First Commonwealth Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Commonwealth Bank Bundle

First Commonwealth Bank navigates a competitive landscape shaped by moderate buyer power and a significant threat from new entrants. Understanding the intensity of rivalry and the influence of suppliers is crucial for their strategic positioning.

The complete report reveals the real forces shaping First Commonwealth Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

First Commonwealth Bank's reliance on a vast and diverse base of individual and institutional depositors significantly dilutes the bargaining power of any single supplier of capital. This broad sourcing of funds, primarily through deposits, means that the bank is not overly dependent on any specific financial institution or large depositor for its operational capital.

The fragmented nature of First Commonwealth Bank's depositor base in 2024 means that individual depositors, while crucial in aggregate, lack the concentrated power to dictate terms. For instance, while the bank held approximately $20.7 billion in total deposits as of Q1 2024, the sheer volume of individual accounts prevents any single entity from exerting substantial leverage on interest rates or other banking services.

First Commonwealth Bank, like many financial institutions, depends significantly on technology and software providers for its core operations. This includes everything from the systems that run its digital banking platforms to the cybersecurity solutions that protect customer data. These specialized tech suppliers can wield considerable bargaining power, particularly when offering proprietary or niche financial technologies, directly influencing the bank's operational expenses and its ability to innovate.

The increasing reliance on fintech is a major driver of supplier power. Banks are boosting their technology budgets, with many expecting these investments to grow by 10% to 20% over the next three years. This trend underscores the growing importance of these technology partners and suggests their leverage in negotiations will likely remain substantial.

Skilled employees, especially in tech, wealth management, and commercial lending, are vital suppliers for First Commonwealth Bank. A scarcity of talent in these specialized financial areas amplifies their bargaining power, driving up compensation demands and complicating hiring efforts.

The intense competition for tech talent, for instance, directly fuels increased salary expenses for banks. In 2024, the average salary for a software engineer in the financial services sector saw a notable increase, reflecting this demand. This trend puts pressure on First Commonwealth Bank to offer competitive packages to attract and retain essential personnel.

Regulatory Bodies as Influential 'Suppliers' of Operating Licenses

Regulatory bodies, like the Federal Reserve and FDIC, act as critical suppliers by granting operating licenses and establishing the rules of engagement for banks. Their influence is substantial, as changes in regulations directly affect a bank's operational costs and strategic choices. For instance, evolving capital requirements or data privacy mandates can necessitate significant investments in technology and compliance personnel, thereby increasing overhead.

The bargaining power of these regulatory 'suppliers' is inherently high due to their monopolistic control over essential operational permissions. First Commonwealth Bank, like its peers, must adhere to these mandates, which can lead to increased compliance costs. In 2023, for example, the financial services industry saw continued investment in regulatory technology (RegTech) to manage these growing burdens.

- Increased Compliance Burden: Financial institutions are facing escalating costs associated with meeting diverse regulatory requirements.

- Impact on Operational Costs: New or revised regulations often mandate system upgrades or process changes, directly raising operating expenses.

- Strategic Constraints: Regulatory frameworks can limit a bank's flexibility in product development, market expansion, and risk-taking.

- Cybersecurity Mandates: Growing regulatory focus on cybersecurity necessitates substantial spending on protective measures and incident response capabilities.

Data and Information Providers

Data and Information Providers hold a degree of bargaining power over First Commonwealth Bank. Access to reliable and timely financial data, market insights, and credit information is absolutely crucial for the bank's effective decision-making and robust risk management. Without this data, operations would be severely hampered.

Key data providers, such as major credit bureaus and financial market data services, can leverage their position. Their offerings are critical inputs for First Commonwealth Bank, meaning these providers can exert some influence over pricing and terms. For instance, a significant portion of a bank's operational costs can be tied to data subscriptions and access fees.

- Critical Data Dependency: Banks rely heavily on external data for loan underwriting, investment analysis, and regulatory compliance.

- Concentration of Providers: In some data segments, a limited number of large providers dominate the market, increasing their bargaining power.

- Cost of Data Services: In 2024, financial data services represent a substantial and often growing operational expense for financial institutions.

