Dick's Sporting Goods SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dick's Sporting Goods Bundle

Dick's Sporting Goods leverages strong brand recognition and a vast product selection as key strengths, but faces challenges from intense competition and evolving consumer preferences. Understanding these dynamics is crucial for anyone looking to invest or strategize within the retail sector.

Want the full story behind Dick's Sporting Goods' market position and future outlook? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Dick's Sporting Goods boasts a powerful omnichannel strategy, seamlessly connecting its brick-and-mortar stores with its online presence. This integration is a significant strength, allowing the company to fulfill a remarkable 90% of its online orders directly from its physical locations. This efficiency not only streamlines operations but also significantly boosts customer convenience and satisfaction.

Dick's Sporting Goods is actively enhancing its retail presence by expanding specialized store formats like House of Sport and Field House. These innovative locations are designed to be more than just shopping destinations, incorporating engaging features such as indoor turf fields and batting cages.

This strategic investment in experiential retail is a key differentiator, attracting customers with unique, hands-on brand interactions. For example, the 'House of Sport' concept aims to create a destination for athletes, offering specialized equipment and services that foster deeper customer loyalty and drive higher sales per square foot.

Dick's Sporting Goods is showing impressive financial strength, with recent quarters marked by record sales and growth in comparable store sales. For instance, in the first quarter of 2025, the company achieved a company record of $3.17 billion in net sales, alongside a robust 4.5% increase in comparable sales.

As the leading specialty sporting goods retailer in the United States, Dick's Sporting Goods is not just maintaining its position but actively expanding its market share. This growth outpaces broader industry trends, underscoring the company's effective strategies and strong market presence.

Growing Portfolio of Private Label Brands

Dick's Sporting Goods has built a robust portfolio of private label brands, including CALIA, DSG, and VRST. These brands are a significant contributor to overall sales, demonstrating strong consumer adoption and brand loyalty. This strategic focus on proprietary brands allows Dick's to offer unique products and capture higher gross margins compared to national brands.

The success of these private label offerings is evident in their growing sales contribution. For instance, in fiscal year 2023, private label penetration reached approximately 20% of total net sales, a key indicator of their importance to the company's revenue. This growth not only boosts profitability but also strengthens Dick's competitive position by reducing dependence on external brand partnerships.

- Strong Sales Contribution: Private label brands accounted for roughly 20% of Dick's Sporting Goods' total net sales in fiscal year 2023.

- Higher Profitability: Proprietary brands like CALIA, DSG, and VRST typically generate higher gross margins, enhancing overall profitability.

- Brand Differentiation: These brands provide a unique product assortment, setting Dick's apart from competitors and appealing directly to consumer preferences.

Strong Brand Relationships and Product Assortment

Dick's Sporting Goods leverages robust relationships with premier national brands, including Nike and Adidas. This allows them to provide a wide selection of genuine, top-tier sports gear, clothing, and shoes. For instance, in fiscal year 2023, Nike and Adidas remained significant contributors to their overall sales mix, reflecting the enduring appeal of these partnerships.

This carefully chosen product offering, enhanced by their own well-performing private labels, effectively serves a broad customer spectrum. From serious athletes to casual outdoor adventurers, the assortment meets diverse needs. The company's private label brands, such as DSG and CALIA, have shown consistent growth, contributing positively to their gross margin in recent quarters.

- Brand Partnerships: Strong ties with Nike, Adidas, and other leading sports brands.

- Product Diversity: Extensive range of authentic sports equipment, apparel, and footwear.

- Private Label Success: Growing contribution from in-house brands like DSG and CALIA.

- Customer Appeal: Caters to both dedicated athletes and general consumers.

Dick's Sporting Goods stands out with a strong omnichannel presence, enabling approximately 90% of online orders to be fulfilled from its physical stores, enhancing customer convenience. The company is strategically expanding experiential retail formats like House of Sport and Field House, offering unique features such as indoor turf fields to drive customer engagement and loyalty.

