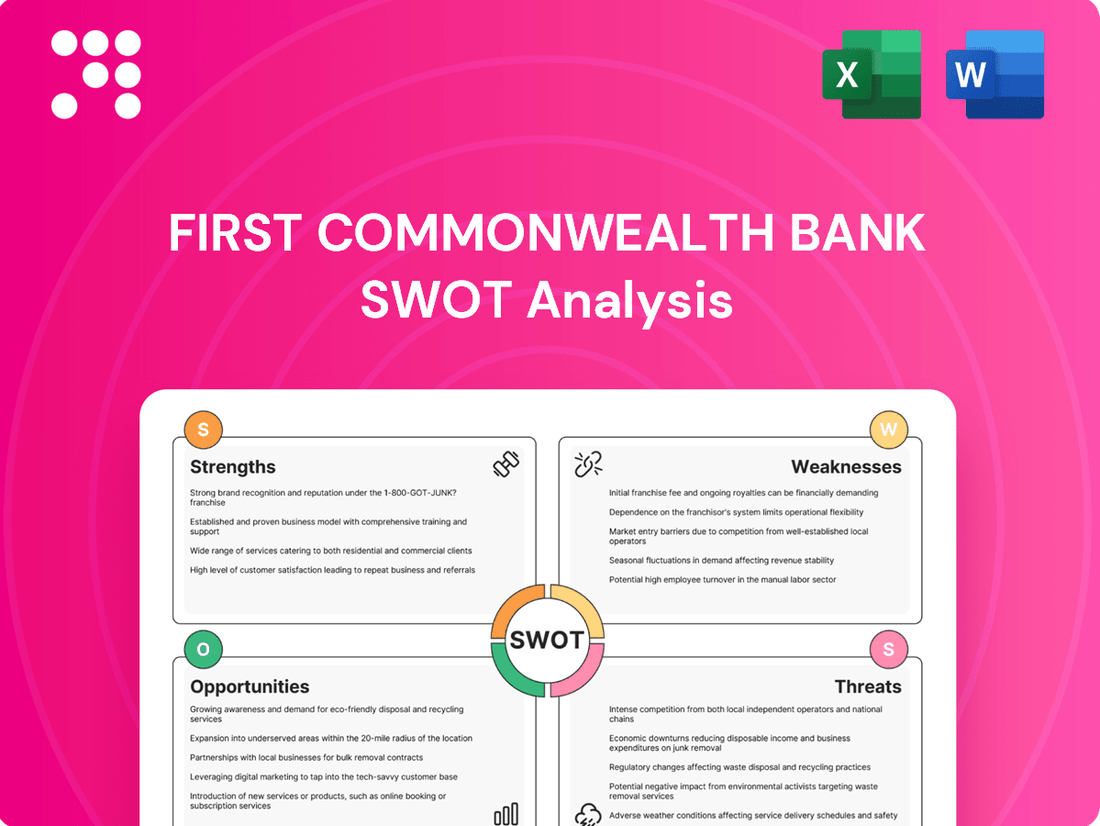

First Commonwealth Bank SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Commonwealth Bank Bundle

First Commonwealth Bank demonstrates strong community ties and a robust digital banking presence, but faces increasing competition and evolving regulatory landscapes. Understand the full picture of their market position and potential for growth.

Want the full story behind First Commonwealth Bank's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

First Commonwealth Bank offers a wide array of financial services, encompassing retail and commercial banking, alongside wealth management and insurance solutions. This broad spectrum of offerings allows the bank to serve a diverse clientele and generate revenue from multiple sources, mitigating risks associated with over-reliance on a single service. In 2024, First Commonwealth reported total assets of $23.5 billion, reflecting the scale of its diversified operations and its capacity to meet varied customer demands.

First Commonwealth Bank boasts a robust regional market presence, primarily across Pennsylvania and Ohio. This deep entrenchment allows for a keen understanding of local economic nuances and strong community relationships, which are invaluable in the banking sector. As of the first quarter of 2024, the bank reported total assets of $22.1 billion, reflecting its substantial footprint in these key areas.

