Emmi Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emmi Bundle

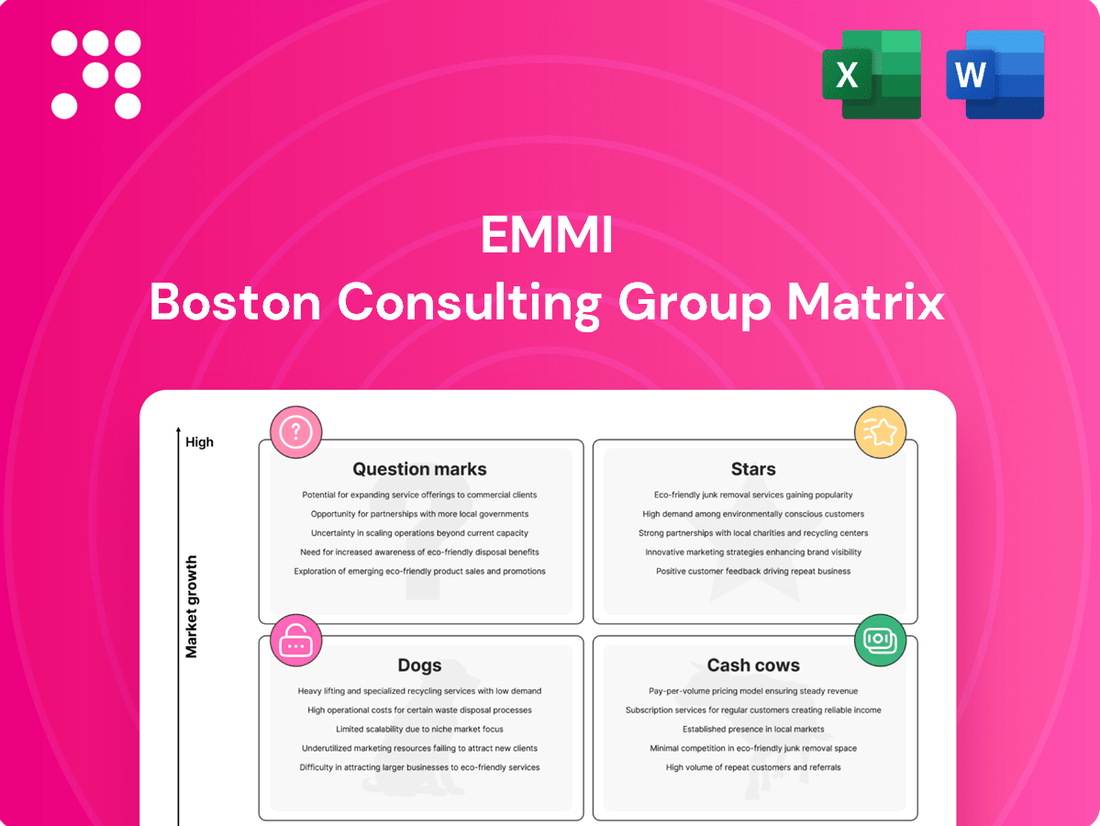

The Emmi BCG Matrix offers a powerful framework to understand the strategic positioning of its diverse product portfolio. By categorizing products into Stars, Cash Cows, Dogs, and Question Marks, it provides a clear snapshot of market share and growth potential.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Emmi.

Stars

Emmi Caffè Latte stands out as a strong performer within Emmi's portfolio, demonstrating robust growth, especially in key European markets and the United Kingdom. Its success is fueled by a dominant position in the expanding ready-to-drink coffee sector, securing a substantial market share.

The brand's commitment to ongoing product innovation and strategic marketing efforts underpins its potential to maintain its leading edge. This focus suggests a promising trajectory, with the expectation that Emmi Caffè Latte will eventually mature into a Cash Cow as the market segment stabilizes.

Kaltbach specialty cheeses, renowned for their unique cave-aged refinement, are a shining example of Emmi's success. This segment, particularly strong in Germany and key export markets, showcases Emmi's leadership in a high-growth niche. The enduring appeal of premium, artisanal cheeses solidifies Kaltbach's star status, necessitating continued investment in production capabilities and marketing efforts to sustain its dominant market share.

