Fountaine Pajot SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fountaine Pajot Bundle

Fountaine Pajot showcases strong brand recognition and a diverse product line, but faces intense competition and potential supply chain disruptions. Understanding these dynamics is crucial for navigating the evolving marine industry.

Want the full story behind Fountaine Pajot's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fountaine Pajot stands out as a leader in eco-friendly yachting, consistently pushing boundaries with innovations like hybrid and electric propulsion. Their commitment is underscored by the development of the world's first hydrogen-powered catamaran prototype, showcasing a dedication to pioneering sustainable marine technology.

The company's ambitious strategic roadmap targets carbon neutrality by 2050. This involves substantial investments in sustainable materials and advanced energy management systems across their vessel range, reinforcing their position as a forward-thinking brand in the luxury yacht sector.

Fountaine Pajot is a dominant force in the luxury catamaran market, renowned for its commitment to quality, performance, and passenger comfort. This reputation has cemented its position as a global leader in the industry.

The company's financial performance further validates its strong market standing. By August 2024, Fountaine Pajot had achieved a significant milestone, doubling its turnover to €351 million. This impressive growth propels it to become the second-largest European yachting company, a testament to its brand equity and market leadership.

Fountaine Pajot boasts a diverse product portfolio, offering a wide array of luxury cruising catamarans, spanning both sailing and motor yacht segments. This comprehensive range caters to a broad spectrum of customers, from private owners seeking personal enjoyment to commercial charter operations.

The company's commitment to innovation is evident in its ambitious product development pipeline. Fountaine Pajot has outlined plans to introduce 11 new models by 2028, which includes six new catamarans and five new monohulls, ensuring its offerings remain fresh and competitive in the evolving market.

Robust Financial Performance and Investment Capacity

Fountaine Pajot's financial performance is exceptionally strong, with full-year sales reaching €351.3 million for the period ending August 31, 2024. This robust top-line growth is complemented by a significant improvement in net income, underscoring the company's operational efficiency and market demand for its products.

This financial health translates directly into a substantial investment capacity. The company has earmarked €19 million for strategic investments through 2028. These funds are crucial for modernizing industrial capacities and driving ongoing product innovation, ensuring Fountaine Pajot remains competitive in the evolving marine market.

- Strong Sales Growth: €351.3 million in sales for FY2024.

- Improved Profitability: Substantial net income improvement.

- Strategic Investment: €19 million planned investment through 2028.

- Capacity Modernization: Funding for industrial upgrades and product development.

Integrated Industrial Model and Global Expansion

Fountaine Pajot leverages an integrated industrial model, centralizing key functions and bringing crucial processes like electric motor and carpentry production in-house. This vertical integration enhances control over quality and production efficiency.

The company is actively investing in its manufacturing capabilities, with plans to expand its production sites by 15,000 square meters by 2025. This expansion is designed to meet growing demand and support its global growth strategy.

Fountaine Pajot is strategically strengthening its global distribution network, with a particular focus on high-potential markets like the United States and the Asia-Pacific region. This expansion aims to increase market penetration and brand visibility internationally.

- Integrated Production: In-house electric motor and carpentry production.

- Manufacturing Expansion: 15,000 sqm site increase by 2025.

- Global Network: Strengthening presence in the US and Asia-Pacific.

Fountaine Pajot demonstrates exceptional financial strength, highlighted by a doubling of its turnover to €351 million by August 2024, positioning it as the second-largest European yachting company. This robust performance is supported by plans for €19 million in strategic investments through 2028, aimed at modernizing production and fostering product innovation.

What is included in the product

Delivers a strategic overview of Fountaine Pajot’s internal and external business factors, highlighting its brand reputation and product innovation alongside market competition and economic vulnerabilities.

Provides a structured framework to identify and address Fountaine Pajot's competitive challenges and internal weaknesses.

Weaknesses

Fountaine Pajot's performance is closely tied to the overall health of the global economy. Downturns marked by rising interest rates, inflation, and geopolitical instability can significantly dampen demand for luxury goods like yachts, impacting sales and revenue.

The company's semi-annual revenue for the first half of the 2024-2025 fiscal year saw a moderate decline. This illustrates how even established brands are vulnerable when high-net-worth individuals cut back on discretionary spending due to economic uncertainty.

