Elementis Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elementis Bundle

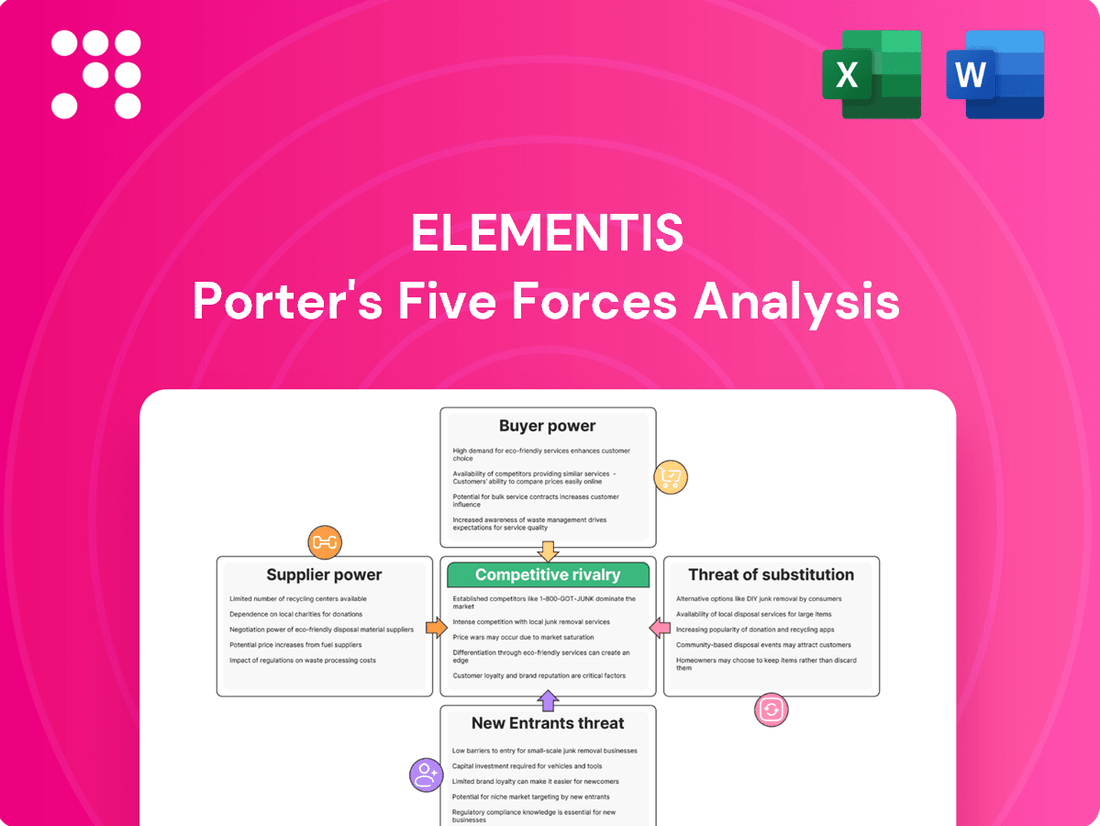

Elementis navigates a landscape shaped by the intense rivalry among existing players and the constant threat of new entrants disrupting the market. Understanding the bargaining power of both suppliers and buyers is crucial to grasping Elementis's operational leverage and pricing strategies.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Elementis’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Elementis's reliance on a concentrated supplier base for critical raw materials significantly enhances supplier bargaining power. For instance, if a small number of chemical manufacturers supply specialized additives essential for Elementis's performance coatings, these suppliers can exert considerable influence over pricing and supply availability. This concentration means Elementis has fewer alternatives, potentially leading to increased production costs and reduced operational agility.

Elementis's reliance on specialized, high-performance additives means its suppliers often provide unique or proprietary raw materials. This uniqueness is a key driver of supplier power, as Elementis may find it difficult to source comparable inputs from alternative providers. For instance, if a supplier develops a novel chemical compound essential for Elementis's flagship products, that supplier gains considerable leverage.

