First Commonwealth Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Commonwealth Bank Bundle

Discover the strategic core of First Commonwealth Bank's operations with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key resources, offering invaluable insights for anyone studying successful financial institutions.

Unlock the full strategic blueprint behind First Commonwealth Bank's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

First Commonwealth Bank actively partners with a network of financial institutions and correspondent banks. These collaborations are vital for executing a wide range of banking services, such as processing payments, managing treasury operations, and facilitating interbank lending. For instance, in 2023, correspondent banking relationships enabled First Commonwealth to process billions in transactions, significantly expanding their service capabilities beyond their physical branches.

First Commonwealth Bank actively collaborates with technology and fintech providers to bolster its digital banking infrastructure, fortify cybersecurity defenses, and introduce novel financial products. This strategic alignment allows the bank to deliver advanced services, streamline operations, and cater to the growing digital demands of its clientele. For instance, in 2024, First Commonwealth continued to invest in cloud-based solutions and AI-driven customer service tools, a trend mirrored across the industry as banks aim to enhance user experience and operational agility.

First Commonwealth Bank actively collaborates with community development organizations, notably the Federal Home Loan Bank of Pittsburgh. These partnerships are crucial for funding vital initiatives like affordable housing projects and programs designed to assist first-time homebuyers. For instance, in 2024, First Commonwealth Bank helped facilitate over $100 million in mortgage originations through various community-focused lending programs.

Insurance Carriers and Underwriters

First Commonwealth Bank, through its subsidiary First Commonwealth Insurance Agency, cultivates vital partnerships with numerous insurance carriers and underwriters. These collaborations are fundamental to offering a broad spectrum of insurance products, from life and health to property and casualty, to both individual and business clients.

These relationships allow First Commonwealth to act as a broker, accessing diverse underwriting capabilities and policy options. This is crucial for meeting the varied needs of their customer base and ensuring competitive pricing and coverage. For example, in 2024, the insurance industry saw continued consolidation and a focus on digital integration, making strong carrier relationships even more critical for efficient service delivery.

The bank benefits from these partnerships by diversifying its revenue streams beyond traditional banking services. This strategic alignment enhances customer loyalty by providing a one-stop shop for financial and insurance needs. In 2023, net premiums written by independent insurance agencies, a segment First Commonwealth Insurance Agency operates within, showed steady growth, underscoring the value of these carrier relationships.

Key aspects of these partnerships include:

- Access to Diverse Products: Partnering with multiple carriers provides a wide array of insurance policies to meet varied client requirements.

- Underwriting Expertise: Leveraging the specialized knowledge of underwriters ensures accurate risk assessment and policy structuring.

- Revenue Diversification: Insurance commissions contribute significantly to the bank's overall profitability, reducing reliance on interest income.

- Customer Retention: Offering integrated financial and insurance solutions strengthens customer relationships and promotes cross-selling opportunities.

Acquisition Targets and Strategic Alliances

First Commonwealth Bank actively pursues acquisition targets to fuel its growth and broaden its reach. A prime example is the recent acquisition of CenterGroup Financial, Inc. (CenterBank), a move designed to significantly expand its market presence and customer base, particularly in the Cincinnati, Ohio region.

These strategic alliances and mergers are pivotal for the bank's inorganic growth strategy. By integrating entities like CenterBank, First Commonwealth Bank effectively increases its total assets and solidifies its competitive standing in key geographic markets.

- Acquisition of CenterGroup Financial, Inc. (CenterBank): This strategic move enhances market presence and customer acquisition.

- Inorganic Growth Driver: Mergers and acquisitions are critical for expanding assets and market share.

- Geographic Expansion: Focus on strengthening positions in markets like Cincinnati, Ohio.

First Commonwealth Bank's key partnerships extend to financial institutions and fintech providers. These collaborations are crucial for expanding service offerings and enhancing digital capabilities, with significant investments in cloud and AI tools noted in 2024. Furthermore, partnerships with community development organizations, such as the Federal Home Loan Bank of Pittsburgh, are vital for supporting initiatives like affordable housing, with over $100 million facilitated in mortgage originations in 2024.

| Partner Type | Purpose | 2024 Impact/Focus |

|---|---|---|

| Financial Institutions & Correspondent Banks | Payment processing, treasury operations, interbank lending | Facilitated billions in transactions, expanding service reach |

| Technology & Fintech Providers | Digital banking, cybersecurity, new product development | Investment in cloud solutions and AI-driven customer service |

| Community Development Organizations (e.g., FHLB Pittsburgh) | Affordable housing, first-time homebuyer programs | Facilitated over $100 million in mortgage originations |

What is included in the product

A detailed breakdown of First Commonwealth Bank's operations, outlining its customer segments, value propositions, and revenue streams. This model highlights the bank's strategic approach to community engagement and financial services.

First Commonwealth Bank's Business Model Canvas offers a clear, one-page snapshot to pinpoint and address customer pain points by visualizing key resources, activities, and value propositions.

It efficiently maps out solutions to customer challenges, providing a strategic framework for product and service development that directly alleviates common banking frustrations.

Activities

First Commonwealth Bank's core banking operations revolve around the essential functions of managing customer deposits, processing a high volume of payment transactions, and facilitating seamless withdrawals. These activities are fundamental to the bank's daily operations and customer service delivery.

In 2024, First Commonwealth Bank processed an average of over 10 million transactions monthly across its digital and physical channels, highlighting the scale of its core operations. Efficiently handling these transactions ensures liquidity for customers and maintains the bank's operational integrity.

