Equinor Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equinor Bundle

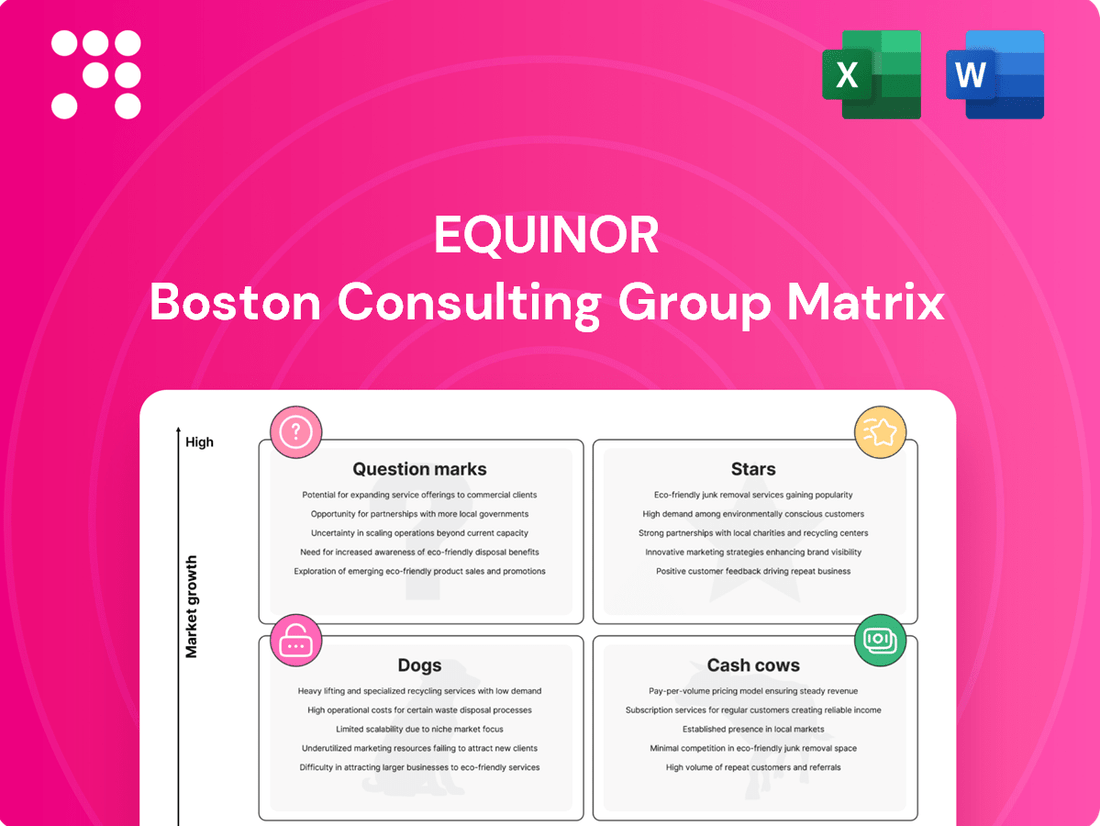

Explore the strategic positioning of Equinor's diverse portfolio through our comprehensive BCG Matrix analysis. Understand which ventures are driving growth, generating stable returns, or requiring careful consideration.

This insightful preview highlights the core of Equinor's market strategy, but to truly unlock its potential and make informed decisions, you need the full picture. Purchase the complete BCG Matrix for detailed quadrant analysis, actionable insights, and a clear roadmap to optimizing your investments.

Stars

The Johan Castberg field, a major new oil and gas venture in the Barents Sea, is poised to become a significant contributor to Equinor's portfolio.

This development is expected to reach a peak production of 220,000 barrels per day by mid-2025, a remarkable achievement occurring just three months after its initial startup.

The field's operational lifespan is projected to extend for at least 30 years, underscoring its long-term value and its role in bolstering Arctic energy security.

Its efficient ramp-up highlights Equinor's expertise in managing complex, large-scale projects in challenging new territories.

