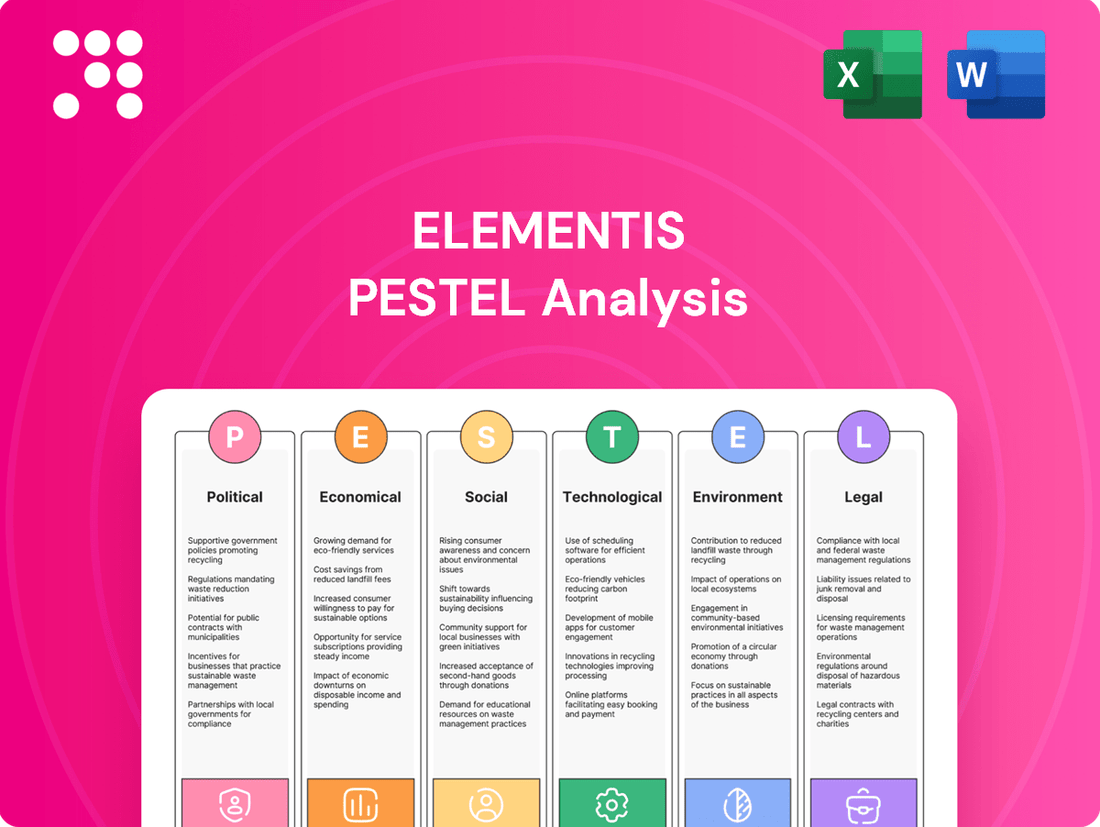

Elementis PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elementis Bundle

Navigate the complex external forces shaping Elementis's future with our detailed PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental factors are creating both opportunities and challenges for the company. Equip yourself with actionable intelligence to make informed strategic decisions. Download the full report now and gain a crucial competitive edge.

Political factors

Elementis's operations are significantly influenced by government stability across North America, Europe, and Asia, with political shifts directly impacting its supply chain resilience and access to crucial markets. For instance, in 2024, ongoing political realignments in parts of Europe presented challenges for consistent regulatory frameworks, necessitating agile adaptation in Elementis's operational planning.

Trade policies and tariffs remain a critical variable. Fluctuations in agreements between major economic blocs, such as potential adjustments to the US-EU trade relationship in 2025, can alter raw material sourcing costs and product pricing strategies. This directly affects Elementis's profitability and its position within the competitive chemical industry landscape.

Geopolitical tensions and evolving trade landscapes continue to shape the global chemical sector. By mid-2025, companies like Elementis must proactively manage complex international relations to ensure supply chain continuity and maintain market access amidst these dynamic conditions.

Government policies and regulatory shifts are pivotal for Elementis. For example, evolving environmental regulations in the EU, particularly REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), continue to shape compliance costs and product development strategies. In 2024, the US Environmental Protection Agency (EPA) is expected to finalize new rules impacting chemical manufacturing, potentially requiring significant investment in process upgrades and safety protocols for companies like Elementis.

