Howmet Aerospace Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Howmet Aerospace Bundle

Unlock the strategic positioning of Howmet Aerospace with our comprehensive BCG Matrix analysis. Understand which of their divisions are market leaders, which are generating consistent revenue, and which require careful consideration for future investment.

This preview offers a glimpse into Howmet Aerospace's portfolio, highlighting key areas of strength and potential challenges. To truly grasp their competitive landscape and inform your investment decisions, dive into the full BCG Matrix report.

Gain actionable insights and a clear roadmap for Howmet Aerospace's product and business units. Purchase the complete BCG Matrix today to equip yourself with the data-driven strategies needed to navigate the aerospace market with confidence.

Stars

Howmet Aerospace's Engine Products segment, a key player in next-generation aircraft components, is demonstrating robust growth. In 2024, revenue saw a significant 14% increase year-over-year, and this momentum continued into Q1 2025 with a 13% rise.

This expansion is fueled by the aerospace industry's demand for more fuel-efficient and quieter engines. Howmet's advanced turbine airfoils and structural parts are central to meeting these evolving requirements, placing them in a strong position within a rapidly expanding market.

The company's commitment to innovation, particularly in advanced materials and cooling technologies for high-performance engines, underpins its market leadership and prospects for sustained growth.

Howmet's Fastening Systems segment is a clear star in the BCG matrix, evidenced by its impressive 17% revenue growth in 2024. This surge reflects a dominant market position within a rapidly expanding industry.

The robust demand for these critical components is directly tied to the increasing production rates of aircraft manufacturers, especially for popular narrow-body models. With substantial order backlogs, the need for advanced fastening solutions is set to continue its upward trajectory.

These systems are indispensable for the construction of new aircraft, playing a vital role in achieving lightweight designs and improving fuel efficiency. This alignment with key industry drivers solidifies Fastening Systems' star status and its bright future.

Howmet Aerospace's defense aerospace segment, particularly its involvement with the F-35 program, represents a significant strength. Revenue in this area saw a robust 15% increase in 2024, followed by another strong 16% growth in the first quarter of 2025. This expansion is directly linked to Howmet's role in supplying essential engine spares and structural components for the growing global F-35 fleet.

Titanium Structural Parts for Airframe and Engine Applications

Howmet Aerospace's Engineered Structures segment, a key player in titanium structural parts for airframes and engines, saw a significant 21% revenue jump in 2024. This impressive growth highlights the increasing demand for advanced materials in the aerospace sector.

The demand is driven by the broader aerospace market, both commercial and defense, which heavily relies on titanium for its unique properties. Titanium's lightweight yet high-strength characteristics make it indispensable for modern aircraft and engine designs.

Howmet's strategic advantage lies in its fully integrated titanium production process. This vertical integration, from ingot production to finished mill products, forgings, and extrusions, solidifies its market leadership.

- 21% revenue increase in 2024 for titanium structural parts.

- High demand driven by commercial and defense aerospace expansion.

- Titanium's lightweight and high-strength properties are critical.

- Vertical integration provides a competitive edge.

Advanced Materials and Sustainable Aviation Solutions

Howmet Aerospace is making significant strides in advanced materials and sustainable aviation solutions, positioning these areas as potential future stars in its portfolio. The company is focused on developing technologies that contribute to lighter, more fuel-efficient aircraft, directly addressing the aviation industry's push for reduced environmental impact.

These innovations are crucial as the sector aims for greater sustainability. For instance, Howmet's commitment is evident in initiatives like its Green Concept Wheel, which demonstrates an impressive 80% reduction in CO2 emissions. This focus on cutting-edge, eco-friendly technologies signals a strong growth trajectory.

- Innovation in lightweight materials: Developing advanced alloys and composites to reduce aircraft weight, leading to improved fuel efficiency.

- Sustainable Aviation Fuel (SAF) integration: Research and development into materials compatible with and enabling the use of SAFs.

- Emerging propulsion technologies: Contributing materials science expertise to next-generation engines, including those powered by hydrogen.

- Environmental impact reduction: Quantifiable achievements like the 80% CO2 reduction via the Green Concept Wheel highlight a tangible commitment to sustainability.

Howmet Aerospace's Engine Products segment is a star performer, showing substantial growth. In 2024, its revenue climbed by 14%, and this trend continued into Q1 2025 with a 13% increase, driven by the demand for fuel-efficient engines.

The Fastening Systems segment is another clear star, boasting a 17% revenue growth in 2024. This is directly linked to increased aircraft production rates and the critical need for advanced fastening solutions in new aircraft construction.

