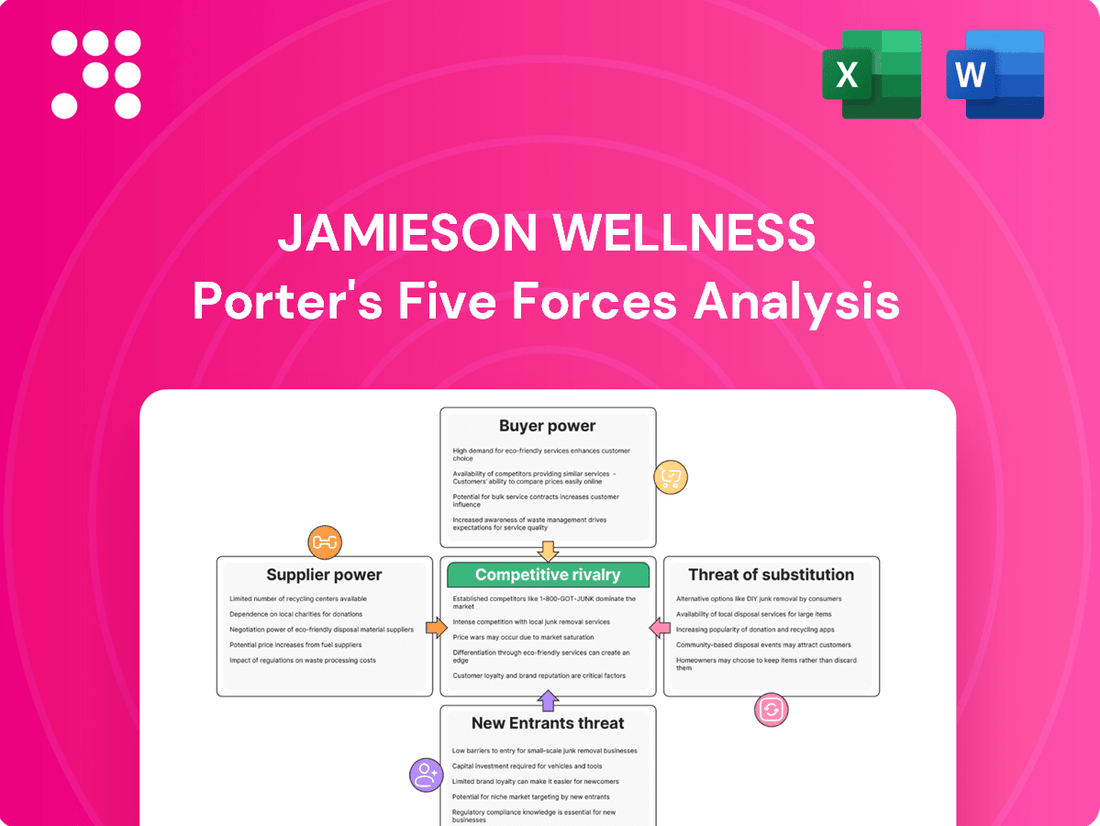

Jamieson Wellness Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jamieson Wellness Bundle

Jamieson Wellness navigates a competitive landscape shaped by moderate bargaining power of buyers and suppliers, yet faces significant threats from substitutes and new entrants. Understanding these dynamics is crucial for strategic advantage.

The complete report reveals the real forces shaping Jamieson Wellness’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Jamieson Wellness faces significant supplier bargaining power when the market for its essential raw materials, such as specific vitamins, minerals, and unique botanical extracts, is highly concentrated. If only a handful of suppliers can provide these critical, high-quality inputs, they gain leverage. This concentration can translate into higher ingredient costs for Jamieson, impacting its profitability. For instance, in 2024, the global vitamin and mineral supplement market experienced supply chain disruptions for certain key nutrients, with a few major producers controlling a significant portion of the output, thereby increasing their pricing power.

