Fountaine Pajot Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fountaine Pajot Bundle

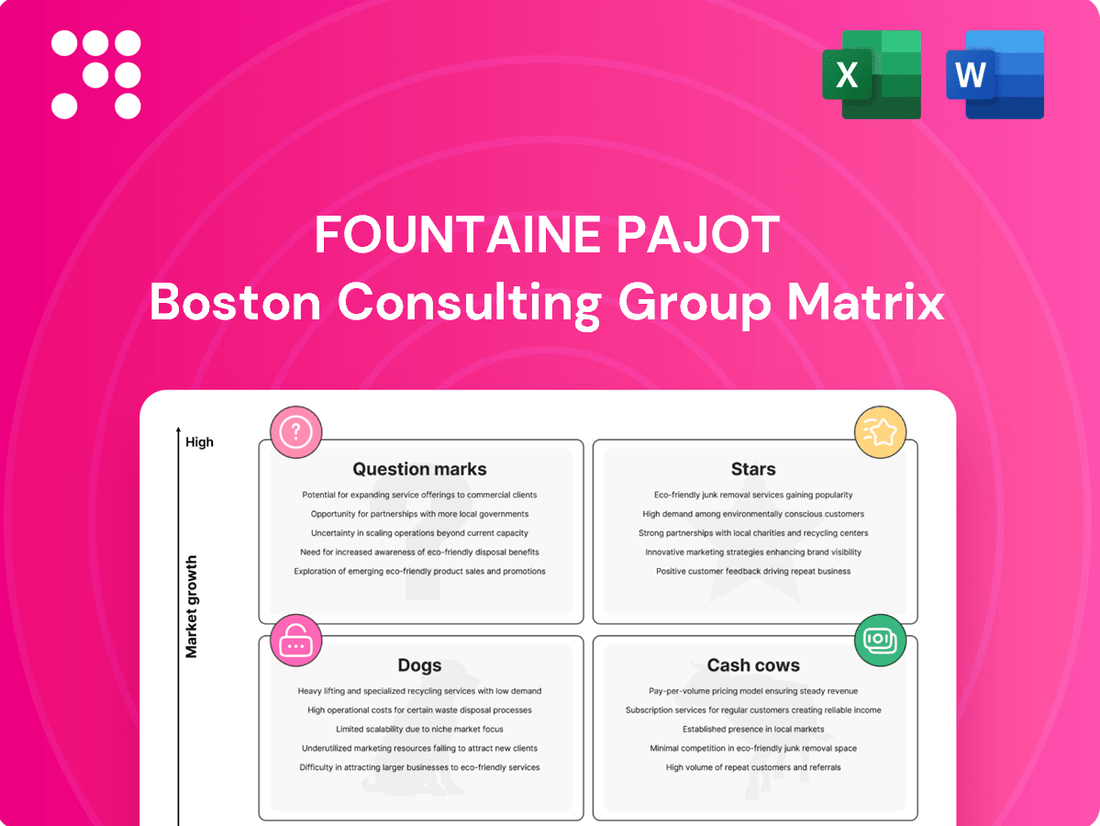

Curious about Fountaine Pajot's strategic product portfolio? This glimpse into their BCG Matrix reveals how their offerings are positioned in the competitive marine market, highlighting potential growth areas and established performers. Don't miss out on the full picture; purchase the complete BCG Matrix for detailed quadrant analysis, actionable insights, and a clear roadmap to optimizing your investment in their innovative yachts.

Stars

Fountaine Pajot is a prominent force in the luxury cruising catamaran sector, commanding a substantial portion of a rapidly expanding market. The company's commitment to innovation and quality has solidified its position as a leader in this niche.

The global catamaran market is experiencing robust growth, with projections indicating continued expansion through 2024 and beyond. Fountaine Pajot's established brand recognition and diverse product offerings are key drivers of its market leadership.

