Howmet Aerospace PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Howmet Aerospace Bundle

Uncover the critical external forces shaping Howmet Aerospace's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes and economic shifts to technological advancements and environmental regulations, understand the full spectrum of influences impacting this aerospace giant. Equip yourself with the strategic foresight needed to navigate these complexities. Download the full PESTLE analysis now and gain actionable intelligence to refine your own market strategy.

Political factors

Government defense spending trends significantly bolster Howmet Aerospace's defense sector. In the first quarter of 2025, this segment saw an impressive 19% year-over-year revenue increase, representing 17% of the company's total sales.

This growth is largely driven by high demand for spare parts for the F-35 program and a rise in orders for both new aircraft and older fighter jet components. The fiscal 2025 Defense Appropriations Act, for instance, directly supports Howmet by enhancing its capacity to win new contracts and sustain demand for its products.

International trade policies and tariffs significantly influence the aerospace sector, affecting production expenses and the reliability of supply chains. Howmet Aerospace has reported a substantial $80 million gross exposure to emerging tariffs.

Looking ahead to 2025, the company anticipates a net financial impact of $15 million due to these tariffs. While Howmet Aerospace aims to transfer these additional costs to its clientele, the dynamic nature of tariff regulations introduces considerable uncertainty, particularly for the commercial transportation segment and its potential effect on truck manufacturing.

Geopolitical events significantly shape the aerospace and defense landscape, directly impacting companies like Howmet Aerospace. Escalating global tensions and conflicts, such as those observed in Eastern Europe and the Middle East throughout 2024, have spurred increased defense budgets among NATO allies and other nations. This trend directly benefits Howmet's defense segment, which supplies critical components for military aircraft and systems.

For instance, the North Atlantic Treaty Organization's (NATO) commitment to increasing defense spending, with many members aiming for 2% of GDP by 2024, translates into substantial opportunities for defense contractors and their suppliers. These increased military expenditures often lead to higher demand for new platforms and upgrades, boosting Howmet's order books.

Conversely, prolonged geopolitical uncertainties can dampen commercial aviation demand. Disruptions to air travel, such as flight restrictions or reduced passenger confidence in affected regions, can slow the growth of Howmet's commercial aerospace segment. While the overall demand for air travel remained robust in 2024, localized geopolitical instability can still create headwinds for specific routes or carriers.

Aerospace Industry Regulations

The aerospace sector operates under rigorous regulatory oversight from agencies like the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA). These bodies mandate strict standards for safety, airworthiness, and environmental impact, directly influencing manufacturing processes and product design.

Howmet Aerospace, as a key supplier of critical components for aircraft and spacecraft, must adhere to these demanding regulations. For instance, FAA certification for new engine components or airframe structures involves extensive testing and documentation, a process that can take years and significant investment. In 2024, the FAA continued to emphasize cybersecurity requirements for avionics and aircraft systems, adding another layer of compliance for component manufacturers.

- FAA and EASA Certifications: Essential for market access, these require rigorous testing and adherence to safety standards.

- Cybersecurity Mandates: Increasingly important for avionics and connected aircraft systems, impacting component design.

- Environmental Regulations: Evolving rules on emissions and noise pollution influence material choices and engine component development.

- Supply Chain Scrutiny: Regulators are also focusing on the security and integrity of the entire aerospace supply chain.

Government Support for Aerospace Innovation

Government initiatives and funding play a crucial role in driving aerospace innovation, directly benefiting companies like Howmet Aerospace. These programs often target advancements in new materials and manufacturing processes. For instance, the U.S. Department of Defense's manufacturing innovation institutes, such as America Makes, have supported research into advanced materials like composites and additive manufacturing, which are key areas for Howmet.

Such government backing directly supports Howmet's strategic focus on developing solutions for quieter, cleaner, and more efficient aerospace engines. This includes investments in research and development for lightweighting technologies and advanced propulsion systems. In 2024, the U.S. government allocated billions towards aerospace R&D, with a significant portion earmarked for next-generation aircraft technologies and sustainable aviation fuels.

Specifically, government support can manifest in several ways:

- Funding for R&D: Grants and contracts for developing new aerospace materials and manufacturing techniques.

- Tax Incentives: Credits for companies investing in innovative technologies and sustainable practices.

- Regulatory Frameworks: Policies that encourage the adoption of advanced, environmentally friendly aerospace solutions.