Emmi's strategic move to acquire Mademoiselle Desserts in July 2024 underscores its aggressive expansion into the premium dessert sector. This acquisition, valued at an undisclosed amount, is a direct response to the burgeoning demand for high-quality, specialty desserts, particularly in the United States.

The premium dessert market is experiencing robust growth, with Emmi targeting a doubling of its sales within this segment. This ambitious goal highlights the company's confidence in its ability to leverage acquired brands and innovate in areas like Italian specialty desserts to capture significant market share.

Emmi Energy Milk and Aktifit

Emmi Energy Milk and Aktifit represent Emmi's strategic push into the health and wellness dairy segment, a key driver of their organic growth in Switzerland. These brands tap into consumer demand for functional benefits, positioning Emmi for continued success in this expanding market.

These brands are classified as Stars within the BCG Matrix due to their high market share in a high-growth category. For instance, the Swiss functional dairy market has seen consistent expansion, with Emmi's innovations playing a significant role. By 2024, the health and wellness food sector in Switzerland continued to show robust growth, with functional dairy products being a notable contributor.

- High Growth Potential: Emmi Energy Milk and Aktifit operate within the expanding health and wellness dairy market.

- Market Share: These brands have secured a significant market share in their respective categories in Switzerland.

- Investment Focus: Continued marketing and product development are essential to maintain their Star status.

- Consumer Demand: They directly address the growing consumer interest in dairy products with added health benefits.

Verde Campo (Brazil)

Verde Campo, a Brazilian dairy company, is positioned as a Star in Emmi's BCG Matrix following Emmi's acquisition of a majority stake in May 2024. This move signifies Emmi's strategic focus on high-growth markets, with Brazil identified as a key region. Verde Campo's specialization in functional premium dairy products, particularly those with high protein content, directly taps into prevailing consumer preferences for health and wellness.

The Brazilian dairy market is experiencing robust growth, driven by increasing consumer demand for healthier and more convenient options. In 2024, the market is projected to continue its upward trajectory, with functional foods playing a significant role. Verde Campo's product portfolio aligns perfectly with these trends, offering a competitive edge in a dynamic market.

- Market Share: Verde Campo holds a significant and growing share in the premium, functional dairy segment in Brazil.

- Growth Rate: The Brazilian dairy market, particularly the premium and functional sub-segments, exhibits a high growth rate, estimated to be in the double digits for 2024.

- Strategic Fit: Emmi's investment leverages Verde Campo's strong brand recognition and product innovation to capture further market share.

- Future Potential: Continued investment and expansion of Verde Campo's product lines are expected to solidify its Star status and contribute significantly to Emmi's global growth.

Emmi Energy Milk and Aktifit are prime examples of Emmi's successful strategy in the high-growth health and wellness dairy sector. These brands leverage strong consumer demand for functional benefits, a trend that continued to shape the Swiss dairy market in 2024. Their significant market share in this expanding category solidifies their position as Stars.

Verde Campo, an acquired Brazilian dairy company, also fits the Star profile. Emmi's majority stake acquisition in May 2024 targets Brazil's rapidly growing functional premium dairy market. Verde Campo's focus on high-protein products aligns with 2024's consumer preference for health-conscious options, positioning it for substantial growth.

Emmi Caffè Latte continues to shine in the ready-to-drink coffee market, demonstrating strong growth, particularly in Europe and the UK. Its dominant share in a growing segment, supported by innovation, indicates a strong Star performance with potential to become a Cash Cow.

Kaltbach specialty cheeses, with their unique cave-aging process, are another key Star performer for Emmi. Strong in Germany and export markets, this premium segment benefits from sustained consumer interest in artisanal products, requiring ongoing investment to maintain its leading position.

| Brand | Category | Market Status | Growth Driver | Key Market |

|---|---|---|---|---|

| Emmi Energy Milk & Aktifit | Health & Wellness Dairy | Star | Functional benefits, consumer demand | Switzerland |

| Verde Campo | Premium Functional Dairy | Star | High-protein products, market growth | Brazil |

| Emmi Caffè Latte | Ready-to-Drink Coffee | Star | Market growth, innovation | Europe, UK |

| Kaltbach | Specialty Cheese | Star | Premium, artisanal appeal | Germany, Export |

What is included in the product

The Emmi BCG Matrix categorizes products into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

It offers strategic guidance on resource allocation, highlighting which product lines to invest in, maintain, or divest.