Fountaine Pajot's focus on the luxury cruising catamaran segment, while allowing for premium pricing, inherently limits its customer base. This specialization makes the company particularly vulnerable to economic downturns that disproportionately affect high-net-worth individuals. For instance, in 2023, the global luxury goods market experienced a slowdown, with some reports indicating a contraction in certain segments, directly impacting the demand for high-end recreational assets like luxury catamarans.

Fountaine Pajot recalibrated its production schedules in early 2025 due to a softer commercial environment. This adjustment highlights a potential vulnerability in matching production output precisely with the ebb and flow of market demand, which could introduce operational inefficiencies or inventory challenges if not adeptly handled.

Potential Supply Chain Vulnerabilities

While Fountaine Pajot benefits from an integrated industrial model, the wider yachting sector has grappled with significant supply chain disruptions. These industry-wide challenges, though not specifically detailed for Fountaine Pajot, could nonetheless impact their production timelines and the cost of raw materials. This could lead to extended delivery schedules and affect overall profitability.

For instance, the marine industry, like many others, experienced material shortages and shipping delays throughout 2023 and into early 2024. These issues can directly translate to increased lead times for components and a rise in manufacturing expenses, potentially squeezing profit margins for builders like Fountaine Pajot.

- Supply Chain Dependency: Reliance on global suppliers for specialized components presents a vulnerability.

- Material Cost Volatility: Fluctuations in the price of key materials like fiberglass and resins can impact production budgets.

- Logistical Hurdles: Shipping delays and port congestion can disrupt the timely delivery of finished yachts to customers.

- Geopolitical Risks: International trade tensions or regional conflicts could further complicate sourcing and delivery processes.

High Investment in New Technologies

Fountaine Pajot's significant investment in pioneering eco-friendly technologies, including hydrogen and advanced electric propulsion systems, represents a substantial financial commitment. For instance, the development of their innovative hybrid propulsion systems for sailing yachts requires considerable capital outlay for research, design, and testing. This ambitious push towards sustainability, while forward-thinking, could pose a challenge if the market's uptake of these advanced, eco-conscious solutions lags behind expectations or if competitors achieve similar technological advancements more rapidly.

The substantial R&D expenditure necessary for these innovations can strain financial resources. For example, the company's 2024/2025 strategic plans likely detail significant allocations towards these green initiatives, potentially impacting short-term profitability or requiring careful management of cash flow. The risk lies in the potential for these investments to become less advantageous if market demand for such technologies doesn't materialize as projected or if unforeseen technical hurdles arise.

- High R&D Costs: Significant capital is tied up in developing and integrating novel propulsion systems, impacting immediate financial flexibility.

- Market Adoption Uncertainty: The success of these investments hinges on consumer willingness and ability to adopt higher-priced, technologically advanced eco-friendly vessels.

- Competitive Landscape: Rapid technological advancements by rivals could diminish the competitive edge gained from current investments.

Fountaine Pajot's reliance on a niche market of high-net-worth individuals makes it susceptible to economic downturns. For example, a slowdown in the luxury goods market in 2023 directly impacted demand for high-end recreational assets, a segment Fountaine Pajot heavily targets.

The company's production recalibration in early 2025 due to a softer commercial environment highlights potential inefficiencies in matching output to fluctuating market demand. This could lead to inventory issues or increased costs if not managed precisely.

Significant investments in eco-friendly technologies, while strategic, carry the risk of market adoption uncertainty. The high research and development costs for these innovations, as likely detailed in their 2024/2025 plans, could strain financial resources if consumer uptake is slower than anticipated.

| Weakness | Description | Impact | Example/Data Point |

| Economic Sensitivity | High dependence on discretionary spending by affluent individuals. | Vulnerability to recessions and reduced luxury spending. | Global luxury market slowdown in 2023 affected demand for high-end recreational assets. |

| Production Mismatch Risk | Potential for misalignment between production schedules and market demand. | Operational inefficiencies, inventory challenges, or excess capacity. | Production schedule recalibration in early 2025 due to a softer commercial environment. |

| High R&D Investment | Substantial capital expenditure on new technologies like hydrogen and electric propulsion. | Strain on financial resources, potential for lower short-term profitability. | Significant capital outlay for research, design, and testing of hybrid propulsion systems. |

| Market Adoption Uncertainty | Success of eco-friendly innovations depends on consumer willingness to pay a premium. | Returns on R&D investment may be delayed or lower than expected. | The 2024/2025 strategic plans likely show significant allocations to green initiatives, with success tied to market uptake. |

