Intercontinental Hotels Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intercontinental Hotels Group Bundle

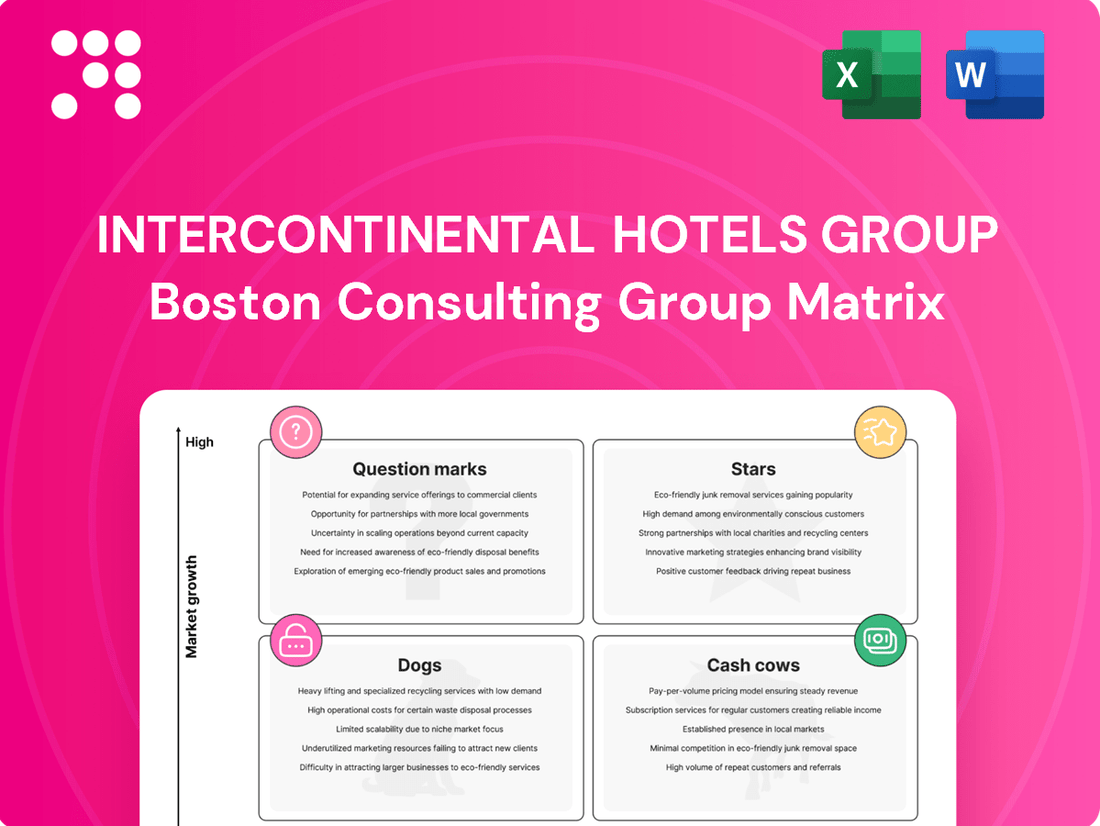

Curious about IHG's strategic positioning? Our BCG Matrix analysis reveals which of their brands are market leaders (Stars), consistent revenue generators (Cash Cows), potential growth opportunities (Question Marks), or underperformers (Dogs).

This preview offers a glimpse into IHG's portfolio, but to truly understand their competitive edge and future investment potential, you need the full picture.

Purchase the complete BCG Matrix report for detailed quadrant placements, data-backed recommendations, and a clear roadmap to optimizing IHG's brand strategy. Gain the insights you need to make informed decisions.

Stars

IHG's Luxury & Lifestyle portfolio is a significant growth engine, commanding 20% of its global development pipeline. This substantial investment reflects a strategic focus on a high-demand market, with the segment's pipeline nearly doubling in just five years.