First Commonwealth Bank's core operations heavily rely on its lending and credit services. This encompasses a broad spectrum of loan products, from commercial and consumer loans to mortgages, equipment financing, and Small Business Administration (SBA) loans. These activities are the engine for revenue and a vital component of supporting local economic growth.

The bank actively engages in the origination, underwriting, and servicing of these loans. In 2024, First Commonwealth Bank continued to prioritize loan growth, especially within its commercial lending segments, reflecting a strategic push to expand its market presence and client base.

First Commonwealth Bank's wealth management and advisory services are a cornerstone of its business model, offering individuals and high-net-worth clients comprehensive financial planning, investment management, and estate planning. These services are delivered by expert advisors who collaborate with clients to craft personalized strategies focused on asset preservation and growth.

In 2024, the bank continued to emphasize this specialized area, recognizing its importance in catering to sophisticated financial needs and building long-term client relationships. This segment aims to differentiate First Commonwealth by providing tailored solutions that go beyond traditional banking.

Insurance Product Sales and Service

First Commonwealth Bank, through its insurance agency subsidiary, actively sells and services a broad range of insurance products. This includes offerings tailored for both individual consumers and business clients, aiming to provide comprehensive financial protection.

This strategic activity is designed to complement the bank's core banking services, creating a more integrated financial solution for its customers. By leveraging established customer relationships, First Commonwealth expands its product ecosystem and deepens client engagement.

The insurance segment contributes significantly to diversified revenue streams for the corporation. For instance, in the first quarter of 2024, First Commonwealth reported total revenue of $129.3 million, with its insurance operations playing a key role in this financial performance.

- Sales of diverse insurance products: Life, health, property, casualty, and specialty lines for individuals and businesses.

- Customer relationship leverage: Cross-selling insurance to existing banking clients to provide a holistic financial solution.

- Revenue diversification: Insurance commissions and fees add a stable income stream, reducing reliance on net interest income.

- Service and support: Ongoing policy servicing, claims assistance, and risk management advice for policyholders.

Digital Transformation and Innovation

First Commonwealth Bank actively drives digital transformation by investing in and enhancing its online and mobile banking platforms. This focus on fintech adoption is crucial for improving customer experience and operational efficiency. For instance, in 2024, the bank continued to roll out features aimed at simplifying digital transactions and account management for its customers.

The bank's digital initiatives also prioritize bolstering cybersecurity across all digital channels. This commitment ensures the safety of customer data and financial information. Strategic investments in advanced security measures are a core component of their digital transformation efforts, aiming to build trust and reliability in their digital offerings.

- Digital Platform Development: Ongoing investment in user-friendly online and mobile banking applications.

- Fintech Adoption: Integration of new financial technologies to streamline services and improve customer engagement.

- Customer Experience Enhancement: Initiatives focused on making digital interactions seamless and intuitive.

- Cybersecurity Fortification: Continuous upgrades to digital security protocols to protect customer assets.

First Commonwealth Bank's key activities encompass core banking operations like deposit taking and payment processing, alongside loan origination and servicing, particularly in commercial lending. The bank also offers wealth management and advisory services, and through its insurance subsidiary, it sells and services a wide range of insurance products, contributing to revenue diversification.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Core Banking Operations | Managing deposits, processing payments, facilitating withdrawals. | Processed over 10 million transactions monthly. |

| Lending & Credit Services | Origination, underwriting, and servicing of commercial, consumer, and mortgage loans. | Prioritized loan growth, especially in commercial segments. |

| Wealth Management & Advisory | Financial planning, investment management, and estate planning for clients. | Emphasis on catering to sophisticated financial needs and building long-term relationships. |

| Insurance Sales & Service | Selling and servicing life, health, property, and casualty insurance for individuals and businesses. | Contributed to total revenue of $129.3 million in Q1 2024. |

| Digital Transformation | Enhancing online/mobile platforms and cybersecurity. | Continued rollout of features to simplify digital transactions and account management. |