Howmet's defense aerospace business, particularly its work on the F-35 program, is also a star. Revenue in this area grew by 15% in 2024 and a further 16% in Q1 2025, reflecting its vital role in supplying components for the expanding global F-35 fleet.

The Engineered Structures segment, with its focus on titanium parts, is a shining star, achieving a remarkable 21% revenue increase in 2024. This growth is fueled by the aerospace industry's increasing reliance on titanium for its lightweight and high-strength properties.

| Segment | 2024 Revenue Growth | Q1 2025 Revenue Growth | Key Driver | BCG Classification |

|---|---|---|---|---|

| Engine Products | 14% | 13% | Demand for fuel-efficient engines | Star |

| Fastening Systems | 17% | N/A | Increased aircraft production rates | Star |

| Defense Aerospace (F-35) | 15% | 16% | Growing F-35 fleet demand | Star |

| Engineered Structures | 21% | N/A | Demand for titanium components | Star |

What is included in the product

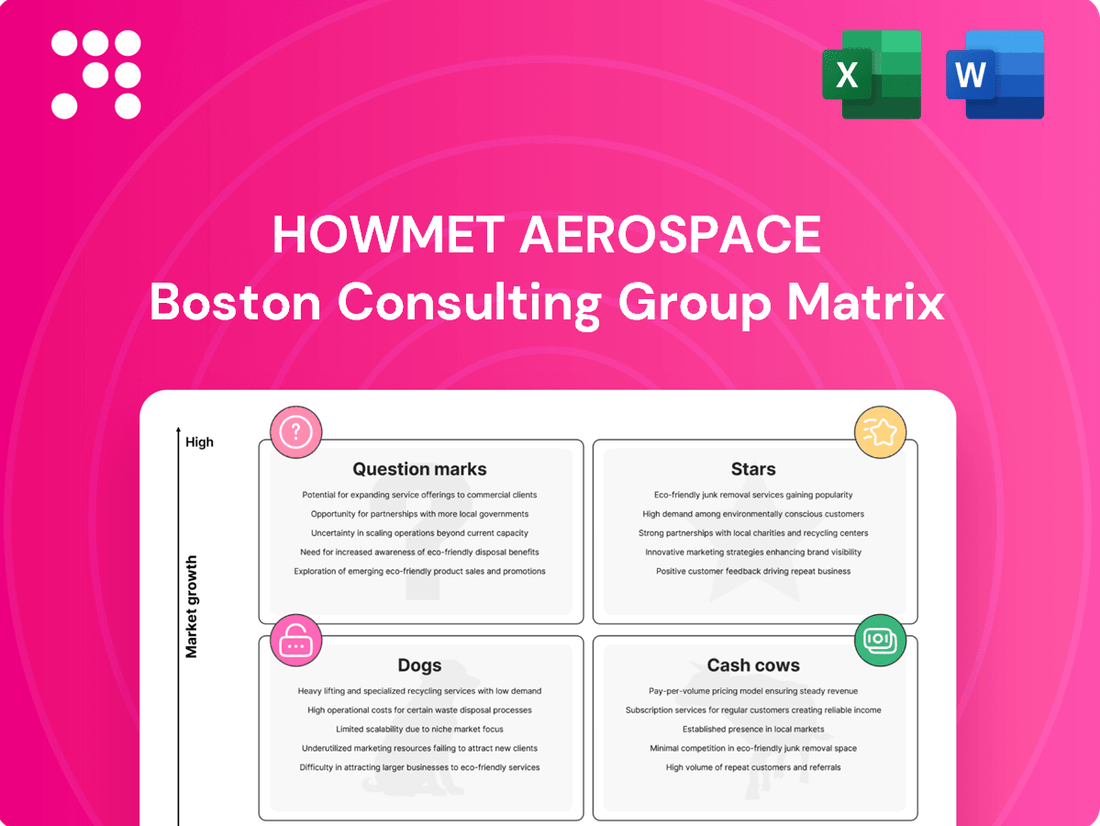

The Howmet Aerospace BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

This analysis guides investment decisions, highlighting which segments to nurture, harvest, or divest for optimal portfolio performance.

A clear BCG Matrix visualizes Howmet Aerospace's portfolio, easing the pain of strategic resource allocation.

Cash Cows

Engine spares for legacy and current programs represent a significant cash cow for Howmet Aerospace. In 2024, this segment delivered substantial revenue, and projections indicate robust growth continuing into 2025, fueled by ongoing demand from both older and newer engine programs.