A clear Emmi BCG Matrix visualizes portfolio strengths, alleviating the pain of strategic uncertainty.

Cash Cows

Emmi, Switzerland's top dairy producer, commands a significant share of the domestic market for traditional milk and yogurt. Despite potentially modest growth in this mature segment, these products are reliable cash generators for the company.

In 2024, Emmi's commitment to innovation within its core milk and yogurt offerings, including plant-based alternatives and premium yogurts, continues to solidify its leading position. The company's strategy centers on leveraging its strong brand equity and extensive distribution network to maintain robust cash flow from these established product lines.

Emmi's natural cheese category, excluding specialty varieties, functions as a robust Cash Cow within its portfolio. While brands like Kaltbach might be considered Stars, the broader natural cheese segment represents a mature market where Emmi holds a significant and stable position.

This segment reliably generates substantial sales and profits for Emmi, underscoring its Cash Cow status. For 2024, Emmi's overall cheese division, which heavily features natural cheeses, continued to be a cornerstone of its financial performance, contributing significantly to group revenue.

Investments in this area are strategically channeled towards optimizing operational efficiency and reinforcing Emmi's market leadership rather than pursuing rapid expansion. This focus ensures continued profitability and stability from a well-established product line.

Emmi's established export cheese varieties, beyond the high-growth Kaltbach, represent significant cash cows within its portfolio. These mature products, particularly popular in European markets, consistently generate substantial revenue, underpinning Emmi's financial stability. Their strong market presence ensures reliable cash flow, allowing Emmi to leverage these established brands effectively.

Industrial Milk Powder and Concentrates (Netherlands)

Emmi's industrial milk powder and concentrates business in the Netherlands, particularly its goat's milk powder segment, stands as a robust Cash Cow. This business-to-business operation has demonstrated consistent sales performance, solidifying Emmi's standing within the industrial dairy market.

The industrial customer segment, while less visible than consumer brands, is a significant contributor to Emmi's financial health. It generates reliable and substantial cash flow, a hallmark of a Cash Cow, within a well-established and mature market. For instance, the global milk powder market was valued at approximately USD 105.6 billion in 2023 and is projected to reach USD 140.1 billion by 2028, showcasing the scale of this industrial sector.

- Strong Market Position: Emmi's goat's milk powder and general industrial milk powder sales in the Netherlands indicate a leading presence in this B2B segment.

- Stable Revenue Generation: This segment provides a consistent and predictable revenue stream, crucial for funding other business units.

- Mature Market Dynamics: Operating in a mature industrial market, the business benefits from established demand and efficient operations.

- Cash Flow Contribution: The unit reliably generates significant cash flow, supporting Emmi's overall financial stability and investment capacity.

Gerber Fondue

Gerber Fondue, a cornerstone of Emmi's Swiss offerings, exemplifies a classic Cash Cow. Its long-standing presence and strong brand recognition within the Swiss market suggest a dominant market share in a mature fondue segment. This maturity translates into stable, predictable revenue streams with minimal need for aggressive marketing or expansion investment.

As a Cash Cow, Gerber Fondue likely requires only modest investment to maintain its market position and operational efficiency. Emmi can leverage the consistent cash flow generated by Gerber Fondue to fund growth initiatives in other parts of its business, such as Stars or Question Marks. For instance, Emmi's overall net profit in 2023 reached CHF 199.1 million, demonstrating the company's ability to generate substantial returns from its established brands.

- Established Brand: Gerber Fondue benefits from high brand awareness and consumer loyalty in Switzerland.

- Mature Market: Operates in a stable, well-defined market segment where growth is limited but market share is high.

- Consistent Cash Flow: Generates reliable profits with low reinvestment needs.

- Strategic Role: Funds investment in Emmi's higher-growth or potential growth product categories.

Emmi's traditional milk and yogurt products, alongside its natural cheese segment, function as reliable Cash Cows. These established lines benefit from strong brand recognition and a significant market share in mature segments, ensuring consistent and substantial cash flow for the company. In 2024, Emmi continues to leverage these strongholds, focusing on operational efficiency to maintain profitability.

