Intercontinental Hotels Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intercontinental Hotels Group Bundle

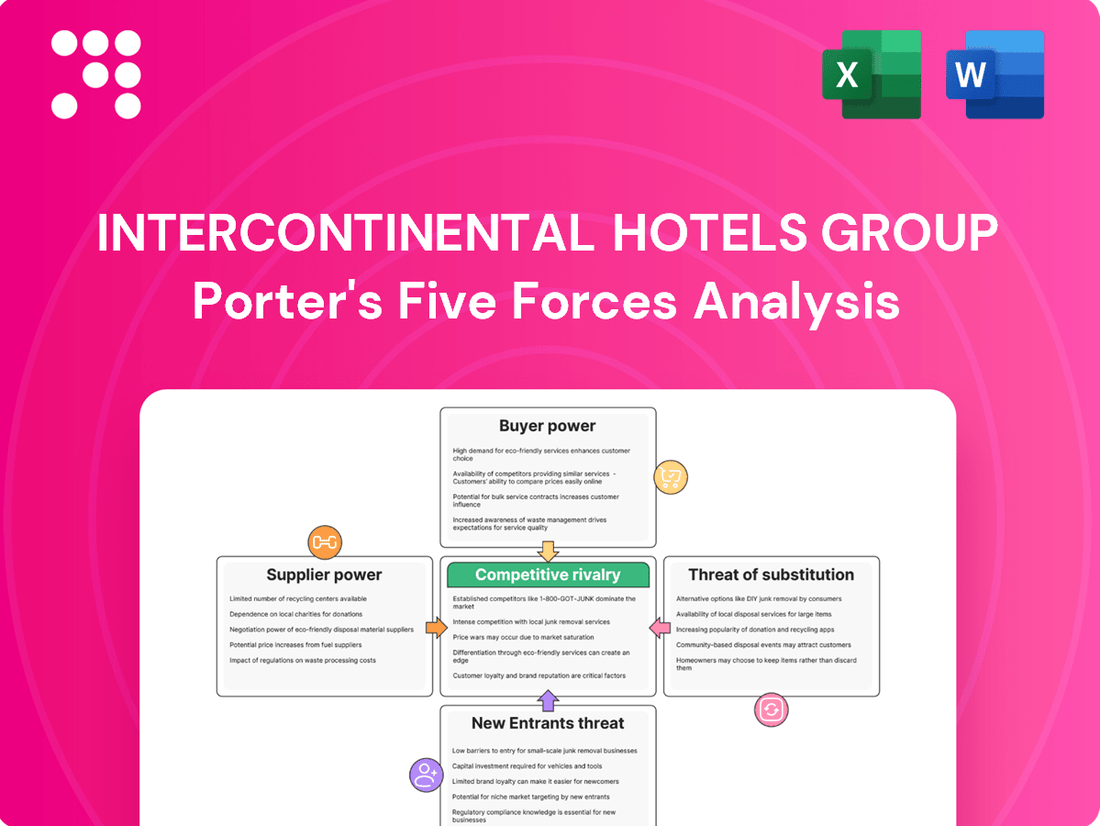

Intercontinental Hotels Group faces significant competitive pressures, including the bargaining power of buyers and the threat of new entrants in the dynamic hospitality market. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Intercontinental Hotels Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Intercontinental Hotels Group (IHG) benefits from a fragmented supplier base across its diverse operational needs, from food and beverage to technology. This wide distribution of suppliers means no single entity holds significant leverage over IHG, as the company can readily switch or diversify its sourcing. For instance, in 2024, IHG's procurement for its vast network of hotels likely involved thousands of individual suppliers globally, making it difficult for any one supplier to dictate terms.

While Intercontinental Hotels Group (IHG) primarily operates on an asset-light model, meaning franchisees handle many day-to-day operations including supplier management, IHG's brand standards and quality requirements significantly influence these relationships. Suppliers must consistently meet IHG's global or regional benchmarks for products and services to be approved, which can give suppliers of specialized, high-quality goods a degree of bargaining power.

Suppliers of critical technology, like property management systems and booking engines, wield considerable influence over Intercontinental Hotels Group (IHG). These systems are fundamental to IHG's daily operations and guest interactions, meaning the cost and complexity of switching to a new provider are substantial.

