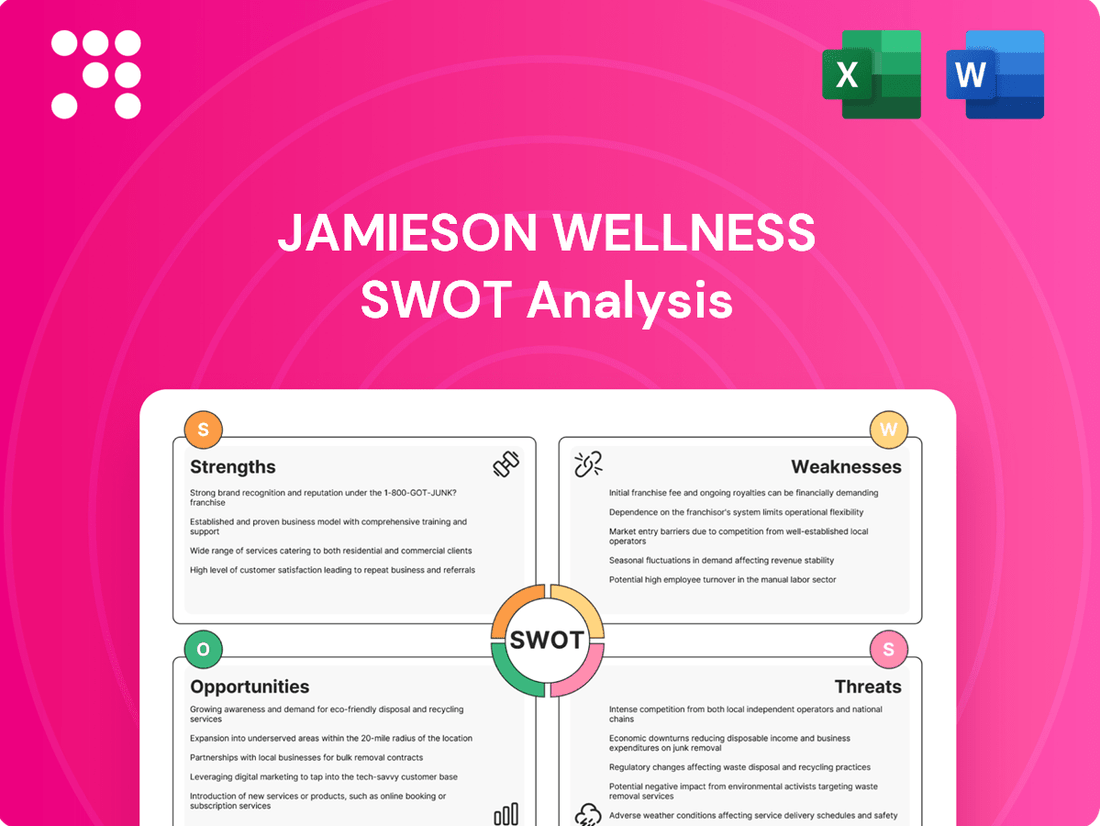

Jamieson Wellness SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jamieson Wellness Bundle

Jamieson Wellness boasts strong brand recognition and a loyal customer base, but faces intense competition and evolving consumer preferences. Our analysis delves into these critical factors, revealing opportunities for expansion and potential threats to its market share.

Want the full story behind Jamieson Wellness's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Jamieson Wellness is firmly established as Canada's leading brand in the vitamins, minerals, and supplements (VMS) sector. This top market position, held since its inception in 1922, underscores a long-standing reputation and deep-rooted consumer trust within its home market.

This enduring leadership translates into a robust and reliable revenue stream, bolstered by significant brand equity and widespread recognition across Canada. The company's consistent performance in its domestic market provides a solid bedrock for its overall financial stability and strategic growth initiatives.

Jamieson Wellness is showing impressive financial strength. In the first quarter of 2025, their consolidated revenue saw a significant jump of 14%. This momentum is expected to continue, with projections for fiscal 2025 anticipating revenue growth in the range of 9.0% to 14.5%.

This consistent upward trend in revenue, alongside improved profitability and robust cash flow generation, highlights the success of Jamieson's strategic initiatives and the strong appeal of its brands in the market.

