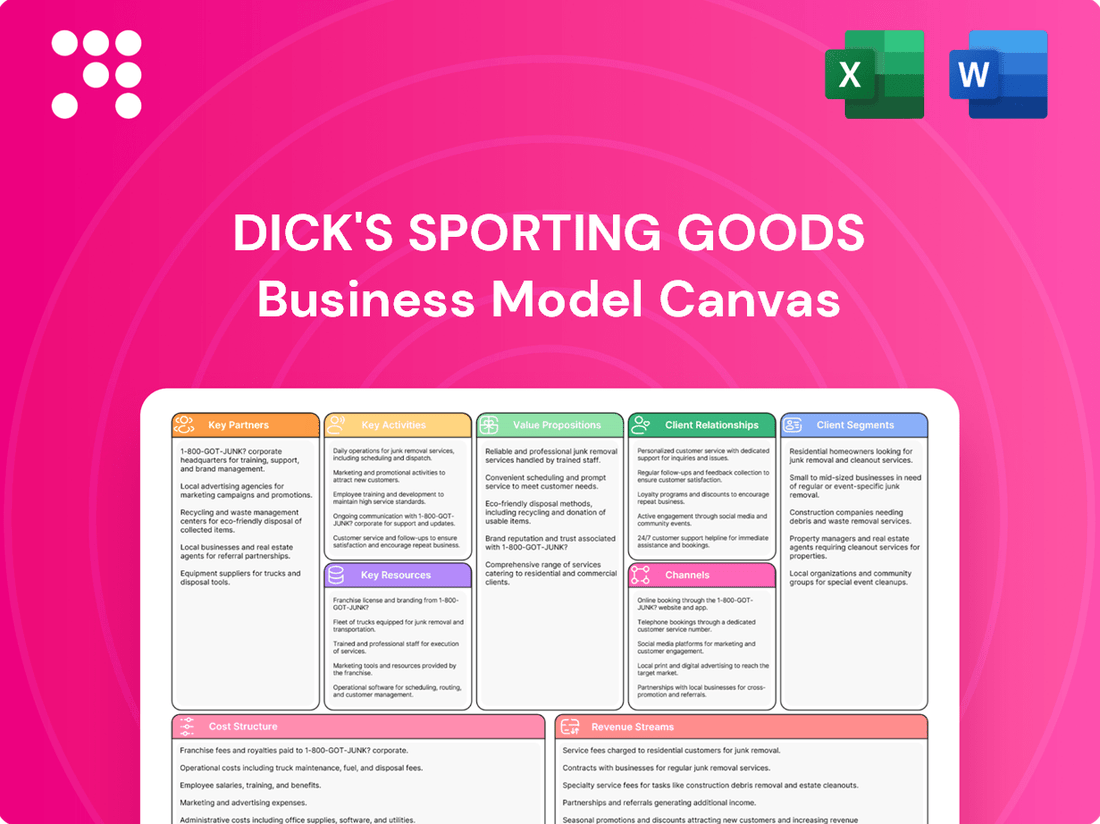

Dick's Sporting Goods Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dick's Sporting Goods Bundle

Explore the strategic engine behind Dick's Sporting Goods's success with a comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear view of their competitive advantage. Unlock the full blueprint to understand how they connect with athletes and outdoor enthusiasts.

Partnerships

Dick's Sporting Goods cultivates key partnerships with industry titans such as Nike, The North Face, and Under Armour. These collaborations are crucial for curating a unique and exclusive product selection that sets Dick's apart. For instance, in 2024, Dick's continued to be a significant retail partner for Nike, contributing to Nike's overall sales performance in the athletic footwear and apparel sector.

These strategic alliances not only bolster Dick's brand image by association but also grant access to coveted merchandise. This exclusivity creates a competitive advantage, making it challenging for rivals to match the breadth and desirability of their offerings. The ability to secure and promote these sought-after items directly impacts customer traffic and loyalty.

Dick's Sporting Goods actively invests in and partners with youth sports organizations to broaden participation and enhance athletic experiences across the country. A significant example is their $120 million commitment to Unrivaled Sports, demonstrating a substantial dedication to this sector.

These partnerships extend to impactful initiatives like the 'It's Her Shot' campaign, a collaboration with Nike and the WNBA aimed at boosting girls' involvement in basketball. Such alliances not only foster community engagement but also align with the company's broader mission to support athletic development from an early age.

Dick's Sporting Goods strategically partners with professional sports teams and leagues, securing multi-year agreements with entities like the Boston Celtics and Red Sox, and the WNBA. These collaborations designate Dick's as an official retail partner, granting them valuable access to tickets, exclusive fan experiences, and intellectual property rights for marketing campaigns.

Technology and Digital Platform Providers

Dick's Sporting Goods' partnerships with technology and digital platform providers are fundamental to its strategy of creating a seamless omnichannel customer experience. These collaborations are vital for developing and integrating advanced features across its e-commerce website, mobile application, and in-store digital touchpoints. For instance, in fiscal year 2023, Dick's continued to invest in its digital capabilities, which directly benefit from these tech partnerships, aiming to enhance website functionality and mobile app features that support improved customer engagement and purchasing convenience.

These alliances enable Dick's to refine its online presence and in-store technology, directly impacting operational efficiency and customer satisfaction. The focus is on creating a cohesive experience, whether a customer is browsing online, using the mobile app for in-store navigation, or utilizing digital tools for order fulfillment. This strategic alignment with tech providers ensures that Dick's remains competitive in a rapidly evolving retail landscape, offering robust digital solutions that cater to modern consumer expectations.

- E-commerce Platform Enhancement: Partnerships focus on upgrading website speed, user interface, and personalization features to drive online sales, which represented a significant portion of Dick's revenue in recent years.

- Mobile App Development: Collaborations are key to building and maintaining a feature-rich mobile app that supports in-store navigation, loyalty programs, and mobile purchasing, enhancing customer interaction.

