Dick's Sporting Goods Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dick's Sporting Goods Bundle

Dick's Sporting Goods navigates a complex retail landscape, facing intense rivalry from both online and brick-and-mortar competitors, while also contending with the growing bargaining power of its suppliers and the constant threat of new market entrants. Understanding these forces is crucial for any stakeholder looking to grasp the company's strategic positioning and future viability.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Dick's Sporting Goods’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Dick's Sporting Goods' reliance on major brands like Nike, Adidas, and Under Armour gives these suppliers considerable bargaining power. These brands boast strong consumer loyalty and unique product lines, allowing them to influence pricing and terms. For instance, Nike's global sales reached $51.2 billion in its fiscal year 2024, underscoring its market dominance.

This brand power can restrict Dick's flexibility in negotiating favorable terms or pricing for key merchandise. However, Dick's strategic development of its own private label brands, such as DSG and CALIA, helps to diversify its product mix and reduce its dependence on external suppliers, thereby somewhat counterbalancing supplier leverage.

The switching costs for Dick's Sporting Goods to significantly alter or replace offerings from major brands are substantial. This involves considerable effort in adapting marketing strategies, overhauling inventory management systems, and potentially reshaping customer expectations and loyalty.

For instance, in 2023, Dick's reported net sales of $10.03 billion, highlighting the scale of operations and the complexity involved in changing supplier relationships.

Completely severing ties with a dominant supplier, even if strategically considered, could alienate a significant portion of Dick's customer base that remains loyal to those specific brands, thereby reinforcing the supplier's bargaining power.

Many major sporting goods brands are increasingly shifting towards direct-to-consumer (DTC) sales via their own websites and physical stores. This move directly challenges traditional retailers like Dick's Sporting Goods by creating new distribution channels for brands. For instance, Nike's strategy of prioritizing its own DTC channels has been a significant factor in its market approach.

Uniqueness and Differentiation of Supplier Products

The bargaining power of suppliers for Dick's Sporting Goods is significantly influenced by the uniqueness and differentiation of the products they offer. Suppliers providing highly differentiated and desirable items, particularly in performance footwear and apparel, hold considerable sway. These specialized products are crucial for Dick's to draw in and keep its customer base, making supplier leverage a key factor.

Exclusive product lines and limited-edition releases from sought-after brands further bolster supplier power. Dick's Sporting Goods relies on these exclusive offerings to maintain its premium and appealing product assortment, directly impacting its sales and market position.

- Brand Exclusivity: Suppliers offering exclusive collaborations or limited-edition runs, like those seen with Nike or Adidas, can command higher prices due to the demand they generate.

- Performance Innovation: Companies that consistently innovate with new materials or technologies in athletic wear and footwear gain leverage, as Dick's needs these cutting-edge products to stay competitive.

- Customer Demand: In 2023, athletic footwear and apparel continued to be strong performers in the retail sector, with categories like running shoes and performance activewear driving significant sales for retailers like Dick's.

Importance of Dick's as a Distribution Channel

Despite the inherent bargaining power of suppliers in the sporting goods industry, Dick's Sporting Goods leverages its substantial market presence as a key counter-balance. As the largest omnichannel sports retailer in the United States, Dick's possesses a significant distribution advantage.

With over 25 million active ScoreCard members as of early 2024, Dick's offers brands unparalleled access to a vast and engaged customer base. This extensive retail footprint and loyal customer loyalty make Dick's an indispensable distribution partner for many manufacturers, thereby granting it leverage in supplier negotiations.

- Market Dominance: Dick's operates over 700 stores across the U.S., providing a broad reach for suppliers.

- Customer Loyalty: The ScoreCard program boasts millions of active members, indicating strong customer engagement and repeat business for brands distributed through Dick's.

- Omnichannel Strength: Dick's integrated online and in-store presence offers a comprehensive sales channel that suppliers value.

Major sporting goods brands like Nike and Adidas wield considerable power over Dick's Sporting Goods due to their strong brand recognition and loyal customer bases. These suppliers can dictate terms and influence pricing, as seen with Nike's substantial global sales of $51.2 billion in fiscal year 2024. Dick's efforts to develop its own private label brands, such as DSG and CALIA, aim to mitigate this reliance and strengthen its negotiating position.