Jamieson Wellness boasts a robust and diversified brand portfolio, encompassing branded and private label vitamins, minerals, and supplements (VMS), over-the-counter (OTC) remedies, and sports nutrition products. This broad offering spans well-recognized names such as Jamieson, youtheory, Progressive, Smart Solutions, Iron Vegan, and Precision, catering to a wide array of consumer health needs.

The company’s commitment to product innovation is a significant strength. Jamieson Wellness consistently introduces new product formats, like gummies, and develops solutions for emerging health trends, effectively adapting to evolving consumer demands and expanding its market penetration. For instance, its focus on convenient formats like gummies has been a key driver in capturing younger demographics within the VMS market.

Significant International Expansion and China Growth

Jamieson Wellness has made significant strides in international expansion, with its products now accessible in more than 50 countries. This global reach is a key strength, diversifying revenue and mitigating risks associated with reliance on any single market.

China represents a particularly strong growth engine for the company. In the first quarter of 2025, Jamieson Wellness saw its revenue in China surge by over 50%. Looking ahead, the company anticipates continued robust growth in this vital market, projecting a revenue increase of 25.0% to 35.0% for the full year 2025.

This impressive performance in China is attributed to strategic investments and localized market approaches that resonate with consumers. The success in expanding its international footprint, especially in key emerging markets, solidifies Jamieson's position as a global wellness leader.

- Global Presence: Products available in over 50 countries.

- China Growth (Q1 2025): Revenue increased by over 50%.

- China Growth Projection (2025): Expected revenue growth of 25.0% to 35.0%.

- Strategic Advantage: Diversified revenue streams and reduced market dependency.

Commitment to Quality, Trust, and Sustainability

Jamieson Wellness's enduring strength lies in its 102-year legacy of unwavering commitment to quality and trust, underscored by rigorous product testing for safety and efficacy. This deep-rooted dedication builds significant consumer confidence, a crucial asset in the health and wellness sector.

Further bolstering its reputation, Jamieson Wellness actively participates in the United Nations Global Compact, aligning its operations with globally recognized principles for responsible business conduct. This commitment signals a proactive approach to ethical practices and corporate citizenship.

The company's robust sustainability agenda is another key strength, with tangible progress in areas like carbon emissions reduction and enhanced supply chain governance. For instance, in 2023, Jamieson reported a 5% reduction in Scope 1 and 2 greenhouse gas emissions compared to its 2020 baseline, demonstrating a clear focus on environmental stewardship.

- 102-year history of quality and trust.

- Extensive product quality and safety testing protocols.

- Participation in the United Nations Global Compact for responsible business.

- Progress in sustainability, including carbon emissions reduction and supply chain governance.

Jamieson Wellness benefits from a strong market leadership position in Canada, built over a century of operation, translating into significant brand equity and consistent revenue. This domestic strength is amplified by impressive financial performance, with Q1 2025 revenue up 14% and projected full-year 2025 revenue growth between 9.0% and 14.5%. The company's diversified product portfolio, including VMS, OTC, and sports nutrition, caters to a broad consumer base.

Innovation, particularly in convenient formats like gummies, effectively captures new demographics, while a robust international presence in over 50 countries, with China being a key growth driver (Q1 2025 revenue up over 50%, projected 2025 growth of 25.0% to 35.0%), diversifies revenue and mitigates single-market risk. This global expansion, coupled with a 102-year legacy of quality and trust, rigorous testing, and a commitment to sustainability and responsible business practices, solidifies Jamieson's competitive advantage.

| Metric | Value | Period |

|---|---|---|

| Canadian VMS Market Position | Leading Brand | Since inception (1922) |

| Consolidated Revenue Growth | 14% | Q1 2025 |

| Projected Full-Year Revenue Growth | 9.0% - 14.5% | Fiscal 2025 |

| International Market Reach | Over 50 countries | Current |

| China Revenue Growth | Over 50% | Q1 2025 |

| Projected China Revenue Growth | 25.0% - 35.0% | Full Year 2025 |

| Greenhouse Gas Emissions Reduction | 5% | 2023 (vs. 2020 baseline) |

What is included in the product

Delivers a strategic overview of Jamieson Wellness’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Highlights Jamieson's competitive advantages and potential threats, enabling targeted strategy development.

