Dongfeng Motor Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dongfeng Motor Group Bundle

Navigate the complex external landscape impacting Dongfeng Motor Group with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are reshaping the automotive industry and Dongfeng's strategic position. Download the full version now to gain actionable intelligence and fortify your market strategy against emerging trends.

Political factors

As a prominent Chinese state-owned enterprise, Dongfeng Motor Corporation is a direct beneficiary of robust government support. This support manifests through favorable industrial policies and substantial subsidies, particularly for new energy vehicles (NEVs). For instance, China's government has consistently prioritized the NEV sector, with significant financial incentives and regulatory backing aimed at accelerating adoption and domestic production.

Dongfeng's strategic alignment with national industrial planning, which focuses on developing and strengthening the domestic automotive industry, provides a stable operational foundation. This government backing ensures access to crucial resources and fosters an environment conducive to innovation and expansion within China's key strategic sectors, contributing to Dongfeng's competitive edge.

Global trade tensions, especially between China and Western nations, pose a significant challenge for Dongfeng Motor Group's international growth and supply chain reliability. For instance, the ongoing trade friction has led to increased scrutiny of Chinese investments in Western markets and potential retaliatory tariffs, impacting the cost of imported components and the competitiveness of exported vehicles.

Tariffs and export controls directly affect Dongfeng's ability to secure advanced automotive technologies and critical components, potentially hindering its joint ventures with international automakers like Stellantis and Nissan. These geopolitical pressures can disrupt the flow of essential parts, impacting production schedules and the development of next-generation vehicles.

Navigating these intricate geopolitical relationships is paramount for Dongfeng's sustained global competitiveness and its access to vital overseas markets. In 2023, China's automotive exports reached a record 4.91 million units, a testament to the industry's growing global reach, but this expansion remains vulnerable to escalating international trade disputes.

The Chinese government's significant oversight of state-owned enterprises (SOEs) like Dongfeng Motor Group means policy shifts directly impact its strategic direction and investment choices. For instance, the ongoing SOE reforms aimed at improving efficiency and market competitiveness, which have been a key focus for the Chinese government through 2024 and into 2025, necessitate Dongfeng's adaptation to new governance structures and performance metrics.

Anti-corruption drives, a recurring theme in China's political landscape, can also influence management stability and operational continuity within SOEs. Dongfeng must remain vigilant in its compliance with national directives and evolving SOE governance standards to ensure operational autonomy and maintain its management structure effectively through this period.

New Energy Vehicle (NEV) Mandates and Incentives

China's commitment to new energy vehicles (NEVs) is a significant political driver for Dongfeng Motor Group. The nation's stringent production mandates, such as those requiring a certain percentage of NEVs in a manufacturer's fleet, directly impact Dongfeng's strategic planning and product development. For instance, the dual-credit policy, which began in 2018 and has been progressively tightened, incentivizes NEV production and penalizes traditional internal combustion engine (ICE) vehicle output. Dongfeng, like other major automakers, must navigate these regulations to avoid penalties and secure necessary credits.

These mandates are coupled with substantial government incentives designed to boost NEV adoption. These include purchase subsidies, tax exemptions, and significant investment in charging infrastructure. By 2024, China aimed to have over 8 million charging piles nationwide, a figure that continues to grow, making NEV ownership more practical. Dongfeng must align its product roadmap to leverage these incentives and meet escalating consumer demand for cleaner mobility solutions.

The political landscape necessitates that Dongfeng Motor Group accelerates its investment in NEV research and development and scales up its production capacity. Failure to meet national NEV targets, which are often revised upwards, can lead to substantial fines and a significant erosion of market share as competitors who adapt more quickly gain an advantage. For example, in 2023, the overall NEV penetration rate in China's passenger vehicle market surpassed 30%, a clear indication of the rapid shift Dongfeng must embrace.

- China's NEV penetration rate reached approximately 35.7% in the first half of 2024, up from 25.7% in the same period of 2023.

- The dual-credit policy incentivizes manufacturers to produce NEVs, with credits tradable between companies.

- Government subsidies, though gradually phasing out, still play a role in consumer purchasing decisions for NEVs in 2024.

- By the end of 2023, China had over 8 million charging facilities, supporting the expansion of NEV use.

Local Government Influence and Regional Development

Dongfeng Motor Group's extensive manufacturing presence across numerous Chinese provinces makes it highly susceptible to the diverse policies and economic development objectives of various local governments. For instance, in 2023, China's central government continued to emphasize regional coordination and development, impacting how local governments might offer incentives or impose regulations on large enterprises like Dongfeng. These regional disparities can significantly shape factory site selections and investment strategies.

Local government incentives, such as tax breaks or land grants, and the prioritization of infrastructure projects, like improved transportation networks around manufacturing hubs, directly influence Dongfeng's operational efficiency and expansion capabilities. Similarly, local employment targets can affect labor costs and availability. For example, Hubei province, Dongfeng's traditional base, often aligns its industrial policies with national goals for advanced manufacturing, which could translate into specific support or requirements for Dongfeng.

- Regional Subsidies: Local governments may offer subsidies for R&D or production, impacting Dongfeng's cost structure.

- Infrastructure Development: Investments in local transport and logistics by provincial governments can reduce Dongfeng's supply chain costs.

- Employment Targets: Local government mandates on job creation could influence Dongfeng's hiring practices and labor expenses.