Jamieson Wellness's reliance on highly specialized or proprietary ingredients significantly influences supplier bargaining power. If key vitamins, minerals, or botanical extracts are patented or difficult to source elsewhere, suppliers can command higher prices. For instance, if Jamieson sources a unique, scientifically validated extract for a flagship product, the supplier of that extract holds considerable leverage.

Jamieson Wellness faces significant switching costs if it were to change its suppliers for key ingredients and packaging. These costs extend beyond mere financial outlays, encompassing the intricate processes of re-qualifying new suppliers, which involves rigorous testing to ensure product consistency and safety. For instance, in the highly regulated health and wellness sector, any change in raw material sourcing necessitates extensive validation to meet stringent quality control standards and obtain necessary regulatory approvals, a process that can take months and incur substantial expense.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into manufacturing and distributing Jamieson Wellness's vitamins, minerals, and supplements (VMS) products is a key consideration. If key suppliers possess the necessary manufacturing expertise, distribution networks, and brand recognition, they could potentially become direct competitors. This would significantly amplify their bargaining power, allowing them to dictate terms or even capture a larger share of the value chain.

For Jamieson Wellness, assessing this threat involves evaluating the capabilities and incentives of its major raw material and ingredient suppliers. For instance, a large-scale agricultural cooperative that supplies a significant portion of Jamieson's botanical extracts might have the infrastructure to process and package these extracts into finished VMS products under its own brand. Such a move would directly challenge Jamieson's market position.

In 2024, the VMS market continued to see consolidation and investment, potentially increasing the financial capacity of suppliers to pursue forward integration. Companies that supply specialized ingredients, for example, might see an opportunity to leverage their unique product offerings by controlling the final consumer experience and brand messaging. This could be particularly true for suppliers of niche or high-demand ingredients where they hold significant intellectual property or supply chain advantages.

- Supplier Capabilities: Assess if key suppliers have the manufacturing, R&D, and quality control infrastructure to produce VMS products that meet regulatory and consumer standards.

- Market Incentives: Evaluate if suppliers have a strong motivation to enter the VMS market, perhaps due to declining margins in their current business or attractive growth prospects in the VMS sector.

- Brand Recognition and Distribution: Consider whether suppliers possess existing brand equity or established distribution channels that could be leveraged for direct-to-consumer sales.

- Competitive Landscape: Analyze how many suppliers possess these capabilities and incentives, as a higher number increases the overall threat of forward integration.

Importance of Jamieson Wellness to Suppliers' Business

Jamieson Wellness's reliance on specific suppliers for key ingredients and packaging materials directly influences the bargaining power of those suppliers. If Jamieson Wellness constitutes a significant portion of a supplier's annual sales, that supplier may be less inclined to exert strong pricing power or impose unfavorable terms, as they depend on Jamieson's continued business. Conversely, if Jamieson is a small client for a supplier, the supplier holds more leverage.

For instance, in 2023, Jamieson Wellness reported that its cost of goods sold was CAD 376.4 million. The proportion of this figure attributed to any single supplier would determine the supplier's leverage. A supplier providing a critical, niche ingredient that Jamieson cannot easily source elsewhere would naturally possess greater bargaining power.

- Supplier Dependence: The degree to which a supplier's revenue stream is tied to Jamieson Wellness is a primary determinant of their bargaining power.

- Ingredient Specificity: Suppliers of unique or specialized ingredients essential for Jamieson's product formulations tend to have higher bargaining power.

- Jamieson's Scale: As a significant buyer, Jamieson's purchasing volume can offset some supplier power, especially for more commoditized inputs.

- Alternative Sourcing: The availability and cost of alternative suppliers for Jamieson directly impact the bargaining power of existing suppliers.

Jamieson Wellness faces substantial supplier bargaining power when its critical inputs, like specialized vitamins or botanical extracts, are controlled by a few dominant companies. This concentration allows suppliers to dictate higher prices, as seen in 2024 when supply chain issues for key nutrients benefited major producers. The switching costs for Jamieson, involving rigorous re-qualification of new suppliers for safety and consistency, further solidify supplier leverage.

