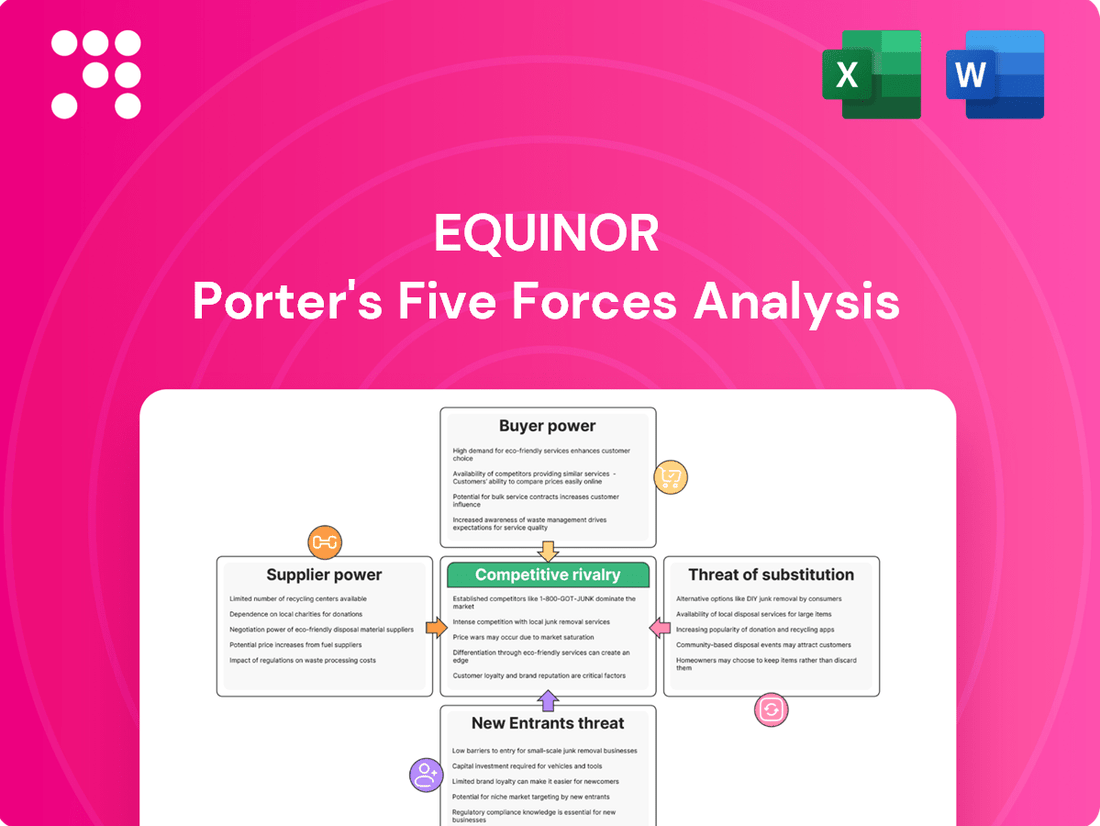

Equinor Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equinor Bundle

Equinor navigates a complex energy landscape, facing significant pressure from powerful buyers and intense rivalry among established players. Understanding the threat of substitutes and the bargaining power of suppliers is crucial for their strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Equinor’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Equinor's reliance on highly specialized technology and equipment for its intricate oil, gas, and renewable energy operations, including deep-water drilling and offshore wind, highlights the significant bargaining power of its suppliers. The unique and often proprietary nature of these critical components, such as advanced subsea production systems, grants these suppliers substantial leverage.

The immense switching costs associated with these specialized items, encompassing potential operational downtime, extensive retraining requirements, and complex integration challenges, further solidify the suppliers' advantageous position. For instance, the cost of replacing a custom-built offshore wind turbine component could run into millions, impacting project timelines and budgets significantly.

In the energy sector, especially in offshore and renewable areas, there's a significant need for highly skilled workers like engineers, geologists, and project managers. This specialized talent is in high demand, giving providers of these human resources and consulting services considerable leverage. For instance, the global shortage of experienced offshore wind engineers is a well-documented challenge, driving up recruitment costs for companies like Equinor.

