Howmet Aerospace Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Howmet Aerospace Bundle

Howmet Aerospace navigates a complex landscape shaped by powerful buyer demands and the constant threat of new entrants. Understanding these forces is crucial for any player in the aerospace manufacturing sector.

The complete report reveals the real forces shaping Howmet Aerospace’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The aerospace sector's dependence on specialized materials like titanium and aluminum alloys means a handful of suppliers often dominate the market. This limited supplier base grants them considerable power when negotiating with companies like Howmet Aerospace.

With fewer alternative sources for crucial components, Howmet faces a situation where its options are restricted. This scarcity directly amplifies the bargaining power of these concentrated suppliers.

For instance, in 2024, the global aerospace aluminum market saw significant price fluctuations driven by supply chain constraints and demand from various sectors. Major aluminum producers, often with integrated mining and refining operations, wield substantial influence over pricing and availability for aerospace manufacturers.

Switching suppliers in the aerospace sector is a complex and costly undertaking for companies like Howmet Aerospace. These transitions involve extensive re-qualification procedures and the validation of new materials and components, which can significantly disrupt production timelines and increase expenses. For instance, the aerospace industry's stringent safety and performance standards necessitate thorough testing and certification for any new supplier, a process that can take months or even years.

This high barrier to changing suppliers inherently strengthens the bargaining power of existing, qualified suppliers to Howmet. Their established track record, deep understanding of Howmet's specific needs, and the significant investment required to onboard a new vendor give them a considerable advantage in negotiations. This means suppliers can often command higher prices or more favorable terms, as the cost and risk of switching are substantial deterrents for Howmet.

Suppliers offering proprietary alloys, specialized coatings, or unique manufacturing processes for Howmet Aerospace's high-performance components hold significant bargaining power. This is because these differentiated inputs are essential for meeting the rigorous performance and safety demands inherent in the aerospace and defense sectors. For instance, in 2023, the aerospace industry continued to rely on specialized material suppliers for advanced composites and superalloys, with lead times for some critical components extending due to high demand and complex production.

Threat of Forward Integration by Suppliers

While not a dominant threat, the possibility of a critical supplier moving into forward integration, meaning they start producing components Howmet Aerospace currently manufactures, could significantly shift the balance of power. This would directly increase supplier leverage.

However, the significant capital investment and technical expertise required to operate at Howmet's level present a substantial hurdle for most raw material providers, effectively limiting this threat. For example, in 2024, the average capital expenditure for advanced aerospace component manufacturing can run into hundreds of millions of dollars, a prohibitive cost for many suppliers.

- Limited Threat: Forward integration by suppliers is a potential but generally low risk for Howmet.

- High Barriers: The immense capital and technical requirements for aerospace component manufacturing deter most suppliers.

- Cost Factor: The estimated hundreds of millions in capital expenditure for advanced manufacturing in 2024 underscores these barriers.

Importance of Howmet to Suppliers

Howmet Aerospace's substantial order volumes make it a critical customer for many specialized aerospace material and component providers. This significant demand creates a degree of interdependence, as these suppliers also depend on Howmet for consistent business and often long-term agreements.

For instance, in 2023, Howmet Aerospace reported significant procurement activities, with substantial portions of its revenue being directed towards its supply chain. This reliance on Howmet's purchasing power can temper the suppliers' ability to dictate terms, especially for those whose product lines are heavily aligned with Howmet's manufacturing needs.

- Supplier Reliance: Many suppliers depend on Howmet for a substantial portion of their revenue, limiting their leverage.

- Long-Term Contracts: Howmet's use of long-term agreements provides stability for suppliers, fostering a more collaborative relationship.

- Specialized Inputs: The unique nature of many aerospace components means suppliers may have fewer alternative customers, increasing their reliance on Howmet.

The bargaining power of suppliers for Howmet Aerospace is considerable due to the specialized nature of aerospace materials and components. A limited number of qualified suppliers for critical inputs like titanium alloys and advanced composites grants them significant leverage in negotiations.