The threat of suppliers integrating forward into manufacturing and distribution amplifies their bargaining power. If suppliers can leverage their expertise and networks to compete directly, they gain significant control. This risk was highlighted in 2024 as market consolidation provided suppliers with greater financial capacity for such expansion, potentially challenging Jamieson's market share.

| Factor | Impact on Jamieson Wellness | 2024 Relevance |

|---|---|---|

| Supplier Concentration | High concentration increases supplier pricing power. | Key nutrient suppliers controlled significant output, raising prices. |

| Switching Costs | High costs for re-qualifying suppliers reinforce existing relationships. | Regulatory hurdles in the VMS sector demand extensive validation for any sourcing changes. |

| Forward Integration Threat | Suppliers entering Jamieson's market increases competitive pressure. | Market consolidation in 2024 offered suppliers increased capital for integration. |

| Jamieson's Dependence | Low dependence on a supplier reduces their leverage. | A supplier providing a niche ingredient Jamieson cannot easily replace holds significant power. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Jamieson Wellness's position in the global health and wellness market.

Jamieson Wellness's Porter's Five Forces analysis, presented in a visually intuitive format, helps alleviate the pain of complex competitive landscape assessment by offering a clear, one-sheet summary for quick strategic decision-making.

Customers Bargaining Power

Jamieson Wellness faces significant customer price sensitivity, particularly in the Vitamins, Minerals, and Supplements (VMS) and Over-the-Counter (OTC) product categories. Consumers often compare prices across numerous brands, making them prone to switching if a competitor offers a lower price point. This sensitivity is heightened by the availability of many alternatives, both from established players and emerging brands.

For instance, in 2024, the global VMS market continued to see intense competition, with promotional pricing and discounts being common tactics to attract and retain customers. Retailers, acting as powerful intermediaries, also exert pressure on manufacturers like Jamieson to maintain competitive pricing to ensure their own shelf space and profitability. This dynamic directly impacts Jamieson's ability to command premium pricing and can squeeze profit margins if not managed strategically.

The health and wellness market, where Jamieson Wellness operates, is characterized by a vast number of readily available substitute products. Customers can easily switch between various brands of vitamins, supplements, and natural health products, as well as private label options offered by major retailers. This abundance of choices significantly enhances customer bargaining power.

In 2024, the global dietary supplements market was valued at approximately $170 billion, with a projected compound annual growth rate of over 8% through 2030. This robust growth indicates intense competition and a wide selection for consumers, reinforcing their ability to demand lower prices or higher quality.

Major retail chains and large e-commerce platforms represent a significant portion of Jamieson Wellness’s distribution channels. Their substantial purchasing volumes, often in the tens of millions of dollars annually for top-tier partners, grant them considerable leverage. This allows these large buyers to negotiate favorable pricing, payment terms, and promotional support, directly impacting Jamieson’s profit margins and operational flexibility.

Customer Information and Transparency

Customers today are remarkably well-informed about product efficacy, ingredients, and pricing across the wellness sector. This heightened awareness is largely driven by the proliferation of online reviews, health blogs, and readily accessible scientific information. For instance, in 2024, platforms like Consumer Reports and various health-focused websites provided detailed comparisons of supplement ingredients and their claimed benefits, directly influencing purchasing decisions.

This increased transparency significantly empowers customers, allowing them to scrutinize claims and compare offerings from brands like Jamieson Wellness against competitors. They can easily research the scientific backing for specific vitamins or supplements and check pricing benchmarks. This makes them more likely to demand clear value for their money and less susceptible to unsubstantiated marketing promises.

- Informed Purchasing: Consumers in 2024 actively research ingredients, efficacy, and price comparisons online before buying wellness products.