This expansion is driven by a commitment to meeting the evolving preferences of travelers seeking distinctive and premium experiences. Brands within this segment are key to IHG's strategy for capitalizing on the burgeoning luxury travel market.

Regent Hotels & Resorts, positioned as InterContinental Hotels Group's (IHG) premier luxury brand, is currently experiencing a significant growth phase. This is evidenced by plans for two new openings in 2025, targeting major global cities, which will further solidify its presence in the high-end market.

The brand's strategic re-entry into the Americas in 2024 with the Regent Santa Monica Beach highlights its robust market standing and upward trajectory within the luxury hospitality sector. This move underscores Regent's status as a high-growth asset for IHG.

Regent's reputation as a highly cherished hotel brand translates into a substantial market share within its specific luxury niche. This strong customer preference is a key indicator of its competitive advantage and future potential.

Kimpton Hotels & Restaurants is a shining star within IHG's portfolio. The brand is experiencing robust growth, with plans for numerous new hotel openings in 2025, particularly in international locations. This expansion signifies Kimpton's strong performance in the high-growth boutique luxury segment, where it's actively increasing its market share through strategic development. Its success demonstrates its potential to be a long-term leader.

voco hotels

voco hotels is a strong contender in the premium segment for Intercontinental Hotels Group (IHG), fitting the profile of a Star in the BCG Matrix. Its rapid growth is a key indicator of this positioning.

As IHG's fastest-growing premium brand, voco hotels achieved a significant milestone by opening its 100th property in less than seven years. This impressive expansion is further bolstered by an additional 95 properties currently in the development pipeline.

- Rapid Expansion: Reached 100 open properties and has 95 in the pipeline, showcasing swift market penetration.

- Record Development in 2024: The brand experienced its highest level of development activity during 2024.

- Future Growth Target: voco aims to reach 200 open or pipeline properties by 2028, underscoring its commitment to continued market leadership.

IHG One Rewards Loyalty Program

The IHG One Rewards loyalty program is a key driver of InterContinental Hotels Group's success, demonstrating robust growth and high member engagement. By the close of 2024, the program boasted over 145 million members, a significant 13% increase in enrollments compared to the previous year.

This impressive membership growth translates directly into business value. Loyalty penetration now surpasses 60% across IHG's global operations, a testament to the program's effectiveness in capturing customer spending and fostering repeat business. This high level of engagement is crucial for driving substantial direct revenue for IHG.

The IHG One Rewards program is positioned as a high-growth asset within the company's portfolio. Its strong market share in both customer engagement and retention is expected to yield further benefits. Specifically, the program is projected to generate incremental fee revenue in 2025 and subsequent years, solidifying its role as a valuable component of IHG's strategy.

- IHG One Rewards Membership Growth: Exceeded 145 million members in 2024, with a 13% year-over-year increase in new enrollments.

- Global Loyalty Penetration: Achieved over 60% loyalty penetration worldwide, indicating strong member commitment.

- Revenue Contribution: Drives substantial direct revenue for IHG through high member engagement and retention.

- Future Revenue Potential: Expected to generate incremental fee revenue from 2025 onwards, highlighting its status as a high-growth asset.

Regent Hotels & Resorts and Kimpton Hotels & Restaurants are prime examples of Stars within IHG's portfolio, demonstrating robust growth and strong market positions. Regent's strategic re-entry into the Americas in 2024 with the Regent Santa Monica Beach, alongside planned openings in 2025, highlights its upward trajectory. Kimpton is also expanding internationally with numerous openings planned for 2025, solidifying its presence in the boutique luxury segment.

| Brand | Market Position | Growth Trajectory | Key Developments (2024-2025) |

|---|---|---|---|

| Regent Hotels & Resorts | Premier Luxury | High Growth | Re-entered Americas (2024), 2 new openings planned (2025) |

| Kimpton Hotels & Restaurants | Boutique Luxury | High Growth | Numerous international openings planned (2025) |

What is included in the product

This BCG Matrix overview identifies IHG's hotel brands as Stars, Cash Cows, Question Marks, and Dogs.

