Intercontinental Hotels Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intercontinental Hotels Group Bundle

InterContinental Hotels Group (IHG) boasts a powerful global brand portfolio and a robust loyalty program, key strengths in a competitive hospitality market. However, they face significant threats from emerging boutique brands and the need to adapt to rapidly changing consumer preferences. Discover the complete picture behind IHG's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

InterContinental Hotels Group (IHG) commands an impressive global brand portfolio, featuring 19 distinct hotel brands across luxury, premium, essentials, and suites. This extensive collection, encompassing over 6,600 hotels in more than 100 countries as of early 2024, effectively captures a broad spectrum of traveler needs and market segments. The strategic inclusion of brands like the ultra-luxury InterContinental and the boutique Kimpton alongside the universally recognized Holiday Inn and Holiday Inn Express demonstrates IHG's ability to appeal to diverse customer bases.

The acquisition of the Ruby brand in late 2023 further bolsters IHG's presence in the dynamic urban lifestyle segment. This move not only broadens its geographical footprint but also introduces a flexible and attractive concept for hotel owners, reinforcing IHG's strength in adapting to evolving market trends and expanding its competitive edge.

InterContinental Hotels Group's (IHG) asset-light business model is a significant strength, primarily functioning as a franchisor and hotel manager. This approach minimizes direct ownership of properties, thereby reducing capital expenditure and operational risks. For instance, as of the first quarter of 2024, IHG's system grew by 4.1% year-on-year, with 94% of its hotels operating under franchise or management agreements, highlighting the prevalence of this asset-light strategy.

This focus on brand building, loyalty programs, and fee-based income allows IHG to maintain agility and adapt swiftly to market shifts. The model fosters robust relationships with a vast network of hotel owners, contributing to a scalable and resilient business structure. By leveraging its brand power and operational expertise, IHG can expand its global footprint efficiently.

IHG's robust loyalty program, IHG One Rewards, boasts over 145 million members globally, a significant asset for customer retention and driving direct bookings. This extensive reach provides a substantial competitive advantage in the hospitality sector.

Substantial investments in technology, particularly the IHG Concerto platform, are enhancing digital capabilities. This focus on cloud-based solutions and AI-powered guest support aims to deliver seamless, app-driven experiences, improving both operational efficiency and guest satisfaction.

Strong Financial Performance and Growth Momentum

InterContinental Hotels Group (IHG) has showcased impressive financial strength, with notable revenue growth and expanding operating margins throughout 2024 and into Q1 2025. This performance is underpinned by a healthy increase in RevPAR, a key industry metric, which rose by 3.3% in the first quarter of 2025. The Americas and EMEAA (Europe, Middle East, Africa, and Asia) regions were particularly strong contributors to this uplift.

Furthermore, IHG’s commitment to future expansion is evident in its substantial development pipeline. The company has a robust pipeline of 334,000 rooms across 2,265 hotels, indicating significant potential for future system size growth and sustained revenue generation.

- Robust Revenue Growth: IHG experienced strong revenue increases in 2024 and Q1 2025.

- RevPAR Increase: Global RevPAR saw a 3.3% rise in Q1 2025, boosted by key regions.

- Improved Margins: Operating margins have shown positive trends, reflecting operational efficiency.

- Extensive Development Pipeline: A pipeline of 334,000 rooms across 2,265 hotels signals considerable future expansion.

Commitment to Sustainability and Responsible Business

InterContinental Hotels Group (IHG) demonstrates a strong commitment to sustainability through its comprehensive 'Journey to Tomorrow' strategy. This plan outlines ambitious targets for environmental, social, and governance (ESG) improvements across its global operations. For instance, by the end of 2023, IHG reported a 15% reduction in carbon intensity compared to their 2019 baseline, exceeding their interim goal.

Further solidifying this commitment, IHG launched the 'Low Carbon Pioneers' program, which specifically targets the reduction of greenhouse gas emissions within the hospitality sector. This initiative focuses on practical solutions like increasing renewable energy use and enhancing building efficiency. By aligning with the UN's Sustainable Development Goals, IHG not only contributes to global environmental efforts but also strengthens its appeal to a growing segment of eco-conscious consumers and corporate partners seeking sustainable travel options.