The switching costs for Dick's to replace key suppliers are high, involving significant operational adjustments and potential customer alienation. For example, in 2023, Dick's reported net sales of $10.03 billion, illustrating the scale of its operations and the complexity of changing supplier relationships. The increasing trend of brands pursuing direct-to-consumer sales further amplifies supplier leverage.

Suppliers offering unique, innovative, or exclusive products, such as performance footwear and limited-edition apparel, hold significant bargaining power. These differentiated offerings are vital for Dick's to maintain its competitive product assortment and attract customers, reinforcing the suppliers' influence. Athletic footwear and apparel remained robust sectors in 2023, driving sales for retailers like Dick's.

| Supplier Factor | Impact on Dick's | Example/Data |

|---|---|---|

| Brand Loyalty & Dominance | High leverage, can dictate terms | Nike's FY24 sales: $51.2 billion |

| Product Uniqueness & Innovation | Essential for competitiveness, increases supplier power | Demand for performance activewear in 2023 |

| Direct-to-Consumer (DTC) Shift | Reduces retailer importance, strengthens supplier position | Nike's strategic focus on DTC channels |

| Switching Costs | High for Dick's, limits flexibility | Complex inventory and marketing adjustments needed |

What is included in the product

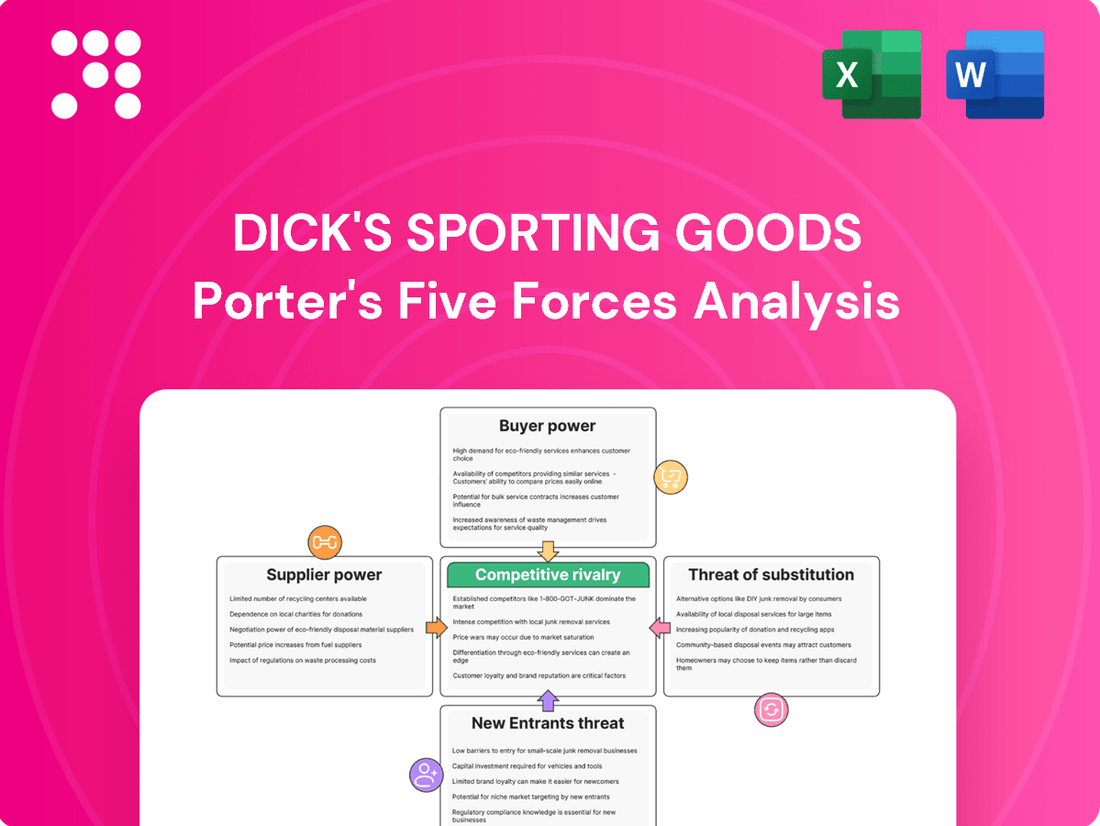

Analyzes the competitive intensity within the sporting goods retail sector, examining buyer power, supplier leverage, threat of new entrants, and the impact of substitutes on Dick's Sporting Goods' profitability.

