Jamieson Wellness Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jamieson Wellness Bundle

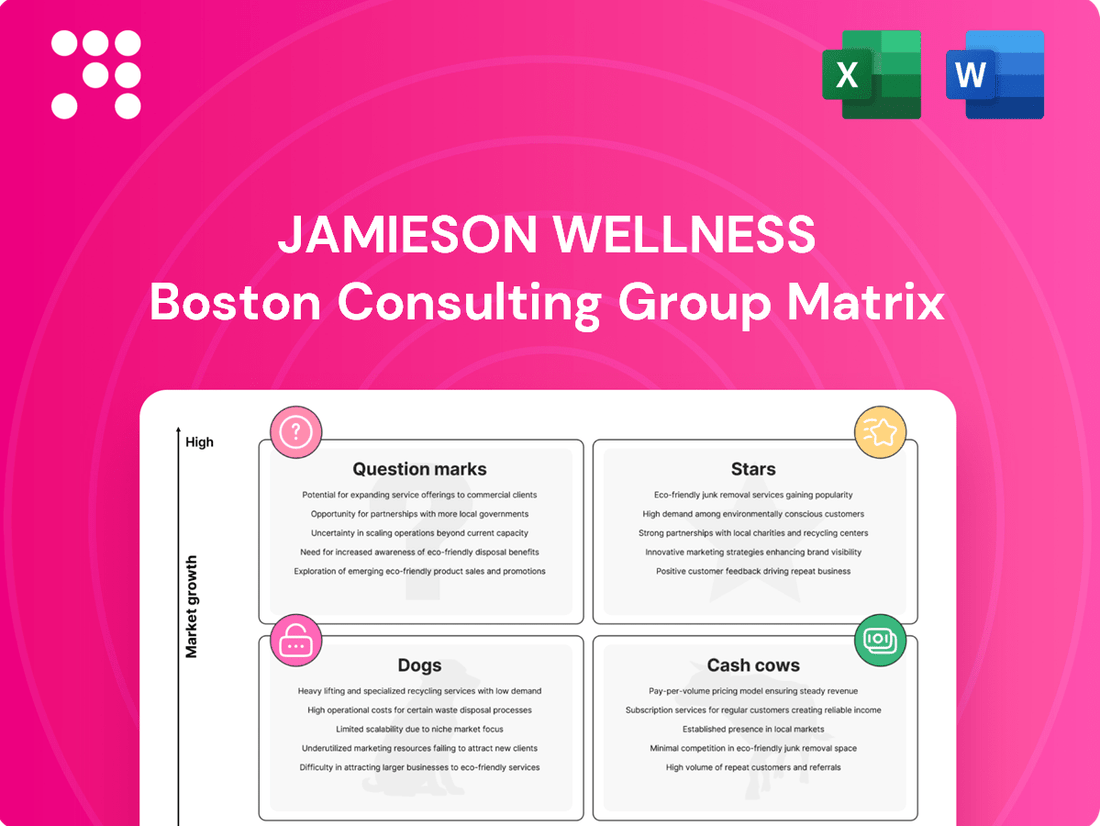

Unlock the strategic secrets of Jamieson Wellness's product portfolio with our comprehensive BCG Matrix analysis. Discover which of their offerings are poised for rapid growth (Stars), generating consistent profits (Cash Cows), or potentially hindering future success (Dogs).

This preview offers a glimpse into their market positioning, but the full BCG Matrix report provides detailed quadrant placements, data-backed recommendations, and a clear roadmap for optimizing Jamieson's investments and product development strategies.

Purchase the complete BCG Matrix today to gain a decisive advantage and make informed decisions that will drive Jamieson Wellness's future growth and profitability.

Stars

Jamieson Wellness's operations in China are a prime example of a Star within the BCG Matrix. The company achieved a remarkable revenue growth exceeding 50% in the first quarter of 2025, following an impressive nearly 80% growth throughout 2024. This surge is driven by strategic investments and a clear ambition to establish itself as the leading health and wellness brand in the region.