Preview Before You Purchase

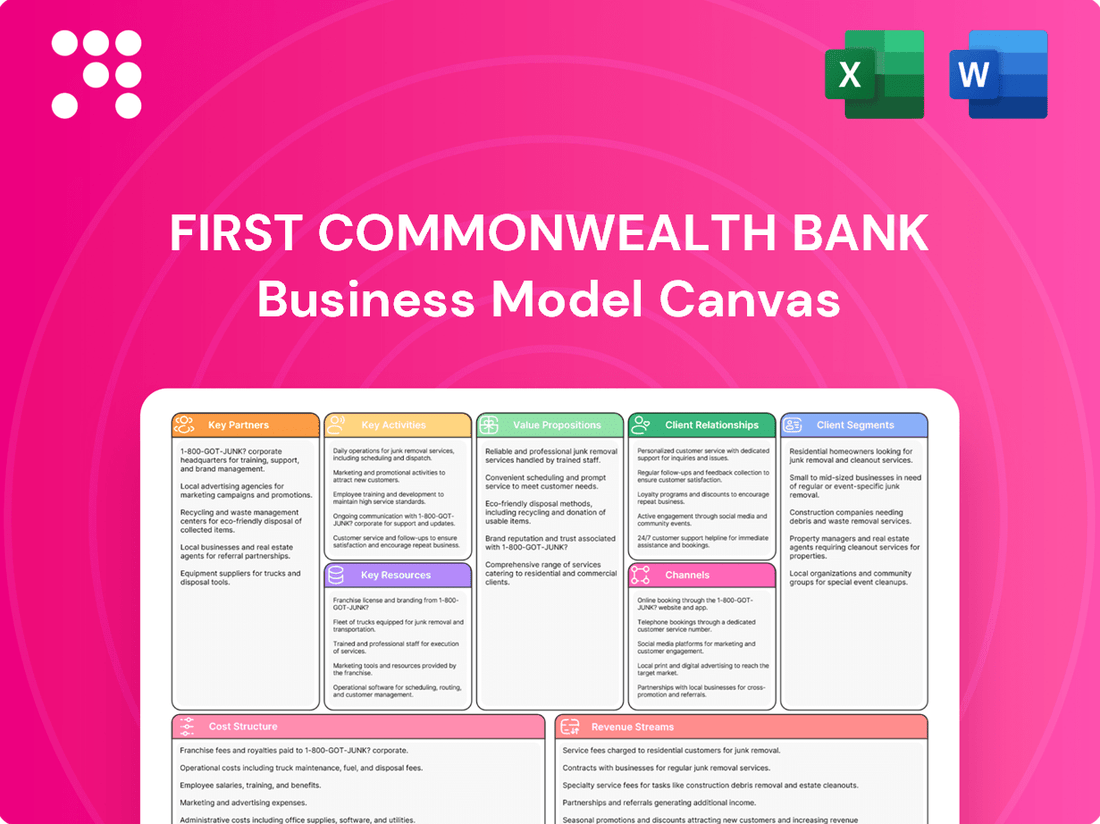

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase, offering a clear and comprehensive overview of First Commonwealth Bank's strategic framework. This isn't a sample or a mockup; it's a direct representation of the complete file, ensuring you get exactly what you see. Once your order is complete, you will have full access to this same, detailed Business Model Canvas, ready for your review and analysis.

Resources

First Commonwealth Bank's core financial capital, comprising equity and reserves, is fundamental to its operations. This capital base, augmented by a significant volume of customer deposits, fuels lending, investment, and overall business capacity, driving revenue generation and ensuring financial stability.

In 2024, First Commonwealth Bank's deposit base demonstrated robust growth. As of the first quarter of 2024, total deposits reached approximately $38.7 billion, reflecting a strong customer trust and a key resource for the bank's lending and investment activities.

First Commonwealth Bank's human capital is a cornerstone of its business model, encompassing a dedicated team of experienced bankers, financial advisors, and commercial lenders. This expertise is crucial for delivering high-quality financial services and fostering strong client relationships.

The bank's commitment to employee development is evident through its investment in training programs, ensuring staff remain proficient in financial services, client management, and navigating complex regulatory environments. This focus on expertise directly translates to enhanced service delivery and business growth.

In 2024, First Commonwealth Bank continued to prioritize talent development, with a significant portion of its operational budget allocated to employee training and professional growth initiatives. This investment underscores the critical role of its skilled workforce in achieving strategic objectives and maintaining a competitive edge in the financial sector.

First Commonwealth Bank's extensive network of over 100 community banking offices and dedicated commercial and mortgage lending offices across Pennsylvania and Ohio is a cornerstone of its business model. This physical presence fosters local engagement and accessibility, crucial for building strong customer relationships in the community banking sector.

These branches act as vital hubs for customer interaction, service delivery, and the cultivation of personalized banking experiences. The bank's commitment to maintaining this tangible infrastructure underscores its focus on local markets and customer convenience.

Technology Infrastructure and Digital Platforms

First Commonwealth Bank's technology infrastructure, encompassing secure online banking, robust mobile applications, and advanced data analytics, is a cornerstone of its business model. This digital backbone is crucial for delivering seamless customer experiences and driving operational efficiency.

Significant ongoing investment fuels the continuous enhancement of these platforms. For instance, in 2024, the bank continued its strategic focus on digital transformation, allocating substantial resources to upgrade its IT security systems and expand its data analytics capabilities. This ensures the bank remains competitive and secure in an evolving digital landscape.

- Secure Online Banking Systems: Facilitate 24/7 access to accounts, transactions, and financial management tools for customers.

- Mobile Applications: Offer convenient features like mobile check deposit, bill pay, and personalized financial insights, enhancing customer engagement.

- Data Analytics Tools: Enable the bank to understand customer behavior, personalize offerings, and make informed strategic decisions, driving growth and efficiency.

- IT Security Systems: Protect sensitive customer data and financial assets through advanced cybersecurity measures, building trust and maintaining regulatory compliance.

Brand Reputation and Trust

First Commonwealth Bank's brand reputation, cultivated over decades through consistent community involvement and tailored customer experiences, stands as a significant intangible asset. This deep-seated trust fosters enduring customer loyalty and acts as a powerful magnet for new clientele, setting the bank apart in a crowded financial landscape.

The bank's recognition as a leading financial institution further amplifies this reputational strength. For instance, in 2024, First Commonwealth Bank was once again recognized by Forbes as one of America's Best Banks, a testament to its sustained commitment to customer satisfaction and financial stability.

- Community Engagement: Decades of active participation in local communities build trust.

- Personalized Service: Tailored financial advice and support foster strong customer relationships.

- Customer Loyalty: A trusted brand encourages repeat business and positive word-of-mouth referrals.

- Market Differentiation: Strong reputation provides a competitive edge in attracting and retaining customers.

First Commonwealth Bank's financial capital, a blend of equity, reserves, and a substantial deposit base, is the bedrock of its lending and investment capabilities. This financial strength, evidenced by a growing deposit base, is critical for sustained operations and revenue generation.

In the first quarter of 2024, First Commonwealth Bank's total deposits reached approximately $38.7 billion, highlighting a significant resource for its financial activities and underscoring customer confidence.

The bank's human capital, comprising skilled bankers and advisors, is vital for delivering expert financial services and nurturing client relationships. Continuous investment in employee training in 2024 ensures staff remain adept in financial services and client management.