Instantly visualize competitive intensity with a dynamic Porter's Five Forces chart, highlighting key threats and opportunities for Dick's Sporting Goods.

Customers Bargaining Power

Customers in the sporting goods sector, particularly with the surge of online shopping, are very attuned to price and can readily compare prices across different stores. This easy access to information empowers consumers to hunt for the best bargains, thereby amplifying their bargaining power and compelling Dick's Sporting Goods to maintain competitive pricing strategies.

For instance, in 2024, the average online shopper spent an estimated 30% more time comparing prices before making a purchase in the apparel and sporting goods category compared to 2023, according to industry reports. This heightened price scrutiny directly impacts retailers like Dick's, forcing them to be more aggressive with promotions and discounts to retain market share.

The bargaining power of customers for Dick's Sporting Goods is significantly influenced by low switching costs. It's quite simple for consumers to move from Dick's to other retailers, whether they are physical stores like Academy Sports + Outdoors or online giants like Amazon, or even directly to brands like Nike or Adidas. This ease of switching means customers have more leverage.

In 2024, the retail landscape continues to be highly competitive, with numerous options available to consumers for sporting goods. This abundance of choice, coupled with the digital accessibility of many competitors, means a customer looking for a specific item can easily compare prices and product offerings across multiple platforms. For instance, a customer might find a pair of running shoes at Dick's and then immediately check prices on Zappos or the manufacturer's own website, often finding comparable or better deals with minimal effort.

Dick's Sporting Goods offers a broad selection of premium, private label, and national brands, which initially seems to empower customers with choices. This extensive in-house variety can make it harder for customers to switch to competitors if they find value in Dick's curated assortment.

However, the sheer volume of sporting goods available from other retailers, both online and brick-and-mortar, presents a significant counterpoint. Customers can readily find comparable products or entirely different brands elsewhere, often at competitive prices, thereby increasing their bargaining power by having readily available alternatives.

Influence of Online Reviews and Social Media

The bargaining power of customers is amplified by the pervasive influence of online reviews and social media. Younger consumers, in particular, heavily rely on these platforms for purchasing decisions. For instance, a 2024 survey indicated that over 80% of Gen Z shoppers consider online reviews before making a purchase, directly impacting brands like Dick's Sporting Goods.

This collective consumer voice grants customers significant indirect power. Negative reviews or trending social media discussions can swiftly damage a retailer's reputation and deter potential buyers. Conversely, positive online sentiment can drive sales, demonstrating how customer feedback shapes market perception and, consequently, a company's performance.

- Customer Reliance on Digital Feedback: A significant majority of consumers, especially younger ones, consult online reviews and social media before buying.

- Reputation Management: Online sentiment directly influences a retailer's brand image and sales volume.

- Influencer Impact: Recommendations from social media influencers can sway purchasing choices, adding another layer to customer power.

Hybrid Retail Expectations

Sporting goods consumers increasingly blend online research with in-store visits, a hybrid retail approach. This allows them to compare prices and product features effectively, giving them significant leverage. For instance, in Q1 2024, Dick's Sporting Goods reported a 5.3% increase in comparable store sales, indicating continued customer engagement with their physical locations, which also serve as hubs for online order pickups and returns.

Customers now expect seamless omnichannel experiences, including hassle-free returns and flexible delivery options. This elevated service standard is a direct result of their increased bargaining power. Dick's, like many retailers, must invest in technology and logistics to meet these demands, which can impact operational costs but is crucial for customer retention.

The ability to easily compare prices and read reviews online before visiting a store or making a purchase significantly strengthens the customer's position. This transparency forces retailers to remain competitive on both price and service.

- Informed Purchasing: Consumers leverage online resources to compare prices and product specifications, increasing their knowledge and bargaining power.

- Omnichannel Demands: Expectations for integrated online and in-store experiences, including easy returns and varied delivery, empower customers.

- Price Sensitivity: The ease of price comparison online makes consumers more sensitive to pricing strategies, pushing retailers towards competitive offers.

- Service Expectations: Customers demand high service levels, such as efficient order fulfillment and responsive customer support, as a baseline.

Customers in the sporting goods market possess considerable bargaining power, largely due to the ease of price comparison and the availability of numerous alternatives. This is exacerbated by the transparency offered by online platforms, where consumers can readily assess product features, read reviews, and compare pricing across various retailers. For instance, in 2024, a significant portion of consumers reported spending more time researching products online before purchasing, directly influencing retailer pricing strategies and promotional activities.