- In-Store Digital Integration: Technology providers help integrate digital signage, self-checkout options, and inventory management systems to streamline the in-store shopping experience.

Logistics and Supply Chain Partners

Dick's Sporting Goods relies heavily on a robust network of logistics and supply chain partners to ensure efficient product flow. These collaborations are critical for timely delivery to both brick-and-mortar stores and direct-to-consumer channels, directly impacting operational costs and customer satisfaction.

In 2024, Dick's continued to refine its distribution strategies, leveraging partnerships to manage a vast inventory. For instance, their focus on optimizing last-mile delivery through third-party logistics providers aims to reduce shipping times and costs, a key factor in maintaining competitive pricing and a positive customer experience.

- Distribution Network: Partnerships with national and regional carriers ensure products reach over 700 stores across the U.S. and support e-commerce fulfillment.

- Inventory Management: Collaborations with third-party logistics (3PL) providers help manage warehouse operations and inventory levels, crucial for meeting demand fluctuations.

- Omnichannel Integration: These partnerships are vital for supporting Dick's omnichannel strategy, enabling features like buy online, pick up in-store (BOPIS) and ship-from-store efficiently.

Dick's Sporting Goods fosters key partnerships with major athletic brands like Nike and Adidas, ensuring access to exclusive products and driving customer traffic. In 2024, these relationships remained central to their merchandising strategy, with continued strong sales performance reported for these brands within Dick's stores. These collaborations are vital for maintaining a competitive edge and offering sought-after merchandise.

Strategic alliances with youth sports organizations and leagues, such as their significant commitment to Unrivaled Sports, underscore Dick's dedication to community engagement and athletic development. These partnerships help broaden participation in sports and enhance the overall athletic experience for young people across the nation.

Dick's also collaborates with technology providers to enhance its digital infrastructure and customer experience. These partnerships are crucial for improving their e-commerce platform, mobile app functionality, and in-store digital integration, ensuring a seamless omnichannel journey for shoppers.

Furthermore, robust logistics and supply chain partnerships are essential for efficient inventory management and timely product delivery. In 2024, Dick's continued to optimize its distribution network, leveraging third-party logistics providers to reduce shipping times and costs, thereby improving customer satisfaction.

What is included in the product

Dick's Sporting Goods' business model focuses on providing a wide selection of sporting goods and apparel through a strong omnichannel strategy, leveraging both brick-and-mortar stores and a robust e-commerce platform to serve a broad customer base.

Dick's Sporting Goods' Business Model Canvas offers a clear, one-page snapshot of how they alleviate customer pain points by providing a wide selection of sporting goods and expert advice, streamlining the shopping experience for active individuals.

Activities

Retail Operations Management for Dick's Sporting Goods is the backbone of its physical presence, overseeing the daily functions across its diverse store formats like Dick's Sporting Goods, Golf Galaxy, Public Lands, and Going Going Gone!. This critical activity ensures efficient inventory management, compelling merchandising, and a positive customer experience at each location.

In fiscal year 2023, Dick's Sporting Goods operated over 700 stores, highlighting the sheer scale of its retail operations. Effective management of these brick-and-mortar touchpoints is crucial for driving sales and reinforcing brand loyalty, especially as the company navigates evolving consumer shopping habits.

Dick's Sporting Goods' key activity in omnichannel sales and marketing centers on seamlessly blending its online and physical store experiences. This includes offering convenient services like Buy Online, Pick Up In-Store (BOPIS), which saw significant adoption and contributed to a strong holiday season in 2023, with digital sales continuing to be a major growth driver.

Personalized digital marketing campaigns are crucial, leveraging customer data to tailor promotions and product recommendations. This approach not only boosts online conversion rates but also encourages customers to visit brick-and-mortar locations, fostering a holistic engagement that drives overall sales and customer loyalty.

Dick's Sporting Goods excels at sourcing a diverse array of authentic, high-quality sports gear, apparel, and footwear. They partner with both premium national brands and develop their own private label collections.

A key strategy is the curation of exclusive in-house brands such as DSG, CALIA, and VRST. This allows them to differentiate their product mix and cater to a broader spectrum of customer preferences and price points.

For example, in fiscal year 2023, Dick's reported net sales of $12.26 billion, with private label penetration playing a significant role in their overall assortment strategy and brand building.

Experiential Store Development

Dick's Sporting Goods is significantly investing in experiential store development, rolling out formats like House of Sport and Field House. These locations are designed to be more than just places to buy gear; they offer immersive experiences. For example, House of Sport stores feature dedicated zones for different sports, complete with interactive elements.

These experiential stores aim to foster deeper customer engagement by offering unique activities that redefine the traditional sports retail experience. This strategy is crucial for differentiating Dick's in a competitive market and building brand loyalty.

- House of Sport: These locations integrate interactive elements such as batting cages, golf simulators, and climbing walls to provide hands-on experiences.

- Field House: Similar to House of Sport, these stores focus on community engagement and active participation, often featuring larger, more dynamic spaces for sports demonstrations and events.

- Customer Engagement: The goal is to create destinations where customers can not only shop but also engage with sports and fitness in a meaningful way, driving repeat visits and increased spending.

Youth Sports Technology and Community Engagement

Dick's Sporting Goods' key activities include operating and developing platforms such as GameChanger. This youth sports mobile app is crucial for live streaming games, managing schedules, and keeping scores, directly engaging with the youth sports community.

This focus on technology extends Dick's reach far beyond its brick-and-mortar stores. It cultivates a strong sense of community by offering essential resources for athletes, coaches, and families involved in youth sports.

- Platform Operation: Maintaining and enhancing digital tools like GameChanger to provide seamless user experiences for scheduling, scoring, and communication within youth sports leagues.

- Community Building: Actively fostering engagement through these platforms, creating a hub for athletes, parents, and coaches to connect and share their passion for sports.

