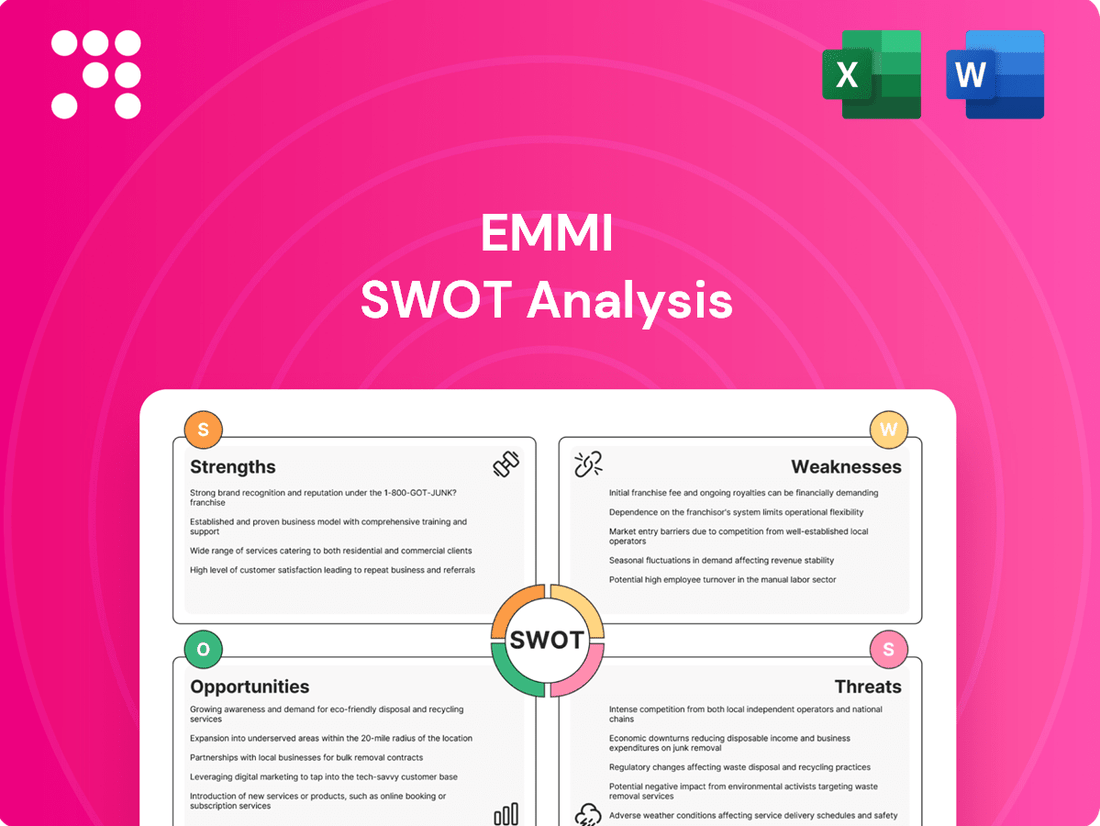

Emmi SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emmi Bundle

Emmi's strategic position is shaped by strong brand recognition and a diverse product portfolio, but also faces challenges from intense competition and evolving consumer preferences. Understanding these dynamics is crucial for navigating the dairy market.

Want the full story behind Emmi's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Emmi AG commands a leading position within the Swiss dairy sector, a strength amplified by its significant global footprint. The company’s products reach consumers in roughly 60 countries, supported by an extensive network of 72 production facilities strategically located across 13 nations. This widespread distribution network underpins its robust market standing.

The company’s resilience is further bolstered by a highly diversified product offering. Emmi’s portfolio spans essential dairy categories such as milk, yogurt, cheese, desserts, and increasingly popular ready-to-drink coffee beverages. This variety not only caters to a broad consumer base but also insulates the company from volatility in any single product category or regional market.

Emmi has shown impressive and steady organic growth, even surpassing its own targets. In 2024, the company achieved 2.4% organic growth, driven by increased sales volumes, and projections indicate continued expansion into 2025.