- Public-Private Partnerships: Collaborative projects that accelerate the development and deployment of cutting-edge aerospace technologies.

Government defense spending remains a significant driver for Howmet Aerospace, with the first quarter of 2025 showing a 19% year-over-year revenue increase in this segment, contributing 17% of total sales.

This growth is fueled by demand for F-35 program parts and increased orders for both new and older fighter jet components, supported by legislation like the fiscal 2025 Defense Appropriations Act.

International trade policies and tariffs present a notable challenge, with Howmet Aerospace reporting an $80 million gross exposure to emerging tariffs and anticipating a $15 million net financial impact in 2025.

Geopolitical events have bolstered defense budgets, benefiting Howmet's defense segment, while also posing risks to commercial aviation demand due to potential travel disruptions.

What is included in the product

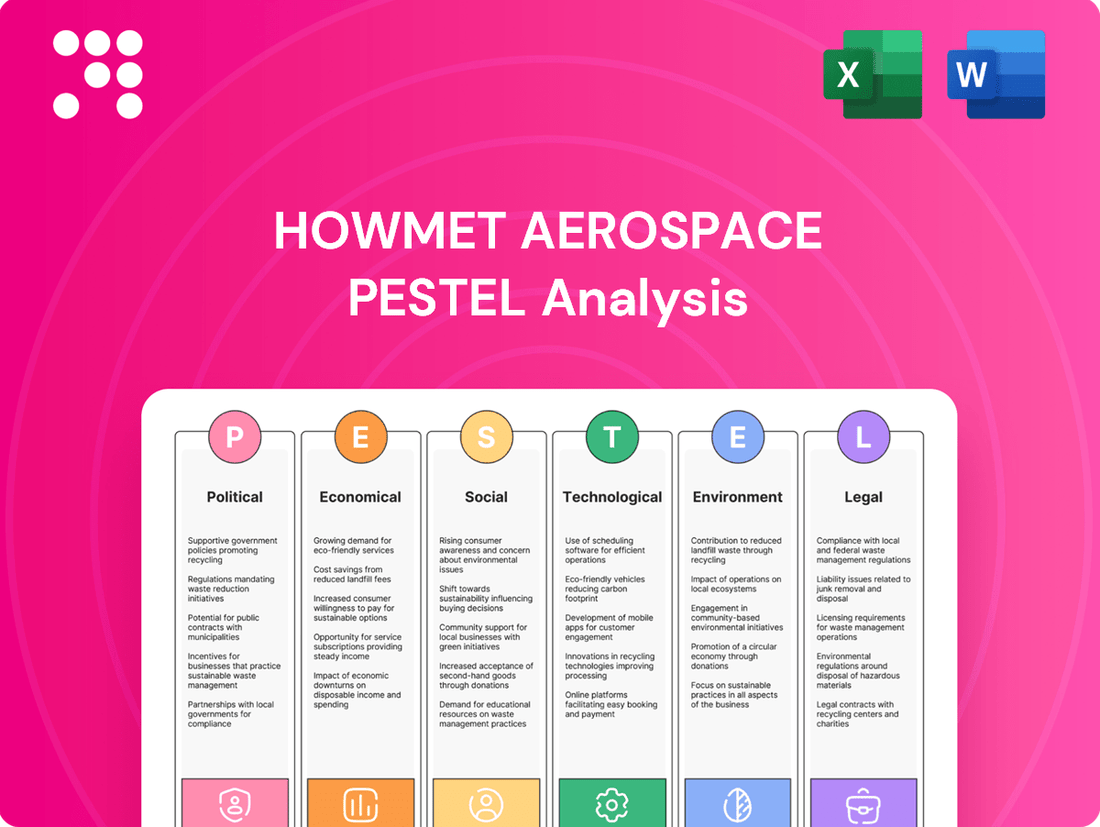

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Howmet Aerospace, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies for executives, consultants, and entrepreneurs to navigate market dynamics and capitalize on emerging opportunities.

A PESTLE analysis for Howmet Aerospace offers a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations, thus relieving the pain point of sifting through extensive data.

Economic factors

Global economic growth is a significant driver for air travel, and by extension, for Howmet Aerospace. As economies expand, so does the demand for passenger and cargo transport, directly boosting the need for new aircraft and aftermarket services. This relationship is fundamental to Howmet's business, as their components are integral to aircraft manufacturing and maintenance.

