Fountaine Pajot Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fountaine Pajot Bundle

Fountaine Pajot faces a dynamic competitive landscape, with the threat of new entrants and the bargaining power of buyers significantly shaping its market. Understanding these forces is crucial for navigating the luxury catamaran sector.

The complete report reveals the real forces shaping Fountaine Pajot’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Fountaine Pajot's reliance on specialized suppliers for crucial elements like marine engines, sophisticated navigation tech, and premium interior fittings significantly shapes supplier power. The intricate nature and limited availability of these components can grant suppliers considerable leverage, especially when alternative providers are scarce or the expense of switching is prohibitive.

Raw material costs are a significant factor in Fountaine Pajot's profitability. The price of key components like fiberglass, resins, and metals can swing wildly due to global economic conditions and unforeseen events. For example, in early 2024, the price of key petrochemicals used in resin production saw an upward trend, driven by geopolitical tensions impacting oil supply. This volatility directly affects Fountaine Pajot's cost of goods sold.

Suppliers of these essential materials hold considerable bargaining power. They can leverage market conditions to increase prices, squeezing Fountaine Pajot's profit margins. If a major supplier faces production issues or decides to consolidate, it can lead to reduced availability and higher costs for Fountaine Pajot, forcing them to absorb these increases or pass them on to customers.

The bargaining power of suppliers, particularly concerning labor and craftsmanship, is a significant factor for yacht builders like Fountaine Pajot. Access to highly skilled individuals capable of intricate composite manufacturing, fine carpentry, and complex electrical systems installation is paramount for producing high-quality vessels.

A limited supply of such specialized talent can significantly amplify the bargaining power of the workforce. For instance, in 2024, the marine industry, like many skilled trades, continued to face shortages in experienced technicians and artisans. This scarcity can translate into upward pressure on wages and benefits, directly impacting Fountaine Pajot's production costs and profit margins.

Proprietary Technology from Suppliers

Suppliers possessing proprietary technologies, like cutting-edge hybrid propulsion or novel composite materials, can leverage this uniqueness to charge higher prices. Fountaine Pajot, with its focus on sustainability and forward-thinking design, might find itself increasingly dependent on these specialized technology providers.

This reliance can translate into significant bargaining power for the suppliers. For instance, if Fountaine Pajot integrates a unique, patented energy management system from a single supplier, that supplier gains considerable leverage in price negotiations and contract terms.

- Proprietary Tech Example: Suppliers of advanced electric or hybrid marine propulsion systems, often protected by patents, can dictate terms.

- Innovation Drive: Fountaine Pajot's investment in R&D for eco-friendly solutions often leads to sourcing specialized components.

- Supplier Dependence: The integration of unique, patented technologies can make Fountaine Pajot reliant on a limited number of suppliers.

- Pricing Power: This reliance allows suppliers to command premium pricing for their exclusive technological offerings.

Limited Number of High-Quality Suppliers

In the discerning luxury yacht market, Fountaine Pajot faces a concentrated supplier base for critical components, particularly those demanding exceptional craftsmanship and advanced marine technology. This scarcity of high-caliber suppliers directly translates to increased bargaining power for these entities. For instance, specialized engine manufacturers or high-performance sailcloth providers often dictate terms due to their unique expertise and limited competition.

This situation compels Fountaine Pajot to accept supplier-imposed pricing and delivery schedules to ensure the uncompromising quality expected by its clientele. Failure to secure these specialized inputs would jeopardize production timelines and, more importantly, the brand's reputation for excellence. In 2024, the average lead time for custom-engineered marine propulsion systems, a key component for luxury yachts, saw an increase of approximately 15% compared to the previous year, reflecting this supplier leverage.

- Limited availability of specialized marine components.

- Suppliers can dictate terms due to high quality and performance demands.

- Impact on Fountaine Pajot's negotiation power and production costs.

- Brand reputation relies on securing these high-quality inputs.