The tangible results of these efforts are evident. In 2024, IHG hotels globally saw a 10% increase in guest participation in their recycling programs. This dedication to responsible business practices is a significant strength, enhancing brand loyalty and attracting investment from socially responsible funds.

- Journey to Tomorrow Strategy: A comprehensive ESG plan with clear targets.

- Low Carbon Pioneers Program: Focuses on reducing emissions through energy efficiency and renewables.

- Environmental Impact: Achieved a 15% reduction in carbon intensity by end of 2023 (vs. 2019 baseline).

- Guest Engagement: Saw a 10% rise in recycling participation in 2024.

IHG's extensive brand portfolio, featuring 19 distinct brands, allows it to cater to a wide range of travelers and market segments globally. This diversity, combined with a strategic asset-light model focused on franchising and management, significantly reduces capital expenditure and operational risks. The company's robust IHG One Rewards loyalty program, with over 145 million members, is a key driver of customer retention and direct bookings, providing a substantial competitive advantage.

Technological advancements, particularly the IHG Concerto platform, are enhancing digital guest experiences and operational efficiency. Furthermore, IHG's strong financial performance, marked by revenue growth and an expanding development pipeline of over 334,000 rooms, positions it for sustained future expansion. The company's commitment to sustainability, demonstrated by its 'Journey to Tomorrow' strategy and a 15% reduction in carbon intensity by the end of 2023, appeals to an increasingly eco-conscious market.

| Strength | Description | Supporting Data |

| Brand Portfolio Diversity | Wide range of brands catering to various segments. | 19 distinct hotel brands. |

| Asset-Light Model | Minimizes capital expenditure and operational risk. | 94% of hotels under franchise/management agreements (Q1 2024). |

| Loyalty Program | Drives customer retention and direct bookings. | Over 145 million IHG One Rewards members. |

| Financial Performance | Strong revenue growth and development pipeline. | 3.3% RevPAR increase (Q1 2025); 334,000 room development pipeline. |

| Sustainability Commitment | Appeals to eco-conscious consumers and partners. | 15% carbon intensity reduction by end of 2023. |