While global air passenger traffic is experiencing growth, particularly in Europe and Asia Pacific, there's a noticeable slowdown in North America. This moderation is attributed to economic uncertainties and trade-related issues, like tariffs. Despite this regional softening, Howmet's original equipment manufacturer (OEM) clients are still reporting robust growth, evidenced by substantial order backlogs, indicating sustained long-term demand for aircraft.

Inflationary pressures and the volatility of raw material prices, particularly for key metals like aluminum and titanium, directly affect Howmet Aerospace's manufacturing costs. These fluctuations can squeeze profit margins if not managed effectively.

However, Howmet Aerospace demonstrated resilience in Q1 2025, reporting an adjusted EBITDA margin of 28.8%. This strong performance suggests the company possesses robust cost control mechanisms and the pricing power to pass on a portion of increased expenses to its clientele.

Fluctuations in interest rates directly impact the cost of borrowing for airlines, influencing their decisions regarding capital expenditures on new aircraft. Higher rates can make financing new fleets more expensive, potentially dampening demand for aircraft components like those produced by Howmet Aerospace. This indirect effect highlights the sensitivity of Howmet's market to broader economic conditions.

Howmet Aerospace has demonstrated robust financial health, enabling it to manage the impact of varying interest rate environments. The company generated substantial free cash flow and actively reduced its debt, strengthening its balance sheet. This financial resilience allows Howmet to continue its strategic investments, with capital expenditures projected to rise by roughly $100 million in 2024, underscoring its commitment to growth despite potential interest rate headwinds.

Supply Chain Resilience and Disruptions

The resilience of the global supply chain is paramount for Howmet Aerospace, a key player in precision-engineered solutions. Disruptions, whether from geopolitical events or unforeseen incidents like the 2023 factory fire at a key supplier, directly affect their capacity to fulfill orders and maintain production schedules. In 2024, companies like Howmet are prioritizing diversification of their supplier base and increasing inventory levels to buffer against these vulnerabilities.

Howmet Aerospace is actively working to fortify its supply chain by securing long-term contracts and exploring near-shoring options. This strategy aims to reduce reliance on single-source suppliers and mitigate the impact of potential disruptions. For instance, the company has been investing in advanced manufacturing capabilities to bring more production in-house, thereby gaining greater control over its supply chain.

- Supplier Diversification: Reducing reliance on single geographic regions or suppliers to spread risk.

- Inventory Management: Increasing strategic stock of critical components to absorb short-term supply shocks.

- Long-Term Contracts: Securing commitments from suppliers to ensure consistent availability and pricing.

- Technological Integration: Utilizing advanced analytics and digital tools for better supply chain visibility and forecasting.

Commercial Aerospace Build Rates and Backlogs

Commercial aerospace build rates and the substantial existing backlogs directly influence Howmet Aerospace's production output. The company is currently experiencing a benefit from record backlogs held by its engine and airframe original equipment manufacturer (OEM) customers. This surge is a result of aircraft under-building in recent years coupled with a strong market appetite for newer, more fuel-efficient aircraft models.

Howmet Aerospace's revenue from spare parts, which is an increasing segment of its overall income, also points to consistent demand that isn't solely tied to new aircraft deliveries. This indicates a stable revenue stream supporting the company's operations.

- Record Backlogs: Major OEMs like Boeing and Airbus reported significant order backlogs extending well into the next decade as of late 2024 and early 2025. For instance, Airbus had over 8,000 aircraft on order, while Boeing's backlog also remained robust, exceeding 5,000 aircraft.

- Increased Build Rates: Following pandemic-induced slowdowns, manufacturers are actively working to increase production rates. Boeing aims to reach monthly production rates of 38 737 MAX aircraft by mid-2025, and Airbus is targeting 75 A320 family aircraft per month by 2026.

- Spares Demand: The aftermarket services and spares segment for Howmet Aerospace is projected to grow, with analysts anticipating it could represent a larger percentage of total revenue in the coming years, potentially reaching over 30% by 2027.

- Fuel Efficiency Focus: The ongoing demand for fuel-efficient aircraft, such as the A320neo family and Boeing 737 MAX, continues to drive new aircraft orders and, consequently, the need for advanced components supplied by Howmet.

Global economic growth directly fuels air travel demand, positively impacting Howmet Aerospace's business through increased orders for new aircraft and aftermarket services. Despite a slowdown in North America due to economic uncertainties, Howmet's OEM clients maintain robust order backlogs, signaling sustained long-term demand.