Fountaine Pajot's bargaining power with suppliers is influenced by the specialized nature of marine components and the availability of skilled labor. Suppliers of proprietary technologies, like advanced propulsion systems, hold significant leverage due to the unique value they bring, impacting Fountaine Pajot's cost and production flexibility. The limited pool of highly skilled artisans in the marine industry further strengthens supplier power, leading to increased labor costs for the company.

| Supplier Characteristic | Impact on Fountaine Pajot | 2024 Data/Trend |

|---|---|---|

| Proprietary Technology (e.g., hybrid propulsion) | High leverage, premium pricing | Increased demand for sustainable tech |

| Specialized Craftsmanship (e.g., composite manufacturing) | Upward pressure on wages, potential delays | Skilled labor shortage persists |

| Raw Material Volatility (e.g., fiberglass, resins) | Impact on Cost of Goods Sold (COGS) | Petrochemical prices saw upward trends early 2024 |

| Concentrated Supplier Base | Limited negotiation power, dictated terms | Average lead time for custom engines increased ~15% |

What is included in the product

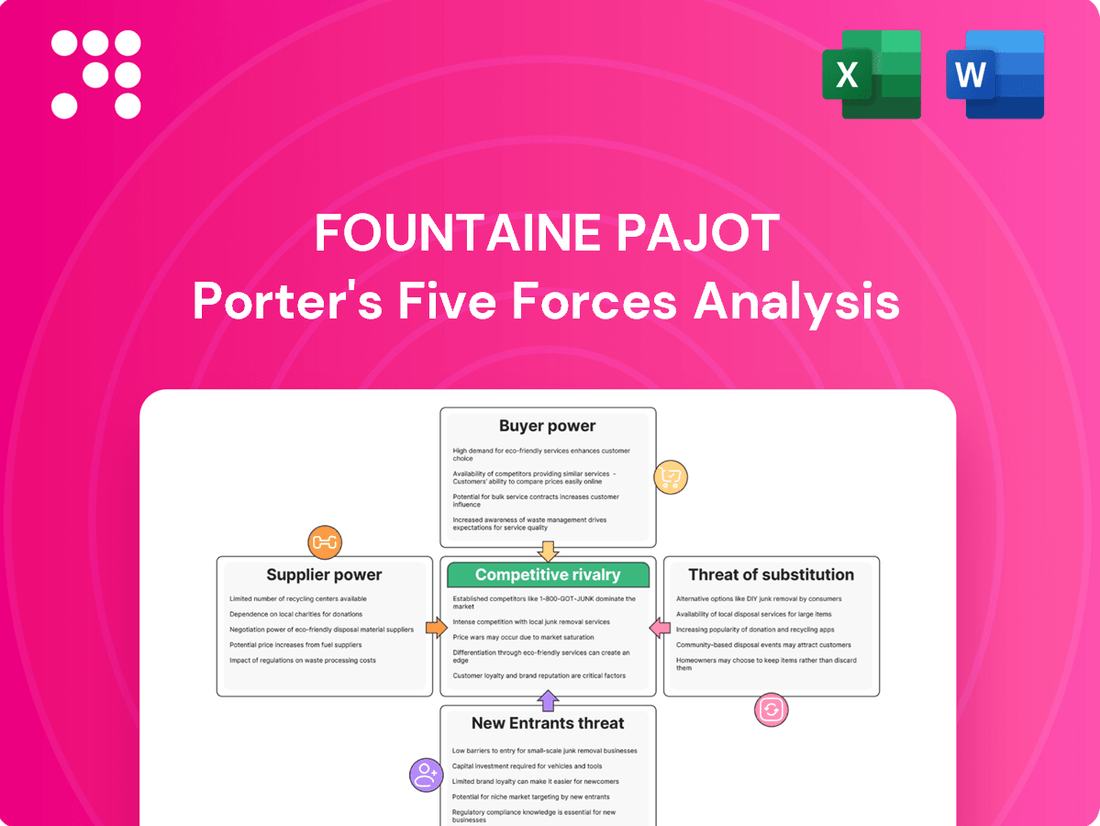

This Fountaine Pajot Porter's Five Forces analysis dissects the competitive intensity within the luxury catamaran market, examining supplier and buyer power, the threat of new entrants and substitutes, and the rivalry among existing players.

Instantly visualize competitive pressures with a dynamic, interactive Porter's Five Forces dashboard, allowing for rapid strategic assessment.

Customers Bargaining Power

The bargaining power of customers in the fragmented private ownership market for luxury yachts, like those produced by Fountaine Pajot, is typically low. While individual buyers are making significant purchases, the emotional attachment and bespoke nature of these high-value assets limit their leverage. For instance, in 2024, the average price for a new Fountaine Pajot sailing catamaran remained in the high six-figure to seven-figure range, indicating a substantial investment where customization often outweighs price sensitivity.