Equinor's U.S. onshore gas assets are performing exceptionally well, demonstrating significant output growth from recent acquisitions. This expansion not only diversifies the company's geographic footprint but also provides a reliable stream of cash.

In the second quarter of 2025, production from these U.S. onshore gas operations surged by 50% year-over-year. This impressive volume increase was coupled with a substantial rise in realized gas prices, which were nearly 80% higher compared to the prior year's second quarter.

The robust performance and promising growth prospects within the North American market firmly place these U.S. onshore gas assets as a star performer in Equinor's portfolio, indicating strong future potential.

Dogger Bank, the world's largest offshore wind farm located in the UK, is a significant asset for Equinor. As of late 2024, the project is moving towards its commercial start-up, with initial production phases contributing to Equinor's growing renewable power portfolio. This massive undertaking underscores Equinor's commitment and leadership in the burgeoning offshore wind industry.

Bałtyk 2 & 3 Offshore Wind Projects

The Bałtyk 2 and Bałtyk 3 offshore wind projects in Poland have reached a significant milestone by securing financial close, with a substantial financing package totaling EUR 6 billion. This financial backing is crucial as these projects, collectively expected to deliver 1.4 GW of capacity, are now moving into critical implementation stages.

These developments are poised to drive substantial activity, with intense construction and operational phases anticipated throughout 2025. The successful financing underscores the projects' viability and Equinor's strategic positioning within the expanding European offshore wind sector.

- Project Capacity: 1.4 GW (combined for Bałtyk 2 & 3)

- Financing Secured: EUR 6 billion

- Key Activity Period: 2025 (construction and operations)

- Market Context: Growing European offshore wind market

Northern Lights Carbon Capture and Storage (Phase 2)

Equinor's Northern Lights project, a significant carbon capture and storage (CCS) initiative, has advanced with a final investment decision for Phase 2. This expansion is set to boost its CO2 storage capacity to 5 million tons annually, underscoring its role in decarbonizing challenging industrial sectors.

This project is a key player in the developing market for low-carbon solutions. By addressing emissions from hard-to-abate industries, Northern Lights Phase 2 exemplifies Equinor's dedication to sustainability and its strategic positioning within the energy transition.

- Project Expansion: Phase 2 of Northern Lights will increase CO2 storage capacity to 5 million tons per year, up from Phase 1's initial 1.5 million tons.

- Market Position: The project targets a high-growth market for CCS, crucial for sectors like cement and chemicals.

- Investment: The final investment decision signifies substantial capital commitment to scaling up CCS infrastructure.

- Strategic Importance: Northern Lights is a cornerstone of Equinor's strategy to develop and offer decarbonization solutions.

The Johan Castberg field, with its projected peak production of 220,000 barrels per day by mid-2025, is a prime example of a Star asset for Equinor. Its long operational lifespan of at least 30 years and efficient ramp-up in challenging Arctic conditions highlight its strong market position and growth potential. Similarly, Equinor's U.S. onshore gas assets, showing a 50% year-over-year production surge in Q2 2025 and nearly 80% higher gas prices, are clearly Stars due to their exceptional performance and diversification benefits.

| Asset | Type | Key Metric | Status/Projection | BCG Category |

|---|---|---|---|---|

| Johan Castberg | Oil & Gas | Peak Production: 220,000 bpd | Mid-2025 | Star |

| U.S. Onshore Gas | Gas | Production Growth: +50% YoY (Q2 2025) | Strong Performance | Star |

| Dogger Bank | Offshore Wind | World's Largest Offshore Wind Farm | Approaching Commercial Start-up (Late 2024) | Star |

| Bałtyk 2 & 3 | Offshore Wind | Capacity: 1.4 GW | EUR 6 Billion Financing Secured, Construction 2025 | Star |

| Northern Lights (Phase 2) | CCS | CO2 Storage: 5 million tons/year | Final Investment Decision, Scaling Up | Star |

What is included in the product

This BCG Matrix overview for Equinor highlights which business units to invest in, hold, or divest based on market growth and share.

