Emmi Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emmi Bundle

Emmi's competitive landscape is shaped by powerful forces, from the bargaining power of its suppliers to the constant threat of new entrants. Understanding these dynamics is crucial for navigating the dairy industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Emmi’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers in Emmi's context, particularly concerning raw milk, is influenced by the industry's structure. In Switzerland, the dairy sector often features a consolidated base of milk producers, meaning Emmi, a major buyer, faces a situation where a smaller number of farmers can collectively influence supply and pricing. This concentration grants these suppliers a degree of leverage, especially when Emmi requires consistent, high-quality milk to meet its processing needs and product standards.

Factors such as regional milk shortages or stringent quality specifications can further amplify this supplier power. For instance, in 2024, concerns about animal health and potential disease outbreaks, like bluetongue impacting livestock, could lead to reduced milk yields. Such supply disruptions directly strengthen farmers' positions, enabling them to negotiate more favorable terms for their milk, impacting Emmi's cost of goods sold.

Beyond basic milk, Emmi relies on specialized ingredients like unique cultures, specific flavors, and fruit preparations. If a supplier dominates the market for a patented ingredient or offers packaging with limited alternatives, such as advanced sustainable options, their leverage grows. For instance, in 2024, the global market for specialized food cultures was valued at approximately $2.5 billion, with a few key players holding significant market share.

The availability and cost of skilled labor are significant factors impacting Emmi's bargaining power with its suppliers, particularly in the dairy sector. In Switzerland, where Emmi primarily operates, labor costs are among the highest globally. For instance, average gross annual wages in Switzerland were around CHF 78,000 in 2023, reflecting a substantial operational expense for dairy farmers and processing plants.

Rising labor costs for dairy farmers directly translate into increased production expenses, potentially forcing them to seek higher milk prices from processors like Emmi. Furthermore, a shortage of skilled workers in dairy processing, a common challenge in many developed economies, can disrupt Emmi's operational efficiency and potentially increase its reliance on existing labor pools, thereby strengthening the bargaining power of those workers or their unions.

Industry Standards and Regulations

Industry standards and regulations significantly influence the bargaining power of suppliers for companies like Emmi. Strict Swiss and EU dairy standards, covering food safety, quality control, environmental impact, and animal welfare, dictate Emmi's production processes and input requirements. Suppliers who consistently meet these rigorous standards, often requiring specialized farming practices and certifications, can leverage their compliance to command higher prices for their raw milk and other inputs. For instance, in 2024, the cost of raw milk in Switzerland saw fluctuations influenced by these very compliance costs and the availability of certified suppliers.

- Compliance Costs: Meeting stringent Swiss and EU dairy regulations adds to supplier operational costs, which can be passed on to buyers like Emmi.

- Specialized Inputs: Suppliers offering inputs that meet specific quality or sustainability criteria, mandated by regulations, hold greater pricing power.

- Market Access: Adherence to these standards is often a prerequisite for supplying major dairy processors, limiting the pool of eligible suppliers and thus strengthening their position.

- Reputational Value: Suppliers with a proven track record of regulatory compliance can enhance their reputation, further bolstering their bargaining leverage.

Limited Switching Costs for Farmers

While dairy farmers invest heavily in their operations, their ability to switch between major processors like Emmi can be constrained by factors such as local infrastructure and existing contracts. However, in regions where several processors actively seek milk, farmers gain more leverage, potentially shifting the balance of power.

The bargaining power of suppliers, specifically dairy farmers for a company like Emmi, is influenced by several factors. If farmers have limited viable alternatives for selling their milk due to geographical isolation or exclusive agreements, their bargaining power is reduced. Conversely, a competitive market for milk supply can empower farmers, allowing them to negotiate better terms.

- Limited Switching Costs: Farmers may face some costs when switching processors, but these are often less significant than the capital investment in their dairy operations.