- Transparency Drivers: Online reviews, health information websites, and social media significantly contribute to customer knowledge and bargaining power.

- Value Demand: Well-informed customers are more likely to seek demonstrable value and question premium pricing without clear justification.

- Competitive Landscape: Jamieson Wellness, like its peers, faces customers who can readily switch brands based on easily accessible comparative data.

Threat of Backward Integration by Customers

The threat of backward integration by customers poses a significant challenge for Jamieson Wellness. Large retail chains, with their substantial market reach and existing supply chain infrastructure, could potentially develop their own private label vitamins, minerals, and supplements (VMS) and over-the-counter (OTC) products. This would directly compete with Jamieson's branded offerings.

If major retailers possess the capacity and financial incentive to manufacture their own supplements, their bargaining power against branded manufacturers like Jamieson Wellness would undoubtedly increase. This could manifest in demands for lower wholesale prices or preferential shelf space for their private label goods.

- Potential for Private Labeling: Major retailers like Walmart and Amazon have demonstrated success with private label brands across various product categories, including health and wellness.

- Cost Advantages for Retailers: By producing their own VMS products, retailers could potentially achieve lower production costs, allowing them to offer more competitive pricing to consumers.

- Control over Supply Chain: Backward integration grants retailers greater control over product quality, sourcing, and inventory management, reducing reliance on external suppliers.

- Market Share Erosion: The introduction of a retailer's private label VMS line could directly siphon market share away from established brands like Jamieson Wellness.

Jamieson Wellness faces substantial customer bargaining power due to the highly competitive nature of the VMS market and the increasing availability of information. Consumers in 2024 are well-equipped to compare prices, ingredients, and efficacy across numerous brands, readily switching to more cost-effective or perceived higher-value options.

The prevalence of online reviews and detailed product comparisons in 2024 empowers consumers to scrutinize claims and demand clear value, making them less susceptible to premium pricing without robust justification. This informed consumer base can significantly pressure Jamieson's pricing strategies and profit margins.

| Factor | Impact on Jamieson Wellness | 2024 Data/Observation |

| Price Sensitivity | High | Intense promotional pricing common in VMS market. |

| Availability of Substitutes | High | Numerous brands and private label options readily available. |

| Customer Information | High | Online reviews and health sites empower informed comparisons. |

| Retailer Power | Significant | Large retailers leverage purchase volume for favorable terms. |

What You See Is What You Get

Jamieson Wellness Porter's Five Forces Analysis

This preview shows the exact Jamieson Wellness Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the wellness industry. This professionally formatted document is ready for your immediate use and strategic planning.

Rivalry Among Competitors

The Vitamins, Minerals, and Supplements (VMS) and Over-the-Counter (OTC) market is characterized by a substantial number of competitors. This includes global pharmaceutical giants, established consumer health companies, and a growing segment of smaller, niche brands focusing on natural and specialized health products.

This fragmentation means that companies like Jamieson Wellness face rivalry not only from direct competitors in the VMS space but also from a broad array of players in the broader health and wellness sector. For instance, in 2024, the global dietary supplements market was valued at over $170 billion, underscoring the sheer scale and diversity of participants vying for market share.

The Vitamins, Minerals, and Supplements (VMS) and Over-the-Counter (OTC) market is experiencing robust growth, projected to reach approximately $330 billion globally by 2026. This expansion fuels intense competition as numerous players, both established and emerging, battle for consumer attention and market share.

While the overall nutraceutical market is expanding at a healthy pace, certain segments within the VMS sector are becoming increasingly saturated. This saturation intensifies rivalry, forcing companies like Jamieson Wellness to differentiate through innovation, branding, and strategic pricing to capture incremental market gains.

Jamieson Wellness benefits from significant brand differentiation, particularly evident in its strong reputation for quality and its #1 market position in Canada for vitamins and supplements. This established brand equity fosters customer loyalty, acting as a buffer against intense competitive rivalry. For instance, Jamieson's commitment to rigorous testing and natural ingredients, a core part of its brand promise, resonates with health-conscious consumers.