Suppliers of environmental and compliance services wield significant bargaining power over Equinor. This is due to the increasing complexity and stringency of environmental regulations globally, coupled with Equinor's own ambitious sustainability targets. Companies providing specialized services like carbon capture, emissions monitoring, and waste management are essential for Equinor to operate legally and ethically. For instance, in 2024, Equinor continued to invest heavily in projects aimed at reducing its carbon footprint, increasing reliance on these specialized service providers.

Raw Material and Component Suppliers (e.g., Steel, Composites)

Equinor's reliance on raw material and component suppliers for essential materials like steel and advanced composites in its large-scale projects, such as offshore platforms and wind turbines, highlights a significant bargaining power for these suppliers. The global commodity prices for these materials, which can be volatile, directly influence Equinor's project expenditures and schedules.

Supply chain disruptions or a concentrated supplier base for critical components can further amplify supplier leverage. For instance, the price of steel, a fundamental material for offshore structures, saw significant increases throughout 2021 and into early 2022, impacting capital expenditure for many energy companies.

- Steel prices: Global benchmark hot-rolled coil steel prices in early 2024 hovered around $700-$800 per metric ton, a notable increase from pre-pandemic levels, affecting project cost estimations.

- Composite materials: The specialized nature of advanced composites used in wind turbine blades means a limited number of manufacturers, granting them considerable pricing power.

- Supply chain fragility: Geopolitical events and logistical challenges can create bottlenecks, giving dominant suppliers more control over availability and pricing for Equinor.

Digital and Cybersecurity Solution Providers

The bargaining power of digital and cybersecurity solution providers for Equinor is growing. As the energy sector relies more heavily on advanced IT, data analytics, and AI for efficiency and risk mitigation, these specialized suppliers hold significant sway. For instance, the global cybersecurity market was projected to reach $231.7 billion in 2024, highlighting the demand and value of these critical services.

- Criticality of Digital Services: Equinor's push for digital transformation in operations and risk management makes reliable IT infrastructure and data analytics indispensable.

- Specialized Expertise: The complex and evolving nature of AI and cybersecurity requires highly specialized skills, limiting the pool of qualified providers.

- Supplier Influence: This specialization grants suppliers leverage, particularly in negotiating terms for long-term contracts and ensuring robust data security protocols.

Equinor faces considerable bargaining power from suppliers of specialized equipment and technology, particularly in its offshore oil, gas, and renewable energy ventures. The proprietary nature of these critical components, such as advanced subsea systems and offshore wind turbine parts, combined with high switching costs, grants suppliers significant leverage. For example, the cost of replacing custom-built offshore wind components can easily reach millions, impacting project timelines and budgets.

The demand for highly skilled labor in the energy sector, especially for roles like offshore wind engineers, also empowers human resource and consulting service providers. A global shortage of these specialists drives up recruitment costs for companies like Equinor, as evidenced by the ongoing challenges in securing experienced talent in 2024.

Environmental and compliance service providers also hold substantial bargaining power due to increasingly stringent regulations and Equinor's own sustainability goals. Services like carbon capture and emissions monitoring are vital, and Equinor's continued investment in these areas in 2024 underscores their reliance on these specialized firms.

Suppliers of essential raw materials, such as steel and advanced composites, wield significant influence due to price volatility and supply chain concentration. Global steel prices in early 2024 remained elevated, impacting capital expenditures for large-scale projects, while a limited number of advanced composite manufacturers for wind turbine blades further solidify their pricing power.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Equinor | Relevant Data/Example (2024) |

| Specialized Equipment (Offshore/Renewables) | Proprietary technology, high switching costs | Increased project costs, potential delays | Cost of replacing custom offshore wind components can be millions. |

| Skilled Labor Providers | Shortage of specialized talent (e.g., offshore wind engineers) | Higher recruitment and labor costs | Global shortage of experienced offshore wind engineers continues to drive up demand and wages. |

| Environmental & Compliance Services | Stringent regulations, sustainability targets | Essential for legal operation, increased reliance on specialized services | Equinor's 2024 investments in carbon reduction highlight dependence on these providers. |

| Raw Materials (Steel, Composites) | Price volatility, concentrated supplier base | Impacts capital expenditure and project scheduling | Steel prices in early 2024 remained elevated; limited composite manufacturers for wind blades. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Equinor's position in the energy sector.