What is included in the product

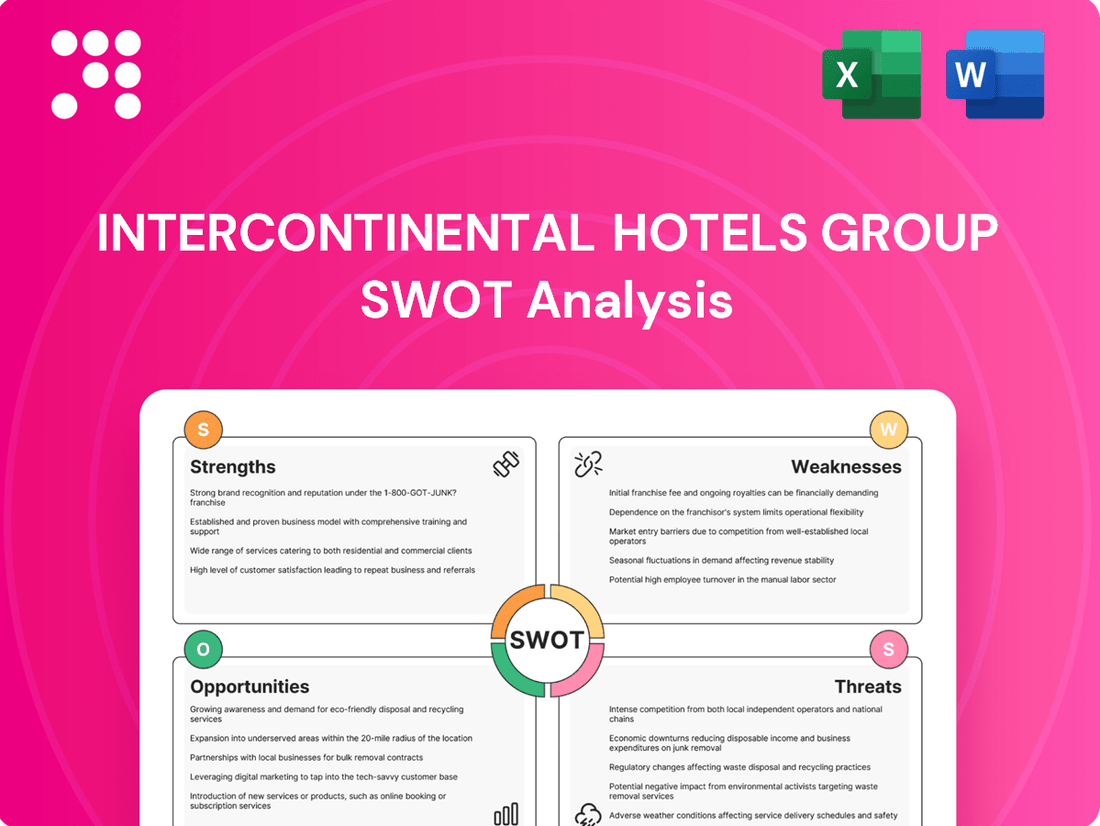

This SWOT analysis offers a comprehensive breakdown of Intercontinental Hotels Group's internal strengths and weaknesses alongside external market opportunities and threats.

Offers a clear breakdown of IHG's competitive landscape, pinpointing areas for strategic improvement and risk mitigation.

Weaknesses

While InterContinental Hotels Group's (IHG) asset-light franchising model provides scalability and reduces capital expenditure, it inherently limits direct oversight of day-to-day operations at franchised locations. This can lead to challenges in maintaining uniform brand standards and ensuring a consistent guest experience across its extensive global portfolio. For instance, a lapse in service quality at a single franchised hotel could inadvertently tarnish the reputation of the entire IHG brand.

While Intercontinental Hotels Group (IHG) saw positive RevPAR trends globally, a notable weakness emerged with a decline in Greater China's RevPAR during the first quarter of 2025. This regional downturn, particularly in a crucial growth market, underscores a susceptibility to localized economic headwinds and geopolitical influences. Such disparities can create performance imbalances across the portfolio.

This geographic unevenness points to a concentration of growth reliance on regions like the Americas and EMEAA. If these key markets face unexpected challenges, IHG's overall financial performance could be disproportionately affected due to the limited diversification of its primary growth engines.

InterContinental Hotels Group (IHG) operates in an intensely competitive global hospitality market. Major rivals such as Marriott International, Hilton Worldwide, Accor, and Hyatt consistently vie for market share, creating significant pressure on pricing strategies and brand visibility.

This fierce competition necessitates ongoing substantial investment in property upgrades, guest experience enhancements, and innovative loyalty programs to maintain brand appeal. For instance, as of the first quarter of 2024, the global hotel occupancy rates hovered around 70%, indicating a robust but highly contested market where differentiation is key to capturing demand.

Furthermore, securing prime locations for new hotel developments presents a considerable challenge, as desirable sites are often already occupied or command premium acquisition costs, impacting expansion plans and profitability.

Financial Stability Concerns Due to Leverage

InterContinental Hotels Group (IHG) faces potential financial stability concerns stemming from its leverage levels. Some analyses highlight negative equity, which, despite a strong share buyback program, can signal vulnerability.

While IHG demonstrates robust financial performance and actively returns capital to shareholders, a high debt-to-EBITDA ratio, which stood at approximately 3.2x as of the end of 2023, presents risks, particularly in a volatile economic environment. This elevated leverage could strain the company's ability to manage debt obligations if market conditions deteriorate.

- High Leverage: A debt-to-EBITDA ratio around 3.2x at year-end 2023 indicates significant reliance on borrowed funds.

- Negative Equity: Some financial assessments point to negative equity, a potential indicator of financial strain.

- Economic Sensitivity: Increased debt levels amplify risks during economic downturns, potentially impacting debt servicing capabilities.

- Shareholder Returns vs. Financial Prudence: The balance between substantial capital returns to shareholders and maintaining a conservative debt profile warrants careful monitoring.