Inflation and raw material price volatility, particularly for aluminum and titanium, pose cost pressures, yet Howmet demonstrated strong cost control with a 28.8% adjusted EBITDA margin in Q1 2025, indicating pricing power.

Rising interest rates can affect airline financing for new aircraft, potentially softening demand for components. However, Howmet's substantial free cash flow and debt reduction, coupled with a projected $100 million increase in capital expenditures for 2024, highlight its financial resilience and commitment to growth.

Supply chain resilience is critical; Howmet is diversifying suppliers and increasing inventory to mitigate disruptions, investing in advanced manufacturing to enhance control.

What You See Is What You Get

Howmet Aerospace PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Howmet Aerospace delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed overview of the external forces shaping its strategic landscape.

Sociological factors

The aerospace and advanced manufacturing sectors, where Howmet Aerospace operates, are heavily reliant on a specialized talent pool. This includes highly qualified engineers, skilled technicians, and experienced manufacturing professionals. The availability and quality of this workforce are critical for innovation, production efficiency, and overall operational success.

Howmet Aerospace actively focuses on building and maintaining a robust global workforce. This involves strategic initiatives for attracting top talent, providing comprehensive training and development programs, and implementing retention strategies to keep their skilled employees engaged. This commitment ensures they have the necessary human capital to support their complex operations and future expansion plans.

The company's ongoing need for skilled personnel is evident in its operational data. For instance, Howmet Aerospace reported absorbing approximately 500 net new employees in its Engine Products segment during the first quarter of 2025. This significant influx underscores the continuous recruitment efforts required to meet the demands of their growing business and technological advancements.

Howmet Aerospace prioritizes managing its workforce demographics and retaining talent, recognizing the highly specialized skills needed for its aerospace components. In 2024, the company continued its focus on diversity, equity, and inclusion initiatives, aiming to attract and keep a broad range of employees. These efforts are critical for maintaining the deep technical expertise essential for their advanced manufacturing processes.

To foster talent retention, Howmet Aerospace invests in comprehensive learning and development programs, including coaching and mentorship. This approach not only enhances individual employee performance but also plays a vital role in preserving invaluable institutional knowledge within the organization. By nurturing employee growth, Howmet aims to build a stable and skilled workforce capable of meeting future industry demands.

Public perception significantly shapes the aerospace and defense sectors, impacting everything from attracting top talent to securing investment capital. A positive public image is increasingly crucial for companies like Howmet Aerospace.

Howmet Aerospace actively cultivates a favorable public image by emphasizing its role in developing quieter, cleaner, and more fuel-efficient engines, alongside its contributions to sustainable ground transportation. This focus resonates with a public increasingly concerned about environmental impact and technological advancement.

Furthermore, Howmet Aerospace's dedication to Environmental, Social, and Governance (ESG) priorities directly addresses evolving societal expectations. For instance, in 2023, Howmet Aerospace reported a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to their 2019 baseline, demonstrating tangible progress aligned with public and investor demands for sustainability.

Demand for Sustainable Aviation Practices

There's a growing push from both the public and the aviation industry itself for more environmentally friendly flight operations. This demand is a significant driver for advancements in areas like fuel efficiency and making aircraft lighter, which are precisely where Howmet Aerospace excels. Their specialized technologies are designed to help customers lower the environmental impact of their planes and commercial vehicles, directly contributing to broader global sustainability goals.

This societal shift is translating into tangible market opportunities. For instance, by 2025, the International Air Transport Association (IATA) aims for a 1.5% annual improvement in fuel efficiency. Howmet's lightweighting solutions, such as advanced composite structures and high-performance engine components, are crucial for achieving these targets. The company's focus on reducing the carbon footprint of aviation aligns with increasing investor and regulatory scrutiny on environmental, social, and governance (ESG) factors.

- Growing Demand: Societal and industry pressure for sustainable aviation practices is intensifying.

- Innovation Driver: This demand fuels innovation in fuel efficiency and lightweighting, core strengths for Howmet Aerospace.

- Carbon Footprint Reduction: Howmet's technologies directly address the need to decrease aircraft and commercial vehicle emissions.

- Alignment with Targets: The company's offerings support global sustainability goals and increasing ESG focus.