Elementis faces significant switching costs from its suppliers, particularly for its specialty chemicals. These costs can include the expense and time involved in re-formulating products to accommodate new chemical inputs, re-qualifying materials with regulatory bodies, and potentially investing in new manufacturing equipment to handle different supplier specifications. For instance, in 2024, the chemical industry continued to see complex regulatory hurdles for new ingredient approvals, making the process of changing a key supplier for a core ingredient a multi-month, if not multi-year, endeavor.

These high switching costs effectively bolster the bargaining power of Elementis's suppliers. When it becomes costly and disruptive to change a supplier, Elementis is less inclined to seek out alternative sources, even if those alternatives offer slightly better pricing. This inherent stickiness in supplier relationships means that established suppliers can often command more favorable terms, as Elementis is constrained by the practical and financial barriers to switching.

Threat of Forward Integration by Suppliers

If Elementis's suppliers possess the capability or strong incentive to move into specialty chemical production themselves, they could emerge as direct rivals. This potential for forward integration significantly bolsters their bargaining position during price and supply negotiations, as Elementis would naturally seek to prevent such a competitive threat.

This leverage allows suppliers to potentially dictate terms, impacting Elementis's cost structure and market access. For instance, a key supplier of rheology modifiers, if capable of producing finished formulations, could shift from a component provider to a direct competitor in certain market segments.

The threat of forward integration is particularly potent when suppliers have proprietary technology or unique access to raw materials that are difficult for Elementis to replicate. This situation could force Elementis to accept less favorable terms to secure essential inputs and avoid direct competition from its own supply chain.

- Supplier Capability: Assess if key suppliers have the technical expertise, capital, and market knowledge to enter Elementis's product segments.

- Supplier Incentive: Evaluate if suppliers see higher profit margins or greater market control by moving into Elementis's business.

- Competitive Landscape: Consider if the specialty chemical market allows for new entrants, especially those with established supply chains.

- Elementis's Dependence: Analyze how reliant Elementis is on specific suppliers for critical raw materials or specialized components.

Importance of Elementis to Supplier's Revenue

Elementis's bargaining power with its suppliers is significantly influenced by how crucial its business is to those suppliers' overall revenue streams. If Elementis constitutes a minor part of a supplier's sales, that supplier has less incentive to accommodate Elementis's demands, thereby wielding greater bargaining power.

Conversely, when Elementis represents a substantial portion of a supplier's income, the supplier becomes more reliant on Elementis's continued business. This dependency naturally reduces the supplier's leverage, making them more amenable to Elementis's pricing and terms.

- Supplier Dependence: Elementis's importance to a supplier's revenue directly correlates to the supplier's bargaining power.

- Revenue Concentration: If a supplier relies heavily on Elementis for a large percentage of its sales, Elementis's negotiating position strengthens.

- Market Share Impact: For example, if Elementis sources a critical raw material from a specialized producer, and Elementis is the producer's largest client, the supplier's power is diminished.

Elementis's bargaining power with suppliers is diminished when its business represents a small fraction of a supplier's total revenue. This means suppliers have less incentive to negotiate favorable terms, as Elementis's business is not critical to their financial stability. In 2024, many specialty chemical producers reported robust demand from multiple sectors, further reducing their reliance on any single customer like Elementis.

Conversely, Elementis can exert more influence when it is a significant client for its suppliers. A supplier that depends heavily on Elementis for a large portion of its sales will be more accommodating to Elementis's pricing and supply demands. This dynamic is crucial for managing input costs and ensuring consistent material availability.

The bargaining power of Elementis's suppliers is also influenced by the availability of substitute products or alternative suppliers. If Elementis can easily switch to another provider without significant cost or disruption, supplier power is naturally curtailed. However, for highly specialized or proprietary inputs, such alternatives are often scarce.