- Policy Alignment: Dongfeng must align its strategies with provincial five-year plans to leverage local government support.

Cultivating robust relationships with regional authorities is therefore paramount for Dongfeng to ensure seamless operations, navigate regulatory landscapes, and pursue future growth opportunities. This includes proactive engagement on environmental standards, labor practices, and local economic contributions.

Government support is a cornerstone for Dongfeng Motor Group, particularly through favorable industrial policies and subsidies for new energy vehicles (NEVs). China's national strategy prioritizes NEV development, offering substantial financial incentives and regulatory backing to accelerate adoption and domestic production. Dongfeng's alignment with national industrial plans, focusing on strengthening the domestic automotive sector, ensures access to critical resources and fosters innovation.

Global trade tensions, especially between China and Western nations, present significant challenges for Dongfeng's international expansion and supply chain stability. These tensions can lead to increased scrutiny of Chinese investments, potential retaliatory tariffs, and disruptions in securing advanced automotive technologies and critical components, impacting joint ventures and production schedules.

China's commitment to NEVs is a major political driver, with stringent production mandates and the dual-credit policy directly influencing Dongfeng's product development and strategy. Government incentives, coupled with a rapidly expanding charging infrastructure, encourage NEV adoption. Dongfeng must align its product roadmap to leverage these incentives and meet escalating consumer demand for cleaner mobility solutions, with NEV penetration rates continuing to climb.

Dongfeng's extensive manufacturing presence across China makes it susceptible to diverse local government policies and economic development objectives. Regional disparities in incentives, infrastructure development, and employment targets can shape factory site selections and investment strategies, necessitating proactive engagement with regional authorities to ensure seamless operations and pursue growth opportunities.

| Political Factor | Impact on Dongfeng | Supporting Data/Examples |

| Government Support & NEV Prioritization | Favorable policies, subsidies, and strategic alignment enhance competitiveness. | China's NEV penetration rate reached ~35.7% in H1 2024. Government aims for over 8 million charging piles by 2024. |

| Global Trade Tensions | Threatens international growth, supply chain reliability, and access to technology. | Trade friction can lead to tariffs on imported components and exported vehicles. |

| SOE Reforms & Governance | Requires adaptation to new governance structures and performance metrics. | Ongoing SOE reforms through 2024-2025 focus on improving efficiency and market competitiveness. |

| Regional Policies & Incentives | Influences operational efficiency, expansion, and cost structures. | Local governments may offer tax breaks, land grants, or infrastructure improvements. Hubei province aligns industrial policies with national advanced manufacturing goals. |

What is included in the product

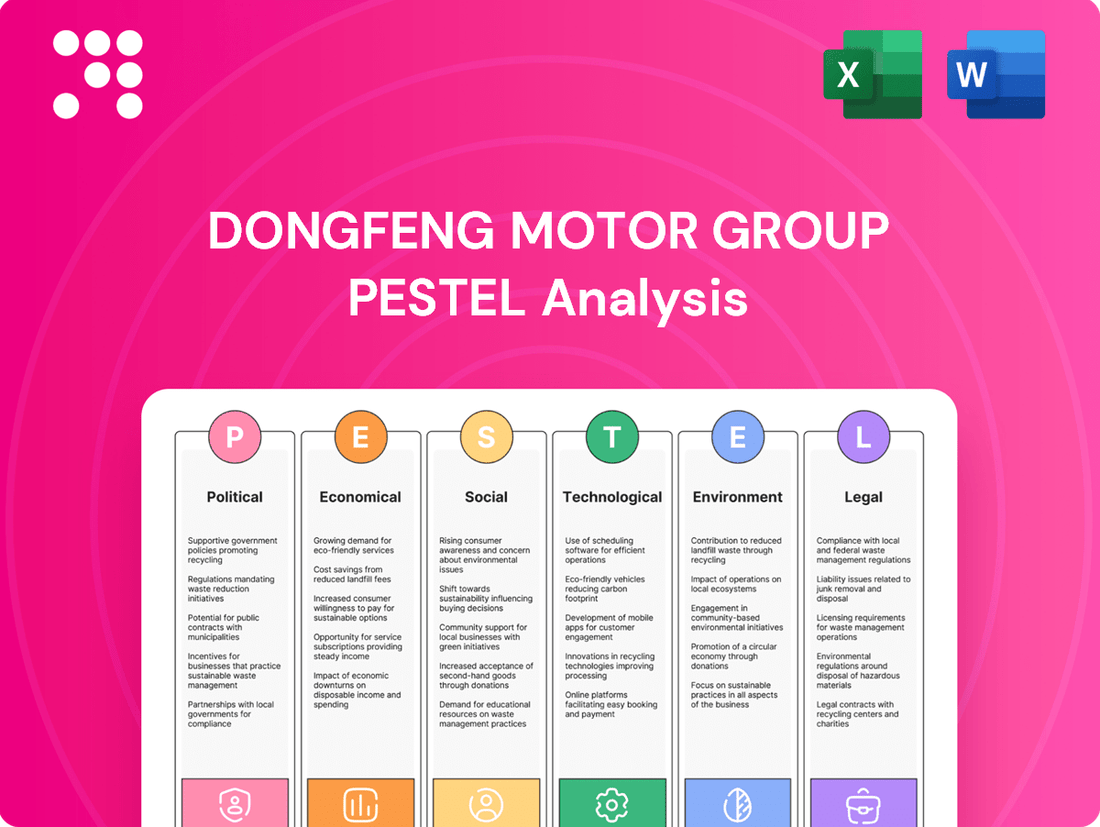

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Dongfeng Motor Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and their implications for the company's future growth and competitive positioning.