It highlights strategic recommendations for investing in Stars and Question Marks, maintaining Cash Cows, and divesting Dogs.

The InterContinental Hotels Group BCG Matrix offers a strategic roadmap, simplifying complex brand portfolios into actionable insights, thereby relieving the pain of resource allocation confusion.

Cash Cows

Holiday Inn Express is a true powerhouse within InterContinental Hotels Group's (IHG) portfolio, firmly positioned as a Cash Cow in the BCG Matrix. As of early 2024, the brand operates a remarkable 3,200 hotels globally, with an impressive pipeline of 600 more under development.

This vast network translates to a significant market share within the mid-scale, essentials-focused segment of the hotel industry. Its maturity and widespread consumer recognition mean it consistently generates strong revenue with comparatively modest marketing expenditures.

The brand's established presence and reliable demand make it a significant contributor to IHG's overall profitability, providing a steady stream of cash flow that can be reinvested into other growth areas of the company.

Holiday Inn Hotels & Resorts, a cornerstone of InterContinental Hotels Group (IHG), operates as a classic Cash Cow. Its extensive global footprint and strong brand recognition in the mid-scale segment have solidified its position, allowing it to capture a significant portion of the market. In 2024, IHG reported a robust performance across its brands, with Holiday Inn and its variations contributing substantially to the group's revenue, demonstrating its consistent ability to generate reliable profits with moderate investment needs.

InterContinental Hotels & Resorts, a cornerstone of InterContinental Hotels Group's portfolio, commands a significant presence with 227 operational hotels and a robust pipeline of 101 properties. This extensive network underscores its dominant market share within the luxury hospitality sector.

As a mature, high-performing brand, InterContinental Hotels & Resorts consistently generates substantial fee revenues for IHG. Its ongoing brand evolution ensures continued leadership and stability, solidifying its role as a dependable cash cow within the group's BCG matrix.

Crowne Plaza Hotels & Resorts

Crowne Plaza Hotels & Resorts functions as a cash cow for Intercontinental Hotels Group (IHG). Its established premium positioning and substantial global footprint, bolstered by a European pipeline that accounts for nearly 20% of its open hotels, signify a strong and consistent market presence.

The brand's reliable performance, evidenced by high guest satisfaction scores, underscores its significant market share within the business and premium travel segments. This consistent customer loyalty translates into a steady and predictable contribution to IHG's overall cash flow.

- Brand Strength: Crowne Plaza is a recognized premium brand with a broad international reach.

- Growth Potential: A robust European pipeline indicates continued expansion and market penetration.

- Financial Contribution: The brand consistently generates substantial cash flow for IHG due to its strong market position.

- Guest Loyalty: High guest satisfaction ratings reinforce its standing in the competitive premium hotel market.

IHG's Asset-Light Business Model

IHG's strategic advantage lies in its asset-light, fee-based business model, primarily functioning as a franchisor and hotel manager. This structure significantly reduces the need for capital expenditure, allowing for robust cash flow generation. For instance, in 2023, IHG reported a gross revenue of £3.5 billion, with a substantial portion derived from management and franchise fees, underscoring the strength of this model.

- Asset-Light Operations: IHG's core business relies on franchising and management contracts rather than direct hotel ownership.

- Fee-Based Revenue: This model generates consistent revenue streams through franchise fees, management fees, and royalties from its extensive global network.

- Cash Flow Generation: The minimal capital investment required allows IHG to generate strong, predictable cash flows, acting as a significant cash cow.

- Strategic Funding: These cash flows are crucial for funding new brand development, market expansion, and returning value to shareholders.

Kimpton Hotels & Restaurants, a distinguished brand within IHG's portfolio, operates as a mature Cash Cow. Its unique boutique positioning and established presence in key urban markets allow it to command premium pricing, generating consistent revenue with relatively stable operational costs.