What is included in the product

This analysis unpacks the competitive intensity within Elementis's markets by examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Instantly visualize competitive intensity with a dynamic five forces dashboard, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

Elementis's bargaining power of customers is influenced by its customer base concentration. If a few major clients represent a substantial share of Elementis's revenue, these customers gain significant leverage. They can negotiate for reduced prices or more favorable terms due to their large purchasing volume.

Customers in sectors like personal care, coatings, and energy often exhibit significant price sensitivity, particularly for products that are more standardized. This means they have more leverage because they can easily switch to a competitor if prices are lower.

For instance, in the coatings industry, where many raw materials are similar, buyers frequently compare prices. Elementis's 2024 revenue from its Coatings segment was $302.5 million, and a substantial portion of this could be subject to price competition, highlighting the importance of cost management and product differentiation.

While Elementis specializes in performance additives, customers often find alternative solutions. For instance, in the coatings industry, customers might opt for different types of rheology modifiers or even reformulate their products to achieve desired flow properties without Elementis' specific offerings. This broadens their choices and strengthens their negotiating position.

The presence of readily available substitutes significantly increases customer bargaining power. If Elementis' products are not indispensable, customers can credibly threaten to switch to a competitor or a different technological approach. This forces Elementis to remain competitive on price and innovation.

For example, the global market for coatings additives, a key segment for Elementis, is highly competitive. In 2023, the market was valued at approximately $28 billion, with numerous players offering a range of solutions. This competitive landscape means customers have a wide array of alternatives to consider, directly impacting Elementis' pricing power.

Customer's Threat of Backward Integration

Elementis's customers, particularly those in the coatings and personal care industries, possess a significant threat of backward integration. If these customers have the technical expertise and financial resources to produce specialty additives in-house or acquire existing additive manufacturers, their leverage over Elementis intensifies. This capability allows them to dictate terms, potentially leading to price reductions or more favorable supply agreements.

The potential for backward integration acts as a constant pressure on Elementis. For instance, large multinational coatings companies might explore developing their own rheology modifiers or surfactants if they perceive Elementis's pricing or supply chain as a constraint on their profitability. This strategic option empowers customers to negotiate from a position of strength.

Consider the implications for Elementis's specialty additives segment, which serves diverse markets. If a key customer in the personal care sector, for example, invests in developing proprietary emulsifiers, they become less reliant on external suppliers like Elementis for those specific components. This reduces the switching costs for the customer and enhances their bargaining power.

- Customer Capability: Large-scale manufacturers in sectors like paints and cosmetics may possess the R&D and production infrastructure to develop or acquire additive manufacturing capabilities.

- Economic Viability: The cost-effectiveness of in-house production versus purchasing from Elementis is a critical factor in the feasibility of backward integration.

- Strategic Importance: If a specific additive is crucial to a customer's product differentiation or cost structure, the incentive to control its production increases.

- Market Dynamics: Consolidation among Elementis's customers could create larger, more powerful entities with greater capacity for backward integration.

Importance of Elementis's Product to Customer's Cost Structure

Elementis's high-performance additives can significantly influence a customer's cost structure. If these additives represent a minor component of a customer's total production expenses, then customers are likely to be less sensitive to price fluctuations. For instance, if a key additive constitutes less than 5% of a customer's final product cost, they might absorb a price increase more readily to maintain product quality and performance.

Conversely, if Elementis's additives are critical for achieving desired product performance and also represent a substantial portion of the customer's cost base, customers will naturally exert more bargaining power. In such scenarios, where an additive might account for 15% or more of a customer's manufacturing cost, they will actively seek competitive pricing and may be more inclined to switch suppliers if price increases are substantial.

- Low Cost Impact: Customers are less price-sensitive when Elementis's additives are a small fraction of their overall product cost.

- High Cost Impact: Customers exert greater pressure when additives are crucial for performance and represent a significant cost component.