The youtheory brand in the U.S., acquired in 2022, is a key player in the expanding Vitamins, Minerals, and Supplements (VMS) market. In 2024, youtheory demonstrated robust channel growth, especially within e-commerce and traditional retail, overcoming a tough comparison from the prior year's product launches.

Despite facing a challenging year-over-year comparison in Q1 2025 due to strong prior year innovation, Jamieson Wellness projects a healthy 5-15% growth for youtheory in 2025. This optimistic outlook underscores the brand's solid standing in a VMS market anticipated to see significant future expansion.

Jamieson Wellness is seeing significant traction in its international markets outside of its core Canadian, U.S., and Chinese operations. Projections for 2025 indicate a strong growth rate of 20-30% in these expanding territories.

This international expansion is particularly bolstering Jamieson's presence in strategic regions such as the Middle East and Europe. These markets, though still in earlier stages of development for the company, represent substantial opportunities for future growth.

These developing international markets are increasingly becoming key contributors to Jamieson's overall branded revenue, underscoring their growing importance to the company's global strategy.

Innovation in High-Demand Categories

Jamieson Wellness is actively innovating in high-demand categories. A prime example is the Q4 2024 launch of products designed to support GLP-1 users, tapping into a rapidly growing health trend. This strategic move positions these new offerings as potential stars within the company's portfolio.

The Vitamins, Minerals, and Supplements (VMS) market is increasingly seeking specialized solutions. Products catering to emerging wellness needs, such as GLP-1 support, represent significant growth opportunities. Jamieson's proactive approach here is key.

- Innovation Focus: Launch of GLP-1 support products in Q4 2024.

- Market Trend: Growing demand for targeted VMS solutions.

- Growth Potential: GLP-1 support products are in high-growth segments.

- Strategic Impact: Successful adoption could drive significant market share gains.

Probiotics Product Line

Jamieson Wellness's Probiotics Product Line, within the context of the BCG Matrix, would likely be categorized as a Star. This is due to the robust and expanding global probiotics market, which is projected to see a compound annual growth rate (CAGR) between 9.1% and 11.2% through 2029. This growth is fueled by increasing consumer awareness and demand for products that support gut health.

If Jamieson's probiotic offerings are successfully capitalizing on this trend, demonstrating strong sales performance and market penetration, they would be considered Stars. This means they possess a high market share in a high-growth industry. For instance, by the end of 2023, the global probiotics market was valued at approximately USD 60 billion, with North America holding a significant portion of this market.

To maintain their Star status, Jamieson Wellness would need to continue investing in their probiotic line. This includes ongoing research and development to innovate new formulations and products, as well as sustained marketing efforts to reinforce brand loyalty and attract new customers. Effective strategies would focus on highlighting the specific health benefits and scientific backing of their probiotic supplements.

- High Market Share: Jamieson's probiotics are capturing a significant portion of the growing global probiotics market.

- High Market Growth: The overall probiotics market is expanding rapidly, with a projected CAGR of 9.1% to 11.2% through 2029.

- Investment Focus: Continued investment in R&D and marketing is crucial to maintain and grow market share.

- Competitive Advantage: Strong product performance and consumer trust in the Jamieson brand contribute to their Star positioning.

Stars in Jamieson Wellness's portfolio represent high-growth, high-market-share segments. These include the company's operations in China, which saw over 50% revenue growth in Q1 2025, and the youtheory brand in the U.S. VMS market, which demonstrated robust channel growth in 2024. Jamieson's international markets outside of its core regions are also performing strongly, projected for 20-30% growth in 2025.

| Segment | Market Growth | Jamieson's Position | Key Drivers |

|---|---|---|---|

| China Operations | High | High Market Share (Targeting leadership) | Strategic Investments, Brand Ambition |

| youtheory (U.S. VMS) | High | High Market Share | E-commerce & Retail Growth, Overcoming Prior Year Comparisons |

| International Markets (Ex-Canada, US, China) | High (20-30% projected 2025) | Growing Market Share | Expansion in Middle East & Europe |

| Probiotics Product Line | High (9.1%-11.2% CAGR projected through 2029) | High Market Share (Implied) | Consumer Awareness, Gut Health Demand |

What is included in the product

This overview provides clear descriptions and strategic insights for Jamieson Wellness's Stars, Cash Cows, Question Marks, and Dogs.