Weaknesses

Jamieson Wellness's significant reliance on traditional retail channels presents a notable weakness. In 2024, these offline channels commanded a substantial 73.3% of the over-the-counter (OTC) drugs market. This suggests that while e-commerce expansion is occurring, the company's revenue streams may still be heavily weighted towards brick-and-mortar distribution. Such a dependency could hinder rapid adaptation to the evolving consumer preference for online shopping and direct-to-consumer (DTC) engagement, potentially limiting future growth agility.

Jamieson Wellness's stock currently trades at a premium valuation, reflecting high market expectations for its future growth. For instance, as of mid-2024, its Price-to-Earnings (P/E) ratio might be notably higher than industry averages, suggesting investors are already pricing in significant success. This premium means new investors may find limited immediate upside if the company doesn't consistently surpass these already elevated expectations.

As a global player, Jamieson Wellness faces inherent risks from fluctuating currency exchange rates and interest rates. These external economic shifts can directly affect the company's bottom line, particularly as its financial reports are denominated in Canadian dollars while its operations span numerous international markets.

For instance, in the first quarter of 2024, Jamieson reported that foreign exchange headwinds, primarily related to the strengthening Canadian dollar against key operating currencies like the US dollar, had a negative impact on its reported revenue and profitability. This sensitivity means that adverse currency movements can erode the value of earnings generated in foreign markets.

Similarly, changes in global interest rates can influence Jamieson's borrowing costs and the attractiveness of its investments. Higher interest rates could increase the expense of servicing debt, while lower rates might reduce the income generated from cash reserves, both impacting overall financial performance.

Competitive Landscape in VMS and OTC Markets

The vitamins, minerals, and supplements (VMS) and over-the-counter (OTC) markets are incredibly crowded. Jamieson Wellness faces a significant challenge from a vast array of competitors, including major pharmaceutical giants and agile, niche brands. This intense rivalry, particularly on a global scale, can strain market share and necessitate aggressive pricing strategies.

This competitive pressure directly impacts Jamieson Wellness by demanding substantial and ongoing investment in research and development for new products, alongside significant marketing spend to maintain brand visibility and appeal. For instance, the global VMS market was valued at approximately USD 150 billion in 2023 and is projected to grow, but this growth is shared among many participants.

- Intense Competition: Jamieson Wellness operates in highly competitive VMS and OTC markets with numerous global and local players.

- Market Share Pressure: Global competition can dilute Jamieson's leading position in Canada, impacting its market share and pricing power.

- Innovation and Marketing Costs: The need to constantly innovate and market effectively requires significant financial resources, potentially impacting profitability.

- Global Market Dynamics: While strong in Canada, expanding globally means facing established international brands and varying consumer preferences.

Potential Impact of Tariffs and Trade Policies

Jamieson Wellness's 2025 financial guidance does not account for potential tariffs on trade between Canada and the United States. This oversight presents a significant risk, as any new or altered trade policies could disrupt its supply chains and increase production expenses. Such disruptions could directly impact the company's overall profitability, creating an unforeseen drag on financial performance.

The company's reliance on international trade makes it particularly vulnerable to shifts in global trade dynamics. For instance, a sudden imposition of tariffs on key raw materials or finished goods could lead to higher cost of goods sold. Jamieson Wellness reported approximately $700 million in revenue for fiscal year 2023, and any significant increase in input costs due to tariffs could erode its margins.

- Trade Policy Vulnerability: Jamieson Wellness's financial projections for 2025 do not incorporate the potential impact of tariffs between Canada and the US.

- Supply Chain Disruption: Unforeseen changes in trade policies could negatively affect the company's ability to source materials and manage production costs.

- Profitability Risk: New tariffs could increase operating expenses, thereby impacting Jamieson Wellness's bottom line and potentially its ability to meet revenue targets.

Jamieson Wellness's product portfolio, while diverse, may not always align with the latest consumer health trends or emerging scientific research. A lag in product innovation or a failure to capitalize on new wellness categories could lead to missed market opportunities. For example, if the market rapidly shifts towards personalized nutrition or novel supplement ingredients, a slower response could cede ground to more agile competitors.

The company's brand perception, while strong in certain markets like Canada, might require significant investment to build comparable recognition and trust in new international territories. Establishing brand equity in diverse global markets can be a slow and costly process, potentially limiting the speed of international expansion and market penetration.

Jamieson Wellness's operational structure, with its global manufacturing and distribution footprint, can introduce complexities in managing quality control and supply chain efficiency across different regions. Ensuring consistent product quality and timely delivery across varied regulatory environments and logistical networks presents an ongoing challenge.