The brand's focus on personalized guest experiences fosters strong loyalty, ensuring a reliable stream of repeat business. This consistent demand, coupled with its established market share, makes Kimpton a predictable and valuable contributor to IHG's overall profitability, providing essential cash flow for strategic investments in other areas of the business.

| Brand | BCG Matrix Position | Key Characteristics | 2024 Contribution |

|---|---|---|---|

| Holiday Inn Express | Cash Cow | Mid-scale, high volume, broad appeal | Significant revenue driver, stable cash flow |

| Holiday Inn Hotels & Resorts | Cash Cow | Mid-scale, established global presence | Substantial revenue, consistent profits |

| InterContinental Hotels & Resorts | Cash Cow | Luxury segment, high fee revenue | Strong fee income, brand leadership |

| Crowne Plaza Hotels & Resorts | Cash Cow | Premium segment, business travel focus | Steady cash flow, high guest satisfaction |

| Kimpton Hotels & Restaurants | Cash Cow | Boutique, urban focus, personalized service | Predictable revenue, loyal customer base |

Delivered as Shown

Intercontinental Hotels Group BCG Matrix

The InterContinental Hotels Group BCG Matrix preview you're viewing is the identical, fully formatted report you'll receive immediately after purchase. This comprehensive analysis, meticulously prepared by industry experts, provides actionable insights into IHG's brand portfolio, categorizing each under the Stars, Cash Cows, Question Marks, and Dogs quadrants for strategic decision-making. You can confidently expect this exact document, free of watermarks or demo content, ready for immediate integration into your business planning and presentations.

Dogs

Individual hotels within Intercontinental Hotels Group (IHG), particularly those in older or less recently renovated properties, can become significant cash drains. Even when operating under strong IHG brands, these locations often suffer from lower occupancy rates and reduced Revenue Per Available Room (RevPAR) compared to their more modern counterparts. For instance, while IHG's overall RevPAR saw a substantial increase in 2024, specific underperforming assets might lag considerably behind this trend.

These struggling properties often find it difficult to attract and retain guests, necessitating substantial capital investment for modernization. The challenge lies in the uncertain return on these investments, making them prime candidates for divestiture by hotel owners. In 2024, many hotel groups are actively reviewing their portfolios, looking to streamline operations and exit non-core or underperforming assets to focus resources on higher-growth opportunities.

Within InterContinental Hotels Group's diverse portfolio, brands exhibiting stagnant development pipelines could be categorized as 'dogs.' This typically means they have a low market share and are in a low-growth market, with little recent expansion activity. For instance, if a brand like Regent Hotels & Resorts, which IHG acquired in 2018, hasn't seen significant new openings or development commitments by mid-2024, it might fit this description.

Brands in this category often struggle to compete against more dynamic offerings, potentially leading to declining profitability or relevance. While IHG is known for its strong pipeline, particularly with brands like Holiday Inn Express and voco, any legacy brands that aren't attracting new investment or development could be considered dogs.

Within Intercontinental Hotels Group's (IHG) portfolio, certain regional pockets might be classified as 'dogs' if they consistently underperform. This occurs when specific markets face prolonged economic slowdowns or an oversupply of hotel rooms, leading to reduced revenue per available room (RevPAR) and occupancy rates.

For example, if a particular region within Greater China, which experienced a RevPAR decline in Q1 2025, continues this downward trend, properties there could exhibit 'dog' characteristics. This would indicate a need for strategic review, potentially involving divestment or significant repositioning to improve performance.

Niche Brands Lacking Scalability

Intercontinental Hotels Group (IHG) might categorize certain highly specialized or niche brands as 'dogs' if they face challenges in achieving widespread market penetration or significant growth. These brands may not be contributing substantially to overall revenue or market share, potentially leading to reduced investment. For instance, a luxury boutique brand with limited locations and high operating costs, if not attracting sufficient occupancy or commanding premium rates consistently, could fit this description.