Financially, Dick's demonstrated robust performance in early 2025, achieving a record $3.17 billion in net sales for the first quarter, with comparable sales increasing by 4.5%. As the leading specialty sporting goods retailer in the U.S., the company is actively growing its market share, outpacing broader industry trends.

The company's private label brands, including CALIA, DSG, and VRST, are a significant strength, contributing around 20% of total net sales in fiscal year 2023 and offering higher gross margins. These proprietary brands differentiate Dick's offerings and foster customer loyalty, reducing reliance on national brands.

Dick's maintains strong relationships with premier national brands like Nike and Adidas, ensuring a wide selection of authentic, high-quality sports gear. This diverse product assortment, complemented by successful private label offerings, effectively caters to a broad customer base, from elite athletes to casual consumers.

| Strength | Description | Supporting Data (as of Q1 2025 or FY 2023) |

| Omnichannel Excellence | Seamless integration of online and physical stores for order fulfillment. | 90% of online orders fulfilled from physical stores. |

| Experiential Retail | Expansion of unique store formats like House of Sport and Field House. | Features include indoor turf fields and batting cages to enhance customer experience. |

| Financial Performance | Record sales and consistent comparable sales growth. | Q1 2025 net sales of $3.17 billion; 4.5% comparable sales increase. |

| Market Leadership | Leading specialty sporting goods retailer in the U.S. | Outpacing broader industry trends in market share growth. |

| Private Label Strength | Robust portfolio of proprietary brands (CALIA, DSG, VRST). | FY 2023 private label penetration ~20% of net sales; higher gross margins. |

| National Brand Partnerships | Strong relationships with premier brands like Nike and Adidas. | Significant sales contribution from key national brand partnerships in FY 2023. |

What is included in the product

Offers a full breakdown of Dick's Sporting Goods’s strategic business environment, examining its internal strengths and weaknesses alongside external opportunities and threats.

Offers a clear breakdown of Dick's Sporting Goods' competitive landscape, highlighting opportunities for growth and mitigating potential threats.

Weaknesses

Dick's Sporting Goods' significant reliance on national brands like Nike and Adidas presents a notable weakness. These powerful brands are increasingly prioritizing their direct-to-consumer (DTC) channels, which could potentially limit Dick's product assortment or exert pressure on their margins. For instance, Nike's strategy to reduce wholesale partners as reported in early 2023 means Dick's must constantly navigate these evolving brand strategies to maintain access to key products.

Dick's Sporting Goods operates in a fiercely competitive retail environment. The rise of online giants like Amazon and Walmart, along with specialized direct-to-consumer brands, intensifies pressure on pricing and market positioning. This makes it a constant challenge for Dick's to not only retain its existing customer base but also to attract new shoppers in a crowded marketplace.

The industry's competitive intensity directly translates into pricing pressure. Retailers often resort to discounts and promotions to draw customers, which can erode profit margins for all players. For Dick's, this means carefully balancing competitive pricing strategies with the need to maintain profitability and invest in its business.

Furthermore, the proliferation of counterfeit goods, particularly through online channels, presents a significant threat to brand integrity and sales. Dick's must actively combat these illicit products to protect its reputation and ensure customers receive authentic merchandise, adding another layer of complexity to its operational strategy.

Dick's Sporting Goods has encountered hurdles with its inventory management. For instance, in Q3 2023, inventory levels were reported to be up 1.7% year-over-year, reaching $3.1 billion. While strategic investments in growth categories are ongoing, maintaining optimal inventory levels is vital to prevent overstocking. This can pressure profit margins through increased markdowns and promotions.

Potential for Declining Net Income Despite Sales Growth

Dick's Sporting Goods has experienced impressive sales growth, but this hasn't always translated directly into higher net income. For instance, in the first quarter of 2025, the company reported a decline in net income despite a rise in sales. This divergence highlights a key weakness: the potential for profitability to be squeezed even as the top line expands.