- Strategic Importance: The criticality of the additive for the customer's end-product performance amplifies their bargaining power, regardless of its cost percentage.

Elementis's customers wield considerable bargaining power, particularly when they are concentrated, price-sensitive, or when substitutes are readily available. For instance, Elementis's Coatings segment generated $302.5 million in revenue in 2024, and a significant portion of this business is subject to competitive pricing pressures. Customers in this sector often compare raw material prices, and if Elementis's additives represent a small fraction of their total costs, they may be less sensitive to price changes. However, if the additives are critical for performance and a larger cost component, their leverage increases substantially.

| Factor | Impact on Customer Bargaining Power | Elementis Relevance (2024 Data) |

|---|---|---|

| Customer Concentration | High if few large customers | Influenced by major clients in key segments |

| Price Sensitivity | High for standardized products | Significant in coatings and personal care |

| Availability of Substitutes | High if alternatives exist | Broad range of solutions in coatings additives market |

| Threat of Backward Integration | High if customers can produce in-house | Potential for large manufacturers in key sectors |

| Cost Impact of Additives | Low if additives are a small cost component | Less sensitivity if <5% of product cost |

| Cost Impact of Additives | High if additives are a large cost component | Greater pressure if 15%+ of manufacturing cost |

Preview the Actual Deliverable

Elementis Porter's Five Forces Analysis

This preview showcases the complete Elementis Porter's Five Forces Analysis, providing a detailed examination of industry competitiveness and profitability. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no surprises. You can trust that this comprehensive analysis is ready for your immediate use and strategic decision-making.

Rivalry Among Competitors

The specialty chemicals market where Elementis operates is characterized by a significant number of competitors, ranging from large, diversified global corporations to smaller, specialized niche players. This broad competitive landscape means Elementis faces rivalry from multiple angles, impacting market share and pricing power.

In 2024, the specialty chemicals sector continues to see robust activity. For instance, companies like BASF, Dow, and Evonik are major players with extensive product portfolios that often overlap with Elementis' offerings in areas like coatings and personal care ingredients. These giants possess substantial resources for R&D and market penetration.

Beyond these large entities, numerous mid-sized and regional chemical manufacturers also compete intensely, particularly in specific geographic markets or product segments. This fragmentation of the market means that Elementis must constantly innovate and differentiate its products to maintain a competitive edge against a diverse array of rivals.

The specialty chemicals market, where Elementis operates, is seeing healthy growth, with forecasts pointing to continued expansion. For instance, the global specialty chemicals market was valued at approximately $700 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 5% through 2030, according to various market research reports available up to mid-2025.

While this positive growth environment can ease some competitive intensity, it doesn't eliminate it. Companies within the sector, including Elementis, remain in a vigorous competition for market share and customer loyalty. This means that even as the overall pie gets bigger, the fight for each slice remains sharp.

Elementis's business model thrives on innovation, developing specialized, high-performance additives that significantly enhance product properties like flow and texture. This focus on unique chemistry and superior performance creates a strong barrier against direct price-based competition, allowing Elementis to command premium pricing for its differentiated offerings.

Switching Costs for Customers

High switching costs significantly benefit Elementis by dampening competitive rivalry. These costs arise from the substantial efforts customers must undertake to change suppliers, including re-formulating products, conducting extensive re-testing, and navigating complex regulatory approval processes. For instance, in the coatings industry, a customer switching from Elementis's specialty additives would need to re-validate their entire product line, a process that can take months and incur considerable expense, thereby locking them into the existing supplier relationship.

The difficulty in switching suppliers means Elementis faces less direct pressure from competitors attempting to win over its established customer base. This creates a more stable market environment where Elementis can focus on product innovation and service rather than constant price wars or aggressive customer acquisition tactics. In 2024, the specialty chemicals sector, where Elementis operates, saw continued emphasis on product differentiation and technical support, further reinforcing the value of these customer lock-ins.