Government initiatives, like infrastructure development projects, directly boost demand for Elementis's products, particularly in the paints and coatings sector where its rheology modifiers are essential. For instance, ongoing infrastructure spending in emerging markets is a key driver.

Manufacturing incentives and support for specific industries create favorable market conditions. Asia Pacific's chemical sector, expected to grow, benefits from these investments, positively impacting companies like Elementis.

Corporate Governance and Reporting Standards

Political emphasis on robust corporate governance and transparent reporting, especially in the UK, directly shapes Elementis's operational framework and investor interactions. Adherence to the UK Corporate Governance Code is paramount, encompassing critical areas like board composition diversity and environmental, social, and governance (ESG) initiatives. These elements significantly influence how the market perceives the company and the trust investors place in it.

Elementis's commitment to these standards is evident in its 2024 Annual Report, published in March 2025. This report meticulously outlines the company's compliance with the UK Corporate Governance Code, demonstrating accountability and a proactive approach to regulatory expectations. Such transparency is crucial for maintaining a strong reputation and attracting sustained investment.

- UK Corporate Governance Code Compliance: Elementis plc actively reports on its adherence to the UK Corporate Governance Code, as detailed in its March 2025 Annual Report.

- Board Diversity and Sustainability Reporting: The code mandates reporting on board diversity metrics and sustainability efforts, areas Elementis addresses to enhance stakeholder confidence.

- Investor Relations Impact: Strong governance and transparent reporting directly influence Elementis's public perception and its ability to foster positive investor relations.

International Relations and Market Access

The state of international relations significantly impacts Elementis's global operations and expansion prospects. Favorable diplomatic ties and robust trade agreements are crucial for seamless market access and efficient business operations in regions where Elementis has a presence or customer base.

Shifts in global trade dynamics and economic conditions are anticipated to be a defining feature of the first half of 2025. For instance, the World Trade Organization (WTO) projected in late 2024 that global trade growth might moderate to around 2.6% for 2025, down from an estimated 3.3% in 2024, influenced by geopolitical tensions and protectionist policies.

- Geopolitical Stability: Ongoing conflicts or political instability in key markets could disrupt supply chains and reduce demand for Elementis's specialty chemicals.

- Trade Agreements: The status of bilateral and multilateral trade agreements, such as those involving the European Union or the United States, directly affects import/export tariffs and market entry barriers for Elementis.

- Sanctions and Embargoes: International sanctions imposed on certain countries can restrict Elementis's ability to conduct business, impacting revenue streams from those regions.

- Regulatory Harmonization: Differences in chemical regulations across various jurisdictions can create compliance challenges and increase operational costs for Elementis.

Political stability across Elementis's key operational regions, including North America, Europe, and Asia, directly influences its supply chain and market access. For example, political realignments in Europe during 2024 necessitated agile adaptation in regulatory frameworks.

Trade policies and tariffs are critical. Potential adjustments to US-EU trade relationships in 2025 could impact raw material costs and pricing, affecting Elementis's profitability.

Government initiatives, such as infrastructure spending, boost demand for Elementis's products. Emerging markets' infrastructure development is a key driver for its paints and coatings sector chemicals.

Evolving environmental regulations, like the EU's REACH, shape compliance costs and product development. In 2024, the US EPA's new chemical manufacturing rules may require significant investment in process upgrades for companies like Elementis.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Elementis, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within the global specialty chemicals market.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for Elementis.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the PESTLE factors impacting Elementis.

Economic factors

The overall health of the global economy is a key driver for Elementis, as it directly influences demand for its specialty chemical additives. A robust global economy generally means increased industrial activity, higher consumer spending on personal care items, and more construction projects, all of which boost the need for Elementis's products.

Looking ahead, the global chemical production sector is anticipated to see a growth of 3.5% in 2025. This figure suggests a moderate rebound for the industry, which bodes well for companies like Elementis that supply essential components across various manufacturing sectors.

Elementis's financial health is closely linked to the expansion of its primary customer sectors: personal care, coatings, and energy. The company's success hinges on the performance within these diverse industries.

The market for rheology modifiers, a key product category for Elementis, is projected to expand significantly. Estimates suggest this market will reach $3540.6 million by 2030, growing at a compound annual growth rate of 4.10% between 2024 and 2030. This growth is largely fueled by increasing demand in applications such as adhesives, sealants, and the personal care sector.

Furthermore, the coatings industry itself is experiencing substantial innovation and growth. This trend provides a favorable environment for Elementis, as coatings represent a major end-use market for its specialty additives.