This segment of Fountaine Pajot's business is characterized by both high market share and high growth potential, making their luxury cruising catamarans a strategic cornerstone. Their 2023 sales figures reflected this strength, with a notable increase in catamaran deliveries.

The Thíra 80 stands as Fountaine Pajot's premier sailing catamaran, recognized for its cutting-edge design and luxury appointments. Its introduction in 2023 and subsequent deliveries throughout 2024 demonstrate robust market penetration in the premium sector, solidifying its position as a key revenue driver.

Fountaine Pajot Motor Yachts has experienced a remarkable surge, with sales doubling in the 2023/2024 financial year. This impressive growth highlights robust demand and an expanding market presence in the luxury motor yacht sector. The brand's commitment to innovation, exemplified by models like the MY6 and the highly anticipated Power 80, is clearly resonating with buyers.

New 41 Sailing Catamaran (2025 Model)

The Fountaine Pajot New 41, a 2025 model, is positioned as a potential star in the company's product lineup. This new generation catamaran emphasizes eco-responsibility, enhanced living space, and offers hybrid propulsion options, aligning with current market trends. Its extensive pre-launch marketing, including upcoming sea trials and boat show appearances, signals aggressive growth expectations.

The company's robust marketing efforts and Fountaine Pajot's established reputation as a leader in the sailing catamaran market strongly suggest the New 41 will capture significant market share rapidly. This rapid adoption is crucial for its classification as a star, requiring high growth and a strong relative market share.

- Market Entry: The 2025 New 41 represents a significant new product introduction.

- Growth Potential: Strong pre-launch promotion and market positioning indicate high anticipated sales growth.

- Brand Strength: Fountaine Pajot's established brand leadership supports expectations of rapid market share acquisition.

- Strategic Focus: Emphasis on eco-responsibility and hybrid options targets a growing segment of the market.

New 44 Sailing Catamaran (2025 Model)

The Fountaine Pajot New 44, a 2025 model, represents a strategic expansion following the success of the New 41. This new catamaran is engineered to deliver increased living space and incorporates advanced technology, such as the ODSea+ electric drivetrain, aiming to capture a larger segment of the cruising catamaran market.

This model is crucial for Fountaine Pajot's growth strategy in the expanding cruising catamaran sector. By focusing on enhanced comfort and performance, the New 44 is designed to bolster the brand's market position and appeal to a discerning clientele.

- Market Positioning: The New 44 is positioned as a premium offering, building on Fountaine Pajot's established reputation for quality and innovation in the catamaran market.

- Technological Advancement: Features like the ODSea+ electric drivetrain highlight a commitment to sustainable and advanced marine technology, a key differentiator.

- Sales Growth Potential: With the global catamaran market projected to grow, the New 44 is expected to contribute significantly to Fountaine Pajot's sales figures in the coming years. For instance, the luxury yacht market, which includes catamarans, saw a global revenue of approximately $20 billion in 2023, with projections indicating continued expansion.

- Competitive Advantage: The combination of increased living space, advanced features, and Fountaine Pajot's brand strength aims to provide a competitive edge against rivals in the 2025 model year.

The Fountaine Pajot New 41 and New 44 are positioned as Stars within the BCG matrix. Both models represent new product introductions with significant anticipated sales growth and are expected to capture substantial market share rapidly due to Fountaine Pajot's strong brand and focus on eco-friendly, technologically advanced features. Their success is crucial for the company's growth strategy in the expanding catamaran market.

| Product | Market Share | Market Growth | BCG Category | Strategic Rationale |

|---|---|---|---|---|

| New 41 | High (Projected) | High | Star | Leverages brand strength and eco-focus for rapid market penetration. |

| New 44 | High (Projected) | High | Star | Expands on successful platform with enhanced features and technology. |

What is included in the product

This BCG Matrix overview details Fountaine Pajot's product portfolio, categorizing each unit to guide strategic investment decisions.

