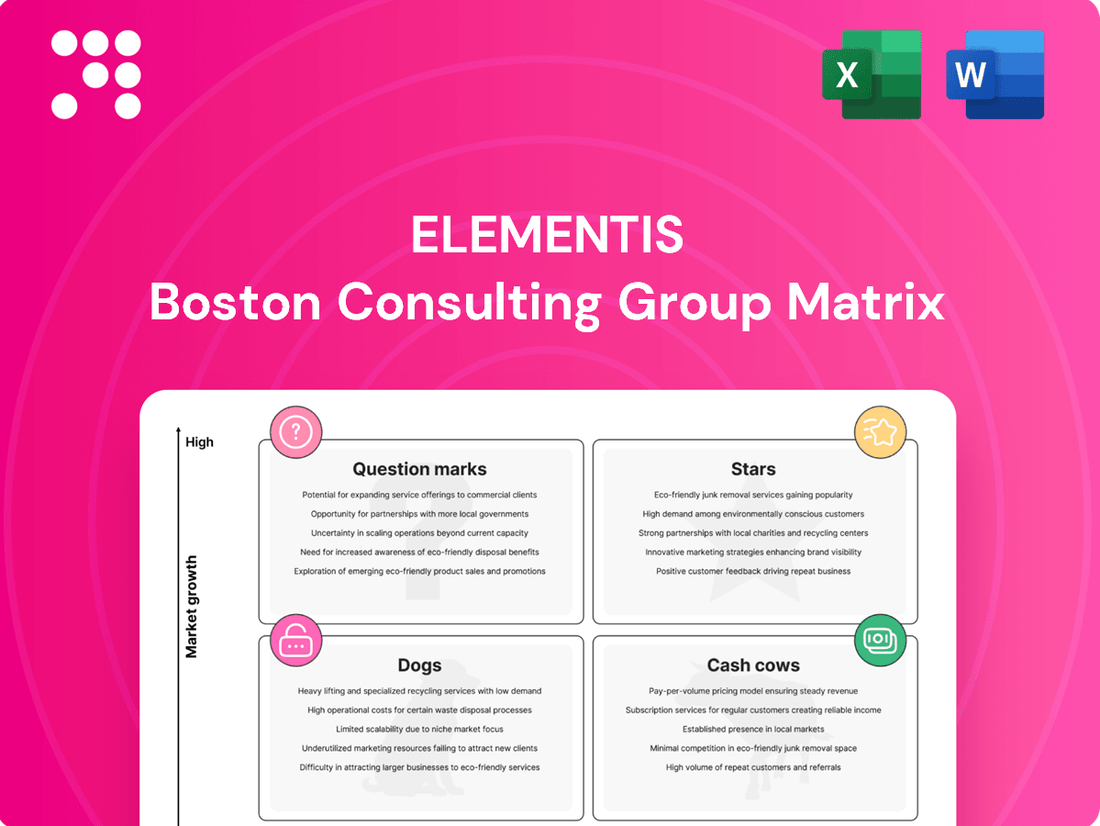

Elementis Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elementis Bundle

Understand Elementis's strategic product portfolio with this insightful BCG Matrix preview. See where their offerings fit as Stars, Cash Cows, Dogs, or Question Marks, guiding your initial assessment.

Ready to transform this understanding into actionable strategy? Purchase the full Elementis BCG Matrix report for a comprehensive quadrant breakdown, detailed market share data, and expert recommendations to optimize your investments and drive growth.

Stars

Elementis is experiencing robust growth in its Personal Care division, specifically within Skin Care and Colour Cosmetics. This expansion is fueled by strategic investments in innovative product development, focusing on natural rheology modifiers and sustainable ingredients that resonate with today's consumers.

The company's commitment to innovation is evident in its Bentone® Ultimate product line and natural film formers. These advancements are not only capturing market share but also effectively addressing unmet consumer needs for high-performance, eco-conscious beauty products.

Asia, in particular, represents a significant growth engine for Elementis's Personal Care segment, with the company reporting substantial expansion in this region. This geographical focus aligns with the high growth potential observed in the global skin care and color cosmetics markets, especially those driven by natural and sustainable trends.

Hectorite-based additives in Elementis's Coatings segment are a standout performer, with revenues surging by more than 30% in 2024. This impressive growth underscores the increasing demand for these specialized solutions.