The bargaining power of these tech suppliers is amplified by the deep integration of their solutions into IHG's infrastructure. For instance, the technology powering the IHG One Rewards loyalty program is a key differentiator, and its seamless operation is vital. IHG's ongoing commitment to digital innovation, as detailed in their 2024 financial disclosures, further solidifies the importance of these technology partnerships, giving suppliers a stronger hand.

Labor Market Dynamics

The hospitality sector, including Intercontinental Hotels Group (IHG), is inherently labor-intensive. This means that the availability and cost of skilled workers, from front desk staff to specialized maintenance technicians, can significantly influence operational expenses, acting as a form of supplier power. In 2024, many regions are experiencing persistent labor shortages, particularly in the hospitality sector, which can give employees more leverage.

When labor markets tighten, or if unionization rates rise in key operating regions, the bargaining power of employees, and by extension, labor suppliers, can increase. This directly impacts IHG's managed and franchised properties through higher wage demands and potentially increased benefits costs. For instance, reports in early 2024 indicated that average hourly wages in the US leisure and hospitality sector saw a notable increase year-over-year, reflecting this dynamic.

- Labor Shortages: Many hospitality markets in 2024 continued to grapple with difficulties in attracting and retaining staff, giving existing employees greater bargaining power.

- Wage Pressures: This scarcity contributed to upward pressure on wages. For example, average hourly earnings in the US leisure and hospitality sector were up by approximately 4.5% in the first half of 2024 compared to the same period in 2023.

- Unionization: In areas with stronger union presence, collective bargaining can further amplify employee influence on wages and working conditions, impacting IHG's cost structure.

- Workforce Empowerment: The broader trend of workforce empowerment, driven by changing employee expectations post-pandemic, also plays a role, potentially leading to demands for better benefits and work-life balance.

Sustainability-Focused Suppliers

Intercontinental Hotels Group's (IHG) commitment to sustainability, particularly its 'Journey to Tomorrow' strategy, which targets significant carbon emission and waste reduction by 2024, can amplify the bargaining power of suppliers who provide eco-friendly materials, energy-efficient technologies, or sustainably sourced food. These specialized suppliers, though potentially fewer in number, can leverage IHG's clear demand for greener alternatives. For instance, the growing market for sustainable building materials and energy-saving HVAC systems means suppliers with proven track records in these areas can command better terms. The increasing regulatory pressure and consumer demand for environmentally responsible hospitality operations further bolster the position of these sustainability-focused suppliers.

The bargaining power of these sustainability-focused suppliers is influenced by several factors:

- Supplier Specialization: The availability of a limited number of suppliers offering genuinely innovative and certified eco-friendly products or services increases their leverage.

- Switching Costs: For IHG, the cost and effort involved in finding, vetting, and integrating new suppliers for sustainable solutions can be substantial, making it more advantageous to retain existing relationships with strong performers.

- Market Growth for Green Products: As the demand for sustainable hospitality solutions expands, suppliers who are early movers and established leaders in this niche can negotiate from a position of strength.

- IHG's Strategic Alignment: IHG's explicit sustainability goals create a direct incentive for suppliers to align their offerings, potentially leading to more collaborative and mutually beneficial agreements, but also giving suppliers with unique solutions more sway.

The bargaining power of suppliers for Intercontinental Hotels Group (IHG) is generally moderate, influenced by the diversity of its needs and its asset-light model. However, suppliers of critical technology and specialized sustainable goods can exert more influence due to integration complexity and strategic alignment, respectively.

Labor, particularly skilled hospitality staff, represents a significant supplier group where bargaining power is elevated in 2024 due to widespread labor shortages and wage pressures. For instance, average hourly earnings in the US leisure and hospitality sector increased by approximately 4.5% in the first half of 2024 compared to the prior year, reflecting this dynamic.

| Supplier Type | Bargaining Power | Key Factors Influencing Power |

| General Goods (F&B, Amenities) | Low to Moderate | Fragmented supplier base, IHG's scale |

| Technology (PMS, Booking Engines) | High | High switching costs, deep integration, strategic importance |

| Labor (Skilled Staff) | Moderate to High (in 2024) | Labor shortages, wage pressures, unionization |

| Sustainability Solutions | Moderate to High | Specialization, IHG's strategic goals, limited alternatives |

What is included in the product

This Porter's Five Forces analysis for InterContinental Hotels Group (IHG) provides a comprehensive examination of the competitive forces shaping the global hospitality industry, offering insights into IHG's strategic positioning and potential vulnerabilities.