- Reduced Competitive Pressure: High switching costs act as a barrier to entry for new competitors and discourage existing ones from aggressive customer poaching.

- Customer Retention: Elementis benefits from a more loyal customer base due to the significant investment required to switch suppliers.

- Example: In specialty coatings, re-formulation and re-testing can represent 10-15% of a product's development cost, making supplier changes a major undertaking.

- Market Stability: These costs contribute to a more predictable revenue stream and allow Elementis to focus on value-added services rather than price competition.

Exit Barriers

High exit barriers in the specialty chemical sector, including the need for specialized production assets and navigating complex regulatory landscapes, can trap even struggling companies within the market. For instance, Elementis itself has significant investments in dedicated manufacturing facilities. These barriers prevent a smooth exit for underperforming rivals, potentially leading to prolonged periods of intense price competition and market overcapacity.

The presence of these exit barriers can significantly amplify competitive rivalry. When companies cannot easily divest or shut down operations, they may continue to compete aggressively, even at low profitability, to recoup some of their sunk costs. This dynamic can suppress overall industry returns and create a challenging environment for all players, including Elementis.

- Specialized Assets: Elementis operates plants with specific equipment tailored for its product lines, making them difficult and costly to repurpose or sell.

- Regulatory Hurdles: Chemical manufacturing involves stringent environmental and safety regulations, adding complexity and expense to any closure or divestiture process.

- Long-Term Contracts: Existing supply agreements can obligate companies to continue production even if it becomes unprofitable, effectively locking them into the market.

Elementis faces intense competition from a broad spectrum of companies, from global giants like BASF and Dow to smaller niche players. This rivalry is particularly sharp in segments where product portfolios overlap, such as coatings and personal care ingredients. The specialty chemicals market, valued at approximately $700 billion in 2023, is projected to grow at a CAGR of around 5% through 2030, indicating a dynamic environment where companies vie for market share.

High switching costs for customers, often involving significant re-formulation and re-testing, create a substantial barrier against direct price competition for Elementis. For example, in the coatings industry, a customer changing specialty additive suppliers might incur costs representing 10-15% of a product's development budget, fostering customer loyalty. This dampens aggressive customer poaching by rivals, contributing to market stability.

The competitive landscape is further shaped by high exit barriers within the specialty chemical sector. Elementis's investment in specialized production assets and the complex regulatory environment make it difficult and costly for underperforming rivals to exit the market. This can lead to prolonged periods of intense competition and potential price wars as companies strive to recoup sunk costs.

SSubstitutes Threaten

The threat of substitutes for Elementis's high-performance additives looms when customers can achieve comparable rheology and functional properties through alternative chemical compounds or entirely different technologies. These substitutes could emerge from various chemical sectors or even non-chemical solutions, potentially impacting Elementis's market share if they offer a compelling value proposition. For instance, in the coatings industry, a significant market for Elementis, the development of water-based formulations or novel curing mechanisms could reduce reliance on certain specialty additives.

Customers often weigh the price-performance trade-off when considering substitutes. If alternative products offer similar functionality at a substantially lower cost, Elementis faces a significant threat.

For instance, in the coatings industry, if a competitor’s additive provides 90% of the performance of an Elementis product but at 30% less cost, it becomes a compelling alternative for price-sensitive buyers.

Elementis must therefore focus on demonstrating superior value, ensuring its specialized solutions justify their price through enhanced performance, durability, or unique application benefits to deter customers from switching to cheaper alternatives.

Elementis's customers, spread across personal care, coatings, and energy sectors, show varying degrees of openness to new formulations. In 2024, the personal care segment, driven by consumer demand for sustainable and novel ingredients, demonstrated a higher willingness to adopt substitutes, particularly those offering enhanced performance or eco-friendly profiles. This openness directly amplifies the threat of substitutes for Elementis's specialty additives in this market.