What You See Is What You Get

Jamieson Wellness SWOT Analysis

This is the same Jamieson Wellness SWOT analysis document you'll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Jamieson Wellness's strategic position.

You’re viewing a live preview of the actual SWOT analysis file for Jamieson Wellness. The complete version, offering detailed insights, becomes available after checkout.

Opportunities

The global market for Vitamins, Minerals, and Supplements (VMS) and Over-the-Counter (OTC) products is seeing strong expansion. This growth is fueled by consumers prioritizing preventive healthcare, taking charge of their own health through self-medication, and a general rise in focus on overall well-being. For instance, the global VMS market was valued at approximately USD 150 billion in 2023 and is projected to reach over USD 220 billion by 2028, demonstrating a compound annual growth rate (CAGR) of around 8.4%.

This pervasive consumer shift towards proactive health management aligns perfectly with Jamieson Wellness's established business model and its diverse range of products. The company's offerings are well-positioned to capitalize on this trend, as consumers increasingly seek solutions to support their health goals. The OTC segment, in particular, is benefiting from this trend, with consumers looking for accessible remedies for common ailments.

The surge in e-commerce presents a significant opportunity for Jamieson Wellness. The company saw its youtheory brand's online platforms and e-commerce channels nearly double their performance in Q1 2025, highlighting the power of digital channels.

Further strategic investments in digital marketing and online distribution are poised to unlock substantial growth. This is especially true in key markets like the United States and China, where online consumer behavior is rapidly evolving.

Consumers are actively looking for health and wellness products tailored to their specific needs, moving beyond traditional pills. This shift is evident in the growing popularity of alternative formats such as gummies, powders, and liquids, which offer a more convenient and enjoyable way to consume supplements. This trend is a significant opportunity for Jamieson Wellness to innovate.

Jamieson Wellness is well-positioned to leverage this demand for personalization and novel delivery methods. By continuing to invest in research and development, the company can expand its portfolio with unique formulations and formats that cater to evolving consumer preferences, potentially capturing a larger market share.

In 2024, the global gummy vitamin market alone was projected to reach over $9 billion, highlighting the substantial consumer appetite for these alternative formats. Jamieson's commitment to innovation in product development directly addresses this growing segment, offering a clear path for increased sales and brand appeal.

Untapped Growth in Emerging International Markets

Jamieson Wellness is well-positioned to capitalize on untapped growth in emerging international markets. Beyond its established strongholds in Canada, the United States, and China, the company sees significant potential in regions like the Middle East and Europe. Consumer engagement with the Jamieson brand has notably increased in these areas, signaling a receptive market for its health and wellness products.

To further solidify its presence, Jamieson can leverage strategic global partnerships and expand its digital commerce initiatives. These efforts are crucial for strengthening its market position and reaching a wider consumer base in these developing international territories. For instance, in 2024, Jamieson reported that its international sales, excluding the US and China, grew by 12%, indicating strong early traction in new markets.

- Middle East & Europe Expansion: Increased consumer engagement in these regions presents a clear avenue for sales growth.

- Strategic Partnerships: Collaborating with local distributors and retailers can accelerate market penetration.

- Digital Commerce Growth: Enhancing online sales platforms will cater to evolving consumer purchasing habits globally.

- 2024 Performance: International sales outside of core markets saw a 12% increase, underscoring the opportunity.

Leveraging Sustainability for Brand Enhancement

Jamieson Wellness can significantly boost its brand image by highlighting its dedication to sustainability. As consumers increasingly prioritize ethical and eco-friendly products, Jamieson's existing sustainability efforts, such as reducing packaging waste and sourcing responsibly, can be amplified. This resonates with a growing segment of the market, attracting environmentally conscious individuals and setting Jamieson apart from competitors. For instance, in 2023, Jamieson reported a 5% reduction in its Scope 1 and 2 greenhouse gas emissions compared to its 2020 baseline, a tangible metric that appeals to this demographic.

Leveraging these initiatives offers a clear path to competitive differentiation. By actively communicating its progress in areas like sustainable ingredient sourcing and waste reduction, Jamieson can cultivate stronger customer loyalty. This proactive approach not only meets but anticipates evolving consumer values, potentially leading to increased market share. The company's 2024 sustainability report noted that 70% of its product packaging now incorporates recycled content, a fact that can be prominently featured in marketing campaigns.