The low switching costs for customers, coupled with the rise of direct-to-consumer (DTC) sales by major brands, further empower buyers. Consumers can easily shift their spending from traditional retailers like Dick's to online marketplaces or brand websites, often finding better deals or exclusive offerings. This dynamic forces Dick's to remain highly competitive in its pricing and product assortment to retain customer loyalty.

The influence of online reviews and social media amplifies customer bargaining power, particularly among younger demographics. In 2024, over 80% of Gen Z shoppers indicated that online reviews heavily influence their purchasing decisions. This collective consumer voice can significantly impact a retailer's reputation and sales, compelling companies to prioritize customer satisfaction and transparent communication.

| Factor | Impact on Dick's Sporting Goods | Supporting Data (2024 Estimates) |

|---|---|---|

| Price Transparency | High | Consumers spent an estimated 30% more time comparing prices online. |

| Switching Costs | Low | Ease of access to online retailers and brand DTC sites. |

| Availability of Alternatives | High | Abundance of online and brick-and-mortar competitors. |

| Online Reviews & Social Media | High | Over 80% of Gen Z shoppers rely on reviews before purchasing. |

Preview the Actual Deliverable

Dick's Sporting Goods Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces Analysis of Dick's Sporting Goods presented here details the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the sporting goods industry. You'll gain valuable insights into the strategic positioning and potential challenges faced by Dick's Sporting Goods.

Rivalry Among Competitors

Dick's Sporting Goods operates in a fiercely competitive environment. The sporting goods retail market is crowded with a wide array of players, from massive general merchandise retailers like Walmart and Target to niche specialty stores focusing on specific sports, and the ever-growing online-only retailers such as Amazon. This broad spectrum of competition, including direct-to-consumer brands that bypass traditional retail channels, significantly intensifies the struggle for market share and customer loyalty.

In 2024, the retail landscape continues to be shaped by this diversity. For instance, Amazon's dominance in e-commerce presents a constant challenge, while Walmart's extensive physical footprint and broad product selection also draw significant consumer spending. Specialty retailers, such as REI for outdoor gear or Fleet Feet for running, cater to dedicated enthusiasts, further fragmenting the market. Dick's must navigate these varied competitive pressures, which include price competition, product assortment, and the customer experience offered by each type of competitor.

While the global sporting goods industry is expected to see continued growth, the North American market is experiencing a stabilization in its growth rate. This shift intensifies competition among players vying for existing market share.

Challenger brands are demonstrating faster growth than many established companies, successfully capturing market share. This trend necessitates continuous innovation and differentiation from retailers like Dick's Sporting Goods to remain competitive.

Competitive rivalry is intense, with rivals constantly striving to differentiate themselves. This often involves offering exclusive product lines, providing specialized services, and creating unique in-store or online shopping experiences. For instance, Dick's Sporting Goods is actively investing in its House of Sport and Field House store concepts, which aim to offer a more curated and experiential shopping journey.

Dick's also focuses on enhancing its omnichannel capabilities, ensuring a seamless experience whether customers shop online or in-store. A key part of their differentiation strategy involves concentrating on high-demand categories, such as athletic footwear, where they aim to capture market share and stand out in a crowded retail landscape. In fiscal year 2023, Dick's saw net sales of $10.03 billion, demonstrating their ability to compete effectively.

Aggressive Pricing and Promotional Activities

The sporting goods retail landscape is marked by fierce competition, driving aggressive pricing and frequent promotional activities. Online players, in particular, often leverage lower overheads to offer deep discounts, putting pressure on traditional retailers like Dick's Sporting Goods. This intense rivalry necessitates a strategic approach to pricing to remain competitive without sacrificing profitability.

Dick's Sporting Goods must continually monitor competitor pricing and adapt its own strategies. For instance, during the 2024 holiday season, many retailers, including those in the sporting goods sector, engaged in significant promotional events like Black Friday and Cyber Monday sales. These events often feature price reductions across a wide range of products, forcing companies to participate to attract customers.

- Price Wars: Competitors frequently engage in price wars, offering discounts that can significantly impact margins.

- Promotional Impact: Aggressive promotions, while driving sales volume, can erode profitability if not managed carefully.

- Online Pressure: E-commerce giants and specialized online retailers often set aggressive price points, creating a benchmark for the entire industry.