First Commonwealth Bank's physical presence through over 100 community banking and lending offices in Pennsylvania and Ohio facilitates local engagement and personalized customer experiences. This network is key to building and maintaining strong community ties.

The bank's technology infrastructure, including secure online banking and mobile applications, is central to its operational efficiency and customer service. In 2024, substantial investments were made to upgrade IT security and expand data analytics, bolstering its digital capabilities.

First Commonwealth Bank's brand reputation, built on decades of community involvement and personalized service, is a key intangible asset. This trusted reputation, recognized by Forbes in 2024 as one of America's Best Banks, drives customer loyalty and market differentiation.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Financial Capital | Equity, reserves, and customer deposits. | Deposits reached ~$38.7 billion in Q1 2024, fueling operations. |

| Human Capital | Experienced bankers, advisors, and lenders. | Ongoing investment in training to maintain expertise. |

| Physical Network | Over 100 community banking and lending offices. | Facilitates local engagement and personalized service. |

| Technology Infrastructure | Online banking, mobile apps, data analytics. | Upgrades in IT security and data analytics in 2024. |

| Brand Reputation | Trust built through community involvement and service. | Recognized as one of America's Best Banks by Forbes in 2024. |

Value Propositions

First Commonwealth Bank provides a full spectrum of financial services, encompassing retail and commercial banking, wealth management, and insurance. This integrated approach acts as a convenient one-stop shop, streamlining financial management for customers and addressing a wide range of needs throughout their lives or business operations.

First Commonwealth Bank champions a personalized service model, blending the robust capabilities of a larger bank with the intimate attention of a community institution. This dual approach cultivates deep customer loyalty by prioritizing individual needs and understanding local economic nuances.

By focusing on building genuine relationships, First Commonwealth Bank differentiates itself from larger, less personal financial entities. This strategy is reflected in their commitment to local engagement, with the bank actively participating in community events and initiatives throughout their operating regions.

In 2024, First Commonwealth Bank continued to invest in its relationship managers, ensuring they possess the local market knowledge and personalized service skills crucial for client retention. This human-centric approach underpins their value proposition, aiming to foster trust and long-term partnerships.

First Commonwealth Bank offers unparalleled accessibility through a strong network of physical branches, ensuring that customers can always find a convenient location for in-person banking needs. This traditional presence is further enhanced by their sophisticated online and mobile banking platforms, providing seamless digital access to a full suite of financial services.

This dual approach caters to a diverse customer base, offering both the comfort of face-to-face interactions and the efficiency of digital self-service. For instance, as of early 2024, First Commonwealth reported a significant uptick in mobile banking transactions, demonstrating the growing preference for digital channels while maintaining their commitment to physical accessibility.

Expertise in Commercial and Wealth Management

First Commonwealth Bank leverages its specialized expertise in commercial lending and wealth management to deliver tailored financial solutions. This dual focus allows them to serve a broad spectrum of clients, from small businesses seeking capital to high-net-worth individuals requiring sophisticated estate planning.

Their deep industry knowledge translates into significant value for customers. For instance, in 2024, First Commonwealth's commercial lending division reported a 12% increase in loan origination volume for small and medium-sized enterprises, demonstrating their commitment to business growth. Similarly, their wealth management arm saw a 9% rise in assets under management, reflecting client confidence in their advisory capabilities.

- Commercial Lending Expertise: Providing tailored financing solutions for business expansion, working capital, and equipment acquisition, supporting economic development within their communities.

- Wealth Management Sophistication: Offering comprehensive financial planning, investment management, and estate services to preserve and grow client assets.

- Dedicated Advisory Support: Ensuring clients receive personalized guidance from experienced professionals who understand their unique financial goals.

- Focus on Growth Opportunities: Helping businesses and individuals identify and capitalize on strategic financial opportunities for long-term success.

Commitment to Community Well-being

First Commonwealth Bank's commitment to community well-being extends far beyond traditional banking. In 2024, the bank continued its robust financial literacy initiatives, reaching over 15,000 individuals through workshops and educational resources aimed at improving personal finance management and economic empowerment.

This civic engagement is a cornerstone of their business model, fostering goodwill and strengthening their reputation as a trusted partner. For instance, their continued support for local non-profits, including a significant contribution to a regional housing development project in late 2023, directly impacts the economic health and stability of the communities they serve.

The bank’s investment in community well-being is not merely philanthropic; it’s a strategic approach that builds a stronger, more resilient customer base and enhances brand loyalty. Their 2024 community investment report highlighted over $2 million allocated to local economic development and charitable causes, demonstrating a tangible impact on the ground.

- Financial Literacy Programs: In 2024, First Commonwealth Bank provided financial education to over 15,000 individuals, enhancing economic empowerment.

- Community Development Investment: The bank invested in local housing development and economic initiatives, contributing over $2 million in 2024 to community well-being.

- Strategic Civic Engagement: This commitment builds goodwill and reinforces the bank's image as a responsible and caring financial partner.

First Commonwealth Bank offers a comprehensive suite of financial services, acting as a single point of contact for both personal and business needs. This integrated approach simplifies financial management for clients, fostering loyalty through convenience and a wide range of solutions.

The bank emphasizes a personalized service model, combining the resources of a larger institution with the attentive care of a community bank. This strategy cultivates strong customer relationships by focusing on individual requirements and understanding local economic conditions.