First Commonwealth Bank's bargaining power with suppliers is influenced by several factors, including its reliance on technology providers and skilled labor. The bank's dependence on specialized fintech solutions, for example, can give these suppliers leverage, especially as banks increase their technology investments. In 2024, the financial services sector is seeing significant growth in tech budgets, with many institutions expecting a 10% to 20% increase in technology spending over the next three years.

Skilled employees, particularly in areas like wealth management and commercial lending, also represent a significant supplier group. The competition for talent in these specialized financial fields is intense, driving up compensation demands and making it harder for banks to attract and retain key personnel. For instance, the average salary for a software engineer in financial services saw a notable increase in 2024, reflecting this high demand.

Regulatory bodies, such as the Federal Reserve and FDIC, act as critical suppliers by providing operating licenses and setting the rules for the banking industry. Their influence is substantial, as changes in regulations can directly impact a bank's operational costs and strategic decisions. For example, evolving capital requirements or data privacy mandates often necessitate significant investments in technology and compliance personnel, thereby increasing overhead.

Data and information providers also hold a degree of bargaining power. Reliable financial data and market insights are crucial for First Commonwealth Bank's decision-making and risk management. Key data providers, like credit bureaus and financial market data services, can leverage their essential offerings to influence pricing and terms, with data services representing a substantial operational expense for financial institutions in 2024.

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to First Commonwealth Bank's regional banking environment.

Gain immediate clarity on competitive pressures with a visual representation of each force, simplifying complex strategic challenges.

Easily adapt the analysis to changing market dynamics by adjusting inputs, ensuring your strategy remains relevant and effective.

Customers Bargaining Power

First Commonwealth Bank operates with a wide-ranging retail customer base spread across Pennsylvania and Ohio. For everyday banking needs such as checking and savings accounts, the individual customer typically holds minimal bargaining power. This is largely because these services are seen as commodities, and there are many other banks and financial institutions offering similar products.

The digital revolution has significantly amplified customer power in banking. With the proliferation of online banking and innovative fintech apps, customers now have unprecedented access to information and a wider array of service providers. This ease of comparison and switching puts pressure on institutions like First Commonwealth Bank to continually improve their offerings and customer experience.

This heightened customer agency necessitates a strong focus on digital engagement and service quality. First Commonwealth Bank, recognizing this trend, has invested in its digital platforms and customer service initiatives. In 2024, the bank reported record highs in customer satisfaction and net promoter scores, underscoring its success in adapting to these evolving customer expectations.

First Commonwealth Bank's commercial and institutional clients wield significant bargaining power, particularly those with substantial transaction volumes or specialized financial needs. These larger clients can leverage their business scale to negotiate more favorable terms on loans, deposit rates, and fees. In 2023, commercial and industrial loans represented a significant portion of First Commonwealth Bank's loan portfolio, indicating a substantial base of clients with this leverage.

Interest Rate Environment and Customer Sensitivity

In a dynamic interest rate landscape, customers, especially those with substantial deposits or loan needs, exhibit heightened rate sensitivity. This increased sensitivity translates into greater bargaining power as they actively pursue the most advantageous terms, potentially squeezing the bank's net interest margin.

Even with anticipated interest rate declines, bank deposit costs are projected to stay high. For instance, in 2024, the Federal Reserve maintained interest rates at a higher level for a significant portion of the year, leading many customers to seek out higher-yield deposit accounts, thereby increasing competition for deposits.

- Customer Rate Sensitivity: Customers are more likely to switch banks or renegotiate terms when interest rates fluctuate significantly.

- Deposit Cost Pressure: Despite potential rate cuts, banks anticipate continued elevated costs for attracting and retaining customer deposits throughout 2024 and into 2025.

- Impact on Net Interest Margin: Increased competition for deposits and customer demands for higher rates directly affect a bank's profitability by narrowing the spread between lending income and borrowing costs.

Importance of Relationship Banking for Customer Retention

While customers today have a wider array of banking options, the enduring value of established relationships, tailored service, and a tangible local presence can significantly decrease their inclination to switch providers. This is particularly relevant in the banking sector where trust and familiarity play a crucial role.

First Commonwealth Bank's strategic emphasis on a community banking model, designed to foster deeper trust and more robust connections with its clientele, serves as a powerful countermeasure against the bargaining power of customers. By prioritizing these relationships, the bank aims to enhance loyalty and reduce churn.