Fountaine Pajot BCG Matrix: A clear, visual roadmap to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

The Isla 40 Sailing Catamaran, with nearly 500 units produced since its launch, stands as a prime example of a Cash Cow for Fountaine Pajot. Its sustained popularity and high production volume indicate a mature product with a robust, established market share.

This model consistently generates significant cash flow, allowing Fountaine Pajot to reduce promotional expenditures while maintaining healthy profitability. The Isla 40’s proven track record in the market solidifies its position as a reliable revenue generator for the company.

Fountaine Pajot's established bareboat and crewed charter offerings represent a significant cash cow. The company provides a diverse fleet designed for these markets, which have seen consistent growth. In 2024, the global yacht charter market was valued at approximately $10 billion, with projections indicating continued expansion.

These charter segments generate a reliable and consistent revenue stream for Fountaine Pajot. The high demand for luxury yacht experiences ensures that their charter-ready vessels are frequently utilized, translating into steady income. The market for luxury charters alone is a substantial contributor, underscoring the strength of this business unit.

Fountaine Pajot's established sailing catamaran range, including models like the Elba 45, Tanna 47, Aura 51, Samana 59, and Alegria 67, are recognized as reliable performers in the market. These catamarans, while not the newest additions, benefit from a strong reputation and consistent customer interest, ensuring a steady revenue stream for the company.

These established models are Fountaine Pajot's cash cows, generating significant and predictable income. For instance, Fountaine Pajot reported a robust order book extending into 2024, with a notable portion attributed to their well-established sailing catamaran lines, underscoring their sustained market appeal and profitability.

'Maestro' Owner Versions

The 'Maestro' owner versions of Fountaine Pajot catamarans represent a strategic 'Cash Cow' within their product portfolio. These models, offering enhanced comfort and customization, appeal to a discerning clientele, likely generating robust and consistent profit margins.

These premium configurations tap into a loyal market segment that values personalization and luxury, ensuring a stable, high-value revenue stream. The established demand for these versions suggests lower marketing and sales acquisition costs compared to introducing entirely new product lines.

- Higher Profitability: 'Maestro' versions likely boast superior profit margins due to their premium positioning and customization options.

- Established Market Demand: These models cater to a known, high-value customer segment, ensuring consistent sales.

- Lower Acquisition Costs: Marketing and sales efforts for these established, desirable versions are typically more efficient than for new entrants.

After-Sales Services and Parts

Fountaine Pajot’s after-sales services and parts division acts as a solid cash cow within its business portfolio. This segment benefits from a substantial global fleet of previously delivered catamarans, ensuring a steady stream of revenue from maintenance, repairs, and the supply of replacement parts. While not a high-growth area, its inherent stability makes it a predictable and reliable income source.

The consistent demand from existing owners for upkeep and upgrades solidifies its cash cow status. This ongoing need for services and parts provides Fountaine Pajot with a stable financial foundation, allowing it to support other, potentially higher-growth but less predictable, areas of the business. For instance, in 2023, the marine aftermarket services sector saw continued growth, with many owners investing in refits and upgrades to extend the life of their vessels.

- Consistent Revenue Generation: Fountaine Pajot's extensive global fleet ensures a continuous demand for after-sales services and parts.

- Low Growth, High Stability: This segment offers predictable income due to the ongoing maintenance needs of existing catamaran owners.

- Reliable Cash Flow: The division serves as a stable financial pillar, supporting overall business operations and investments.

- Market Trend Support: The marine aftermarket is robust, with owners increasingly investing in vessel upkeep and enhancements.

Fountaine Pajot’s established sailing catamaran range, including popular models like the Elba 45 and Tanna 47, represent significant cash cows. These models benefit from a strong brand reputation and consistent customer demand, ensuring a steady revenue stream.

These well-regarded catamarans generate predictable income for Fountaine Pajot, allowing the company to allocate resources effectively. The company's robust order book, extending into 2024, highlights the sustained market appeal and profitability of these established lines.