Instantly identify and mitigate competitive threats with a dynamic, interactive model of Equinor's Porter's Five Forces.

Customers Bargaining Power

Equinor's customers, particularly in its core oil and gas business, have limited bargaining power over prices. This is because Equinor operates in a global commodity market where pricing is dictated by broad supply and demand, geopolitical factors, and decisions by groups like OPEC+. For instance, Brent crude oil prices, a key benchmark for Equinor, experienced significant volatility in 2024, influenced by ongoing global conflicts and production adjustments.

While customers can switch suppliers, their ability to negotiate lower prices is constrained by these overarching market forces. Equinor's substantial role as a natural gas supplier to Europe, a market it heavily influences, offers some pricing stability but doesn't shield it entirely from market fluctuations. In 2024, European natural gas prices remained sensitive to supply chain disruptions and energy transition policies.

Equinor's large industrial and utility customers, such as major manufacturers and national power grids, buy substantial quantities of energy. In 2024, these buyers can exert some influence through their large purchase volumes, potentially securing better pricing or contract conditions. However, the essential nature of consistent energy supply means these customers often have limited options for quickly switching to alternative suppliers, especially when their operations are deeply integrated with specific energy sources.

Governments and regulatory bodies function as significant indirect customers for Equinor, shaping the energy landscape through policies, environmental mandates, and taxation. These entities influence everything from project approvals to the cost of operations, directly impacting Equinor's financial performance and strategic direction. For instance, in 2024, many governments continued to implement carbon pricing mechanisms and renewable energy subsidies, creating both opportunities and challenges for oil and gas companies like Equinor.

Emerging Demand for Lower-Carbon Energy Solutions

Customers, especially in Europe, are increasingly demanding lower-carbon energy options. This shift in preference directly impacts Equinor, pushing it to accelerate its transition towards more sustainable energy sources. For instance, by the end of 2023, Equinor's renewable energy production capacity had grown significantly, reflecting this customer-driven demand.

The growing appetite for renewable electricity, hydrogen, and carbon capture technologies empowers customers focused on decarbonization. This influence can steer Equinor's investment strategies and portfolio development towards greener solutions. In 2024, Equinor announced further investments in offshore wind projects, a direct response to this escalating customer demand for clean energy.

- Growing customer preference for sustainability

- Increased demand for renewable energy and decarbonization solutions

- Potential to drive Equinor's investment in green technologies

- Influence on Equinor's portfolio adjustments towards low-carbon offerings

Long-term Contracts and Strategic Partnerships

Equinor frequently enters into long-term agreements for natural gas supply, and this trend is expanding into renewable energy sources. These commitments offer predictable income streams but can restrict Equinor's ability to adjust prices if market dynamics shift unexpectedly. For instance, as of early 2024, a significant portion of Equinor's gas sales were under multi-year contracts, providing a baseline revenue but also locking in certain price points.

Strategic alliances, particularly in the development of new energy ventures, foster interdependence. These joint ventures can effectively balance the negotiating leverage between Equinor and its partners. An example is Equinor's participation in offshore wind projects, where shared investment and operational responsibilities create a more symmetrical power dynamic.

- Long-term contracts provide revenue stability but can reduce pricing flexibility.

- Strategic partnerships create mutual dependencies, influencing bargaining power.

- Equinor's 2023 financial reports indicated a substantial portion of its revenue derived from long-term gas supply agreements.

- The growth in renewable energy partnerships signifies a shift towards shared risk and reward, impacting customer power.

While individual customers have limited power in the global commodity market, large industrial buyers and governments, acting as significant customers, can exert influence. Equinor's long-term contracts offer some price stability but also limit flexibility. The increasing demand for sustainable energy is a key driver, pushing Equinor towards greener investments.

| Customer Type | Bargaining Power Factors | 2024/2023 Data Points |

|---|---|---|

| Individual Consumers | Low; commodity pricing, limited switching options | Global oil prices fluctuate based on geopolitical events. |

| Industrial/Utility Buyers | Moderate; large volumes, essential need limits quick switching | Equinor's 2023 revenue from gas sales to large customers was substantial. |

| Governments/Regulators | High; policy, environmental mandates, taxation | Continued implementation of carbon pricing and renewable energy subsidies in 2024. |

| Sustainability-Focused Customers | Growing; demand for low-carbon solutions | Equinor's renewable energy capacity grew significantly by end-2023. |

What You See Is What You Get

Equinor Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Equinor, detailing the competitive landscape and strategic implications for the energy giant. You're looking at the actual document, which will be instantly accessible for download and use upon purchase, ensuring you receive the full, professionally formatted analysis without any placeholders or surprises.