These hectorite products are particularly sought after in demanding applications such as marine and protective coatings, where their performance characteristics are critical. Furthermore, their utility as replacements for PFAS chemicals in powder coatings highlights their alignment with growing sustainability trends and regulatory pressures.

The strong market reception and Elementis's robust competitive standing within this expanding niche for eco-friendly coating technologies position hectorite-based solutions as a key growth driver for the company.

Elementis' Coatings segment, specifically its Adhesives, Sealants, and Construction Additives business, is a significant growth driver. The THIXATROL® product line saw an impressive expansion of over 40% in 2024, showcasing strong market adoption and demand. This rapid growth, coupled with a more than 25% increase in hectorite-based additives during the same year, highlights the dynamism and potential within this sector.

The company has set an ambitious goal to double its market share in this adjacency by 2026. This strategic objective is underpinned by a commitment to ongoing innovation and the deployment of specialized sales teams focused on this segment. Elementis' focus on this area reflects its recognition of its high growth trajectory and its increasing penetration within a rapidly evolving market.

High-Efficacy Antiperspirant Actives

Elementis holds a dominant global position in high-efficacy antiperspirant actives, a segment bolstered by product innovation and efficient production consolidation. This category is poised for continued success.

The company's commitment to developing advanced solutions, such as a novel non-aluminum deodorant active slated for a 2025 release, solidifies its Star status. This forward-looking approach in a thriving market segment demonstrates strong leadership and a clear growth trajectory.

- Market Leadership: Elementis is a global leader in high-efficacy antiperspirant actives.

- Growth Drivers: Innovation in product development and successful production consolidation fuel growth.

- Future Prospects: A new non-aluminum deodorant active launching in 2025 positions this as a Star in a growing market.

Strategic Growth Platforms & New Business

Elementis's strategic growth platforms are key drivers of future expansion. In 2024, these platforms, focusing on Personal Care and Coatings, generated $26 million in revenue growth exceeding market expectations. This success was fueled by 22 new product introductions and a robust pipeline of future business opportunities.

The company has set an ambitious target of achieving $75 million in above-market revenue by 2026 from these strategic areas. This demonstrates a clear commitment to investing in and capitalizing on opportunities where Elementis can gain significant market share.

- 2024 Above-Market Revenue Growth: $26 million from Personal Care and Coatings platforms.

- New Product Launches in 2024: 22 new products supported growth.

- 2026 Revenue Target: Aiming for $75 million in above-market revenue.

- Strategic Focus: Investing in areas for significant market share expansion.

Elementis's antiperspirant actives business is a clear Star in its portfolio. This segment is a global leader, driven by continuous product innovation and efficient production. The company's strategic focus on this area, including a new non-aluminum deodorant active launching in 2025, positions it for sustained high growth in a thriving market.

| Business Segment | BCG Category | Key Growth Drivers | 2024 Performance Highlight |

|---|---|---|---|

| Antiperspirant Actives | Star | Product innovation, efficient production, new non-aluminum active (2025 launch) | Global leadership in high-efficacy actives |

What is included in the product

The Elementis BCG Matrix provides a framework for analyzing its business units based on market growth and share, guiding strategic decisions for investment and resource allocation.

The Elementis BCG Matrix provides a clear visual of business unit performance, alleviating the pain of uncertainty in strategic resource allocation.

Cash Cows

Elementis's established rheology modifiers and specialty additives for coatings are prime examples of cash cows within its portfolio. These products serve mature markets, primarily industrial finishes and architectural coatings, where Elementis enjoys a robust and entrenched market position. The consistent demand in these established segments means these offerings generate substantial and reliable profits with minimal need for aggressive new investment, fueling the company's overall financial strength.

Elementis's mature personal care segments, including bath, soap, and specific hair and skin care products, represent significant cash cows. These established lines leverage Elementis's existing market presence and strong customer ties, ensuring consistent revenue streams. For instance, in 2023, the Personal Care segment contributed a substantial portion to Elementis's overall revenue, demonstrating the enduring strength of these mature offerings.

Elementis's Chromium Chemicals segment, a key player in supplying chromium compounds for pigments, leather tanning, and metal finishing, operates as a Cash Cow. While not experiencing rapid expansion, its mature market position and efficient production ensure a reliable and substantial cash flow for the company.