The 'Maestro' owner versions of Fountaine Pajot catamarans are also key cash cows. Their premium features and customization options appeal to a loyal, high-value customer segment, leading to strong and consistent profit margins with potentially lower marketing costs compared to newer models.

Fountaine Pajot's after-sales services and parts division is another reliable cash cow. With a large global fleet of existing catamarans, there's a continuous demand for maintenance and parts, providing a stable and predictable income stream that supports the company's overall financial health.

| Product/Service | BCG Category | Key Characteristics | Market Context (2024) | Revenue Contribution |

|---|---|---|---|---|

| Established Catamaran Models (e.g., Elba 45, Tanna 47) | Cash Cow | High market share, mature product, strong brand loyalty, consistent demand. | Global yacht market continues to see demand for well-established, reputable models. | Significant and predictable revenue stream. |

| 'Maestro' Owner Versions | Cash Cow | Premium positioning, high customization, appeals to discerning clientele, strong profit margins. | Demand for luxury and personalized boating experiences remains robust. | Generates high-value, stable income with potentially lower acquisition costs. |

| After-Sales Services & Parts | Cash Cow | Benefits from extensive existing fleet, consistent demand for maintenance and repairs, low growth but high stability. | Marine aftermarket services sector shows ongoing growth as owners invest in vessel upkeep. | Provides a reliable and predictable income source, bolstering financial stability. |

What You See Is What You Get

Fountaine Pajot BCG Matrix

The Fountaine Pajot BCG Matrix preview you are viewing is the identical, fully completed document you will receive immediately after your purchase. This means you'll get the exact same strategic analysis, with no watermarks or demo content, ready for your immediate business planning and decision-making.

Dogs

Fountaine Pajot's older, less fuel-efficient sailboat models, particularly those predating significant advancements in hull design and engine technology, could be categorized as dogs. For instance, models from the early 2000s might struggle to compete with current offerings that boast fuel consumption reductions of up to 20% due to lighter materials and more efficient propulsion systems, as reported by industry trends in 2024.

Fountaine Pajot's discontinued or phased-out models represent legacy designs that no longer compete effectively in the current market. These vessels, while historically significant, now hold minimal to negligible market share in new boat sales and contribute very little to the company's ongoing revenue streams. For instance, older models like the Lavezzi 40, which saw its production end around 2009, would now be firmly in this category, with its market presence limited to the pre-owned sector.

Fountaine Pajot's 'Dogs' category likely includes past experimental or highly specialized yacht models that didn't gain significant traction. These could be niche designs targeting very specific sailing preferences or early attempts at incorporating unproven technologies that ultimately failed to achieve widespread market acceptance. Without explicit financial disclosures for individual models, this classification is an inference based on common product lifecycle patterns in the marine industry.

Models from Acquired Brands (if underperforming)

Within Fountaine Pajot's strategic portfolio, models from acquired brands that are underperforming are categorized as 'dogs.' These are typically products that aren't meeting sales targets or aligning with the company's overarching growth objectives. For instance, if a specific Dufour Yachts model, acquired in a strategic move, were to show consistently low sales figures and high inventory levels, it would be flagged for review.

While Fountaine Pajot's acquisition of Dufour Yachts was a significant strategic step, the performance of individual models within the acquired brand is crucial. If any Dufour models were to exhibit sluggish sales or negative profitability, they would be classified as dogs. However, current market sentiment suggests a different story for Dufour.

Recent accolades for Dufour models, such as the Dufour 41 receiving industry awards in 2023 and early 2024, indicate strong market reception and positive performance. This suggests that, as of mid-2024, Fountaine Pajot's acquired Dufour brand is largely avoiding the 'dog' classification for its key models, instead showing signs of being a potential 'star' or 'cash cow' depending on its market share and profitability.

- Underperforming Acquired Models: Fountaine Pajot's strategy includes integrating acquired brands like Dufour Yachts. Models from these acquisitions that fail to meet sales expectations or strategic alignment are classified as dogs.