This market is mature, characterized by consistent, high demand for replacement parts. Howmet's established position as a global leader in critical engine components like turbine blades likely translates to a high market share, solidifying its cash cow status.

These essential products consistently generate strong cash flow. Given their critical nature, the investment required for promotion remains relatively low, further enhancing their profitability within the BCG matrix.

Howmet's established aerospace fastening systems are a classic cash cow. These components are critical for the integrity of existing aircraft and jet engines, operating within a mature market where Howmet boasts a significant and enduring market share.

The vast installed base of aircraft worldwide, coupled with the continuous demand for maintenance, repair, and overhaul (MRO) activities, provides a stable and predictable revenue stream for these fastening systems. This consistent demand, combined with Howmet's established operational efficiencies, translates into robust profit margins.

The segment's financial performance in 2024 clearly illustrates its cash cow status. Howmet reported an increased Segment Adjusted EBITDA Margin for this business, demonstrating its capacity to generate substantial profits and cash flow through operational and commercial advancements.

Howmet Aerospace's Forged Aluminum Wheels for Commercial Transportation represent a classic Cash Cow within the BCG Matrix. The company's pioneering invention of the forged aluminum truck wheel in 1948 solidified its leadership in this sector, a position it maintains today.

Although the commercial transportation market faced a cyclical downturn in 2024 and is projected to remain subdued through mid-2025, Howmet's premium offerings and robust market standing enable it to navigate these challenges effectively.

Even with reduced volumes, the Forged Wheels segment demonstrated impressive financial resilience in 2024, achieving a Segment Adjusted EBITDA margin of 27.2%. This strong profitability highlights its capacity to generate substantial cash flow, even during periods of slower market growth.

Standard Airframe Structural Components for Mature Aircraft

For established aircraft models with long production runs, Howmet Aerospace supplies a variety of standard airframe structural components. This segment operates within a mature market characterized by stable demand, where Howmet's established reputation for quality and precision engineering helps maintain its market share.

The ongoing need for these parts in aircraft maintenance and upgrades translates into a consistent revenue stream and robust profit margins, fitting the profile of a cash cow within the BCG matrix. For instance, in 2024, the aerospace aftermarket for structural components remained a significant contributor to industry revenue, with demand driven by the extensive global fleet of established aircraft.

- Market Position: Dominant share in a mature, stable market.

- Revenue Generation: Consistent, high-margin revenue from ongoing maintenance and upgrades.

- Demand Drivers: Long production runs of established aircraft models and aftermarket support.

- Profitability: High profit margins due to economies of scale and established processes.

Industrial Gas Turbine Components

Howmet Aerospace's Industrial Gas Turbine (IGT) components, particularly their critical turbine airfoils, are a prime example of a Cash Cow within the BCG Matrix. These components are essential for enhancing the performance and fuel efficiency of power generation units. The demand for these parts is bolstered by the significant uptick in data center construction, creating a stable, predictable revenue stream.

Howmet's established global leadership in manufacturing turbine blades for the IGT sector solidifies this product line's position as a strong cash generator. The consistent demand from the industrial sector ensures a steady flow of income, allowing Howmet to leverage its market dominance.

- Market Position: Global leader in IGT turbine blades.

- Demand Drivers: Increased data center construction, general industrial power needs.

- Financial Contribution: Stable, strong cash generation.

- Growth Outlook: Moderate, consistent growth.

Howmet Aerospace's engine spares for legacy and current programs represent a significant cash cow. In 2024, this segment experienced robust demand, contributing substantially to revenue. The mature market for replacement parts, coupled with Howmet's leading position in critical components, ensures consistent high-margin cash flow with minimal promotional investment.

Established aerospace fastening systems are another classic cash cow, vital for aircraft integrity. The vast global aircraft fleet and ongoing maintenance needs provide a stable revenue stream. Howmet's strong market share and operational efficiencies in 2024 led to an increased Segment Adjusted EBITDA Margin, underscoring its profitability.

Forged Aluminum Wheels for Commercial Transportation, despite a 2024 market downturn, demonstrate cash cow resilience. Howmet's pioneering invention and sustained leadership in this sector, evidenced by a 27.2% Segment Adjusted EBITDA margin in 2024, highlight its ability to generate substantial cash even with reduced volumes.

Standard airframe structural components for established aircraft models also function as cash cows. The mature market, driven by maintenance and upgrades for a large global fleet, generates consistent, high-margin revenue. The aerospace aftermarket for these parts remained a key revenue contributor in 2024.