First Commonwealth Bank’s strength lies in its ability to serve a remarkably broad customer base. This includes individuals managing personal finances, small businesses navigating local economies, and larger corporations and institutions with more complex financial needs.

This wide segmentation is a significant advantage, offering stability and resilience. By not relying on a single customer group, the bank’s deposit and loan portfolio becomes more robust, better able to withstand economic fluctuations affecting specific sectors.

For instance, as of the first quarter of 2024, community banks like First Commonwealth often see a strong performance in their small business lending, which can offset slower growth in other areas. This diversification allows them to capitalize on opportunities across various economic cycles, from consumer spending trends to corporate investment patterns.

Relationship-Based Banking Model

First Commonwealth Bank’s relationship-based banking model fosters deep connections, especially with small to medium-sized businesses and affluent clients. This personalized approach cultivates loyalty and boosts customer retention, setting it apart from more impersonal national banks.

This strategy translates into tangible results. For instance, in the first quarter of 2024, First Commonwealth reported a net interest margin of 3.45%, indicating the profitability of its customer relationships. The bank’s emphasis on personalized service contributes to its strong standing in community banking, a segment often prioritizing trust and tailored solutions.

- Personalized Service: Focuses on individual client needs, building trust and long-term partnerships.

- Customer Loyalty: Drives higher retention rates compared to transactional banking models.

- Competitive Advantage: Differentiates First Commonwealth from larger, less personal financial institutions.

Experienced Management and Local Expertise

First Commonwealth Bank benefits from a management team boasting substantial experience in regional banking, coupled with an intimate understanding of the Pennsylvania and Ohio markets. This deep-seated local expertise is instrumental in making sound strategic choices, managing risks effectively, and quickly adapting to the nuances of local economic shifts. For instance, as of Q1 2024, the bank reported a return on average assets of 1.15%, reflecting efficient operations often driven by seasoned leadership.

This stable and knowledgeable leadership cadre is vital for successfully navigating intricate regulatory landscapes and dynamic market conditions. Their collective insights enable First Commonwealth Bank to maintain a competitive edge and foster strong community relationships, which are key differentiators in the banking sector.

The management's proficiency translates into tangible benefits, such as the bank's consistent growth in net interest income, which increased by 7.5% year-over-year through the end of 2023. This success underscores the value of their informed decision-making and localized strategic focus.

First Commonwealth Bank’s diversified service portfolio is a significant strength, allowing it to cater to a wide range of customer needs from retail banking to wealth management. This broad offering, as evidenced by its $23.5 billion in total assets in 2024, spreads revenue streams and enhances financial stability.

The bank's deep regional presence in Pennsylvania and Ohio fosters strong community ties and an understanding of local economic conditions, which is crucial for effective banking. This localized focus, reflected in its $22.1 billion in assets as of Q1 2024, builds trust and customer loyalty.

First Commonwealth Bank excels at serving a broad customer base, from individuals to large corporations, creating a resilient deposit and loan portfolio. This diversification, particularly in areas like small business lending, helps mitigate risks associated with economic downturns in specific sectors.

The bank's relationship-based banking model cultivates strong client partnerships, especially with small to medium-sized businesses and affluent individuals. This personalized approach, contributing to a net interest margin of 3.45% in Q1 2024, differentiates it from larger, less personal competitors.

Experienced management with deep regional knowledge guides First Commonwealth Bank, enabling strategic decision-making and effective risk management. This seasoned leadership contributed to a 7.5% year-over-year increase in net interest income by the end of 2023.

| Strength | Description | Supporting Data (as of Q1 2024, unless otherwise noted) |

|---|---|---|

| Diversified Services | Offers retail and commercial banking, wealth management, and insurance. | Total Assets: $22.1 billion (Q1 2024); $23.5 billion (2024) |

| Strong Regional Presence | Deep market penetration in Pennsylvania and Ohio. | Total Assets: $22.1 billion (Q1 2024) |

| Broad Customer Base | Serves individuals, small businesses, and large corporations. | Resilient deposit and loan portfolio. |

| Relationship Banking | Focuses on personalized service and building client loyalty. | Net Interest Margin: 3.45% (Q1 2024) |

| Experienced Management | Seasoned leadership with deep understanding of regional markets. | Net Interest Income growth: 7.5% YoY (end of 2023); Return on Average Assets: 1.15% (Q1 2024) |

What is included in the product

Delivers a strategic overview of First Commonwealth Bank’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear breakdown of First Commonwealth Bank's competitive landscape, highlighting areas for improvement and leveraging existing strengths to overcome market challenges.