Large bareboat and crewed charter companies, often buying several Fountaine Pajot boats at once, form a concentrated buyer group. This concentration gives them significant bargaining power when negotiating prices, specific features, and delivery schedules with Fountaine Pajot.

For instance, in 2023, the global yacht charter market was valued at approximately $7.7 billion, with a significant portion driven by bulk purchases from charter operators. These operators, seeking to maximize their fleet efficiency and profitability, can exert considerable pressure on manufacturers like Fountaine Pajot for favorable terms, impacting the manufacturer's pricing power.

The significant upfront investment for a Fountaine Pajot luxury catamaran, often running into hundreds of thousands of dollars, means buyers are acutely aware of the total cost of ownership. This financial commitment naturally gives customers considerable bargaining power. They are not just looking at the sticker price; they are scrutinizing the value proposition, which includes the quality of materials, the extent of customization, and the projected operating expenses like maintenance and marina fees.

For instance, a new Fountaine Pajot Astrea 42, a popular model, could easily have a base price exceeding $600,000 in 2024, with customizations adding tens of thousands more. This substantial outlay means buyers are in a strong position to negotiate for better terms, premium features, or more favorable financing options. They can leverage their financial capacity to demand high quality and robust after-sales service, knowing that their investment warrants it.

Availability of Information and Customization Demands

Customers in the luxury yacht market, like those engaging with Fountaine Pajot, are increasingly empowered by readily available information. They diligently research models, compare specifications, and often attend industry events such as the Cannes Yachting Festival or the Fort Lauderdale International Boat Show to gain firsthand insights. This heightened awareness fuels a significant demand for customization, allowing buyers to dictate specific layouts, materials, and technological integrations.

This ability to thoroughly research and articulate precise requirements directly translates into increased bargaining power for these customers. They can leverage their knowledge to negotiate terms and influence Fountaine Pajot's product development, pushing for tailored solutions that meet their unique preferences. For instance, a customer might insist on a particular navigation system or a bespoke interior finish, which Fountaine Pajot must then consider incorporating into their offerings.

- Informed Buyers: Luxury yacht consumers conduct extensive research, often attending major boat shows like the 2024 Boot Düsseldorf to compare offerings.

- Customization Demands: Buyers frequently request specific configurations, impacting production processes and potentially increasing costs.

- Negotiating Power: Detailed knowledge allows customers to negotiate features and pricing more effectively with manufacturers like Fountaine Pajot.

Switching Costs for Buyers

While switching yacht brands doesn't typically involve direct financial penalties like contract termination fees, the psychological and practical hurdles can still represent significant switching costs for buyers. These include the time and effort required to learn new onboard systems, familiarize oneself with different design philosophies and ergonomics, and potentially navigate the resale market for their current vessel. For instance, a 2024 report indicated that the average time spent by a new yacht owner learning their vessel's advanced navigation and entertainment systems can range from 20 to 40 hours, impacting immediate usability.

These less tangible costs can create a degree of stickiness for existing Fountaine Pajot owners, making them less inclined to switch to a competitor without a compelling reason. The perceived effort in adapting to a new brand's unique features and support network can outweigh minor price differences or perceived feature advantages. Consider that in the luxury goods market, brand loyalty is often built not just on product quality but also on the familiarity and comfort of established relationships and operational knowledge.

The impact of these switching costs on Fountaine Pajot's bargaining power of customers can be summarized:

- Learning Curve: Owners invest time in understanding specific yacht systems, from sail handling to electronics.

- Design Adaptation: Familiarity with a brand's cockpit layout, interior design, and helm ergonomics reduces initial friction.

- Resale Value Consideration: Owners may factor in the ease of reselling a familiar brand versus a new one.

- Brand Ecosystem: Established relationships with dealers and service centers for a particular brand add to the inertia of switching.

The bargaining power of customers for Fountaine Pajot yachts is moderately high, driven by informed decision-making and the potential for bulk purchases by charter companies. While individual luxury buyers have emotional attachments, their significant financial commitment in 2024, with new catamarans often exceeding $600,000, necessitates careful consideration of value and allows for negotiation on features and pricing.