Consumer Confidence in Air Travel

Consumer confidence in air travel is a significant driver for the aerospace industry, directly influencing airline profitability and, by extension, the demand for new aircraft and maintenance services. For Howmet Aerospace, a dip in this confidence can translate to slower order books for new planes and reduced need for MRO.

While the commercial aerospace market faces potential headwinds from fluctuating consumer sentiment, Howmet's position is bolstered by a substantial backlog of orders and consistent demand for spare parts. This provides a degree of insulation against short-term confidence shifts.

Data from the International Air Transport Association (IATA) indicated a robust recovery in global air passenger traffic in 2023, with expectations for continued growth into 2024 and 2025. However, any prolonged period of reduced consumer confidence, perhaps due to economic uncertainty or geopolitical events, could temper this growth. For instance, a significant global event causing widespread travel apprehension could see passenger numbers plateau or decline, impacting airline investment in new fleets.

Key considerations include:

- Impact on Demand: Lower consumer confidence can lead airlines to defer or cancel aircraft orders, directly affecting manufacturers like Boeing and Airbus, and subsequently suppliers like Howmet.

- Resilience Factors: Howmet's strong backlog and steady demand for aftermarket services (spares and MRO) offer a buffer against volatility in new aircraft sales.

- Market Growth: Despite potential confidence fluctuations, the long-term trend for air travel remains positive, driven by economic development and increasing global mobility, supporting sustained demand for aerospace products.

- Economic Sensitivity: Consumer confidence is closely tied to economic health; a recessionary environment would likely dampen travel and, consequently, aerospace demand more significantly than isolated confidence dips.

Societal expectations are increasingly driving demand for sustainable aviation solutions. Howmet Aerospace's focus on lightweighting and fuel efficiency directly addresses this, aligning with industry goals like IATA's aim for 1.5% annual fuel efficiency improvement by 2025. This trend is further amplified by investor focus on ESG factors, making Howmet's environmental contributions a key differentiator.

Consumer confidence in air travel significantly influences airline purchasing decisions, impacting Howmet's order pipeline. While a robust backlog provides some stability, prolonged periods of low confidence, potentially due to economic downturns, could temper demand for new aircraft. However, the long-term outlook for air travel remains positive, supported by global economic growth.

| Societal Factor | Impact on Howmet Aerospace | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Sustainability Demand | Drives innovation in fuel efficiency and lightweighting. | IATA target: 1.5% annual fuel efficiency improvement by 2025. Howmet's ESG focus aligns with investor demands. |

| Consumer Confidence in Air Travel | Influences airline order books for new aircraft. | IATA reported strong recovery in 2023, with continued growth expected into 2024-2025, but sensitive to economic uncertainty. |

Technological factors

Advancements in additive manufacturing, commonly known as 3D printing, are revolutionizing how complex aerospace components are created. This technology allows for the production of intricate designs and lighter-weight parts that were previously impossible or prohibitively expensive to manufacture. Howmet Aerospace, a key player in engineered solutions for the aerospace industry, is well-positioned to benefit from these developments.

Howmet Aerospace's commitment to innovation and advanced manufacturing techniques means they are actively exploring and integrating technologies like 3D printing. Their expertise in next-generation alloys, crucial for aerospace applications, directly complements the capabilities of additive manufacturing. This synergy enables the creation of enhanced product functionalities and more efficient production processes, potentially reducing lead times and material waste.

Howmet Aerospace's core business relies heavily on the advancement of high-performance alloys and materials. Their commitment to innovation in this area directly impacts the creation of lighter, more fuel-efficient components for the aerospace and automotive sectors. This focus is supported by a robust intellectual property portfolio, with approximately 1,170 granted and pending patents underscoring their leadership in proprietary material technologies.

The integration of automation and robotics is a cornerstone for modern manufacturing, driving improvements in efficiency, accuracy, and overall cost reduction. Howmet Aerospace actively invests in these advanced technologies to streamline its production lines.

In 2023, Howmet Aerospace reported that its investments in automation and lean manufacturing principles contributed to a notable uplift in margins, particularly within its Fastening Systems and Engineered Structures segments. This strategic focus on technological advancement is crucial for maintaining a competitive edge in the aerospace industry.