- Margin Compression: The need to match competitive pricing can lead to reduced profit margins for all market participants.

Omnichannel Capabilities and Customer Experience

The competition for omnichannel capabilities is fierce, as retailers strive to offer a seamless experience across online and physical stores. Dick's Sporting Goods' strategic investments in its e-commerce platform, alongside in-store fulfillment options like buy online, pick up in-store (BOPIS), are vital for staying competitive. These efforts directly address customer expectations for convenience and choice.

Dick's also leverages digital tools such as its GameChanger app to enhance the customer journey, offering features like personalized recommendations and inventory visibility. This integration of digital and physical touchpoints is a key battleground for customer loyalty and market share. For instance, in fiscal year 2023, Dick's reported that its digital sales represented a significant portion of its overall revenue, underscoring the importance of these omnichannel investments.

- Omnichannel Integration: Dick's focuses on bridging online and in-store experiences, allowing customers to browse, purchase, and return items across channels effortlessly.

- Digital Tools: Investments in applications like GameChanger aim to personalize the shopping experience and provide valuable information, driving engagement.

- Customer Retention: A strong omnichannel strategy is crucial for retaining customers who expect flexibility and convenience in their retail interactions.

- E-commerce Growth: The company's continued development of its online presence is essential, as digital sales remain a critical driver of revenue and competitive advantage.

Competitive rivalry within the sporting goods sector is exceptionally high, characterized by aggressive pricing and continuous promotional efforts from a diverse range of competitors. Dick's Sporting Goods faces pressure from large general retailers, specialized stores, and online-only giants, all vying for customer attention and market share.

In 2024, this intensity is evident as companies like Amazon and Walmart leverage their scale and e-commerce prowess, while niche players like REI offer specialized appeal. Dick's strategic focus on differentiating through experiential store formats like House of Sport and robust omnichannel capabilities, including its GameChanger app, is crucial for navigating this competitive landscape.

The need to match competitor pricing, especially from online retailers with lower overheads, can lead to margin compression. Dick's reported net sales of $10.03 billion in fiscal year 2023, indicating its ability to compete, but the ongoing price wars and promotional activities necessitate careful margin management.

The competition for omnichannel excellence is a key battleground, with Dick's investing in seamless online-to-in-store experiences and digital tools to enhance customer engagement and retention.

SSubstitutes Threaten

Major athletic brands are increasingly shifting towards direct-to-consumer (DTC) sales. This means companies like Nike and Adidas are selling their products directly through their own websites and physical stores, bypassing retailers like Dick's Sporting Goods.

This trend presents a significant threat of substitutes because consumers can now get the same products, often with exclusive access or personalized experiences, directly from the brands themselves. For instance, Nike's DTC sales accounted for approximately 41% of its total revenue in fiscal year 2024, highlighting the growing consumer preference for this channel.

The burgeoning second-hand sporting goods market and the increasing prevalence of equipment rental services pose a significant threat of substitution for DICK'S Sporting Goods. These alternatives offer consumers a more budget-friendly option, particularly for specialized or high-cost items. For instance, the resale market for items like skis or bicycles can significantly undercut the price of new equipment, appealing to both cost-conscious individuals and those who require gear for infrequent use.

This trend is amplified by platforms facilitating the buying and selling of used gear, making it easier than ever for consumers to access affordable alternatives. In 2024, the global used goods market is projected to reach over $100 billion, with sporting equipment being a notable segment. Rental services also provide a compelling substitute, allowing consumers to access a wide range of equipment without the commitment of ownership, further fragmenting the demand for new sporting goods.

The rise of athleisure has significantly blurred the lines between sportswear and everyday fashion. This trend allows consumers to find athletic-inspired clothing from general apparel and lifestyle brands, not just dedicated sporting goods retailers. For instance, in 2024, brands like Lululemon, though focused on athletic wear, also cater to a broader lifestyle market, directly competing with traditional sporting goods in certain segments. This expansion of the competitive landscape means Dick's Sporting Goods faces substitutes from a wider array of fashion-forward companies.

Home Fitness Solutions and Digital Subscriptions

The growing popularity of home fitness solutions presents a significant threat of substitutes for traditional sporting goods retailers like Dick's Sporting Goods. Consumers are increasingly opting for convenient and cost-effective alternatives that bypass the need for specialized gear or physical location memberships. This trend was particularly evident in 2024, with the home fitness market continuing its robust expansion.