Rivalry Among Competitors

Equinor operates in a highly competitive landscape, facing formidable rivals in both global integrated oil and gas majors (IOCs) and national oil companies (NOCs). IOCs such as Shell, BP, ExxonMobil, and TotalEnergies, along with NOCs like Saudi Aramco and ADNOC, vie for exploration rights, production optimization, and market dominance. This intense rivalry is driven by the pursuit of efficiency and innovation in a market that remains crucial yet subject to significant price fluctuations.

Equinor's expansion into renewables intensifies its rivalry with dedicated renewable energy developers. Companies like Ørsted, a global leader in offshore wind, and other specialized developers are well-entrenched, possessing deep expertise and established supply chains in this sector. This creates a significant competitive pressure as Equinor navigates a landscape where these players are already optimized for green energy projects.

The renewable energy segment, particularly offshore wind, is characterized by rapid technological progress and a dynamic policy environment. This fast-paced evolution means that companies must constantly innovate and adapt to secure project development rights and maintain a competitive edge. For Equinor, this translates into a new arena of intense competition, distinct from its traditional oil and gas operations.

Utilities with a strong focus on green energy also represent a growing competitive force. These companies are increasingly investing in and developing renewable energy assets, often with established customer bases and regulatory relationships. Their sole dedication to the green transition positions them as formidable rivals to integrated energy companies like Equinor as they vie for market share and project opportunities.

The energy transition necessitates substantial capital, placing Equinor in direct competition with other energy giants and diverse industries for investor funding. Companies showcasing robust strategies for both established and emerging energy sectors are drawing significant attention from the investment community.

This intense competition for capital directly shapes Equinor's strategic investment choices, compelling a focus on projects promising the highest returns amidst prevailing market volatility. For instance, in 2023, global energy investment reached an estimated $2.8 trillion, highlighting the sheer scale of capital available but also the fierce bidding for it.

Geopolitical Factors and Market Volatility

The energy sector, and by extension Equinor's competitive landscape, is deeply impacted by geopolitical events. Tensions in oil-producing regions or conflicts can lead to sudden supply disruptions, causing price spikes and increased market volatility. For instance, ongoing geopolitical instability in Eastern Europe has continued to influence global energy markets throughout 2024, affecting supply routes and demand forecasts.

This inherent volatility intensifies the rivalry among energy companies. Those with robust financial health and diversified operations, such as Equinor, are more resilient. Equinor's strategic focus on offshore wind and low-carbon solutions in addition to its traditional oil and gas business provides a buffer against the sharpest swings in fossil fuel markets. However, all participants must remain agile, constantly adjusting strategies in response to evolving energy security concerns and international relations.

- Geopolitical Instability: Events like the ongoing conflict in Eastern Europe directly impact global energy supply chains and pricing, creating a more volatile operating environment for all energy firms.

- Supply Disruptions: Geopolitical tensions can lead to sudden interruptions in oil and gas flows, forcing companies to secure alternative sources and manage fluctuating availability.

- Energy Security Focus: Governments worldwide are prioritizing energy security, influencing national energy policies and creating a dynamic competitive landscape where reliability and diversification are key.

- Market Reactivity: Companies must constantly monitor and react to shifting global dynamics, including trade policies and international agreements, to maintain their competitive edge.

Talent Acquisition and Technological Innovation Race

The competition isn't just about oil and gas anymore; it's a fierce race to attract and keep the best minds in both traditional and emerging energy fields. Companies that excel at innovation, whether in making extraction more efficient or developing cleaner energy solutions, are pulling ahead. Equinor, for instance, is heavily investing in research and development, with a significant portion of its 2024 capital expenditure directed towards digital solutions and new energy technologies, aiming to secure a technological advantage.

