Equinor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equinor Bundle

Navigate the complex external landscape impacting Equinor with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces shaping the energy giant's future. Gain a strategic advantage by leveraging these expert insights. Download the full report now to unlock actionable intelligence and refine your market strategy.

Political factors

Equinor's strategic direction is heavily shaped by government backing for the energy transition, especially within Norway and the European Union. This support manifests through incentives for renewable energy ventures, such as offshore wind farms, and crucial funding for carbon capture and storage (CCS) projects.

For instance, Norway's commitment to offshore wind development, with targets like the 2030 goal of 30 GW installed capacity, directly benefits Equinor's significant investments in this sector. Similarly, EU policies like the Green Deal and the Innovation Fund, which supports low-carbon technologies, provide a stable framework for Equinor's CCS initiatives, such as the Northern Lights project.

The consistency and evolution of these governmental policies are paramount, directly influencing Equinor's capital allocation and long-term strategic planning. A clear and sustained policy environment encourages substantial investment in low-carbon technologies, reinforcing Equinor's transition strategy.

Geopolitical instability, particularly the ongoing conflict in Ukraine, has significantly reshaped the energy landscape. This has elevated the importance of energy security for nations, especially in Europe, where Equinor plays a vital role as a natural gas supplier. In 2023, Equinor's natural gas production in Norway reached approximately 112 billion standard cubic meters (bscm), a substantial portion of which was exported to Europe, underscoring its critical contribution to the continent's energy needs amidst these global tensions.

The intricate and often unpredictable nature of regulatory and permitting processes directly impacts Equinor's project execution, influencing both timelines and expenditures for its oil and gas ventures as well as its growing renewable energy portfolio. Navigating these hurdles is a critical component of operational success.

Significant delays or shifts in regulatory frameworks, especially for major undertakings like offshore wind farms, can trigger substantial financial impairments and considerable project delays. For instance, changes in permitting requirements in the US contributed to significant challenges for Equinor's Empire Wind project, highlighting the financial risks associated with regulatory uncertainty.

International Climate Policy and Agreements

Equinor's strategic direction is firmly anchored in international climate accords, notably the Paris Agreement, with a stated ambition to achieve net-zero emissions by 2050. This commitment shapes its operational framework and investment priorities.

The dynamic global climate policy environment, characterized by expanding carbon pricing mechanisms and increasingly stringent emissions reduction targets, directly impacts Equinor's long-term investment decisions and its decarbonization trajectory. For instance, the EU Emissions Trading System (ETS) saw carbon prices averaging around €65 per tonne of CO2 in 2023, a significant factor in operational cost assessments.

- Net-Zero Target: Equinor aims for net-zero greenhouse gas emissions across its value chain by 2050, aligning with global climate goals.

- Policy Influence: Evolving international climate policies, including carbon taxes and emissions standards, are key drivers for Equinor's strategic planning and capital allocation towards low-carbon solutions.

- Investment Shift: The company is increasingly directing capital towards renewable energy projects and low-carbon technologies, responding to regulatory pressures and market demand for sustainable energy sources.

- Decarbonization Efforts: Equinor's investments in areas like carbon capture and storage (CCS) and offshore wind are direct responses to the need to meet these international climate commitments.

National Energy Policies and Ownership

Equinor's status as a majority state-owned entity by the Norwegian government means its strategic direction is heavily influenced by national energy policies. This connection is particularly evident in decisions regarding exploration and production on the Norwegian Continental Shelf, a key operational area for the company.

Norway's commitment to managing its hydrocarbon resources, while also fostering new energy technologies, directly shapes Equinor's investment priorities. For instance, the Norwegian government has set ambitious targets for offshore wind development, which Equinor is actively pursuing, aligning its business with national decarbonization goals.

- State Ownership: The Norwegian state holds 67% of Equinor's shares, giving it significant influence over the company's strategic direction and operational mandates.

- Norwegian Continental Shelf: Equinor is the primary operator for a substantial portion of Norway's oil and gas production, making national resource management policies critical.

- Energy Transition: National policies supporting renewable energy, such as offshore wind and carbon capture, utilization, and storage (CCUS), are driving Equinor's diversification efforts. In 2023, Equinor announced significant investments in offshore wind projects, reflecting this policy alignment.

Governmental support for the energy transition, particularly in Norway and the EU, significantly influences Equinor's strategy, with incentives for renewables and CCS projects. Norway's 2030 goal of 30 GW for offshore wind capacity directly benefits Equinor's investments, while EU policies like the Green Deal bolster its CCS initiatives.