In 2024, the banking industry continued to see a trend where personalized customer service directly impacts retention. For instance, studies indicated that banks with strong relationship management programs reported higher customer lifetime values. First Commonwealth Bank's approach, focusing on local branches and dedicated bankers, directly addresses this trend.

- Relationship Value: Customers often prioritize personalized service and trust over solely transactional benefits, making established relationships a retention driver.

- Community Focus: First Commonwealth Bank's local presence and community engagement build loyalty, reducing the ease with which customers can switch.

- Service Differentiation: In a competitive market, superior customer service and tailored financial advice offered by relationship managers can be a key differentiator, mitigating price sensitivity.

The bargaining power of customers for First Commonwealth Bank is multifaceted, influenced by the commoditization of basic banking services and the ease of digital switching, which empowers individual customers. However, the bank mitigates this by fostering strong, personalized relationships and emphasizing its community presence. Larger commercial clients, on the other hand, possess significant leverage due to their transaction volumes, enabling them to negotiate better terms, a factor highlighted by their substantial contribution to the bank's loan portfolio in 2023.

| Factor | Impact on First Commonwealth Bank | 2024 Data/Trend |

|---|---|---|

| Individual Customer Power | Low for commodity services, high for digital access/switching | Record highs in customer satisfaction and NPS scores indicate successful adaptation to digital expectations. |

| Commercial Client Power | High due to transaction volume and specialized needs | Commercial and industrial loans formed a significant part of the loan portfolio in 2023. |

| Rate Sensitivity | Increased power for rate-conscious customers | Elevated deposit costs persisted in 2024 due to higher Federal Reserve rates, driving customer pursuit of higher yields. |

| Relationship & Trust | Mitigates switching inclination | Studies in 2024 showed strong correlation between relationship management and higher customer lifetime values. |