- Content Development: Providing valuable content and features within the app that support skill development, team management, and the overall enjoyment of youth sports participation.

Dick's Sporting Goods' key activities encompass the strategic sourcing and curation of a wide product range, balancing partnerships with premier national brands and the development of exclusive private label collections like DSG, CALIA, and VRST. This dual approach, evident in their fiscal year 2023 net sales of $12.26 billion, allows for market differentiation and appeals to diverse customer segments.

Full Version Awaits

Business Model Canvas

The Business Model Canvas for Dick's Sporting Goods you are previewing is the genuine article, not a sample. Upon completing your purchase, you will receive the exact same, fully comprehensive document, ready for your immediate use and analysis.

This preview offers a direct glimpse into the complete Business Model Canvas for Dick's Sporting Goods that you will acquire. Once your order is processed, you'll gain full access to this identical, professionally structured document, ensuring you receive precisely what you see.

Resources

Dick's Sporting Goods operates an extensive retail store network, a cornerstone of its business model. As of early 2024, the company maintained over 700 locations across the United States, encompassing its flagship Dick's Sporting Goods stores, along with specialized formats like Golf Galaxy and the newer Public Lands stores. This broad physical presence ensures widespread customer accessibility.

The company's strategic expansion into new concepts like Dick's House of Sport and Dick's Field & Stream further diversifies its retail footprint. These newer formats are designed to offer enhanced experiences and cater to specific customer needs, complementing the core offerings. This multi-format approach strengthens their market penetration.

This vast network serves as a critical asset for their omnichannel strategy, enabling efficient buy online, pick up in-store (BOPIS) and ship-from-store capabilities. In 2023, for instance, a significant portion of online sales were fulfilled through their brick-and-mortar locations, highlighting the network's importance in driving sales and customer convenience.

Dick's Sporting Goods thrives on a robust brand portfolio, encompassing both premier national brands and its own successful private-label lines. This strategy allows them to offer a wide selection, catering to diverse customer preferences and price points.

The company's private-label brands, such as DSG, CALIA, and VRST, are increasingly important. These brands not only provide unique product offerings but also contribute substantially to overall sales and profit margins, demonstrating their growing significance in Dick's retail strategy.

In 2023, private brands represented a significant portion of Dick's sales, highlighting their increasing customer acceptance and contribution to the company's financial performance. This dual approach of national and private labels is a cornerstone of their business model.

Dick's Sporting Goods' omnichannel technology platform is the backbone of its customer experience, seamlessly connecting its e-commerce website, mobile app, and in-store digital tools. This sophisticated infrastructure allows for conveniences like buy-online-pickup-in-store (BOPIS), which saw significant adoption and contributed to the company's strong digital sales growth, reaching $2.0 billion in Q3 2024.

The platform facilitates personalized marketing efforts, leveraging customer data to offer tailored promotions and product recommendations, thereby enhancing engagement and driving sales. In fiscal year 2023, digital sales represented approximately 20% of total net sales, underscoring the platform's crucial role in the company's revenue generation and customer retention strategies.

Skilled and Knowledgeable Workforce

Dick's Sporting Goods' skilled and knowledgeable workforce is a cornerstone of its business model. These teammates, often enthusiasts themselves, offer invaluable advice, significantly boosting customer engagement and satisfaction both in physical stores and through digital channels. Their expertise directly translates into a superior shopping experience, fostering loyalty.

This human capital is critical for differentiating Dick's in a competitive retail landscape. The company invests in training to ensure its employees are well-versed in product knowledge and customer service best practices. For instance, in 2024, Dick's continued its focus on teammate development, aiming to equip them with the insights needed to guide customers effectively.

- Expert Product Guidance: Teammates provide personalized recommendations, enhancing the customer's purchasing decisions.

- Enhanced Customer Experience: Knowledgeable staff contribute to a positive and helpful shopping environment.

- Brand Advocacy: Passionate employees act as brand ambassadors, reinforcing Dick's reputation.

- Sales Conversion: Expertise directly impacts sales by helping customers find the right products, leading to higher conversion rates.

Customer Data and Loyalty Programs

Dick's Sporting Goods leverages its ScoreCard loyalty program as a cornerstone of its key resources. This program boasts over 25 million active members, a significant number that underscores its reach and impact.

The extensive membership base of the ScoreCard program provides Dick's with a rich repository of customer data. This data is invaluable, offering deep insights into purchasing habits, product preferences, and overall customer behavior.

- ScoreCard Loyalty Program: Over 25 million active members.

- Data Insights: Detailed understanding of purchasing behavior and preferences.

- Strategic Application: Fuels personalized marketing campaigns.

- Operational Benefits: Aids in inventory management and strategic decision-making.

Dick's Sporting Goods' extensive retail network, exceeding 700 stores by early 2024, forms a critical physical asset. This broad footprint, including specialized formats like Golf Galaxy and Public Lands, ensures widespread customer accessibility and supports an omnichannel strategy with efficient fulfillment options like BOPIS.

The company's robust brand portfolio, featuring both national brands and successful private labels such as DSG and CALIA, is a key resource. In 2023, private brands contributed significantly to sales, demonstrating their growing importance in offering unique products and enhancing profit margins.

Dick's sophisticated omnichannel technology platform connects its e-commerce, mobile app, and in-store digital tools, driving customer experience and digital sales, which reached $2.0 billion in Q3 2024. This platform enables personalized marketing and efficient operations.

A skilled and knowledgeable workforce, often comprised of product enthusiasts, provides expert guidance, enhancing customer satisfaction and driving sales. The company's investment in teammate development in 2024 ensures they are equipped to offer superior customer service.