Weaknesses

First Commonwealth Bank's operational focus is largely confined to Pennsylvania and Ohio. This geographic concentration means the bank is more exposed to the economic health and regulatory environment of just these two states, potentially missing out on growth avenues elsewhere. For instance, a downturn in the industrial sector of Pennsylvania could disproportionately impact the bank's performance.

This limited footprint can also make First Commonwealth Bank more vulnerable to regional economic shocks or specific state-level policy changes that might not affect a bank with a more diversified national presence. While expansion offers growth, it also presents significant capital investment requirements and execution risks.

First Commonwealth Bank operates in banking markets in Pennsylvania and Ohio that are exceptionally crowded. It faces rivalry not only from large national banks and other regional players but also from nimble community banks and disruptive fintech firms. This intense competition puts constant pressure on the bank's ability to achieve favorable loan yields and deposit rates, directly impacting its overall profitability and making customer acquisition and retention a significant challenge.

First Commonwealth Bank's core operations might still lean heavily on traditional branch-based banking and lending, potentially slowing its adaptation to evolving digital preferences. This reliance could mean higher operational costs compared to more digitally-native competitors, and a less appealing experience for customers who prioritize seamless online interactions.

Vulnerability to Interest Rate Fluctuations

As a bank, First Commonwealth Bank's earnings are directly tied to interest rate movements. When interest rates change, especially rapidly, it can squeeze the difference between what the bank earns on loans and pays on deposits, known as the net interest margin. This sensitivity means that shifts in the economic environment can significantly impact profitability.

For instance, a sudden spike in interest rates could increase funding costs faster than asset yields adjust, leading to a compressed margin. Conversely, prolonged periods of very low rates can also limit earning potential. In 2023, for example, many banks experienced margin compression due to the Federal Reserve's aggressive rate hikes which increased deposit costs. First Commonwealth Bank, like its peers, would have had to navigate these challenges through careful management.

- Net Interest Margin Sensitivity: The bank's profitability is directly linked to the spread between its lending and deposit rates.

- Impact of Rate Volatility: Rapid increases or decreases in interest rates can negatively affect earnings by compressing this margin.

- Hedging and Management Needs: Effective management of interest rate risk through financial instruments and asset-liability strategies is crucial.

Brand Recognition and Scale Compared to Larger Banks

First Commonwealth Bank's brand recognition might be less widespread than that of national banking behemoths, potentially limiting its appeal to customers outside its core service regions. This can also translate to a smaller scale for significant technology upgrades or broad marketing initiatives, making it tougher to attract top-tier talent or major corporate accounts that often gravitate towards larger, more established financial institutions.

The bank's more limited scale can present challenges in achieving the same economies of scale as its larger competitors, impacting cost efficiencies and investment capacity. For instance, while major banks might invest billions in digital transformation, regional banks often operate with more constrained budgets.

- Limited Brand Reach: First Commonwealth's brand recognition may not extend as far as national banks, impacting customer acquisition in new markets.

- Scale Disadvantage: Smaller asset size compared to national peers can limit the bank's ability to undertake massive technology investments or large-scale marketing campaigns.

- Talent and Client Acquisition: Perceived stability and broader reach of larger banks can make it harder to compete for top talent and significant corporate clients.

First Commonwealth Bank's geographic concentration in Pennsylvania and Ohio makes it susceptible to regional economic downturns and state-specific regulatory changes. This limited footprint also hinders its ability to capitalize on growth opportunities in other markets, while expansion carries significant investment and execution risks.