Effortlessly navigate the competitive landscape of the hotel industry by understanding the specific pressures on IHG, from buyer power to new entrants, enabling targeted strategic responses.

Customers Bargaining Power

Customers in the hospitality sector, including both vacationers and business travelers, frequently show a strong inclination towards price, particularly for typical room types. This sensitivity is heightened by the widespread availability of online platforms that facilitate easy price comparisons, significantly reducing the effort and cost associated with switching to a competitor.

For Intercontinental Hotels Group (IHG), this translates to a substantial bargaining power for its customers. In 2024, the travel industry continued to see intense competition, with many hotels vying for bookings. For instance, a traveler can easily check rates across multiple booking sites for a standard room in a major city, finding numerous options within a narrow price range.

Intercontinental Hotels Group (IHG) actively manages customer bargaining power through its robust loyalty program, IHG One Rewards. By the close of 2024, this program boasted an impressive membership exceeding 145 million individuals. This extensive network of loyal customers is a key strategy to reduce price sensitivity and encourage repeat business.

The benefits offered through IHG One Rewards, such as exclusive member rates and personalized experiences, directly incentivize customers to book directly with IHG. This diminishes the power customers hold when comparing prices across various booking platforms, thereby strengthening IHG's position.

Intercontinental Hotels Group (IHG) manages a diverse portfolio of 19 distinct hotel brands, strategically designed to serve a wide array of market segments. This extensive range spans from ultra-luxury properties to more budget-friendly essential services, effectively catering to varied customer preferences and price sensitivities.

By segmenting its offerings, IHG can address specific customer needs with tailored experiences and pricing structures. This approach helps to mitigate the collective bargaining power of a broad customer base, as different customer groups are less likely to find a single, universally appealing or price-competitive alternative across the entire spectrum of IHG's brands.

Influence of Online Reviews and Social Media

The rise of online review platforms like TripAdvisor and Google Reviews, coupled with active social media engagement, has dramatically amplified customer bargaining power. A single negative review can quickly deter potential guests, impacting booking volumes and revenue. For InterContinental Hotels Group (IHG), this means maintaining exceptional service is paramount to cultivating positive online sentiment and attracting new business.

Consider these points regarding the influence of online reviews and social media:

- Amplified Voice: Platforms like TripAdvisor allow customers to share experiences widely, directly influencing the decisions of future guests.

- Reputation Risk: Negative feedback can spread rapidly, potentially damaging IHG's brand image and leading to decreased occupancy rates. For instance, a study by ReviewTrackers in 2023 found that 94% of consumers avoided a business after reading a negative online review.

- Service Imperative: IHG's success hinges on consistently delivering superior guest experiences to generate positive reviews and maintain a strong online reputation.

Demand for Personalized Experiences

Modern travelers are increasingly demanding unique and personalized experiences. This shift means customers have more leverage, expecting hotels to adapt to their specific preferences, whether it's room setup or how they interact digitally. For InterContinental Hotels Group (IHG), this translates into a need to deeply understand and cater to individual guest needs to maintain loyalty and competitive advantage.

IHG's strategic focus on digital advancements and personalized loyalty programs, like IHG One Rewards, directly addresses this growing customer power. By investing in technology that allows for tailored offers and experiences, IHG aims to meet and exceed these evolving expectations. For instance, in 2024, IHG continued to enhance its digital platforms, allowing guests to customize their stays more granularly through the IHG One Rewards app, a key driver in retaining guests who value personalized service.

- Personalization Drives Loyalty: Guests who receive tailored experiences are more likely to become repeat customers.

- Digital Engagement is Key: IHG's investment in its app and digital services directly impacts its ability to offer personalized interactions.