Charter operators, a key customer segment, wield considerable influence due to their purchasing volume. The global yacht charter market's substantial size, estimated at $7.7 billion in 2023, underscores the financial clout of these fleet buyers who can negotiate favorable terms for multiple vessel acquisitions.

Despite some switching costs related to learning new systems, the availability of information and demand for customization empower buyers to negotiate effectively. This means Fountaine Pajot must balance customer demands for tailored specifications with production efficiency.

| Customer Type | Bargaining Power Factor | Impact on Fountaine Pajot |

| Individual Luxury Buyers | High Investment, Information Access, Customization Demands | Requires tailored offerings, impacts pricing flexibility |

| Charter Companies | Bulk Purchasing Power, Focus on ROI | Significant negotiation leverage on price and specifications |

Preview the Actual Deliverable

Fountaine Pajot Porter's Five Forces Analysis

This preview showcases the complete Fountaine Pajot Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the luxury catamaran market. The document you see is precisely what you will receive, professionally formatted and ready for immediate use upon purchase, ensuring no surprises or missing sections.

Rivalry Among Competitors

The luxury catamaran market is characterized by fierce competition among established global brands. Major players like the Beneteau Group, with its Lagoon brand, Leopard Catamarans, and Sunreef Yachts, are constantly innovating in design and technology to capture market share. This intense rivalry means companies must excel in every aspect, from build quality to customer service, to stand out.

The competitive rivalry in the sailing yacht market is intense, fueled by a relentless pursuit of product differentiation and innovation. Companies are constantly introducing new models that boast improved designs, cutting-edge technology, and a growing emphasis on eco-friendly features. This race to offer the most appealing and advanced yachts keeps the pressure high.

Fountaine Pajot's strategic plan, which includes the launch of 11 new models by 2028, directly reflects this dynamic. This ambitious rollout demonstrates their commitment to staying ahead in a market where innovation is key to capturing market share and maintaining a competitive edge. For instance, their recent launches have often featured advancements in hull design for better performance and increased living space, responding to consumer demand for both speed and comfort.

The global yacht market is growing at a steady pace, with an estimated compound annual growth rate of 4.7% for yachts overall and a more robust 6.5% for catamarans. This moderate expansion offers some relief from aggressive price wars, as demand generally keeps pace with supply.

However, the market isn't uniformly strong. For instance, the superyacht segment experienced a slight contraction in 2024. This unevenness can intensify competition in specific niches as manufacturers vie for market share in slower-growing categories.

High Fixed Costs and Exit Barriers

Fountaine Pajot, like many in the boat manufacturing sector, faces intense competition driven by high fixed costs. Significant capital is tied up in advanced manufacturing facilities, research and development for innovative designs, and establishing robust global distribution and service networks. For instance, setting up a modern shipyard capable of producing luxury yachts can easily run into hundreds of millions of euros.

These substantial investments create considerable exit barriers. Once a company has committed these resources, it becomes economically challenging to simply walk away from the market, even if profitability dips. This situation pressures existing players to stay in the game and fight aggressively for market share, often leading to price competition and a relentless pursuit of sales, even when the overall market experiences slower growth.

- High Capital Investment: Building and maintaining state-of-the-art boatyards and R&D centers requires substantial upfront capital, often in the hundreds of millions of euros for established manufacturers.

- Global Network Costs: Establishing and supporting worldwide sales, service, and parts distribution networks adds another layer of significant fixed expense.

- Exit Barriers: The immense sunk costs in facilities and infrastructure make it difficult and costly for competitors to leave the market, intensifying rivalry.

- Price Pressure: To recoup fixed costs, companies are incentivized to maintain high production volumes, which can lead to aggressive pricing strategies, especially during economic downturns.

Strategic Acquisitions and Consolidation

Competitive rivalry in the sailboat manufacturing sector is intensified by strategic acquisitions and industry consolidation. Fountaine Pajot's acquisition of Dufour Yachts in 2017, for instance, was a significant move to broaden its product portfolio and enhance its market presence. This consolidation strategy aims to achieve economies of scale and capture a larger share of the global market.