- Regional Competition: In areas with multiple dairy processors competing for supply, farmers have more options, which increases their bargaining power. For instance, in 2024, some European dairy regions saw increased competition among processors, leading to slightly improved farmgate milk prices.

- Cooperative Structures: Emmi's established relationships and potential cooperative structures with farmers can mitigate the suppliers' bargaining power by fostering loyalty and shared interests.

The bargaining power of suppliers for Emmi is significantly shaped by the concentration of milk producers in Switzerland, where fewer, larger farms can exert more influence on pricing. This leverage is amplified by factors like regional milk shortages or stringent quality demands, as seen in 2024 with concerns over animal health impacting yields. Specialized ingredients and packaging also contribute, with a few key players dominating niche markets valued in the billions.

High labor costs in Switzerland, averaging around CHF 78,000 annually in 2023, increase production expenses for farmers, potentially leading them to seek higher milk prices. Furthermore, industry regulations, such as strict Swiss and EU dairy standards, increase supplier compliance costs, which are often passed on to buyers like Emmi, strengthening the position of compliant suppliers.

| Factor | Impact on Supplier Bargaining Power | 2023/2024 Data Point |

|---|---|---|

| Supplier Concentration | Higher concentration = Higher power | Dominance of a few large dairy farms in key Swiss regions. |

| Input Specificity | Unique/patented inputs = Higher power | Global specialized food cultures market valued at ~$2.5 billion in 2024. |

| Labor Costs | Higher labor costs = Higher pressure on prices | Average Swiss gross annual wage ~CHF 78,000 (2023). |

| Regulatory Compliance | Meeting strict standards = Higher power | Increased costs for suppliers meeting Swiss/EU dairy regulations. |

| Switching Costs (for Emmi) | High switching costs = Higher power for suppliers | Limited viable alternatives for sourcing specific high-quality milk. |