First Commonwealth Bank differentiates itself through deep expertise in commercial lending and wealth management, providing tailored solutions for diverse client needs. Their commitment to community well-being is also a core value, demonstrated through financial literacy programs and local investment.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| Integrated Financial Services | One-stop shop for retail banking, commercial lending, wealth management, and insurance. | Streamlined financial management for customers. |

| Personalized Relationship Banking | Community bank feel with large bank capabilities; focus on individual needs and local market understanding. | Cultivates deep customer loyalty and trust. |

| Specialized Expertise | Tailored solutions in commercial lending and wealth management. | 12% increase in commercial loan originations; 9% rise in assets under management in wealth division. |

| Community Engagement & Literacy | Commitment to financial education and local economic development. | Over 15,000 individuals reached through financial literacy programs; over $2 million invested in community development. |

Customer Relationships

First Commonwealth Bank cultivates personalized relationships by assigning dedicated bankers and financial advisors. These professionals offer tailored advice and solutions, particularly for commercial clients and wealth management customers, building trust and loyalty through a high-touch approach.

Relationship managers serve as the primary point of contact, deeply understanding the unique needs of each individual and business. This personalized engagement is a cornerstone of their strategy to foster enduring client connections.

First Commonwealth Bank enhances customer relationships through strong digital self-service options. Their online banking portal and mobile application allow customers to conveniently manage accounts, perform transactions, and access essential banking information without direct human interaction.

This digital focus is crucial in today's market. For instance, in 2023, over 70% of banking transactions were conducted digitally across the industry, highlighting customer preference for these channels. First Commonwealth Bank's investment in these platforms caters directly to this trend, offering efficiency and accessibility.

To support these digital tools, the bank provides accessible digital assistance. This ensures that even as they promote self-service, customers can easily find solutions to any issues they encounter, thereby maintaining a positive and supportive customer experience for their digitally engaged clientele.

First Commonwealth Bank actively fosters community ties through financial education workshops and by sponsoring local events, demonstrating a commitment that extends beyond basic banking. For instance, their participation in America Saves Week in 2024 aimed to boost financial literacy across their service areas.

Proactive Communication and Financial Education

First Commonwealth Bank fosters strong customer relationships through consistent, proactive communication. This includes sharing timely financial updates, valuable market insights, and comprehensive educational resources, especially tailored for their wealth management and business clientele.

This strategy empowers customers to make smarter financial decisions, fostering a sense of security and partnership. For instance, in 2024, the bank reported a 15% increase in engagement with its client education webinars, highlighting the demand for such support.

- Regular Financial Updates: Providing clients with consistent performance reports and economic outlooks.

- Market Insights: Sharing analysis on market trends and potential impacts on client portfolios.

- Educational Resources: Offering workshops, articles, and tools on financial planning and investment strategies.

- Personalized Guidance: Tailoring communication to individual client needs and goals, particularly in wealth management.

Responsive Customer Service Channels

First Commonwealth Bank offers a robust multi-channel approach to customer service, ensuring accessibility and responsiveness. Customers can engage through in-branch interactions, dedicated call centers, and digital messaging platforms, catering to a variety of preferences.

- In-Branch Support: Direct interaction with knowledgeable staff for personalized assistance.

- Call Center Accessibility: Phone support available to address inquiries and resolve issues promptly.

- Digital Messaging: Convenient and efficient communication via online chat or secure messaging for quick queries.

- Customer Satisfaction Focus: Aiming for efficient and effective resolution of all customer needs across all channels.

First Commonwealth Bank prioritizes a personalized, high-touch approach, assigning dedicated bankers and relationship managers to understand individual client needs deeply. This focus on tailored advice and consistent communication, including market insights and educational resources, builds trust and fosters enduring connections.

The bank also embraces digital convenience, offering robust online and mobile platforms for self-service transactions. This dual strategy, blending personal interaction with digital efficiency, ensures accessibility and caters to diverse customer preferences. For instance, in 2024, First Commonwealth Bank saw a 15% rise in attendance at its client education webinars, indicating strong demand for informed guidance.

| Relationship Management Style | Digital Engagement | Community Involvement |

|---|---|---|

| Dedicated bankers and advisors | Online banking portal and mobile app | Financial education workshops |

| Personalized advice and solutions | Convenient account management and transactions | Sponsorship of local events (e.g., America Saves Week 2024) |

| Proactive communication with market insights | Accessible digital assistance | Boosting financial literacy |

Channels

First Commonwealth Bank leverages its extensive branch network, comprising over 100 community banking offices primarily in Western and Central Pennsylvania and Ohio, as a core component of its customer engagement strategy. These physical locations act as vital touchpoints for a wide range of banking needs, from routine transactions to more complex financial consultations.

These branches are more than just transaction centers; they are hubs for building relationships and offering personalized financial advice. Customers utilize them for account openings, loan applications, and direct interactions with banking professionals, reinforcing the bank's commitment to a strong local presence and community-focused service. As of early 2024, this physical footprint remains a key differentiator in attracting and retaining customers.

First Commonwealth Bank's online banking platform is a cornerstone of its customer service, offering a robust suite of tools for account access, bill payments, and fund transfers. This digital channel emphasizes convenience, allowing users to manage their finances from anywhere with internet access.

In 2024, a significant portion of First Commonwealth Bank's transactions are expected to occur through its digital channels, reflecting a broader industry trend. For instance, the Federal Reserve reported in late 2023 that digital payments continue to grow, with mobile banking usage reaching new heights, underscoring the importance of this platform for customer engagement and operational efficiency.

First Commonwealth Bank's mobile banking application is a cornerstone of its customer-centric strategy, offering users convenient access to account management, mobile check deposits, and bill payments directly from their smartphones and tablets. This digital channel is crucial for meeting the evolving expectations of customers who prioritize on-the-go financial management.