What You See Is What You Get

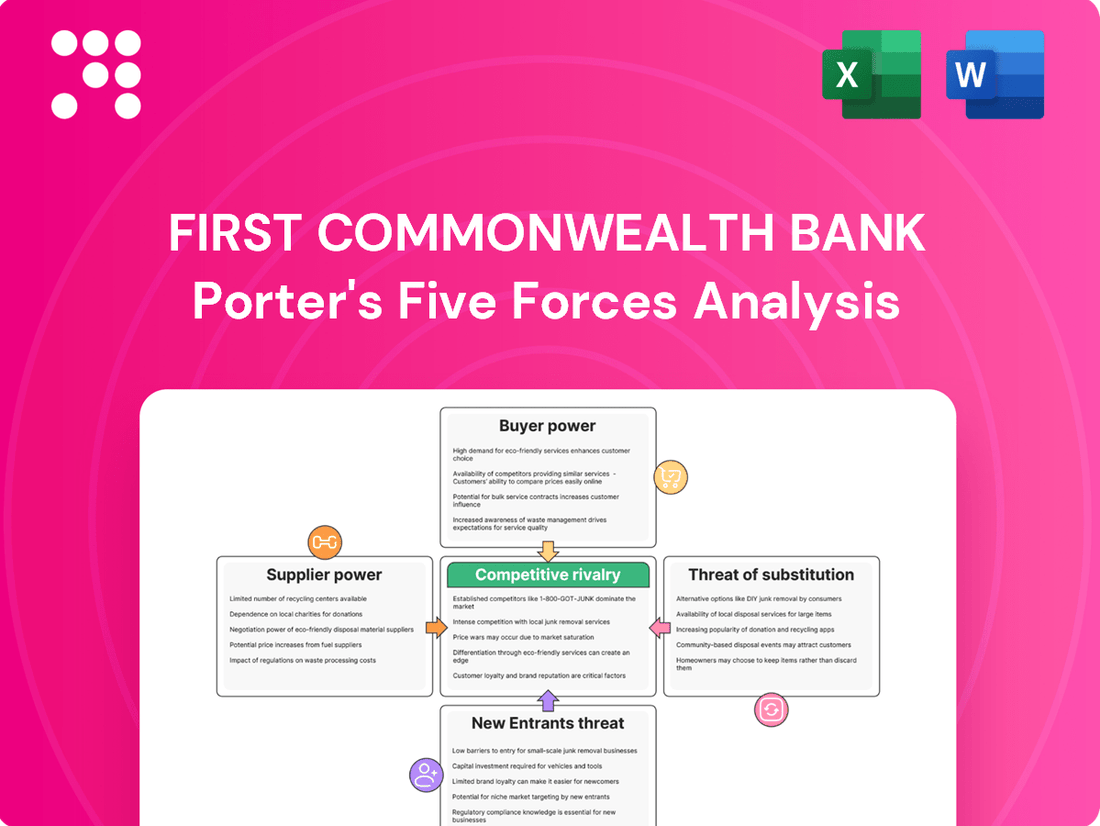

First Commonwealth Bank Porter's Five Forces Analysis

This preview shows the exact First Commonwealth Bank Porter's Five Forces analysis you'll receive immediately after purchase, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. You'll gain a comprehensive understanding of the bank's competitive landscape and strategic positioning without any surprises or placeholders.

Rivalry Among Competitors

First Commonwealth Bank faces fierce competition across its Pennsylvania and Ohio markets. The landscape is crowded with large national banks, numerous regional players, and many community banks and credit unions, all vying for customer business. This intense rivalry means constant pressure on pricing and service offerings.

The bank operates 124 community banking offices spread across 30 counties in Western and Central Pennsylvania and Ohio. This significant physical presence underscores the localized nature of much of the competition, where community banks often have deep roots and strong customer relationships.

In 2024, the banking sector continued to see consolidation, but the regional and community bank segment remained highly fragmented. For instance, in Pennsylvania, there are hundreds of financial institutions, and Ohio also boasts a substantial number of banks and credit unions. This sheer volume of competitors intensifies the fight for market share in deposits and loans.

Price-based competition is a significant factor for First Commonwealth Bank, especially in areas like mortgages and basic deposit accounts where services are largely similar. Banks frequently engage in offering attractive interest rates on savings or lower rates on loans to win and keep customers, which can unfortunately narrow their profit margins.

In 2024, the banking sector has seen regional banks leverage the persistent higher interest rate environment. This has allowed institutions like First Commonwealth Bank to improve their financial standing by adjusting their balance sheets, potentially offering more competitive pricing strategies as a result of improved profitability.

Beyond just interest rates, banks are increasingly vying for customers through superior service, a wider array of financial products, and advanced digital capabilities. This intense competition means that investment in technology and digital innovation is not just beneficial, but essential for staying ahead.

First Commonwealth Bank recognizes this, evidenced by their mortgage team's recognition for outstanding customer satisfaction. In 2023, for instance, customer satisfaction scores in the banking sector generally remained high, with many institutions reporting improvements in digital engagement metrics, a trend First Commonwealth Bank is actively participating in.

Mergers and Acquisitions Activity

Mergers and acquisitions are a constant in the banking world, especially for regional players like First Commonwealth Bank. These deals are driven by the desire for greater scale, broader market reach, and cost savings. For instance, in May 2025, First Commonwealth Financial Corporation finalized its acquisition of CenterGroup Financial, Inc., demonstrating this trend.

This consolidation can significantly heat up competition. When banks combine, they often become larger and more powerful entities, forcing existing competitors to adapt or risk falling behind. This ongoing M&A activity means the competitive landscape is always shifting.

- Increased Scale: Acquisitions allow banks to grow their asset base and customer reach.

- Market Share Expansion: Mergers can immediately boost a bank's presence in key geographic areas.

- Efficiency Gains: Combining operations can lead to reduced overhead and improved profitability.

- Intensified Rivalry: Larger, consolidated banks can exert greater competitive pressure on smaller institutions.

Regulatory Environment and Compliance Burden

The financial sector faces a demanding regulatory climate, with compliance costs acting as a significant hurdle, particularly for smaller institutions. This environment, while potentially limiting new entrants, also imposes ongoing operational expenses and strategic considerations for established banks like First Commonwealth. For instance, the anticipated implementation of new capital and liquidity requirements in 2025 is projected to directly influence the cost structures of all players in the market.