- Dufour Performance: Recent data indicates strong performance for Dufour models. For example, the Dufour 41 has garnered industry awards, suggesting it is not a dog but rather a strong performer.

- Strategic Review: Any underperforming models, regardless of whether they are from Fountaine Pajot's original lines or acquired brands, would undergo a strategic review to determine their future within the portfolio.

High-Maintenance, Low-Demand Used Models

Within the broader context of Fountaine Pajot's market presence, very old, high-maintenance used models can be categorized as 'dogs'. These vessels, while carrying the respected Fountaine Pajot name, often demand significant investment in repairs and refurbishments. This can make them less appealing to potential buyers compared to newer or better-maintained alternatives, potentially impacting the brand's overall image of quality and desirability.

These older Fountaine Pajot models, despite their heritage, represent a challenge. The cost and effort required to bring them up to a desirable standard can deter many buyers. For instance, a 20-year-old Fountaine Pajot might require a complete engine overhaul, sail replacement, and significant interior refitting, costs that could easily exceed tens of thousands of dollars. This situation is compounded by the fact that the resale value of such heavily depreciated assets may not justify the extensive investment needed.

- High Refurbishment Costs: Older models often require substantial investment in engine, rigging, and hull maintenance.

- Lower Resale Value: The market demand for these older, high-maintenance boats is typically low, impacting their resale price.

- Brand Perception Risk: Unmanaged, these 'dogs' can negatively affect the Fountaine Pajot brand's reputation for quality and performance.

- Limited Market Appeal: Buyers seeking Fountaine Pajot quality often prefer newer models, leaving a niche and price-sensitive market for older units.

Fountaine Pajot's 'dogs' are essentially older, less competitive models or those from acquired brands that are underperforming. These products have low market share and low growth potential, offering minimal profit. For example, discontinued lines or experimental designs that didn't gain traction would fall into this category, representing a drain on resources without significant returns.

Older, high-maintenance used Fountaine Pajot models also fit the 'dog' profile. The substantial costs associated with their refurbishment, such as engine overhauls or sail replacements, often outweigh their depreciated resale value. This makes them less attractive to buyers, potentially impacting the brand's overall quality perception.

The Dufour 41, recognized with industry awards in 2023 and early 2024, exemplifies a strong performer, indicating that Fountaine Pajot's acquired brands are largely avoiding the 'dog' classification for their key offerings as of mid-2024. This contrasts with hypothetical underperforming Dufour models that would be flagged for strategic review.

In essence, 'dogs' within Fountaine Pajot's portfolio are products that no longer contribute positively to the company's growth or profitability. These might include legacy models with outdated technology or niche products that failed to capture significant market interest, requiring careful management to avoid negatively impacting the brand.

Question Marks

Fountaine Pajot's Samana 59 RexH2 prototype positions its hydrogen propulsion technology firmly in the question mark category of the BCG Matrix. This innovative approach to yachting taps into a high-growth potential market driven by increasing environmental consciousness and regulatory pushes for sustainable maritime solutions.

While the Samana 59 RexH2 showcases Fountaine Pajot's commitment to pioneering this future-forward technology, the current market share for hydrogen-powered yachts remains extremely low. This is largely due to the technology's early stage of development, which translates into significant research and development costs and a higher price point for consumers. For instance, the broader marine industry is still grappling with the infrastructure and cost-effectiveness of hydrogen fuel cells, with global investments in marine hydrogen refueling infrastructure still in their infancy, though growing. The market for hydrogen-powered leisure craft is nascent, with only a handful of prototypes and limited commercial availability as of 2024.

The Code 07 Power Catamaran, a new venture with Couach, targets significant international expansion, especially in the lucrative US market. This strategic collaboration marks Fountaine Pajot's entry into a potentially high-growth segment of the power catamaran market.