Maintaining this differentiation requires continuous innovation. Jamieson actively invests in research and development to introduce new formulations and product formats, ensuring its offerings remain appealing and relevant in a dynamic market. This proactive approach helps to solidify customer loyalty and provides a competitive edge against rivals who may rely more heavily on price or broad product availability.

Switching Costs for Consumers

Switching costs for consumers in the Vitamins, Minerals, and Supplements (VMS) market are generally low, which can intensify competition for Jamieson Wellness. Consumers can easily try new brands based on price, perceived effectiveness, or marketing claims without significant financial or practical barriers.

This ease of switching means that brands must constantly innovate and offer compelling value propositions to retain customers. For instance, if a competitor launches a new product with a novel ingredient or a more attractive price point, consumers may readily shift their allegiance.

- Low Switching Costs: Consumers face minimal barriers when moving between VMS brands.

- Impact on Competition: Low switching costs increase competitive pressure by encouraging brand experimentation.

- Brand Loyalty Factors: For Jamieson Wellness, building strong brand loyalty relies on consistent quality, effective marketing, and potentially loyalty programs rather than inherent switching barriers.

Exit Barriers for Competitors

Jamieson Wellness faces a competitive landscape where exiting the market can be challenging for rivals. Specialized manufacturing equipment for vitamins and supplements, often requiring significant capital investment and tailored for specific production processes, can be difficult to repurpose or sell at a favorable price. This can trap competitors in segments even when profitability declines.

High fixed costs associated with maintaining production facilities, research and development for new formulations, and extensive distribution networks also contribute to elevated exit barriers. For instance, companies heavily invested in dedicated facilities for softgel encapsulation or tablet pressing might find it uneconomical to shut down operations without incurring substantial losses.

Furthermore, brand loyalty and established market presence can create emotional or strategic attachments, making it harder for competitors to divest. A company that has spent years building a reputation for quality in the Canadian health supplement market, for example, may be reluctant to exit despite increasing competitive pressure, hoping for a market turnaround.

- Specialized Assets: High capital expenditure on unique production machinery for vitamins and supplements limits resale options.

- High Fixed Costs: Significant investments in manufacturing plants, R&D, and distribution networks create ongoing financial commitments.

- Brand Loyalty and Market Presence: Established reputations and customer relationships can foster a reluctance to exit even in challenging market conditions.

The competitive rivalry within the Vitamins, Minerals, and Supplements (VMS) market is fierce, driven by a large number of players ranging from global giants to niche brands. This intense competition is further fueled by the market's substantial growth, with the global dietary supplements market valued at over $170 billion in 2024 and projected to reach approximately $330 billion by 2026. While this expansion presents opportunities, it also intensifies the battle for market share, forcing companies like Jamieson Wellness to continually innovate and differentiate.

Jamieson's strong brand differentiation, particularly its #1 market position in Canada for vitamins and supplements, serves as a key defense against this rivalry. This brand equity, built on a reputation for quality and commitment to natural ingredients, fosters customer loyalty. However, low switching costs for consumers mean that brand allegiance can be fragile, requiring ongoing efforts in product innovation and marketing to retain customers in a dynamic market.

The intensity of competition is also influenced by the high exit barriers for competitors. Specialized manufacturing equipment and significant investments in R&D and distribution networks can make it difficult and costly for companies to leave the market, potentially prolonging competitive pressures.

| Factor | Description | Impact on Jamieson Wellness |

| Number of Competitors | Large and diverse, including global pharmaceutical companies and niche brands. | High rivalry, demanding continuous innovation and strong marketing. |

| Market Growth | Global dietary supplements market valued at over $170 billion in 2024, projected to reach $330 billion by 2026. | Attracts new entrants and intensifies competition for market share. |

| Brand Differentiation | Jamieson's #1 position in Canada and reputation for quality. | Provides a competitive advantage and customer loyalty. |

| Switching Costs | Generally low for consumers. | Increases pressure to retain customers through value and innovation. |

| Exit Barriers | High due to specialized assets and fixed costs. | Can lead to prolonged competition from entrenched players. |