Technological Advancements Enabling Substitutes

Rapid advancements in material science and biotechnology present a significant threat of substitutes for Elementis's specialty chemicals. For instance, breakthroughs in bio-based polymers or advanced composite materials could offer comparable or even superior performance characteristics, potentially at a lower cost or with improved environmental profiles. Elementis needs to actively track these emerging technologies to anticipate and respond to potential market disruptions.

The development of new manufacturing processes can also create viable substitutes. Innovations in additive manufacturing (3D printing) or novel chemical synthesis routes might allow competitors to produce materials that fulfill similar functions to Elementis's offerings without relying on traditional methods or existing product formulations. Staying ahead requires continuous investment in research and development to understand these evolving technological landscapes.

- Biotechnology Innovations: Companies exploring bio-derived additives for coatings, personal care, or industrial applications pose a direct threat. For example, the growing market for biodegradable surfactants could displace petroleum-based alternatives.

- Material Science Breakthroughs: The discovery of new high-performance polymers or advanced ceramics might offer functional replacements for certain Elementis additives in demanding applications like automotive or aerospace.

- Process Technology: Advancements in chemical synthesis, such as flow chemistry or enzymatic processes, could enable more efficient and cost-effective production of substitute chemicals.

- Market Trends: Increasing consumer demand for sustainable and natural ingredients in personal care and home products is driving innovation in bio-based substitutes, impacting Elementis's market share in these segments.

Regulatory or Sustainability Shifts Favoring Substitutes

Regulatory or sustainability shifts can significantly impact Elementis by favoring alternative products. For instance, if governments implement stricter environmental regulations on certain chemical compounds used by Elementis, or if consumer demand surges for products with natural and biodegradable ingredients, then substitutes that meet these new criteria could gain a competitive edge. This could force Elementis to adapt its product lines or face reduced market share, even if the substitutes aren't direct chemical replacements.

Consider the increasing global focus on reducing plastic waste. While Elementis might not directly produce plastics, its additives could be used in plastic manufacturing. If regulations push for biodegradable packaging or if brands actively seek to eliminate non-biodegradable components, then Elementis's current additive portfolio could be challenged by alternatives that enable such sustainable solutions. For example, by mid-2024, several major consumer goods companies announced ambitious targets to increase the use of recycled content and reduce virgin plastic, indirectly pressuring suppliers like Elementis to align their offerings.

- Regulatory Pressure: New environmental laws could restrict certain chemicals, making substitutes more attractive.

- Sustainability Demand: Growing consumer and corporate preference for natural or biodegradable components favors alternatives.

- Market Adaptation: Elementis may need to innovate or reformulate products to meet evolving sustainability standards.

- Competitive Landscape: Companies offering compliant substitutes could capture market share if Elementis lags in adaptation.

The threat of substitutes for Elementis's additives is amplified by advancements in material science and biotechnology, with bio-based polymers and advanced composites offering comparable or superior performance. For instance, by early 2025, several key markets saw increased adoption of bio-derived surfactants, impacting traditional chemical additives. Elementis must monitor these innovations to anticipate and counter potential market disruptions, as breakthroughs could offer cost or environmental advantages.

Entrants Threaten

Entering the specialty chemicals sector, especially for advanced additives, demands substantial upfront capital. This includes significant investment in cutting-edge research and development, state-of-the-art manufacturing plants, and specialized machinery.

These considerable capital outlays create a formidable barrier for potential new competitors looking to establish a foothold in the market.

For instance, companies like Elementis often invest hundreds of millions of dollars annually in R&D and capital expenditures to maintain their competitive edge.

Elementis's commitment to innovation, evidenced by its focus on specialty chemicals and tailored solutions, likely involves proprietary technology and robust patent protection. For instance, in 2024, the company continued to invest in research and development, aiming to secure its technological edge in key markets like personal care and coatings. This strong intellectual property portfolio acts as a significant barrier, making it challenging and costly for potential competitors to replicate Elementis's unique product offerings and manufacturing processes.