This PESTLE analysis of Dongfeng Motor Group offers a clear, summarized version of complex external factors, acting as a pain point reliever by simplifying strategic discussions and decision-making for leadership.

Economic factors

China's economic expansion is a primary driver for Dongfeng Motor Group, directly impacting how much consumers can spend on vehicles. A strong economy generally means more disposable income, leading to increased demand for both passenger cars and commercial trucks. For instance, in 2023, China's GDP grew by 5.2%, signaling a healthy consumer base ready for vehicle purchases and upgrades.

Conversely, economic slowdowns can significantly dampen consumer confidence and spending. When the economy faces headwinds, people tend to hold onto their money, delaying large purchases like new vehicles. This cautiousness directly affects Dongfeng's sales figures, highlighting the company's deep reliance on the overall health and stability of the Chinese domestic market.

The Chinese automotive landscape is a battleground, with a crowded field of domestic and global manufacturers, particularly in the burgeoning New Energy Vehicle (NEV) sector. This intense rivalry, evident in 2024, frequently triggers aggressive pricing strategies, pushing companies like Dongfeng Motor Group to constantly innovate and streamline operations to remain cost-effective. For instance, BYD's aggressive pricing in early 2024 significantly impacted competitors' margins.

Global supply chain disruptions, including the persistent semiconductor shortage that impacted automotive production throughout 2023 and into early 2024, directly affect Dongfeng Motor Group's manufacturing capabilities and vehicle delivery timelines. Fluctuations in raw material costs, particularly for battery components like lithium and nickel, present a significant challenge, with lithium carbonate prices experiencing volatility, sometimes dipping below ¥100,000 per ton in late 2023 before recovering.

To counter these headwinds, Dongfeng is prioritizing investments in advanced supply chain management systems and exploring diversification strategies for critical component sourcing. This proactive approach aims to reduce reliance on single suppliers and mitigate the impact of geopolitical events or natural disasters on production.

Effective cost control for essential components remains a cornerstone of Dongfeng's profitability strategy. For instance, managing the procurement costs of high-voltage batteries, which can represent a substantial portion of an electric vehicle's total cost, is crucial for maintaining competitive pricing and healthy margins in the rapidly evolving EV market.

Interest Rates and Access to Capital

Fluctuations in interest rates directly impact Dongfeng Motor Group by altering the cost for consumers to finance vehicle purchases, potentially dampening demand. For Dongfeng itself, higher rates increase the expense of borrowing for critical investments in new technologies and production capacity, especially in the competitive New Energy Vehicle (NEV) market.

Access to capital remains a cornerstone for Dongfeng's strategic objectives, particularly its significant push into the NEV segment. In 2024, China's benchmark lending rates, such as the Loan Prime Rate (LPR), have seen adjustments, influencing the cost of capital for major industrial players. For instance, the one-year LPR, a key benchmark, has been subject to reductions, aiming to stimulate economic activity.

- Interest Rate Impact: Higher interest rates in 2024-2025 increase consumer financing costs for Dongfeng vehicles and the company's own borrowing expenses for R&D and expansion.

- Capital Access for NEVs: Affordable capital is vital for Dongfeng's substantial investments in the capital-intensive NEV sector, supporting its growth and technological advancement plans.

- Favorable Conditions: Lower interest rate environments, as seen with potential benchmark rate adjustments by the People's Bank of China, generally support Dongfeng's ability to fund its ambitious expansion and innovation strategies.

- 2024 Lending Environment: The average weighted interest rate on new loans for manufacturing enterprises in China, a relevant indicator, has shown trends influenced by monetary policy, impacting companies like Dongfeng.

Foreign Exchange Rate Fluctuations

Foreign exchange rate fluctuations significantly influence Dongfeng Motor Group's operations, particularly given its numerous international joint ventures and potential export activities. When the Chinese Yuan strengthens, it makes Dongfeng's exports pricier for foreign buyers, potentially dampening international sales. Conversely, a stronger Yuan makes imported components and technologies cheaper, which can lower production costs for vehicles assembled using foreign parts.

For instance, in 2023, the Yuan experienced periods of depreciation against major currencies like the US Dollar, which could have offered some advantage to Dongfeng's export competitiveness. However, managing these currency shifts is a continuous strategic imperative. Dongfeng's financial planning must account for the impact of these volatile rates on its profitability, especially when dealing with revenue generated in foreign currencies or costs incurred for imported materials and components.

- Impact on Exports: A stronger Yuan can make Dongfeng vehicles less competitive in international markets by increasing their price for overseas customers.

- Cost of Imports: Conversely, a weaker Yuan can raise the cost of imported parts and technologies, potentially impacting manufacturing expenses.

- Profitability: Exchange rate volatility directly affects the translation of foreign earnings and the cost of imported inputs, thereby influencing overall profitability.

- Currency Risk Management: Dongfeng actively employs financial strategies to mitigate the risks associated with fluctuating foreign exchange rates.