The industrial milk powder and concentrates business, particularly goat's milk powder, and established export cheese varieties also represent key Cash Cows. These B2B operations and mature export products contribute significantly to Emmi's financial stability, providing predictable revenue streams that fund other strategic initiatives. The global milk powder market's substantial valuation in 2023 highlights the scale of this industrial segment.

| Emmi Product Category | BCG Matrix Role | Key Characteristics | 2024 Strategic Focus |

|---|---|---|---|

| Traditional Milk & Yogurt | Cash Cow | High market share, mature market, stable cash flow | Maintain market leadership, optimize operations |

| Natural Cheese (excluding specialty) | Cash Cow | Strong brand equity, stable demand, significant revenue contributor | Reinforce market position, operational efficiency |

| Industrial Milk Powder & Concentrates (Netherlands) | Cash Cow | B2B focus, consistent sales, mature market, reliable cash generation | Leverage established customer base, operational excellence |

| Established Export Cheese Varieties | Cash Cow | Mature products, strong European presence, consistent revenue | Maximize profitability, support other business units |

Full Transparency, Always

Emmi BCG Matrix

The Emmi BCG Matrix preview you are viewing is the definitive document you will receive upon purchase. This means that the detailed analysis, clear visual representation of products or business units, and strategic insights presented here are precisely what you will download, ready for immediate application in your business planning.

Dogs

Emmi divested Gläserne Molkerei in August 2023, a move that aligns with the strategic principle of managing 'Dogs' in the BCG Matrix. This divestiture suggests Gläserne Molkerei likely occupied a low-share, low-growth quadrant, tying up valuable resources without generating sufficient returns for Emmi.

Emmi's regional milk powder export business from Switzerland is currently classified as a Dog within the BCG Matrix. This designation stems from a noticeable decline in sales within this segment, indicating a market with low growth prospects and a potentially shrinking market share for Emmi.

In 2024, the global milk powder market, while large, has seen varied regional performance. Switzerland, known for its premium dairy products, faces intense competition in export markets, particularly from countries with lower production costs. This pressure contributes to the underperformance of Emmi's regional milk powder exports, suggesting a need for strategic review.

The strategic implication for Emmi is clear: resources invested in this underperforming Dog segment might yield better returns if reallocated to Emmi's more promising business units, such as its high-growth cheese or branded dairy product divisions, which are performing significantly better in 2024.

Within Emmi's extensive product range, certain conventional dairy items, like standard milk or basic yogurt in mature European markets, might be considered Dogs. These products often contend with intense competition from private labels and specialized brands, leading to low market share and minimal growth potential. For instance, in 2023, the European yogurt market saw a growth rate of only 1.5%, indicating a challenging environment for established players.

Products with declining consumer relevance or high competition in certain regions

Products experiencing a downturn in consumer interest or facing aggressive competition in particular markets, especially where Emmi's market share is already limited, would fall into this category. These items are likely to demand significant resources for even modest gains, making them potential candidates for divestment or reduced investment.

For instance, consider Emmi's traditional cheese offerings in regions where plant-based alternatives have rapidly gained traction. If Emmi's market share in these specific cheese categories within those regions is below 10%, and the growth of plant-based dairy is exceeding 15% annually, these products would fit the Dogs quadrant. Emmi's 2023 annual report indicated a slight decline in the Swiss cheese market's volume, a trend that could be exacerbated in competitive international markets.

- Declining Consumer Relevance: Products like certain niche dairy beverages or traditional cheese varieties in markets rapidly shifting towards health-conscious or alternative options.

- High Regional Competition: Emmi's position in specific dairy product segments within highly competitive Asian or North American markets where local players have strong brand loyalty and distribution.

- Weak Market Position: Products where Emmi holds less than a 5% market share in a particular country or product category, coupled with low or negative growth rates.

- Investment Dilemma: These products often require substantial marketing and innovation investment to counter competitive pressures and shifting consumer preferences, yielding low potential returns.

Legacy products without clear differentiation or innovation

Legacy products without clear differentiation or innovation, often found in mature or declining markets, are typically classified as Dogs in the BCG Matrix. These offerings struggle to compete as consumer preferences shift and new, more advanced alternatives emerge. For instance, a company might have a line of feature phones that, despite historical success, now faces intense competition from smartphones, leading to a significant drop in market share.