SSubstitutes Threaten

The threat of substitutes for Jamieson Wellness's vitamins, minerals, and supplements (VMS) is significant. Consumers can address similar health concerns through prescription medications, which saw a 4.5% increase in sales in 2023 according to IQVIA data, or by adopting lifestyle changes like increased exercise or improved sleep. Dietary modifications, such as focusing on whole foods, also present an alternative, potentially reducing the perceived need for VMS.

The threat of substitutes for Jamieson Wellness's vitamins, minerals, and supplements (VMS) hinges on the price-performance trade-off of alternative health solutions. Consumers constantly weigh the perceived benefits of VMS against their cost. If other health approaches, like dietary changes or lifestyle modifications, can deliver comparable or superior outcomes more affordably, Jamieson's market share could be impacted.

For instance, while the global VMS market was valued at approximately $151.7 billion in 2023 and projected to reach $250.6 billion by 2030, the rise of functional foods and beverages, which offer added health benefits through natural ingredients, presents a significant substitute. These products often integrate vitamins and minerals directly into everyday consumables, potentially offering a more convenient and cost-effective way for consumers to meet their nutritional needs without purchasing separate supplements.

Jamieson Wellness faces a growing threat from substitutes as consumers become more informed and open to alternative health solutions. Increased public health awareness, amplified by readily available online information and social media trends, encourages exploration beyond traditional vitamin and supplement offerings. For instance, a 2024 report indicated that over 60% of consumers actively research health and wellness alternatives online before making purchase decisions, highlighting a significant shift in consumer behavior.

Regulatory Environment for Substitutes

The regulatory environment significantly influences the threat of substitutes for Jamieson Wellness products. Stricter regulations on the marketing or efficacy claims of Vitamins, Minerals, and Supplements (VMS) could make alternative health solutions more appealing to consumers. Conversely, more favorable regulations for VMS could bolster Jamieson's competitive position against substitutes.

For instance, in 2024, Health Canada continued to emphasize evidence-based claims for natural health products, potentially increasing scrutiny on efficacy. This regulatory stance could indirectly benefit Jamieson if its products meet these standards, while making it harder for less substantiated substitute products to gain traction.

The accessibility and promotion of substitutes are directly impacted by these regulations. For example:

- Stricter advertising standards for VMS can push consumers towards less regulated wellness practices.

- Increased regulatory approval for certain functional foods or medical foods could offer consumers viable alternatives to traditional supplements.

- Evolving regulations around personalized nutrition might create new substitute categories that bypass traditional supplement channels.

- Global regulatory harmonization efforts could either level the playing field for substitutes or introduce new barriers depending on the specific product category.

Perceived Efficacy and Trust in Substitutes

The perceived efficacy and trust consumers place in alternatives significantly impact the threat of substitutes for branded vitamins, minerals, and supplements (VMS). If consumers increasingly believe that lifestyle modifications, such as improved diet and exercise, or pharmaceutical interventions offer comparable or superior health benefits, the demand for traditional VMS products will likely decline.

In 2024, a growing segment of consumers is exploring holistic health approaches that may reduce reliance on supplements. For instance, a significant portion of health-conscious individuals are prioritizing nutrient-dense foods over vitamin pills. This shift is partly driven by increased awareness of the potential for over-supplementation and a desire for natural health solutions.

- Consumer Trust in Lifestyle Changes: Growing consumer confidence in the power of diet and exercise to achieve health goals directly substitutes for VMS.

- Pharmaceutical Alternatives: The development and marketing of pharmaceuticals targeting specific health concerns can be perceived as more potent or reliable than supplements by some consumer groups.