China's economic growth is a crucial factor for Dongfeng Motor Group, directly influencing consumer spending on vehicles. Robust economic expansion, such as the 5.2% GDP growth in 2023, generally translates to higher disposable income and increased demand for automobiles. Conversely, economic slowdowns can significantly reduce consumer confidence and spending, negatively impacting Dongfeng's sales volumes.

The competitive landscape in China's automotive sector, especially the New Energy Vehicle (NEV) market, intensifies pricing pressures. Companies like Dongfeng must continuously innovate and manage costs effectively to remain competitive. For example, aggressive pricing by rivals in early 2024 highlighted the need for operational efficiency and strategic pricing for Dongfeng.

Supply chain stability and raw material costs remain key economic considerations for Dongfeng. Disruptions, like the semiconductor shortage affecting production in 2023-2024, and price volatility in materials such as lithium carbonate, pose significant challenges. Effective cost control, particularly for battery components, is vital for maintaining profitability in the EV market.

Interest rate fluctuations directly affect both consumer demand for financed vehicles and Dongfeng's borrowing costs for expansion and R&D. Access to capital is essential for Dongfeng's NEV ambitions, with monetary policy adjustments influencing the cost of capital. For instance, changes in China's benchmark lending rates impact the company's investment capacity.

Foreign exchange rates play a significant role in Dongfeng's international operations and profitability. A strengthening Yuan can make exports more expensive, while a weaker Yuan increases the cost of imported components. Managing these currency fluctuations is a continuous strategic imperative for the company.

Full Version Awaits

Dongfeng Motor Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Dongfeng Motor Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic direction. You'll gain a deep understanding of the external forces shaping the automotive industry and Dongfeng's position within it.

Sociological factors

Societal awareness and a growing preference for New Energy Vehicles (NEVs) are significantly reshaping the automotive market. This trend is fueled by increasing environmental consciousness, supportive government policies, and rapid improvements in battery technology and charging infrastructure. For instance, by the end of 2023, China's NEV sales surpassed 9.49 million units, a 37.9% year-on-year increase, highlighting this powerful consumer shift.

Dongfeng Motor Group must strategically align its product offerings with this evolving consumer demand. Introducing appealing and dependable electric and hybrid vehicle models is crucial for meeting these changing preferences and maintaining market relevance. This proactive approach ensures Dongfeng can capitalize on the burgeoning NEV market, which is fundamentally altering the competitive landscape.

China's ongoing urbanization, with projections indicating that 65% of its population will live in cities by 2025, directly impacts Dongfeng Motor Group's market. This trend fuels demand for smaller, more efficient vehicles suitable for congested urban environments, alongside a growing reliance on ride-sharing and public transit. Dongfeng must align its product development with these evolving urban mobility preferences, potentially by investing in micro-mobility options or increasing its involvement in car-sharing platforms.

China's demographic shifts, including a rapidly aging population and a trend towards smaller family units, directly influence vehicle purchasing decisions, favoring smaller, more maneuverable cars and those with advanced safety and comfort features. For instance, by the end of 2023, China's population aged 60 and above reached 296.97 million, a significant increase, impacting the demand for specific vehicle types.

Younger Chinese consumers, a key demographic for the automotive sector, increasingly prioritize technological integration, smart connectivity, and environmentally friendly options, with electric vehicles (EVs) and advanced driver-assistance systems (ADAS) becoming major selling points. In 2024, the penetration rate of new energy vehicles (NEVs) in China's passenger car market was projected to exceed 50%, highlighting this strong preference.

Dongfeng Motor Group must strategically adapt its product development and marketing efforts to resonate with these evolving consumer preferences across different age groups and lifestyle segments. This includes developing a diverse portfolio that caters to both the practical needs of an aging population and the tech-savvy demands of younger buyers, ensuring continued market relevance.

Brand Perception and Trust

Consumer trust is a critical sociological element for Dongfeng Motor Group, especially when comparing domestic brands against international joint venture marques. Building and sustaining a robust brand image, highlighting quality, safety, and technological advancement, is paramount for Dongfeng to effectively compete with well-established global automotive manufacturers.

Positive public perception directly influences market acceptance and underpins long-term business viability. For instance, in 2023, Chinese domestic auto brands saw their market share in China reach 56%, a notable increase from previous years, indicating a growing trust in local manufacturers.

- Brand Image: Dongfeng must consistently reinforce its commitment to quality and safety to foster consumer confidence.

- Competitive Landscape: The perception of domestic versus international brands significantly impacts purchasing decisions in the Chinese market.

- Market Share Growth: The increasing share of domestic brands in China suggests a positive shift in consumer trust towards local automotive companies.

Digital Connectivity and Smart Vehicle Features

Societal expectations are increasingly shaped by digital integration, with consumers demanding seamless connectivity in all aspects of their lives, including their vehicles. This trend is pushing automakers like Dongfeng to prioritize advanced infotainment systems, sophisticated driver-assistance features, and the convenience of over-the-air software updates. By 2024, the global connected car market was projected to reach over $200 billion, highlighting the significant consumer appetite for these technologies.

Dongfeng's strategic response must involve substantial investment in smart vehicle technologies and related services. This proactive approach is crucial for meeting evolving consumer desires for features such as enhanced navigation, personalized digital experiences, and the growing interest in semi-autonomous driving capabilities. For instance, by the end of 2023, over 60% of new vehicles sold in major markets offered some form of advanced driver-assistance systems (ADAS).