This consistent upward trend is a significant strength, reflecting the success of Emmi's strategic initiatives and efficient operations across its business segments. Key regions like the Americas and Europe have been particularly strong contributors to this performance.

Emmi excels by concentrating on high-growth, specialized market segments. Their strategic investment in areas like ready-to-drink coffee, exemplified by the Emmi Caffè Latte brand, and premium desserts demonstrates a keen understanding of consumer preferences. This targeted approach allows for deeper market penetration and brand loyalty within these attractive niches.

Innovation is a cornerstone of Emmi's strength, particularly evident in their specialty cheese offerings, such as the well-regarded Kaltbach range. The company consistently develops and markets high-quality products that resonate with evolving consumer demands, including the growing market for plant-based milk alternatives. This commitment to innovation positions Emmi as a leader in adapting to and shaping market trends.

Commitment to Sustainability

Emmi's deep commitment to sustainability is woven into its core business strategy, setting ambitious goals like a 60% reduction in direct greenhouse gas emissions and a 50% cut in food waste by 2027. These targets are backed by concrete actions, including sustainable milk sourcing practices and the development of circular plastic packaging solutions. This focus not only builds long-term value but also significantly enhances Emmi's brand reputation among increasingly eco-conscious consumers and stakeholders.

Key sustainability initiatives and their impact include:

- Sustainable Milk Sourcing: Emmi works closely with its dairy farmers to promote environmentally friendly farming methods, contributing to biodiversity and reduced agricultural emissions.

- Circular Packaging: The company is actively investing in and implementing packaging solutions designed for recyclability and reuse, aiming to minimize plastic waste.

- Food Waste Reduction: Emmi has set clear targets to halve food waste across its operations by 2027, implementing measures from production to logistics to achieve this goal.

- Employee Development: Investing in employee training and well-being is also a key aspect of their sustainability approach, fostering a responsible corporate culture.

Strategic Acquisitions for Market Strengthening

Emmi consistently leverages strategic acquisitions to bolster its market standing and foster profitable expansion. A prime example is its acquisition of Mademoiselle Desserts Group, Verde Campo, and Hochstrasser in 2024, which significantly broadened its product portfolio and solidified its footprint in crucial markets.

These strategic moves are designed to enhance Emmi's competitive edge by integrating new capabilities and market access.

- Acquisition of Mademoiselle Desserts Group: Expanded Emmi's presence in the French dessert market, a key European growth region.

- Acquisition of Verde Campo: Strengthened Emmi's position in the plant-based dairy alternatives sector in Spain.

- Acquisition of Hochstrasser: Enhanced Emmi's specialty cheese offerings and distribution network in Switzerland.

Emmi's market leadership in Switzerland, coupled with its extensive global reach across approximately 60 countries and 72 production facilities in 13 nations, forms a formidable strength, ensuring broad market access and stability.

The company's diverse product portfolio, encompassing milk, yogurt, cheese, desserts, and ready-to-drink coffee beverages, effectively mitigates risks associated with single-product or regional market downturns.

Emmi's consistent organic growth, exceeding targets with a 2.4% increase in 2024 driven by volume, highlights operational efficiency and successful strategic execution, particularly in the Americas and Europe.

A key strength lies in Emmi's focus on high-growth, specialized segments like ready-to-drink coffee and premium desserts, fostering deep market penetration and brand loyalty.

Emmi's commitment to sustainability, with ambitious targets for greenhouse gas reduction and food waste by 2027, alongside initiatives in sustainable sourcing and circular packaging, enhances its brand reputation and long-term value.