The high cost and complexity associated with switching suppliers, involving rigorous re-qualification and certification processes, further strengthens the position of existing vendors. This makes it difficult and expensive for Howmet to find and onboard alternative sources, even when facing unfavorable terms.

Suppliers who offer proprietary technologies or unique manufacturing capabilities essential for Howmet's high-performance products possess even greater power. In 2023, lead times for some specialized aerospace components extended due to high demand, highlighting supplier control over availability and pricing.

While Howmet's substantial order volumes provide some leverage, the specialized nature of many inputs means suppliers often have fewer alternative customers, increasing their reliance on Howmet. However, the overall supplier power remains elevated due to the critical, often proprietary, nature of the goods and services provided.

| Factor | Impact on Howmet Aerospace | Supporting Data/Example |

|---|---|---|

| Supplier Concentration | High | Limited number of qualified suppliers for titanium and advanced composites. |

| Switching Costs | High | Months or years for re-qualification and certification of new suppliers. |

| Product Differentiation | High | Proprietary alloys, coatings, and manufacturing processes are critical. |

| Customer Dependence (Supplier's view) | Moderate to High | Howmet's significant order volumes create interdependence. |

What is included in the product

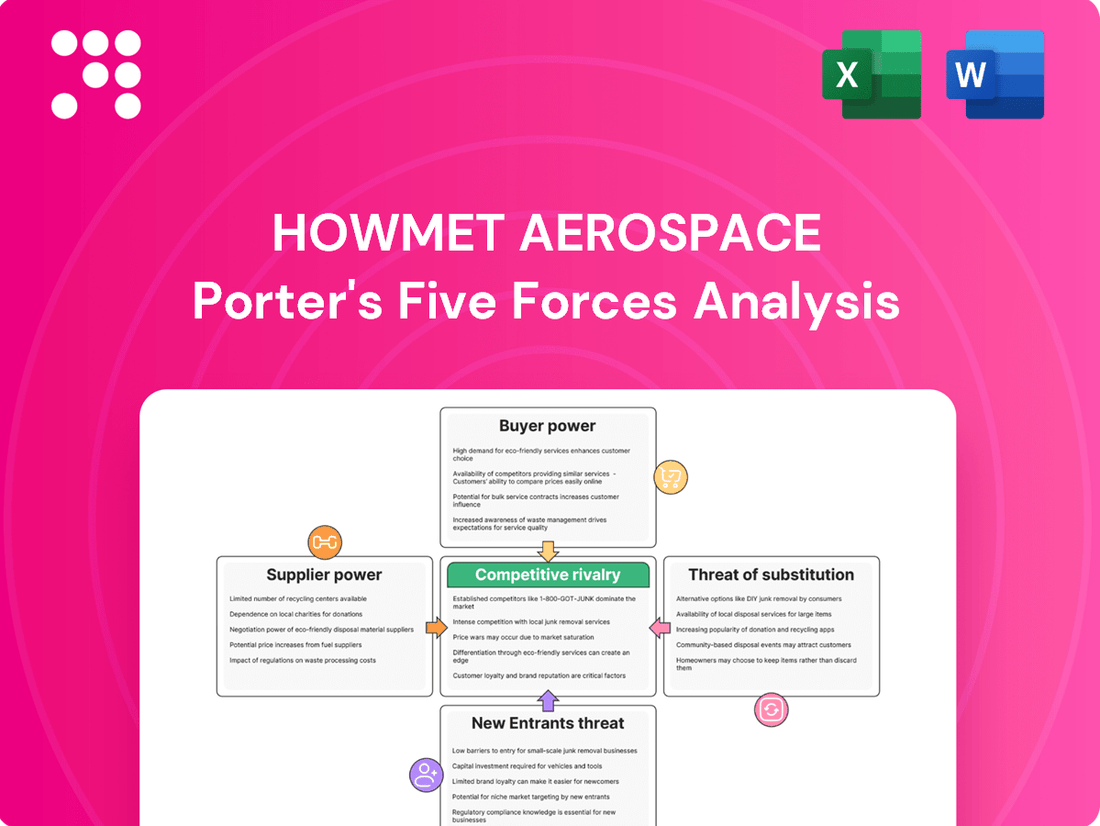

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Howmet Aerospace, examining threats from new entrants, substitutes, and buyer/supplier power.