Geopolitical shifts, such as the conflict in Ukraine, have heightened energy security concerns, positioning Equinor as a crucial natural gas supplier to Europe. In 2023, Equinor supplied approximately 112 billion standard cubic meters (bscm) of natural gas from Norway to Europe, highlighting its vital role.

Regulatory and permitting processes, both for traditional oil and gas and emerging renewable projects, directly impact Equinor's operational timelines and costs. Delays in US permitting, for example, significantly challenged Equinor's Empire Wind project, underscoring the financial risks of regulatory uncertainty.

Equinor's commitment to net-zero emissions by 2050, aligned with the Paris Agreement, shapes its investments. The expanding global carbon pricing mechanisms, with EU ETS carbon prices averaging around €65 per tonne in 2023, directly influence operational costs and decarbonization strategies.

What is included in the product

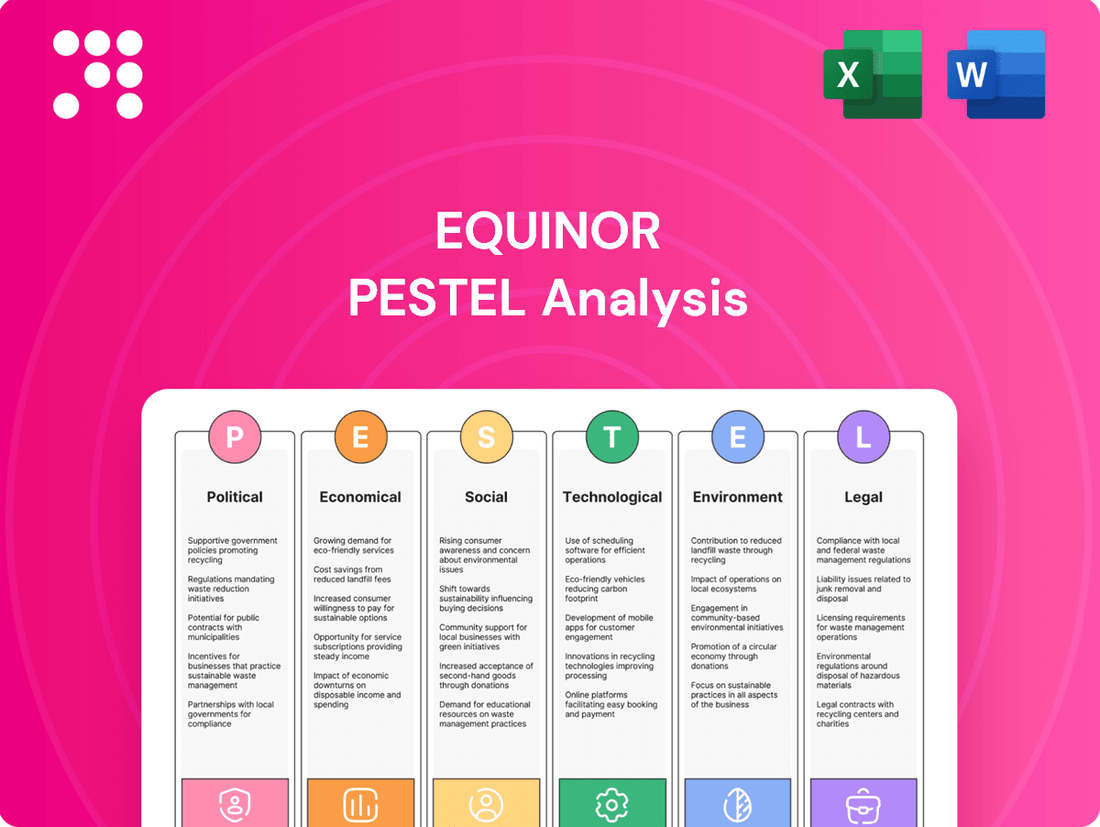

This Equinor PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategy.

It provides a comprehensive overview of the external landscape, highlighting key trends and potential challenges for Equinor's future growth.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Equinor's external landscape.

Helps support discussions on external risk and market positioning during planning sessions by highlighting key political, economic, social, technological, environmental, and legal factors impacting Equinor.

Economic factors

Equinor's financial health is deeply tied to the unpredictable swings in global energy demand and oil and gas prices. For instance, while Equinor reported strong operational performance in 2024, contributing to robust financials, the company must contend with market volatility. Even with high gas prices potentially offsetting lower oil prices, a significant drop in crude oil prices can still dampen overall profits.