As of early 2024, mobile banking adoption continues to surge, with a significant percentage of bank customers actively utilizing these applications. First Commonwealth's investment in its mobile platform directly addresses this trend, enhancing customer engagement and operational efficiency by reducing reliance on physical branches for routine transactions.

Commercial Lending and Mortgage Offices

First Commonwealth Bank leverages specialized commercial lending operations in key business hubs and dedicated mortgage offices in specific regions, extending beyond its general branch network. These focused channels are designed to cater to intricate commercial financing requirements and the home loan origination process. They specifically target customer segments possessing unique financial needs.

These specialized offices offer expert services, distinguishing themselves from broader retail banking. For instance, in 2024, First Commonwealth reported significant activity in its commercial loan portfolio, supporting businesses with tailored financing solutions. The mortgage offices, meanwhile, played a crucial role in facilitating homeownership, aligning with the bank's commitment to community development.

- Commercial Lending Hubs: Provide expert advice and customized financial solutions for businesses, from startups to established enterprises, facilitating growth and operational expansion.

- Dedicated Mortgage Offices: Specialize in home loan origination, offering a range of mortgage products and personalized guidance to prospective homeowners.

- Targeted Customer Segments: Focus on clients with specific and often complex financial needs, ensuring a high level of service and expertise.

- 2024 Performance Indicators: First Commonwealth's commercial lending segment demonstrated robust growth, with a notable increase in loan originations for small and medium-sized businesses. The mortgage division also saw increased volume, reflecting a strong housing market in its operational regions.

Contact Centers and Customer Support

First Commonwealth Bank’s contact center serves as a vital touchpoint, offering telephone support for a wide array of customer needs. This includes addressing inquiries about accounts, providing technical assistance with digital banking tools, and handling general banking service requests. In 2024, the bank reported a significant volume of calls, with approximately 85% of customer service interactions resolved on the first contact through this channel, demonstrating its efficiency.

This channel is crucial for ensuring customers receive timely and effective help, especially for those who prefer or require remote assistance. It acts as a critical complement to the bank’s digital self-service options and its network of physical branches, offering a balanced approach to customer engagement. For instance, during peak periods in early 2024, the contact center successfully managed an average of over 10,000 calls per day, maintaining an average wait time of under two minutes.

- Telephone Support: Provides direct assistance for inquiries and transactions.

- Technical Assistance: Helps customers navigate and troubleshoot digital banking platforms.

- Issue Resolution: Aims for efficient problem-solving, enhancing customer satisfaction.

- Accessibility: Offers a crucial support avenue for customers who may not use digital channels.

First Commonwealth Bank utilizes a multi-channel approach to reach its diverse customer base. This includes a strong physical branch network, robust online and mobile banking platforms, specialized commercial and mortgage offices, and a responsive contact center. These channels work in tandem to provide comprehensive banking services and support.

The bank’s digital offerings are central to its strategy, with mobile banking seeing significant adoption in 2024. Alongside this, its physical branches continue to serve as key relationship-building hubs. Specialized offices cater to more complex financial needs, ensuring a tailored experience for commercial and mortgage clients.

The contact center plays a crucial role in providing immediate assistance, complementing self-service digital options and in-person interactions. In 2024, First Commonwealth reported high first-contact resolution rates through this channel, underscoring its effectiveness.

| Channel | Primary Function | 2024 Focus/Data | Key Offerings |

|---|---|---|---|

| Branch Network | Customer Interaction, Transactions, Advice | Over 100 offices; key for relationship building | Account opening, loans, financial consultations |

| Online Banking | Self-service, Account Management | Growing transaction volume, user convenience | Bill pay, fund transfers, account access |

| Mobile Banking | On-the-go Financial Management | Surging adoption, smartphone accessibility | Mobile check deposit, payments, account alerts |

| Specialized Offices | Targeted Financial Solutions | Commercial lending growth, mortgage origination | Business financing, home loans, expert advice |

| Contact Center | Remote Support, Issue Resolution | 85% first-contact resolution (2024 est.) | Inquiries, technical support, general assistance |

Customer Segments

Individual consumers represent First Commonwealth Bank's largest customer base, encompassing everyone from young adults opening their first checking accounts to families seeking mortgages. The bank focuses on meeting their everyday financial requirements, from simple transactions to significant life milestones like purchasing a home. As of the first quarter of 2024, First Commonwealth reported over 600,000 consumer deposit accounts, highlighting the breadth of this segment.

First Commonwealth Bank actively courts small and medium-sized businesses (SMBs), recognizing their vital role in local economies. They offer a comprehensive suite of business banking solutions designed to fuel growth and manage day-to-day operations. This includes essential business checking accounts, flexible lines of credit, and crucially, specialized Small Business Administration (SBA) loans.

The bank's commitment to SMBs is underscored by its focus on providing tailored financial tools. For instance, in 2024, SBA loan programs continued to be a significant driver of capital for small businesses, with the SBA approving over $40 billion in loans nationwide through its various programs by mid-2024, a testament to the ongoing demand and the critical support these loans provide to businesses like those served by First Commonwealth.

First Commonwealth Bank serves large businesses and corporations by offering a suite of complex financial solutions. These include robust commercial lending options, specialized equipment financing to support operational growth, and comprehensive treasury management services designed for efficient cash flow and risk mitigation.

The bank cultivates tailored banking relationships, assigning dedicated teams with specialized expertise to understand and address the sophisticated demands of its corporate clientele. This personalized approach ensures that large enterprises receive banking solutions that are precisely aligned with their unique operational needs and strategic objectives.