Potential for Market Saturation in Developed Markets

While InterContinental Hotels Group (IHG) has a strong global presence, developed markets like North America and Europe are showing signs of maturity. This could mean fewer prime locations are available for new hotel developments, potentially slowing down expansion in these already competitive areas. For instance, in 2023, IHG's RevPAR (Revenue Per Available Room) growth in the Americas was robust, but the sheer density of existing hotels means finding unexploited opportunities is becoming more challenging.

This increasing saturation in established regions might necessitate a strategic pivot towards emerging markets. However, these growth frontiers often come with their own set of complexities. Factors such as currency fluctuations, varying regulatory environments, and potential political instability in these newer territories can introduce a higher degree of risk compared to their more developed counterparts. IHG's strategy in 2024 and 2025 will likely involve carefully balancing the opportunities in these dynamic markets with the inherent risks.

- Market Saturation: Developed markets present fewer prime locations for new hotel openings.

- Growth Limitation: Increased competition in mature markets may cap future expansion rates.

- Emerging Market Focus: A greater reliance on emerging markets for growth is probable.

- Associated Risks: Emerging markets carry potential economic and political uncertainties.

InterContinental Hotels Group's (IHG) asset-light model, while efficient, can lead to inconsistent brand standards due to limited direct control over franchised properties. This reliance on franchisees means that guest experience quality can vary significantly, potentially impacting overall brand perception. For example, a decline in Greater China's RevPAR in Q1 2025 highlights vulnerability to localized economic issues, creating performance imbalances across its global portfolio.

Same Document Delivered

Intercontinental Hotels Group SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at Intercontinental Hotels Group's Strengths, Weaknesses, Opportunities, and Threats.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details IHG's competitive advantages and areas for improvement.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, providing strategic insights into IHG's market position.

Opportunities

Intercontinental Hotels Group (IHG) has a prime opportunity to grow its footprint in rapidly developing regions like Asia-Pacific, the Middle East, and Latin America. These markets represent a vast, largely untapped potential for the hospitality sector, offering fertile ground for new hotel developments and brand introductions.

The company is particularly keen on markets such as China and India, where demand for quality accommodation is surging. Projections indicate substantial growth in hotel development in these key areas, aligning perfectly with IHG's expansion strategy.

For instance, in 2023, IHG announced plans to open over 50 new hotels in India by the end of 2028, highlighting a strong commitment to this high-growth market. Similarly, in the Asia-Pacific region, IHG's pipeline continues to expand, with a notable increase in signings and openings across various brands.

The demand for unique, experience-focused travel is surging, especially within the luxury and lifestyle sectors. IHG is well-positioned to capitalize on this trend, having strategically grown its premium and luxury brand offerings. For instance, their acquisition of brands like Six Senses and Kimpton demonstrates a clear commitment to this high-value market segment.

This strategic expansion into luxury and lifestyle allows IHG to attract and retain discerning travelers willing to spend more. By focusing on these premium segments, IHG can achieve higher revenue per available room and enhance its overall profitability. In 2024, IHG reported significant growth in its luxury and lifestyle portfolio, with occupancy rates in these brands often exceeding the system average.

InterContinental Hotels Group (IHG) has a prime opportunity to further elevate guest satisfaction and streamline operations by continuing its commitment to digital advancements. This includes a strong push for mobile-first strategies, leveraging artificial intelligence for customer service, and enriching its loyalty programs. These technological investments are key to creating more seamless and personalized guest journeys.

IHG's strategic focus on technology, particularly its direct digital booking platforms, offers a significant avenue for revenue growth. By enhancing these channels, the company can not only capture more direct bookings, reducing reliance on third-party commissions, but also gain valuable data to tailor offerings and services more precisely to individual guest preferences.

Strategic Acquisitions and Partnerships

Intercontinental Hotels Group (IHG) has a proven track record of leveraging strategic acquisitions and partnerships to fuel expansion. For instance, their acquisition of the Ruby brand and their alliance with Novum Hospitality in Germany highlight this approach. These moves are designed to accelerate growth and broaden IHG's reach into new markets and appealing segments.