Digitalization and Industry 4.0 Adoption

Howmet Aerospace is actively integrating digitalization and Industry 4.0, focusing on smart manufacturing for enhanced efficiency. This includes implementing real-time monitoring across its production lines and supply chains, aiming to streamline operations and reduce waste. For instance, the company utilizes advanced digital monitoring and machine learning algorithms specifically for defect detection, a key component of its data-driven operational strategy.

The adoption of these technologies is crucial for maintaining a competitive edge in the aerospace sector. By leveraging smart manufacturing systems, Howmet can achieve greater precision and faster turnaround times. This commitment to continuous improvement through data analytics underpins its approach to optimizing production processes and ensuring product quality.

Key areas of technological advancement include:

- Smart Manufacturing: Implementing automated processes and interconnected systems for optimized production flow.

- Real-time Monitoring: Utilizing sensors and data analytics to track production parameters and supply chain movements instantaneously.

- Machine Learning for Quality Control: Employing AI-driven systems for early and accurate defect identification, improving product reliability.

- Digital Twin Technology: Exploring virtual replicas of physical assets and processes to simulate performance and identify potential improvements before physical implementation.

Research and Development in Propulsion and Airframe Design

Howmet Aerospace's commitment to quieter, cleaner, and more fuel-efficient aerospace engines and industrial gas turbines drives significant investment in research and development. This focus on innovation is crucial for staying competitive and meeting the stringent performance and environmental standards of the aerospace and defense sectors.

The company's R&D efforts in propulsion and airframe design directly support its mission. For instance, advancements in materials science and manufacturing techniques are key to developing lighter, stronger components that contribute to fuel savings and reduced emissions. This ongoing technological evolution ensures Howmet Aerospace's products remain at the forefront of industry capabilities.

- Investment in R&D: Howmet Aerospace consistently allocates substantial resources to research and development, aiming to enhance engine efficiency and reduce environmental impact.

- Propulsion System Advancements: Focus areas include developing advanced materials and designs for turbine blades, combustors, and other critical engine components.

- Airframe Design Integration: R&D also extends to airframe technologies that complement propulsion systems, such as aerodynamic improvements and advanced structural components.

- Meeting Evolving Demands: These technological pursuits are essential for addressing the aerospace industry's increasing demand for sustainability and operational performance.

Technological advancements, particularly in additive manufacturing and smart production, are reshaping aerospace component creation. Howmet Aerospace leverages these innovations, integrating 3D printing for intricate, lighter parts and employing automation for enhanced efficiency and cost reduction. Their significant patent portfolio, with around 1,170 granted and pending patents, highlights their leadership in proprietary material technologies, crucial for developing lighter, more fuel-efficient aerospace solutions.

Howmet Aerospace's investment in R&D is pivotal for developing advanced materials and designs that improve engine efficiency and reduce environmental impact. Their focus on digitalization and Industry 4.0 principles, including real-time monitoring and machine learning for defect detection, streamlines operations and ensures product quality. This strategic technological integration is key to maintaining a competitive edge and meeting the industry's evolving demands for sustainability and performance.

| Key Technology Focus | Impact on Howmet Aerospace | Supporting Data/Examples |

| Additive Manufacturing (3D Printing) | Enables complex, lighter-weight components | Complements expertise in next-generation alloys |

| Automation & Robotics | Improves production efficiency, accuracy, and cost reduction | Contributed to margin uplift in 2023 (Fastening Systems, Engineered Structures) |

| Digitalization & Industry 4.0 | Enhances efficiency through smart manufacturing and real-time monitoring | Utilizes machine learning for defect detection; aims to reduce waste |

| Research & Development (R&D) | Drives innovation in materials science and engine/airframe design | Focus on quieter, cleaner, fuel-efficient engines; ~1,170 patents |

Legal factors

Howmet Aerospace must adhere to exceptionally strict safety and certification standards for its aircraft and spacecraft components. This includes regulations from bodies like the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA), which are critical for market access and operational legitimacy.

Failure to meet these stringent requirements, such as those outlined in FAA Advisory Circulars or EASA Type Certification Basis, can lead to significant delays, product recalls, and severe reputational damage. For instance, the FAA's rigorous certification process for new aircraft designs, which impacts component suppliers like Howmet, can take years and involve extensive testing and documentation.

The company's commitment to compliance underpins its entire business model, ensuring the reliability and safety of its products, which is paramount for maintaining customer trust and securing contracts with major aerospace manufacturers. In 2023, the aerospace industry continued to see investments in advanced materials and manufacturing processes, all requiring stringent validation against evolving safety protocols.