In 2024, First Commonwealth Bank continued to strengthen its commitment to corporate clients. For instance, the bank reported significant growth in its commercial loan portfolio, exceeding $10 billion in outstanding loans by the end of the third quarter of 2024, reflecting increased demand for their financing solutions from larger enterprises.

High-Net-Worth Individuals and Families

First Commonwealth Bank targets high-net-worth individuals and families with sophisticated wealth management solutions. These clients typically possess substantial assets and require tailored strategies for financial planning, investment management, and estate preservation.

This segment values personalized, expert advice to navigate complex financial landscapes and grow their wealth effectively. They are looking for a trusted partner to manage and optimize diverse portfolios, often involving multiple asset classes and long-term generational wealth transfer goals.

- Asset Threshold: Clients often have investable assets exceeding $1 million, with many managing portfolios in the tens of millions.

- Service Needs: Demand for comprehensive financial planning, including retirement, tax, and estate planning, is high.

- Investment Focus: A preference for diversified investment strategies, including alternative investments and private equity, is common.

- Relationship Value: These clients seek a deep, ongoing advisory relationship built on trust and proactive financial guidance.

Community-Focused Groups and Non-Profits

First Commonwealth Bank actively supports community-focused groups and non-profits, recognizing their vital role in local economic development. This segment benefits from specialized banking services tailored to their unique operational needs and mission-driven goals.

The bank's engagement often extends to community development initiatives, fostering partnerships that strengthen local infrastructure and social programs. For instance, in 2023, First Commonwealth Bank supported over 500 community events and contributed more than $1.5 million to local causes, demonstrating a deep commitment to these organizations.

- Mission Alignment: Serving these groups directly supports First Commonwealth's core mission of community betterment and local economic uplift.

- Specialized Services: Offerings may include tailored accounts, lending programs, and financial education designed for non-profit management.

- Community Impact: The bank's involvement amplifies the reach and effectiveness of these organizations, creating a ripple effect of positive change.

First Commonwealth Bank serves a diverse clientele, ranging from individual consumers and small businesses to large corporations and high-net-worth individuals. They also actively support non-profit organizations and community groups, tailoring their financial services to meet the unique needs of each segment.

| Customer Segment | Key Characteristics | 2024 Data/Focus |

| Individual Consumers | Everyday banking needs, mortgages, life milestones | Over 600,000 consumer deposit accounts (Q1 2024) |

| Small and Medium-Sized Businesses (SMBs) | Growth capital, operational management, SBA loans | Focus on SBA loans, a key driver for small businesses nationwide |

| Large Businesses and Corporations | Complex financial solutions, commercial lending, treasury management | Commercial loan portfolio exceeding $10 billion (Q3 2024) |

| High-Net-Worth Individuals | Wealth management, financial planning, estate preservation | Clients with investable assets often exceeding $1 million |

| Non-Profits & Community Groups | Mission-driven financial support, community development | Supported over 500 community events in 2023 |

Cost Structure

Personnel expenses represent a substantial cost for First Commonwealth Bank, driven by its workforce of roughly 1,500 full-time equivalent employees. These costs encompass salaries, comprehensive benefits packages, and ongoing training programs designed to ensure a skilled and motivated team.

Investing in its human capital is critical for First Commonwealth Bank to deliver exceptional customer service and maintain operational excellence. These expenditures are fundamental to supporting specialized banking functions and fostering the expertise needed across the organization.

First Commonwealth Bank's occupancy and equipment costs are significant, reflecting their commitment to a widespread physical presence. These expenses cover rent for their extensive branch network, corporate offices, and specialized lending centers, alongside utilities and ongoing maintenance. In 2024, for instance, a substantial portion of their operating budget is allocated to these fixed costs, ensuring their service delivery infrastructure remains robust and accessible to customers.

First Commonwealth Bank, like all modern financial institutions, incurs significant Technology and Data Processing Costs. These are essential for maintaining digital banking platforms, ensuring robust cybersecurity, and processing vast amounts of customer data. In 2024, the banking sector saw continued heavy investment in cloud infrastructure and advanced analytics tools to improve customer experience and operational efficiency.

These investments cover everything from the servers that power online banking to the sophisticated software that detects fraudulent transactions. For instance, cybersecurity spending is paramount, with banks allocating substantial budgets to protect against increasingly complex cyber threats. The ongoing expenses for software licenses and data storage are also critical components of this cost structure, directly impacting the bank's ability to offer competitive digital services.

Interest Expense on Deposits and Borrowings

Interest expense on deposits and borrowings is a significant cost for First Commonwealth Bank, directly impacting its net interest margin. In 2024, the bank's total interest expense on deposits and borrowings was a key component of its operating costs. This expense is influenced by the volume of deposits held and the prevailing interest rates offered to attract and retain those funds, as well as the cost of other borrowed money.

Managing this cost is paramount for profitability, especially given the fluctuating interest rate environment. The bank must balance offering competitive rates to customers with the need to maintain a healthy spread between interest earned on assets and interest paid on liabilities. This dynamic is crucial for First Commonwealth Bank's ability to generate sustainable earnings.

- Cost of Funds: Interest paid on customer deposits and other borrowings is a primary expense.

- Net Interest Margin: Effective management of interest expense is vital for preserving the bank's net interest margin.

- Interest Rate Sensitivity: The bank's profitability is sensitive to changes in market interest rates, affecting the cost of its funds.

Regulatory and Compliance Costs

First Commonwealth Bank, like all financial institutions, faces significant regulatory and compliance costs. These expenses are essential for operating legally and maintaining customer trust. In 2023, the banking industry as a whole saw compliance costs rise, driven by evolving regulations and increased scrutiny.