Further strategic acquisitions and collaborations offer IHG a powerful avenue to enhance its competitive position. By integrating new brands or partnering with established players, IHG can quickly gain market share and diversify its offerings, catering to a wider range of traveler preferences. This strategy is crucial for staying agile in the dynamic hospitality industry.

The ongoing pursuit of such opportunities is expected to bolster IHG's brand portfolio and operational footprint. For example, in 2024, IHG continued to expand its luxury and lifestyle segment, which has shown strong RevPAR (Revenue Per Available Room) growth. These strategic integrations are key to unlocking new revenue streams and strengthening brand loyalty.

Key strategic moves include:

- Acquiring brands in high-growth markets: Expanding into regions with increasing travel demand.

- Forming alliances with complementary businesses: Enhancing guest experiences through integrated services.

- Investing in technology partnerships: Improving operational efficiency and customer engagement.

Increasing Demand for Sustainable Travel Options

The growing global awareness of environmental impact fuels a significant demand for sustainable travel. IHG's proactive approach, demonstrated by initiatives like its 'Low Carbon Pioneers' program, positions it favorably to capture this expanding market segment. This commitment translates into a tangible competitive edge.

By actively promoting hotels that are certified green or operate with reduced carbon emissions via its booking platforms, IHG can effectively attract a discerning clientele. This includes both individual travelers and corporate entities increasingly prioritizing eco-friendly choices to align with their own sustainability goals.

- Growing Market Share: The sustainable tourism market is projected to grow significantly, with some estimates suggesting it could reach over $1 trillion globally by 2027, presenting a substantial revenue opportunity for IHG.

- Brand Loyalty: Travelers who prioritize sustainability often exhibit higher brand loyalty, leading to repeat business and a more stable customer base for IHG.

- Corporate Partnerships: Many corporations are setting ambitious ESG (Environmental, Social, and Governance) targets, making IHG's sustainable offerings attractive for business travel bookings and partnerships.

IHG's expansion into emerging markets, particularly in Asia-Pacific and the Middle East, presents a significant growth avenue. These regions are experiencing robust travel demand, with IHG actively developing its presence. For instance, the company's pipeline in India alone includes over 50 new hotels by 2028.

The increasing consumer preference for luxury and experiential travel offers another prime opportunity. IHG's strategic acquisitions, such as Six Senses and Kimpton, bolster its portfolio in these high-margin segments, as evidenced by strong RevPAR growth in its luxury and lifestyle brands during 2024.

Continued investment in digital transformation and direct booking channels is crucial for enhancing guest experience and driving revenue. IHG's focus on mobile-first strategies and AI integration aims to create more personalized guest journeys and reduce reliance on third-party bookings.

Strategic acquisitions and partnerships remain a key enabler for market penetration and brand diversification. Recent moves, like the alliance with Novum Hospitality, demonstrate IHG's commitment to accelerating growth and capturing new market segments.

The growing demand for sustainable tourism provides IHG with a competitive advantage. By highlighting eco-friendly hotels and initiatives, IHG can attract environmentally conscious travelers and corporate partners, tapping into a market projected to exceed $1 trillion globally by 2027.

Threats

Global economic uncertainties, such as persistent inflation and ongoing geopolitical conflicts, pose a significant threat to Intercontinental Hotels Group (IHG). These factors directly impact consumer confidence and discretionary spending, which are critical drivers of travel demand. For instance, rising inflation in major economies like the US and UK in 2023 and early 2024 has put pressure on household budgets, potentially reducing leisure travel spending.

Furthermore, a slowdown in economic growth, particularly in IHG's key markets in Asia and Europe, could lead to decelerated RevPAR growth. If major economies experience recessions, the impact on business and leisure travel would be substantial, directly affecting IHG's revenue streams and overall profitability. The IMF's projections for global growth in 2024, while showing some resilience, still highlight significant downside risks that could materialize.

The hospitality sector is fiercely competitive, with InterContinental Hotels Group (IHG) facing rivals like Marriott, Hilton, and Accor, alongside a growing number of independent hotels and short-term rental platforms such as Airbnb. This intense rivalry directly impacts pricing power, forcing IHG to constantly evaluate its rate strategies to remain competitive.