For new companies looking to enter markets like personal care, coatings, or energy, securing access to established distribution channels and building strong customer relationships presents a significant hurdle. Elementis benefits from its existing, well-developed network, which new entrants would struggle to replicate quickly or cost-effectively.

Economies of Scale and Experience Curve

Established players like Elementis leverage significant economies of scale in manufacturing, raw material sourcing, and research and development. This allows them to achieve lower per-unit costs, a crucial advantage in the specialty chemicals market. For instance, in 2024, Elementis's integrated production facilities and global supply chain likely contributed to cost efficiencies that new entrants would find difficult to replicate immediately.

The experience curve also plays a vital role; as Elementis has refined its processes over time, it has gained efficiencies and knowledge that translate into competitive pricing. New entrants would face a steep learning curve and higher initial operating costs, making it challenging to compete on price against a company with decades of operational optimization. This cost disadvantage can be a substantial barrier, deterring new companies from entering the market.

- Economies of Scale: Elementis benefits from lower unit costs due to large-scale production and procurement.

- Experience Curve: Decades of operational refinement lead to enhanced efficiency and cost competitiveness.

- Cost Disadvantage for Entrants: New players would struggle to match established cost structures.

- Barrier to Entry: The significant cost advantage of incumbents acts as a deterrent to new competitors.

Regulatory Hurdles and Compliance

The specialty chemicals sector faces substantial regulatory burdens, especially concerning product safety and environmental stewardship. For instance, in 2024, the European Chemicals Agency (ECHA) continued its rigorous enforcement of REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), requiring extensive data submission and risk assessments for new substances. This complex web of rules significantly elevates the cost and time required for new companies to enter the market, acting as a formidable barrier.

Navigating these intricate regulations is a major hurdle for potential new entrants in the specialty chemicals industry. Compliance with standards like those set by the U.S. Environmental Protection Agency (EPA) for chemical manufacturing and use demands significant investment in research, testing, and legal expertise. For example, the Toxic Substances Control Act (TSCA) reform in recent years has increased scrutiny on chemical substances, adding layers of complexity for any new player.

- Stringent Safety Standards: Regulations like REACH and TSCA mandate thorough testing and documentation for chemical products, increasing upfront costs for new entrants.

- Environmental Compliance: Adherence to emissions limits, waste disposal protocols, and sustainable manufacturing practices adds operational complexity and expense.

- Product Registration Costs: Obtaining necessary approvals for new chemical formulations can involve substantial fees and lengthy review periods, deterring smaller or less capitalized competitors.

- Global Regulatory Variations: Companies must navigate differing regulatory landscapes across various international markets, further complicating market entry and expansion efforts.

The threat of new entrants into the specialty chemicals market, where Elementis operates, is generally considered moderate to low. Significant capital investment is required for R&D and advanced manufacturing, creating a substantial barrier. For instance, Elementis's ongoing investments in innovation and proprietary technology, as seen in its 2024 R&D focus, make it difficult for newcomers to replicate its offerings.

Economies of scale and the experience curve further solidify Elementis's competitive position, leading to cost advantages that new entrants would struggle to match. The complex regulatory environment, including compliance with standards like REACH and TSCA, also adds considerable cost and time, deterring potential competitors.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment in R&D, manufacturing, and technology. | Significant deterrent due to substantial upfront costs. |

| Proprietary Technology & Patents | Elementis's innovation and protected intellectual property. | Makes it difficult and costly for new firms to replicate products. |

| Economies of Scale & Experience | Lower unit costs from large-scale operations and process optimization. | Creates a cost disadvantage for new entrants. |

| Regulatory Hurdles | Compliance with stringent safety and environmental standards (e.g., REACH, TSCA). | Increases time, cost, and complexity for market entry. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, industry-specific market research, and publicly available financial filings. This ensures a comprehensive understanding of competitive dynamics.