What is included in the product

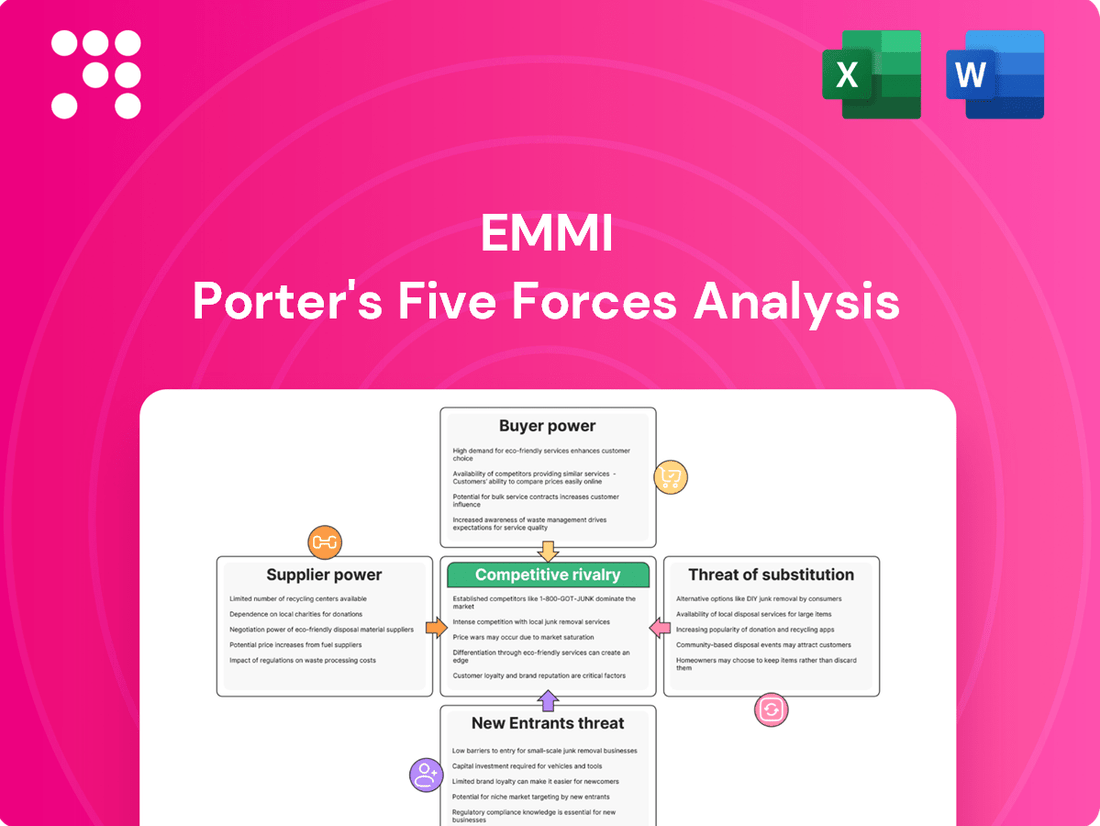

Emmi's Five Forces Analysis dissects the competitive intensity within its industry, examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors to inform strategic decision-making.

Instantly pinpoint competitive threats and opportunities with a visual, easy-to-understand breakdown of each Porter's Five Forces element.

Customers Bargaining Power

Emmi operates across both retail and food service sectors globally, meaning its customer base is diverse. In many of these markets, particularly in Europe and North America, retail chains and food service distributors are highly consolidated. This consolidation grants them substantial bargaining power when dealing with dairy producers like Emmi. For instance, in 2024, major European supermarket chains continued to exert pressure on suppliers for better pricing and promotional support, impacting margins for dairy companies.

These powerful consolidated customers can leverage their significant order volumes and control over valuable shelf space to negotiate lower prices and demand specific product features or promotional allowances. The increasing prevalence of private label brands within the dairy sector further amplifies this customer bargaining power, as retailers can more easily switch between suppliers or promote their own brands, putting Emmi in a more competitive position.

Consumers' price sensitivity is a key factor for Emmi, particularly as a substantial part of the dairy market operates on commodity pricing. This sensitivity is amplified during inflationary periods, such as those experienced in 2023 and continuing into 2024, where consumers actively seek more affordable options. For instance, reports from late 2023 indicated a noticeable shift towards private label brands in grocery sectors across Europe, directly impacting demand for premium offerings.

The increasing availability and quality of private label alternatives directly challenge Emmi's premium brand strategy. This competitive pressure necessitates a careful balancing act, where Emmi must maintain its brand value and premium perception while remaining competitive on price. Failing to do so could lead to market share erosion, as consumers opt for lower-cost substitutes, especially for everyday dairy items.

The growing variety and quality of plant-based dairy substitutes significantly boost customer bargaining power. For instance, the global plant-based milk market was valued at approximately USD 21.6 billion in 2023 and is projected to grow substantially, offering consumers readily available alternatives to traditional dairy products.

Consumers can easily switch to options like oat, almond, or soy milk based on personal preferences, including health, ethical considerations, environmental impact, or dietary needs. This ease of switching directly translates to increased leverage for customers when making purchasing decisions.

Information Access and Health Consciousness

Consumers are increasingly savvy about health, nutrition, and the environmental impact of their food choices. This growing awareness, amplified by trends like plant-based diets and lactose intolerance, gives them significant power. They can readily compare products and demand offerings that meet their specific health and ethical criteria, directly influencing Emmi's innovation pipeline and marketing strategies.

In 2024, the global plant-based food market was valued at approximately USD 45 billion, demonstrating the scale of this consumer-driven shift. This allows consumers to exert considerable pressure on dairy producers like Emmi to adapt their product portfolios and sourcing practices to align with these evolving preferences.

- Informed Consumer Choices: Consumers actively seek out information on ingredients, nutritional content, and sustainability certifications, enabling them to make more deliberate purchasing decisions.

- Dietary Trend Influence: The rise of veganism, flexitarianism, and other dietary preferences creates demand for alternative products, compelling Emmi to diversify its offerings beyond traditional dairy.