The increasing complexity of financial regulations, such as those stemming from the Dodd-Frank Act and subsequent amendments, necessitates substantial investment in compliance technology and personnel. For example, a 2024 survey indicated that U.S. banks spent an average of $100 million annually on regulatory compliance, a figure expected to rise with new mandates. This ongoing financial commitment can strain resources, impacting profitability and competitive positioning.

- Increased Compliance Costs: Banks must allocate significant resources to meet evolving regulatory demands, impacting operational budgets.

- Barrier to Entry: The high cost of regulatory adherence can deter new competitors from entering the banking market.

- Strategic Challenge: Existing banks must continuously adapt their strategies and systems to remain compliant, a dynamic and ongoing process.

- 2025 Regulatory Impact: Upcoming changes in capital and liquidity rules are expected to necessitate further adjustments to cost structures and business models.

Competitive rivalry is a defining characteristic for First Commonwealth Bank, operating in a market saturated with national, regional, and community banks, as well as credit unions. This intense competition forces the bank to constantly innovate in pricing, service, and digital offerings to attract and retain customers. The fragmented nature of the market, particularly in its core Pennsylvania and Ohio regions, means that even small community banks can exert significant competitive pressure through strong local relationships.

The ongoing trend of consolidation within the banking sector, as seen with First Commonwealth's acquisition of CenterGroup Financial in May 2025, further intensifies this rivalry. Larger, merged entities often possess greater scale and market reach, compelling other players to adapt their strategies. Price competition remains a key battleground, especially for core products like mortgages and deposits, where banks frequently adjust interest rates to gain an edge.

In 2024, the banking industry navigated a high-interest-rate environment, which allowed institutions like First Commonwealth to improve profitability, potentially enabling more aggressive pricing strategies. However, competition extends beyond price, encompassing the quality of customer service and the sophistication of digital platforms. Banks are investing heavily in technology to meet evolving customer expectations, making digital capabilities a critical differentiator.

The regulatory environment also plays a role, with compliance costs acting as a barrier to entry and an ongoing expense for existing players. For example, new capital and liquidity requirements anticipated for 2025 will necessitate further strategic adjustments and financial commitments across the industry. This complex interplay of market saturation, consolidation, price sensitivity, digital innovation, and regulatory demands underscores the high level of competitive rivalry First Commonwealth Bank faces.

SSubstitutes Threaten

Fintech companies are increasingly offering specialized services like peer-to-peer lending and mobile payments, directly competing with traditional bank offerings. These digital alternatives provide convenience and often lower fees, attracting customers seeking modern financial solutions. Projections indicate fintech revenue growth will significantly outpace traditional banking, nearly tripling between 2022 and 2028, highlighting the growing threat of substitution.

Credit unions present a significant threat of substitution, leveraging their member-focused approach and often lower fee structures to attract customers away from traditional banks like First Commonwealth. For instance, in 2023, credit unions saw substantial growth, with total assets reaching over $2.2 trillion in the US, indicating their increasing competitiveness.

Non-bank lenders and burgeoning online platforms further intensify this threat, offering specialized and often faster loan origination, particularly in the mortgage and personal loan sectors. These entities bypass the established infrastructure of traditional banks, providing a streamlined alternative for borrowers seeking quick access to capital.

The broader banking landscape is also marked by increased merger and acquisition (M&A) activity among regional banks. This trend, as seen with numerous deals throughout 2023 and into early 2024, aims to consolidate market share and achieve greater economies of scale, enabling these larger entities to compete more effectively with national players and, by extension, with the offerings of credit unions and non-bank lenders.

For First Commonwealth Bank's wealth management and investment services, direct substitutes exist in the form of brokerage firms, independent financial advisors, and online investment platforms. These alternatives can offer specialized expertise and a wider array of investment choices, potentially drawing customers away from traditional banking channels.

These substitute providers often compete on fees, customization, and user experience. For instance, many robo-advisors offer low-cost portfolio management, while independent advisors can provide highly personalized financial planning. This competitive landscape puts pressure on banks to innovate and differentiate their wealth management offerings.

Despite the competitive pressures, wealth management and investment revenues can be a significant revenue stream for banks. In 2024, many financial institutions reported robust growth in their wealth management divisions, driven by market performance and increased client engagement. For example, some larger banks saw wealth management fees contribute a substantial portion of their overall non-interest income.