In 2024, the demand for chromium chemicals remained stable, driven by consistent industrial applications. Elementis's established infrastructure and long-standing customer relationships in this segment solidify its role as a predictable revenue generator, allowing for investment in other growth areas of the business.

Cost Efficiency Programs

Elementis's cost efficiency programs are performing exceptionally well, acting as a true cash cow for the company. In 2024, these initiatives successfully generated $18 million in cost savings.

Looking ahead to 2025, an additional $12 million in savings are anticipated, further solidifying the financial strength derived from these efforts.

These programs are instrumental in not only reducing operational expenses but also in boosting adjusted operating margins and enhancing cash conversion rates. This consistent internal funding capability is crucial for the company's ongoing profitability and growth initiatives.

- 2024 Cost Savings: $18 million

- 2025 Projected Savings: $12 million

- Impact: Reduced operational costs, improved adjusted operating margins, and enhanced cash conversion.

Consolidated Manufacturing Footprint

Elementis's strategic consolidation of its manufacturing footprint, exemplified by the closure of the AP actives plant in Middletown, is a key driver for optimizing production and reducing operational overheads. This initiative directly enhances efficiency and cost-effectiveness.

By streamlining operations, Elementis ensures that its established product lines can be manufactured with improved profit margins. This allows these mature products to contribute more significantly to the company's overall cash flow, positioning them as strong cash cows within the BCG matrix.

- Optimized Production: The closure of the Middletown plant streamlines Elementis's manufacturing network, leading to more efficient production processes.

- Reduced Overheads: Consolidating facilities directly cuts down on operational expenses, boosting profitability for existing product lines.

- Enhanced Profit Margins: Increased efficiency and reduced costs translate to higher profit margins on products manufactured within the consolidated footprint.

- Stronger Cash Flow Contribution: These higher margins enable mature product lines to generate more substantial cash flow for the company.

Elementis's established rheology modifiers and specialty additives for coatings, along with its mature personal care segments, are prime examples of cash cows. These products serve mature markets, generating substantial and reliable profits with minimal need for aggressive new investment. The Chromium Chemicals segment also operates as a cash cow, benefiting from stable demand in industrial applications and Elementis's established infrastructure.

| Product Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Illustrative) |

|---|---|---|---|

| Rheology Modifiers & Specialty Additives (Coatings) | Cash Cow | Mature markets, robust market position, consistent demand | Significant |

| Personal Care Products | Cash Cow | Established lines, strong customer ties, consistent revenue | Substantial |

| Chromium Chemicals | Cash Cow | Mature market, efficient production, reliable cash flow | Consistent |

Delivered as Shown

Elementis BCG Matrix

The Elementis BCG Matrix preview you're seeing is the exact, fully formatted document you'll receive upon purchase, offering a clear strategic roadmap for your business. This comprehensive analysis, devoid of any watermarks or demo content, is ready for immediate application in your strategic planning and decision-making processes. You can confidently use this preview as a direct representation of the professional, analysis-ready file that will be instantly downloadable after your purchase. This means no surprises, just a high-quality, actionable BCG Matrix report designed for clarity and impact.

Dogs

Elementis's Talc business is classified as a 'Dog' in its BCG Matrix. This designation stems from a strategic review revealing significantly reduced volumes in key European markets since 2019. This decline led to a substantial impairment of $126 million in 2024.

The company has excluded the Talc segment from its 2026 growth program. Furthermore, Elementis has announced the sale of this business, a clear indicator of its 'Dog' status, characterized by low market growth and a shrinking market share.

Underperforming legacy products within Elementis's portfolio, those lacking recent innovation and failing to align with current market demands or growth areas, would be classified as Dogs. These products typically exhibit low sales volume and a shrinking market share, often representing a drain on company resources without contributing meaningfully to profitability. For instance, older chemical formulations that haven't been updated to meet evolving environmental standards or performance requirements are prime candidates for this category.

Segments with limited regional expansion, often referred to as Dogs in the BCG Matrix, are those product lines or business units facing geographical constraints that hinder growth beyond their existing, potentially shrinking, markets. These segments struggle to achieve economies of scale or tap into new customer bases due to factors like local regulations, established distribution networks, or specific customer demands. For instance, Talc, a key product for many chemical companies, often falls into this category.