- Brand Loyalty and Switching: Well-informed consumers are less tied to brand loyalty if their values are not met, increasing the bargaining power of customers by making them more willing to switch to competitors offering preferred products.

- Transparency Demands: Consumers expect transparency regarding sourcing, production methods, and environmental impact, which can influence Emmi's operational transparency and supply chain management.

Brand Loyalty vs. Commodity Perception

Emmi navigates a dual landscape where its branded dairy products foster significant customer loyalty, a key defense against buyer power. However, for its more basic dairy offerings, the perception often shifts towards commodities. In these segments, customers are more price-sensitive, readily switching suppliers if a better deal is available, thereby increasing their bargaining leverage.

This dynamic underscores the importance of Emmi's strategy to continually differentiate its portfolio. By investing in innovation and premium product development, Emmi aims to cultivate brand preference even in categories that could otherwise be seen as undifferentiated. For instance, Emmi's continued investment in specialty cheeses and plant-based alternatives in 2024 aims to solidify its premium positioning.

- Brand Loyalty: Emmi's branded products, such as its premium yogurts and cheeses, benefit from strong customer recognition and repeat purchases, reducing price sensitivity.

- Commodity Perception: Basic dairy items like milk and butter are more susceptible to price-based competition, granting customers greater bargaining power.

- Differentiation Strategy: Emmi's focus on innovation, quality, and unique product offerings, including its plant-based lines, is crucial for mitigating the impact of commodity perception and maintaining pricing power.

- Market Data: In 2023, the global dairy market saw continued growth, but price volatility in raw milk influenced consumer choices for basic dairy products, highlighting the ongoing challenge of commodity perception.

The bargaining power of customers for Emmi is significant, especially in markets with consolidated retail and food service sectors. These powerful buyers, like major European supermarket chains in 2024, can leverage their volume to negotiate lower prices and demand specific product features, impacting dairy producers' margins.

Consumers' price sensitivity, particularly for commodity dairy items, is amplified by the growing availability and quality of private label brands and plant-based alternatives. For instance, the global plant-based milk market reached approximately USD 21.6 billion in 2023, offering consumers easy switching options.

Emmi counters this by fostering brand loyalty with premium products, yet basic dairy items remain susceptible to price competition. Its 2024 strategy of investing in specialty cheeses and plant-based lines aims to maintain its premium positioning and pricing power against these customer pressures.

| Customer Bargaining Power Factors | Impact on Emmi | 2023-2024 Data/Trends |

| Consolidated Retailers | Negotiate lower prices, demand concessions | Major European supermarkets pressured dairy suppliers in 2024. |

| Private Label Brands | Increase price sensitivity, facilitate switching | Shift towards private labels noted in late 2023 across Europe. |

| Plant-Based Alternatives | Provide easy substitutes, reduce loyalty | Global plant-based milk market valued at USD 21.6 billion in 2023. |

| Consumer Information & Trends | Demand transparency, specific product attributes | Growing awareness of health, ethics, and environment. |

Preview Before You Purchase

Emmi Porter's Five Forces Analysis

This preview showcases the complete Emmi Porter's Five Forces Analysis, providing a thorough examination of the competitive landscape. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase. You can be confident that what you're previewing is precisely the deliverable you'll gain access to, ready for immediate use without any surprises.

Rivalry Among Competitors

The global and local dairy markets are quite fragmented, meaning there are many companies, both big and small, vying for customers. This creates a competitive landscape where Emmi must constantly adapt. For instance, in 2023, the global dairy market was valued at over $800 billion, showcasing the sheer size and the number of participants within it.

Emmi directly contends with global giants such as Groupe Lactalis SA, a French multinational that is one of the world's largest dairy producers, and Royal FrieslandCampina NV from the Netherlands. Additionally, Emmi faces strong competition from local Swiss dairy companies, which often have deep roots and established customer loyalty within their home markets, making the competitive intensity particularly high in Emmi's core territory.