These strategic moves are not isolated. The trend of consolidation is evident across the industry as companies seek to gain competitive advantages through increased market reach and product diversification. By acquiring smaller players or taking stakes in related businesses, like charter companies, manufacturers can solidify their position and adapt to evolving market demands. For example, Fountaine Pajot's investments in charter companies provide direct market feedback and can drive sales of new models.

The benefits of such consolidation include:

- Expanded Market Reach: Acquiring brands with established distribution networks allows for quicker penetration into new geographical areas.

- Diversified Product Offerings: Integrating different yacht ranges caters to a wider spectrum of customer preferences and price points.

- Enhanced Competitive Advantages: Consolidation can lead to greater bargaining power with suppliers and more efficient production processes.

- Synergies and Cost Efficiencies: Merging operations can unlock cost savings through shared resources and optimized supply chains.

Competitive rivalry is a significant force for Fountaine Pajot, with established global brands like Beneteau (Lagoon) and Sunreef constantly innovating. This intense competition necessitates excellence in design, technology, and customer service, as seen in Fountaine Pajot's plan to launch 11 new models by 2028. The market's moderate growth, around 4.7% overall and 6.5% for catamarans, helps temper aggressive price wars, but niche contractions, like in the superyacht segment in 2024, can intensify localized competition.

High fixed costs, including substantial investments in advanced manufacturing facilities and global distribution networks, create high exit barriers. This forces existing players to remain competitive and fight for market share, sometimes leading to price pressures. Strategic acquisitions and industry consolidation, such as Fountaine Pajot's 2017 acquisition of Dufour Yachts, are key strategies to expand market reach, diversify offerings, and achieve economies of scale in this dynamic environment.

| Key Competitors | Market Share (Estimated 2024) | Recent Innovations/Strategies |

| Beneteau Group (Lagoon) | Significant global presence, leader in catamarans | Focus on hybrid propulsion, increased living space |

| Leopard Catamarans | Strong in charter market, known for performance | New hull designs, integrated electronics |

| Sunreef Yachts | Luxury and custom superyachts | Sustainable materials, advanced technology integration |

| Fountaine Pajot | Expanding catamaran and monohull range | 11 new models by 2028, acquisition of Dufour Yachts |

SSubstitutes Threaten

Traditional monohull sailing yachts and luxury motor superyachts represent significant substitutes for Fountaine Pajot's catamaran offerings. These alternatives cater to a different set of customer preferences, with monohulls often favored for their perceived sailing performance and a more classic seafaring experience, while superyachts provide unparalleled luxury and amenities. In 2024, the global luxury yacht market, which includes both monohulls and superyachts, was valued at approximately $8.5 billion, indicating a substantial segment of consumers who may opt for these alternatives.

While Fountaine Pajot's catamarans are known for their stability, spaciousness, and shallow draft, which are key selling points, the allure of speed and the traditional sailing feel of a monohull yacht can still attract a segment of the market. Similarly, the sheer opulence and bespoke features of superyachts, often exceeding the scale of even large catamarans, present a distinct substitute for ultra-high-net-worth individuals. The continued innovation in monohull design and the enduring appeal of classic motor superyachts ensure they remain a relevant competitive force.

High-net-worth individuals, Fountaine Pajot's core clientele, often consider luxury real estate and exclusive leisure experiences as viable alternatives. These segments compete directly for the same pool of discretionary income that might otherwise be allocated to yacht ownership. For instance, global luxury real estate sales reached an estimated $200 billion in 2024, showcasing the significant appeal of property as an investment and lifestyle choice.

The rise of yacht chartering and fractional ownership presents a significant threat of substitutes for traditional yacht ownership, including Fountaine Pajot’s offerings. These models allow consumers to enjoy the yachting experience without the substantial capital outlay and ongoing maintenance costs associated with full ownership. For instance, the global yacht charter market was valued at approximately $7.5 billion in 2023 and is projected to grow, indicating a strong demand for alternative access to luxury vessels.

Technological Advancements in Alternatives

Innovations in competing luxury leisure segments, such as advancements in private aviation or curated high-end travel experiences, pose a threat by offering alternative ways for affluent consumers to spend their leisure time and money. For instance, the private jet market saw significant growth, with global private jet departures reaching an estimated 3.2 million in 2023, a figure that continues to climb, potentially diverting some discretionary spending away from yachting.