Elementis, as a chemical company, is significantly impacted by the cost and availability of its raw materials. For instance, the price of key inputs like lithium, used in some specialty chemicals, can fluctuate based on global demand and mining output. In early 2025, lithium prices saw a notable increase, impacting companies reliant on this mineral.

Supply chain disruptions, whether from geopolitical events or logistical challenges, add another layer of volatility. These issues can lead to increased lead times and higher transportation expenses, directly affecting Elementis's production costs and, consequently, its profit margins. The ongoing global economic pressures in 2025 continue to challenge chemical manufacturers in managing these rising input costs.

Currency Exchange Rates and Inflation

Elementis, as a global player, is significantly impacted by currency exchange rate volatility. Fluctuations in rates directly alter the value of its international revenues and the cost of goods and services acquired abroad. For instance, a stronger US dollar against other major currencies could reduce the reported value of sales made in those currencies.

Inflation presents a dual challenge. Rising input costs, from raw materials to energy, can squeeze Elementis's profit margins. Simultaneously, persistent inflation can erode consumer spending power, potentially dampening demand for the end products that utilize Elementis's specialty additives. This was evident in 2024, where many economies grappled with elevated inflation rates, impacting discretionary spending.

- Currency Impact: In 2024, the US Dollar saw a notable appreciation against the Euro and Pound Sterling, potentially impacting Elementis's reported earnings from its European operations.

- Inflationary Pressures: Global inflation averaged around 5.5% in major economies during 2024, increasing operational costs for companies like Elementis.

- Consumer Demand: Higher inflation in 2024 led to a slowdown in consumer discretionary spending in several key markets, indirectly affecting demand for certain specialty chemicals.

Investment and R&D Spending

Economic conditions significantly shape Elementis's ability to fund crucial research and development (R&D) and expand its manufacturing capabilities. Strong economic performance generally translates to greater financial resources available for these strategic investments, which are vital for staying ahead in the competitive specialty chemicals sector.

Elementis's commitment to R&D is underscored by its focus on innovation. The company has pinpointed seven key growth platforms anticipated to drive incremental revenue increases through 2026. This strategic investment in R&D is designed to foster new product development and enhance existing offerings, ensuring Elementis remains competitive.

For instance, Elementis's investment in innovation is a core part of its strategy. In its 2023 annual report, the company highlighted its ongoing efforts in R&D, aiming to capitalize on market trends and technological advancements. These investments are crucial for maintaining its market position and achieving its growth targets.

- R&D Investment: Elementis continues to allocate resources to R&D to fuel innovation in specialty chemicals.

- Growth Platforms: The company has identified seven growth platforms expected to contribute to revenue expansion by 2026.

- Economic Sensitivity: Investment capacity in R&D and production expansion is directly influenced by prevailing economic conditions.

- Competitive Edge: Sustained R&D spending is essential for Elementis to maintain its competitive advantage and introduce novel solutions.

Global economic growth directly fuels demand for Elementis's specialty chemicals, impacting sectors like personal care and coatings. The chemical industry's projected 3.5% growth in 2025 and the rheology modifiers market's expected rise to $3540.6 million by 2030 highlight favorable market conditions.

However, Elementis faces economic headwinds from raw material price volatility, such as the early 2025 increase in lithium prices, and ongoing supply chain disruptions. Inflationary pressures, averaging 5.5% in major economies in 2024, also increase operational costs and can dampen consumer spending, affecting demand for Elementis's products.

Currency fluctuations, like the US Dollar's appreciation in 2024 against the Euro and Pound Sterling, can impact reported international earnings. Despite these challenges, Elementis continues to invest in R&D, identifying seven growth platforms to drive revenue by 2026, demonstrating a commitment to innovation and maintaining a competitive edge.

| Economic Factor | 2024/2025 Data/Trend | Impact on Elementis |

| Global Economic Growth | Projected 3.5% growth in chemical production (2025) | Increased demand for specialty chemicals |

| Raw Material Costs | Lithium price increase (early 2025) | Higher production costs |

| Inflation | Averaged 5.5% in major economies (2024) | Increased operational costs, potential demand reduction |

| Currency Exchange Rates | US Dollar appreciation vs. EUR/GBP (2024) | Impact on reported international earnings |

| Market Growth (Rheology Modifiers) | Projected to reach $3540.6 million by 2030 (4.10% CAGR 2024-2030) | Favorable market for key product category |

Same Document Delivered

Elementis PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Elementis PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain valuable insights into the external forces shaping Elementis's strategic landscape.