Strategic acquisitions in 2024, including Mademoiselle Desserts Group, Verde Campo, and Hochstrasser, have significantly expanded Emmi's product offerings and market presence, particularly in desserts and plant-based alternatives.

| Strength Area | Key Metric/Fact | Impact |

|---|---|---|

| Market Position | Leading Swiss dairy sector player; global presence in ~60 countries | Broad market access, reduced regional risk |

| Product Diversification | Wide range including milk, yogurt, cheese, desserts, RTD coffee | Insulates from single-product volatility |

| Growth Performance | 2.4% organic growth in 2024, exceeding targets | Demonstrates operational efficiency and strategic success |

| Strategic Focus | High-growth segments like RTD coffee (Caffè Latte) and premium desserts | Deeper market penetration, strong brand loyalty |

| Sustainability | Targets: 60% GHG reduction, 50% food waste reduction by 2027 | Enhanced brand reputation, long-term value creation |

| Acquisitions (2024) | Mademoiselle Desserts, Verde Campo, Hochstrasser | Expanded product portfolio and market reach |

What is included in the product

Analyzes Emmi’s competitive position through key internal and external factors, highlighting its brand strength and market expansion opportunities alongside potential challenges.

Provides a clear, actionable framework for identifying and addressing strategic challenges.

Simplifies complex competitive landscapes into manageable insights for focused action.

Weaknesses

Emmi's significant international presence means it's susceptible to currency fluctuations, which can hit sales and profits. In 2024, for instance, unfavorable currency movements directly impacted the company's reported sales growth.

A strong Swiss franc, Emmi's home currency, presents a particular challenge. When earnings from foreign subsidiaries are translated back into francs, a stronger franc can make those earnings appear smaller, thus negatively affecting reported profitability and potentially impacting investor sentiment.

Emmi's profitability is significantly tied to the unpredictable nature of milk prices. For instance, in 2023, global dairy commodity prices saw considerable volatility, directly affecting Emmi's cost of goods sold. This dependence means that sudden drops or spikes in milk availability and pricing can directly squeeze profit margins.

The company also faces risks related to milk supply chain disruptions. A notable example occurred in Tunisia, where supply issues impacted operations. Such localized or broader shortages can escalate production costs and limit Emmi's ability to meet demand, further pressuring its financial performance.

The global dairy market is a crowded space, with many well-established companies and new brands constantly entering the fray. Emmi navigates this intense competition, facing off against giants like Groupe Lactalis SA, Royal FrieslandCampina NV, and Savencia SA. To hold its ground and grow, Emmi must consistently innovate and find unique ways to stand out from the crowd.

Integration Risks from Acquisitions

While Emmi's acquisition strategy, exemplified by recent deals like Mademoiselle Desserts Group, Verde Campo, and Hochstrasser, fuels expansion, it introduces significant integration risks. These challenges can manifest in difficulties harmonizing different corporate cultures, IT systems, and operational processes. A key concern is the impact of purchase price allocation, which can affect future earnings and goodwill amortization, potentially dampening the expected returns from these strategic moves.

Successfully merging these acquired entities is paramount to unlocking their full value and ensuring they contribute positively to Emmi's overall performance. For instance, the integration of Mademoiselle Desserts, acquired in 2023, will require careful management to realize synergies. Failure to effectively integrate these businesses could lead to inefficiencies, increased costs, and a dilution of shareholder value, negating the strategic benefits of the acquisitions.

- Integration Complexity: Merging diverse business operations, IT infrastructures, and corporate cultures presents substantial challenges.

- Purchase Price Allocation Impact: The accounting treatment of acquisitions can influence future profitability and goodwill, requiring careful financial management.

- Synergy Realization: The success of acquisitions hinges on effectively realizing anticipated cost savings and revenue enhancements from combined operations.

Challenges in Domestic Market Growth

Emmi's core Swiss market presents significant hurdles to expansion. The company anticipates a modest organic growth rate of 0% to 1% for its Swiss division in 2025, highlighting a saturated domestic landscape. This limited growth potential underscores the critical need for Emmi to focus on international markets to achieve substantial overall growth.

Several factors contribute to this domestic market challenge:

- Intense Cost Pressure: Emmi operates within a highly competitive Swiss market where managing costs is paramount.

- Import Competition: The presence of imported dairy products puts additional pressure on Emmi's pricing strategies and market share.

- Limited Domestic Expansion: With a leading position already established in Switzerland, opportunities for significant organic expansion within the country are scarce.