- Perceived Efficacy Gap: If scientific evidence or public perception suggests VMS offer marginal benefits compared to lifestyle changes or pharmaceuticals, the threat intensifies.

- Regulatory Scrutiny: Increased scrutiny and regulation of supplement claims can erode consumer trust, pushing them towards more regulated pharmaceutical options or perceived natural alternatives.

The threat of substitutes for Jamieson Wellness's products remains substantial, driven by evolving consumer preferences and the availability of diverse health solutions. Consumers are increasingly exploring lifestyle changes, dietary adjustments, and functional foods as alternatives to traditional vitamins and supplements. For example, in 2024, the functional food and beverage market continued its upward trajectory, with analysts projecting continued growth driven by consumer demand for integrated health benefits.

The perceived value and effectiveness of these substitutes are key. If consumers believe that a nutrient-rich diet or specific lifestyle habits can adequately address their health needs, the appeal of supplements diminishes. This is particularly true as more information becomes accessible, allowing consumers to make more informed choices about their wellness routines.

The competitive landscape is further shaped by the accessibility and cost-effectiveness of substitutes. Products that offer comparable health outcomes at a lower price point or with greater convenience pose a direct challenge. For instance, the increasing availability of fortified food products in 2024 offered consumers a more integrated approach to nutrient intake, potentially reducing the need for standalone supplements.

Here's a look at some key substitute categories and their market relevance:

| Substitute Category | Key Characteristics | Market Trend (2024 Focus) | Impact on VMS |

|---|---|---|---|

| Lifestyle Modifications (Diet, Exercise) | Natural, holistic health approach; perceived long-term benefits. | Continued strong consumer interest; focus on personalized wellness plans. | Can reduce perceived need for supplements if effective. |

| Functional Foods & Beverages | Nutrient-fortified consumables; convenience and integration into daily diet. | Growing market share; innovation in product offerings. | Directly competes by providing essential nutrients in food form. |

| Prescription Medications | Targeted health solutions; regulated efficacy and safety. | Steady growth in specific therapeutic areas. | Can be seen as a more potent alternative for specific health concerns. |

Entrants Threaten

The vitamins, minerals, and supplements (VMS) and over-the-counter (OTC) product sectors face substantial regulatory hurdles. For instance, in Canada, Health Canada mandates rigorous Good Manufacturing Practices (GMP) and detailed product labeling, while the U.S. Food and Drug Administration (FDA) oversees similar requirements under the Food, Drug, and Cosmetic Act.

These stringent rules translate into high compliance costs and lengthy approval timelines, significantly deterring potential new entrants. Establishing the necessary infrastructure and expertise to meet these standards, such as obtaining site licenses and ensuring product safety and efficacy documentation, represents a considerable upfront investment.

For example, the cost of navigating FDA regulations alone can run into tens of thousands of dollars per product, not including ongoing monitoring and quality assurance. This financial and administrative burden acts as a powerful deterrent, effectively limiting the number of new companies able to enter the market and compete with established players like Jamieson Wellness.

Brand loyalty is a significant barrier for new entrants in the wellness industry, especially for companies like Jamieson Wellness. Jamieson has cultivated over 95 years of consumer trust, a powerful asset that is difficult and costly for newcomers to replicate. This deep-seated loyalty means consumers often stick with familiar, trusted brands for their health and wellness needs, making it challenging for new players to gain market share.

Jamieson Wellness faces a moderate threat from new entrants due to the significant capital required to enter the competitive health and wellness market. Establishing state-of-the-art manufacturing facilities, crucial for quality control and efficiency in producing vitamins and supplements, demands substantial investment. For instance, companies need to invest in advanced production lines and adhere to stringent Good Manufacturing Practices (GMP) which can run into millions of dollars.