Equinor is navigating a complex energy landscape by balancing ongoing investments in its lucrative oil and gas operations with a deliberate pivot towards renewable energy and lower-carbon alternatives. This dual strategy acknowledges the present demand for hydrocarbons while positioning the company for a future energy transition.

Recent financial reports highlight a more cautious and value-focused approach to renewable energy projects. For instance, in 2023, Equinor revised its capital expenditure plans, indicating a greater emphasis on profitability and return on investment for renewables, partly in response to rising inflation and interest rates impacting project economics.

This strategic recalibration saw Equinor adjust its previously ambitious renewable capacity targets, opting for a more disciplined deployment of capital. The company reported approximately $20 billion in capital expenditure for 2024, with a significant portion still allocated to oil and gas, but with increasing allocations to low-carbon solutions and renewables, reflecting this evolving investment philosophy.

Rising inflation and interest rates directly affect the cost of capital for Equinor's extensive renewable projects, particularly offshore wind farms which demand significant upfront investment. For instance, in early 2024, the US Federal Reserve maintained its key interest rate range at 5.25%-5.50%, a level that increases borrowing costs for large infrastructure projects.

These macroeconomic shifts have prompted Equinor to reassess its renewable development pipeline, prioritizing projects that offer stronger returns and potentially scaling back others. This strategic adjustment aims to safeguard profitability and ensure value creation amidst a more challenging financial environment.

Taxation and Fiscal Regimes

Equinor's financial performance is significantly shaped by the tax and fiscal policies of the nations where it operates, with Norway being a primary example. For instance, in 2023, Equinor paid approximately $63 billion in taxes and government take globally, with a substantial portion originating from its Norwegian operations. These regimes directly impact the company's profitability and available cash flow, as adjustments in tax rates or royalty payments can alter net income considerably.

The Norwegian petroleum tax system, in particular, is designed to capture a large share of the resource rent. This system includes a standard corporate tax rate, a special tax on petroleum activities, and a resource rent tax. Changes to these rates, such as potential adjustments to the special tax or resource rent tax, could directly influence Equinor's investment decisions and overall financial health. For example, any increase in the effective tax rate on its Norwegian production would reduce its post-tax earnings.

- Norway's Petroleum Tax: Includes corporate tax, special tax, and resource rent tax, impacting Equinor's net income.

- Global Tax Payments: Equinor paid around $63 billion in taxes and government take worldwide in 2023.

- Fiscal Regime Sensitivity: Changes in tax rates or royalty structures in operating countries can significantly alter Equinor's cash flow and profitability.

Supply Chain Costs and Disruptions

Global supply chain challenges, marked by escalating costs and persistent disruptions, have significantly affected the speed and financial viability of energy transition initiatives. This is particularly evident in burgeoning sectors such as offshore wind and hydrogen production, where the availability and price of specialized equipment and raw materials are critical. Equinor, like many in the industry, is navigating these headwinds by strategically focusing on projects that offer the most robust returns on investment, ensuring capital is deployed where it yields the greatest impact amidst this volatile environment.

For instance, the cost of key components for offshore wind turbines has seen substantial increases. Reports from late 2023 and early 2024 indicated that prices for certain steel structures and specialized vessels could be 15-25% higher than pre-2022 levels. These elevated costs directly impact project economics, potentially delaying or scaling back investments in new renewable energy capacity. Equinor's approach involves rigorous cost management and a focus on securing long-term supply agreements to mitigate some of this volatility.

The impact extends to hydrogen projects as well, where the supply of electrolyzers and associated infrastructure remains a bottleneck. Disruptions in manufacturing and logistics for these advanced technologies can lead to extended project timelines and increased capital expenditure. Equinor's strategy to address this involves:

- Prioritizing projects with secured supply chains: Focusing on opportunities where critical components are already contracted or readily available.

- Investing in supply chain resilience: Exploring partnerships and vertical integration opportunities to gain more control over key material and equipment sourcing.

- Phasing investments based on cost-effectiveness: Adjusting project timelines and scale in response to fluctuating supply chain costs and availability, aiming for optimal economic outcomes.

Global economic trends significantly influence Equinor's financial performance, particularly through fluctuating energy prices and demand shifts. For example, in 2024, while Equinor reported strong operational results, the company remains susceptible to crude oil price volatility, which directly impacts profitability despite potentially higher gas prices.

Preview Before You Purchase

Equinor PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Equinor delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. Understand the external landscape that shapes Equinor's future.