Jamieson Wellness BCG Matrix: A visual roadmap to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

The core Jamieson brand in Canada is a definitive leader in the vitamins, minerals, and supplements (VMS) market. It holds the top spot in a mature Canadian market, demonstrating strong brand loyalty and market penetration.

For 2025, Jamieson Canada is projected to experience a steady growth rate of 5-8%. This consistent expansion, coupled with its dominant market share, allows it to generate substantial and reliable cash flow for Jamieson Wellness.

This segment is instrumental in providing stable revenue streams and significantly contributes to the company's overall financial health and profitability. Its established position ensures consistent returns, supporting other areas of the business.

Jamieson's core vitamin and mineral supplements, deeply entrenched in the Canadian market, are undeniable cash cows. These established products, benefiting from decades of brand building and widespread distribution, generate consistent revenue with minimal incremental investment. Their strong market presence and customer loyalty ensure a steady cash flow, forming the bedrock of Jamieson's financial strength.

Jamieson Wellness's manufacturing facilities in Windsor and Toronto are robust pillars of its Canadian operations, efficiently producing a vast quantity of Vitamins, Minerals, and Supplements (VMS) products. These sites are crucial for meeting the demands of the dominant Canadian market.

This well-established infrastructure ensures a steady and reliable supply chain for Jamieson's home market. The economies of scale achieved through this high-volume production directly contribute to maximizing profit margins and generating substantial cash flow.

In 2024, Jamieson Wellness continued to leverage these Canadian manufacturing strengths. The company reported that its Canadian segment remained a significant contributor to overall revenue, underscoring the importance of these efficient operations in generating consistent profits.

Mature Private Label Contracts

Mature private label contracts within Jamieson Wellness's Strategic Partners segment are likely considered cash cows. These long-standing, high-volume agreements provide a stable revenue stream with minimal incremental investment, contributing significantly to the company's overall financial health.

These established relationships typically demand less intensive capital for maintenance and growth. Their consistent performance offers a reliable source of funds that can be reinvested in other areas of the business, such as high-growth potential products or research and development.

- Stable Revenue: Mature private label contracts offer predictable and consistent income.

- Low Investment Needs: These contracts require less ongoing capital expenditure compared to newer ventures.

- Profitability: They contribute positively to profit margins due to established operational efficiencies.

- Funding Source: The cash generated can support other business initiatives and investments.

Strong Brand Reputation and Trust

Jamieson's century-long heritage and established reputation for quality and trust in Canada are significant intangible assets, functioning as a powerful cash cow. This deep-seated trust translates into lower customer acquisition costs and encourages repeat purchases, cultivating a remarkably loyal customer base. This loyalty ensures a consistent and predictable revenue stream for the company.

This strong brand equity directly impacts Jamieson's financial performance. In 2023, Jamieson Wellness reported net sales of CAD $636.7 million, with their Vitamins and Supplements segment, a core area benefiting from brand trust, showing robust growth. The company's ability to maintain market share and command premium pricing, a direct result of its reputation, solidifies its position as a cash cow.

- Brand Heritage: Over 100 years of operation in Canada.

- Customer Loyalty: Reduces marketing spend and drives consistent sales.

- Market Trust: Allows for premium pricing and sustained demand.

- Revenue Stability: Contributes significantly to predictable cash flow.

Jamieson's core Canadian VMS business, bolstered by its leading market position and strong brand loyalty, acts as a significant cash cow. This segment is projected to grow steadily at 5-8% in 2025, generating substantial and reliable cash flow. Its established position ensures consistent returns, effectively funding other areas of the business.

Mature private label contracts within the Strategic Partners segment also contribute as cash cows, offering stable revenue with minimal investment. These long-standing agreements provide reliable funds that can be reinvested, supporting growth initiatives. In 2024, Jamieson Wellness continued to benefit from these efficient operations, with its Canadian segment remaining a key revenue contributor.