A clear visual of Equinor's business units, categorized by market growth and share, alleviates the pain of strategic uncertainty.

Cash Cows

The Norwegian Continental Shelf (NCS) is a cornerstone of Equinor's operations, characterized by robust production from key fields like Johan Sverdrup and Troll. This mature region consistently delivers substantial cash flow, acting as a vital engine for Equinor's growth and shareholder returns.

In 2023, Equinor's equity production from the NCS averaged approximately 1.2 million barrels of oil equivalent per day (mboepd), highlighting its significance. The NCS's stable output and efficient operations generate significant free cash flow, estimated to be in the tens of billions of dollars annually, which is crucial for funding new energy ventures and capital distributions.

The Johan Sverdrup field is a prime example of Equinor's cash cows, consistently delivering exceptional production volumes. In 2023, the field's average daily production reached approximately 720,000 barrels of oil equivalent, a testament to its efficiency and scale. This remarkable output directly translates into substantial revenue for Equinor, solidifying its position as a cornerstone of the company's financial strength.

The Troll field, alongside Johan Sverdrup, significantly bolsters Equinor's production from the Norwegian Continental Shelf. In 2023, Equinor's total oil and gas production averaged 2.06 million barrels of oil equivalent per day, with the Norwegian Continental Shelf being a primary source.

As a crucial supplier of natural gas to Europe, the Troll field offers enduring energy security and consistent revenue streams for Equinor. This field is a cornerstone of the company's gas export strategy, contributing substantially to Europe's energy needs.

With its mature and highly efficient operations, the Troll field guarantees dependable cash flow for Equinor. Its high operational regularity and established infrastructure make it a predictable and reliable asset.

Existing Oil and Gas Infrastructure

Equinor's existing oil and gas infrastructure, especially on the Norwegian Continental Shelf, acts as a significant cash cow. This mature network allows for cost-effective production and stable operations, maximizing returns from established assets with reduced investment requirements. For instance, in 2023, Equinor's production from the NCS remained robust, contributing substantially to its overall cash flow.

The optimization of these existing assets is key. By focusing on efficiency and maximizing recovery from fields already in production, Equinor can generate consistent cash with lower capital expenditure compared to exploring and developing entirely new projects. This strategy ensures a steady stream of revenue.

- Norwegian Continental Shelf Dominance: Equinor's extensive infrastructure on the NCS is a primary driver of its cash cow status.

- Cost Efficiency: Mature infrastructure leads to lower operating costs per barrel, enhancing profitability.

- Stable Cash Generation: Continued optimization ensures a reliable and consistent cash flow, minimizing the need for high-risk, high-reward investments in new ventures.

- Asset Value Maximization: Equinor focuses on extracting maximum value from its existing, proven reserves through technological advancements and operational improvements.

Global Crude Oil and Petroleum Products Marketing

Equinor's global crude oil and petroleum products marketing segment functions as a significant Cash Cow within its portfolio. This business area encompasses the vital activities of transporting, refining, and marketing crude oil and its derivatives, forming a stable and foundational revenue generator for the company.

This established segment consistently delivers reliable cash flows, playing a crucial role in Equinor's overall financial health. The ongoing global demand for petroleum products, even within a mature market, guarantees a steady stream of cash generation, underpinning the company's operations and investments.

- Established Revenue Streams: The marketing of crude oil and petroleum products provides Equinor with consistent and predictable income.

- Market Stability: Despite market maturity, global demand ensures ongoing revenue generation.

- Financial Contribution: This segment is a significant contributor to Equinor's overall financial performance and cash generation.

Equinor's marketing and processing segment, particularly its crude oil and petroleum products operations, acts as a significant cash cow. This segment leverages established infrastructure and global demand to generate consistent revenue, providing a stable financial base for the company.

The segment's ability to transport, refine, and market oil and its derivatives ensures a reliable cash inflow, even in mature markets. This consistent performance is vital for funding other business areas and distributing returns to shareholders.