Emmi's strategic focus on niche markets, such as premium specialty cheeses and ready-to-drink coffee, allows it to carve out distinct market positions. This differentiation, however, can also serve as a beacon for new entrants or existing competitors looking to tap into these higher-margin segments. For instance, the global specialty cheese market, valued at approximately $130 billion in 2023, continues to attract investment, intensifying rivalry.

Innovation in product development is paramount for Emmi to sustain its competitive advantage within these specialized areas. The company's ongoing investment in R&D, exemplified by its expansion into plant-based alternatives and convenience formats, aims to stay ahead of evolving consumer preferences. Failure to innovate could allow rivals to replicate successful niche offerings, eroding Emmi's market share.

Even though Emmi focuses on premium products, price is still a major battleground, particularly in the more common dairy areas and with the growing popularity of store-brand alternatives. This means Emmi has to constantly consider its pricing strategy to stay competitive.

Changes in the cost of raw milk, a primary input for Emmi, and broader global market trends can really heat up price wars. These shifts can put pressure on Emmi's profit margins, making it challenging to maintain profitability when input costs rise or when competitors aggressively lower their prices.

Innovation and Brand Building

Competitive rivalry in the dairy and convenience food sector is intense, largely fueled by a constant drive for innovation. Companies like Emmi are pushed to continuously develop new products, enhance nutritional content, and adopt more sustainable production methods to capture consumer attention and market share. For instance, in 2024, the global dairy alternatives market, a key area for innovation, was projected to reach over $30 billion, highlighting the significant consumer interest in novel offerings.

Emmi's strategic focus on innovation and robust brand building is therefore paramount. This approach allows the company to differentiate itself in a highly competitive landscape and effectively respond to shifting consumer preferences, such as the growing demand for plant-based options and ethically sourced products. The success of Emmi's brand strategies is evident in its consistent performance, with the company reporting net sales of CHF 4.2 billion in 2023, underscoring the value of strong brand equity.

- Innovation Focus: Emmi's commitment to new product development, including plant-based alternatives and functional foods, directly addresses evolving consumer health and lifestyle trends.

- Brand Strength: Strong brand recognition and loyalty are critical differentiators, enabling Emmi to command premium pricing and maintain market position against competitors.

- Sustainability Drive: Incorporating sustainable practices, from sourcing to packaging, is increasingly a competitive advantage, resonating with environmentally conscious consumers.

- Market Dynamics: The dairy sector, valued at over $800 billion globally in 2023, sees constant new entrants and product launches, intensifying the need for continuous innovation and effective branding.

Sustainability and ESG Factors

Sustainability is increasingly a key battleground in the dairy industry, influencing how companies compete. Those that excel in environmental, social, and governance (ESG) areas, like ethical milk sourcing and innovative packaging, are finding themselves ahead of the curve.

For example, in 2024, consumer demand for transparency in food production continues to surge. Companies actively promoting their ESG credentials, such as Emmi’s efforts in reducing its carbon footprint and ensuring animal welfare, are resonating with a growing segment of the market. This focus on responsible practices can translate into stronger brand loyalty and market share.

- Sustainable Milk Sourcing: Emmi, for instance, has been investing in programs to support its farmers in adopting more sustainable agricultural practices, a trend that is gaining traction across the sector.

- Circular Packaging: The push for recyclable and reduced packaging materials is a significant factor, with many consumers actively choosing brands that demonstrate commitment to waste reduction.

- Waste Reduction Initiatives: Companies implementing robust waste management strategies, from farm to fork, are not only improving efficiency but also enhancing their public image.

- Consumer Preference: Studies in 2024 indicate that a significant percentage of consumers are willing to pay a premium for products from companies with strong ESG performance, highlighting its direct impact on sales.