Sociological factors

Equinor faces increasing public scrutiny regarding its ongoing oil and gas operations and expansion plans, largely driven by growing concerns about climate change. Civil society organizations and the public are demanding greater accountability, making a strong social license to operate crucial for the company's continued success. For instance, in 2023, Equinor reported a 1.2% reduction in Scope 1 and 2 emissions intensity from its upstream operations compared to 2022, a figure closely watched by stakeholders.

To maintain this vital social license, Equinor must prioritize transparent communication about its decarbonization efforts and demonstrate tangible progress. This includes clear reporting on its investments in renewable energy and its strategies for reducing the carbon footprint of its existing oil and gas assets. The company's 2023 capital expenditures allocated approximately $20 billion to oil and gas, alongside $13 billion for renewables and low-carbon solutions, a balance that continues to be a focal point for public debate.

The global energy transition is reshaping the labor market, demanding new skill sets. Equinor, like many energy giants, must navigate this shift by investing in training for its employees to adapt to renewable energy technologies and carbon capture solutions. For instance, as of early 2024, the company has been actively promoting internal training programs focused on offshore wind and hydrogen technologies, aiming to reskill thousands of its employees.

Attracting new talent is equally crucial. By 2025, projections indicate a significant demand for engineers and technicians specialized in areas like battery storage and digital solutions within the energy sector. Equinor's strategy includes partnerships with universities and vocational schools to build a pipeline of skilled workers ready to contribute to its low-carbon ambitions, a move supported by a reported 15% increase in recruitment for these specialized roles in 2024.

Large energy projects, like those Equinor undertakes, inevitably affect local communities, whether they involve traditional oil and gas or newer renewable sources. For instance, the development of offshore wind farms can create both jobs and potential disruptions to local fishing industries. Equinor aims to mitigate these effects by focusing on a just transition, which means ensuring communities see lasting social and economic advantages from their operations.

Equinor’s strategy emphasizes creating long-term benefits for its operational areas. This commitment is crucial for maintaining social license to operate and fostering positive relationships. As of early 2025, Equinor has invested billions in renewable energy projects globally, with a significant portion of these investments earmarked for community development programs and local content initiatives, aiming to boost local economies and skills.

Health, Safety, and Security Standards

Equinor places an paramount emphasis on health, safety, and security, striving for zero harm across its operations. This commitment is not just ethical but also a core business imperative, directly impacting its reputation and operational continuity. In 2023, Equinor reported a Total Recordable Injury Frequency Rate (TRIFR) of 1.8, demonstrating a continued focus on reducing incidents.

The company actively pursues continuous improvement in its safety performance, recognizing that robust standards are vital for maintaining stakeholder trust and ensuring efficient, uninterrupted operations. This dedication is reflected in their ongoing investments in advanced safety technologies and rigorous training programs designed to foster a strong safety culture throughout the organization.

Key aspects of Equinor's approach include:

- Zero Harm Goal: An overarching objective to prevent all injuries, occupational illnesses, and environmental damage.

- Safety Culture: Fostering an environment where every employee feels responsible for their own safety and the safety of others.

- Risk Management: Implementing comprehensive systems to identify, assess, and mitigate potential hazards in all operational activities.

- Incident Investigation: Thoroughly analyzing all incidents and near misses to learn from them and prevent recurrence.

Consumer Behavior and Energy Consumption Patterns

Consumer preferences are definitely shifting, and this is a big deal for energy companies like Equinor. People are increasingly looking for ways to reduce their carbon footprint, which means a growing demand for cleaner energy options. This trend directly impacts how much energy is needed and which types of energy projects will be successful in the long run.

Equinor is paying close attention to this. They recognize that electricity is becoming more central to how we power our lives and industries. Their strategy reflects this by focusing on developing low-carbon solutions, especially for those sectors that are traditionally difficult to decarbonize, like heavy industry and long-haul transport.

- Growing demand for EVs: By the end of 2024, it's estimated that over 30 million electric vehicles will be on the road globally, a significant increase from previous years, signaling a major shift in transportation energy needs.

- Energy efficiency gains: In 2024, many countries are implementing stricter building codes and appliance standards, aiming for an average energy efficiency improvement of 2-3% annually in the residential and commercial sectors.

- Consumer willingness to pay: Surveys from early 2025 indicate that a majority of consumers in developed economies are willing to pay a premium of 5-10% for energy derived from renewable sources.

- Focus on electrification: Projections for 2025 show that electricity's share in total final energy consumption could reach over 25% in many advanced economies, up from around 20% in 2020.

Societal expectations are increasingly influencing Equinor's operations, pushing for greater environmental responsibility and a faster transition to renewable energy sources. Public and stakeholder pressure regarding climate change impacts Equinor's social license to operate, making transparency in decarbonization efforts critical. For instance, in 2023, Equinor reported a 1.2% reduction in upstream emissions intensity, a figure closely monitored by these groups.