Direct Corporate Financing and Capital Markets

Large corporations increasingly tap into capital markets, sidestepping traditional bank lending. In 2024, the U.S. corporate bond market saw significant issuance, with companies raising hundreds of billions directly from investors. This trend offers an alternative to commercial bank loans, posing a direct substitute threat to First Commonwealth Bank's corporate financing services.

Private equity and venture capital also provide substantial funding avenues. These non-bank financing channels can offer more flexible terms and faster access to capital than conventional bank loans. For instance, global private equity deal value remained robust in early 2024, demonstrating the continued appeal of these substitute financing methods.

- Direct access to capital markets: Large firms can issue corporate bonds, bypassing banks.

- Private equity and venture capital: These offer alternative funding sources with potentially different structures.

- Reduced reliance on banks: Companies seeking capital may find these substitutes more attractive for speed or terms.

- Threat to corporate lending: These alternatives directly compete with First Commonwealth Bank's core business.

Emerging Technologies (e.g., Blockchain, AI)

New technologies like blockchain and artificial intelligence present a significant threat of substitutes for First Commonwealth Bank. These innovations are fostering entirely new ways to manage and transact finances, potentially bypassing traditional banking channels. For instance, decentralized finance (DeFi) platforms built on blockchain offer lending and borrowing services without intermediaries, directly challenging core banking functions.

The rapid advancement of AI is particularly concerning. By 2025, AI is projected to be a key driver in how financial products are created and priced. This means AI-powered fintech companies could offer highly personalized and competitively priced services that are difficult for established banks to match. Imagine AI algorithms that can assess credit risk more efficiently or offer tailored investment advice, directly competing with services currently provided by First Commonwealth Bank.

While First Commonwealth Bank is investing in these technologies, the pace of change means that entirely new substitute offerings could emerge unexpectedly. Consider the potential for AI-driven robo-advisors to handle wealth management, or blockchain-based payment systems to facilitate cross-border transactions more cheaply than traditional wire transfers. These emerging solutions represent a tangible threat that could erode market share if not proactively addressed.

- Blockchain's impact: Enabling peer-to-peer lending and payment systems, offering alternatives to traditional bank loans and transfer services.

- AI's role in 2025: Expected to revolutionize product development and pricing, leading to highly competitive and personalized financial offerings.

- Fintech disruption: New entrants leveraging AI and blockchain can offer specialized services, directly challenging established banking models.

- Pace of innovation: The rapid evolution of these technologies creates a risk of unforeseen substitutes that could rapidly gain market traction.

The threat of substitutes for First Commonwealth Bank is multifaceted, encompassing fintech innovations, credit unions, non-bank lenders, and direct access to capital markets. These alternatives often provide greater convenience, lower costs, or specialized services that can draw customers away from traditional banking.

Fintech companies, in particular, are rapidly expanding their reach, with projections indicating their revenue will nearly triple between 2022 and 2028, significantly outpacing traditional banking growth. This rapid expansion highlights the increasing challenge these digital alternatives pose.

| Substitute Type | Key Offerings | Competitive Advantage | Market Trend (2023-2024) |

| Fintech Companies | P2P lending, mobile payments, digital wallets | Convenience, lower fees, user experience | Rapid revenue growth, increasing market share |

| Credit Unions | Member-focused services, lower fees | Community ties, personalized service | Growing asset base (over $2.2 trillion in US assets in 2023) |

| Non-Bank Lenders | Specialized loans (mortgages, personal) | Speed, streamlined processes | Increased competition in loan origination |

| Capital Markets | Corporate bonds, private equity | Direct access to funding, flexible terms | Significant corporate bond issuance in 2024 |

Entrants Threaten

The banking sector faces formidable regulatory hurdles, demanding substantial capital reserves, specialized licenses, and robust compliance systems, all of which significantly deter new players from entering the market.

These stringent requirements create a high barrier to entry, making it difficult and costly for aspiring banks to establish themselves and compete effectively.

Looking ahead to 2025, anticipated regulatory shifts, such as revised Community Reinvestment Act (CRA) thresholds and updated FDIC signage regulations, are expected to further shape the competitive landscape and potentially increase these entry barriers.