The ScoreCard loyalty program, with over 25 million active members, is a vital resource, providing rich customer data that fuels personalized marketing and informs strategic decisions. This program enhances customer engagement and loyalty.

| Key Resource | Description | Key Metric/Data Point |

|---|---|---|

| Retail Store Network | Extensive physical presence across the US. | Over 700 locations (early 2024). |

| Brand Portfolio | Mix of national and private-label brands. | Private brands significant sales contribution (2023). |

| Omnichannel Technology | Integrated e-commerce, mobile, and in-store digital tools. | $2.0 billion in digital sales (Q3 2024). |

| Workforce Expertise | Knowledgeable and engaged store teammates. | Ongoing investment in teammate development (2024). |

| ScoreCard Loyalty Program | Customer loyalty and data platform. | Over 25 million active members. |

Value Propositions

Dick's Sporting Goods provides a vast array of genuine sports gear, apparel, and shoes, featuring top-tier national brands alongside their own private labels. This extensive catalog covers numerous sports and outdoor activities, ensuring customers have access to all necessary equipment for their athletic endeavors.

In 2024, Dick's continued to emphasize its broad product assortment. For instance, their private label brands, such as DSG and CALIA, offer competitive alternatives, contributing significantly to their overall sales mix and providing value to a wide customer base seeking quality at accessible price points.

Dick's Sporting Goods' 'House of Sport' and 'Field House' concepts offer customers unparalleled in-store experiences. These locations feature interactive elements like batting cages, climbing walls, and golf simulators, allowing shoppers to test products firsthand. This experiential approach transforms shopping from a transaction into an engaging activity.

This focus on immersion is crucial in today's retail landscape. For example, Dick's reported a comparable store sales increase of 5.0% for the first quarter of 2024, indicating that these experiential formats are resonating with consumers and driving traffic. This strategy differentiates them from online-only competitors.

Dick's Sporting Goods excels at providing a seamless omnichannel experience, allowing customers to move effortlessly between online and in-store shopping. This means you can browse products on their website, check availability at your local store, and even pick up your order there. In 2023, approximately 70% of their online sales included a ship-from-store component, highlighting the integration of their physical and digital footprints.

Expert Advice and Customer Service

Dick's Sporting Goods leverages its expert advice and customer service as a key value proposition. Knowledgeable staff offer specialized guidance, helping shoppers navigate product selections and make informed decisions. This personal touch is crucial for differentiating the brand from online-only retailers.

In 2024, Dick's continued to emphasize in-store experiences, where associates are trained to provide product expertise across various sporting categories. This human interaction aims to build customer loyalty and drive sales by ensuring a satisfactory shopping journey, a factor often missing in purely digital transactions.

- Expert Staff: Associates possess deep product knowledge, aiding customers in selecting the right gear.

- Personalized Support: Tailored recommendations enhance the customer's purchasing confidence.

- In-Store Experience: The human element provides a distinct advantage over online competitors.

- Customer Engagement: This focus fosters loyalty and repeat business.

Community Engagement and Youth Sports Support

Dick's Sporting Goods goes beyond just selling equipment by actively supporting youth sports. Through programs like their GameChanger app, they facilitate team management and communication, fostering a more connected sports community. This commitment to grassroots sports participation builds significant brand loyalty.

Their financial year 2023 saw continued investment in these community initiatives. For instance, Dick's donated over $100 million to youth sports programs since 2014, demonstrating a long-term dedication to this value proposition. This deepens customer relationships, creating an emotional connection that transcends transactional purchases.

- Community Engagement: Dick's facilitates participation and connection within youth sports.

- Brand Loyalty: Supporting sports fosters deeper, more emotional customer ties.

- Youth Sports Support: Initiatives like GameChanger directly aid young athletes and teams.

- Financial Commitment: Over $100 million donated to youth sports since 2014 highlights this value.

Dick's Sporting Goods offers a comprehensive selection of authentic sports equipment, apparel, and footwear from leading national brands and their own private labels. This broad assortment caters to a wide range of sports and outdoor activities, ensuring customers can find everything they need for their athletic pursuits. In 2024, private labels like DSG and CALIA continued to be a strong part of their sales mix, providing value and choice.

The company's unique in-store concepts, such as 'House of Sport' and 'Field House', provide engaging, experiential shopping environments. These locations often feature interactive elements like batting cages or golf simulators, allowing customers to test products before buying. This experiential approach was evident in their Q1 2024 comparable store sales increase of 5.0%, showing customer engagement with these formats.

Dick's excels in delivering a cohesive omnichannel experience, blending online and in-store shopping seamlessly. Customers can easily check local store inventory online and utilize services like buy online, pick up in-store. This integration is substantial, with about 70% of their online sales in 2023 involving a ship-from-store component.

Expert advice and dedicated customer service are core value propositions, with knowledgeable associates assisting customers. This personal touch is vital for differentiating Dick's from online-only competitors. In 2024, continued emphasis on associate training reinforced this commitment to providing specialized product knowledge and personalized support, fostering customer loyalty.

Beyond retail, Dick's actively supports youth sports through initiatives like the GameChanger app, enhancing community engagement and fostering brand loyalty. Their commitment is substantial, with over $100 million donated to youth sports programs since 2014, building strong emotional connections with customers.

Customer Relationships

Dick's Sporting Goods' ScoreCard loyalty program is a cornerstone of its customer relationships, offering members exclusive discounts and special offers. In 2024, the program continued to drive engagement by providing personalized recommendations tailored to individual purchase histories, effectively encouraging repeat business and strengthening brand affinity.

Dick's Sporting Goods cultivates customer relationships through interactive in-store experiences at its House of Sport and Field House locations. These specialized stores offer opportunities for product trials and host community events, fostering deeper engagement.

These engaging activities are designed to increase the time customers spend in the store, creating memorable interactions that build brand loyalty. For instance, the House of Sport concept, launched in 2021, aims to be more than just a retail space, offering a destination for athletes and enthusiasts.

Dick's Sporting Goods actively engages customers through its robust e-commerce site, user-friendly mobile app, and active social media presence. This digital ecosystem facilitates ongoing communication, delivering personalized content, exclusive promotions, and responsive customer support. For instance, the GameChanger app fosters community engagement within youth sports, demonstrating a commitment to diverse customer segments.