Sociological factors

Consumers worldwide increasingly favor products that minimize environmental impact, a significant shift especially noticeable in the personal care and coatings industries. This growing preference directly influences Elementis's strategy, pushing the company to innovate and promote greener options like bio-based additives and environmentally friendly formulations.

The market for rheology control additives is witnessing a profound transformation, with sustainability emerging as a critical driver of consumer choice and product development. In 2024, for instance, the global market for sustainable chemicals was projected to reach over $110 billion, with a significant portion driven by consumer demand for eco-friendly products in sectors where Elementis operates.

Heightened awareness among consumers and the public about the safety of chemical ingredients significantly shapes how products are formulated and labeled. This trend directly fuels demand for chemicals perceived as safer and for greater transparency regarding ingredient lists, compelling companies like Elementis to continuously ensure their offerings align with these evolving safety expectations.

For example, in the personal care sector, upcoming regulatory shifts in 2025 are heavily influenced by increasingly stringent safety standards, a direct reflection of this growing societal focus. This means Elementis must remain agile, adapting its product development and communication strategies to meet these heightened safety benchmarks and consumer demands for clear ingredient information.

Global demographic shifts are significantly shaping consumer needs. By 2024, the proportion of the world's population aged 65 and over is projected to reach 10.7%, a trend that increases demand for specialized personal care products, a key market for Elementis. Concurrently, the continued economic expansion in emerging markets, with some experiencing GDP growth rates exceeding 5% in 2024, fuels higher disposable incomes, boosting sales for Elementis's performance additives in sectors like coatings and personal care.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for companies to actively engage in corporate social responsibility (CSR) are on a significant upward trend. Elementis's dedication to sustainability, ethical operations, and community involvement directly shapes its public image and appeal to a broad range of stakeholders, including consumers, potential employees, and investors.

Elementis's 2024 Annual Report details its strategic focus on sustainability, outlining initiatives aimed at reducing environmental impact and fostering positive social contributions. This commitment is crucial for maintaining a strong brand reputation in a market increasingly valuing corporate accountability.

- Sustainability Initiatives: Elementis reported a 15% reduction in Scope 1 and 2 greenhouse gas emissions in 2023 compared to its 2019 baseline, demonstrating tangible progress towards its environmental targets.

- Ethical Sourcing: The company has implemented stricter supplier codes of conduct, with 90% of its key raw material suppliers audited for ethical and environmental compliance by the end of 2024.

- Community Engagement: Elementis invested over $500,000 in community development programs globally in 2023, focusing on education and local environmental projects.

- Employee Well-being: A commitment to diversity and inclusion resulted in a 10% increase in female representation in leadership roles by early 2025.

Talent Attraction and Retention

Attracting and keeping skilled workers is a major sociological challenge for companies in the chemical sector, including Elementis. An aging workforce, coupled with a scarcity of specialized talent, can directly impact how efficiently operations run and how innovative the company can be. This makes having strong plans for managing and developing employees absolutely essential.

Elementis itself highlights the dedication and perseverance of its workforce as key drivers behind its solid performance. For instance, in its 2023 annual report, the company noted its ongoing efforts to foster a culture that supports employee growth and engagement, recognizing this as vital for navigating industry complexities and achieving strategic goals.

The chemical industry, in particular, faces a growing skills gap. A 2024 report by the American Chemistry Council indicated that nearly 80% of chemical companies surveyed expressed concerns about finding qualified personnel for specialized roles. This trend underscores the critical need for proactive talent acquisition and retention strategies.

- Aging Workforce: The average age of skilled workers in the chemical industry is increasing, leading to potential knowledge transfer challenges and a reduction in the available experienced labor pool.

- Skills Shortage: There's a documented deficit in workers possessing specialized technical skills, such as chemical engineering, process operations, and advanced analytics, impacting operational capacity and innovation.

- Talent Management Focus: Companies like Elementis are investing in robust training, development, and employee engagement programs to mitigate these sociological pressures and ensure a pipeline of skilled talent.

- Industry-Wide Concern: Data from industry surveys consistently shows that talent attraction and retention remain top concerns for chemical manufacturers globally, directly affecting productivity and competitive advantage.

Societal expectations for corporate social responsibility (CSR) are increasingly influencing consumer and investor decisions. Elementis's commitment to sustainability, ethical practices, and community involvement is crucial for its brand reputation. For example, Elementis reported a 15% reduction in Scope 1 and 2 greenhouse gas emissions in 2023 compared to its 2019 baseline, showcasing tangible progress.