As a nascent product, the Code 07 currently holds a negligible market share. Its future trajectory hinges on successful market penetration, consumer acceptance, and sustained strategic investment to capture its intended market potential.

Fountaine Pajot is targeting the Asia-Pacific region for significant growth, recognizing it as a rapidly expanding market for catamarans. This strategic move aims to capitalize on emerging consumer demand and increasing leisure spending in countries like Thailand, Australia, and parts of Southeast Asia. For instance, the global marine industry, including the yacht and catamaran sector, saw robust growth in the Asia-Pacific region in recent years, with projections indicating continued expansion through 2025.

However, this expansion into Asia-Pacific markets presents challenges as Fountaine Pajot is still in the process of establishing and strengthening its distribution channels and brand presence. Building a robust dealer network and ensuring adequate after-sales support are crucial for success in these diverse markets. The company's investment in this area is substantial, reflecting a long-term vision to capture a significant market share, though the full realization of these returns is anticipated over the next few years.

Development of Bio-sourced and Recycled Materials

Fountaine Pajot is investing heavily in bio-sourced and recycled materials, aligning with a circular economy approach for its catamarans. This focus taps into a rapidly expanding segment within the marine industry, driven by environmental consciousness. While precise market share figures for Fountaine Pajot's specific use of these materials are not publicly detailed, the broader trend indicates significant growth potential.

The integration of these advanced materials represents a strategic move towards innovation and sustainability, positioning Fountaine Pajot to capture future market demand.

- Innovation Focus: Fountaine Pajot's R&D in bio-sourced and recycled materials targets enhanced sustainability in yacht manufacturing.

- Growth Potential: This initiative aligns with the high-growth trajectory of sustainable manufacturing in the yachting sector.

- Market Integration: While the current market share of products utilizing these specific materials is likely nascent, the technological advancements are paving the way for wider adoption.

- Industry Trend: The global market for sustainable marine materials is projected to see substantial growth, with estimates suggesting a compound annual growth rate (CAGR) of over 7% in the coming years, underscoring the strategic importance of Fountaine Pajot's efforts.

Advanced Digital Controls and Smart Technologies Integration

Fountaine Pajot's commitment to integrating advanced digital controls and smart technologies, like their ODSea+ system, positions them at the forefront of a high-growth trend in the yachting sector. This strategic investment, while currently a cash consumer for research and development, is designed to build a significant competitive advantage.

While the yachting market is increasingly recognizing the value of these innovations, widespread adoption and clear differentiation based solely on smart features are still evolving. For instance, the global smart yacht market is projected to grow substantially, with estimates suggesting it could reach over $10 billion by 2028, indicating a strong future demand.

- Investment in R&D: Fountaine Pajot is channeling resources into developing sophisticated digital interfaces and connectivity solutions.

- Market Adoption Curve: The demand for integrated smart technologies in yachts is rising, but the market is still maturing in its appreciation and willingness to pay a premium.

- Future Differentiation: These technological advancements are key to establishing Fountaine Pajot as a leader in user experience and operational efficiency.

- Cash Flow Impact: Initial development and implementation of these advanced systems require significant capital expenditure, impacting short-term cash flow.

The Fountaine Pajot Samana 59 RexH2 prototype, with its hydrogen propulsion, is a prime example of a Question Mark in the BCG matrix. It operates in a high-growth potential market driven by sustainability demands, yet its current market share is minimal due to early-stage technology and high costs. The broader marine sector is still developing hydrogen infrastructure, with limited commercial availability of hydrogen-powered leisure craft as of 2024.

These nascent technologies require substantial investment and face uncertain market acceptance, making their future success a question mark. Their potential for high growth is undeniable, but the path to achieving significant market share is fraught with challenges, including infrastructure development and consumer education.

BCG Matrix Data Sources

Our Fountaine Pajot BCG Matrix is built on comprehensive market data, integrating sales figures, production volumes, and customer feedback to reflect current market standing.