Knowledgeable Sales Associates

Dick's Sporting Goods leverages knowledgeable sales associates to build strong customer relationships. These teammates offer expert advice and high-quality service, helping shoppers select the best gear for their activities.

This personalized approach fosters trust and encourages customers to return, as they feel supported and confident in their purchases. For instance, in 2023, Dick's reported a 3.4% increase in same-store sales, partly attributed to enhanced in-store experiences and associate engagement.

- Expert Guidance: Sales associates are trained to provide informed recommendations, ensuring customers find products that meet their specific needs and skill levels.

- Personalized Service: Building rapport through friendly and helpful interactions creates a positive shopping environment.

- Product Knowledge: Associates possess deep understanding of sporting goods, from apparel technology to equipment specifications, empowering customers.

- Customer Support: Offering assistance with product selection, usage, and even post-purchase inquiries solidifies loyalty.

Community and Youth Sports Initiatives

Dick's Sporting Goods actively cultivates customer loyalty through its foundation and various community partnerships, particularly focusing on youth sports. This approach transcends simple sales, fostering a deeper connection with families and aspiring athletes.

In 2023, the DICK'S Sporting Goods Foundation continued its mission to support youth sports, providing over $100 million in grants to organizations nationwide. This investment underscores their commitment to building strong community ties and nurturing the next generation of athletes.

- Community Engagement: The foundation's work directly impacts local communities by supporting access to sports for underserved youth.

- Brand Affinity: These initiatives build significant goodwill and strengthen the brand's emotional connection with its customer base.

- Long-Term Relationships: By investing in youth sports, Dick's establishes relationships that can last for years, potentially leading to lifelong customers.

- 2024 Focus: For 2024, the company plans to further expand its "Sports Matter" program, aiming to reach even more young athletes and communities.

Dick's Sporting Goods fosters strong customer relationships through its ScoreCard loyalty program, offering personalized rewards and exclusive access, which saw continued growth in member engagement throughout 2024. The company also prioritizes in-person interactions at its specialized House of Sport and Field House locations, creating community hubs that encourage deeper customer connection beyond transactional exchanges.

Furthermore, Dick's leverages its digital platforms, including a user-friendly app and active social media presence, to maintain consistent communication and deliver tailored content. This multi-channel approach, combined with knowledgeable sales associates providing expert advice, aims to build trust and lasting loyalty.

| Customer Relationship Aspect | Description | 2024/2023 Data & Insights |

|---|---|---|

| Loyalty Program | ScoreCard offers exclusive discounts and personalized recommendations. | Continued growth in member engagement and repeat purchases. |

| In-Store Experience | House of Sport/Field House concepts offer product trials and community events. | Designed to increase dwell time and create memorable brand interactions. |

| Digital Engagement | E-commerce, mobile app, and social media for communication and support. | Personalized content and promotions drive ongoing customer interaction. |

| Sales Associate Expertise | Knowledgeable staff provide expert advice and personalized service. | Contributes to customer confidence and repeat business; 3.4% same-store sales increase reported in 2023 partly due to associate engagement. |

| Community & Foundation | DICK'S Sporting Goods Foundation supports youth sports, building brand affinity. | Over $100 million in grants provided in 2023; 2024 focus on expanding the "Sports Matter" program. |

Channels

Dick's Sporting Goods' physical retail stores form the backbone of its distribution strategy, encompassing its flagship Dick's Sporting Goods locations alongside specialized banners like Golf Galaxy and Public Lands. These brick-and-mortar outlets are crucial for sales, allowing customers to see and touch products, and serve as vital touchpoints for brand engagement and customer service.

In 2023, Dick's Sporting Goods operated approximately 700 stores across its various banners. These stores are increasingly designed to offer more than just transactions, incorporating experiential elements such as in-store clinics, personalized fitting services, and community events to enhance customer loyalty and drive foot traffic.

Dick's Sporting Goods' e-commerce website, DICK'S.com, is a cornerstone of its customer outreach. This digital storefront offers an extensive product catalog, rivaling and often exceeding in-store variety, with detailed product information and customer reviews to aid purchasing decisions.

The platform is designed for ease of use, allowing customers to browse, compare, and purchase items conveniently from any location. This accessibility is crucial for reaching a broader customer base and catering to evolving shopping habits.

In the first quarter of 2024, Dick's Sporting Goods reported that its e-commerce sales represented a significant portion of its overall revenue, demonstrating the channel's vital role in the company's financial performance and customer engagement strategy.

Dick's Sporting Goods leverages dedicated mobile applications as key digital channels. The primary Dick's Sporting Goods app allows for seamless shopping, access to loyalty rewards, and personalized offers. This digital presence is vital for engaging customers and driving sales in the current retail landscape.

The GameChanger app further extends Dick's reach, specifically targeting the youth sports community. It offers features like live scoring, team management, and player statistics, fostering a deeper connection with this important demographic. In 2023, mobile commerce continued its significant growth, with app-based sales forming a substantial portion of overall e-commerce revenue for many retailers, a trend Dick's actively participates in.

'Buy Online, Pick Up In-Store' (BOPIS)

Dick's Sporting Goods leverages Buy Online, Pick Up In-Store (BOPIS) as a key component of its omnichannel strategy. This allows customers to conveniently purchase items online and collect them at their preferred physical store location, often within hours.

BOPIS significantly enhances customer convenience and is a strong driver of in-store traffic. Data from 2024 indicates that a substantial percentage of online orders for retailers offering BOPIS are fulfilled this way, with many customers making additional, unplanned purchases once inside the store.

- Omnichannel Integration: BOPIS seamlessly connects online and physical retail channels.

- Customer Convenience: Offers immediate access to purchased goods, saving shipping time.