Instantly grasp competitive pressures with a visual breakdown of Howmet Aerospace's Five Forces, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

Howmet Aerospace faces a significant bargaining power from its customers due to a highly concentrated customer base. Key customers like Boeing and Airbus represent a substantial portion of Howmet's revenue, giving them considerable leverage in price negotiations.

This concentration means that losing even one major client could have a material impact on Howmet's financial performance, reinforcing the customers' strong negotiating position. For instance, Boeing's orders have historically been a critical driver for Howmet's commercial aerospace segment.

Howmet Aerospace faces significant customer bargaining power, largely driven by the substantial purchase volumes of its key clients. Major airlines and aircraft manufacturers, by consolidating their orders, can exert considerable leverage, pushing for better pricing and more favorable contract terms. This is particularly evident in the commercial aerospace sector where a few dominant players account for a large portion of demand.

The aerospace industry's characteristic long product life cycles mean that customers often engage in sustained, high-volume orders over many years. For instance, a single aircraft model's production run can span decades, providing customers with consistent demand and a strong negotiating position throughout that period. This long-term commitment amplifies their ability to influence suppliers like Howmet.

While Howmet Aerospace’s highly engineered components are often customized, diminishing standardization, customers still wield significant bargaining power. This pressure is evident in their relentless pursuit of competitive pricing and superior performance, even for critical, precision-made parts. For instance, in 2024, major aerospace manufacturers like Boeing and Airbus, key Howmet customers, continued to negotiate aggressively on volume and delivery terms, impacting Howmet's margins on specialized engine components and airframe structures.

Price Sensitivity and Performance Requirements

Howmet Aerospace's customers, primarily major aircraft manufacturers and defense contractors, are acutely price-sensitive. While the aerospace industry demands unparalleled performance, reliability, and quality for critical components, these buyers are constantly seeking cost reductions. This creates a significant pressure point for Howmet, as customers negotiate hard on price while still expecting top-tier product specifications.

The bargaining power of customers is amplified by their substantial order volumes and the long-term nature of their contracts. For instance, in 2024, major commercial aircraft orders, like those from Boeing and Airbus, represent multi-billion dollar commitments, giving these customers considerable leverage in price discussions. Howmet must therefore balance its own cost structures with the aggressive pricing demands of these key clients.

- Price Sensitivity: Despite the critical nature of aerospace components, customers actively seek cost efficiencies, impacting Howmet's pricing strategies.

- Performance vs. Cost: Customers must balance the need for high-performance, reliable parts with their financial objectives, creating a negotiation dynamic.

- Customer Leverage: Large order volumes and long-term contracts with major aircraft manufacturers grant customers significant bargaining power.

- Competitive Landscape: The presence of alternative suppliers in the aerospace component market further empowers customers to demand better pricing.

Customer Switching Costs

Customer switching costs for aerospace components are indeed significant, often involving extensive qualification and certification processes that can take years and cost millions. For instance, a new supplier for a critical aircraft part might need to undergo rigorous testing and validation by aviation authorities like the FAA or EASA, alongside the airframe manufacturer's own stringent requirements. This complexity discourages frequent supplier changes.

However, the immense purchasing power of major aerospace customers, such as Boeing or Airbus, allows them to exert considerable leverage. These customers often place massive, long-term orders, giving them substantial bargaining power. Even with high switching costs, they can use their volume and the threat of future business to negotiate more favorable terms, driving down prices or demanding better service levels.

- High Switching Costs: Aerospace customers face substantial costs and time delays when switching suppliers for critical components due to rigorous qualification and certification requirements.

- Customer Bargaining Power: Major aerospace manufacturers, like Boeing and Airbus, possess significant purchasing power, enabling them to negotiate favorable terms despite these switching costs.