These products often reside in low-growth market segments, making it challenging to regain traction. The cost of revitalizing them through significant R&D or marketing efforts can be prohibitively high, especially when the potential return on investment is uncertain. Consider the traditional CD player market; as streaming services and digital downloads became dominant, sales of CD players plummeted, leaving many manufacturers with inventory and declining revenue streams. In 2023, global sales of physical music formats like CDs continued their downward trend, with vinyl showing a resurgence but CDs remaining a niche product.

- Stagnant Market Share: Products in this category typically experience a decline or stagnation in their market share due to a lack of competitive advantage.

- Low Growth Environment: They are usually found in industries or product categories with minimal overall growth prospects.

- High Revitalization Costs: Significant investment in innovation, marketing, or repositioning is often required to improve their performance, which may not be economically viable.

- Potential for Divestment: Companies often consider divesting or discontinuing these products to reallocate resources to more promising ventures.

Emmi's regional milk powder export business from Switzerland is a prime example of a 'Dog' in the BCG Matrix. This segment faces declining sales and operates in a low-growth market, indicating a need for strategic reassessment. The global milk powder market in 2024 presents challenges, with Switzerland's premium products encountering cost-competitive international rivals, further pressuring this export business.

The strategic imperative for Emmi is to consider reallocating resources from these underperforming 'Dog' segments to more lucrative areas, such as their strong cheese or branded dairy divisions, which are demonstrating better performance in 2024. This proactive management of 'Dogs' is crucial for optimizing overall portfolio health and maximizing returns.

Within Emmi's portfolio, certain conventional dairy items, like standard milk or basic yogurt in mature European markets, may also be classified as Dogs. These products contend with intense competition from private labels and specialized brands, resulting in low market share and minimal growth potential. For instance, the European yogurt market grew by a modest 1.5% in 2023, highlighting a challenging environment.

Products experiencing a decline in consumer interest or facing aggressive competition, especially where Emmi's market share is limited, fall into the 'Dog' category. These items often demand significant resources for even marginal gains, making them candidates for divestment or reduced investment. For example, Emmi's traditional cheese offerings in regions where plant-based alternatives are rapidly gaining traction, coupled with a market share below 10% in those specific categories, would fit this classification.

| Emmi Business Segment | BCG Category | Market Growth | Emmi Market Share | Strategic Implication |

|---|---|---|---|---|

| Regional Milk Powder Exports (Switzerland) | Dog | Low | Declining | Resource reallocation, potential divestment |

| Standard Milk/Yogurt (Mature European Markets) | Dog | Low (e.g., 1.5% in EU yogurt 2023) | Low | Focus on efficiency, potential discontinuation |

| Traditional Cheese (Plant-Based Alternative Markets) | Dog | Negative or Stagnant | Low (<10% in specific regions) | Strategic review, potential niche focus or divestment |

Question Marks

Emmi's plant-based milk alternatives are currently positioned as Dogs in the BCG matrix. This is due to a decline in overall sales, despite the general high-growth nature of the plant-based market. For example, while the global plant-based milk market was projected to reach over $40 billion by 2026, Emmi's specific segment has struggled.

The combination of a low market share and declining sales indicates that these products are not performing well. This situation demands either a significant strategic shift or substantial investment to try and reverse the trend and capture a more meaningful portion of the market.

Emmi's strategic focus on new product innovations within emerging niches, such as advanced functional dairy and unique flavor profiles, positions them to capture future market growth. These ventures, while starting with a small market share, target high-potential segments. For example, the global functional foods market was valued at over $270 billion in 2023 and is projected to grow significantly, indicating the potential of these niche areas.

When Emmi ventures into new geographical markets with low initial penetration, its early product portfolio would likely focus on its most established and universally appealing dairy products, such as high-quality yogurts and cheeses. These markets, while offering significant growth potential, demand considerable investment to build brand awareness and distribution networks. For instance, Emmi’s expansion into Southeast Asia in the early 2020s, where its brand recognition was minimal, required substantial marketing spend and partnerships to gain shelf space.