- Increased Foot Traffic: Drives customers into brick-and-mortar locations, boosting potential for impulse buys.

- Inventory Management: Optimizes stock levels by utilizing store inventory for online orders.

Direct-to-Consumer (DTC) Sales of Private Brands

Dick's Sporting Goods leverages its extensive retail footprint and online presence for direct-to-consumer (DTC) sales of its private label brands, such as DSG. This strategy allows them to offer unique products and maintain complete control over the customer experience for these exclusive lines.

In fiscal year 2023, private label penetration remained a key focus for Dick's. While specific DTC figures for private brands aren't broken out separately, the overall strength of their private label offerings contributed to their competitive edge. For instance, in Q3 2023, Dick's reported net sales of $2.77 billion, demonstrating the scale of their retail operations where these brands are sold.

- Brand Differentiation: Private labels like DSG provide exclusive merchandise not available through other retailers, enhancing Dick's unique value proposition.

- Margin Control: Direct sales of private brands allow for greater control over pricing and potentially higher profit margins compared to third-party brands.

- Customer Loyalty: Offering proprietary brands can foster stronger customer loyalty by creating a distinct brand identity and experience.

- Inventory Management: Direct control over private brand production and sales aids in more efficient inventory management and responsiveness to market trends.

Dick's Sporting Goods utilizes a multi-channel approach, blending physical stores, a robust e-commerce platform, and dedicated mobile apps to reach its diverse customer base. This omnichannel strategy is designed to provide convenience and enhance the overall shopping experience. The company's commitment to integrating these channels is evident in its continued investment in digital capabilities and in-store enhancements.

In the first quarter of 2024, Dick's Sporting Goods reported that its e-commerce sales constituted a significant portion of its total revenue, underscoring the importance of its online presence. Furthermore, the company's mobile applications, including the primary Dick's app and the specialized GameChanger app, are critical for customer engagement and driving sales, with mobile commerce continuing its upward trajectory.

Buy Online, Pick Up In-Store (BOPIS) is a key driver of customer convenience and in-store traffic, with a substantial percentage of online orders fulfilled this way in 2024. This seamless integration between online and physical channels not only saves customers shipping time but also encourages additional purchases once they are in the store.

Direct-to-consumer (DTC) sales of private label brands, such as DSG, allow Dick's Sporting Goods to offer exclusive products and maintain control over the customer experience, contributing to brand differentiation and potentially higher profit margins. These private label offerings are a key focus for the company, bolstering its competitive edge.

| Channel | Key Features | 2023/2024 Data Points |

|---|---|---|

| Physical Stores | Flagship Dick's, Golf Galaxy, Public Lands; experiential elements | Approx. 700 locations; focus on in-store clinics and services |

| E-commerce (DICK'S.com) | Extensive catalog, detailed product info, customer reviews | Significant portion of Q1 2024 revenue |

| Mobile Apps | Shopping, loyalty rewards, personalized offers; youth sports features (GameChanger) | Mobile commerce growth; substantial app-based sales |

| BOPIS | Online purchase, in-store pickup | Drives foot traffic; many customers make additional purchases |

| DTC (Private Labels) | Exclusive brands (e.g., DSG), margin control | Key focus in FY2023; contributes to competitive edge |

Customer Segments

Dick's Sporting Goods caters to athletes across the entire spectrum, from those just starting out to seasoned competitors. This includes individuals playing weekend soccer, serious marathon runners, and dedicated basketball players. In 2024, the sports participation rate remained robust, with over 60% of Americans engaging in some form of physical activity weekly, highlighting the vastness of this customer base.

These athletes are looking for more than just basic equipment; they seek authenticity and quality that can enhance their performance. They appreciate a wide array of choices, whether they need specialized running shoes, durable team sports equipment, or the latest fitness apparel. Dick's extensive inventory, featuring brands trusted by professionals, directly addresses this need for comprehensive and high-quality gear.

Outdoor Enthusiasts are a key customer segment for Dick's Sporting Goods, encompassing individuals passionate about activities such as hiking, camping, fishing, and various other outdoor pursuits. They actively seek high-quality, specialized equipment, durable apparel, and reliable footwear to enhance their adventures.

This group is particularly drawn to brands and retailers that understand their specific needs and offer a curated selection of products designed for performance and longevity in diverse environments. Dick's Sporting Goods aims to meet these demands by stocking a wide array of technical gear and outdoor lifestyle clothing.

The acquisition of Public Lands, a specialty chain, directly addresses this segment by providing a more focused and immersive retail experience for outdoor adventurers. This strategic move allows Dick's to cater more effectively to the nuanced preferences of those who prioritize exploration and nature-based activities.

Families with youth athletes represent a crucial customer segment for Dick's Sporting Goods. This group is primarily motivated by the needs of their children involved in organized sports, seeking a comprehensive range of team sports equipment, specialized apparel, and accessories. In 2024, the youth sports market in the US was estimated to be worth billions, with parents consistently investing in their children's athletic pursuits.

Beyond just products, these families value services that simplify the logistics of youth sports. Dick's Sporting Goods' integration with platforms like the GameChanger app, which aids in scheduling, communication, and tracking team progress, directly addresses this need. This dual focus on quality gear and practical support makes Dick's a go-to destination for this active and engaged demographic.

Fitness and Wellness-Focused Individuals

Fitness and wellness-focused individuals represent a core customer base for Dick's Sporting Goods. This group actively seeks out apparel, footwear, and equipment tailored for a range of activities, from general fitness and gym workouts to the increasingly popular athleisure trend. They place a high value on products that offer a blend of comfort for everyday wear, style that reflects current trends, and performance features that enhance their athletic pursuits.

This segment's purchasing decisions are often influenced by the intersection of functionality and fashion. For instance, in 2024, the athleisure market continued its robust growth, with many consumers opting for versatile pieces that can transition from a workout to casual social settings. Dick's Sporting Goods caters to this by offering a wide selection of brands known for their quality and aesthetic appeal in this space.