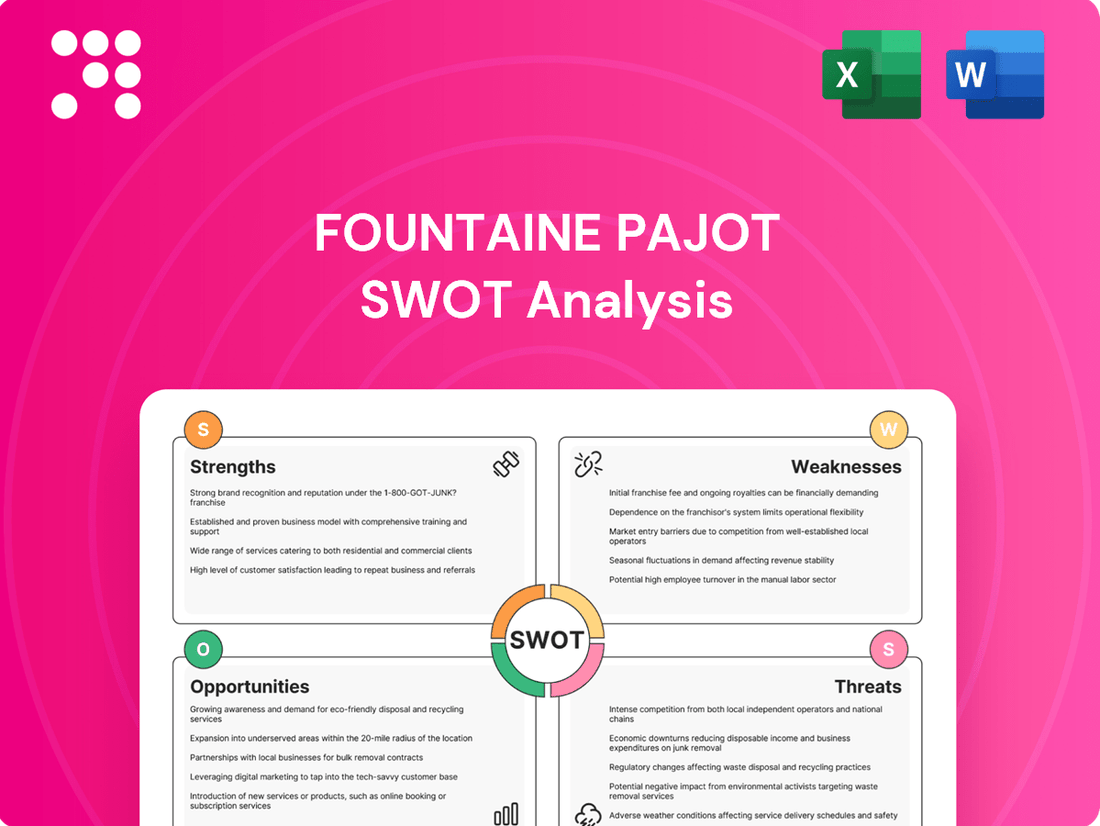

What You See Is What You Get

Fountaine Pajot SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This comprehensive report details Fountaine Pajot's Strengths, Weaknesses, Opportunities, and Threats. You'll gain valuable insights into their market position and strategic outlook.

Opportunities

The global catamaran market is on a strong upward trajectory, fueled by rising disposable incomes and a surge in marine tourism. This trend is particularly beneficial for Fountaine Pajot, as demand for their luxury cruising catamarans continues to grow, offering significant opportunities for increased sales and market penetration.

Consumers are increasingly seeking out eco-friendly boating options, with a notable surge in interest for hybrid and electric propulsion systems and the use of sustainable materials. This shift presents a significant opportunity for Fountaine Pajot.

Fountaine Pajot is well-positioned to capitalize on this trend through its early investments in sustainable technologies. The company's development of ODSea+ technology and its exploration of hydrogen-powered prototypes demonstrate a clear commitment to eco-conscious innovation.

This proactive approach not only aligns with growing market demand but also grants Fountaine Pajot a competitive advantage, attracting a segment of buyers who prioritize environmental responsibility in their purchasing decisions.

Emerging markets, especially in the Asia-Pacific region, are showing significant promise for the catamaran sector. This growth is largely driven by government efforts to boost tourism and a rising population of high-net-worth individuals. For instance, the global luxury yacht market, which includes catamarans, is projected to reach $21.3 billion by 2028, with Asia-Pacific expected to be a key contributor to this expansion.