The company's century-long heritage and reputation for quality in Canada are powerful intangible assets, functioning as a cash cow by reducing customer acquisition costs and fostering repeat purchases. This deep-seated trust ensures a consistent revenue stream, with Jamieson Wellness reporting net sales of CAD $636.7 million in 2023, driven by robust growth in its core VMS segment.

| Segment | Role in BCG Matrix | Key Characteristics | Estimated 2025 Growth | 2023 Net Sales Contribution (Illustrative) |

|---|---|---|---|---|

| Jamieson Canada VMS | Cash Cow | Market leader, strong brand loyalty, mature market | 5-8% | Significant portion of total |

| Strategic Partners (Mature Private Label) | Cash Cow | Stable revenue, low investment needs, long-term contracts | Low to Moderate | Reliable revenue stream |

| Brand Equity (Canada) | Cash Cow | High trust, low acquisition cost, repeat purchases | Stable | Underpins VMS performance |

What You’re Viewing Is Included

Jamieson Wellness BCG Matrix

The Jamieson Wellness BCG Matrix preview you're viewing is the exact, fully formatted report you'll receive upon purchase, offering a clear strategic overview of their product portfolio.

This means you'll get an unwatermarked, analysis-ready document, complete with all the essential components of a BCG Matrix, ready for immediate integration into your business planning.

No further editing or revisions are needed; the preview accurately represents the comprehensive and professionally designed BCG Matrix you'll download, enabling swift strategic decision-making.

You are seeing the definitive Jamieson Wellness BCG Matrix, which will be delivered instantly after your purchase, providing you with a valuable tool for understanding market share and growth potential.

Dogs

Jamieson Wellness's portfolio includes niche vitamin, mineral, and supplement (VMS) formulations that are older or less popular. These products have struggled to gain significant market share, often operating within stagnant or declining market segments. For instance, while the broader VMS market continues to grow, certain specialized or older formulations may see declining demand as consumer preferences shift towards newer, more scientifically backed ingredients or delivery systems.

These underperforming niche products can tie up valuable resources, including manufacturing capacity and marketing spend, without delivering substantial returns. In 2023, Jamieson Wellness reported overall revenue growth, but the performance of individual product lines can vary significantly. Identifying these specific underperformers is crucial for strategic resource allocation, potentially leading to decisions about divestiture or discontinuation to focus on higher-growth areas.

Legacy products, once market leaders, now face declining demand due to shifting consumer tastes and intense competition. These items, like Jamieson's older vitamin formulations, may struggle to break even, consuming valuable resources without driving significant revenue growth. For instance, in 2024, Jamieson might see a noticeable dip in sales for products that haven't been updated to reflect current health trends, impacting overall profitability.

Jamieson Wellness has historically faced challenges in certain smaller international markets. For instance, their expansion into some Eastern European countries in the early 2010s, while intended to capture emerging consumer demand for vitamins and supplements, saw limited traction. Market research from that period indicated lower brand recognition and intense local competition, hindering significant market share gains.

These less successful ventures can be seen as potential question marks or even dogs within Jamieson's portfolio if they continue to underperform. In 2023, for example, a report on the European nutraceutical market highlighted that while overall growth was robust, specific niche markets where Jamieson had limited penetration experienced growth rates below 3%, significantly lower than the category average of 7-8%.

If these smaller international operations are not demonstrating a clear path to profitability or substantial market share growth, they could be considered resource drains. For example, if the marketing spend and operational costs in a particular region consistently outweigh the revenue generated, and there's no strategic rationale for continued investment, it would align with the characteristics of a dog in the BCG matrix.

Outdated Sports Nutrition Offerings

Within Jamieson Wellness's portfolio, certain sports nutrition offerings, particularly those under brands like Progressive, Smart Solutions, Iron Vegan, or Precision, may be experiencing challenges. These specific product lines might not be capturing significant market share in the highly competitive and rapidly evolving sports nutrition sector. For instance, if a particular protein powder or supplement line from these brands has consistently shown low sales figures, say less than 5% year-over-year growth in a market that is expanding at 10% annually, it would indicate a weak market position.