- Apparel Needs: Focus on comfortable, breathable, and stylish activewear for gym sessions and everyday use.

- Footwear Preferences: Demand for versatile sneakers suitable for various workouts and casual wear, prioritizing both support and aesthetics.

- Equipment Interest: Purchases include items for home workouts, gym accessories, and general fitness tools.

- Brand Loyalty: Often drawn to well-known athletic brands that align with their lifestyle and performance expectations.

Golf Enthusiasts

Golf enthusiasts are a core customer segment for Dick's Sporting Goods, primarily served through its dedicated Golf Galaxy and Golf Galaxy Performance Center stores. This group includes golfers at every skill level, from beginners to seasoned players, all looking for a comprehensive range of golf-related products and services.

These customers seek everything from clubs, balls, and bags to specialized apparel and accessories. Beyond just retail, they value expert advice and personalized services. For example, they are drawn to offerings like detailed swing analysis and custom club fitting, which directly contribute to improving their game.

- Dedicated Channels: Golf Galaxy and Golf Galaxy Performance Centers cater specifically to this segment.

- Comprehensive Offerings: This includes equipment, apparel, accessories, and specialized services.

- Skill Level Inclusivity: Serves golfers from novice to expert levels.

- Value-Added Services: Swing analysis and club fitting are key draws for this customer base.

Dick's Sporting Goods serves a broad customer base, including dedicated athletes across various sports, from casual weekend players to serious competitors. This segment is characterized by a demand for authentic, high-quality gear that enhances performance, with over 60% of Americans actively participating in sports weekly in 2024, underscoring the market's depth.

Outdoor enthusiasts form another key demographic, seeking specialized equipment and durable apparel for activities like hiking and camping. The company's acquisition of Public Lands further solidifies its commitment to this segment by offering a more tailored retail experience for nature lovers.

Families with youth athletes are crucial, driven by their children's sports needs and investing heavily in the multi-billion dollar youth sports market in 2024. Dick's supports this by providing comprehensive gear and integrating with platforms like GameChanger for easier team management.

Fitness and wellness individuals, including those embracing athleisure, prioritize comfort, style, and performance in their apparel and footwear. The athleisure market's continued growth in 2024 highlights the demand for versatile, trend-conscious athletic wear.

Golf enthusiasts are specifically targeted through Golf Galaxy and its performance centers, seeking expert advice and services like custom club fitting alongside a full range of equipment and apparel.

Cost Structure

Dick's Sporting Goods' Cost of Goods Sold (COGS) primarily includes the direct expenses of acquiring inventory from major brands and producing their own private-label items. This encompasses the cost of raw materials, manufacturing processes, and the freight charges to get these goods into their stores or distribution centers. For fiscal year 2023, Dick's reported a COGS of $6.58 billion, which is a significant portion of their overall revenue, highlighting the importance of efficient inventory management.

Dick's Sporting Goods faces substantial store operations and occupancy costs, reflecting its commitment to a vast physical retail footprint. These expenses encompass rent for its numerous locations, essential utilities like electricity and water, ongoing maintenance to keep stores presentable, and wages for the sales associates and in-store service staff who directly interact with customers. In fiscal year 2023, the company reported selling, general, and administrative expenses of $3.2 billion, a significant portion of which is tied to these store-level operations.

Selling, General, and Administrative (SG&A) expenses for Dick's Sporting Goods cover crucial areas like marketing, executive salaries, and technology upgrades. These costs are essential for brand building and operational efficiency.

Dick's has been strategically investing in its digital presence and in-store experiences, alongside marketing campaigns. For instance, in the first quarter of 2024, SG&A expenses increased by 3.7% to $764.5 million compared to the same period in 2023, reflecting these growth initiatives.

These investments, while increasing short-term SG&A deleverage, are designed to drive long-term customer engagement and sales growth. The company aims to achieve operating leverage as these strategic investments mature and contribute to revenue expansion.

Supply Chain and Distribution Costs

Dick's Sporting Goods incurs significant expenses in its supply chain and distribution network. These costs encompass warehousing, managing inventory, and the physical movement of goods to both retail stores and directly to customers' homes for e-commerce sales. The company actively seeks to streamline these operations to lower overall expenses and improve delivery speed.

Optimizing these logistics is crucial for maintaining competitive pricing and customer satisfaction. For instance, in fiscal year 2023, Dick's reported that its selling, general, and administrative (SG&A) expenses, which include many supply chain and distribution costs, were approximately $2.7 billion.

- Warehousing: Expenses associated with maintaining and operating distribution centers.

- Logistics & Transportation: Costs for shipping products from suppliers to distribution centers and then to stores or customers.

- E-commerce Fulfillment: Costs directly related to picking, packing, and shipping online orders.

- Inventory Management: Costs linked to holding and managing stock across the supply chain.

Technology and Digital Development Costs

Dick's Sporting Goods invests heavily in technology and digital development to support its omnichannel strategy and digital expansion. These costs include ongoing enhancements to its e-commerce website and a robust mobile app presence, notably its GameChanger platform for youth sports. The company also allocates significant resources to advanced data analytics to better understand customer behavior and personalize offerings.

In 2023, Dick's Sporting Goods reported capital expenditures of $585 million, a portion of which was dedicated to technology and digital initiatives aimed at improving the customer experience across all touchpoints. This commitment is vital for maintaining a competitive edge in the evolving retail landscape.

- E-commerce Platform Enhancements: Continuous upgrades to the website ensure a seamless shopping experience and support growing online sales.

- Mobile App Development: Investments in apps like GameChanger enhance customer engagement and provide valuable services.

- Data Analytics Capabilities: Building sophisticated data infrastructure allows for deeper customer insights and targeted marketing efforts.

- In-Store Technology: Implementing new technologies in physical stores further bridges the gap between online and offline shopping.

