Dongfeng Motor Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dongfeng Motor Group Bundle

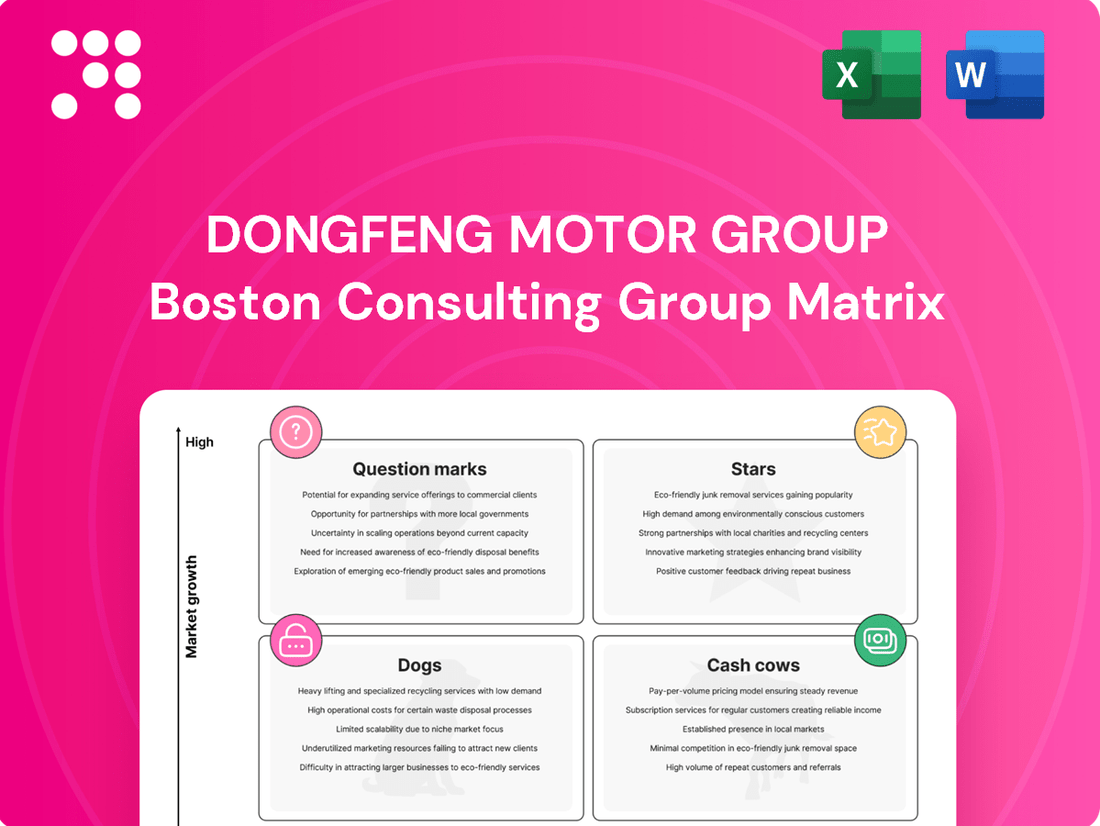

Curious about Dongfeng Motor Group's market performance? This snapshot hints at their product portfolio's potential, but to truly understand their strategic positioning—identifying Stars, Cash Cows, Dogs, and Question Marks—you need the full picture. Unlock a comprehensive breakdown of their BCG Matrix and gain the clarity needed for informed investment decisions.

Don't miss out on the detailed quadrant analysis and actionable insights that will empower your strategic planning. Purchase the complete Dongfeng Motor Group BCG Matrix report today to uncover their market leaders, resource drains, and optimal capital allocation strategies, all presented in a ready-to-use format.

Stars

Voyah, Dongfeng Motor's premium new energy vehicle (NEV) brand, is a clear Star in the BCG Matrix. In 2024, the brand achieved impressive sales, delivering 85,697 units, which represents a substantial 70% increase compared to the previous year. This robust growth highlights Voyah's strong market traction within the rapidly expanding NEV sector.

The brand's ambitious target of 200,000 units for 2025 underscores its significant growth potential and its strategic positioning in a high-demand market segment. Voyah's expansion into international markets further reinforces its status as a high-growth, high-market-share entity, characteristic of a Star in the BCG framework.