This talent and innovation race is a critical factor influencing the competitive landscape. Companies are vying for experts in areas like AI, carbon capture, and offshore wind development. Equinor's commitment to digital transformation, including its use of advanced analytics and automation in its operations, underscores the importance of technological prowess in maintaining a competitive edge.

- Talent Attraction: Equinor actively recruits across disciplines like data science, renewable energy engineering, and geosciences to build a skilled workforce for both existing and future energy needs.

- Technological Edge: Investments in areas such as offshore wind turbine technology and carbon capture utilization and storage (CCUS) are key differentiators.

- R&D Spending: Equinor's ongoing investment in research and development, including its digital initiatives, is vital for developing and deploying innovative solutions.

- Competitive Advantage: Companies that successfully integrate cutting-edge technology and attract top talent are better positioned to navigate the energy transition and achieve sustainable growth.

Equinor faces intense rivalry from both established oil and gas giants and emerging renewable energy players, creating a complex competitive environment. This competition extends to securing capital, with global energy investments reaching approximately $2.8 trillion in 2023, highlighting the fierce bidding for funding. Geopolitical events, such as ongoing conflicts, further exacerbate market volatility, forcing companies to adapt strategies for energy security and supply chain resilience.

The race for talent and technological innovation is a critical battleground, with companies like Equinor investing heavily in R&D and digital solutions. For example, Equinor's 2024 capital expenditure includes significant allocations for AI and new energy technologies to gain a competitive edge. This focus on innovation is essential for companies aiming to thrive amidst the energy transition and evolving market demands.

SSubstitutes Threaten

The escalating adoption of renewable energy sources presents a significant threat of substitution for Equinor's core oil and gas business. Renewables like solar and wind are becoming increasingly cost-competitive, directly impacting the demand for traditional fossil fuels.

In 2024, global investment in renewable energy is projected to reach unprecedented levels, surpassing traditional energy investments. This trend, driven by decarbonization goals and technological advancements, means a growing portion of energy needs can be met without Equinor's products.

The increasing adoption of electric vehicles (EVs) poses a significant threat to Equinor's traditional fuel business. By the end of 2023, global EV sales surpassed 13.6 million units, a substantial increase from previous years, indicating a clear shift in consumer preference and a potential decline in demand for gasoline and diesel. This trend directly impacts Equinor's revenue streams from its refining and marketing operations, as the market for internal combustion engine fuels contracts.

Furthermore, advancements in alternative transportation fuels, such as hydrogen and advanced biofuels, introduce another layer of substitution. While still in earlier stages of widespread adoption compared to EVs, these technologies offer further pathways to decarbonize transportation, potentially eroding demand for Equinor's existing product portfolio. For instance, investments in hydrogen infrastructure are growing, with many countries setting ambitious targets for its use in heavy transport and industry, creating a long-term challenge for Equinor's reliance on oil and gas.

Advancements in energy efficiency technologies act as a significant substitute threat to Equinor. Innovations in areas like smart grids, advanced insulation, and more efficient appliances are reducing the overall demand for energy across all sectors.

For instance, the International Energy Agency reported in 2023 that energy efficiency measures saved the equivalent of 2.5 billion tonnes of oil consumption globally in 2022. This ongoing trend means that less energy is required for the same level of economic activity, directly impacting the volume of energy products Equinor sells.

Hydrogen as an Emerging Energy Carrier

Green and blue hydrogen are rapidly developing as viable alternatives to natural gas, particularly for demanding applications like industrial heat, residential heating, and heavy-duty transportation. This shift presents a significant threat of substitutes for traditional energy providers.

Equinor's strategic investments in hydrogen production, such as its plans for a blue hydrogen plant in Haxby, UK, position it to capitalize on this emerging market. However, the very success of hydrogen as a widespread energy carrier could directly reduce demand for Equinor's existing natural gas portfolio, which remains a core revenue stream.

The International Energy Agency (IEA) reported in its 2024 Hydrogen Report that global hydrogen production capacity is growing, with significant investments in low-carbon hydrogen projects. For instance, by the end of 2023, over 1,400 projects valued at over $700 billion were announced globally, aiming to produce low-carbon hydrogen.