Launching a new bank demands significant upfront capital for everything from physical branches and robust IT systems to regulatory compliance and initial marketing efforts. For instance, a new entrant would need to match the approximately $6 billion in assets and 124 offices that First Commonwealth Bank currently operates to even begin to compete on scale.

New banks face a significant hurdle in establishing brand recognition and customer trust, areas where established institutions like First Commonwealth Bank have a distinct advantage. Building this level of loyalty takes considerable time and investment, often years or even decades. First Commonwealth Bank, with its roots tracing back to 1982 through various mergers and acquisitions, has cultivated a deep-seated presence and reputation within its operating regions.

Technological Investment and Expertise

New entrants into the banking sector face substantial hurdles due to the immense technological investment and specialized expertise required. To compete, they must deploy cutting-edge digital platforms and robust cybersecurity measures, a significant financial undertaking. For instance, in 2024, the global banking sector's investment in fintech solutions continued to climb, with many institutions allocating billions to digital transformation initiatives. This high cost of entry, coupled with the need for specialized talent in areas like AI and blockchain, deters many potential new players.

- High Capital Outlay: Startups need substantial capital for advanced technology and cybersecurity.

- Talent Acquisition: Access to specialized technical expertise is crucial and often scarce.

- Industry Investment Trends: Banks are heavily investing in fintech, signaling high entry costs.

- Customer Expectations: Meeting sophisticated digital service demands requires significant technological infrastructure.

Niche Market Entry by Fintechs

Fintechs are increasingly entering the financial services landscape by focusing on specific niches, often starting with less regulated, single-product offerings. This allows them to bypass some of the high entry barriers faced by traditional, full-service banks. For instance, companies specializing in peer-to-peer lending or digital wallets can gain traction without immediately confronting the extensive compliance requirements of deposit-taking institutions.

However, this niche entry strategy can evolve. As these fintechs mature and expand their service portfolios, they inevitably encounter greater regulatory oversight and find themselves in direct competition with established players like First Commonwealth Bank. This escalating competition is a significant threat, as successful fintechs can chip away at market share in profitable segments.

The fintech sector demonstrated resilience and continued investment activity, with a slight uptick in investment observed in the fourth quarter of 2024. This suggests that despite potential regulatory headwinds, innovation and new market entrants remain a persistent concern for incumbent banks.

- Niche Specialization: Fintechs often target underserved or specific customer segments with specialized products, reducing initial regulatory hurdles.

- Evolving Competition: As fintechs grow and diversify, they move from niche players to direct competitors, increasing the threat to established banks.

- 2024 Investment Trends: A slight increase in fintech investment in Q4 2024 indicates ongoing new entrant activity and innovation in the financial sector.

The threat of new entrants for First Commonwealth Bank remains moderate due to significant regulatory capital requirements and the need for extensive licensing, which act as substantial deterrents.

Established brand loyalty and the high cost of replicating First Commonwealth Bank's infrastructure, including its 124 offices and approximately $6 billion in assets, present further barriers.

While fintechs can enter niche markets with lower initial barriers, their expansion into broader banking services inevitably brings them into direct competition, intensifying the threat.

Anticipated regulatory changes in 2025, such as updated CRA thresholds, are likely to maintain or even elevate these entry barriers.

| Barrier Type | Description | Impact on New Entrants | First Commonwealth Bank's Position |

| Regulatory Capital & Licensing | High upfront capital, licenses, and compliance systems required. | Significant deterrent. | Established compliance infrastructure. |

| Brand Recognition & Trust | Building customer loyalty takes years. | Challenging for new entrants. | Deep-seated presence since 1982. |

| Technological Investment | Costly deployment of advanced digital platforms and cybersecurity. | High barrier, requires specialized talent. | Ongoing investment in fintech solutions. |

| Economies of Scale | Matching existing asset size and branch network is costly. | Difficult to compete on operational efficiency. | Operates 124 offices with ~$6 billion in assets. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for First Commonwealth Bank leverages data from their annual reports, investor relations website, and SEC filings. We also incorporate industry-specific research from financial news outlets and banking sector analysis firms to provide a comprehensive view of the competitive landscape.