- Long-Term Relationships: The lengthy nature of aerospace programs often locks in suppliers, but customers can still leverage their market position to secure better pricing and conditions.

- Impact on Howmet Aerospace: This dynamic means Howmet Aerospace, despite its specialized products, must continually demonstrate value and competitive pricing to retain its key customers.

Howmet Aerospace's customers, particularly large aircraft manufacturers like Boeing and Airbus, wield considerable bargaining power due to their immense order volumes and the long-term nature of aerospace contracts. In 2024, these major players continued to negotiate aggressively on pricing and terms for critical components, impacting Howmet's margins despite the high switching costs for specialized parts. This leverage is a constant factor in Howmet's strategic planning.

| Customer Segment | Key Customers | Estimated Revenue Concentration (2024) | Impact on Bargaining Power |

|---|---|---|---|

| Commercial Aerospace | Boeing, Airbus | ~60-70% of Howmet's Commercial Revenue | Very High |

| Defense Aerospace | Lockheed Martin, Northrop Grumman | ~20-30% of Howmet's Defense Revenue | High |

What You See Is What You Get

Howmet Aerospace Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of Howmet Aerospace thoroughly examines the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the aerospace industry, providing actionable insights for strategic decision-making.

Rivalry Among Competitors

The aerospace and defense components sector is dominated by a handful of major, well-established companies, creating a highly competitive environment where Howmet Aerospace operates. This intense rivalry means companies often differentiate themselves through advanced technology, superior quality, and dependable supply chains, rather than just competing on price.

In 2024, the aerospace sector continues to see consolidation pressures, with companies like Howmet Aerospace actively managing their portfolios through strategic acquisitions and divestitures to strengthen their market position. For instance, Howmet Aerospace reported significant revenue growth in its Commercial Jet Engine segment in early 2024, driven by increased production rates from its key customers.

The aerospace manufacturing sector is characterized by enormous fixed costs, stemming from the need for cutting-edge machinery, extensive research and development, and highly specialized production facilities. For instance, setting up a new aerospace manufacturing plant can easily run into billions of dollars. This high cost structure compels companies like Howmet Aerospace to prioritize maximizing their capacity utilization.

To cover these significant fixed expenses, companies must aggressively pursue and secure a high volume of orders. This constant drive to fill production lines intensifies competition among established players and new entrants alike. In 2023, for example, the global commercial aerospace market saw intense bidding for new aircraft orders, directly impacting pricing and profit margins for component suppliers.

Howmet Aerospace stands out by offering precision-engineered solutions, advanced materials, and proprietary technologies. These innovations directly contribute to improved fuel efficiency and a reduced carbon footprint for their aerospace clients. For instance, in 2023, Howmet reported significant advancements in their forged and cast components, crucial for next-generation engine designs aimed at sustainability.

The aerospace industry demands constant innovation, and Howmet's commitment to research and development is key to staying ahead. Their focus on lightweight, high-strength materials and advanced manufacturing processes, like additive manufacturing, allows them to create components that meet increasingly stringent performance and environmental standards. This continuous push for technological superiority directly combats competitive pressures.

Growth Rate of the Industry

The aerospace and defense industry's growth, driven by a rebound in commercial air travel and increased defense budgets, intensifies competition. As demand rises, companies like Boeing and Airbus are not only battling for existing contracts but also for dominance in emerging markets and new aircraft technologies. This expansion creates opportunities but also sharpens the focus on market share acquisition.

For instance, the International Air Transport Association (IATA) projected global airline industry profits to reach $25.7 billion in 2024, a significant increase from previous years. This financial health in the commercial sector directly translates to higher demand for aircraft manufacturing and related components, fueling the competitive landscape. Defense spending also plays a crucial role; the Stockholm International Peace Research Institute (SIPRI) reported a 6.8% increase in global military expenditure in 2023, reaching $2,443 billion, with major players like the United States and China significantly contributing to this rise.

- Commercial Aerospace Growth: Post-pandemic recovery has seen a surge in passenger traffic, boosting demand for new aircraft and aftermarket services.