Protecting its intellectual property is paramount for Howmet Aerospace's ongoing success. As of late 2023, the company held approximately 1,170 granted and pending patents. These patents are vital for safeguarding its innovations, which focus on developing lighter, more fuel-efficient components for the aerospace and commercial vehicle industries, thereby maintaining its competitive edge.

Howmet Aerospace, as a key supplier of critical aerospace components, operates under stringent product liability and warranty regulations. These rules are designed to ensure the safety and reliability of parts used in demanding aviation environments. Failure to meet these standards can result in significant legal and financial repercussions.

The company's commitment to quality is directly tied to managing these legal risks. For instance, in 2023, the aerospace industry saw a notable increase in product recall costs, highlighting the financial impact of component failures. Howmet’s proactive approach to rigorous testing and quality control is therefore essential to avoid such liabilities and maintain customer trust.

International Trade Compliance and Export Controls

Howmet Aerospace's extensive international operations necessitate strict adherence to global trade regulations, including sanctions and export controls. These rules dictate the cross-border movement of its sophisticated aerospace components and systems. Failure to comply can result in severe financial penalties and operational limitations.

For instance, in 2023, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) continued to enforce export control regulations, impacting the technology transfer for advanced materials and manufacturing processes critical to the aerospace sector. Howmet Aerospace's commitment to navigating these complex legal landscapes is crucial for maintaining its global market access and avoiding disruptions.

- Export Control Compliance: Adherence to regulations like the International Traffic in Arms Regulations (ITAR) and the Export Administration Regulations (EAR) is paramount for Howmet Aerospace.

- Sanctions Enforcement: Staying abreast of evolving international sanctions regimes, such as those imposed by the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC), is vital to prevent business interruptions.

- Trade Agreements: Understanding and leveraging international trade agreements can provide opportunities but also requires careful navigation of associated compliance requirements.

- Customs and Duties: Managing import and export duties, tariffs, and customs procedures efficiently is a continuous legal and operational challenge for a global manufacturer like Howmet.

Environmental Regulations and Compliance

Howmet Aerospace navigates a complex web of environmental regulations governing its manufacturing operations, particularly concerning emissions and waste disposal. These legal frameworks necessitate strict adherence to maintain operational integrity and avoid penalties.

The company's commitment to responsible operations is underscored in its 2024 ESG Report, which highlights its compliance initiatives. Importantly, Howmet Aerospace anticipates no significant capital investments in environmental control facilities for the 2025 fiscal year, suggesting a current state of compliance and effective management of existing environmental infrastructure.

- Compliance Focus: Adherence to regulations on emissions and waste management is critical for Howmet Aerospace's manufacturing processes.

- 2024 ESG Report: This report details the company's ongoing efforts in environmental compliance and responsible operational practices.

- 2025 Outlook: No material capital expenditures are projected for environmental control facilities in 2025, indicating current regulatory alignment.

Howmet Aerospace's legal landscape is dominated by stringent safety and certification mandates, including those from the FAA and EASA, crucial for market access. Non-compliance can lead to costly recalls and reputational damage, as seen with the lengthy certification processes for new aircraft designs impacting suppliers. Protecting its intellectual property, with over 1,170 patents as of late 2023, is vital for maintaining its competitive edge in developing advanced aerospace components.

Environmental factors

The aviation sector is under intense scrutiny to curb its environmental impact, particularly concerning carbon emissions. This global push for sustainability directly influences companies like Howmet Aerospace, which plays a vital role in enabling greener flight.

Howmet Aerospace addresses this environmental challenge by innovating products designed for lighter weight and improved fuel efficiency in aircraft and commercial vehicles. These advancements empower their customers to meet increasingly stringent CO2 emission reduction targets.

Demonstrating its commitment, Howmet Aerospace set a short-term goal to decrease its Scope 1 and Scope 2 greenhouse gas (GHG) emissions by 21.5% by 2024, using 2019 as its baseline. Impressively, the company reported achieving a 21.7% reduction against this 2019 baseline in 2024, surpassing its initial objective.

Howmet Aerospace is increasingly prioritizing the sustainable sourcing of critical raw materials, especially metals like aluminum and titanium, which are fundamental to its operations. This focus is driven by growing environmental awareness and regulatory pressures within the aerospace sector.