Consumer demand for safer chemical ingredients and greater transparency is a significant sociological factor. Elementis must ensure its products align with these evolving safety standards and provide clear ingredient information, especially with upcoming regulatory shifts in 2025 impacting sectors like personal care.

Demographic shifts, such as an aging global population and economic growth in emerging markets, are reshaping consumer needs and purchasing power. The increasing proportion of the world's population aged 65 and over by 2024 boosts demand for specialized personal care products, a key area for Elementis.

Attracting and retaining skilled talent is a major challenge in the chemical industry due to an aging workforce and a scarcity of specialized skills. Elementis's focus on employee development and engagement is vital for operational efficiency and innovation, especially as an industry report in 2024 indicated nearly 80% of chemical companies expressed concerns about finding qualified personnel.

| Sociological Factor | Elementis Action/Impact | Supporting Data (2023-2025) |

|---|---|---|

| CSR Expectations | Enhances brand reputation and stakeholder appeal. | 15% reduction in Scope 1 & 2 GHG emissions (vs 2019 baseline). Over $500k invested in community programs (2023). |

| Safety & Transparency Demands | Drives product formulation and communication strategies. | Upcoming regulatory shifts in 2025 impacting personal care safety standards. |

| Demographic Shifts | Influences product demand and market growth. | 10.7% projected global population aged 65+ by 2024. Emerging markets GDP growth >5% (2024). |

| Talent Acquisition & Retention | Impacts operational efficiency and innovation. | 80% of chemical companies concerned about finding skilled personnel (2024 report). 10% increase in female leadership roles by early 2025. |

Technological factors

Elementis's core strategy hinges on continuous innovation in additive chemistry, particularly in areas like rheology modification and functional properties. This focus allows them to develop high-performance solutions that meet evolving industry demands. For instance, their 2023 annual report highlighted significant R&D investment aimed at enhancing the performance characteristics of their existing product lines and exploring novel material science applications.

Elementis benefits from the increasing adoption of digital technologies and automation in manufacturing. These advancements, often termed Industry 4.0, are key to boosting efficiency, cutting expenses, and elevating product quality. For instance, the company can leverage advanced process control and data analytics to optimize its production lines.

Predictive maintenance, powered by digitalization, is another crucial technological factor. By analyzing real-time data, Elementis can anticipate equipment failures, minimizing downtime and associated costs, thereby ensuring smoother operations and consistent output for its rheology modifiers.

The broader trend of digitalization within materials science is a significant tailwind for the rheology modifiers market. As research and development increasingly rely on digital tools and simulation, the demand for specialized materials like those produced by Elementis is expected to grow, reaching an estimated global market size of $9.5 billion by 2025.

Elementis can leverage advancements in new materials and their applications to broaden its offerings. For instance, the growing use of nanotechnology in coatings and personal care products presents a significant opportunity. The global nanotechnology market was valued at approximately USD 25.5 billion in 2023 and is projected to reach USD 76.7 billion by 2030, demonstrating substantial growth potential.

The development of smart coatings, such as those with self-healing capabilities, is another area where Elementis can innovate and tap into new market segments. These advanced materials offer enhanced performance and durability, appealing to industries seeking premium solutions. The market for smart coatings is expected to see robust growth, driven by demand for increased longevity and reduced maintenance.

Specifically, nano-based modifiers are a key trend within the rheology modifiers market, a core area for Elementis. These innovative ingredients allow for precise control over product viscosity and texture, which is crucial for formulators in sectors ranging from paints and coatings to cosmetics and pharmaceuticals. The increasing demand for high-performance, sustainable additives will continue to drive innovation in this space.

Research and Development Investment

Elementis's dedication to research and development is a cornerstone of its strategy, enabling the creation of innovative and specialized solutions for diverse industrial sectors. This commitment is crucial for adapting to evolving customer needs and stringent regulatory landscapes, ensuring Elementis products maintain a competitive edge. For instance, in 2023, Elementis reported R&D expenses of $58.2 million, reflecting a strategic focus on future growth and product differentiation.

The company's investment in R&D is further enhanced by its integration of digital technologies, particularly artificial intelligence. This allows for more efficient product development cycles and a deeper understanding of market trends. Elementis's 2024 outlook indicates continued investment in these areas, with a focus on leveraging AI for accelerated innovation in performance additives.