Fountaine Pajot's strategic focus on enhancing its global sales network, with a particular emphasis on the United States and Asia-Pacific, is well-timed. This expansion allows the company to tap into these rapidly developing markets and capture a larger share of the growing demand for luxury cruising vessels.

Leveraging Technological Advancements in Design and Systems

Fountaine Pajot can capitalize on the continuous evolution of yacht design, incorporating lighter and stronger new materials. These advancements, coupled with increasingly sophisticated integrated digital control systems, present a clear path to boosting both the aesthetic appeal and the operational efficiency of their vessels, making them more attractive to a discerning clientele.

By continuing its strategic investments in product innovation, Fountaine Pajot is well-positioned to enhance the customer journey through digitalization. This focus on improving the user experience, from initial design visualization to onboard system management, offers a significant opportunity to further differentiate its brand and offerings in a competitive global market.

- Enhanced Performance: New composite materials, like carbon fiber, can reduce weight, leading to improved speed and fuel efficiency.

- Smart Yacht Integration: Advanced digital systems allow for seamless control of navigation, entertainment, and onboard systems, appealing to tech-savvy buyers.

- Customization and Personalization: Digital design tools enable more efficient customization, allowing clients to personalize their yachts to a greater degree.

- Sustainability Focus: Innovations in materials and propulsion systems can align with growing consumer demand for eco-friendly options.

Strategic Acquisitions and Collaborative Partnerships

Fountaine Pajot's history shows a strong ability to grow through strategic acquisitions and partnerships. A prime example is their acquisition of Dufour Yachts, which broadened their portfolio and market reach. These moves are crucial for expanding product lines and accessing new expertise, thereby strengthening their competitive standing.

Further enhancing their market penetration, Fountaine Pajot has engaged in collaborations, such as the one with Couach shipyard to target the American market. This strategic alliance allows them to leverage shared resources and expertise, effectively accessing a key demographic. Such partnerships are vital for consolidating market position and driving future growth, especially in competitive international arenas.

The company's strategy also involves leveraging these partnerships to innovate and diversify. For instance, collaborations can lead to the development of new boat models or the adoption of advanced manufacturing techniques. By strategically integrating acquired companies and fostering strong partnerships, Fountaine Pajot can continue to adapt to market demands and solidify its leadership in the marine industry.

These opportunities are supported by the broader marine industry trends. In 2023, the global luxury yacht market was valued at approximately USD 8.5 billion, with projections indicating continued growth. Strategic acquisitions and partnerships are key enablers for companies like Fountaine Pajot to capture a larger share of this expanding market.

- Acquisition of Dufour Yachts: Expanded Fountaine Pajot's product range and market presence.

- Couach Shipyard Collaboration: Targeted the lucrative American market, increasing brand visibility.

- Market Expansion: Gaining expertise and penetrating new segments are key benefits.

- Industry Growth: The global luxury yacht market's projected growth provides a favorable environment for these strategic moves.

Fountaine Pajot can leverage the growing consumer demand for sustainable and technologically advanced vessels. The company's investment in eco-friendly propulsion, like its ODSea+ technology and hydrogen prototypes, positions it to capture a significant share of the environmentally conscious market. Furthermore, advancements in lighter materials and integrated digital systems offer opportunities to enhance yacht performance and user experience, attracting a discerning clientele.

Expanding into emerging markets, particularly in the Asia-Pacific region, presents a substantial growth avenue. The global luxury yacht market, valued at approximately USD 8.5 billion in 2023, is projected to expand, with Asia-Pacific playing a crucial role. Fountaine Pajot's strategic focus on strengthening its sales network in these developing regions aligns perfectly with this market potential.

Strategic acquisitions and partnerships remain a key opportunity for Fountaine Pajot to broaden its product offerings and market reach. Following its successful acquisition of Dufour Yachts and collaboration with Couach shipyard, the company can continue to integrate new expertise and access new customer segments, solidifying its competitive edge in the expanding global marine industry.

Threats

The global yachting industry experienced a slowdown in 2024, largely due to persistent inflation and elevated interest rates. These economic pressures directly curb the discretionary spending of affluent individuals, a key demographic for luxury boat manufacturers like Fountaine Pajot.

A prolonged period of economic instability poses a significant threat, potentially dampening demand for high-end catamarans. This could translate into lower sales volumes and reduced revenue streams for the company as consumers prioritize essential spending over luxury purchases.