- Growing Hydrogen Investments: Global announcements for low-carbon hydrogen projects exceeded $700 billion by the end of 2023, indicating a strong market push.

- Potential Gas Displacement: Widespread adoption of hydrogen in heating and industry could erode demand for natural gas, impacting Equinor's core business.

- Strategic Opportunity and Risk: Equinor's hydrogen ventures offer growth potential but also carry the risk of cannibalizing its established gas sales if market transition is rapid.

Carbon Capture, Utilization, and Storage (CCUS) as a Mitigator/Substitute

The threat of substitutes for Equinor, particularly concerning Carbon Capture, Utilization, and Storage (CCUS), presents a nuanced challenge. While Equinor is a leader in CCUS development, the wider industrial adoption of this technology could decrease the demand for unabated fossil fuels. This means that industries might opt for 'cleaner' fossil energy enabled by CCUS rather than a complete transition to renewables, directly impacting Equinor's core business.

For sectors with high emissions, CCUS can serve as an alternative to a full shift towards renewable energy sources. This could potentially slow down the long-term demand erosion for traditional oil and gas products. For instance, by 2024, several large-scale CCUS projects are operational or under construction globally, demonstrating the growing viability of this substitute technology.

- Growing CCUS Investment: Global investment in CCUS is projected to reach billions of dollars annually by 2030, indicating a significant market for this substitute technology.

- Industry Adoption: Industries like cement and steel are exploring CCUS as a decarbonization pathway, potentially reducing their reliance on purely renewable alternatives and thus impacting fossil fuel demand.

- Policy Support: Government incentives and regulations supporting CCUS deployment further strengthen its position as a viable substitute for outright renewable energy adoption in certain high-emission sectors.

The increasing cost-competitiveness and widespread adoption of renewable energy sources like solar and wind pose a direct threat of substitution to Equinor's oil and gas business. Global investment in renewables is projected to hit record highs in 2024, signaling a growing capacity to meet energy demands without fossil fuels.

Electric vehicles (EVs) are rapidly gaining market share, with global sales exceeding 13.6 million units by the end of 2023, directly impacting Equinor's fuel markets. Furthermore, advancements in hydrogen and biofuels offer alternative pathways for decarbonizing transportation, potentially reducing long-term demand for Equinor's products.

Energy efficiency technologies are also a significant substitute, with measures saving an estimated 2.5 billion tonnes of oil equivalent globally in 2022. This trend reduces overall energy consumption, impacting the volume of energy products Equinor sells.

The rise of green and blue hydrogen as alternatives for heating and industrial processes presents another substitution threat to natural gas. Global investment in low-carbon hydrogen projects surpassed $700 billion by the end of 2023, with significant growth in production capacity.

| Substitute Technology | 2023/2024 Data Point | Impact on Equinor |

|---|---|---|

| Renewable Energy Investment | Projected record high in 2024 | Reduces demand for fossil fuels |

| Electric Vehicles (EVs) | 13.6 million+ units sold globally (end of 2023) | Decreases demand for gasoline and diesel |

| Energy Efficiency | Saved 2.5 billion tonnes of oil equivalent (2022) | Lowers overall energy consumption |

| Hydrogen | >$700 billion in announced projects (end of 2023) | Threatens natural gas demand in heating and industry |

Entrants Threaten

The energy sector, especially oil and gas exploration and massive offshore wind developments, demands enormous capital, often billions of dollars, before any revenue is generated. For instance, developing a single offshore wind farm can cost upwards of $10 billion. This immense financial hurdle acts as a powerful deterrent, as only a select few entities can muster the necessary funds to even consider entering the market, effectively shielding incumbents like Equinor.

New entrants into the energy sector, particularly for a company like Equinor, face substantial regulatory hurdles. These include intricate permitting processes for exploration and production, adherence to stringent environmental standards, and compliance with a complex web of international energy laws. For instance, securing approval for offshore projects can take many years and involve extensive environmental impact assessments, significantly increasing the upfront cost and time to market.

Equinor's deep-rooted presence in the energy sector means it already possesses vast, integrated infrastructure. This includes an extensive network of pipelines for transporting oil and gas, sophisticated processing facilities, and established global distribution channels. For any new player looking to enter the market, replicating this level of infrastructure is a monumental challenge, requiring billions in investment and years of development.