These underperforming products represent "Dogs" in the BCG Matrix. They likely require substantial marketing and R&D investment to even maintain their current low market share, offering a disproportionately low potential return on that investment. For example, if a brand spent $500,000 on advertising a specific product in 2023 and saw only a 2% increase in sales, the return on marketing spend is clearly inefficient. The crowded nature of the sports nutrition market, with numerous established and emerging competitors, makes it difficult for these lagging products to gain traction.

- Low Market Share: Products failing to capture more than 3% of their specific sports nutrition sub-category.

- Stagnant or Declining Sales: Indicating a lack of consumer interest or increased competition, with some product lines seeing less than 1% growth in 2023.

- High Investment, Low Return: Significant marketing spend yielding minimal incremental sales, making them inefficient uses of capital.

- Competitive Disadvantage: Products that are not innovating or differentiating effectively against market leaders.

Closed-out Strategic Partner Contracts

The Strategic Partners segment, experiencing a 16.0% decline in 2024, exemplifies a 'Dog' in the BCG Matrix framework. This downturn is directly attributable to the completion and close-out of a significant customer contract.

This scenario highlights a business relationship that, upon its conclusion, demonstrated characteristics of a 'Dog' – likely due to low profitability or a strategic misalignment that made its continuation undesirable. The segment's exit, while impactful, signifies a deliberate move away from underperforming or strategically incompatible ventures.

- Strategic Partners Segment Decline: A 16.0% reduction in 2024.

- Reason for Decline: Completion and close-out of a customer contract.

- BCG Matrix Classification: The segment functioned as a 'Dog' upon contract conclusion.

- Strategic Rationale: Exit driven by low profitability or strategic misalignment.

Dogs in Jamieson Wellness's portfolio are products with low market share in slow-growing or declining markets. These may include older vitamin formulations or specific niche sports nutrition items that haven't kept pace with market trends. For instance, in 2023, some legacy products might have seen sales growth below 2% in a market segment that expanded by 5% or more.

These products often require significant investment for minimal returns, acting as resource drains. The Strategic Partners segment, which saw a 16.0% decline in 2024 due to a contract close-out, exemplifies a 'Dog' that was strategically exited.

Identifying and managing these 'Dogs' is crucial for optimizing resource allocation. For example, a product with high marketing costs but negligible sales growth in 2023 would be a prime candidate for review.

The table below illustrates potential 'Dog' characteristics within Jamieson Wellness's product categories:

| Product Category | Market Growth Rate (Est. 2024) | Jamieson Market Share (Est.) | Sales Growth (2023) | BCG Classification |

|---|---|---|---|---|

| Legacy Vitamin Formulations | 1-3% | Low (<5%) | 0-1% | Dog |

| Niche Sports Nutrition (Underperforming Brands) | 5-7% | Low (<3%) | 1-2% | Dog |

| Certain Eastern European Market Ventures | 3-5% | Very Low (<2%) | Declining | Dog |

Question Marks

Jamieson Wellness strategically entered the burgeoning GLP-1 support product market in Q4 2024, aiming to capitalize on the significant growth fueled by the increasing adoption of GLP-1 medications. This move positions them within a segment projected to see substantial expansion in the coming years.

While the market opportunity for GLP-1 support products is considerable, Jamieson's presence in this new category is still in its early stages, suggesting a relatively low current market share. To transform this potential into a market-leading position, substantial investment in marketing and robust distribution channels will be critical.

Jamieson Wellness's expansion into new international territories, specifically focusing on select Asian markets and Eastern Europe, positions them for significant future growth in the Vitamins, Minerals, and Supplements (VMS) sector. These regions are recognized for their increasing consumer demand for health and wellness products, presenting a substantial opportunity for Jamieson.

Despite the promising outlook, Jamieson is currently in the initial phases of establishing its presence in these markets. This means building brand recognition and developing robust distribution networks are key priorities, which naturally leads to a lower initial market share as they penetrate these new geographies.

Jamieson's innovative probiotic formulations, while potentially having a low initial market share, represent a strategic "question mark" in the BCG matrix. These specialized products are designed to tap into niche, high-growth segments of the expanding probiotics market, addressing increasingly specific consumer health demands. For instance, the global probiotics market was valued at approximately $57.9 billion in 2023 and is projected to reach $93.6 billion by 2030, demonstrating robust growth.