Industrial Gas Turbine (IGT) components, especially turbine airfoils, are prime cash cows, driven by demand for power generation and data centers. Howmet's global leadership in IGT turbine blades ensures stable, strong cash generation from this sector, with moderate, consistent growth expected.

| Segment | BCG Category | 2024 Performance Highlight | Key Drivers |

|---|---|---|---|

| Engine Spares (Legacy & Current) | Cash Cow | Substantial revenue contribution, robust demand. | Mature market, high demand for replacement parts, Howmet's market leadership. |

| Aerospace Fastening Systems | Cash Cow | Increased Segment Adjusted EBITDA Margin. | Vast installed aircraft base, ongoing MRO, Howmet's market share. |

| Forged Aluminum Wheels (Commercial Transport) | Cash Cow | 27.2% Segment Adjusted EBITDA Margin despite market downturn. | Pioneering invention, sustained market leadership, premium offerings. |

| Standard Airframe Structural Components | Cash Cow | Consistent revenue from aftermarket support. | Large global fleet of established aircraft, ongoing maintenance needs. |

| Industrial Gas Turbine (IGT) Components | Cash Cow | Stable, strong cash generation. | Global leadership in turbine blades, increased data center construction. |

Delivered as Shown

Howmet Aerospace BCG Matrix

The Howmet Aerospace BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no placeholder text, and no missing information; it's the complete strategic analysis ready for immediate application in your business planning.

Rest assured, the BCG Matrix report for Howmet Aerospace that you're previewing is the definitive version you'll download after completing your purchase. This professionally crafted document is designed for clarity and strategic insight, ensuring you receive a ready-to-use analysis without any hidden surprises or need for further editing.

Dogs

Obsolete or low-demand legacy components, often supporting older aircraft or industrial equipment, represent Howmet Aerospace's potential 'dogs' in the BCG matrix. These items typically operate in shrinking markets with minimal growth, holding a low market share.

For instance, components for aircraft models phased out of production or facing significant obsolescence risk would fall into this category. Such products can consume resources and capital without yielding substantial profits, impacting overall portfolio efficiency.

Howmet's strategic approach, particularly within its Engineered Structures segment, involves a continuous review and rationalization of its product portfolio. This proactive management aims to identify and divest or minimize investment in underperforming product lines, including these legacy components.

Within Howmet Aerospace's portfolio, certain highly commoditized fasteners, characterized by intense price competition and minimal product differentiation, would likely be classified as 'dogs' in the BCG matrix. These segments often exhibit low market share and operate within slow-growing markets. For instance, the standard aerospace fastener market, while essential, can see margins pressured by numerous suppliers, especially for less specialized components.

These 'dog' fastener products might struggle to achieve profitability, potentially breaking even or even consuming cash due to the relentless competitive pressures and lack of unique value propositions. In 2024, the aerospace industry continued to see demand for fasteners, but the basic, high-volume segments faced significant pricing challenges from both established and emerging competitors, impacting profitability for suppliers focused solely on these areas.

Howmet Aerospace's strategy for these 'dog' segments would typically involve minimizing further investment, focusing on operational efficiency to maintain break-even status, or considering divestiture if the cash drain becomes unsustainable. The company's strength lies in its advanced fastening systems, where innovation commands higher margins and market differentiation.

Beyond its renowned forged wheels, Howmet Aerospace may have other commercial transportation products facing persistent low demand and market share. These less differentiated offerings, potentially including certain engine components or structural parts, could be categorized as dogs within the BCG matrix. The broader commercial transportation sector experienced significant volatility in 2023 and early 2024 due to supply chain disruptions and shifts in freight demand, impacting the performance of many product lines.

Sustained low growth and market share in these secondary product categories necessitate a strategic re-evaluation. Howmet's approach would likely involve minimizing further investment to conserve resources and exploring options for divestiture or phasing out these underperforming assets. For instance, if a specific line of legacy engine parts saw a 5% year-over-year decline in orders and held less than a 2% market share in 2023, it would fit this dog profile.

Divested or Phased-Out Product Lines

Divested or phased-out product lines at Howmet Aerospace would likely fall into the 'dogs' category of the BCG matrix. These are segments with low market share in industries that aren't growing much, or are even shrinking. Companies often divest these to focus resources on more promising areas.