- Defense Spending Increases: Geopolitical tensions and evolving security needs are driving higher defense budgets globally, creating opportunities for suppliers.

- Market Share Competition: Companies are aggressively bidding for large-scale contracts and investing in innovation to capture a larger portion of this expanding market.

- Technological Advancements: The race to develop more fuel-efficient, sustainable, and advanced defense platforms intensifies rivalry among manufacturers and their supply chains.

Global and Geopolitical Factors

Geopolitical tensions and evolving national defense priorities are major drivers of competition in the aerospace and defense sector. Increased global instability, as seen with conflicts in Eastern Europe and the Middle East, directly translates to heightened defense spending by governments. For instance, the U.S. Department of Defense's budget for fiscal year 2024 was approximately $886 billion, reflecting a significant commitment to national security and advanced military capabilities. This surge in defense expenditure creates opportunities for companies like Howmet Aerospace, particularly in its defense segment, as demand for specialized components and systems rises.

These geopolitical shifts also compel a stronger focus on secure and resilient domestic supply chains. Nations are increasingly prioritizing the onshoring or near-shoring of critical manufacturing to mitigate risks associated with international disruptions. This trend presents both a challenge and an advantage for global players. Howmet, with its established manufacturing footprint, must navigate these evolving supply chain requirements while potentially leveraging its existing domestic capabilities to meet heightened demand for secure production. The emphasis on national security can lead to preferential treatment for domestic suppliers, impacting competitive dynamics.

- Geopolitical Instability Drives Defense Spending: Global conflicts and tensions directly correlate with increased government defense budgets. The U.S. FY2024 defense budget of $886 billion underscores this trend.

- Supply Chain Security Becomes Paramount: Nations are prioritizing domestic and near-shored manufacturing to ensure supply chain resilience, impacting global players.

- Opportunities for Domestic Suppliers: The focus on secure supply chains can create advantages for companies with strong domestic production capabilities, potentially influencing Howmet's competitive positioning.

Competitive rivalry within the aerospace sector is fierce, driven by a limited number of large, established players like Howmet Aerospace. Differentiation hinges on technological prowess, quality, and supply chain reliability, rather than solely on price. The industry's substantial fixed costs, often in the billions for new facilities, necessitate high production volumes, intensifying competition for orders.

In 2024, the aerospace market is experiencing robust growth, with the International Air Transport Association projecting global airline industry profits to reach $25.7 billion. This financial health fuels demand for new aircraft, thereby intensifying competition among component suppliers like Howmet Aerospace. Simultaneously, increased global defense spending, with the U.S. FY2024 defense budget at $886 billion, further amplifies competitive pressures in the defense segment.

| Metric | 2023 Value | 2024 Projection | Impact on Rivalry |

| Global Airline Industry Profits | (Reported 2023) | $25.7 billion | Increased demand for aircraft components, higher competition. |

| U.S. Defense Budget | (Reported FY2023) | $886 billion (FY2024) | Heightened demand for defense components, intensified competition in defense sector. |

| Global Military Expenditure | $2,443 billion (2023) | (Growing) | Sustained demand and competition in defense aerospace. |

SSubstitutes Threaten

The relentless pace of advanced materials development, including novel alloys and high-performance composites, presents a significant long-term threat to Howmet Aerospace's traditional metallic components. These emerging materials often promise enhanced durability, reduced weight, and potentially more efficient manufacturing processes, directly challenging the existing material base.

Additive manufacturing, or 3D printing, further amplifies this threat by enabling the creation of complex, optimized geometries that were previously impossible with conventional methods. For instance, advancements in titanium alloys for 3D printing are enabling lighter, stronger aerospace parts, potentially displacing conventionally machined components.

While Howmet Aerospace excels in advanced metallic solutions, the threat of substitutes is present, especially from polymer matrix composites. These composites are increasingly favored for applications like aircraft interiors due to their significant weight reduction benefits. For instance, the aerospace industry is seeing a growing demand for lighter materials to improve fuel efficiency, a trend that could impact traditional metallic component suppliers.