- Data Analytics for Preferences: Understanding guest data allows IHG to anticipate and fulfill individual needs, thereby increasing customer bargaining power.

Customers wield significant bargaining power in the hotel industry due to easy price comparison and the availability of numerous substitutes. This power is amplified by online review platforms, where negative feedback can swiftly impact bookings. IHG counters this by fostering loyalty through its IHG One Rewards program, which had over 145 million members by the end of 2024, and by offering a diverse brand portfolio to cater to varied customer segments.

| Factor | Impact on IHG | IHG's Mitigation Strategy |

|---|---|---|

| Price Sensitivity & Substitutes | High - easy online comparison, many competitors | Loyalty program (IHG One Rewards), brand segmentation |

| Online Reviews & Social Media | High - reputation risk, influence on bookings | Focus on superior guest experience, digital reputation management |

| Demand for Personalization | Increasing - customers expect tailored experiences | Digital advancements, personalized offers via IHG One Rewards app |

Full Version Awaits

Intercontinental Hotels Group Porter's Five Forces Analysis

This preview showcases the complete InterContinental Hotels Group Porter's Five Forces analysis, offering a deep dive into the competitive landscape. You're viewing the exact, professionally formatted document that will be delivered instantly upon purchase, ensuring no discrepancies or missing information. This comprehensive analysis will equip you with crucial insights into the industry's dynamics, ready for immediate application.

Rivalry Among Competitors

Intercontinental Hotels Group (IHG) operates in a fiercely competitive global hospitality market. The industry is populated by a multitude of large international brands, regional operators, and independent establishments all seeking to capture guest loyalty and revenue.

Key rivals such as Marriott International, Hilton Worldwide, and Accor are direct competitors across IHG's diverse brand portfolio and geographic reach. This intense rivalry means constant innovation and strategic maneuvering are essential for market position.

The hospitality sector experienced robust growth in 2024, with Revenue Per Available Room (RevPAR) reaching record highs. This surge in industry performance underscores the dynamic and active nature of the competitive environment IHG navigates.

Major hotel groups, including InterContinental Hotels Group (IHG), are constantly growing their brand offerings and branching out into different market areas, such as luxury, lifestyle, and extended stays. This brand proliferation means more choices for consumers but also a more crowded competitive landscape.

IHG boasts 19 distinct hotel brands, and its substantial development pipeline indicates continued expansion. This growth strategy intensifies rivalry not only within specific hotel categories but also across the entire hospitality market. For instance, IHG's acquisition of the Ruby brand in 2024 directly strengthened its position in a particular segment.

Intercontinental Hotels Group (IHG) thrives on an asset-light, fee-based, largely franchised model. This strategy fuels quick growth and minimizes capital outlay, but intensifies competition for securing and keeping hotel owners. For instance, in 2024, IHG continued to expand its franchised portfolio, demonstrating the ongoing importance of owner relationships in a crowded market.

Technological Advancements and Digital Platforms

Technological advancements significantly fuel competitive rivalry within the hotel industry. Online travel agencies (OTAs) and direct booking platforms, powered by sophisticated algorithms, offer consumers vast choices and price comparisons, intensifying pressure on established brands. Hotels must continuously invest in digital experiences, including user-friendly mobile apps and AI-driven guest services, to capture and retain customer loyalty. For instance, InterContinental Hotels Group (IHG) has been actively investing in new technology systems and enhancing its IHG One Rewards loyalty program to bolster its competitive standing.

The drive for innovation means companies like IHG face constant pressure to upgrade their property management systems and digital infrastructure. This includes adopting cloud-based solutions and data analytics to personalize guest experiences and streamline operations. Failure to keep pace with technological evolution can lead to a loss of market share as competitors offer more seamless and engaging digital interactions. In 2024, the hospitality sector saw continued investment in AI for customer service and operational efficiency, with major players like IHG prioritizing digital transformation.

- Online Travel Agencies (OTAs) and Direct Booking Platforms: These digital channels increase price transparency and choice for consumers, intensifying competition.

- Investment in Digital Experiences: Hotels must offer advanced mobile apps and AI-powered guest support to remain competitive.