Dongfeng's wholly-owned New Energy Vehicle (NEV) brands shine brightly as Stars in the BCG matrix, demonstrating impressive growth. These brands are on a trajectory to achieve 810,000 units in sales for 2024, marking a substantial 122.5% surge compared to the previous year.

This rapid sales expansion within the booming NEV sector highlights their significant potential to transition into future Cash Cows. Sustaining this momentum is crucial for solidifying their position as market leaders and consistent revenue generators.

M-Hero, Dongfeng's premium electric off-road marque, is classified as a Star within the BCG Matrix. This designation stems from its strategic positioning in the rapidly expanding luxury electric off-road vehicle segment, a market showing significant upward trajectory.

The M-Hero 917, a flagship model, exemplifies the brand's appeal with its blend of cutting-edge technology and distinctive styling, resonating well with consumers seeking both performance and luxury in their off-road adventures.

Demonstrating strong growth potential, M-Hero has made a notable international debut in Dubai, and continues to build momentum with pre-sales for its newer models, underscoring its strategic importance to Dongfeng Motor Group's future market penetration.

Overall New Energy Vehicle Segment Growth

Dongfeng Motor's new energy vehicle (NEV) segment is a standout 'Star' within the company's portfolio. This is largely due to its operation within China's rapidly expanding NEV market. By November 2024, annual NEV sales in China had already exceeded 10 million units, indicating robust industry growth.

Dongfeng's own performance in this sector is particularly strong. From January to August 2024, the company experienced a significant surge in NEV sales, with an impressive 108.5% year-over-year increase. This upward trajectory is further supported by Dongfeng's ambitious target of selling over 1 million NEVs in 2025.

- Market Dominance: China's NEV market surpassed 10 million annual sales by November 2024.

- Exceptional Growth: Dongfeng's NEV sales grew by 108.5% from January to August 2024.

- Future Ambitions: The company aims for over 1 million NEV sales in 2025.

- Strategic Position: This segment represents a high-growth area where Dongfeng is steadily increasing its market share.

Expanding Overseas Operations for Own Brands

Dongfeng Motor Group's strategy for its own brands, particularly under the 'Let's Voyah' global initiative, points towards significant overseas expansion. This aggressive push into new international markets, where Dongfeng's brand recognition and market share are currently nascent but the growth potential is substantial, clearly categorizes these operations as Stars in the BCG Matrix.

The company's passenger vehicle exports saw an impressive surge, with orders climbing 225% year-over-year in March 2025, underscoring the rapid traction these expanding operations are gaining. Dongfeng's ambitious target to establish a presence in 60 countries by 2030 further solidifies the Star classification, indicating a commitment to investing heavily in high-growth, emerging markets to capture future market share.

- Voyah's Global Ambitions: Dongfeng's 'Let's Voyah' strategy targets international markets with high growth potential.

- Export Growth: Passenger vehicle exports experienced a 225% year-over-year increase in orders as of March 2025.

- Market Penetration Goal: The group aims to operate in 60 countries by 2030, signifying a strong focus on expanding its global footprint.

- Star Classification: These overseas operations are considered Stars due to low current market share but high market growth potential.

Dongfeng's wholly-owned NEV brands are firmly positioned as Stars, exhibiting remarkable growth. These brands are projected to achieve 810,000 unit sales in 2024, a significant 122.5% increase year-over-year. This rapid expansion in the booming NEV sector indicates strong potential to evolve into future Cash Cows.

Voyah, Dongfeng's premium NEV brand, is a prime example of a Star, with 85,697 units delivered in 2024, a 70% year-over-year increase. Its international expansion further solidifies its high-growth, high-market-share status.

The M-Hero, a premium electric off-road marque, also shines as a Star, capitalizing on the growing luxury electric off-road vehicle market, evidenced by its international debut in Dubai.

Dongfeng's overall NEV segment is a Star, operating within China's rapidly expanding market where annual sales surpassed 10 million units by November 2024. Dongfeng's NEV sales saw a 108.5% year-over-year increase from January to August 2024, with a target of over 1 million NEVs sold in 2025.

| Brand/Segment | BCG Classification | 2024 Sales (Units) | YoY Growth (%) | Key Growth Driver |

| Dongfeng NEV Brands (Wholly-owned) | Star | 810,000 (Projected) | 122.5% | Booming NEV Market |

| Voyah | Star | 85,697 | 70% | Premium NEV Segment, International Expansion |

| M-Hero | Star | N/A (New Model Focus) | N/A | Luxury Electric Off-Road Segment |

| Dongfeng NEV Segment (Overall) | Star | N/A (Segment Growth) | 108.5% (Jan-Aug 2024) | China's Rapid NEV Market Expansion |

What is included in the product

Dongfeng Motor Group's BCG Matrix analyzes its product portfolio by market share and growth, guiding investment decisions.