- Consumer demand for integrated digital experiences in vehicles is rapidly growing.

- Advanced infotainment and autonomous driving features are becoming key differentiators.

- Over-the-air (OTA) updates are expected for continuous improvement and feature additions.

- Dongfeng's investment in smart vehicle technology is essential to remain competitive and meet user expectations.

The increasing demand for New Energy Vehicles (NEVs) is a significant sociological factor, driven by environmental awareness and policy support. By the end of 2023, China's NEV sales exceeded 9.49 million units, a 37.9% increase, demonstrating this shift. Dongfeng Motor Group must align its product development with this trend, offering compelling electric and hybrid models to capture this growing market segment.

Urbanization in China, projected to reach 65% by 2025, influences vehicle preferences towards smaller, efficient urban cars and greater use of ride-sharing. Dongfeng should consider micro-mobility and car-sharing services to cater to these evolving urban mobility needs. Demographic changes, like an aging population (296.97 million aged 60+ by end of 2023), favor smaller, safer, and more comfortable vehicles, impacting Dongfeng's product strategy.

Younger consumers prioritize technology, connectivity, and eco-friendliness, with NEVs and advanced driver-assistance systems (ADAS) being key selling points. The NEV penetration rate in China's passenger car market was expected to exceed 50% in 2024. Dongfeng needs to develop a diverse portfolio catering to both older and younger demographics, emphasizing smart features and sustainability.

Consumer trust in domestic brands is rising, with Chinese brands capturing 56% market share in 2023, up from previous years. Dongfeng must build on this by reinforcing its commitment to quality, safety, and technological advancement to compete effectively against international brands. Meeting consumer expectations for digital integration, including advanced infotainment and over-the-air updates, is crucial, as the global connected car market was projected to exceed $200 billion in 2024.

Technological factors

Rapid advancements in battery density, charging speed, and cost reduction are critical for Dongfeng's competitiveness in the New Energy Vehicle (NEV) market. For instance, by the end of 2024, battery pack costs are projected to fall below $100 per kilowatt-hour, a significant milestone that will boost NEV affordability.

Dongfeng must continue to invest heavily in research and development for next-generation battery technologies, including solid-state batteries, and efficient electric powertrains. This focus on innovation is crucial for offering vehicles with longer ranges and improved energy management, a key differentiator in the rapidly evolving NEV landscape.

Staying at the forefront of NEV technology is paramount for Dongfeng's sustained growth. By Q1 2025, the global NEV market is expected to see battery electric vehicles (BEVs) account for over 20% of all new car sales, highlighting the urgent need for Dongfeng to maintain technological leadership.

Autonomous driving and AI integration are reshaping the automotive landscape, pushing manufacturers like Dongfeng Motor Group to innovate rapidly. The progression from driver-assistance systems to fully autonomous capabilities is a significant industry shift. Dongfeng's strategic imperative involves forging partnerships with leading technology firms and channeling investments into crucial areas like artificial intelligence, advanced sensor technology, and sophisticated software development to embed these advanced features into their vehicle lineup. This technological advancement is becoming a critical factor in distinguishing Dongfeng's offerings in a competitive market.

Dongfeng Motor Group's embrace of Industry 4.0, incorporating automation, robotics, the Internet of Things (IoT), and advanced data analytics, is a key technological driver. This integration is designed to boost production efficiency, elevate quality control, and improve cost-effectiveness across its manufacturing operations. For instance, the company has been investing in smart factory technologies to streamline its production lines, aiming to reduce operational costs and enhance product consistency.

The adoption of smart factories and digital twin technologies offers Dongfeng the potential to meticulously optimize its manufacturing processes. By creating virtual replicas of its physical operations, the group can simulate scenarios, identify bottlenecks, and implement improvements that minimize waste and resource consumption. This digital approach is vital for maintaining a competitive edge in the rapidly evolving automotive sector, where innovation in production is as critical as product design.

Digitalization and Connectivity in Vehicles

The automotive industry's digital transformation extends beyond autonomous capabilities, encompassing sophisticated infotainment, vehicle-to-everything (V2X) communication, and over-the-air (OTA) updates. Dongfeng Motor Group needs to invest in strong software and connectivity to deliver integrated digital experiences, catering to the growing consumer desire for smart, connected vehicles. For instance, in 2024, the global automotive software market was projected to reach over $60 billion, highlighting the significant opportunity.

Meeting these evolving consumer expectations requires Dongfeng to build robust software platforms and seamless connectivity solutions. This digital integration is crucial for offering an appealing and modern vehicle experience. By 2025, it's estimated that over 90% of new vehicles sold globally will feature some form of advanced connectivity.

Furthermore, data security and privacy are paramount considerations in this digital shift. Dongfeng must implement stringent measures to protect user data and maintain trust. The increasing reliance on connected car technology means that cybersecurity threats are a growing concern, making robust data protection a non-negotiable aspect of vehicle design and operation.

- Digitalization Scope: Beyond autonomous driving, focus on advanced infotainment, V2X communication, and OTA updates.

- Consumer Demand: Consumers increasingly expect seamless digital experiences and smart, connected car features.

- Market Growth: The global automotive software market is expanding rapidly, projected to exceed $60 billion by 2024.