- IHG's Technology Investments: IHG has focused on upgrading technology systems and enhancing its loyalty program to drive performance and customer engagement.

Geographic Expansion and Market Penetration

The hotel industry is characterized by intense competition fueled by aggressive geographic expansion. Companies are actively seeking to broaden their global reach, with a particular emphasis on high-growth regions. In 2024, Intercontinental Hotels Group (IHG) significantly expanded its global footprint, adding thousands of new rooms and maintaining a robust pipeline of properties under development.

This expansion strategy is not unique to IHG; many competitors are also pushing into emerging markets and secondary cities. This broad-based growth intensifies rivalry not only in established territories but also in newly entered markets, as companies vie for market share and customer loyalty.

- Global Footprint Expansion: IHG's addition of thousands of rooms globally in 2024 underscores the industry's growth trajectory.

- Emerging Market Focus: A strategic emphasis on emerging markets and secondary cities by IHG and its competitors intensifies competition in these key areas.

- Pipeline Strength: A healthy pipeline of properties under development signals continued investment and future competitive pressure.

- Heightened Rivalry: Aggressive expansion by multiple players directly increases competitive intensity in both existing and new geographic markets.

Competitive rivalry is a dominant force for InterContinental Hotels Group (IHG), with major global players like Marriott, Hilton, and Accor constantly vying for market share. This intense competition is amplified by IHG's asset-light, franchised growth model, which allows for rapid expansion but also intensifies the competition for hotel owners. In 2024, IHG continued to expand its brand portfolio and global presence, adding thousands of rooms and strengthening its position in key markets, a strategy mirrored by its competitors, leading to increased pressure across the industry.

| Competitor | Key Brands | 2024 Global Room Count (Approx.) | IHG's 2024 Global Room Count (Approx.) |

|---|---|---|---|

| Marriott International | Marriott, Sheraton, Westin | Over 9,000 hotels, 1.4 million rooms | |

| Hilton Worldwide | Hilton, Conrad, Waldorf Astoria | Over 7,500 hotels, 1.3 million rooms | |

| Accor | Sofitel, Novotel, Ibis | Over 5,500 hotels, 1.1 million rooms | |

| IHG Hotels & Resorts | InterContinental, Holiday Inn, Kimpton | Over 6,300 hotels, 990,000+ rooms | 990,000+ rooms |

SSubstitutes Threaten

The threat of substitutes for Intercontinental Hotels Group (IHG) is significant, primarily stemming from a growing array of alternative accommodation options. Platforms like Airbnb, vacation rentals, serviced apartments, and co-living spaces present compelling alternatives by offering diverse experiences, unique amenities, or often more competitive pricing. These substitutes can directly siphon demand from traditional hotel bookings, particularly for leisure travelers seeking local immersion or extended stays.

The proliferation of homestays and peer-to-peer rental platforms like Airbnb presents a significant threat of substitution for InterContinental Hotels Group (IHG). These alternatives offer travelers unique, localized experiences and often more competitive pricing, especially for extended stays or larger groups. In 2024, Airbnb reported over 1.5 million listings in the US alone, highlighting the vastness of this alternative lodging market.

The rise of extended-stay hotels and branded residences presents a significant threat of substitutes for InterContinental Hotels Group (IHG). These options cater to travelers needing longer accommodations, often offering apartment-style living with kitchens and separate living areas, which traditional hotel rooms cannot match.

For instance, in 2024, the extended-stay segment continued its robust growth, with brands like IHG's own Staybridge Suites and Candlewood Suites seeing strong performance. This trend is fueled by demand from business travelers on longer assignments and individuals seeking more value and comfort than a standard hotel room provides, directly competing with IHG's core offerings.

Non-Lodging Travel Experiences

The rise of non-lodging travel experiences presents a growing substitute threat to traditional hotel accommodations. Consumers are increasingly prioritizing unique activities and immersive journeys over just a place to sleep. For instance, the global adventure tourism market was valued at approximately $1.4 trillion in 2023 and is projected to grow significantly, indicating a shift in discretionary spending away from conventional lodging.