Several factors contribute to this. Significant investments in crucial areas like digital retail infrastructure and expanded marketing efforts, while necessary for future growth, can put a strain on current earnings. Additionally, changes in tax rates can also impact the bottom line, as seen in recent periods. This underscores the challenge of managing expenses effectively while pursuing ambitious growth strategies.

- Declining Net Income: Q1 2025 results showed net income falling despite sales increases, indicating margin pressure.

- Investment Costs: Higher operating expenses due to investments in digital capabilities and marketing campaigns are impacting profitability.

- Tax Rate Impact: Increased tax rates have also played a role in reducing net income.

- Profitability Management: The company faces the challenge of balancing expansion initiatives with cost control to ensure sustainable profit growth.

Macroeconomic Sensitivities

Dick's Sporting Goods, as a seller of non-essential items, is quite sensitive to broader economic shifts. Think about things like ongoing inflation and consumers being more careful with their money. These economic headwinds can really dampen people's confidence and make them less likely to spend on things like sporting goods, directly impacting sales and profits.

For example, if inflation remains stubbornly high throughout 2024 and into 2025, consumers might prioritize essential purchases over discretionary ones. This cautious spending environment directly challenges retailers like Dick's, as their product categories often fall into the discretionary bucket. The Federal Reserve's interest rate policies, aimed at curbing inflation, can also indirectly affect consumer spending power by increasing borrowing costs for major purchases, further pressuring sales of higher-ticket sporting equipment.

- Inflationary Pressures: Persistent inflation in 2024 and projected for 2025 can erode consumer purchasing power, leading to reduced spending on discretionary items like athletic apparel and equipment.

- Consumer Confidence: Economic uncertainties, including job market fluctuations and interest rate hikes, can lower consumer confidence, making individuals more hesitant to make non-essential purchases.

- Interest Rate Sensitivity: Higher interest rates can impact consumers' ability to finance larger purchases, potentially affecting sales of higher-priced sporting goods and equipment.

Dick's reliance on major national brands like Nike and Adidas is a significant vulnerability. These brands are increasingly focusing on their own direct-to-consumer sales, which could limit Dick's product selection or force them to accept lower profit margins. For example, Nike's stated intention to reduce its wholesale partnerships, as reported in early 2023, means Dick's must continually adapt to these brand strategies to ensure continued access to essential products.

The company also faces intense competition from online retailers and specialized direct-to-consumer brands, putting pressure on pricing and market share. This makes it a challenge to keep customers and attract new ones in a crowded market. Additionally, Dick's has experienced inventory management issues, with inventory levels rising in Q3 2023 to $3.1 billion, which can lead to increased markdowns and reduced profitability.

Dick's Sporting Goods' profitability can be squeezed even when sales are growing, as seen in Q1 2025 where net income declined despite higher sales. This is partly due to significant investments in digital infrastructure and marketing, which, while important for future growth, can impact current earnings. Higher tax rates have also contributed to this profit reduction.

Economic sensitivity is another key weakness. Persistent inflation throughout 2024 and into 2025 could reduce consumer spending on discretionary items like sporting goods. Furthermore, higher interest rates may make it harder for consumers to finance larger purchases, impacting sales of more expensive equipment.