- Connectivity Penetration: Over 90% of new vehicles are expected to have advanced connectivity by 2025.

- Key Challenge: Ensuring robust data security and privacy is critical for consumer trust and adoption.

Research and Development (R&D) Investment and Innovation

Dongfeng Motor Group's commitment to research and development (R&D) is crucial for its competitiveness, particularly in the rapidly evolving electric vehicle (NEV) and intelligent mobility sectors. Substantial and ongoing investment fuels the development of proprietary technologies and the acquisition of patents, fostering an innovative environment essential for future product pipelines and market positioning.

Strategic alliances in R&D further bolster Dongfeng's technological capabilities. For instance, in 2023, Dongfeng Motor announced plans to invest over 100 billion yuan in technological innovation by 2027, with a significant portion allocated to NEVs and intelligent driving systems. This investment underscores their focus on developing advanced battery technology, autonomous driving features, and connected car services.

Key R&D focus areas for Dongfeng include:

- Development of next-generation NEV powertrains and battery management systems.

- Advancement in autonomous driving and intelligent connectivity technologies.

- Exploration of new materials and lightweight construction for improved efficiency.

- Enhancement of digital platforms for customer experience and vehicle services.

Dongfeng's technological advancement is heavily focused on New Energy Vehicles (NEVs), with battery technology a key area. By the end of 2024, battery pack costs are expected to drop below $100 per kilowatt-hour, making NEVs more accessible. The company is also investing in next-generation batteries like solid-state, aiming for longer ranges and better energy management.

The integration of autonomous driving and AI is a significant technological push, with Dongfeng partnering with tech firms to enhance sensor technology and software. This is crucial as global NEV sales are projected to exceed 20% of new car sales by Q1 2025, indicating a strong market shift.

Industry 4.0 principles, including smart factories and IoT, are being implemented to boost production efficiency and quality. Dongfeng is also prioritizing digital transformation beyond autonomous features, focusing on advanced infotainment and V2X communication, with over 90% of new vehicles expected to feature advanced connectivity by 2025.

Dongfeng's R&D investment is substantial, with plans to invest over 100 billion yuan in technological innovation by 2027, particularly in NEVs and intelligent driving. This includes developing advanced battery management systems and enhancing digital platforms for customer experience.

| Key Technological Focus | 2024/2025 Projections & Data | Impact on Dongfeng |

| NEV Battery Costs | Projected < $100/kWh by end of 2024 | Increases NEV affordability and competitiveness |

| Global NEV Market Share | BEVs to exceed 20% of new car sales by Q1 2025 | Highlights urgency for technological leadership in NEVs |

| Automotive Software Market | Projected > $60 billion in 2024 | Underscores the importance of investing in vehicle software and connectivity |

| Vehicle Connectivity | > 90% of new vehicles with advanced connectivity by 2025 | Necessitates robust software platforms and seamless connectivity solutions |

| R&D Investment | > 100 billion yuan planned by 2027 | Supports development of next-gen NEVs, autonomous driving, and intelligent systems |

Legal factors

Dongfeng Motor Group navigates a complex web of automotive safety regulations, including China's GB standards and international benchmarks like Euro NCAP. These mandate rigorous crashworthiness, advanced driver-assistance systems (ADAS), and improved pedestrian impact protection, crucial for market entry and maintaining consumer confidence.

Failure to meet these evolving legal requirements, such as the upcoming stricter emissions and safety mandates expected to be phased in through 2025, can result in costly recalls and significant penalties. For instance, in 2024, several automakers faced substantial fines globally for safety non-compliance, underscoring the financial risks.

China's vehicle emissions standards are becoming more stringent, with the China VI standard now in effect, requiring significant reductions in pollutants. This directly impacts Dongfeng Motor Group by necessitating substantial investments in cleaner engine technologies and advanced exhaust treatment systems. For instance, meeting these standards often involves sophisticated catalytic converters and particulate filters, adding to production costs and complexity.

Fuel economy regulations are also tightening, pushing automakers like Dongfeng to improve the efficiency of their internal combustion engine vehicles and accelerate the adoption of new energy vehicles (NEVs). Dongfeng's strategic focus on NEVs, including battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), is a direct response to these mandates, aiming to reduce average fuel consumption across its fleet. By 2025, China has set ambitious targets for NEV sales, which Dongfeng is actively working to meet through its product development and partnerships.

Non-compliance with these evolving environmental regulations carries significant risks for Dongfeng. Penalties can range from substantial fines to restrictions on production volumes, impacting market access and profitability. Dongfeng's ongoing efforts to develop and market a wider range of NEVs, such as its Voyah and eπ brands, are crucial for maintaining regulatory compliance and competitive positioning in the Chinese automotive market.

Dongfeng Motor Group's extensive network of joint ventures, including significant partnerships with Stellantis and Nissan, necessitates meticulous management of intellectual property rights. These collaborations involve complex licensing agreements and technology sharing, making the protection of Dongfeng's proprietary innovations and adherence to partner IP crucial. For instance, the ongoing development of new energy vehicle (NEV) technologies within these joint ventures requires clear legal frameworks to govern IP ownership and usage, especially as China's IP protection landscape continues to evolve.