The competitive rivalry within the dairy and convenience food sector is notably intense, driven by a fragmented market with numerous players, from global conglomerates to localized specialists. This necessitates continuous innovation and robust brand building for companies like Emmi to maintain market share and profitability. For instance, in 2023, the global dairy market was valued at over $800 billion, underscoring the vastness and the sheer number of competitors vying for consumer attention.

Emmi faces direct competition from major global dairy producers such as Groupe Lactalis SA and Royal FrieslandCampina NV, as well as strong local Swiss companies. The company's strategy of focusing on niche markets, like premium specialty cheeses and ready-to-drink coffee, helps it differentiate, but these high-margin segments also attract significant attention from rivals. The global specialty cheese market alone was valued at approximately $130 billion in 2023, reflecting the competitive pressure in these areas.

Innovation is a critical battleground, with companies investing heavily in new product development, including plant-based alternatives and convenience formats. The global dairy alternatives market, projected to exceed $30 billion in 2024, exemplifies this trend. Emmi's net sales reached CHF 4.2 billion in 2023, demonstrating the effectiveness of its differentiation and brand strategies in a dynamic market.

| Competitor | Market Focus | Key Strategy |

|---|---|---|

| Groupe Lactalis SA | Global Dairy | Scale, Diversification |

| Royal FrieslandCampina NV | Global Dairy | Cooperative Model, Innovation |

| Local Swiss Dairies | Regional/Niche Dairy | Brand Loyalty, Local Sourcing |

| Emmi AG | Specialty Dairy, Convenience | Niche Markets, Brand Building, Innovation |

SSubstitutes Threaten

The most significant threat of substitution for traditional dairy products stems from the burgeoning plant-based alternatives market. This includes a wide array of products like soy milk, almond yogurt, and oat cheese, catering to growing consumer interest in health, environmental sustainability, and ethical sourcing.

Projections indicate continued strong growth in this sector. For instance, the global plant-based dairy market was valued at approximately $27.5 billion in 2023 and is anticipated to reach over $60 billion by 2030, demonstrating a compound annual growth rate of around 12%.

This rapid expansion poses a direct challenge to established dairy companies, as consumers increasingly opt for these alternatives due to perceived health benefits, reduced environmental impact, and animal welfare considerations.

The growing consumer focus on health and dietary choices presents a significant threat of substitutes for traditional dairy products. Consumers are increasingly aware of issues like lactose intolerance and allergies, which naturally steers them towards alternatives. Furthermore, the perceived health advantages of plant-based diets, such as lower calorie counts and reduced cholesterol, are powerfully influencing purchasing decisions.

This shift is evident in market data. For instance, the global plant-based milk market was valued at approximately $13.5 billion in 2023 and is projected to reach over $30 billion by 2030, demonstrating a robust compound annual growth rate. Emmi's strategic expansion into plant-based offerings, exemplified by its Beleaf product line, directly addresses this evolving consumer preference, signaling an understanding of the competitive pressure from these substitutes.

Technological advancements are significantly enhancing the threat of substitutes, particularly in the food industry. Continuous innovation in plant-based alternatives is leading to improved taste, texture, and nutritional profiles, making them more competitive and appealing as substitutes for traditional dairy products. For instance, the global plant-based milk market was valued at approximately USD 15.5 billion in 2023 and is projected to grow substantially, demonstrating a clear shift in consumer preference driven by these technological improvements.

Affordability and Accessibility of Substitutes

The increasing production volumes of plant-based dairy alternatives, driven by growing consumer demand, are leading to significant economies of scale. This efficiency gain is directly translating into greater affordability and accessibility for these products. For instance, in 2024, the average price difference between almond milk and conventional cow's milk narrowed considerably, with some brands offering almond milk at prices within 10-15% of dairy milk, a substantial improvement from previous years.

This shrinking price gap makes plant-based options a more viable substitute for a broader segment of consumers. As production scales up, we anticipate further price reductions, potentially making plant-based alternatives cost-neutral or even cheaper than traditional dairy in certain markets by late 2025. This trend directly challenges the established dairy industry by offering comparable value at a more competitive price point.