This competitive landscape necessitates significant and ongoing investment in marketing and brand building to differentiate IHG's offerings and maintain its market share. For instance, the global hotel market is projected to reach over $1 trillion by 2027, highlighting the sheer scale of competition and the substantial marketing spend required to capture even a small portion of this market.

Geopolitical tensions, particularly in regions like the Middle East, and the ongoing dynamic between major global powers such as China and Western nations, can significantly disrupt international travel patterns. These events often lead to a decrease in tourism and business travel, directly impacting InterContinental Hotels Group's revenue per available room (RevPAR) and overall financial health in affected areas.

For instance, the ongoing conflicts and political instability in various regions can manifest as travel advisories or outright bans, causing a sharp decline in bookings. In 2024, the travel industry has already seen how localized conflicts can lead to significant drops in visitor numbers to neighboring countries, a trend that directly impacts hotel occupancy rates and profitability.

Rising Operating Costs and Supply Chain Issues

InterContinental Hotels Group (IHG), like many in the hospitality sector, is grappling with escalating operating costs. Labor expenses, a significant component of hotel operations, have seen a notable upward trend throughout 2024 and into early 2025, driven by increased demand for skilled staff and broader wage pressures. This rise in personnel costs directly affects the bottom line.

Furthermore, persistent inflation continues to exert pressure on supplier costs, impacting everything from food and beverage to linens and cleaning supplies. These increased input costs, coupled with ongoing supply chain vulnerabilities that can lead to shortages or delayed deliveries, pose a significant challenge to maintaining healthy profit margins. Effective cost management and strategic sourcing are therefore critical for IHG to navigate these headwinds and preserve profitability in the current economic climate.

- Labor Cost Increases: Wages in the hospitality sector have risen, with some reports indicating average hourly wage increases of 5-7% in key markets during 2024.

- Supplier Cost Inflation: The Consumer Price Index (CPI) for services, including accommodation, has shown elevated levels, reflecting broader inflationary pressures on goods and services used by hotels.

- Supply Chain Disruptions: While easing from pandemic peaks, disruptions in global logistics and the availability of certain goods continue to pose risks, potentially leading to higher procurement costs or service interruptions.

- Impact on Margins: The combination of higher labor and supplier costs can compress operating margins if not offset by strategic pricing or efficiency gains.

Changes in Consumer Behavior and Travel Patterns

Evolving consumer preferences present a significant threat to InterContinental Hotels Group (IHG). For instance, a growing demand for sustainable travel options means brands that don't prioritize eco-friendly practices could lose market share. In 2024, reports indicated a 15% increase in consumer searches for "eco-friendly hotels" compared to the previous year, highlighting this trend.

Furthermore, a continued bifurcation in travel demand, where luxury segments consistently outperform economy options, can create challenges for brands positioned in the mid-market. IHG needs to adapt its offerings and marketing to cater to these shifting demands, ensuring relevance across its diverse brand portfolio. This adaptability is crucial for maintaining competitive advantage in the dynamic hospitality landscape.

- Shifting Demand: Consumer preferences are moving towards sustainable and experiential travel, impacting brand loyalty.

- Market Bifurcation: Luxury travel is outperforming economy segments, requiring strategic brand positioning.

- Adaptation Necessity: IHG must continuously evolve its offerings and marketing to meet these changing consumer needs.

- Brand Relevance: Failure to adapt risks diminishing the relevance of IHG's diverse brand portfolio.

Intensified competition from both established hotel chains and emerging players like Airbnb continues to pressure pricing power and market share for InterContinental Hotels Group. The rapid growth of alternative accommodation options, which often offer more localized experiences, presents a unique challenge to traditional hotel models. This competitive environment requires continuous innovation and investment in guest experience to differentiate IHG's brands.

SWOT Analysis Data Sources

This InterContinental Hotels Group SWOT analysis is built upon a foundation of credible data, including their official financial filings, comprehensive market intelligence reports, and expert commentary from industry analysts, ensuring a robust and informed assessment.