This focus on sustainability can translate into tangible financial benefits. Attracting environmentally conscious consumers often correlates with higher willingness to pay and increased brand advocacy. Jamieson's investment in sustainable practices, therefore, acts as a strategic differentiator, enhancing brand perception and potentially driving sales growth. Market research from early 2025 indicates that over 60% of Canadian consumers are more likely to purchase from brands with demonstrable sustainability commitments.

- Brand Enhancement: Capitalize on growing consumer demand for sustainable and ethically produced goods.

- Competitive Differentiation: Showcase Jamieson's commitment to responsible business practices and sustainability initiatives.

- Customer Attraction: Appeal to environmentally conscious consumers, aligning with their values and preferences.

- Data Support: Highlight metrics like a 5% reduction in Scope 1 and 2 GHG emissions (2023 vs. 2020) and 70% recycled content in packaging (2024 report).

Jamieson Wellness is positioned to benefit from the increasing global demand for vitamins, minerals, and supplements, driven by a consumer focus on preventive health and overall well-being. The company's strong e-commerce performance, particularly with brands like youtheory, which saw online channels nearly double in Q1 2025, highlights the significant potential in digital expansion, especially in key markets like the US and China.

The growing consumer preference for alternative supplement formats, such as gummies, presents a substantial innovation opportunity for Jamieson. The global gummy vitamin market was projected to exceed $9 billion in 2024, and Jamieson's commitment to developing novel delivery methods can capture this expanding segment. Furthermore, the company's international expansion, with a 12% growth in sales outside core markets in 2024, demonstrates strong traction in emerging regions like the Middle East and Europe, signaling further growth potential.

Jamieson's sustainability initiatives offer a powerful avenue for brand enhancement and competitive differentiation. With over 60% of Canadian consumers in early 2025 showing preference for brands with sustainability commitments, amplifying efforts like reducing packaging waste and responsible sourcing can attract environmentally conscious consumers. Tangible metrics, such as a 5% reduction in Scope 1 and 2 GHG emissions by 2023 and 70% recycled content in packaging as of their 2024 report, provide concrete evidence of their commitment.

| Opportunity Area | Key Data Point | Implication for Jamieson |

|---|---|---|

| E-commerce Growth | Youtheory online channels nearly doubled in Q1 2025 | Significant potential for increased sales through digital platforms. |

| Alternative Formats | Global gummy vitamin market projected over $9 billion in 2024 | Opportunity to innovate and capture market share with new product formats. |

| International Expansion | 12% growth in international sales (ex-US/China) in 2024 | Untapped potential in emerging markets like the Middle East and Europe. |

| Sustainability Focus | 70% recycled content in packaging (2024 report) | Attracts environmentally conscious consumers, enhancing brand image and loyalty. |

Threats

Jamieson Wellness operates in the Vitamins, Minerals, and Supplements (VMS) and Over-the-Counter (OTC) markets, which are increasingly subject to stricter and evolving regulatory oversight. Potential new legislation, like New York state's proposed regulations on health claims or the federal Dietary Supplement Listing Act of 2024, could significantly impact how products are formulated and marketed.

These regulatory shifts necessitate robust compliance strategies, potentially affecting production processes and requiring adjustments to product formulations to meet new standards. Failure to adapt could lead to market access restrictions or increased operational costs, as seen with past regulatory actions impacting the broader supplement industry.

Economic slowdowns directly impact Jamieson Wellness by reducing disposable income, making consumers more hesitant about discretionary spending. This heightened price sensitivity is particularly concerning in the over-the-counter (OTC) health supplement market, where affordability often dictates purchasing choices.

During economic downturns, consumers are likely to reduce spending on non-essential items like vitamins and supplements, or switch to cheaper, private-label alternatives. This shift can directly affect Jamieson's sales volume and profit margins, as seen in periods of economic contraction where consumer spending on health and wellness products has historically seen a dip.

The growing presence of private label and generic vitamins, minerals, and supplements (VMS) and over-the-counter (OTC) products presents a significant threat. These alternatives can chip away at Jamieson's market share by offering more budget-friendly choices to consumers.

This trend is particularly concerning in economic climates where consumers are more price-sensitive, potentially forcing Jamieson to reconsider its premium pricing strategy. For instance, by mid-2024, many major retailers were expanding their private label VMS lines, capturing an estimated 15-20% of the market in key regions, a notable increase from previous years.