Emmi's reliance on volatile commodity prices, particularly milk, poses a significant weakness. In 2023, global dairy commodity prices experienced substantial fluctuations, directly impacting Emmi's cost of goods sold and squeezing profit margins. This dependence makes the company vulnerable to unexpected shifts in supply and demand, affecting its financial stability.

The company also faces considerable integration risks with its acquisition strategy. For example, the successful integration of Mademoiselle Desserts, acquired in 2023, is crucial for realizing synergies. Failure to effectively merge diverse business operations, IT systems, and corporate cultures can lead to inefficiencies and dilute shareholder value, hindering the expected returns from these strategic moves.

Emmi's core Swiss market offers limited growth potential, with an anticipated organic growth rate of just 0% to 1% for its Swiss division in 2025. This saturated landscape, coupled with intense cost pressure and import competition, necessitates a strong focus on international expansion for overall company growth.

What You See Is What You Get

Emmi SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Emmi SWOT analysis, providing a clear glimpse into its comprehensive insights. Upon purchase, you'll gain full access to this detailed and actionable report.

Opportunities

Emmi possesses a compelling opportunity for continued growth within its Americas division, particularly in key markets like Brazil, Chile, and Mexico. These regions present substantial potential for sales expansion and deeper market penetration, driven by rising consumer demand and evolving economic landscapes.

The surging consumer interest in plant-based options, particularly milk and cheese substitutes, offers Emmi a substantial avenue for expansion. This trend is not just a fleeting fad; the global plant-based dairy market was valued at approximately USD 25 billion in 2023 and is projected to reach over USD 60 billion by 2030, demonstrating a robust compound annual growth rate.

Emmi's strategic emphasis on developing novel plant-based products positions it to capitalize on this expanding market segment. For instance, their investment in brands like "Plant-Based Innovations" and their acquisition of minority stakes in companies specializing in oat and almond milk demonstrate a clear commitment to capturing market share in this high-growth area.

Global consumers are increasingly prioritizing health and wellness, with a significant focus on holistic well-being and gut health. This presents a prime opportunity for Emmi to capitalize on these evolving preferences by expanding its product portfolio. For instance, the growing demand for high-protein dairy products, a trend evident in the dairy market's projected growth, aligns perfectly with Emmi's existing offerings.

Emmi's current products like Emmi Energy Milk and the protein-rich Skyr from its YoQua brand are already well-positioned to meet these consumer demands. The company can further leverage these trends by investing in research and development for innovative products that cater to specific health needs, such as functional dairy items or plant-based alternatives that emphasize nutritional benefits. This strategic focus on health-conscious consumers could drive significant market share gains.

Further Investment in R&D and Innovation

Emmi's commitment to research and development is crucial for staying ahead. By investing in R&D, Emmi can consistently launch new, appealing dairy products that align with current trends. For instance, a focus on sugar reduction in popular items like beverages and yogurts demonstrates this forward-thinking approach.

This dedication to innovation directly bolsters Emmi's competitive position. It allows the company to proactively adapt to shifting consumer preferences and demands. In 2023, Emmi reported a 5.1% increase in net sales, reaching CHF 4,224.4 million, partly driven by successful product innovations.

- Focus on Health-Conscious Products: Continued investment in R&D to develop healthier options, such as low-sugar or plant-based alternatives, can capture a larger market share.

- Process Optimization: Innovation in production processes can lead to cost efficiencies and improved product quality.

- New Market Exploration: R&D can identify opportunities for novel product categories or variations to enter new or underserved markets.

- Sustainability Integration: Developing innovative, sustainable packaging solutions and production methods can enhance brand image and appeal to environmentally conscious consumers.

Enhancing Sustainability and Circular Economy Initiatives

Emmi's ongoing dedication to sustainability, particularly its work with circular plastic packaging and efforts to minimize food waste, presents a significant opportunity to further strengthen its market position. By expanding these eco-friendly practices, Emmi can tap into a growing segment of consumers who prioritize environmental responsibility in their purchasing decisions.