In 2023, Equinor's adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) from its marketing, midstream, and processing segment reached $7.7 billion, underscoring its substantial contribution to the company's overall financial strength.

The company's strategic focus on optimizing its marketing and processing operations enhances profitability. By efficiently managing its supply chain and leveraging market opportunities, Equinor maximizes the cash generated from these core activities.

| Segment | 2023 Adjusted EBITDA (USD billion) | Key Drivers |

|---|---|---|

| Marketing, Midstream & Processing | 7.7 | Global demand for petroleum products, optimized supply chain, refining efficiency |

What You’re Viewing Is Included

Equinor BCG Matrix

The Equinor BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just a comprehensive strategic analysis ready for your use. You can confidently assess the quality and detail of this document, knowing the final version will be exactly the same, enabling you to make informed decisions about your investment. This preview ensures transparency and guarantees that the purchased Equinor BCG Matrix will be a professionally crafted tool for your business planning and strategic insights.

Dogs

Equinor’s divestment from Nigeria, a market where it had a significant presence, signals a strategic shift. This move, completed in late 2023, involved selling stakes in onshore and shallow-water assets, aligning with the company's goal to optimize its portfolio.

Similarly, Equinor exited its Azerbaijan operations in early 2024, divesting its participating interest in the Karabakh field. This decision underscores a broader strategy to focus capital on core areas and potentially higher-return international opportunities, freeing up resources for future growth.

The fourth quarter of 2024 saw Equinor's Sleipner B platform shut down following a fire. This operational disruption had a direct negative impact on Equinor's production figures for that period.

While the shut-in might be temporary, such events in mature fields like Sleipner B can significantly reduce cash flow. The need for substantial investment in repairs and remediation efforts further solidifies its position as a potential 'dog' within Equinor's portfolio during this challenging phase, underscoring the inherent risks of aging infrastructure.

Planned and unplanned maintenance at Equinor's Hammerfest LNG facility, like the extensive work in 2023 and early 2024 following the 2020 fire, has directly impacted production. These necessary but costly interruptions temporarily reduce output and revenue, fitting the profile of a cash-consuming operation during these periods.

For instance, the prolonged shutdown of the Melkøya facility, which houses the Hammerfest LNG plant, for repairs and upgrades after the 2020 incident meant significant lost production. While specific 2024 figures for maintenance-related downtime are still emerging, the historical impact demonstrates how such events can act as a drag on overall financial performance, particularly impacting short-term cash flow generation.

Older, Naturally Declining Fields

Older, naturally declining fields, often categorized as 'dogs' in the BCG matrix, represent a segment of Equinor's portfolio where production and profitability are naturally decreasing. Equinor's total equity production saw a slight year-over-year decrease, partly attributed to the natural decline inherent in mature oil and gas assets.

These fields, while a normal part of the lifecycle, can become problematic if they don't receive new investment or advanced recovery techniques. Without such interventions, their ability to generate profits shrinks, potentially turning them into cash drains rather than contributors.

- Natural Decline: Fields with significant natural decline without reinvestment are prone to becoming 'dogs'.

- Profitability Erosion: Diminishing production volumes directly impact revenue and profitability.

- Cash Trap Risk: Continued operational costs without sufficient returns can create a cash trap.

- Strategic Management: Careful oversight is crucial to manage these assets effectively and avoid negative cash flow.

Non-Strategic International Upstream Portfolio

Equinor's approach in 2024 to its international upstream portfolio centers on strategic refinement, which often means identifying and potentially divesting assets that don't align with its core objectives. This is akin to managing 'dogs' in a portfolio, where assets are evaluated for their profitability and growth potential.

Assets characterized as 'dogs' within Equinor's international upstream holdings are typically those situated in markets with limited growth prospects or where the company holds a minimal market share. These assets may struggle to achieve profitability, potentially breaking even or even becoming cash drains.

- Portfolio High-Grading: Through 2024, Equinor actively reviewed its international upstream assets, aiming to divest underperforming or non-strategic holdings.