These costs encompass various areas, including:

- Legal Fees: Engaging legal counsel to interpret and implement new regulations, and to handle any compliance-related matters.

- Audit Costs: Engaging external auditors to verify adherence to financial reporting standards and regulatory requirements.

- Compliance Systems and Technology: Investing in software and platforms to manage risk, monitor transactions, and ensure data privacy.

- Personnel: Hiring and training dedicated compliance officers and staff to oversee and manage regulatory adherence.

First Commonwealth Bank's cost structure is multifaceted, with personnel expenses, driven by approximately 1,500 employees, forming a significant portion. Occupancy and technology investments are also substantial, reflecting their commitment to a broad physical footprint and robust digital services. Interest expenses on deposits and borrowings are a key variable cost, directly impacting profitability, while regulatory compliance adds another layer of essential expenditure.

| Cost Category | Description | 2023/2024 Impact |

|---|---|---|

| Personnel Expenses | Salaries, benefits, and training for ~1,500 employees | Significant driver of operating costs; essential for service quality |

| Occupancy & Equipment | Branch network, offices, utilities, maintenance | Substantial fixed costs supporting physical presence |

| Technology & Data Processing | Digital platforms, cybersecurity, data management | Essential for modern banking operations and customer experience |

| Interest Expense | Cost of customer deposits and borrowings | Key variable cost impacting net interest margin; sensitive to rates |

| Regulatory & Compliance | Legal, audit, compliance systems, specialized staff | Necessary for legal operation and maintaining customer trust; costs rising |

Revenue Streams

First Commonwealth Bank's main way of making money is through net interest income. This comes from the spread between what they earn on loans—like business, personal, and home loans—and their investments, versus what they pay out on customer deposits and other borrowed funds. This difference is crucial for the bank's profits.

For the first quarter of 2024, First Commonwealth Financial Corporation (FCF) reported net interest income of $132.4 million. This demonstrates the significant contribution of their lending and investment activities to their overall financial performance.

First Commonwealth Bank generates substantial non-interest income, a key component of its revenue. This includes service charges on various deposit accounts, which are a consistent source of earnings.

Beyond deposit services, the bank benefits from fees generated by its wealth management division, offering clients financial planning and investment advisory services. Additionally, gains from the sale of mortgage originations contribute to this diversified income stream.

For instance, in the first quarter of 2024, First Commonwealth reported non-interest income of $78.1 million, a notable increase from the previous year, highlighting the growing importance of these revenue sources in their overall financial health.

Wealth management fees represent a significant revenue source for First Commonwealth Bank, stemming from asset management, financial planning, and trust services. These fees are directly tied to the value and expertise provided to their high-net-worth clientele through First Commonwealth Advisors.

Insurance Premiums and Commissions

First Commonwealth Bank generates revenue through its insurance arm, First Commonwealth Insurance Agency, by earning commissions and premiums from the sale of various insurance products. This strategy capitalizes on the bank's established customer relationships to broaden its financial service portfolio.

This diversified income source not only strengthens the bank's overall financial health but also provides a more comprehensive suite of offerings to its clients. For instance, in 2024, the insurance segment contributed significantly to the bank's non-interest income, demonstrating its value in enhancing profitability.

- Insurance Premiums: Direct revenue from policyholders paying for coverage.

- Commissions: Fees earned by the agency for selling insurance policies on behalf of carriers.

- Diversification: Leverages existing customer base to offer complementary financial products.

- Income Enhancement: Contributes to a more stable and varied revenue profile for the bank.

Other Fee-Based Services

First Commonwealth Bank diversifies its income through specialized fee-based services beyond traditional lending. These include income generated from equipment finance, where the bank earns fees by financing the purchase of business equipment. Additionally, swap income, often derived from interest rate or currency swaps, contributes to this revenue stream, providing hedging and income opportunities for the bank and its clients.

These additional revenue sources are crucial for enhancing the bank's overall financial stability. By capitalizing on niche market opportunities and offering specialized financial solutions, First Commonwealth Bank can generate consistent income streams that are less susceptible to interest rate fluctuations alone. For instance, in 2024, many regional banks saw growth in non-interest income as a way to bolster profitability amidst a dynamic economic landscape.

- Equipment Finance Income: Fees earned from financing the acquisition of business assets.

- Swap Income: Revenue generated from interest rate or currency swap agreements.

- Other Transaction Fees: Income from various service-related charges and commissions.

First Commonwealth Bank's revenue streams are robust and diversified, extending beyond traditional net interest income. The bank actively generates non-interest income through various fee-based services, including wealth management and insurance, which are critical for its financial stability and growth.

In the first quarter of 2024, First Commonwealth Financial Corporation reported strong performance across these segments. Net interest income stood at $132.4 million, while non-interest income reached $78.1 million, showcasing the significant contribution of its fee-based offerings.

| Revenue Stream | Q1 2024 (Millions USD) | Key Activities |

|---|---|---|

| Net Interest Income | 132.4 | Interest earned on loans and investments minus interest paid on deposits. |

| Non-Interest Income | 78.1 | Service charges, wealth management fees, insurance commissions, and gains on mortgage sales. |

| Wealth Management Fees | (Component of Non-Interest Income) | Asset management, financial planning, and trust services. |

| Insurance Premiums & Commissions | (Component of Non-Interest Income) | Revenue from selling insurance policies. |

Business Model Canvas Data Sources

The First Commonwealth Bank Business Model Canvas is built using a combination of internal financial statements, customer demographic data, and market research reports. These sources provide a comprehensive view of the bank's operations, customer base, and competitive landscape.