While specific brand performance data for IHG's portfolio is proprietary, the general concept of 'dogs' in the BCG matrix applies to any business unit or product line that exhibits low growth and low market share. For IHG, this could manifest in brands that cater to a very specific traveler segment, making scalability difficult. Without robust demand or a clear path to expansion, such brands might struggle to generate a positive return on investment.

- Niche Market Constraints: Brands targeting very specific, limited customer bases may struggle with scalability.

- Low Market Share & Growth: 'Dog' brands typically operate in mature or declining markets with minimal competitive advantage.

- Investment Re-evaluation: IHG would likely assess if continued investment in these niche brands aligns with their overall strategic objectives and profitability goals.

Non-Core, Legacy Owned/Leased Assets

Non-core, legacy owned/leased assets within Intercontinental Hotels Group (IHG) would likely fall into the 'Dogs' category of the BCG Matrix. These are properties that IHG might still directly own or lease, but they are underperforming or no longer align with the company's strategic focus on an asset-light model.

These legacy assets can be a drain on resources, tying up capital that could be better deployed in higher-growth areas. Their low returns make them candidates for divestment to improve overall portfolio efficiency.

- Underperforming Assets: These are properties with low occupancy rates or declining profitability, often due to age, location, or competition.

- Capital Tie-up: Owning or leasing these assets requires ongoing investment in maintenance, renovations, and operational costs without generating substantial returns.

- Strategic Divestment: IHG's strategy favors brand management and franchising, making non-strategic, owned properties less attractive. Divesting these can free up capital for more profitable ventures.

- Focus on Core Business: By shedding these 'dogs', IHG can concentrate its efforts and resources on its core, asset-light operations, which typically offer higher margins and scalability.

Within Intercontinental Hotels Group's (IHG) portfolio, certain brands or individual properties might be classified as 'dogs' if they exhibit low market share and operate in low-growth or declining markets. These units typically require significant investment but offer minimal returns, acting as cash drains.

For example, a legacy brand that has not seen substantial new development or renovation commitments by mid-2024, and faces intense competition from newer, more appealing offerings, could be considered a 'dog'. Such segments may struggle to achieve target occupancy rates or RevPAR growth, potentially impacting overall profitability.

IHG's strategic focus on an asset-light model means that owned or leased properties that are underperforming and no longer align with the company's core business are prime candidates for divestment. These 'dogs' tie up capital that could be better allocated to high-growth brands and markets.

By identifying and managing these 'dog' segments, IHG can streamline its operations, improve capital allocation, and focus on brands that offer greater potential for sustained growth and profitability in the evolving hospitality landscape.

Question Marks

InterContinental Hotels Group's Vignette Collection, launched in 2021, represents a strategic move into the independent luxury hotel segment. This collection brand is designed to attract and convert high-end, standalone properties, capitalizing on the growing demand for unique and personalized travel experiences.

As a relatively new entrant in 2024, Vignette Collection is positioned as a question mark within IHG's BCG matrix. While it operates in a high-growth luxury market with strong potential for conversion opportunities, it is still in the process of establishing its market share and brand recognition against more established luxury players.

Garner hotels, a recent addition to the InterContinental Hotels Group (IHG) portfolio, is positioned as a question mark in the BCG matrix. This new midscale conversion brand is experiencing rapid growth, with nearly 60 hotels either open or planned across the Americas.

Operating in a high-growth market segment that emphasizes conversions, Garner hotels currently holds a relatively small market share within IHG's extensive brand offerings. This strategic placement suggests significant upside potential, contingent on successful market penetration and continued investment.

Ruby, acquired by IHG in Q1 2025, fits the question mark category in the BCG matrix. While it targets the burgeoning urban lifestyle segment, a high-growth market, its current market share within IHG's extensive brand family is relatively low. This positions Ruby as a potential star if IHG can successfully execute its ambitious global expansion plans across Europe, the Americas, and Asia.