Preview the Actual Deliverable

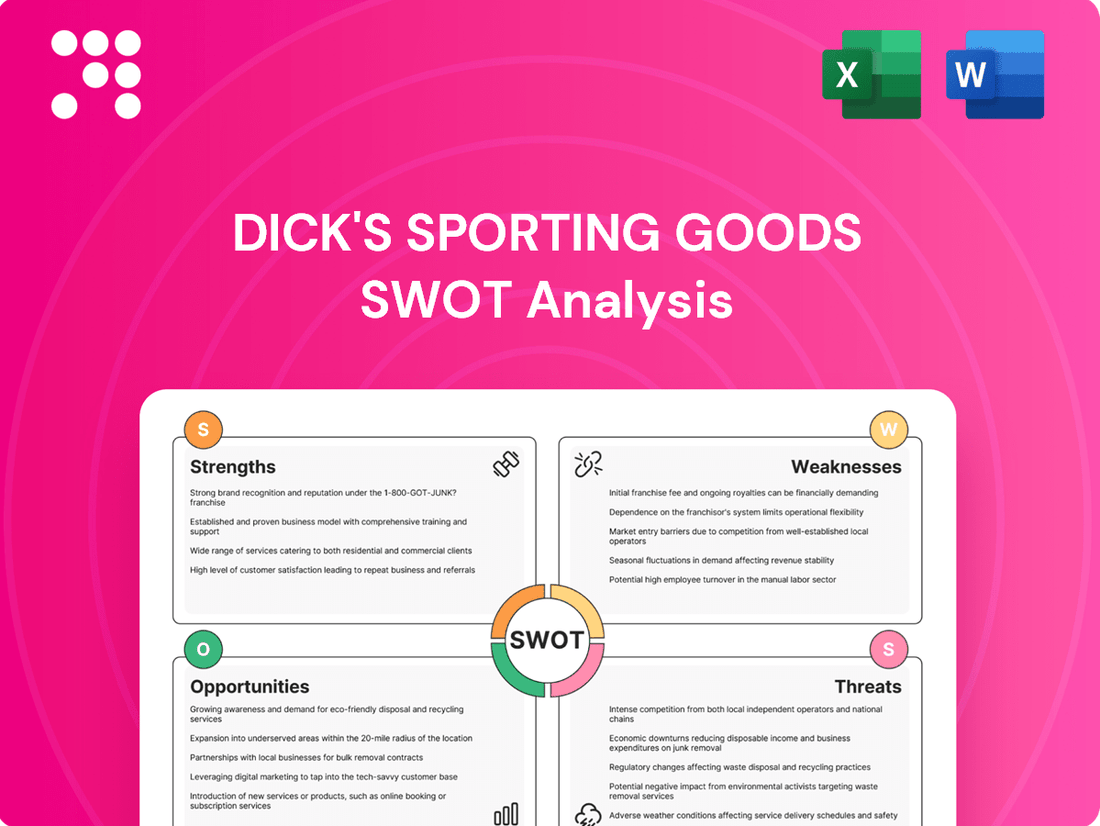

Dick's Sporting Goods SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report on Dick's Sporting Goods is ready for your strategic planning needs.

This is a real excerpt from the complete Dick's Sporting Goods SWOT analysis. Once purchased, you’ll receive the full, editable version, providing comprehensive insights into the company's strengths, weaknesses, opportunities, and threats.

Opportunities

Dick's Sporting Goods has a clear opportunity to grow by expanding its experiential store formats. The company is actively rolling out its 'House of Sport' and 'Field House' concepts, which are designed to be more engaging and interactive for customers.

These specialized stores have shown strong performance, driving both customer engagement and sales. Dick's plans to open around 16 new House of Sport stores and 18 Field House stores in 2025, with a broader goal of reaching 75 to 100 House of Sport locations by 2027.

Dick's Sporting Goods is strategically capitalizing on the burgeoning e-commerce landscape. The company's continued investment in its digital infrastructure, including its GameChanger app and Dick's Media Network, is a key driver for capturing greater market share and providing a seamless omnichannel customer experience.

The profitability of its e-commerce operations is a strong indicator of future success. By aggressively reinvesting in these digital channels, Dick's Sporting Goods is positioning itself for sustained long-term sales growth and improved profit margins, reflecting the broader trend of increasing online retail penetration in the sporting goods sector.

Dick's Sporting Goods can significantly boost customer loyalty and sales by using advanced data analytics and AI. These tools offer deep insights into what customers want, allowing for tailored product recommendations and marketing campaigns. For instance, in Q1 2024, Dick's reported a 5.3% increase in same-store sales, partially driven by their focus on personalized customer engagement through their loyalty program.

