat of new entrants is significantly influenced by the complexity of regulatory and compliance knowledge required to operate. For instance, in the financial services sector, navigating regulations like the Dodd-Frank Act in the US or MiFID II in Europe demands specialized expertise that is costly and time-consuming to acquire. New players entering this space must invest heavily in legal counsel, compliance officers, and training programs to ensure adherence to these intricate frameworks.

Consider the healthcare industry, where compliance with HIPAA in the United States or GDPR in Europe for patient data handling presents a substantial hurdle. Companies must implement robust data security measures and privacy protocols, adding considerable operational overhead. In 2024, the global regulatory technology (RegTech) market is projected to reach over $20 billion, underscoring the significant investment companies are making to manage these compliance burdens, a cost that new entrants must also bear.

This need for specialized knowledge acts as a powerful barrier. New entrants must not only develop a competitive product or service but also demonstrate an immediate and thorough understanding of all applicable laws and standards. This is particularly true in sectors with evolving regulations, such as fintech or sustainable finance, where staying abreast of new directives and reporting requirements is crucial for survival and growth.

- Regulatory Expertise: New entrants must master diverse legal and compliance landscapes, which vary significantly by industry and region.

- Compliance Costs: Acquiring the necessary knowledge and implementing compliant systems can involve substantial upfront investment in legal, technology, and personnel.

- Industry Examples: Sectors like finance (Dodd-Frank, MiFID II) and healthcare (HIPAA, GDPR) exemplify industries with high regulatory barriers.

- Market Trends: The growing RegTech market, valued in the tens of billions of dollars annually, highlights the significant ongoing investment in compliance management.

The threat of new entrants into the data and digital consulting space is moderate, primarily due to high capital requirements for talent and technology, coupled with the difficulty of building immediate brand credibility. While not requiring extensive physical assets, significant financial outlay is necessary for skilled personnel and advanced infrastructure.

The intense competition for specialized talent, such as data scientists and AI engineers, presents a substantial barrier. In 2024, demand for these roles outpaced supply, with job postings for AI specialists increasing by 20% year-over-year according to LinkedIn data, making it challenging for newcomers to assemble a qualified team.

Established firms like Keyrus benefit from economies of scale, with a global presence across 28 countries and over 3,200 employees, enabling cost efficiencies and a broader service portfolio that new entrants struggle to match. This scale allows for more competitive pricing and investment in training, further solidifying their market position.

| Factor | Impact on New Entrants | Keyrus's Advantage |

|---|---|---|

| Capital Requirements | High (Talent, Technology) | Established infrastructure and R&D budget |

| Talent Acquisition | Challenging (High Demand, Low Supply) | Strong employer brand and competitive compensation packages |

| Brand Reputation & Trust | Difficult to build quickly | Decades of experience and global client relationships |

| Economies of Scale | Limited | Global operational footprint, cost efficiencies |

| Regulatory Complexity | High (Industry-specific knowledge) | Existing compliance frameworks and expertise |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, integrating information from financial statements, industry-specific market research reports, and publicly available company filings. This comprehensive approach ensures a thorough understanding of competitive dynamics.