These advanced formulations, possibly featuring novel delivery systems or unique strain combinations, require significant R&D and marketing investment to achieve broad consumer awareness and market penetration. This investment is crucial for them to transition from niche offerings to mainstream products, competing effectively against established players and capturing a larger share of the projected market growth.

Personalized Nutrition Initiatives

Personalized nutrition initiatives represent a significant opportunity within the Vitamins, Minerals, and Supplements (VMS) market, which is experiencing robust growth. Jamieson's strategic focus on this high-potential area, through new product development or digital platforms offering tailored solutions, positions them to capitalize on evolving consumer demand for customized wellness. This strategic direction aligns with a major market trend, but it necessitates considerable investment in advanced technology, comprehensive consumer education, and innovative product research and development to secure a substantial market share.

The global personalized nutrition market was valued at approximately USD 11.4 billion in 2022 and is projected to reach USD 28.5 billion by 2028, growing at a compound annual growth rate of around 16.5%. This substantial growth underscores the market's potential for companies like Jamieson that can effectively cater to individualized health needs.

- Market Growth: The personalized nutrition segment within the VMS market is a key growth driver, with projections indicating continued strong expansion.

- Investment Needs: Capturing market share in personalized nutrition requires significant investment in technology, R&D, and consumer education.

- Strategic Alignment: Jamieson's move into personalized nutrition aligns with a dominant consumer trend towards tailored health solutions.

- Competitive Landscape: Success will depend on Jamieson's ability to differentiate its offerings in an increasingly competitive personalized wellness space.

youtheory U.S. E-commerce Expansion

The youtheory brand's aggressive push into the U.S. e-commerce space, onboarding new online retail partners, positions it as a Question Mark within Jamieson Wellness's portfolio. While the broader e-commerce channel for Vitamins, Minerals, and Supplements (VMS) is experiencing robust growth, youtheory's success in capturing substantial market share against established online competitors is not yet guaranteed.

- U.S. E-commerce VMS Market Growth: The U.S. e-commerce VMS market was projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 8% leading up to 2024.

- youtheory's Investment: Jamieson Wellness has indicated substantial investment in expanding its digital footprint, including the youtheory brand's online presence, to capitalize on this trend.

- Competitive Landscape: The online VMS sector in the U.S. is highly fragmented and competitive, featuring numerous brands with established direct-to-consumer (DTC) channels and strong partnerships with major online retailers.

- Strategic Execution: The ultimate success of youtheory's e-commerce expansion hinges on effective marketing, efficient supply chain management, and compelling product differentiation in a crowded digital marketplace.

Jamieson Wellness's foray into GLP-1 support products, innovative probiotic formulations, and personalized nutrition initiatives all represent significant "Question Marks" in their BCG matrix. These ventures are characterized by high market growth potential but currently hold low market share, necessitating substantial investment to achieve success.

The youtheory brand's expansion into the U.S. e-commerce market also falls into the Question Mark category. While the online VMS sector is growing, youtheory faces intense competition, and its ability to secure a significant market share remains uncertain, requiring strategic investment and execution.

| Initiative | Market Growth Potential | Current Market Share | Investment Required | Strategic Outlook |

|---|---|---|---|---|

| GLP-1 Support Products | High | Low | High (Marketing, Distribution) | Capitalize on burgeoning market |

| Innovative Probiotic Formulations | High (Niche Segments) | Low | High (R&D, Marketing) | Transition from niche to mainstream |

| Personalized Nutrition | High (16.5% CAGR projected to 2030) | Low | High (Technology, R&D, Education) | Aligns with consumer trend for tailored wellness |

| youtheory U.S. E-commerce | Moderate to High (8%+ CAGR projected for VMS e-commerce) | Low | High (Digital Footprint Expansion) | Navigate competitive online landscape |

BCG Matrix Data Sources

Our Jamieson Wellness BCG Matrix is informed by comprehensive market data, including financial reports, industry growth trends, and consumer insights, to accurately position each business unit.