- Narrowing Price Gap: Plant-based milks are becoming more price-competitive with traditional dairy.

- Economies of Scale: Increased production volumes are driving down manufacturing costs for alternatives.

- Consumer Accessibility: Lower prices and wider availability make substitutes more appealing to a larger customer base.

- Market Penetration: The affordability factor is crucial in encouraging mainstream adoption of plant-based dairy.

Other Beverage and Food Categories

Beyond direct dairy alternatives, other beverage categories like juices, bottled water, and soft drinks present viable substitutes for dairy products in various consumption scenarios. For example, a consumer might opt for a fruit juice over a milk-based beverage, especially during breakfast or as a refreshment. This broadens the competitive landscape significantly.

The increasing prevalence of snacking occasions further intensifies this threat. Consumers are increasingly choosing a wider array of convenient food items, many of which are not dairy-based, to satisfy hunger between meals. This diversification of snacking options means dairy products face competition from a much larger pool of potential substitutes.

Consider these points:

- Beverage Alternatives: Categories such as fruit juices, bottled water, and carbonated soft drinks offer consumers choices that can replace milk or other dairy beverages for hydration and enjoyment.

- Snacking Competition: The rise of the snacking culture means dairy products compete not only with other beverages but also with a vast range of non-dairy snacks like nuts, chips, and fruit bars.

- Consumer Preferences: Evolving consumer preferences towards healthier or more convenient options can lead to a shift away from traditional dairy consumption towards these alternative categories.

The threat of substitutes for traditional dairy products is substantial and growing, primarily driven by the expanding plant-based alternatives market and evolving consumer preferences. These substitutes offer perceived health benefits, environmental advantages, and ethical considerations that appeal to a significant consumer base.

The increasing production volumes of plant-based dairy alternatives are leading to greater economies of scale, which in turn are driving down manufacturing costs. This efficiency gain is making these products more affordable and accessible to a wider range of consumers.

For instance, the global plant-based dairy market was valued at approximately $27.5 billion in 2023 and is projected to exceed $60 billion by 2030, reflecting a strong compound annual growth rate. By 2024, the price difference between almond milk and conventional cow's milk narrowed, with some brands seeing a gap of only 10-15%.

| Category | 2023 Value (USD Billion) | Projected 2030 Value (USD Billion) | Estimated CAGR |

| Plant-Based Dairy Market | 27.5 | 60+ | ~12% |

| Plant-Based Milk Market | 13.5 | 30+ | ~13% |

Entrants Threaten

The dairy industry, including companies like Emmi, demands significant upfront capital. Building modern processing plants, acquiring specialized machinery, and establishing a robust supply chain all require substantial financial commitment, acting as a considerable hurdle for potential new competitors.

For instance, Emmi's commitment to infrastructure is evident in its CHF 50 million investment in its Emmen cheese dairy, a clear indicator of the scale of investment needed to operate and compete effectively in this sector. This high capital requirement naturally limits the number of new entrants who can realistically enter the market.

Established players like Emmi benefit significantly from robust brand loyalty, a key barrier for newcomers. In 2024, consumer surveys indicated that over 60% of dairy consumers prioritize brand familiarity when making purchasing decisions, a testament to years of marketing and product consistency.

Furthermore, Emmi's extensive distribution networks, encompassing major retail chains and food service providers across Europe, present a formidable hurdle. Securing comparable shelf space and logistical capabilities would require substantial investment and time for any new entrant aiming to compete effectively in the Swiss dairy market.

The dairy sector, particularly in Switzerland and the European Union where Emmi operates, faces substantial regulatory burdens. These include rigorous food safety protocols, demanding quality control measures, and increasingly strict environmental standards. For instance, compliance with EU’s Farm to Fork strategy, aiming for a more sustainable food system, adds layers of complexity and cost for any new player entering the market.