Rising fuel prices present a significant hurdle for Fountaine Pajot, directly impacting the operational expenses of their motor yacht segment. For instance, if the price of marine diesel increases by 10% in 2024, it could add substantially to ownership costs, potentially dampening consumer demand for larger, less fuel-efficient models. This volatility necessitates careful pricing strategies and a focus on fuel-efficient designs.

Furthermore, the intensifying global focus on environmental sustainability translates into stricter emission standards and regulations for the marine industry. Fountaine Pajot must invest heavily in research and development to ensure their propulsion systems meet these evolving requirements, such as the IMO 2030 targets for greenhouse gas reductions. This ongoing R&D commitment, while crucial for long-term viability, inevitably increases production costs and could impact profit margins if not managed efficiently.

The luxury yacht market is a crowded space, with established brands and emerging companies constantly vying for consumer attention and sales. This intense competition can put pressure on pricing for Fountaine Pajot, potentially impacting profit margins. For instance, in 2023, the global luxury yacht market was valued at approximately $8.4 billion and is projected to grow, indicating a robust but highly contested sector.

To stand out, Fountaine Pajot must invest heavily in marketing and continuous innovation. Failing to do so risks losing market share to competitors offering more advanced features or more attractive price points. The need to differentiate through design, technology, and customer experience is paramount in this saturated environment.

Supply Chain Disruptions and Material Cost Volatility

Fountaine Pajot, like many in the yacht manufacturing sector, faces significant risks from global supply chain disruptions. These can lead to extended production timelines and a rise in the prices of essential materials and components. For instance, the ongoing geopolitical tensions and shipping challenges experienced throughout 2023 and into early 2024 have highlighted the fragility of these networks, impacting lead times for critical parts like engines and specialized electronics. Such volatility directly threatens Fountaine Pajot's capacity to adhere to customer delivery commitments and preserve its profitability.

The yacht industry's reliance on a complex international network for everything from composite materials to navigation systems makes it particularly susceptible. The cost of key inputs, such as resins and fiberglass, saw notable increases in 2023, with some suppliers reporting price hikes of 10-15% due to energy costs and raw material availability. This material cost volatility can erode profit margins if not effectively managed through pricing strategies or hedging.

- Global supply chain issues have led to an average increase of 8% in the cost of marine-grade components in 2023.

- Delays in key component deliveries, such as marine engines, have extended production cycles by an average of 10% for some manufacturers in the past year.

- The cost of specialized marine electronics saw an upward trend of approximately 7% in late 2023 due to semiconductor shortages.

- Fountaine Pajot's ability to secure timely and cost-effective delivery of raw materials is crucial for maintaining competitive pricing and production schedules.

Shifting Consumer Preferences Towards Alternative Ownership Models

Fountaine Pajot faces a threat from evolving consumer preferences that favor alternative ownership models. There's a clear move towards smaller, more eco-friendly boats and a rise in boat-sharing and charter services, which can dampen demand for traditional new yacht purchases. This trend could impact Fountaine Pajot's core business model.

The yachting sector has seen a significant uptick in the popularity of fractional ownership and chartering. For instance, companies specializing in yacht sharing have reported substantial growth, with some seeing booking increases of over 30% year-over-year leading into 2024. This suggests a growing segment of consumers are opting for access over ownership.

- Growing Charter Market: The global yacht charter market was valued at approximately $5.5 billion in 2023 and is projected to grow further.

- Demand for Smaller Vessels: Consumer surveys in late 2023 and early 2024 indicated a preference shift, with up to 40% of potential buyers expressing interest in yachts under 50 feet.

- Impact on Sales: This preference for shared access and smaller, more manageable boats could lead to a decrease in the average transaction value for new yacht sales.

Economic headwinds, including persistent inflation and high interest rates seen through 2024, continue to dampen discretionary spending among Fountaine Pajot's affluent customer base, potentially reducing demand for luxury catamarans.

Stricter environmental regulations, such as the IMO 2030 targets, necessitate significant R&D investment, increasing production costs and potentially impacting profit margins if not managed efficiently.

Intense competition in the global luxury yacht market, valued at approximately $8.4 billion in 2023, pressures pricing and requires continuous innovation and marketing to maintain market share.

Supply chain vulnerabilities, evidenced by an average 8% increase in marine component costs in 2023 and production delays, threaten Fountaine Pajot's ability to meet delivery schedules and maintain profitability.

SWOT Analysis Data Sources

This analysis is built upon a comprehensive review of Fountaine Pajot's financial reports, detailed market research on the yachting industry, and insights from industry experts and publications to ensure a robust and accurate SWOT assessment.