Supply Chain Disruptions and Raw Material Costs

Jamieson Wellness faces a significant threat from global supply chain vulnerabilities and the volatile costs of raw materials, especially for its natural ingredients. These fluctuations can directly affect production efficiency and overall profitability. For instance, during 2024, many companies in the health and wellness sector experienced increased input costs due to persistent logistical challenges and geopolitical instability impacting commodity prices.

The company's operational success hinges on its ability to secure essential raw materials and other necessary inputs from suppliers on favorable terms. Disruptions in this sourcing process, or unfavorable pricing agreements, could materially hinder Jamieson's ability to meet demand and maintain its competitive edge.

- Supply Chain Vulnerabilities: Continued global shipping delays and port congestion observed through early 2024 have created uncertainty in delivery times for key ingredients.

- Raw Material Cost Fluctuations: Prices for certain botanical extracts and vitamins have seen year-over-year increases of 5-10% as of Q2 2024, driven by weather patterns and agricultural yields.

- Supplier Dependence: A reliance on a limited number of suppliers for specialized natural ingredients could exacerbate the impact of any sourcing disruptions.

- Production Efficiency Impact: Delays or increased costs in acquiring raw materials can lead to production slowdowns, potentially impacting Jamieson's ability to fulfill orders promptly.

Emergence of Disruptive Health Technologies and Treatments

The emergence of disruptive health technologies presents a significant threat. For instance, the widespread adoption of GLP-1 medications for weight management, which saw substantial growth in 2024, could divert consumer spending and attention from traditional vitamin and mineral supplements (VMS) if they are perceived as more comprehensive wellness solutions.

Furthermore, the accelerating pace of digital health innovation and the increasing availability of personalized medicine approaches may further shift consumer focus away from conventional supplement regimens. This trend is particularly relevant as digital health platforms are projected to continue their rapid expansion through 2025, potentially offering integrated solutions that encompass diet, exercise, and targeted medical interventions.

- GLP-1 medications: These treatments have gained significant traction, with market forecasts indicating continued strong growth into 2025, potentially impacting the VMS market by offering an alternative perceived as a more complete health solution.

- Digital Health Evolution: The expanding reach and capabilities of digital health technologies and personalized medicine could lead consumers to prioritize these integrated platforms over traditional supplement usage.

- Consumer Perception Shift: A key threat lies in the potential for consumers to view these new technologies as superior or more holistic alternatives to VMS, thereby reducing demand for Jamieson Wellness's core product categories.

Jamieson Wellness faces increasing regulatory scrutiny, with potential new legislation in 2024 and 2025 impacting product claims and formulations, necessitating costly compliance measures. Economic pressures also pose a threat, as reduced consumer disposable income may lead to decreased spending on discretionary items like supplements, favoring cheaper private-label alternatives which have grown to capture an estimated 15-20% market share in key regions by mid-2024.

Supply chain disruptions and volatile raw material costs, with some ingredient prices rising 5-10% year-over-year by Q2 2024, can impact production and profitability. Furthermore, the rise of disruptive health technologies, such as GLP-1 medications which saw strong growth in 2024 and are projected to continue into 2025, could divert consumer spending from traditional supplements.

| Threat Category | Specific Risk | Impact | Data Point/Example |

|---|---|---|---|

| Regulatory Changes | Stricter health claim regulations | Increased compliance costs, marketing limitations | Federal Dietary Supplement Listing Act of 2024 |

| Economic Downturn | Reduced consumer spending | Lower sales volume, margin pressure | Increased price sensitivity in the OTC market |

| Competition | Growth of private label VMS/OTC | Market share erosion, pricing pressure | Private labels captured 15-20% market share by mid-2024 |

| Supply Chain & Costs | Raw material price volatility | Production cost increases, potential shortages | 5-10% price increase for certain vitamins by Q2 2024 |

| Disruptive Technologies | Alternative wellness solutions (e.g., GLP-1s) | Shift in consumer spending and focus | Strong growth of GLP-1s in 2024, projected into 2025 |

SWOT Analysis Data Sources

This Jamieson Wellness SWOT analysis is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert industry analysis. These sources provide a well-rounded view of the competitive landscape and Jamieson's internal capabilities.