Digital workout apps and subscription-based fitness programs offer engaging content and personalized training without requiring significant upfront investment in equipment. For instance, many consumers who might have previously purchased running shoes or gym apparel are now channeling those funds into monthly subscriptions for platforms like Peloton Digital or Apple Fitness+. This shift directly impacts the demand for the core products sold by traditional sporting goods retailers.

The convenience and perceived value of home-based fitness are key drivers. Consumers can access a vast library of workouts anytime, anywhere, often at a lower cost than maintaining gym memberships or purchasing multiple pieces of specialized athletic equipment. This makes substitutes highly attractive, especially for casual participants or those with busy schedules.

- Home Fitness Market Growth: The global home fitness market was projected to reach over $15 billion by 2024, indicating a substantial shift in consumer spending away from traditional fitness venues and associated equipment purchases.

- Digital Subscription Dominance: Digital fitness subscriptions saw continued strong adoption, with major platforms reporting millions of active users in 2024, demonstrating a clear preference for accessible, on-demand content.

- Reduced Need for Specialized Gear: Many digital fitness programs require minimal equipment, such as yoga mats or resistance bands, thereby reducing the necessity for consumers to purchase more expensive, specialized gear like skis, tennis rackets, or cycling equipment from traditional retailers.

Alternative Leisure and Entertainment Options

Consumers today have an incredibly diverse range of leisure and entertainment choices that don't necessarily involve purchasing specialized sporting equipment. This broad spectrum of alternatives presents a significant threat of substitutes for Dick's Sporting Goods.

For instance, the booming video game industry, with major releases and esports events, directly competes for consumer time and disposable income. In 2024, the global video game market was projected to generate over $200 billion in revenue, showcasing the immense appeal of digital entertainment.

Similarly, the continued growth of streaming services for movies, TV shows, and music offers readily accessible and often lower-cost entertainment. The subscription video-on-demand market alone is expected to exceed $200 billion by 2027, indicating a strong preference for passive entertainment.

- Gaming: The global gaming market's substantial revenue indicates a significant draw away from physical activities.

- Streaming Services: The widespread adoption and increasing revenue of streaming platforms highlight a shift towards accessible digital entertainment.

- Non-Sporting Hobbies: The rise of diverse hobbies, from crafting to travel, also diverts discretionary spending that might otherwise go to sporting goods.

The threat of substitutes for Dick's Sporting Goods is amplified by the increasing accessibility of direct-to-consumer (DTC) channels from major athletic brands. Companies like Nike and Adidas are increasingly selling directly to consumers, offering exclusive products and personalized experiences, as evidenced by Nike's 41% DTC revenue share in fiscal year 2024. This bypasses traditional retailers, presenting a direct alternative for customers seeking branded athletic wear and equipment.

Entrants Threaten

Establishing a new national sporting goods retail chain demands immense capital. This includes significant upfront investment in physical store locations, warehousing, sophisticated e-commerce platforms, and a vast inventory to compete effectively. For example, building out a robust omnichannel experience, which is crucial in today's market, can easily run into hundreds of millions of dollars.

The sheer scale of investment needed to acquire prime retail real estate, stock a wide variety of merchandise, and implement advanced supply chain and technology systems creates a formidable barrier. New entrants must also contend with the marketing and brand-building costs necessary to gain traction against established players like Dick's Sporting Goods, further increasing the capital hurdle.

Existing large retailers like Dick's Sporting Goods leverage significant economies of scale in purchasing, marketing, and distribution. This allows them to secure better pricing from suppliers and spread fixed costs over a larger volume, resulting in lower per-unit costs. For instance, in 2023, Dick's reported net sales of $10.01 billion, demonstrating a scale that is difficult for new entrants to replicate.

New entrants face a substantial hurdle in matching these cost advantages. Without the same purchasing power, they would likely pay higher prices for inventory and incur greater per-unit expenses for marketing and logistics. This initial cost disadvantage makes it challenging for them to compete effectively on price with established players like Dick's, impacting their ability to gain market share quickly.

Dick's Sporting Goods benefits from significant brand loyalty, evidenced by its robust ScoreCard loyalty program with over 25 million active members. This established customer base and strong brand recognition create a substantial barrier for new entrants. Building comparable trust and awareness would require immense marketing expenditure and time, making it difficult for newcomers to gain traction quickly.