- Identifying 'Dogs': This process specifically targets assets in low-growth markets with low market share, fitting the 'dog' profile.

- Cash Flow Impact: Such assets may generate minimal returns, potentially breaking even or consuming more cash than they generate, impacting overall financial performance.

- Strategic Alignment: The divestment of these 'dogs' allows Equinor to reallocate capital towards more promising opportunities that better align with its long-term strategic goals.

Equinor's 'dogs' are assets with low growth and market share, often facing natural decline or operational challenges. The company's strategic exits from Nigeria and Azerbaijan in late 2023 and early 2024, respectively, highlight a portfolio optimization effort that includes shedding such underperforming assets. These divestments free up capital for more promising ventures, aligning with Equinor's goal of focusing on core, higher-return areas.

Operational disruptions, such as the Sleipner B platform shutdown in Q4 2024 and ongoing maintenance at Hammerfest LNG, exemplify the cash-consuming nature of some mature or problem-prone assets. While these are often necessary, they can temporarily reduce cash flow and profitability, reinforcing their 'dog' characteristics if not strategically managed or remediated.

Equinor's active review and potential divestment of international upstream assets in 2024 targets these 'dog' categories. By identifying and exiting low-growth, low-market-share holdings, Equinor aims to improve overall portfolio efficiency and financial performance.

These 'dog' assets, while a natural part of an energy company's lifecycle, require careful management to prevent them from becoming significant cash drains. Strategic decisions, including divestment or targeted investment, are crucial for maintaining a healthy and profitable asset base.

| Asset Category | Characteristics | 2024 Strategic Action/Impact |

|---|---|---|

| Mature Fields (e.g., Sleipner) | Natural decline, aging infrastructure, potential for operational disruptions | Q4 2024 platform shutdown impacting production; requires investment for repairs. |

| Underperforming International Assets | Low growth prospects, minimal market share, potentially low profitability | Strategic review and divestment of non-core holdings, including exits from Nigeria and Azerbaijan. |

| LNG Facilities (e.g., Hammerfest) | Requires significant maintenance and upgrades, impacting production uptime | Ongoing maintenance and repairs following prior incidents, leading to temporary production reductions. |

Question Marks

Empire Wind 1 and 2 represent Equinor's significant investments in the burgeoning US offshore wind sector. However, the path forward has been fraught with challenges, notably the resumption of development for Empire Wind 1 was accompanied by a substantial impairment charge of USD 955 million in Q2 2025, highlighting the project's current difficulties.

Despite the US offshore wind market's high growth potential, Equinor's presence through these projects is characterized by a low market share and considerable cash consumption. The uncertain returns are exacerbated by recent policy shifts and increased tariffs, placing these ventures in a challenging position within the BCG matrix.

Equinor's early-phase low-carbon hydrogen and ammonia projects are positioned as potential Stars within the BCG Matrix. These initiatives target rapidly expanding markets crucial for decarbonizing sectors like heavy industry and long-haul shipping.

While these markets exhibit high growth potential, Equinor currently holds a modest market share, necessitating substantial capital deployment for scaling. For instance, by the end of 2024, Equinor has committed billions to projects like H2H Saltend in the UK, aiming to produce low-carbon hydrogen.

The future success of these ventures as Stars hinges on overcoming significant hurdles. These include achieving critical technological advancements in electrolysis and carbon capture, fostering widespread market adoption through competitive pricing, and navigating evolving, supportive regulatory landscapes globally.

Equinor's foray into critical mineral extraction, particularly lithium, positions it as a 'question mark' in the BCG matrix. This strategic move targets the burgeoning demand for minerals essential to clean energy technologies, a sector experiencing rapid growth.

The company's current market share in critical mineral extraction is virtually nonexistent, reflecting the nascent stage of this venture. For instance, global lithium demand is projected to surge, with estimates suggesting a need for over 1.5 million tonnes of lithium carbonate equivalent by 2025, a significant increase from 2023 levels.