Acquisition and Strategic Partnerships

The potential acquisition of Foot Locker, a move discussed in late 2023 and early 2024, could significantly bolster Dick's Sporting Goods' global footprint and market presence. This strategic move aims to unlock substantial value by expanding market share and diversifying product categories within the athletic and lifestyle apparel space. Such a combination could create powerful synergies, enhancing Dick's competitive advantage.

Strategic partnerships and potential acquisitions are key avenues for Dick's Sporting Goods to accelerate growth and enhance its market position. For instance, exploring collaborations with emerging athletic brands or complementary businesses could broaden its product assortment and customer reach. These alliances can also provide access to new technologies and distribution channels, vital for staying ahead in the dynamic retail landscape.

- Acquisition Potential: Dick's Sporting Goods has been exploring strategic opportunities, including potential acquisitions, to drive growth and expand its market reach.

- Market Expansion: Acquiring or partnering with companies like Foot Locker could significantly enhance Dick's global presence and diversify its product offerings.

- Synergy Opportunities: Strategic combinations can lead to operational efficiencies, improved supply chain management, and enhanced marketing capabilities, ultimately driving shareholder value.

- Competitive Positioning: In a competitive market, such moves are crucial for maintaining and strengthening Dick's position against rivals by offering a more comprehensive customer experience.

Tapping into Growing Health and Wellness Trends

The heightened consumer interest in personal health, fitness, and outdoor pursuits directly translates into a robust and enduring demand for sporting goods. Dick's Sporting Goods is well-positioned to leverage this trend by offering a comprehensive range of products that align with shifting consumer tastes. This includes a growing emphasis on home fitness solutions, equipment for outdoor recreation, and the integration of smart wearable technology.

This opportunity is supported by market data indicating continued growth in these sectors. For instance, the global health and wellness market was valued at over $4.9 trillion in 2023 and is projected to expand further. Specifically, the U.S. sporting goods market saw significant growth, with sales reaching an estimated $130 billion in 2024, driven by increased participation in sports and fitness activities.

- Expanding Home Fitness Offerings: Capitalizing on the sustained popularity of at-home workouts, Dick's can broaden its selection of treadmills, weights, and connected fitness devices.

- Enhancing Outdoor Recreation Assortment: With a surge in interest in camping, hiking, and cycling, the company can increase its inventory of related gear, apparel, and accessories.

- Integrating Smart Wearables: The growing market for fitness trackers and smartwatches presents an opportunity to integrate these products into the core sporting goods offering, appealing to tech-savvy consumers.

- Promoting Active Lifestyles: Dick's can further engage consumers through content and promotions that encourage participation in various health and wellness activities, reinforcing its brand as a lifestyle enabler.

Dick's Sporting Goods can leverage its expanding experiential store formats, like House of Sport and Field House, to drive customer engagement and sales, with plans to significantly increase their presence in the coming years.

The company's strategic investment in e-commerce, including its digital infrastructure and apps, positions it for sustained long-term sales growth and improved profit margins in an increasingly online retail environment.

Utilizing advanced data analytics and AI can enhance customer loyalty and personalize marketing efforts, as evidenced by recent sales increases linked to improved customer engagement.

Potential strategic acquisitions, such as the previously explored Foot Locker deal, offer opportunities to expand global footprint, diversify product categories, and create significant synergies.

Capitalizing on the growing consumer interest in health, fitness, and outdoor activities by expanding relevant product offerings, including home fitness and smart wearables, presents a significant growth avenue, supported by robust market data.

Threats

Dick's Sporting Goods faces a significant threat from specialized brands and direct-to-consumer (DTC) players. These agile competitors often focus on niche sports or product categories, offering unique merchandise and personalized customer engagement that can be difficult for larger retailers to replicate. For instance, the rise of brands like Lululemon in athletic apparel or specialized cycling shops highlights how focused players can capture dedicated customer bases.

This intensifying competition means Dick's must remain vigilant in its strategy. In 2023, the sporting goods market saw continued growth, but also increased fragmentation. DTC brands, in particular, have been effective in building strong communities around their products, often leveraging social media and influencer marketing to bypass traditional retail channels. This trend is projected to continue, putting pressure on established retailers to adapt or risk losing market share to these more specialized and digitally native competitors.