The demand for regional supply resilience, particularly for critical raw materials like Talc, can act as a significant barrier to international expansion. Customers may prioritize suppliers with established local presence and shorter lead times, making it difficult for companies to penetrate new geographic markets. This was evident in 2024, where supply chain disruptions continued to emphasize the importance of regional sourcing for many industrial consumers.

Products Impacted by Substitution Trends

Products facing significant substitution pressure without a clear reformulation strategy would be categorized as Dogs in the Elementis BCG Matrix. These are offerings that are becoming obsolete due to shifts in consumer demand towards more sustainable or technologically advanced alternatives. For instance, if Elementis has legacy products in its portfolio that are being rapidly displaced by newer, greener chemistries in the coatings or personal care sectors, these would likely fall into this quadrant.

The impact of substitution can be severe, leading to declining sales and profitability. For example, in 2024, the global specialty chemicals market saw a notable trend towards bio-based and biodegradable ingredients, putting pressure on traditional petrochemical-derived products. If Elementis’s product lines are heavily reliant on these older chemistries, they may experience a shrinking market share. This trend is exacerbated by increasing regulatory scrutiny on certain chemical compounds, pushing manufacturers to seek out replacements.

Elementis’s performance in areas susceptible to substitution is a key indicator. For example, if a significant portion of its revenue in 2024 came from products that are easily replaced by more environmentally friendly options, this would signal a need for strategic intervention. The company’s ability to innovate and adapt its product offerings is crucial to avoid being categorized as a Dog.

- Declining Market Share: Products losing ground to newer, more sustainable alternatives.

- Lack of Reformulation: Offerings without a clear path to adapt to evolving industry standards.

- Regulatory Pressure: Chemicals facing increased scrutiny or bans due to environmental concerns.

- Evolving Consumer Preferences: Shifts in demand towards bio-based, recyclable, or less toxic ingredients.

Non-Strategic Assets Not Generating Value

Non-strategic assets at Elementis that aren't core to its future plans and aren't significantly contributing to revenue or profit are prime candidates for divestiture. These underperforming units can divert crucial management focus and capital away from more promising ventures. For instance, if a particular chemical additive line, acquired years ago, now represents a small fraction of total sales and shows declining margins, it might fall into this category.

These assets often just break even, offering minimal return on investment while consuming resources. Elementis, like many diversified chemical companies, periodically reviews its portfolio to identify such units. In 2024, for example, companies in the specialty chemicals sector have been actively streamlining operations. Elementis's own financial reports from late 2023 and early 2024 indicate a strategic push towards higher-growth, specialty areas, suggesting a potential pruning of less synergistic businesses.

- Divestiture Candidates: Business units or assets not aligned with Elementis's long-term strategic vision.

- Value Drain: Assets that consume management attention and capital without generating substantial returns beyond operational costs.

- Focus Shift: Minimizing or divesting these assets allows for reallocation of resources to core, growth-oriented segments.

- Portfolio Optimization: Elementis's strategy, as evidenced by recent financial communications in 2024, emphasizes a focus on higher-margin, specialty product lines.

Elementis's Talc business fits the 'Dog' profile due to its declining European volumes since 2019, leading to a $126 million impairment in 2024. This segment is excluded from the 2026 growth program and is slated for sale, reflecting low market growth and a shrinking share.

Products with limited innovation and failing to meet current market demands are also 'Dogs'. These often have low sales and shrinking market share, draining resources. For example, older chemical formulations not updated for environmental standards or performance needs would be classified as such.

Segments facing geographical constraints that hinder growth are considered 'Dogs'. These struggle with economies of scale or accessing new customers due to local regulations or specific demands. The demand for regional supply resilience in 2024, particularly for raw materials like Talc, further limits international expansion.