Products resulting from recent small, unproven acquisitions

Products stemming from recent, smaller, unproven acquisitions often fall into the Question Marks category of the BCG Matrix. These ventures, typically in niche markets or emerging technologies, start with low market share and uncertain growth potential. For instance, a company acquiring a small AI startup in early 2024 might see its new AI-powered analytics tool struggle to gain traction against established players, despite significant initial investment.

These products require careful strategic evaluation and substantial investment to determine if they can achieve higher market share and become Stars or if they should be divested. Their future is a gamble; they could become the next big thing or fade into obscurity. For example, a biotech firm acquiring a small lab developing a novel gene therapy in late 2023 might find that regulatory hurdles and clinical trial costs are higher than anticipated, leaving its market penetration minimal by mid-2024.

- Low Market Share: These products typically hold a very small percentage of their respective markets upon introduction.

- Uncertain Growth: Their future growth trajectory is speculative, dependent on market acceptance and competitive landscape evolution.

- High Investment Needs: Significant capital is often required for research, development, marketing, and sales to foster growth.

- Strategic Gamble: They represent a strategic bet on future market potential, with a high risk of failure but also the possibility of high reward.

Specific functional dairy products in nascent categories

Emmi's strategic expansion into specific functional dairy products within nascent categories represents a classic "Question Mark" in the BCG matrix. These products, often developed through innovation or acquisitions like Verde Campo (which itself is a Star in the Brazilian market), target high-growth potential segments but currently hold a small market share. For instance, Emmi has been investing in plant-based alternatives and specialized protein-enhanced yogurts, areas experiencing rapid consumer interest but still in early adoption phases.

The success of these functional dairy offerings hinges on significant investment in marketing, distribution, and consumer education to drive market adoption. Emmi's 2024 strategy likely involves identifying and nurturing these emerging product lines, understanding that they require substantial capital to gain traction. For example, the global functional foods market, including dairy, was projected to reach over $290 billion by 2024, highlighting the opportunity but also the competitive landscape these new Emmi products will face.

- Focus on Niche Markets: Emmi targets specific health and wellness trends with functional dairy, such as gut health or enhanced nutrition.

- High Growth Potential, Low Share: These products operate in rapidly expanding categories but are still building brand recognition and consumer loyalty.

- Investment Required: Significant marketing and R&D spend is necessary to overcome low market share and drive adoption.

- Strategic Acquisitions: Acquisitions like Verde Campo can provide a foothold in these nascent categories, even if the acquired entity is a Star in its own right.

Question Marks in Emmi's portfolio represent products with low market share in high-growth industries, demanding significant investment to determine their future potential. These are essentially new ventures or niche products that Emmi is nurturing, hoping they will evolve into Stars. For example, Emmi's investment in specialized, protein-enriched yogurts, targeting the growing health and wellness trend, fits this description. The global market for yogurts, particularly those with added health benefits, saw substantial growth, with the functional yogurt market alone projected to exceed $15 billion by 2024.

These products are characterized by their uncertain future; they could either capture significant market share and become market leaders or fail to gain traction and be divested. Emmi's strategic approach involves careful monitoring and targeted investment in these areas. For instance, the company's focus on expanding its offerings in plant-based alternatives, while a growing market, still represents a segment where Emmi has a relatively low share compared to established players, requiring continued investment to build presence.

The challenge with Question Marks lies in their high investment needs and the inherent risk. Emmi must decide whether to invest heavily to increase market share or to cut its losses. The company’s 2024 strategy likely involves a rigorous evaluation of these products, prioritizing those with the most promising outlook for future growth and profitability. The overall plant-based food market, for example, was expected to reach over $74 billion globally by 2030, indicating substantial opportunity for well-positioned products.

Emmi's strategic positioning of certain innovative dairy products, such as those with unique probiotic strains or enhanced nutritional profiles, places them squarely in the Question Mark category. These products are entering a market with high growth potential, estimated to be in the double digits annually for functional foods, but currently possess a low market share. For example, Emmi’s efforts in developing lactose-free premium dairy products in emerging markets exemplify this strategy, requiring significant marketing to educate consumers and build demand.

BCG Matrix Data Sources

Our Emmi BCG Matrix leverages comprehensive market data, including financial performance reports, industry growth projections, and competitor analyses, to accurately position each business unit.