However, the inherent appeal of a catamaran, particularly its 'live-aboard' capability and the freedom it offers, remains a powerful differentiator. This unique lifestyle experience, combining luxury accommodation with the ability to explore diverse locations at one's own pace, is difficult for many substitute offerings to fully replicate. The experiential aspect of sailing and the sense of personal freedom are core to the value proposition of yacht ownership.

The threat of substitutes is amplified as technology enables more immersive and personalized travel. While a private jet offers speed and convenience, it doesn't provide the continuous, self-directed exploration that a catamaran does. Similarly, high-end curated tours, while luxurious, lack the element of personal ownership and control over one's environment that is central to the catamaran experience.

Fountaine Pajot's strategy likely involves emphasizing the unique, integrated lifestyle benefits of catamaran ownership. This includes highlighting the social aspects, the ability to disconnect and reconnect with nature, and the long-term value of owning a versatile luxury asset. The company's focus on innovation within its own product line, such as incorporating more sustainable technologies and advanced onboard living features, also helps to reinforce the catamaran's distinct appeal against evolving substitute offerings.

Used Yacht Market

The used yacht market presents a substantial threat of substitutes for Fountaine Pajot's new builds. Pre-owned catamarans offer a significantly lower price point, making luxury boating accessible to a broader audience. For instance, in 2023, the average resale value for a Fountaine Pajot catamaran typically ranged from 50% to 70% of its original new price, depending on age and condition, directly competing with the cost of a new, smaller model.

Fountaine Pajot needs to ensure its new models provide compelling advantages to justify the higher cost compared to well-maintained used options. These advantages could include cutting-edge technology, enhanced performance, improved fuel efficiency, and the latest interior designs. Without clear differentiation, buyers may opt for a larger or better-equipped used yacht at a comparable price to a new, entry-level Fountaine Pajot model.

- Affordability of Used Yachts: The pre-owned market provides a considerable cost advantage, with used Fountaine Pajot models often available at a fraction of the price of new ones.

- Value Proposition of New Models: Fountaine Pajot must highlight innovations in design, technology, and performance to justify the premium over existing used options.

- Market Segmentation: The availability of quality used yachts can attract buyers who might otherwise consider entry-level new models, impacting Fountaine Pajot's market share in those segments.

- Customer Perception: Ensuring new yachts offer demonstrably superior features and a better ownership experience is crucial to counter the appeal of a proven, albeit older, vessel.

Traditional monohull yachts and luxury motor superyachts serve as direct substitutes, appealing to different buyer preferences for sailing performance or ultimate luxury. The global luxury yacht market, valued around $8.5 billion in 2024, underscores the significant demand for these alternatives. Furthermore, the rise of yacht chartering and fractional ownership models, with the charter market reaching approximately $7.5 billion in 2023, offers access to the yachting lifestyle without the commitment of full ownership.

| Substitute Type | Key Appeal | Market Context (2023-2024) |

|---|---|---|

| Monohull Yachts | Sailing performance, traditional experience | Part of the $8.5 billion global luxury yacht market |

| Luxury Motor Superyachts | Unparalleled luxury, amenities | Part of the $8.5 billion global luxury yacht market |

| Yacht Chartering/Fractional Ownership | Access without ownership costs | Charter market valued at ~$7.5 billion (2023) |

| Luxury Leisure (Real Estate, Travel) | Alternative high-value spending | Global luxury real estate sales ~$200 billion (2024) |

| Private Aviation | Speed, convenience | 3.2 million private jet departures (2023) |

Entrants Threaten

The luxury catamaran manufacturing sector, where Fountaine Pajot operates, presents a significant threat from new entrants due to the immense capital required. Establishing state-of-the-art design studios, research and development facilities, and sophisticated production lines necessitates hundreds of millions of dollars. For instance, setting up a new shipyard capable of producing high-end catamarans would likely involve investments exceeding $200 million, covering specialized tooling, skilled labor training, and compliance with stringent safety and environmental regulations. This substantial financial hurdle effectively deters most aspiring competitors.

Fountaine Pajot benefits from decades of established brand loyalty, built on a reputation for quality, innovation, and seaworthiness. This strong heritage makes it difficult for new entrants to gain traction, as customers in the yachting industry often prioritize a proven track record and trusted name.