The threat of substitutes for Howmet Aerospace's products is moderated by the rigorous cost-benefit analysis potential customers undertake. This analysis extends beyond the raw material price to include manufacturing complexity, costly certification processes, and ongoing maintenance requirements. For instance, adopting a new alloy might seem cheaper initially, but if it requires entirely new machining techniques or extensive re-testing to meet aerospace standards, the overall cost advantage can evaporate.

In critical aerospace applications, where failure is not an option, the proven reliability and established performance of existing materials often trump marginal cost savings offered by substitutes. Companies like Howmet invest heavily in material science and rigorous testing, building a reputation for dependability that is hard for new or alternative materials to match quickly. This customer loyalty to proven solutions significantly dampens the threat of substitutes.

Regulatory and Certification Hurdles

The aerospace industry's rigorous regulatory environment acts as a significant barrier to substitutes. For instance, the Federal Aviation Administration (FAA) certification process for new materials or components can take years and involve substantial investment, effectively slowing the market entry of potential alternatives. This lengthy validation process, often requiring extensive testing and documentation, makes it difficult for new entrants to challenge established suppliers like Howmet Aerospace, whose products already possess the necessary approvals.

Howmet's existing portfolio benefits from these established certifications and the deep trust built with customers over decades. This is crucial because, in aerospace, reliability and safety are paramount, and switching to unproven substitutes carries immense risk. For example, a new alloy replacing a certified one would need to undergo exhaustive testing for fatigue, corrosion resistance, and performance under extreme conditions, a process that can cost millions and still not guarantee approval.

- Regulatory Approval Time: FAA certification for new aerospace materials can extend from 18 months to over 5 years.

- Cost of Certification: Companies can spend upwards of $10 million to certify a single new aerospace component.

- Customer Trust: Long-term relationships and proven performance history with existing suppliers are highly valued in the industry.

Technological Advancements in Manufacturing

Technological advancements, particularly in additive manufacturing (3D printing), present a significant threat of substitution for Howmet Aerospace. These new techniques allow for the creation of intricate parts with less material waste and innovative designs, directly challenging traditional methods like forging and casting that Howmet relies on.

For instance, advancements in metal 3D printing have reached a point where complex aerospace components, previously requiring multi-step machining from forged blocks, can now be printed in a single process. This not only reduces lead times but also opens up possibilities for lighter, more efficient designs that were not feasible with conventional manufacturing.

- Additive manufacturing can create complex geometries with reduced material waste compared to traditional forging and casting.

- These new techniques enable novel component designs, potentially offering performance advantages over conventionally produced parts.

- The growing maturity of 3D printing for aerospace applications, evidenced by increasing certifications for printed parts, signals a tangible shift in manufacturing possibilities.

The threat of substitutes for Howmet Aerospace is influenced by the increasing adoption of advanced materials like polymer matrix composites and innovations in additive manufacturing. While Howmet's established metallic components benefit from rigorous certification and customer trust, the aerospace industry's drive for fuel efficiency and design optimization presents ongoing challenges.

The cost and time involved in certifying new materials, often exceeding $10 million and taking years, serve as a significant barrier for substitutes. However, the growing maturity of additive manufacturing, with an increasing number of 3D-printed parts receiving certifications, indicates a tangible shift in manufacturing possibilities that could impact traditional component suppliers.

While Howmet Aerospace's deep customer relationships and proven reliability are strong deterrents, the potential for substitutes to offer lighter weight and more intricate designs at competitive life-cycle costs remains a key consideration for the industry.

Entrants Threaten

Entering the aerospace and defense components manufacturing sector, where Howmet Aerospace operates, requires substantial upfront capital. Companies need to invest heavily in research and development, cutting-edge manufacturing facilities, and sophisticated machinery. For instance, the cost of setting up a facility capable of producing advanced aerospace materials or components can easily run into hundreds of millions of dollars, creating a significant barrier to entry.