Consumer Protection and Product Liability Laws

Dongfeng Motor Group operates under stringent consumer protection laws that dictate product quality, warranty provisions, and the crucial aspect of after-sales service. This means Dongfeng must consistently ensure its vehicles meet rigorous safety and performance standards, offering clear remedies for any identified defects. Failure to comply can lead to substantial legal and financial penalties.

Product liability is a significant concern, especially given the potential for accidents or malfunctions stemming from vehicle defects. For instance, in 2024, the automotive industry globally saw an increase in recalls related to safety issues, highlighting the importance of robust quality control. Dongfeng's commitment to meticulous manufacturing processes and thorough testing is therefore paramount to mitigating risks associated with product liability claims, which can result in significant financial repercussions and damage to brand reputation.

- Product Quality Standards: Dongfeng must adhere to national and international automotive safety and emissions standards, such as those set by China's GB standards and potentially Euro NCAP for export markets.

- Warranty Obligations: The company is legally bound to honor warranty terms, covering defects in materials and workmanship, impacting customer satisfaction and repair costs.

- After-Sales Service: Regulations often mandate availability of spare parts and qualified repair services for a specified period post-sale, influencing operational costs and customer loyalty.

- Product Liability Risks: In 2023, China's Supreme People's Court reported a notable volume of product liability cases, underscoring the need for Dongfeng to maintain high product integrity to avoid costly litigation and compensation payouts.

Data Privacy and Cybersecurity Regulations

Dongfeng Motor Group faces a complex legal landscape concerning data privacy and cybersecurity, especially with the growing integration of connected technologies in its vehicles. China's Personal Information Protection Law (PIPL), effective since November 1, 2021, mandates stringent rules on how companies collect, process, and store personal data, including that generated by vehicle telematics and autonomous driving systems. Failure to comply can result in significant fines, with PIPL allowing penalties up to 5% of the previous year's annual turnover or 50 million yuan, whichever is higher, for serious violations.

The cybersecurity of connected vehicles is paramount. Dongfeng must implement robust measures to protect against data breaches and cyberattacks. A significant data breach could not only lead to substantial financial penalties but also severely damage customer trust and brand reputation. For instance, in 2023, the automotive industry globally saw an increase in reported cyber incidents, highlighting the persistent threat landscape.

- PIPL Compliance: Dongfeng must adhere to China's PIPL, governing the collection and use of customer data, vehicle telematics, and autonomous driving information.

- Cybersecurity Imperative: Ensuring the security of connected vehicle systems is a critical legal and ethical obligation to prevent data breaches.

- Penalties for Non-Compliance: Violations of data privacy laws can lead to severe financial penalties, impacting profitability and operational continuity.

- Trust and Reputation: Data breaches can erode customer trust, leading to long-term damage to Dongfeng's brand image and market standing.

Dongfeng Motor Group must navigate evolving safety standards, including China's GB standards and international benchmarks, to ensure market access and consumer trust. Failure to meet these, such as stricter emissions and safety mandates expected through 2025, can lead to significant fines, as seen with other automakers facing penalties in 2024 for non-compliance.

The company is also subject to stringent consumer protection laws, requiring adherence to product quality, warranty terms, and after-sales service provisions. Product liability remains a key concern, particularly with increased recalls globally in 2023 for safety issues, emphasizing the need for robust quality control to avoid litigation and reputational damage.

Data privacy and cybersecurity are critical legal areas, especially with connected vehicles. Compliance with China's Personal Information Protection Law (PIPL) is essential, with violations potentially incurring fines up to 5% of annual turnover. Robust cybersecurity measures are vital to prevent data breaches, which can lead to substantial penalties and erode customer trust, a challenge faced by the automotive industry in 2023.

| Legal Factor | Key Requirements for Dongfeng | Potential Consequences of Non-Compliance | Relevant Data/Trends |

| Safety & Emissions Standards | Adherence to China's GB standards, potential Euro NCAP compliance for exports. Meeting stricter emissions and safety mandates through 2025. | Costly recalls, significant penalties, restricted market access. | Automakers faced fines in 2024 for safety non-compliance. China VI emissions standard in effect. |

| Consumer Protection & Product Liability | Ensuring product quality, honoring warranty terms, providing adequate after-sales service. Mitigating product defects. | Legal and financial penalties, damage to brand reputation, costly litigation. | Increased recalls globally in 2023 for safety issues. Notable volume of product liability cases in China in 2023. |

| Data Privacy & Cybersecurity | Compliance with PIPL for data collection and usage. Implementing robust cybersecurity for connected vehicles. | Fines up to 5% of annual turnover, severe financial penalties, loss of customer trust, reputational damage. | PIPL effective Nov 2021. Increase in reported cyber incidents in automotive industry in 2023. |

Environmental factors

China's commitment to cleaner air means Dongfeng Motor Group must significantly cut vehicle emissions. This involves producing cars with lower tailpipe pollutants and speeding up the shift to electric and other zero-emission vehicles. For instance, by the end of 2023, Dongfeng's new energy vehicle sales had reached 334,000 units, a 72.4% increase year-on-year, reflecting this strategic pivot.

Navigating these increasingly stringent environmental rules presents both ongoing hurdles and avenues for growth. Dongfeng's investment in advanced powertrain technologies and sustainable manufacturing processes is crucial for maintaining market competitiveness and meeting national environmental targets, such as the dual-carbon goals aiming for peak emissions before 2030 and carbon neutrality before 2060.