- R&D Investment: Elementis allocated $58.2 million to R&D in 2023.

- Innovation Focus: R&D drives the development of tailored solutions for industrial applications.

- Digital Integration: AI is being leveraged to accelerate innovation and market responsiveness.

- Future Outlook: Continued investment in R&D is planned for 2024 to maintain market leadership.

Intellectual Property Protection

Elementis places significant emphasis on protecting its intellectual property (IP), particularly through patents and trade secrets, which is vital for its specialty chemicals business. This focus is directly tied to its strategy of developing unique chemistry and highly customized solutions for its clients. Safeguarding these innovations is key to maintaining a competitive edge and ensuring a return on its substantial research and development (R&D) expenditures. For instance, in 2023, Elementis reported R&D expenses of £42.5 million, underscoring the importance of IP protection to recoup these investments.

The company's business model is fundamentally built upon continuous innovation and the creation of tailored product offerings. Therefore, robust IP protection mechanisms are not merely a legal formality but a core enabler of its market differentiation and long-term profitability. Elementis's ability to secure patents for novel formulations and processes directly translates into exclusive market access and pricing power for its advanced materials.

Key aspects of Elementis's IP strategy include:

- Patent Portfolio: Maintaining and expanding a portfolio of patents covering its core technologies and product innovations.

- Trade Secret Management: Implementing strict internal controls to protect proprietary manufacturing processes and formulations that are not publicly disclosed.

- Freedom to Operate: Conducting thorough analyses to ensure its products and processes do not infringe on existing third-party IP rights.

- Enforcement: Actively monitoring the market for potential infringement and taking appropriate legal action to defend its IP rights.

Technological advancements are reshaping Elementis's operational landscape, driving efficiency and innovation. The company's strategic investment in R&D, which reached $58.2 million in 2023, underscores its commitment to developing cutting-edge solutions in additive chemistry.

Elementis is actively integrating digital technologies like AI into its product development, aiming to accelerate innovation and enhance market responsiveness. This digital transformation is crucial for optimizing manufacturing processes and maintaining a competitive edge in the specialty chemicals sector.

The growing demand for advanced materials, such as nanotechnology-based modifiers, presents significant opportunities. The global nanotechnology market, valued at approximately $25.5 billion in 2023, highlights the potential for Elementis to expand its product portfolio and capture new market segments through continued technological innovation.

Elementis's focus on intellectual property protection, including patents and trade secrets, is vital for safeguarding its innovations and ensuring a return on its R&D investments, which totaled £42.5 million in 2023.

| Technology Area | 2023 Data/Outlook | Impact on Elementis |

|---|---|---|

| R&D Investment | $58.2 million (2023) | Drives innovation in additive chemistry |

| Digitalization & AI | Integration for accelerated innovation | Enhances efficiency, product development |

| Nanotechnology | Global market ~$25.5 billion (2023) | Opportunity for new product development |

| Intellectual Property | £42.5 million R&D spend (2023) | Protects proprietary technologies |

Legal factors

Global chemical regulations like the EU's REACH and the US's TSCA demand rigorous compliance for substances. Elementis faces stringent requirements for chemical registration, evaluation, and potential restrictions, impacting product development and market access. For instance, REACH compliance can involve substantial costs, with studies estimating tens of thousands of euros per substance for full registration.

The EU's Chemicals Strategy for Sustainability is further tightening these rules, aiming to phase out hazardous chemicals and encourage the adoption of safer alternatives. This evolving landscape necessitates continuous investment in research and development for Elementis to ensure its product portfolio aligns with these ambitious environmental and health protection goals.

Product safety and labeling laws are becoming more rigorous, impacting industries where Elementis operates. The US Modernization of Cosmetics Regulation Act (MoCRA), enacted in 2022, mandates facility registration and product listing, alongside enhanced safety substantiation and adverse event reporting. Similarly, EU cosmetic regulations continue to evolve, demanding strict adherence to safety and transparency standards.

Elementis must proactively adapt its product formulations and labeling strategies to meet these escalating regulatory demands. For instance, the increased scrutiny on ingredient safety and clear labeling, as seen with MoCRA's focus on responsible persons and mandatory safety reviews, requires meticulous attention to detail in product development and communication. Failure to comply can result in significant penalties and reputational damage, underscoring the critical nature of these legal factors for Elementis's market access and consumer trust.

Environmental laws significantly shape Elementis's operational landscape, dictating how it manages emissions, handles waste, and utilizes potentially hazardous materials. For instance, adherence to stringent regulations such as the Clean Air Act necessitates ongoing investment in advanced pollution control technologies.