Equinor's strategic allocation of capital reflects these societal shifts, with significant investments directed towards low-carbon solutions alongside traditional oil and gas. The company's 2023 capital expenditures of approximately $13 billion in renewables and low-carbon solutions, compared to $20 billion in oil and gas, highlights this balancing act, which remains a subject of public discussion.

The energy transition is reshaping the workforce, necessitating new skills in areas like offshore wind and hydrogen. Equinor is addressing this by investing in employee training, with thousands of employees targeted for reskilling in these emerging technologies by early 2024. Furthermore, by 2025, the demand for specialized talent in battery storage and digital solutions is projected to grow, prompting Equinor to forge university partnerships to secure this future workforce, evidenced by a 15% increase in recruitment for these roles in 2024.

Equinor's commitment to community engagement and ensuring a just transition is vital for maintaining its social license. By early 2025, the company's global renewable energy investments include substantial allocations for community development and local content initiatives, aiming to foster economic growth and skill development in operational areas.

Technological factors

Equinor is at the forefront of developing and implementing Carbon Capture and Storage (CCS) technologies, notably through its involvement in the Northern Lights project. This initiative is vital for reducing emissions from industries that are difficult to decarbonize, presenting a significant new market avenue.

The company is actively investing in expanding storage capacity for captured carbon. For instance, Northern Lights aims to store up to 1.5 million tonnes of CO2 per year initially, with plans for significant expansion. This focus on CCS is driven by the growing global demand for decarbonization solutions.

Equinor is heavily investing in offshore wind, particularly in floating offshore wind, which promises to unlock vast new energy resources. This technology is crucial for accessing deeper waters where fixed-bottom turbines aren't feasible.

Recent advancements are remarkable. For instance, by 2024, the average offshore wind turbine capacity is expected to exceed 15 MW, a significant leap from earlier models. This scaling directly translates to lower levelized costs of energy (LCOE), making offshore wind increasingly competitive with traditional power sources.

Equinor is actively pursuing electrification and efficiency upgrades within its oil and gas operations to slash carbon intensity. For instance, the company is deploying electric subsea tree systems, a move that significantly cuts down on the need for power generation from fossil fuels on offshore platforms. This technological shift is designed to make hydrocarbon production more sustainable by directly reducing operational emissions.

Hydrogen Production and Infrastructure Development

Equinor is actively pursuing opportunities in clean hydrogen production, aiming to utilize its existing offshore infrastructure and extensive operational expertise. This strategic focus positions the company to capitalize on the growing demand for low-carbon energy solutions.

The realization of a robust hydrogen economy hinges on significant technological progress across production, transportation, and storage. These advancements are crucial for overcoming current hurdles and unlocking the full potential of hydrogen as a clean energy carrier.

- Technological Advancements: Innovations in electrolysis, carbon capture for blue hydrogen, and efficient storage solutions are critical for cost-effective production.

- Infrastructure Needs: Developing specialized pipelines, liquefaction facilities, and refueling stations requires substantial investment and technological integration.

- Equinor's Role: Equinor's pilot projects, such as the H2H Saltend facility in the UK, demonstrate its commitment to scaling up hydrogen production and exploring new infrastructure models.

- Market Growth Projections: The global hydrogen market is projected to reach hundreds of billions of dollars by 2030, with clean hydrogen expected to capture a significant share, driven by supportive policies and technological improvements.

Digitalization and Data Analytics

Equinor is significantly leveraging digitalization and data analytics across its entire value chain. This integration is crucial for enhancing operational efficiency, from the initial stages of exploration and production to the management of its growing renewable energy portfolio. For instance, advanced analytics are employed to optimize drilling operations and predict equipment maintenance needs, thereby reducing downtime and costs. The company's commitment to digital transformation is evident in its substantial investments in research and development for cutting-edge digital solutions, directly supporting its strategic objectives in both traditional energy and new energy ventures.

The company's digital initiatives are designed to streamline processes and improve decision-making capabilities. By harnessing vast amounts of data, Equinor can identify patterns, forecast trends, and make more informed strategic choices. This data-driven approach is particularly vital in the complex and volatile energy markets, allowing Equinor to adapt quickly to changing conditions and capitalize on emerging opportunities. Their investment in digital technologies underscores a forward-looking strategy focused on innovation and sustainable growth.