The company is actively engaging with its suppliers to gain a clearer understanding of their carbon footprints. This initiative is a key component of Howmet's strengthened Global Supplier Sustainability Program, which aims to ensure responsible practices throughout its supply chain and aligns with voluntary aerospace industry standards for sustainability.

Howmet Aerospace is actively working to minimize waste from its manufacturing processes and increase recycling rates. The company's commitment is evident in its Environmental, Social, and Governance (ESG) reporting, which details specific initiatives aimed at reducing landfill waste intensity.

In 2023, Howmet Aerospace reported a notable reduction in its landfill waste intensity, a key metric showcasing their progress. This proactive stance on waste management not only supports environmental sustainability but also aligns with growing regulatory pressures and investor expectations for responsible corporate practices.

Energy Efficiency in Manufacturing Operations

Howmet Aerospace is actively pursuing energy efficiency within its manufacturing processes as a core environmental strategy. This focus is crucial for reducing its carbon footprint and aligning with broader sustainability goals. The company's commitment extends to investing in technologies and products that support alternative energy sources, directly impacting its greenhouse gas emission reduction objectives.

These investments are not just about compliance; they represent a strategic move towards more sustainable operations. For instance, Howmet Aerospace has reported progress in reducing its Scope 1 and Scope 2 greenhouse gas emissions. In 2023, the company achieved a reduction in absolute Scope 1 and 2 emissions compared to its 2019 baseline, demonstrating tangible results from its energy efficiency initiatives.

- Manufacturing Efficiency: Howmet Aerospace implements advanced manufacturing techniques to minimize energy consumption per unit produced.

- Investment in Renewables: The company explores and invests in renewable energy sources for its facilities to power operations.

- Emission Reduction Targets: Howmet Aerospace has set specific targets for reducing greenhouse gas emissions, driven by energy efficiency improvements.

- Operational Sustainability: Enhancing energy efficiency is integral to Howmet Aerospace's broader strategy for long-term operational sustainability and environmental stewardship.

Compliance with Environmental Protection Agencies

Howmet Aerospace is committed to meeting the stringent requirements set by environmental protection agencies and the various regulations that oversee its global operations. This dedication is clearly outlined in their sustainability reporting.

The company's 2024 Environmental, Social, and Governance (ESG) Report highlights its adherence to recognized standards, including the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB). These frameworks demonstrate Howmet's proactive approach to managing and disclosing its environmental impact, ensuring accountability and transparency in its performance.

- Adherence to GRI Standards: Howmet Aerospace aligns its environmental reporting with the Global Reporting Initiative, a widely adopted framework for sustainability disclosure.

- SASB Compliance: The company follows the Sustainability Accounting Standards Board guidelines, focusing on financially material sustainability information relevant to the aerospace and defense industry.

- Regulatory Oversight: Operations are managed to comply with all applicable environmental laws and regulations in the jurisdictions where Howmet Aerospace operates.

The aviation industry faces increasing pressure to reduce its environmental footprint, particularly concerning greenhouse gas emissions. Howmet Aerospace is actively contributing to this by developing lighter, more fuel-efficient components. The company has made significant strides in reducing its own operational emissions, exceeding its 2024 target.

Howmet Aerospace is also focused on the sustainable sourcing of key materials like aluminum and titanium, engaging suppliers to understand and reduce their carbon impact. Waste reduction and increased recycling are further priorities, with the company reporting a decrease in landfill waste intensity in 2023.

Energy efficiency is a cornerstone of their environmental strategy, with investments in technologies that support alternative energy sources. This commitment is reflected in their adherence to global sustainability reporting standards like GRI and SASB, ensuring transparency and accountability in their environmental performance.

| Environmental Metric | 2023 Performance | Target/Baseline | Notes |

|---|---|---|---|

| Scope 1 & 2 GHG Emissions Reduction | 21.7% reduction | 21.5% by 2024 (vs. 2019 baseline) | Exceeded short-term goal |

| Landfill Waste Intensity | Reduced | N/A | Specific reduction figures detailed in ESG reports |

| Energy Efficiency Initiatives | Ongoing Investment | N/A | Focus on manufacturing processes and renewable energy adoption |

PESTLE Analysis Data Sources

Our Howmet Aerospace PESTLE analysis is built on a robust foundation of data from official government publications, leading economic indicators, and reputable industry analysis firms. We incorporate insights from regulatory bodies, market research reports, and technological forecasting services to ensure comprehensive coverage.