The evolving regulatory environment, including the EU's focus on microplastics bans and the comprehensive Eco-design for Sustainable Products Regulation (ESPR), directly influences Elementis's product development and manufacturing strategies, pushing for greater sustainability and resource efficiency.

Corporate Governance and Reporting Compliance

Elementis, as a publicly traded entity, is bound by stringent corporate governance codes and financial reporting mandates in the UK and globally. This necessitates the punctual release of annual reports, adherence to stock exchange listing requirements, and open dialogue with its investors. For instance, Elementis published its 2024 Annual Report and Accounts in March 2025, confirming its alignment with UK regulatory frameworks.

Key compliance areas for Elementis include:

- Annual Reporting: Timely submission of audited financial statements and operational reviews, such as the March 2025 release of the 2024 Annual Report.

- Listing Rules: Maintaining compliance with the London Stock Exchange's listing and disclosure obligations.

- Shareholder Communication: Ensuring transparent and consistent communication regarding financial performance, strategic decisions, and governance matters.

- Regulatory Adherence: Meeting the requirements of financial authorities like the Financial Conduct Authority (FCA) in the UK.

Anti-Trust and Competition Laws

Elementis operates within a highly competitive global landscape, necessitating strict adherence to anti-trust and competition laws. These regulations are designed to curb monopolistic behavior and ensure fair market practices, which directly impacts Elementis's operational strategies and market access.

The coatings industry, including segments where Elementis is active, has seen a notable trend of mergers and acquisitions. Each such transaction requires thorough legal scrutiny to guarantee compliance with competition frameworks, avoiding any actions that could stifle market rivalry or lead to undue market concentration.

Elementis's recent divestment of its Talc business in late 2023, for instance, likely involved significant consideration of competition law implications. Such sales can reshape market dynamics and require regulatory approval to ensure that the transaction does not adversely affect competition in the relevant markets.

- Regulatory Scrutiny: Elementis must navigate a complex web of global anti-trust regulations, with significant fines possible for non-compliance. For example, the European Commission can impose fines of up to 10% of a company's total worldwide annual turnover for competition law infringements.

- M&A Compliance: In 2024, regulatory bodies worldwide, such as the US Federal Trade Commission (FTC) and the UK's Competition and Markets Authority (CMA), have maintained robust oversight of M&A activity, scrutinizing deals for potential anti-competitive effects.

- Divestiture Impact: The sale of Elementis's Talc business, valued at approximately $120 million, was completed in November 2023. This move aimed to streamline its portfolio, but the competition authorities in relevant jurisdictions would have assessed its impact on market competition in talc production and supply.

Elementis must navigate a complex web of global chemical regulations, including the EU's REACH and the US's TSCA, which demand rigorous compliance for substances and can impact product development and market access. The evolving EU Chemicals Strategy for Sustainability further tightens rules, pushing for safer alternatives and necessitating continuous R&D investment.

Product safety and labeling laws are also intensifying, with regulations like the US MoCRA and evolving EU cosmetic rules requiring strict adherence to safety and transparency standards. Elementis must proactively adapt formulations and labeling to meet these demands, as non-compliance can lead to significant penalties.

Elementis faces stringent corporate governance and financial reporting mandates, requiring timely submissions of reports like its 2024 Annual Report in March 2025 and adherence to London Stock Exchange listing rules. Maintaining transparent shareholder communication and meeting FCA requirements are key compliance areas.

The company must also adhere to anti-trust and competition laws, particularly in light of industry consolidation. The 2023 divestment of its Talc business, valued around $120 million, involved significant competition law considerations, and ongoing M&A activity globally, as scrutinized by bodies like the FTC and CMA in 2024, requires careful legal navigation.

Environmental factors

Elementis is navigating a landscape increasingly defined by global efforts to combat climate change and curb greenhouse gas (GHG) emissions. This environmental pressure necessitates the company's commitment to ambitious reduction targets across its Scope 1, 2, and 3 emissions.

In a significant move towards sustainability, Elementis submitted its science-based target for validation to the Science Based Targets initiative (SBTi) during the first half of 2025. This submission underscores the company's dedication to aligning its operations with global climate goals, aiming for Net Zero emissions by 2050.

Global concerns about resource scarcity, especially water, are increasingly impacting chemical manufacturing. Elementis acknowledges this, integrating water management into its environmental strategy. The company has set a target to reduce water withdrawal by 10% per tonne of production, reflecting a commitment to operating more sustainably.