Ongoing global turbulence, such as the lingering effects of the pandemic and geopolitical tensions, continues to pose a significant threat to supply chains. For Dick's Sporting Goods, this can translate into delays in receiving inventory and increased shipping costs. For instance, global shipping costs saw a substantial increase in late 2023 and early 2024, impacting many retailers.

Inflationary pressures, including potential tariff increases on imported goods, directly affect production and purchasing costs. This can squeeze profit margins if Dick's Sporting Goods is unable to pass these higher costs onto consumers. The Consumer Price Index (CPI) in the US showed persistent inflation in key categories throughout 2023 and into 2024, highlighting this ongoing challenge.

Persistent inflation and economic uncertainty are making consumers more cautious, impacting spending on non-essential items like sporting goods. This shift could lead to reduced sales volumes for Dick's Sporting Goods as shoppers prioritize value or necessary purchases. For example, in early 2024, consumer confidence indexes showed continued volatility, reflecting these concerns.

Rapid Technological Advancements and Digital Disruption

The relentless march of technology, particularly in areas like AI-powered personalization and immersive virtual try-on experiences, continually elevates what consumers expect from their shopping journeys. Dick's Sporting Goods must actively adapt to these shifts to remain competitive.

Failing to integrate cutting-edge digital tools, such as advanced data analytics for inventory management or sophisticated customer relationship management systems, risks leaving Dick's behind. For instance, a 2024 report indicated that retailers investing heavily in AI saw an average 15% increase in customer engagement.

- AI-Driven Personalization: Enhancing customer experience through tailored product recommendations and targeted marketing campaigns.

- Virtual Try-On Technologies: Reducing return rates and improving online conversion by allowing customers to visualize products.

- Connected Fitness Equipment Integration: Offering seamless experiences for users of smart treadmills, bikes, and wearables, creating new revenue streams.

- Supply Chain Optimization: Leveraging technology for more efficient inventory management and faster delivery times.

Brand Loyalty Challenges and Counterfeit Products

Dick's Sporting Goods faces ongoing hurdles in retaining customer loyalty within a highly competitive retail landscape, where consumers can easily switch between numerous brands and online platforms. This fragmentation means constant effort is needed to keep customers engaged and coming back. In 2023, the sporting goods market saw intense competition, with players like Nike and Adidas continuing to innovate and capture consumer attention, putting pressure on retailers like Dick's to differentiate their offerings and loyalty programs.

The growing prevalence of counterfeit goods, especially through online channels, presents a significant threat. These fake products not only divert sales from legitimate retailers but also damage the reputation and trustworthiness of established brands. For instance, reports in late 2024 highlighted an increase in counterfeit athletic apparel being sold on third-party marketplaces, directly impacting consumer confidence in the authenticity of sporting goods purchases.

- Brand Loyalty: Maintaining customer loyalty is increasingly difficult in a market with abundant choices and direct-to-consumer (DTC) brand options.

- Counterfeit Market: The online proliferation of counterfeit sporting goods directly impacts sales and erodes customer trust in product authenticity.

- Reputational Damage: Counterfeit products can lead to negative customer experiences, harming Dick's brand image and potentially reducing future sales.

Dick's Sporting Goods faces intense competition from specialized brands and direct-to-consumer (DTC) companies that excel in niche markets and personalized engagement. The ongoing rise of these agile competitors, often leveraging social media and influencer marketing, pressures established retailers. For example, in 2023, the market saw continued fragmentation, with DTC brands effectively building strong communities and capturing dedicated customer bases, a trend expected to persist and challenge market share for larger players.

SWOT Analysis Data Sources

This analysis is built upon a foundation of reliable data, including Dick's Sporting Goods' financial statements, comprehensive market research reports, and expert industry analysis to provide a robust and accurate SWOT assessment.