Beyond production, building a robust distribution network is a major hurdle. This involves securing shelf space in retail stores, establishing relationships with online marketplaces, and managing complex logistics. In 2023, the global vitamins and dietary supplements market was valued at approximately $170 billion, indicating a large and attractive market, but one that also requires significant capital to gain meaningful market share against established players like Jamieson.

Access to Distribution Channels

New entrants face significant challenges in securing shelf space within major retail chains, pharmacies, and prominent online marketplaces. Established brands like Jamieson Wellness have cultivated long-standing relationships and existing contracts with key distributors, making it difficult for newcomers to gain access. This limited access to distribution channels acts as a substantial barrier, impeding the ability of new companies to reach a broad consumer base and compete effectively.

Established players often benefit from preferred placement and promotional support from retailers, further solidifying their market position. For instance, in 2024, the top five vitamin and supplement brands in Canada accounted for over 60% of retail sales, highlighting the concentration of market power and the difficulty for new entrants to break through.

- Limited Retail Shelf Space: Major retailers often have limited space, prioritizing established brands with proven sales records.

- Existing Distributor Contracts: New entrants must navigate complex and often exclusive agreements between existing brands and distributors.

- High Slotting Fees: Securing prime shelf placement can require substantial upfront payments, a significant hurdle for startups.

- Online Platform Competition: Even online, visibility is often driven by advertising spend and established brand recognition, making it hard for new products to be discovered.

Economies of Scale in Manufacturing and Marketing

Jamieson Wellness, like many established players in the health and wellness sector, benefits significantly from economies of scale in both manufacturing and marketing. This presents a substantial barrier for potential new entrants. For instance, in 2023, Jamieson Wellness reported total revenue of CAD $545.4 million, indicating a large operational footprint that allows for cost efficiencies in sourcing raw materials and production processes.

New companies entering the market would find it challenging to match the per-unit production costs that Jamieson can achieve due to its high-volume output. Furthermore, the substantial marketing budgets of established firms, which can run into tens of millions annually, enable widespread brand recognition and consumer reach. Competing with these established marketing efforts, which often involve significant investment in digital advertising, influencer collaborations, and retail promotions, would require a considerable upfront capital outlay for any new entrant.

- Manufacturing Scale: Jamieson's large-scale production facilities allow for lower per-unit manufacturing costs, a significant advantage over smaller, newer operations.

- Marketing Reach: Established brands command higher marketing spend, creating strong brand awareness that new entrants struggle to replicate without substantial investment.

- Pricing Pressure: The cost advantages derived from scale enable incumbents to offer competitive pricing, making it difficult for new entrants to gain market share on price alone.

The threat of new entrants for Jamieson Wellness is moderate, primarily due to high capital requirements and established brand loyalty. Significant investment is needed for manufacturing, distribution, and marketing to compete effectively. For example, the global vitamins and dietary supplements market, valued around $170 billion in 2023, is attractive but requires substantial capital to gain traction against established players.

Regulatory compliance, including GMP and FDA standards, adds considerable cost and time, acting as a substantial barrier. Furthermore, securing retail shelf space is challenging, as established brands like Jamieson have strong distributor relationships. In 2024, the top five vitamin brands in Canada held over 60% of retail sales, illustrating the difficulty for newcomers to gain visibility.

| Barrier | Description | Impact on New Entrants |

| Capital Requirements | High investment for manufacturing, distribution, and marketing. | Significant hurdle, limiting the number of viable new entrants. |

| Brand Loyalty | Jamieson's 95+ years of consumer trust. | Makes it difficult for new brands to attract and retain customers. |

| Regulatory Hurdles | Stringent GMP and FDA compliance. | Increases costs and lengthens time-to-market, deterring smaller players. |

| Distribution Access | Securing shelf space and navigating existing contracts. | Limits reach and visibility for new products. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Jamieson Wellness leverages data from company annual reports, investor presentations, and industry-specific market research reports to understand competitive dynamics.

We also incorporate insights from trade publications, competitor websites, and financial news outlets to provide a comprehensive view of the competitive landscape.