The bank faces intense competition in its operating markets from national banks, other regional players, community banks, and fintech companies. This crowded landscape pressures loan yields and deposit rates, impacting profitability and making customer acquisition and retention a constant challenge.

Reliance on traditional branch banking may slow adaptation to digital preferences, leading to higher operational costs and a less appealing experience for digitally-minded customers compared to fintech competitors.

What You See Is What You Get

First Commonwealth Bank SWOT Analysis

The preview you see is the same First Commonwealth Bank SWOT analysis document you'll receive upon purchase. This ensures you know exactly what you're getting – a comprehensive and professionally structured report. Unlock the full insights and actionable strategies by completing your purchase.

Opportunities

The regional banking landscape remains quite fragmented, offering First Commonwealth Bank a clear runway for expansion. This presents a significant opportunity to boost market share and extend its geographic reach through well-chosen mergers and acquisitions. For instance, in the first quarter of 2024, the banking sector saw several smaller institutions being acquired, highlighting this trend.

By acquiring smaller community banks, First Commonwealth can tap into new customer pools and achieve greater operational efficiency via economies of scale. This strategy also allows for a broader range of services to be offered. The bank's focus on careful due diligence in these potential acquisitions will be key to ensuring smooth integration and realizing the full benefits.

First Commonwealth Bank can seize opportunities by deepening its investment in digital banking platforms and mobile capabilities. Integrating with cutting-edge fintech solutions promises to significantly elevate both customer experience and operational efficiency. For instance, by adopting AI for customer service, banks saw a 20% reduction in query resolution times in 2024, and advanced analytics can refine risk assessment processes.

A strong digital strategy is crucial for attracting younger demographics, a key growth area. In 2024, digital-native customers accounted for 60% of new account openings for leading banks. Streamlining online account opening processes and enhancing mobile functionality are vital steps in this direction, improving overall service delivery and competitiveness in the evolving financial landscape.

First Commonwealth Bank's wealth management and insurance segments present substantial growth opportunities. With an aging demographic, there's a rising need for detailed financial planning and retirement solutions. In 2024, the U.S. wealth management market was valued at over $7 trillion, indicating a robust demand for these services.

Expanding these offerings via specialized advisors and tailored marketing can cultivate higher-margin revenue. These segments typically require less capital than traditional lending, making them an efficient way to deepen client relationships and increase profitability.

Targeting Underserved Niche Markets

First Commonwealth Bank can gain a competitive edge by identifying and serving specific niche markets within its operational areas. This could involve specialized commercial lending, such as focusing on sectors like healthcare, real estate, or agriculture, or offering customized financial solutions designed for particular demographic groups. By concentrating on these segments, the bank can cultivate specialized expertise and forge robust customer relationships, which can translate into increased profitability and enhanced customer loyalty.

This strategic focus on underserved niches can also serve to mitigate direct competition. For instance, as of Q1 2024, community banks like First Commonwealth are increasingly leveraging their local market knowledge to identify unmet needs. A 2023 FDIC report indicated that while larger banks dominate overall market share, smaller institutions often excel in specific local commercial lending categories.

- Specialized Commercial Lending: Targeting sectors like healthcare, where loan demand was robust in 2024, or agriculture, which saw increased investment in technology.

- Demographic Tailoring: Developing financial products for growing segments such as young professionals or small business owners in specific industries.

- Competitive Differentiation: Reducing direct competition from larger, more generalized financial institutions by building deep expertise in select areas.

- Relationship Building: Fostering loyalty through tailored services and local market understanding, a key differentiator for community banks.

Leveraging Data Analytics for Personalized Services

Leveraging data analytics offers First Commonwealth Bank a significant opportunity to deepen customer understanding. By analyzing behavioral patterns and financial needs, the bank can tailor product offerings and service delivery, fostering greater loyalty. For instance, insights from 2024 data could reveal that customers aged 30-45 are increasingly seeking digital-first mortgage solutions, allowing for targeted marketing and product development in this area.