Atwell Suites

Atwell Suites, a newer entrant in the all-suites category, is positioned as a question mark within IHG's BCG Matrix. The brand is actively developing and rolling out new prototypes in 2024, with initial property openings slated for 2025. This strategic expansion targets the burgeoning extended-stay market, a segment that saw continued demand throughout 2024. While the extended-stay sector demonstrates robust growth potential, Atwell Suites is still in the crucial phase of building its brand identity and securing market share.

The extended-stay market is a key area of focus for the hospitality industry. In 2024, the U.S. extended-stay hotel segment continued to show resilience and growth, with occupancy rates often outpacing the overall hotel market. For instance, reports from late 2024 indicated that extended-stay hotels maintained occupancy levels in the high 70s to low 80s percent range, a testament to consistent demand for longer-term accommodation solutions. Atwell Suites' entry into this space, with its new prototype options and planned 2025 debuts, places it squarely in a position to capitalize on this trend, though its current market penetration is still developing.

Atwell Suites' current status as a question mark suggests a need for continued investment and strategic marketing to convert its potential into market leadership.

- Market Position: Emerging brand in the growing extended-stay segment.

- Growth Potential: High, driven by increasing demand for longer-term accommodations.

- Investment Need: Significant, to build brand recognition and market share.

- Future Outlook: Potential to become a strong performer if market penetration is achieved.

Candlewood Suites (European Market Entry)

Candlewood Suites' entry into the European market, specifically Germany with 14 signed hotels for its 2025 debut, positions it as a question mark within IHG's portfolio. While the brand is well-established in the US, this expansion signifies a move into a new, potentially high-growth territory where its market share and brand recognition are yet to be proven. This strategic initiative requires significant investment and careful execution to navigate the competitive European hospitality landscape and establish a strong foothold.

- High Growth Potential: The European market, particularly Germany, presents a significant opportunity for expansion, driven by strong travel demand and a need for extended-stay accommodations.

- Market Entry Challenges: As a new entrant, Candlewood Suites will face established competitors and the need to build brand awareness and customer loyalty from the ground up.

- Investment and Risk: The planned 2025 launch involves substantial capital investment, and success hinges on effectively adapting the brand's value proposition to European consumer preferences and operational standards.

- Strategic Importance: This move is crucial for IHG's diversification strategy, aiming to capture a new segment of travelers and enhance its overall market presence beyond its traditional strongholds.

Question marks in IHG's portfolio represent brands with high growth potential but currently low market share. These brands are in developing markets or are new entries that require significant investment to gain traction. Success hinges on their ability to capture market share and transition into stars.

For instance, Vignette Collection, launched in 2021, targets the independent luxury segment, a high-growth area. However, as a new brand in 2024, its market share is still minimal, making it a question mark. Similarly, Garner hotels, a midscale conversion brand, is rapidly expanding with nearly 60 properties planned by 2024 but holds a small share within IHG's overall brand family.

Ruby, acquired in Q1 2025, also falls into this category. It operates in the growing urban lifestyle segment but has a low current market share, positioning it as a potential star if IHG's expansion plans are successful. Atwell Suites, targeting the extended-stay market, is another question mark, with new prototypes in development for 2024 and openings planned for 2025, aiming to capture a segment that showed strong demand throughout 2024.

Candlewood Suites' European expansion, with 14 signed hotels in Germany for a 2025 debut, places it as a question mark. While established in the US, its market share and brand recognition in Europe are unproven, requiring substantial investment to navigate the competitive landscape.

| Brand | Market Segment | Growth Potential | Current Market Share | BCG Status |

|---|---|---|---|---|

| Vignette Collection | Independent Luxury | High | Low | Question Mark |

| Garner Hotels | Midscale Conversion | High | Low | Question Mark |

| Ruby | Urban Lifestyle | High | Low | Question Mark |

| Atwell Suites | Extended-Stay | High | Low | Question Mark |

| Candlewood Suites (Europe) | Extended-Stay | High | Low | Question Mark |

BCG Matrix Data Sources

Our Intercontinental Hotels Group BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.