Products facing significant substitution pressure without a clear reformulation strategy are 'Dogs'. These are being displaced by more sustainable or technologically advanced alternatives. In 2024, the specialty chemicals market saw a strong trend towards bio-based ingredients, pressuring traditional petrochemical products.

| Elementis Business Unit | BCG Category | Key Rationale | 2024 Impact |

|---|---|---|---|

| Talc | Dog | Declining European volumes, excluded from growth program, slated for sale. | $126 million impairment. |

| Legacy Chemical Formulations | Dog | Lack of innovation, failing to meet evolving standards. | Low sales volume, shrinking market share. |

| Products facing substitution | Dog | Displaced by sustainable/advanced alternatives, increasing regulatory scrutiny. | Potential shrinking market share due to shift towards bio-based ingredients. |

Question Marks

Elementis is investing in new skincare formulations, like those using hectorite technology for lighter, natural products, to tap into trends like K-beauty and the broader 'skinification' movement. These innovations aim to capture a larger share of the growing skincare market.

Despite the skincare sector's appeal, Elementis's past limited involvement means these new products are essentially question marks. Significant investment is needed to transform them from potential future Stars into established market leaders.

Elementis is strategically targeting the powder coatings sector, a dynamic segment valued at approximately $200 million. Their focus is on leveraging their specialized hectorite and thixotrope additives to capture a larger share of this expanding market.

The powder coatings industry is characterized by robust growth, making it an attractive area for Elementis to increase its footprint. Currently holding a smaller market position, the company views this segment as a 'Question Mark' within its portfolio, necessitating focused investment to drive significant market penetration and growth.

Elementis's planned launch of a non-aluminum based deodorant active in April 2025 places this product squarely in the 'Question Mark' category of the BCG Matrix. This new offering targets a growing market segment that prefers natural ingredients and is seeking effective sweat reduction without traditional aluminum compounds.

The success of this deodorant active hinges on its market reception and its ability to outperform existing natural alternatives. For instance, the global natural deodorant market was valued at approximately $8.1 billion in 2023 and is projected to grow significantly. If Elementis's product can achieve strong market penetration and establish a dominant position, it has the potential to transition into a 'Star' performer.

Rheology Modifier for Automotive Sector

Elementis' planned 2025 launch of a new rheology modifier for the automotive sector, focusing on enhanced lower temperature stability, places this product squarely in the 'Question Mark' category of the BCG Matrix.

This strategic move targets a specific, potentially high-growth niche within the automotive industry, where Elementis may currently hold a limited market share.

- Market Potential: The global automotive coatings market, a key application for rheology modifiers, was valued at approximately USD 20.5 billion in 2023 and is projected to grow.

- Strategic Investment: Significant investment will be required to establish market presence, build brand recognition, and secure distribution channels for this new product.

- Competitive Landscape: Elementis will face established competitors in the automotive coatings additives space, necessitating a strong value proposition and effective marketing.

- Performance Advantage: The promised improvement in lower temperature stability could offer a distinct competitive advantage, especially in regions with extreme climates.

Expansion into New Geographic Markets for Personal Care

Expansion into new geographic markets for personal care, particularly within Asia, positions Elementis's Personal Care segment as a potential star in the BCG matrix. While the overall Asian personal care market is experiencing robust growth, Elementis's strategic focus on optimizing its route-to-market and forging new partnerships in specific emerging sub-regions and countries is crucial.

These targeted emerging markets, though starting from a relatively low market share for Elementis, present significant growth opportunities. Elementis's investment in these areas aims to capitalize on this potential, building a stronger market presence.

- Asia's Personal Care Market Growth: The global personal care market is projected to reach over $780 billion by 2025, with Asia-Pacific being a key driver, expected to account for a substantial portion of this growth.

- Elementis's Strategy: Elementis is actively working to refine its distribution channels and build new relationships within specific Asian sub-regions, aiming to penetrate markets with high untapped potential.

- Investment Focus: The company's investment in these emerging markets is designed to increase market share from a low base, establishing a more significant footprint in these high-growth territories.

Elementis's new skincare formulations and its powder coatings additives are currently considered Question Marks. These represent areas with high growth potential but where Elementis has a limited market share, requiring substantial investment to become market leaders.

The company's non-aluminum deodorant active and its new automotive rheology modifier also fall into the Question Mark category. Their success depends on market acceptance and Elementis's ability to gain traction against established competitors in growing markets.

Elementis's expansion into new geographic markets for personal care in Asia is also a Question Mark. While the overall market is strong, Elementis's current low market share necessitates strategic investment to build its presence and capitalize on growth opportunities.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Elementis's annual reports, investor presentations, and market research firms to assess product performance and market share.