This personalized approach is crucial for enhancing customer engagement and unlocking cross-selling potential. Imagine a scenario where data analytics identifies a customer segment that frequently uses the bank's mobile app for checking balances and recently viewed investment products; this presents a prime opportunity for personalized nudges towards wealth management services. Such targeted interventions can significantly boost campaign effectiveness and customer satisfaction.

Furthermore, data-driven decision-making extends to optimizing risk management and operational efficiency. By analyzing transaction data and credit behaviors, First Commonwealth Bank can refine its underwriting processes, potentially reducing loan defaults by a projected percentage in 2025. This analytical rigor also allows for the streamlining of internal operations, leading to cost savings and a more agile business model.

- Personalized Product Development: Tailoring offerings based on granular customer data, such as customized loan rates or investment portfolios.

- Enhanced Customer Engagement: Proactive outreach and relevant service suggestions based on predictive analytics of customer needs.

- Optimized Marketing Campaigns: Increased ROI through highly targeted marketing efforts, reducing wasted spend on irrelevant customer segments.

- Improved Risk Mitigation: More accurate credit scoring and fraud detection through advanced analytical models.

First Commonwealth Bank can capitalize on the fragmented regional banking sector through strategic mergers and acquisitions, aiming to increase market share and geographic presence. The bank can also enhance its digital banking platforms and mobile capabilities, integrating fintech solutions to improve customer experience and efficiency, especially for younger demographics who increasingly favor digital channels. Furthermore, expanding its wealth management and insurance services, driven by an aging population's need for financial planning, offers a path to higher-margin revenue and deeper client relationships. Lastly, identifying and serving niche markets, such as specialized commercial lending or tailored demographic financial solutions, can reduce competition and build strong customer loyalty.

Threats

Economic downturns, particularly those impacting Pennsylvania and Ohio, present a significant threat to First Commonwealth Bank. A recession could trigger a rise in loan defaults and non-performing assets, directly affecting the bank's financial health. For instance, during the 2008 financial crisis, many banks saw substantial increases in their non-performing loan ratios, a risk First Commonwealth must manage.

The banking sector, including First Commonwealth Bank, faces a growing wave of regulations covering capital adequacy, consumer safeguards, and anti-money laundering efforts. These evolving rules necessitate significant investment in compliance infrastructure and personnel, potentially impacting operational agility and profitability. For instance, the Federal Reserve's stress tests, which became more rigorous following the 2008 financial crisis, require banks to hold substantial capital reserves, directly affecting lending capacity.

First Commonwealth Bank, like all financial institutions, faces significant threats from increasingly sophisticated cyberattacks and data breaches. Handling sensitive customer information and substantial financial transactions makes it a prime target. A successful breach could result in substantial financial penalties, severe damage to its reputation, and a critical loss of customer confidence.

The financial sector saw a 20% increase in cyberattacks in 2024 compared to the previous year, with ransomware attacks being particularly prevalent. For instance, in Q1 2025, the banking industry reported an average of $4.7 million in losses per incident due to data breaches. This underscores the critical need for First Commonwealth Bank to maintain and continuously enhance its cybersecurity infrastructure to protect its assets and customer data.

Disruptive Innovation from Fintech Companies

Fintech companies are increasingly offering specialized, digital-first financial services that can be more convenient and cost-effective than traditional banking. This trend, evident in areas like online lending and payment apps, directly challenges established players like First Commonwealth Bank. For instance, the global fintech market was valued at over $2.4 trillion in 2023 and is projected to grow significantly, indicating a substantial competitive landscape.

These agile fintechs often operate with lower overheads, allowing them to undercut traditional banks on pricing for specific services. This can lead to a gradual erosion of market share in profitable niches, forcing incumbent institutions to accelerate their own digital transformation and technology investments to maintain relevance and competitiveness. For example, the rise of buy now, pay later services, often provided by fintechs, has already impacted traditional credit card revenues.

- Digital-Only Services: Fintechs excel in offering streamlined, user-friendly digital platforms for services like payments, lending, and wealth management.

- Cost Advantage: Lower operational costs for fintechs often translate into more competitive pricing for consumers and businesses.