- Digital Transformation Investment: Equinor has consistently invested in digital solutions, with a significant portion of its capital expenditure allocated to technology and data analytics capabilities as of 2024, aiming to boost productivity by an estimated 10-15% in key operational areas.

- AI and Machine Learning in Operations: The company utilizes AI and machine learning for predictive maintenance on offshore platforms, reducing unplanned downtime. In 2023, these initiatives contributed to a notable decrease in maintenance-related disruptions.

- Renewable Energy Data Management: Equinor is employing sophisticated data analytics to optimize the performance of its wind farms, including forecasting energy output and managing grid integration, which is critical for their expanding renewable energy segment.

- Exploration Efficiency: Data analytics are also applied to seismic data processing and reservoir modeling, enhancing the accuracy and efficiency of hydrocarbon exploration efforts, a key component of their integrated energy strategy.

Equinor's technological focus spans carbon capture, offshore wind, and hydrogen. The Northern Lights CCS project, aiming for 1.5 million tonnes of CO2 storage annually by 2025, highlights a commitment to decarbonization. In offshore wind, turbine capacity is projected to exceed 15 MW by 2024, driving down costs.

The company is also investing in clean hydrogen production, recognizing the need for technological advancements in electrolysis and storage. Digitalization is key, with AI and machine learning used for predictive maintenance, contributing to reduced downtime in 2023.

| Technology Area | Key Initiative/Advancement | Impact/Projection |

| Carbon Capture & Storage (CCS) | Northern Lights Project | Initial 1.5 million tonnes CO2 storage/year by 2025; growing market for decarbonization. |

| Offshore Wind | Floating Offshore Wind; Turbine Capacity | Accessing deeper waters; average turbine capacity >15 MW by 2024, lowering LCOE. |

| Hydrogen | Clean Hydrogen Production | Leveraging infrastructure; market growth projected to hundreds of billions by 2030. |

| Digitalization & AI | Predictive Maintenance, Data Analytics | Improved operational efficiency; reduced unplanned downtime in 2023; estimated 10-15% productivity boost. |

Legal factors

Equinor navigates a dense landscape of environmental rules, both global and local, covering everything from greenhouse gas emissions to how they handle waste and protect wildlife. Staying compliant with agreements like the Paris Agreement and specific EU directives is absolutely critical, directly shaping how they operate and where they invest their capital.

For instance, the EU's Emissions Trading System (ETS) is a major factor, with carbon prices fluctuating and impacting operational costs. In 2023, the average price for an EU ETS allowance hovered around €90 per tonne of CO2, a figure that directly influences Equinor's strategies for decarbonization and investment in renewable energy sources.

Equinor's sustainability reporting is increasingly shaped by legal mandates like the Corporate Sustainability Reporting Directive (CSRD). This directive, which came into full effect for many companies in early 2024, requires detailed reporting across environmental, social, and governance (ESG) areas, pushing for greater transparency.

The implementation of European Sustainability Reporting Standards (ESRS) under the CSRD framework means Equinor must provide more granular data on its impacts, risks, and opportunities. For instance, the ESRS E1 standard specifically addresses climate-related disclosures, demanding quantitative data on greenhouse gas emissions and transition plans.

These legal requirements directly influence Equinor's accountability, compelling the company to demonstrate its commitment to sustainability through verifiable disclosures. Failure to comply can lead to regulatory scrutiny and reputational damage, making adherence a critical operational factor.

Equinor's operations are heavily influenced by permitting and licensing laws, especially for new oil and gas fields and renewable energy installations. Securing these approvals is a complex, multi-stage process that can significantly affect project timelines and overall financial feasibility.

The energy sector, particularly offshore wind, has seen substantial impacts from regulatory uncertainty. For instance, in the United States, evolving permitting processes and potential legal challenges have caused delays and increased costs for several offshore wind projects, a trend Equinor closely monitors.

Anti-Corruption and Compliance Laws

Equinor, operating in numerous countries, must navigate a complex web of global anti-corruption and compliance laws. These regulations, such as the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, mandate strict adherence to prevent bribery and corruption in all business dealings. In 2023, Equinor reported that its compliance programs, including those focused on anti-corruption, were a critical component of its risk management framework, with ongoing training and audits conducted across its operations to ensure adherence.

Maintaining a strong code of conduct and effective anti-corruption programs is not merely a legal obligation but a fundamental requirement for Equinor's continued license to operate and its overall reputation. Failure to comply can result in severe penalties, including substantial fines and reputational damage, impacting investor confidence and market access. For instance, companies in the energy sector have faced multi-million dollar settlements for compliance breaches in recent years, underscoring the financial and operational risks involved. Equinor's commitment to transparency and ethical conduct is therefore paramount to its long-term sustainability.