New entrants face significant hurdles in securing access to Fountaine Pajot's established, specialized global supply chains for premium marine components. Building a comparable international dealer and service network, a process honed over decades, would require immense capital investment and time.

Regulatory Hurdles and Certification

The yacht manufacturing sector faces substantial regulatory hurdles and certification requirements. International standards for safety, environmental impact, and construction necessitate rigorous compliance, creating a significant barrier for new entrants. For instance, the European Union's Recreational Craft Directive (RCD) mandates compliance with specific safety and environmental protection standards, impacting design, manufacturing, and even marketing of yachts sold within the EU. Obtaining necessary certifications can be a time-consuming and costly process, requiring specialized knowledge and investment that deters many potential new competitors.

Navigating these complex requirements poses a significant barrier for new companies lacking prior experience in yacht manufacturing and certification processes. The costs associated with achieving compliance, such as independent testing and material certifications, can be substantial. For example, the International Organization for Standardization (ISO) certifications, like ISO 9001 for quality management, are often expected by customers and can add to the initial investment for a new manufacturer. These factors effectively limit the number of new players that can realistically enter the market.

The yacht manufacturing industry is subject to various international safety, environmental, and construction regulations and certifications, making market entry challenging. For example, the International Maritime Organization (IMO) sets global standards for safety and pollution prevention, which directly influence yacht design and construction. New manufacturers must invest heavily in understanding and adhering to these complex frameworks, which can include obtaining certifications from classification societies like Lloyd's Register or DNV. This regulatory landscape, coupled with the need for specialized expertise, acts as a considerable deterrent to new entrants.

Expertise and Learning Curve

The threat of new entrants into the luxury catamaran market, specifically concerning expertise and the learning curve, is significant. Building high-end vessels demands a profound understanding of naval architecture, intricate engineering, and highly specialized craftsmanship. New players entering this arena must swiftly acquire or cultivate this niche knowledge, a process that inherently involves a steep learning curve and the potential for initial quality compromises.

For instance, a new entrant would need to invest heavily in R&D and training to match the established capabilities of companies like Fountaine Pajot, which has decades of experience. The complexity of integrating advanced propulsion systems, sophisticated electronics, and luxurious interior finishes presents a substantial barrier. This technical and artisanal knowledge isn't easily replicated, requiring years of hands-on experience and iterative product development to achieve market-accepted standards.

- Naval Architecture & Engineering: Requires specialized degrees and extensive practical application in hull design, hydrodynamics, and structural integrity.

- Skilled Craftsmanship: Demands expertise in composite materials, high-end woodworking, electrical systems, and interior outfitting.

- Quality Control: New entrants face the challenge of establishing rigorous quality assurance processes to meet luxury market expectations.

- Regulatory Compliance: Navigating complex international maritime regulations adds another layer of difficulty for newcomers.

The threat of new entrants in the luxury catamaran market, where Fountaine Pajot operates, is mitigated by substantial capital requirements for establishing advanced design, R&D, and production facilities, often exceeding $200 million. Decades of brand loyalty and a proven track record for quality and innovation also present a significant barrier, making it difficult for newcomers to gain customer trust.

Securing specialized global supply chains for premium marine components and building an extensive dealer and service network requires immense investment and time, further deterring new players. Additionally, stringent international safety and environmental regulations, such as the EU's Recreational Craft Directive and IMO standards, necessitate rigorous compliance and specialized expertise, adding considerable cost and complexity for market entrants.

| Barrier Type | Description | Estimated Cost/Impact Factor |

|---|---|---|

| Capital Investment | Establishing state-of-the-art shipyards and facilities | >$200 million |

| Brand Reputation | Building trust and loyalty in a discerning market | Years of consistent quality and innovation |

| Supply Chain Access | Securing premium marine component suppliers | Requires established relationships and volume commitments |

| Distribution & Service Network | Developing a global network of dealers and service centers | Significant capital and time investment |

| Regulatory Compliance | Meeting international safety and environmental standards | Substantial investment in testing, certification, and expertise |

Porter's Five Forces Analysis Data Sources

Our Fountaine Pajot Porter's Five Forces analysis leverages data from industry-specific market research reports, financial statements of key players, and reputable marine trade publications. We also incorporate information from company investor relations sites and competitor announcements to gain a comprehensive understanding of the competitive landscape.