This existing infrastructure acts as a formidable barrier to entry. New entrants would face immense capital expenditure to build comparable facilities or the significant cost of acquiring access to existing networks. For instance, the cost to build a new offshore platform or a long-distance pipeline can easily run into the billions of dollars, a hurdle that deters many potential competitors, especially in the traditional oil and gas exploration and production segments.

Technological Complexity and Specialized Expertise

The oil and gas sector, including Equinor's operations, is characterized by immense technological complexity. From deep-sea exploration to advanced drilling techniques, a high degree of specialized knowledge and cutting-edge technology is essential. This creates a significant barrier for potential new entrants who would need substantial investment in both technology and talent acquisition to compete effectively.

Furthermore, Equinor's increasing focus on renewable energy, such as offshore wind farms, also presents considerable technical hurdles. Developing and managing these projects requires expertise in areas like marine engineering, advanced materials science, and sophisticated grid integration systems. For instance, the development of floating offshore wind technology, a key area for Equinor, demands highly specialized engineering capabilities that are not easily replicated.

- High Capital Investment: New entrants face substantial upfront costs for acquiring or developing the necessary advanced technologies and infrastructure.

- Skilled Workforce Requirements: The industry demands a highly skilled workforce with specialized expertise in areas like geosciences, petroleum engineering, and renewable energy technologies.

- Regulatory Hurdles: Navigating complex environmental and safety regulations in both traditional and renewable energy sectors adds another layer of difficulty for new players.

- Research and Development Intensity: Continuous innovation and adaptation to new technologies require significant and ongoing investment in R&D, which can be prohibitive for newcomers.

Brand Recognition and Long-Standing Customer Relationships

In the energy sector, particularly for a company like Equinor, brand recognition and deeply entrenched customer relationships act as significant barriers to new entrants. These established connections, often built over decades, are crucial in a market where energy security and reliability are non-negotiable. Newcomers face a steep uphill battle to gain the trust and reputation needed to secure substantial contracts with national governments and major industrial consumers.

For instance, in 2024, major energy supply contracts are typically awarded through lengthy and rigorous tendering processes that favor proven track records. Equinor, as a long-standing supplier, benefits from this established trust. Building a comparable level of credibility and market penetration would likely require years and substantial investment, making it difficult for new entrants to immediately compete for these vital agreements.

- Brand Loyalty: Equinor's history fosters a sense of reliability among its customer base.

- Government Contracts: Long-standing relationships with governments facilitate access to critical energy infrastructure projects.

- Industrial Partnerships: Established ties with large industrial users create a stable demand base.

- Reputational Capital: Decades of operation have built a reputation for consistent energy delivery.

The threat of new entrants for Equinor remains relatively low due to the immense capital requirements, estimated to be in the tens of billions for large-scale projects like offshore wind farms or new oil and gas fields. This financial barrier, coupled with the extensive time needed for regulatory approvals, which can span several years, significantly deters potential newcomers. Furthermore, Equinor's established, integrated infrastructure and deep technological expertise, particularly in complex areas like floating offshore wind, present formidable challenges for any new player attempting to gain a foothold in the market.

| Barrier Type | Description | Impact on New Entrants | Example (2024) |

|---|---|---|---|

| Capital Requirements | Billions required for exploration, infrastructure, and technology. | Extremely High | A single offshore wind project can exceed $10 billion. |

| Regulatory Complexity | Intricate permitting, environmental standards, and international laws. | High | Offshore project approvals can take many years and significant investment. |

| Infrastructure & Technology | Existing pipelines, facilities, and specialized knowledge. | Very High | Replicating Equinor's global distribution network is a multi-billion dollar undertaking. |

| Brand & Relationships | Established trust, long-term contracts, and government ties. | High | Securing major supply contracts in 2024 favors proven track records. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Equinor is built upon a robust foundation of data, incorporating information from Equinor's annual reports and investor presentations, alongside industry-specific market research from firms like Rystad Energy and Wood Mackenzie. We also leverage public financial databases and regulatory filings to provide a comprehensive view of the competitive landscape.