- Global Reach, Local Laws: Equinor's international presence means compliance with diverse anti-corruption statutes is essential.

- Reputational Capital: Adherence to ethical standards directly impacts Equinor's brand image and stakeholder trust.

- Risk Mitigation: Robust compliance programs are vital to avoid legal penalties and operational disruptions.

- Industry Benchmarking: Equinor's compliance efforts are benchmarked against global best practices in the energy sector.

Contractual Obligations and Investment Protection

Equinor's vast operations are underpinned by a complex web of contractual obligations, spanning partnerships, supply chains, and government agreements. Legal certainty regarding these contracts and robust investment protection measures are paramount, particularly as policy landscapes and regulatory frameworks evolve, potentially altering project profitability.

The company's commitment to long-term projects, such as its significant offshore wind developments in the North Sea, relies heavily on the stability of these legal frameworks. For instance, in the UK, the Contracts for Difference (CfD) scheme provides a degree of revenue certainty, acting as a key investment protection mechanism for projects like the Dogger Bank wind farm, a joint venture where Equinor holds a significant stake. This legal structure is crucial for attracting the substantial capital required for such ventures.

- Contractual Dependencies: Equinor's portfolio includes numerous joint ventures and partnerships, necessitating clear contractual terms for revenue sharing, operational responsibilities, and dispute resolution.

- Investment Protection: Legal frameworks, including bilateral investment treaties and specific project agreements, safeguard Equinor's assets against adverse governmental actions or policy changes that could negatively impact project economics.

- Regulatory Compliance: Adherence to evolving environmental, safety, and energy regulations across different jurisdictions is a constant legal consideration, impacting operational costs and project viability.

- Dispute Resolution: Equinor actively manages potential legal disputes arising from contractual disagreements or regulatory challenges, employing arbitration and litigation as necessary to protect its interests.

Equinor's operations are deeply intertwined with evolving legal frameworks, particularly concerning environmental regulations and carbon pricing mechanisms. The EU Emissions Trading System (ETS) continues to be a significant factor, with allowance prices impacting operational costs and investment decisions in decarbonization efforts. For example, in early 2024, ETS prices remained robust, reinforcing the economic incentive for Equinor to invest in lower-emission technologies and renewable energy projects, such as its offshore wind developments.

Furthermore, the implementation of directives like the Corporate Sustainability Reporting Directive (CSRD) and the associated European Sustainability Reporting Standards (ESRS) mandates increased transparency in Equinor's environmental, social, and governance (ESG) disclosures. This legal requirement means Equinor must provide more detailed, quantitative data on its climate-related impacts and transition strategies, enhancing accountability for its sustainability performance.

Navigating a patchwork of international anti-corruption laws, including the U.S. Foreign Corrupt Practices Act and the UK Bribery Act, is crucial for Equinor's global operations. Maintaining robust compliance programs, as highlighted by Equinor's 2023 risk management framework, is essential to prevent bribery and corruption, thereby safeguarding its reputation and license to operate. The company's proactive approach to compliance aims to mitigate severe penalties, including significant fines, that have affected other energy sector players.

Environmental factors

Equinor, like many energy companies, is under significant pressure to decarbonize due to global climate change concerns. This translates into a strategic imperative to reduce greenhouse gas emissions across its operations and product portfolio.

The company has set ambitious targets, aiming to cut its operated greenhouse gas emissions by 50% by 2030 and achieve net-zero emissions by 2050. These goals are driving substantial investments into developing and deploying low-carbon solutions and expanding its renewable energy business.

In 2023, Equinor reported Scope 1 and 2 emissions intensity of 4.2 kg CO2e/boe, a reduction from previous years, reflecting ongoing efforts in decarbonization. The company's capital expenditure for renewables and low-carbon solutions is projected to increase significantly in the coming years, with a substantial portion of its 2024 capital budget allocated to these areas.

Equinor's extensive offshore and onshore operations, including oil and gas exploration and production, can significantly affect marine and terrestrial biodiversity and ecosystems. For instance, seismic surveys and physical infrastructure like platforms and pipelines can disrupt marine life, while onshore activities might impact land habitats.

The company has publicly stated its commitment to minimizing these negative environmental effects. This commitment is underpinned by its biodiversity position, which guides its practices to ensure responsible operations. Equinor aims to avoid, reduce, and mitigate impacts, and where impacts are unavoidable, to compensate for them.