This trend means that Intercontinental Hotels Group (IHG) faces competition not just from other hotel chains, but also from alternative travel formats where accommodation is secondary. Consider the burgeoning popularity of luxury cruises, which offer a comprehensive travel package often encompassing lodging, dining, and entertainment, directly competing for vacation budgets that might otherwise be allocated to hotel stays.

- Adventure Tourism Growth: The adventure tourism sector, a key substitute, is expected to see robust growth, capturing a larger share of travel spending.

- Cruise Market Expansion: The cruise industry continues to expand its capacity and offerings, providing an all-inclusive alternative to land-based vacations.

- Experiential Travel Demand: A growing segment of travelers seeks unique experiences, potentially reducing demand for standard hotel room nights.

Improved Transportation and Day Trips

The increasing ease of travel, particularly for shorter durations, presents a threat of substitutes for Intercontinental Hotels Group (IHG). Enhanced transportation networks, including high-speed rail and more accessible air travel, make day trips and weekend getaways more feasible for many consumers. This reduces the necessity for overnight accommodations for certain types of travel, particularly for business meetings or leisure activities within a reasonable commuting distance.

For instance, in 2024, the expansion of high-speed rail networks in Europe and North America has significantly cut travel times between major cities. This could lead to a decrease in demand for hotel rooms for short business trips or even weekend city breaks, as travelers opt for same-day round trips. This trend particularly impacts urban hotels that cater to short-stay business and leisure travelers.

- Reduced Overnight Stays: Advances in transportation make day trips a viable alternative to overnight hotel stays for many.

- Impact on Urban Markets: Cities with excellent connectivity are more susceptible to this substitution effect.

- Competitive Pressure: The growing convenience of day travel puts indirect pressure on hotel pricing and service offerings.

The threat of substitutes for InterContinental Hotels Group (IHG) remains robust, driven by evolving consumer preferences and the expansion of alternative accommodation models. Beyond direct lodging competitors, the growing emphasis on experiential travel means that vacation budgets are increasingly allocated to activities rather than just accommodation.

For example, the global wellness tourism market, which often incorporates travel and unique experiences, was projected to reach $1.5 trillion in 2024, indicating a significant portion of travel spending that might bypass traditional hotels. This highlights how non-lodging experiences can act as substitutes for hotel stays by capturing discretionary travel funds.

| Substitute Category | Key Examples | 2024 Relevance/Data Point |

| Peer-to-Peer Rentals | Airbnb, Vrbo | Over 6.5 million active listings globally in early 2024. |

| Extended Stay/Serviced Apartments | Aparthotels, Branded Residences | Continued strong growth in the extended-stay segment, with occupancy rates often exceeding traditional hotels in key markets. |

| Experiential Travel | Adventure Tourism, Wellness Retreats, Cruises | Wellness tourism market projected to reach $1.5 trillion in 2024; Cruise industry capacity increased significantly post-pandemic. |

| Alternative Transportation Impact | High-speed rail, accessible air travel | Increased feasibility of day trips and weekend getaways in well-connected regions, potentially reducing overnight stays. |

Entrants Threaten

While InterContinental Hotels Group (IHG) leans towards an asset-light model, the threat of new entrants is somewhat mitigated by the immense capital needed to establish new physical hotels. Building a new hotel, from acquiring land to construction and furnishing, can easily run into tens or even hundreds of millions of dollars, creating a significant hurdle for potential competitors.

Established hotel brands like Intercontinental Hotels Group (IHG) leverage strong brand recognition, built over decades, which acts as a significant barrier to entry. In 2024, IHG continued to invest heavily in marketing, aiming to reinforce its presence across its diverse portfolio of brands, from luxury InterContinental to mid-scale Holiday Inn.

IHG's extensive loyalty program, IHG One Rewards, boasts millions of active members, fostering repeat business and customer stickiness. The sheer scale and established infrastructure of such programs require new entrants substantial time and capital to replicate, making it difficult to attract and retain customers away from established loyalty benefits.

New entrants struggle to replicate InterContinental Hotels Group's (IHG) established global distribution networks, including access to Online Travel Agencies (OTAs) and Global Distribution Systems (GDS). Building comparable technological infrastructure, such as sophisticated booking engines and loyalty programs, requires significant upfront investment, creating a substantial barrier.