New entrants in the aerospace components market face substantial hurdles due to stringent regulatory approvals and certifications. Obtaining certifications from bodies like the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) is a lengthy and expensive undertaking, often requiring years of development and rigorous testing. For instance, the certification process for a single new aircraft engine component can cost tens of millions of dollars and take over a decade to complete.

Howmet Aerospace leverages its decades of experience and existing, well-established certifications as a significant barrier to entry. Their deep understanding of complex aerospace specifications and proven track record in compliance provide a competitive advantage that is difficult for newcomers to replicate. This established expertise and regulatory adherence are critical for securing contracts with major aerospace manufacturers.

Howmet Aerospace's substantial portfolio of proprietary technology and intellectual property presents a significant barrier to entry for potential competitors. Their advanced engineered solutions and specialized manufacturing processes, developed over decades, are not easily replicated, requiring new entrants to invest heavily in research and development and incur substantial lead times.

Strong Customer Relationships and Supply Chain Integration

Established players like Howmet Aerospace benefit significantly from deeply entrenched customer relationships, particularly with major Original Equipment Manufacturers (OEMs). These relationships often translate into long-term contracts and intricate integration into the customer's supply chain, making it exceptionally difficult for new entrants to replicate this level of trust and operational alignment.

The threat of new entrants is substantially reduced by Howmet Aerospace's strong customer loyalty and integrated supply chains. For instance, Howmet's significant presence in the aerospace sector means many of its contracts are multi-year, providing a stable revenue base and a high barrier to entry. In 2023, Howmet Aerospace reported that approximately 70% of its revenue came from established, long-term programs, highlighting the stickiness of its customer relationships.

- Deep OEM Integration: Howmet's components are often designed into aircraft from the initial stages, creating a high switching cost for airlines and manufacturers.

- Long-Term Contracts: Many of Howmet's aerospace contracts extend for 10 years or more, securing a predictable revenue stream and deterring new competitors.

- Supply Chain Dependencies: New entrants would face the immense challenge of building comparable supply chain infrastructure and proving reliability to demanding aerospace clients.

Economies of Scale and Experience Curve

Existing players like Howmet Aerospace leverage significant economies of scale in their advanced manufacturing processes. This scale allows them to spread fixed costs over a larger production volume, driving down per-unit costs. For instance, in 2023, aerospace manufacturers often reported optimized production lines achieving cost efficiencies through high-volume output.

The experience curve also poses a substantial barrier. Companies with decades of operational history have refined their processes, learned from past challenges, and developed proprietary efficiencies. This accumulated knowledge translates into lower production costs and higher quality, making it difficult for newcomers to match their cost structure without substantial upfront investment and time.

- Economies of Scale: Higher production volumes lead to lower per-unit costs for established aerospace component manufacturers.

- Experience Curve: Decades of operational refinement allow incumbents to achieve greater efficiency and cost savings.

- Cost Disadvantage for New Entrants: New firms would face significantly higher initial production costs, hindering their ability to compete on price.

- Capital Investment: Achieving comparable scale and efficiency would require massive capital investment, a major hurdle for potential new competitors.

The threat of new entrants for Howmet Aerospace is considerably low due to immense capital requirements, stringent regulatory hurdles, and the significant advantage of established players' proprietary technology and deep OEM integration. For example, in 2023, the aerospace sector continued to see massive investments in R&D and manufacturing capabilities, with new aircraft programs alone requiring billions in upfront development costs.

New entrants face a steep climb in obtaining critical certifications like FAA and EASA, a process that can take over a decade and cost tens of millions of dollars per component. Howmet's existing, long-standing certifications and decades of operational refinement, contributing to a cost advantage through economies of scale, further solidify its position. In 2023, Howmet Aerospace reported that approximately 70% of its revenue stemmed from established, long-term programs, underscoring the difficulty for newcomers to penetrate these secured markets.

Porter's Five Forces Analysis Data Sources

Our Howmet Aerospace Porter's Five Forces analysis is built upon a foundation of robust data, including Howmet's annual reports and SEC filings, alongside industry-specific market research from firms like Deloitte and PwC.