- Market Share Erosion: Specialized fintech offerings can capture specific customer segments, reducing traditional banks' overall market penetration.

- Investment Pressure: Banks must invest heavily in technology to match or exceed the digital capabilities and customer experience provided by fintech competitors.

Talent Acquisition and Retention Challenges

First Commonwealth Bank, like many regional financial institutions, faces significant hurdles in acquiring and keeping top-tier talent, especially in high-demand fields. The banking industry, increasingly reliant on technology and data, sees fierce competition for professionals skilled in areas such as cybersecurity, AI, and digital transformation. For instance, in 2024, the U.S. Bureau of Labor Statistics reported a 3.5% unemployment rate for computer and mathematical occupations, underscoring the scarcity of qualified candidates. This competition extends beyond traditional banks, with fintech firms and major tech companies actively recruiting from the same talent pools, often offering more competitive compensation and cutting-edge work environments.

The challenge is amplified for regional banks like First Commonwealth when vying against larger national banks and tech giants that possess greater resources for recruitment and retention. This can lead to a gap in specialized expertise, potentially hindering innovation and the ability to offer advanced digital services. A 2025 industry survey indicated that over 60% of financial institutions cited talent shortages as a primary barrier to adopting new technologies. Consequently, a deficit in skilled labor can directly impact service quality, operational efficiency, and the bank's capacity to adapt to evolving market demands.

The impact of these talent acquisition and retention challenges can be far-reaching for First Commonwealth Bank. A shortage of experienced professionals in critical areas like data analytics could slow down the development of personalized customer offerings or the implementation of more efficient risk management strategies. Furthermore, high employee turnover, a common consequence of intense competition, can disrupt team cohesion, increase training costs, and negatively affect institutional knowledge. By mid-2025, reports suggest that the average cost to replace an employee in the financial services sector could exceed 1.5 times their annual salary, highlighting the financial strain of this issue.

Key areas of concern for First Commonwealth Bank include:

- Competition for Tech Talent: Intense rivalry from fintechs and large tech firms for specialists in AI, data science, and cloud computing.

- Retention of Experienced Staff: Difficulty in retaining seasoned professionals, particularly those in wealth management and commercial lending, who are sought after by competitors.

- Impact on Innovation: A potential slowdown in developing new digital products and services due to a lack of specialized IT and data analytics expertise.

- Operational Efficiency: Challenges in maintaining optimal operational performance and customer service levels when critical roles remain unfilled or are filled by less experienced staff.

Intensifying competition from agile fintech companies poses a significant threat to First Commonwealth Bank. These digital-first entities often offer specialized, cost-effective services that challenge traditional banking models, potentially eroding market share in lucrative niches. For instance, the global fintech market's projected growth, valued at over $2.4 trillion in 2023, highlights the scale of this competitive landscape and the pressure on incumbent institutions to innovate.

The banking sector is also subject to a dynamic and increasingly stringent regulatory environment. Evolving rules concerning capital adequacy, consumer protection, and anti-money laundering demand substantial investments in compliance infrastructure, which can impact operational flexibility and profitability. For example, stricter capital reserve requirements, a consequence of post-2008 financial reforms, directly influence a bank's lending capacity.

Cybersecurity threats represent a critical vulnerability for First Commonwealth Bank, given its handling of sensitive financial data. The banking industry experienced a notable 20% rise in cyberattacks in 2024, with ransomware being a primary concern. In Q1 2025, data breaches in the sector resulted in average losses of $4.7 million per incident, underscoring the imperative for robust cybersecurity measures.

Talent acquisition and retention, particularly for specialized roles in technology and data analytics, present a considerable challenge. Fierce competition from fintechs and major tech firms for skilled professionals, evidenced by a low unemployment rate in computer-related fields in 2024, can hinder innovation and service delivery. Reports from mid-2025 suggest the cost to replace an employee in financial services can exceed 1.5 times their annual salary, emphasizing the financial impact of talent shortages.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of comprehensive data, including First Commonwealth Bank's official financial statements, detailed market research reports, and expert industry analyses, ensuring a robust and informed strategic perspective.