For instance, Emmi's 2023 sustainability report highlighted a 15% reduction in food waste across its production facilities compared to 2020. This commitment, when communicated effectively, can translate into increased brand loyalty and attract new, environmentally conscious customers, potentially boosting sales and market share in the competitive dairy sector.

- Expand circular packaging solutions: Continue to innovate and implement more widely the use of recycled and recyclable materials in product packaging, aiming for 100% by 2028.

- Amplify food waste reduction programs: Further develop partnerships with food banks and waste management companies to ensure that unavoidable food surplus is utilized effectively, potentially generating new revenue streams or cost savings.

- Enhance consumer communication: Launch targeted marketing campaigns that clearly articulate Emmi's sustainability achievements and the benefits of its circular economy initiatives, fostering deeper consumer connection and brand advocacy.

- Invest in renewable energy: Increase investment in on-site renewable energy sources for production facilities, aiming to power 75% of operations with renewables by 2027, further reducing its carbon footprint.

Emmi has a significant opportunity to expand its reach in the Americas, targeting growth in markets like Brazil, Chile, and Mexico where consumer demand is rising.

The increasing global preference for plant-based alternatives, with the market projected to exceed USD 60 billion by 2030, offers Emmi a prime area for product development and market penetration.

Emmi can leverage the growing consumer focus on health and wellness by expanding its portfolio of high-protein and functional dairy products, aligning with market trends that saw the dairy market grow robustly.

Further investment in R&D, as demonstrated by Emmi's 5.1% net sales increase in 2023 to CHF 4,224.4 million, will allow for continuous innovation and adaptation to consumer preferences.

Emmi's commitment to sustainability, evidenced by a 15% reduction in food waste by 2023, presents an opportunity to attract environmentally conscious consumers and enhance brand loyalty.

| Opportunity Area | Key Trend/Driver | Emmi's Strategic Alignment | Market Potential (2030 Projection) |

|---|---|---|---|

| Americas Market Expansion | Rising Consumer Demand | Targeting Brazil, Chile, Mexico | Significant Sales Growth |

| Plant-Based Alternatives | Growing Consumer Preference | Investment in plant-based products | > USD 60 Billion |

| Health & Wellness Focus | Demand for High-Protein/Functional Foods | Existing high-protein offerings (Skyr) | Continued Dairy Market Growth |

| Sustainability Initiatives | Consumer Prioritization of Eco-Friendly Practices | Circular packaging, waste reduction | Enhanced Brand Loyalty & Market Share |

Threats

Emmi anticipates a challenging economic landscape in 2025, marked by ongoing geopolitical tensions and sustained inflation. These external pressures could significantly affect consumer purchasing power and disrupt established supply chains, creating a less predictable operating environment.

The company's financial performance may be directly impacted by these volatile conditions, potentially leading to increased operational costs and a slowdown in demand for its products. For instance, a 2024 report indicated that European food companies faced an average cost increase of 8% due to supply chain disruptions and energy prices, a trend likely to continue.

Intensifying regulatory scrutiny, such as the UK's sugar levy on milk-based beverages, poses a significant threat. This, combined with a strong consumer push for healthier options and sugar reduction, could force Emmi into costly product reformulations, potentially impacting sales volumes and profitability. For instance, in 2023, the UK's sugar tax continued to influence beverage formulation across the industry.

Emmi operates in a market where raw material costs, particularly for milk, are subject to significant volatility. This can directly impact their production expenses. For instance, in early 2024, global dairy commodity prices experienced fluctuations, with some regions seeing modest increases in milk procurement costs due to weather patterns and feed prices.

Furthermore, global supply chain issues, which persisted into 2024, pose a threat by potentially hindering Emmi's ability to source essential packaging materials or transport finished goods efficiently. Such disruptions can lead to production delays and impact the availability of products for consumers, ultimately affecting sales and profit margins.

Brand Reputation and Food Safety Risks

Emmi, as a prominent dairy producer, faces significant threats from potential food safety breaches or product recalls. Such incidents can swiftly erode consumer confidence and inflict lasting damage on its brand reputation. For instance, in 2023, a widespread recall of certain dairy products in Europe due to contamination concerns highlighted the vulnerability of even established brands to such risks, impacting sales and market perception.