For instance, if Howmet had a manufacturing process that became obsolete or a product line that consistently underperformed, leading to low profitability, it would be a prime candidate for this quadrant. The decision to phase out such offerings is usually made when the cost and effort to revive them are deemed too high compared to the potential return.

Howmet's strategic moves, such as debt reduction and share repurchases, underscore a commitment to portfolio optimization. These actions suggest a deliberate effort to shed underperforming assets and reinvest in areas with higher growth potential, aligning with the principles of managing 'dog' business units.

- Divestment Rationale: Product lines or processes with low profitability, obsolescence, or strategic misalignment are categorized as 'dogs'.

- Market Dynamics: These typically operate in stagnant or declining markets with minimal market share.

- Strategic Focus: Howmet's debt reduction and share repurchase activities signal a portfolio optimization strategy, often involving the divestment of 'dog' assets.

- Example Scenario: A manufacturing process replaced by newer technology or a product with declining demand would fit this classification.

Niche or Specialized Parts with Limited Market Adoption

Certain highly specialized or niche parts, even with impressive engineering, might fall into the dog category if they haven't gained widespread market acceptance or are linked to very limited production runs. For instance, if a specific component is designed for a niche military application with a small, stagnant demand, and Howmet Aerospace holds a minor share of that market, it would be difficult to generate substantial cash. In 2023, the aerospace industry saw continued investment in advanced materials, but adoption of highly specialized, low-volume components can still be slow.

The challenge for these niche parts lies in their limited market size and growth potential. If Howmet's market share within these specialized segments is also low, these products would likely be cash drains rather than contributors. The company's strategy for such items would typically involve either maximizing short-term cash flow through a harvesting approach or divesting them to focus resources on more promising areas.

- Limited Market Adoption: Components tied to niche applications with low overall demand.

- Low Market Share: Howmet's inability to capture a significant portion of even a small market.

- Cash Flow Struggles: Difficulty in generating substantial revenue and profit from these offerings.

- Strategic Options: Potential for harvesting remaining value or divesting the business unit.

Howmet Aerospace's 'dogs' represent product lines with low market share in slow-growing or declining industries. These could include legacy components for older aircraft, highly commoditized fasteners facing intense price competition, or niche parts with limited market adoption. For example, standard aerospace fasteners, a segment where Howmet might hold a small share, faced significant pricing pressure in 2024 due to numerous suppliers.

These underperforming segments often struggle to generate profits and can become cash drains. Howmet's strategy for these 'dogs' typically involves minimizing investment, optimizing for break-even, or divesting them to reallocate resources to more promising ventures, a move supported by their 2023 debt reduction efforts.

The company's focus on advanced fastening systems and engineered structures highlights a deliberate move away from such low-margin, low-growth areas. This strategic rationalization is crucial for maintaining overall portfolio health and maximizing shareholder value.

For instance, a specific line of legacy engine parts experiencing a year-over-year decline in orders and holding less than a 2% market share in 2023 would be a classic example of a 'dog' within Howmet's portfolio.

Question Marks

The burgeoning Urban Air Mobility (UAM) sector, featuring electric Vertical Take-Off and Landing (eVTOL) aircraft, is a rapidly expanding market with substantial long-term prospects. Companies like Joby Aviation and Archer Aviation are actively developing eVTOLs, with significant investment flowing into the sector; for instance, Archer Aviation announced in 2024 a substantial order book and ongoing development partnerships.

Howmet Aerospace, leveraging its established strengths in advanced lightweight materials and intricate precision engineering, is strategically positioned to supply critical components for this nascent market. While Howmet's current market share in UAM is likely minimal due to the segment's early development phase, its technological capabilities offer a strong foundation for future growth.

Investments in UAM components are inherently speculative, characterized by high initial cash outlays and considerable research and development expenses. However, these ventures hold the promise of evolving into significant revenue generators, potentially becoming future market leaders as the UAM ecosystem matures and scales.

The pursuit of hypersonic technology, encompassing speeds exceeding Mach 5, is a burgeoning sector in aerospace and defense, fueled by national security interests. Howmet Aerospace's expertise in advanced materials, such as high-temperature alloys and composites, positions them to supply critical components for these demanding applications.

While the potential for hypersonic systems is immense, the market is still in its nascent stages, characterized by significant research and development costs and a limited number of existing programs. Consequently, Howmet's current market share in this highly specialized area is likely to be minimal, classifying these products as question marks within the BCG matrix.