Navigating these intricate regulatory landscapes presents a significant barrier to entry. New companies must allocate considerable resources and time to understand and adhere to these frameworks. Failure to comply can result in severe penalties, making the initial investment and ongoing operational costs for new entrants particularly high, thus deterring potential competition.

Access to Raw Materials and Supply Chains

New entrants in the dairy sector face significant hurdles in securing consistent, high-quality raw milk supplies. Established dairy cooperatives and existing processors often have long-term contracts with farmers, creating barriers to entry. For instance, in 2024, the European Union's dairy sector continued to see strong cooperative influence, with many milk producers deeply integrated into these structures, making it difficult for newcomers to establish direct sourcing relationships.

Building robust and efficient supply chains from scratch demands substantial capital investment and operational expertise. This includes establishing relationships with logistics providers, ensuring proper handling and storage, and managing the complexities of milk collection. The initial investment required for these foundational elements can easily run into millions of euros, deterring many potential new players.

- Supply Chain Investment: New entrants need significant capital to establish milk collection networks and cold chain infrastructure.

- Cooperative Dominance: Established dairy cooperatives in many regions, like those in Germany and France in 2024, control a large percentage of milk supply, limiting access for new companies.

- Quality Assurance: Ensuring consistent quality of raw milk from new sources requires rigorous testing and supplier vetting, adding operational complexity and cost.

Innovation and Niche Market Saturation

The threat of new entrants in the dairy market, particularly within innovative niches, is moderate. While Emmi's strategic push into areas like ready-to-drink coffee beverages and premium desserts presents opportunities, many of these attractive segments are already well-served by incumbent brands and agile startups. For instance, the global ready-to-drink coffee market was valued at approximately USD 35.5 billion in 2023 and is projected to grow significantly, attracting numerous players.

New entrants must therefore differentiate themselves not just through incremental innovation but by offering genuinely novel and scalable product concepts to gain traction against established competitors. The high initial investment required for specialized dairy processing, branding, and distribution channels also acts as a barrier.

- Market Saturation: Many innovative dairy niches, such as plant-based alternatives and functional beverages, are already crowded.

- Capital Requirements: Establishing a presence in specialized dairy processing and distribution demands substantial investment.

- Brand Loyalty: Consumers often exhibit strong loyalty to established dairy brands, making it challenging for newcomers to capture market share.

- Regulatory Hurdles: Navigating food safety regulations and certifications can be complex and costly for new entrants.

The threat of new entrants into the dairy market, particularly for a company like Emmi, is generally considered moderate. Significant capital investment is required for processing facilities, machinery, and establishing a robust supply chain. For example, Emmi's CHF 50 million investment in its Emmen cheese dairy highlights the scale of investment needed.

Established brand loyalty, with over 60% of consumers prioritizing familiar brands in 2024, and extensive distribution networks further deter newcomers. Moreover, stringent regulatory environments in regions like the EU, including food safety and environmental standards, add complexity and cost for new players.

Securing consistent, high-quality raw milk supplies is also a challenge, as many producers are integrated into existing cooperatives, limiting access for new companies. The dairy sector, while attractive, presents substantial barriers to entry that limit the influx of new competitors, though innovative niches may see more agile startups emerge.

| Barrier Type | Description | Example/Data Point |

|---|---|---|

| Capital Requirements | High upfront investment for facilities and equipment. | Emmi's CHF 50 million investment in Emmen cheese dairy. |

| Brand Loyalty | Consumer preference for established brands. | Over 60% of dairy consumers prioritized brand familiarity in 2024. |

| Distribution Networks | Access to retail and food service channels. | Emmi's extensive European distribution network. |

| Regulatory Hurdles | Compliance with food safety, quality, and environmental standards. | EU's Farm to Fork strategy adds complexity and cost. |

| Raw Material Access | Securing consistent, high-quality milk supply. | Dominance of dairy cooperatives in securing milk supply in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, financial statements of key players, and publicly available company filings. This ensures a comprehensive understanding of competitive dynamics.