Regulatory Hurdles and Local Expertise

New entrants face substantial challenges due to the complex web of regulations and the necessity of deep local market understanding. Navigating diverse legal frameworks, securing permits, and grasping nuanced consumer behaviors across Intercontinental Hotels Group's (IHG) vast global footprint, spanning over 100 countries, presents a formidable barrier.

Established players like IHG benefit immensely from existing relationships with local authorities and suppliers, a critical advantage that newcomers struggle to replicate quickly. This localized knowledge is not easily transferable and often takes years to cultivate, acting as a significant deterrent to new competition.

- Regulatory Complexity: IHG operates in jurisdictions with varying licensing, zoning, and operational requirements, making market entry costly and time-consuming for new hotel brands.

- Local Market Nuances: Understanding local labor laws, cultural sensitivities, and consumer preferences is crucial for success, a knowledge base that new entrants lack.

- Established Relationships: IHG's long-standing ties with local governments, tourism boards, and service providers offer preferential treatment and operational advantages.

Intense Competition and Market Saturation in Key Segments

The threat of new entrants for Intercontinental Hotels Group (IHG) is somewhat mitigated by the significant capital requirements and established brand loyalty in the hospitality sector. However, the market remains attractive, with many segments and geographic locations experiencing high saturation. For instance, in 2024, the global hotel market is projected to reach over $550 billion, indicating robust demand but also intense existing competition.

Newcomers face the hurdle of building brand recognition and operational scale to compete effectively with giants like IHG. They would need substantial investment to match existing players' marketing reach, loyalty programs, and property portfolios. This makes it difficult for new entrants to gain significant market share without a highly differentiated offering or targeting very specific, underserved niches within the broader hotel industry.

- High Capital Investment: Establishing a new hotel brand requires substantial upfront costs for property acquisition, development, and marketing, creating a barrier for many potential entrants.

- Brand Loyalty and Recognition: IHG benefits from strong brand equity across its portfolio (e.g., Holiday Inn, Kimpton), making it challenging for new brands to attract customers away from established favorites.

- Economies of Scale: IHG's extensive global network allows for greater purchasing power and operational efficiencies, which new, smaller entrants cannot easily replicate.

- Regulatory and Licensing Hurdles: Navigating local regulations, zoning laws, and licensing requirements in different markets can be complex and time-consuming for new businesses.

The threat of new entrants for InterContinental Hotels Group (IHG) is generally moderate, primarily due to the significant capital investment required to establish new physical properties and the time needed to build comparable brand recognition and loyalty programs. However, the rise of online travel agencies and boutique hotel concepts presents a more accessible entry point for some, particularly in niche markets.

In 2024, the global hotel market's continued growth, projected to exceed $550 billion, signals ongoing attractiveness for new players. While IHG's established brands like Holiday Inn and its robust IHG One Rewards program create substantial barriers, the increasing availability of flexible hotel models and digital platforms could lower entry costs for certain types of competitors.

New entrants must overcome IHG's economies of scale, global distribution networks, and established supplier relationships. Successfully replicating these advantages demands considerable financial resources and operational expertise, making direct competition with IHG's core offerings challenging without a highly differentiated strategy.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Building new hotels costs millions, requiring land, construction, and furnishing. | High barrier, limiting the number of well-funded entrants. |

| Brand Recognition & Loyalty | Decades of marketing and loyalty programs (IHG One Rewards) create customer stickiness. | Difficult for new brands to attract and retain customers. |

| Distribution & Technology | Access to OTAs, GDS, and sophisticated booking systems requires significant investment. | New entrants need substantial tech infrastructure to compete. |

| Regulatory & Local Knowledge | Navigating diverse regulations and understanding local market nuances takes time and expertise. | Complex and costly for newcomers to replicate IHG's global operational footprint. |

Porter's Five Forces Analysis Data Sources

Our Intercontinental Hotels Group Porter's Five Forces analysis is built on a foundation of comprehensive data, including IHG's annual reports, industry-specific market research from firms like Statista and IBISWorld, and relevant regulatory filings.