In 2023, Equinor reported investing approximately $1.5 billion in renewable energy projects, a move intended to transition away from fossil fuels and thereby lessen the long-term impact on ecosystems. This strategic shift reflects a growing awareness and response to the environmental pressures associated with traditional energy extraction.

Equinor's operations continue to be heavily influenced by carbon emissions from its oil and gas production. Despite a stated commitment to diversification, a substantial portion of its energy output still originates from fossil fuels. This reliance directly translates into significant Scope 1, 2, and 3 emissions, a critical environmental challenge for the company.

A primary environmental objective for Equinor is to reduce the carbon intensity associated with its oil and gas extraction. Key strategies include the electrification of offshore platforms, which aims to replace gas turbines with renewable power sources, and ongoing efforts to enhance operational efficiency across its production sites.

In 2023, Equinor reported Scope 1 and 2 emissions intensity of 0.6 kg CO2e per boe for its oil and gas production. The company has set targets to reduce this intensity, aiming for below 0.5 kg CO2e per boe by 2030.

Renewable Energy's Environmental Footprint

While renewable energy is key to the energy transition, it's not without its environmental considerations. Offshore wind farms, for instance, can affect marine ecosystems and alter visual landscapes. Equinor, as a major player, needs to proactively manage these impacts through meticulous planning and effective mitigation measures.

Equinor is investing heavily in reducing its environmental impact. In 2023, the company reported a 12% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to 2022, reaching 6.0 kg CO2 equivalent per boe. This commitment extends to its renewable projects, where environmental impact assessments are standard practice.

- Marine Life Protection: Equinor employs measures like noise reduction during construction and monitoring programs to minimize disruption to marine mammals and fish populations.

- Visual Impact Management: Site selection and turbine design are considered to reduce visual intrusion on coastlines and local communities.

- Biodiversity Offsetting: For unavoidable impacts, Equinor explores biodiversity offsetting schemes to compensate for habitat loss.

- Circular Economy Principles: The company is increasingly focusing on recycling and reusing materials from its renewable energy infrastructure.

Carbon Capture and Storage (CCS) as a Mitigation Tool

Carbon Capture and Storage (CCS) is a crucial environmental mitigation strategy for Equinor, focusing on capturing and permanently storing CO2 from industrial operations. The expansion of initiatives like the Northern Lights project is paramount for decarbonizing challenging sectors.

Equinor's commitment to CCS is underscored by its significant investments and participation in large-scale projects. For instance, the Northern Lights project, a joint venture with TotalEnergies and Shell, aims to transport and permanently store CO2 captured from industrial customers across Europe. This project is expected to have a storage capacity of 1.5 million tonnes of CO2 per year initially, with potential for expansion.

- Northern Lights Project: Equinor is a key partner in this pioneering CCS project in Norway, which began initial operations in 2024.

- Decarbonization of Hard-to-Abate Sectors: CCS is vital for industries like cement and steel production, where emissions are difficult to eliminate through other means.

- Regulatory Support: Government policies and incentives, particularly in Europe, are crucial for the economic viability and scaling of CCS technologies.

Equinor faces significant environmental pressures, particularly concerning greenhouse gas emissions from its oil and gas operations. The company has set targets to reduce its emissions intensity, aiming for below 0.5 kg CO2e per boe for oil and gas production by 2030, down from 0.6 kg CO2e per boe in 2023.

The company's investments in renewables are growing, with approximately $1.5 billion allocated in 2023. However, renewable projects like offshore wind farms also present environmental considerations, such as impacts on marine ecosystems and visual landscapes, which Equinor aims to manage through careful planning and mitigation.

Carbon Capture and Storage (CCS) is a key strategy, exemplified by the Northern Lights project, which began initial operations in 2024 and is designed to store CO2 from industrial sources. This technology is crucial for decarbonizing hard-to-abate sectors, supported by evolving European regulatory frameworks.

| Environmental Factor | 2023 Data/Initiatives | 2024/2025 Outlook/Targets |

| Greenhouse Gas Emissions Intensity (Oil & Gas) | 0.6 kg CO2e/boe | Target: Below 0.5 kg CO2e/boe by 2030 |

| Renewable Energy Investment | ~$1.5 billion | Continued significant investment |

| CCS Projects | Northern Lights project initial operations | Expansion of CCS capacity and application |

| Biodiversity Management | Noise reduction, monitoring programs, site selection | Focus on circular economy principles, biodiversity offsetting |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Equinor draws from a comprehensive range of data, including reports from international energy agencies, government policy documents, and reputable financial news outlets. This ensures a robust understanding of the political, economic, and social landscapes impacting the company.