The development and production of hypersonic components require substantial capital investment in specialized manufacturing processes and ongoing R&D to meet the extreme thermal and structural challenges. For instance, the U.S. Department of Defense alone allocated over $3.8 billion to hypersonic research and development in fiscal year 2023, highlighting the significant investment required in this field.

The aerospace sector is heavily investing in sustainable aviation, with hydrogen and electric propulsion systems at the forefront of innovation. Howmet Aerospace's expertise in high-performance alloys and advanced manufacturing techniques positions them to supply critical components for these next-generation aircraft. For instance, the development of specialized nickel-based superalloys is crucial for withstanding the extreme temperatures and pressures within hydrogen fuel cells and electric motor systems.

While the market for hydrogen and electric aircraft is still emerging, with initial deployments anticipated in smaller regional jets and potentially cargo applications, its long-term growth potential is substantial. Companies like Airbus are actively pursuing hydrogen-electric concepts, aiming for commercialization by the mid-2030s, indicating a significant future demand for specialized materials and parts. This nascent market represents a question mark for Howmet, requiring considerable investment in research and development to secure a leading position as these technologies mature.

Additive Manufacturing (3D Printing) for Aerospace Applications

Howmet Aerospace is strategically investing in additive manufacturing, also known as 3D printing, for complex aerospace components. This commitment reflects a broader industry trend towards embracing advanced production methods that can unlock new design possibilities and improve material utilization. For instance, by 2024, the aerospace additive manufacturing market was projected to reach over $5 billion globally, highlighting its rapid expansion.

While 3D printing offers considerable advantages, its integration into highly critical aerospace applications is still in a developmental phase. The technology allows for intricate geometries and reduced part counts, leading to lighter and more efficient aircraft structures. However, rigorous testing, certification processes, and scaling production remain key challenges for widespread adoption in flight-critical systems.

Early-stage additive manufacturing capabilities at Howmet, focusing on novel component designs or materials, can be viewed as question marks within the BCG matrix. These represent high-growth potential areas driven by technological innovation, but currently possess a relatively small market share in the broader aerospace manufacturing landscape. Significant ongoing investment is crucial to mature these technologies and capture a larger market position.

- Market Growth: The global aerospace 3D printing market is experiencing substantial growth, driven by demand for lighter, more complex parts.

- Technological Advancement: Howmet's investment signifies a commitment to staying at the forefront of advanced manufacturing technologies.

- Challenges: Widespread adoption in critical aerospace applications faces hurdles related to certification, scalability, and material qualification.

- Strategic Positioning: Early additive manufacturing efforts represent potential future stars, requiring continued investment to move from question marks to stars.

Strategic Acquisitions in Emerging Aerospace Tech Companies

Howmet Aerospace has signaled a strategic focus on acquisitions, particularly targeting companies emerging from private equity ownership. This approach aligns with a desire to inject innovation and high-growth potential into its portfolio.

Acquiring small, cutting-edge firms in areas like AI for aerospace or advanced air mobility would position these entities as question marks within Howmet's BCG matrix. These startups operate in rapidly expanding markets but, initially, would possess a modest market share under Howmet's established structure.

- Emerging Technologies: Focus on AI in aerospace, novel sensor technologies, and advanced air mobility (AAM) startups.

- Private Equity Exit Targets: Preference for companies transitioning from private equity ownership.

- BCG Matrix Classification: Acquired firms would likely begin as question marks, operating in high-growth sectors with low initial market share.

- Investment and Integration: Significant capital and strategic integration are necessary to cultivate these question marks into stars.

The burgeoning Urban Air Mobility (UAM) sector, featuring electric Vertical Take-Off and Landing (eVTOL) aircraft, is a rapidly expanding market with substantial long-term prospects. Companies like Joby Aviation and Archer Aviation are actively developing eVTOLs, with significant investment flowing into the sector; for instance, Archer Aviation announced in 2024 a substantial order book and ongoing development partnerships.

Howmet Aerospace, leveraging its established strengths in advanced lightweight materials and intricate precision engineering, is strategically positioned to supply critical components for this nascent market. While Howmet's current market share in UAM is likely minimal due to the segment's early development phase, its technological capabilities offer a strong foundation for future growth.

Investments in UAM components are inherently speculative, characterized by high initial cash outlays and considerable research and development expenses. However, these ventures hold the promise of evolving into significant revenue generators, potentially becoming future market leaders as the UAM ecosystem matures and scales.

BCG Matrix Data Sources

Our Howmet Aerospace BCG Matrix leverages comprehensive data from financial reports, market research, and internal performance metrics to accurately assess business unit standing.