Furthermore, Dick's has cultivated deep-rooted relationships with major national sporting goods brands. These established partnerships grant them preferential access to popular products and favorable terms, which are difficult for new competitors to replicate. New entrants would face challenges in securing similar product assortments and supplier agreements, impacting their ability to offer competitive merchandise.

Access to Distribution Channels and Supply Chain Complexity

Securing prime retail locations and building an efficient, agile supply chain network is a complex and capital-intensive undertaking. For instance, as of Q1 2024, Dick's Sporting Goods operated 732 stores, requiring significant investment in real estate and logistics to maintain its market presence.

Dick's extensive distribution network and focus on omnichannel fulfillment create a high barrier for new players to replicate. Their commitment to integrating online and in-store experiences, including curbside pickup and same-day delivery options, demands substantial technological and operational infrastructure, which new entrants would find challenging to match quickly.

- High Capital Investment: Establishing a nationwide retail footprint and a sophisticated supply chain requires billions in upfront capital, a significant hurdle for emerging competitors.

- Established Logistics: Dick's advanced distribution centers and transportation fleet, honed over years, offer economies of scale and speed that are difficult for newcomers to achieve.

- Omnichannel Complexity: The integration of online sales, inventory management across all channels, and diverse fulfillment options represents a substantial operational and technological barrier.

Regulatory Hurdles and Product Safety Standards

The sporting goods sector faces significant regulatory challenges. New entrants must comply with stringent product safety standards, import quotas, and consumer protection laws, which can significantly increase startup costs and operational complexity. For instance, regulations around materials used in athletic footwear or safety equipment can necessitate expensive testing and certification processes.

These regulatory hurdles act as a substantial barrier, deterring potential new competitors. Navigating compliance requires specialized knowledge and investment, making it difficult for smaller, less-resourced companies to enter the market. This environment favors established players with existing infrastructure and expertise in managing regulatory affairs.

- Product Safety: Compliance with standards like the Consumer Product Safety Improvement Act (CPSIA) in the US requires rigorous testing for lead and phthalates in children's apparel and accessories.

- Import Regulations: Tariffs and trade agreements can impact the cost of goods, particularly for items manufactured overseas, adding another layer of complexity for new entrants.

- Consumer Protection: Laws governing advertising, labeling, and warranties protect consumers and require careful adherence by all market participants.

The threat of new entrants in the sporting goods retail market is relatively low for Dick's Sporting Goods. The immense capital required for store build-outs, inventory, and sophisticated e-commerce platforms, coupled with established brand loyalty and deep supplier relationships, creates significant barriers to entry.

New competitors must overcome substantial hurdles in matching Dick's economies of scale, which allow for lower per-unit costs in purchasing, marketing, and distribution. For example, Dick's reported net sales of $10.01 billion in 2023, a scale that is exceptionally difficult for newcomers to replicate and compete against on price.

Furthermore, regulatory compliance, such as adhering to product safety standards and import regulations, adds another layer of complexity and cost for potential new entrants, favoring established players with existing expertise and infrastructure.

| Barrier Type | Description | Impact on New Entrants | Example for Dick's Sporting Goods |

|---|---|---|---|

| Capital Requirements | High investment for physical stores, e-commerce, and inventory. | Significant hurdle, requiring substantial funding. | Building a national omnichannel presence can cost hundreds of millions. |

| Economies of Scale | Lower per-unit costs due to large-scale operations. | Disadvantage for new entrants on pricing and efficiency. | 2023 Net Sales: $10.01 billion, enabling better supplier terms. |

| Brand Loyalty & Relationships | Established customer base and strong brand recognition. | Difficult for new entrants to gain market share and trust. | Over 25 million active members in the ScoreCard loyalty program. |

| Distribution & Logistics | Efficient supply chain and omnichannel fulfillment capabilities. | Challenging for new players to replicate speed and cost-effectiveness. | Operated 732 stores as of Q1 2024, with an extensive distribution network. |

| Regulatory Compliance | Adherence to product safety, import, and consumer laws. | Increases startup costs and operational complexity. | Compliance with CPSIA for children's apparel and accessories. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Dick's Sporting Goods leverages a comprehensive blend of data, including company annual reports, SEC filings, and industry-specific market research from firms like IBISWorld. This approach ensures a robust understanding of competitive dynamics within the sporting goods retail sector.