Growing global emphasis on a circular economy and increasingly stringent waste management regulations are compelling Elementis to prioritize waste reduction and investigate avenues for recycling and reusing its products and by-products. This environmental shift directly influences operational strategies and product lifecycle considerations.

Elementis has set a clear objective to achieve a 10% reduction in waste sent to third parties for every tonne of production. This target underscores the company's commitment to minimizing its environmental footprint and enhancing resource efficiency in its manufacturing processes.

Pollution Control and Hazardous Substances

Stricter regulations on pollution and hazardous substances, like per- and polyfluoroalkyl substances (PFAS) and microplastics, are compelling Elementis to continuously invest in research and development for product reformulation and cleaner manufacturing processes. These environmental mandates require substantial capital expenditure to ensure compliance and minimize ecological footprint.

The European Union's proactive stance on microplastic contamination, for instance, sets a precedent for global environmental policy, pushing companies like Elementis to innovate towards sustainable alternatives and production methods. Meeting these evolving standards is crucial for maintaining market access and brand reputation.

- Regulatory Pressure: Elementis faces increasing regulatory scrutiny globally concerning hazardous substances, impacting product development and operational costs.

- Investment in Technology: The company must allocate resources to adopt cleaner production technologies to comply with environmental standards, potentially affecting profit margins in the short term.

- Product Reformulation: Adapting product lines to eliminate or reduce restricted substances requires significant R&D investment and may lead to changes in product performance or cost.

- Market Access: Adherence to stringent environmental regulations, especially those driven by bodies like the EU, is vital for continued market access and competitive positioning.

Biodiversity and Ecosystem Protection

Elementis's commitment to biodiversity and ecosystem protection, while less direct, impacts its sourcing of raw materials, especially for bio-based ingredients. The company's environmental responsibility extends to its overall ecological footprint, influencing operational choices and supply chain management. For instance, in 2023, Elementis reported progress in its sustainability initiatives, aiming to reduce its environmental impact across its value chain, which inherently includes considerations for biodiversity.

The company focuses on developing innovative solutions that not only enhance product performance but also promote sustainability. This dual focus means that as global awareness of ecosystem health grows, Elementis is positioned to adapt its product development to meet these evolving demands. Their strategy often involves seeking out responsibly sourced materials, which is a direct response to the increasing emphasis on preserving natural habitats and species.

- Sourcing Impact: Growing concerns for biodiversity can steer Elementis towards suppliers with verifiable sustainable sourcing practices, particularly for natural or bio-derived components used in their specialty additives.

- Operational Footprint: Regulations and public pressure concerning ecosystem protection may influence where and how Elementis operates its manufacturing facilities, pushing for reduced environmental impact and conservation efforts.

- Product Innovation: The drive for biodiversity protection encourages the development of products that are biodegradable, have lower toxicity, or utilize renewable resources, aligning with Elementis's goal of delivering sustainable solutions.

Elementis is actively addressing environmental factors, including climate change and resource scarcity. The company submitted its science-based targets for validation to the SBTi in the first half of 2025, aiming for Net Zero by 2050.

Water management is a key focus, with a target to reduce water withdrawal by 10% per tonne of production. Elementis is also prioritizing waste reduction, aiming for a 10% decrease in waste sent to third parties per tonne of production.

Stricter regulations on hazardous substances and microplastics are driving R&D for product reformulation and cleaner manufacturing. The EU's stance on microplastics, for example, influences Elementis's innovation towards sustainable alternatives.

Biodiversity concerns impact Elementis's sourcing of raw materials, particularly bio-based ingredients, encouraging the development of biodegradable products and responsibly sourced materials.

| Environmental Factor | Elementis's Action/Target | Year/Period |

|---|---|---|

| Climate Change/GHG Emissions | Submitted science-based targets for validation to SBTi | H1 2025 |

| Climate Change/GHG Emissions | Net Zero emissions target | 2050 |

| Water Scarcity | Reduce water withdrawal by 10% per tonne of production | Ongoing |

| Waste Management | Reduce waste sent to third parties by 10% per tonne of production | Ongoing |

| Hazardous Substances/Microplastics | Invest in R&D for product reformulation and cleaner processes | Ongoing |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Elementis is meticulously constructed using a blend of official government publications, reputable industry analysis firms, and global economic data providers. This comprehensive approach ensures that every political, economic, social, technological, legal, and environmental insight is grounded in accurate and timely information.