This high-risk, high-reward profile necessitates substantial investment to develop expertise and secure a foothold. Equinor's commitment to this area, however, signals a long-term vision to capitalize on the energy transition's material needs.

Large-Scale Floating Offshore Wind Projects (Beyond Hywind Tampen)

Equinor's strategic vision extends beyond its pioneering Hywind Tampen project, aiming for global leadership in offshore wind. This ambition is clearly reflected in its pursuit of large-scale floating offshore wind developments, such as the Bandibuli project in South Korea.

Floating offshore wind is a burgeoning sector, projected to capture 10% of the overall offshore wind market by 2030, indicating significant future growth potential. However, many of these advanced projects are still in the development stages, meaning Equinor's current market share in this specific segment, outside of its established projects, is relatively small.

- Bandibuli, South Korea: A key example of Equinor's commitment to expanding its floating wind portfolio beyond Hywind Tampen.

- Market Growth: Floating offshore wind is anticipated to grow to 10% of the total offshore wind market by 2030, highlighting its strategic importance.

- Maturation Phase: Many large-scale floating projects are still in development, representing a nascent market share for Equinor in this segment.

- Investment Needs: Significant capital is required to transition these projects from the development phase to commercial operation.

New Exploration Acreage (e.g., Santos Basin, New NCS Licenses)

Equinor's strategic pursuit of new exploration acreage, exemplified by its ventures in Brazil's Santos Basin and securing new licenses on the Norwegian Continental Shelf, places these assets squarely within the question mark category of the BCG matrix. These are high-potential, high-growth areas where the company is investing heavily to uncover new reserves, though their current market share contribution is nil.

These exploration efforts are characterized by substantial upfront capital expenditure and inherent uncertainty regarding the commercial viability of any discoveries. For instance, in 2023, Equinor participated in multiple exploration wells, with outcomes yet to be fully determined, reflecting the typical risk profile of question marks. The success of these ventures could propel them into star status, significantly boosting Equinor's future market share and profitability.

- Santos Basin, Brazil: Equinor has a significant presence in Brazil, including exploration blocks in the pre-salt Santos Basin, a region known for its prolific oil and gas discoveries.

- Norwegian Continental Shelf (NCS): Equinor continues to bid for and acquire new exploration licenses on the NCS, its home turf, aiming to replenish its reserve base. In the 2024 APA (Award in Predefined Areas) licensing round, Equinor was awarded interests in several new production licenses.

- Investment & Risk: These activities represent substantial investments with the potential for high returns but also the risk of dry holes or non-commercial finds, a hallmark of question mark investments.

- Future Potential: The success of these exploration programs is crucial for Equinor's long-term growth, potentially transforming these question marks into future cash cows if significant discoveries are made and developed.

Equinor's ventures into critical mineral extraction, such as lithium, and its expansion into new exploration acreage, like the Santos Basin, are prime examples of 'Question Marks' in its BCG matrix. These areas represent significant growth opportunities with substantial investment requirements but currently hold minimal market share, making their future success uncertain.

The company is investing heavily in these nascent sectors, aiming to capitalize on the energy transition's demand for new materials and energy sources. For instance, global lithium demand is projected to exceed 1.5 million tonnes of lithium carbonate equivalent by 2025, underscoring the market's potential. However, Equinor's current market share in these specific areas is negligible, reflecting the early stage of these investments.

These 'Question Marks' require careful management and significant capital allocation to overcome technological hurdles, establish market presence, and navigate regulatory landscapes. The success of these ventures could transform them into future 'Stars' or 'Cash Cows,' but the inherent risks mean they could also fail to gain traction.

| BCG Category | Equinor Examples | Market Growth | Market Share | Investment/Cash Flow | Potential Outcome |

| Question Marks | Critical Minerals (Lithium), New Exploration Acreage (Santos Basin, Brazil) | High (e.g., Lithium demand surge) | Low/Negligible | High Investment, Negative Cash Flow | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix leverages Equinor's comprehensive financial disclosures, internal performance metrics, and extensive market research to provide a data-driven strategic overview.