Dick's Sporting Goods' cost structure is dominated by the cost of goods sold, reflecting its extensive product inventory. Significant expenses also arise from operating its large physical store network, including rent and staffing. The company's investment in technology and marketing, while driving growth, also contributes to its overall cost base.

| Cost Category | Description | Fiscal Year 2023 (in billions) |

|---|---|---|

| Cost of Goods Sold (COGS) | Direct costs of acquiring inventory and private-label production. | $6.58 |

| Selling, General & Administrative (SG&A) | Includes marketing, salaries, technology, and store operations support. | $3.20 (approximate, includes many store-level costs) |

| Capital Expenditures | Investments in technology, digital initiatives, and store improvements. | $0.585 |

Revenue Streams

Dick's Sporting Goods' main income source is the sale of athletic gear, clothing, and shoes. They offer a broad selection of items, from top-tier and well-known national brands to their own private label merchandise, available both in their physical stores and through their e-commerce channels.

For the fiscal year 2023, Dick's Sporting Goods reported net sales of $10.01 billion, demonstrating the significant volume of product sales that form the backbone of their revenue.

Dick's Sporting Goods generates substantial revenue through its private label brands, including DSG, CALIA, and VRST. These exclusive offerings are key drivers of sales, contributing a significant portion to the company's top line.

These in-house brands not only boost overall sales volume but also provide a distinct advantage by offering higher profit margins compared to national brands. This strategy allows Dick's to capture more value from its product assortment.

For instance, in fiscal year 2023, Dick's reported net sales of $12.30 billion, and while specific segment reporting for private label isn't always detailed, the company has consistently highlighted the growth and profitability of these brands as a strategic pillar.

Dick's Sporting Goods generates revenue through its specialty stores, Golf Galaxy and Public Lands. Golf Galaxy caters to golf aficionados with a wide selection of equipment, apparel, and accessories, alongside services like club fitting. Public Lands focuses on outdoor recreation, offering gear for activities such as hiking, camping, and climbing.

In the first quarter of 2024, Dick's Sporting Goods reported net sales of $2.00 billion. While specific segment breakdowns for Golf Galaxy and Public Lands aren't always detailed publicly, these specialty banners contribute to the overall sales performance by attracting dedicated customer bases seeking specialized products and experiences.

Digital and E-commerce Sales

Dick's Sporting Goods generates substantial revenue through its digital channels, encompassing both its website, DICK'S.com, and its mobile applications. This online sales channel is a critical component of its business model, offering customers convenience and accessibility. A key driver of this revenue is the popular Buy Online, Pick Up In-Store (BOPIS) service, which seamlessly integrates the online and physical store experiences.

The company has consistently highlighted e-commerce as a significant growth area, demonstrating its strategic focus on digital expansion. For the fiscal year 2023, Dick's Sporting Goods reported that its e-commerce sales represented approximately 18% of its total net sales, a testament to the channel's importance. This digital presence allows the company to reach a wider customer base and adapt to evolving consumer shopping habits.

- Digital Revenue Streams: Sales generated through DICK'S.com and mobile apps.

- Key Service: Buy Online, Pick Up In-Store (BOPIS) enhances customer convenience and drives online sales.

- Growth Area: E-commerce continues to be a significant contributor to the company's overall revenue growth.

- 2023 Performance: E-commerce sales accounted for roughly 18% of total net sales in fiscal year 2023.

GameChanger and Dick's Media Network Revenue

Dick's Sporting Goods is diversifying its revenue through emerging digital platforms. The company anticipates substantial revenue generation from its youth sports mobile application, GameChanger, through potential subscription models or advertising. This platform offers a centralized hub for team management and communication, creating a valuable user base.

Furthermore, Dick's is actively developing its retail media network, Dick's Media Network. This initiative aims to leverage its customer data and physical store presence to offer advertising opportunities to brands. This strategic move capitalizes on the growing trend of retail media, allowing for targeted marketing within the Dick's ecosystem.

- GameChanger: Expected to be a significant revenue contributor via subscriptions and advertising.

- Dick's Media Network: Developing a retail media platform to generate advertising revenue from brands.

- Synergy: These digital platforms aim to enhance customer engagement and create new monetization avenues beyond traditional retail sales.

Dick's Sporting Goods' primary revenue streams stem from the sale of athletic apparel, footwear, and equipment across its diverse brand portfolio. This includes both national brands and its own high-margin private label lines like DSG and CALIA, contributing significantly to its overall sales performance.

The company also leverages its specialty banners, Golf Galaxy and Public Lands, to capture niche markets and drive incremental revenue through specialized product offerings and services. These focused retail concepts cater to distinct customer segments with tailored experiences.

Digital channels, including DICK'S.com and its mobile app, are crucial revenue generators, further enhanced by services like Buy Online, Pick Up In-Store (BOPIS). In fiscal year 2023, e-commerce represented approximately 18% of Dick's total net sales, underscoring the growing importance of its online presence.

Emerging digital platforms, such as the youth sports app GameChanger and the Dick's Media Network for brand advertising, represent future growth avenues. These initiatives aim to monetize user engagement and leverage customer data for new revenue streams.

| Revenue Stream | Description | Fiscal Year 2023 Impact |

|---|---|---|

| Product Sales (National & Private Label) | Sale of athletic gear, apparel, and footwear. | Net sales of $12.30 billion. |

| Specialty Stores | Revenue from Golf Galaxy and Public Lands. | Contributes to overall sales performance. |

| E-commerce | Sales via DICK'S.com and mobile apps, including BOPIS. | Approximately 18% of total net sales. |

| Emerging Digital Platforms | Potential revenue from GameChanger and Dick's Media Network. | Future growth and monetization opportunities. |

Business Model Canvas Data Sources

The Dick's Sporting Goods Business Model Canvas is informed by a blend of financial disclosures, market research reports, and internal operational data. These sources provide a comprehensive view of customer behavior, competitive landscape, and cost structures.