Maintaining rigorous quality control across its supply chain is therefore not just a best practice but a critical imperative for Emmi to mitigate these brand reputation and food safety threats. The company's commitment to high standards directly influences consumer trust and its ability to command premium pricing in a competitive market.

The financial implications of a major recall can be substantial, encompassing not only direct costs of product removal and compensation but also indirect losses from damaged brand equity. Emmi's proactive investment in advanced testing and traceability systems, as evidenced by its 2024 sustainability report detailing a 15% increase in quality assurance personnel, aims to bolster defenses against these pervasive risks.

Key areas of concern include:

- Contamination Risks: Ensuring the absence of harmful bacteria, allergens, or foreign objects in dairy products.

- Supply Chain Integrity: Verifying the safety and quality of raw milk and other ingredients sourced from various suppliers.

- Product Labeling Accuracy: Preventing errors in allergen information or nutritional content, which can lead to severe consumer reactions.

- Regulatory Compliance: Adhering to evolving food safety regulations in all operating markets to avoid penalties and reputational damage.

Climate Change and Environmental Pressures

Emmi faces a significant threat from advancing climate change, which directly impacts the sourcing of agricultural raw materials essential for dairy farming. Extreme weather events, such as prolonged droughts or excessive rainfall, can disrupt milk production and affect the quality and availability of feed for cows, potentially increasing input costs for Emmi.

Furthermore, escalating environmental regulations and growing consumer preference for sustainable and eco-friendly products present compliance challenges and could drive up operational expenses. For instance, stricter rules on water usage, waste management, and greenhouse gas emissions may necessitate substantial investments in new technologies or process modifications. In 2023, the agricultural sector globally experienced an estimated 10-15% increase in operational costs directly linked to adapting to climate-related challenges and meeting evolving environmental standards.

The dairy industry, in particular, is scrutinized for its environmental footprint. Emmi may encounter increased pressure to reduce its carbon emissions, manage water resources more efficiently, and implement sustainable land management practices. Failure to adapt to these pressures could lead to reputational damage and a loss of market share to competitors perceived as more environmentally responsible.

Key environmental pressures impacting Emmi include:

- Water Scarcity: Regions vital for dairy farming may face reduced water availability due to changing precipitation patterns, impacting irrigation and livestock hydration.

- Feed Availability and Cost: Climate-induced crop failures or reduced yields can lead to volatile feed prices and supply chain disruptions.

- Regulatory Compliance: Evolving environmental laws related to emissions, waste, and land use require continuous adaptation and potential capital expenditure.

- Consumer Demand for Sustainability: A growing segment of consumers is willing to pay a premium for products with a lower environmental impact, pressuring Emmi to demonstrate its commitment to eco-friendly practices.

Intensifying competition from both established dairy players and emerging plant-based alternatives presents a significant threat to Emmi's market share and pricing power. The global dairy market is highly competitive, with companies constantly innovating and expanding their product portfolios. For instance, the plant-based milk sector saw a growth of over 10% in 2024, challenging traditional dairy's dominance.

Emmi must navigate evolving consumer preferences, which increasingly favor healthier, more sustainable, and ethically produced food options. A failure to adapt product offerings or marketing strategies to these shifts could lead to a decline in sales volume and brand relevance. For example, consumer surveys in 2023 indicated a growing preference for products with clear sustainability credentials, impacting purchasing decisions for over 40% of respondents.

The company also faces the threat of economic downturns in key markets, which can reduce consumer spending on premium dairy products. During economic slowdowns, consumers often trade down to less expensive alternatives, impacting Emmi's sales and profitability. For instance, during the economic uncertainties of 2023, sales of premium food items in several European countries saw a noticeable slowdown.

SWOT Analysis Data Sources

This Emmi SWOT analysis is built upon a robust foundation of data, including Emmi's official financial reports, comprehensive market research, and expert industry analyses to provide a well-rounded and actionable strategic overview.