Dongfeng's vehicle production, particularly for New Energy Vehicles (NEVs), is heavily dependent on critical raw materials like lithium, cobalt, and rare earth elements. The global supply of these materials is often concentrated, leading to potential supply chain disruptions and price volatility. For instance, China dominates the processing of rare earth elements, a key component in electric vehicle motors and batteries.

To navigate these challenges, Dongfeng must prioritize sustainable sourcing strategies and invest in circular economy initiatives. This includes exploring advanced material recycling technologies to recover valuable components from end-of-life vehicles. Optimizing resource efficiency throughout its manufacturing processes is also crucial to reduce reliance on virgin materials and mitigate the financial risks associated with scarcity.

Environmental regulations are tightening, pushing automakers like Dongfeng to prioritize responsible waste management. This includes stringent rules for recycling end-of-life vehicles and, crucially, the batteries powering electric models. For instance, China's updated regulations in 2023 emphasize extended producer responsibility for battery recycling, aiming to build a robust system by 2025.

Dongfeng needs robust strategies for battery recycling and manufacturing waste disposal to minimize its environmental impact. Embracing circular economy principles, such as designing vehicles for easier disassembly and establishing effective collection networks for used components, is key. This proactive approach not only addresses regulatory compliance but also unlocks potential cost savings and resource efficiency.

Climate Change Policies and Carbon Neutrality Goals

China's national pledge to achieve carbon neutrality by 2060 significantly shapes the automotive sector. This ambitious goal necessitates a comprehensive decarbonization strategy for Dongfeng Motor Group, covering its manufacturing processes, supply chain, and the entire lifecycle of its vehicles. For instance, by 2023, China's New Energy Vehicle (NEV) sales surpassed 9.5 million units, indicating a strong market shift that Dongfeng must actively participate in and lead.

Dongfeng is compelled to establish and meet aggressive carbon reduction objectives. This includes integrating renewable energy sources into its production facilities and championing the adoption of low-carbon transportation alternatives. The company's commitment to sustainability is not merely an option but a fundamental long-term strategic necessity, aligning with national environmental priorities and global market trends.

- National Target: China aims for carbon neutrality by 2060.

- Industry Impact: Automotive sector faces pressure to decarbonize operations and products.

- Dongfeng's Role: Must set ambitious carbon reduction targets and transition to green energy.

- Market Shift: Over 9.5 million NEVs sold in China in 2023 highlights the growing demand for sustainable transport.

Impact of Manufacturing Operations on Local Ecosystems

Dongfeng Motor Group’s extensive manufacturing presence can significantly affect local ecosystems. Their large-scale operations involve substantial water consumption and the discharge of wastewater, which, if not properly treated, can impact local water quality. Furthermore, there's a potential for soil contamination from industrial activities.

To mitigate these environmental effects, Dongfeng is committed to robust environmental management systems. This includes adhering to China's increasingly stringent environmental protection laws and engaging in responsible land use practices for its facilities. For instance, in 2023, China's Ministry of Ecology and Environment continued to emphasize stricter enforcement of pollution control standards for the automotive sector, pushing companies like Dongfeng to invest further in cleaner production technologies.

Effective community engagement regarding environmental performance is also a key focus. Dongfeng understands that maintaining positive relationships with local communities hinges on demonstrating a commitment to environmental stewardship. This involves transparent communication about their environmental initiatives and addressing community concerns proactively. Reports from 2024 indicate a growing trend of community-led environmental advocacy in China, making this aspect crucial for corporate reputation.

- Water Management: Dongfeng implements advanced wastewater treatment technologies to meet or exceed discharge standards, aiming to minimize the ecological footprint of its water usage.

- Emissions Control: Investments in air pollution control equipment are ongoing to reduce atmospheric emissions from manufacturing processes.

- Waste Reduction: The company focuses on reducing solid waste generation and increasing recycling rates across its production sites.

China's commitment to cleaner air means Dongfeng Motor Group must significantly cut vehicle emissions, accelerating the shift to electric and other zero-emission vehicles. By the end of 2023, Dongfeng's new energy vehicle sales reached 334,000 units, a 72.4% increase year-on-year, reflecting this strategic pivot towards meeting national environmental targets and the dual-carbon goals.

Dongfeng's production of New Energy Vehicles (NEVs) relies on critical raw materials like lithium and cobalt, whose global supply chains are subject to potential disruptions and price volatility, especially given China's dominance in rare earth element processing. To counter this, the company must prioritize sustainable sourcing and invest in circular economy initiatives, including advanced material recycling technologies for end-of-life vehicles.

China's national pledge for carbon neutrality by 2060 significantly impacts the automotive sector, compelling Dongfeng to establish aggressive carbon reduction objectives and integrate renewable energy into its production. This aligns with the strong market shift seen in 2023, where China's NEV sales surpassed 9.5 million units, underscoring the necessity for Dongfeng's commitment to sustainability.

Dongfeng's manufacturing operations must adhere to increasingly stringent environmental laws, particularly concerning water consumption and wastewater discharge, to minimize ecological impact. In 2023, China's Ministry of Ecology and Environment continued to emphasize stricter pollution control standards for the automotive sector, pushing companies like Dongfeng to invest in cleaner production technologies and responsible land use.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Dongfeng Motor Group draws from a robust mix of official government publications, international economic reports, and leading automotive industry analyses. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.