A clear BCG Matrix visual, showing Dongfeng's portfolio, alleviates the pain of strategic uncertainty.

Cash Cows

Dongfeng Commercial Vehicles represents a classic Cash Cow for Dongfeng Motor Group. Historically a leader in China's commercial vehicle sector, the company is targeting sales exceeding 1 million commercial vehicles by 2025, underscoring its established market presence.

Even with a dip in the medium-duty truck market during the first half of 2025, Dongfeng managed to grow its market share. This resilience highlights the segment's maturity and Dongfeng's stable, strong position within it, ensuring consistent cash generation.

Dongfeng's established traditional internal combustion engine (ICE) passenger vehicles, despite the industry's shift, remain a robust revenue generator. These models, particularly from its wholly-owned brands, continue to capture a substantial portion of the market, ensuring consistent sales volume. In 2024, these wholly-owned brands represented 55% of Dongfeng's total sales, underscoring their importance as cash cows.

Dongfeng Motor's auto parts and components division is a clear Cash Cow. This segment, responsible for engines and various automotive parts, is a bedrock of the company's operations, ensuring a steady supply for its vehicle manufacturing. Its integral position in the supply chain suggests reliable profit margins and consistent cash flow.

Military Vehicle Production

Dongfeng Motor Group's specialization in military vehicle production positions this segment as a Cash Cow within their BCG Matrix. As a major Chinese state-owned manufacturer, Dongfeng benefits from a consistent and reliable revenue stream in this specialized market.

The military vehicle sector is characterized by long-term contracts and generally lower market volatility compared to the consumer automotive market. This stability translates into steady cash generation for Dongfeng, even with more modest growth expectations.

- Consistent Revenue: Dongfeng's military vehicle division provides a predictable income source due to the nature of government contracts.

- Low Volatility: This segment is less susceptible to the rapid shifts seen in consumer demand, ensuring financial stability.

- Steady Cash Generation: The reliable demand and contract structures allow for consistent cash flow generation.

- Mature Market: While growth may be limited, the established demand in the military sector supports its Cash Cow status.

Financial and Related Automotive Services

Dongfeng Motor Group's financial and related automotive services represent a significant Cash Cow. This segment, encompassing vehicle financing and after-sales support, thrives in a mature market where demand is consistent and predictable, minimizing the need for extensive marketing efforts.

These services generate steady, reliable revenue streams for Dongfeng. For instance, in 2023, Dongfeng's financial services segment reported consistent profitability, contributing significantly to the group's overall financial stability.

- Stable Income: The mature nature of the automotive services market ensures a predictable and ongoing income for Dongfeng.

- Low Investment Needs: Established demand means less capital is required for promotion and market expansion compared to growth-oriented segments.

- Profitability Driver: These services act as a reliable profit generator, supporting other business units within the group.

Dongfeng's established traditional internal combustion engine (ICE) passenger vehicles remain a robust revenue generator, even as the industry shifts. These models, particularly from its wholly-owned brands, continue to capture a substantial portion of the market, ensuring consistent sales volume. In 2024, these wholly-owned brands represented 55% of Dongfeng's total sales, underscoring their importance as cash cows.

Dongfeng Motor Group's auto parts and components division is a clear Cash Cow. This segment, responsible for engines and various automotive parts, is a bedrock of the company's operations, ensuring a steady supply for its vehicle manufacturing. Its integral position in the supply chain suggests reliable profit margins and consistent cash flow.

Dongfeng Motor Group's specialization in military vehicle production positions this segment as a Cash Cow within their BCG Matrix. As a major Chinese state-owned manufacturer, Dongfeng benefits from a consistent and reliable revenue stream in this specialized market, characterized by long-term contracts and lower market volatility, translating into steady cash generation.

Dongfeng Motor Group's financial and related automotive services represent a significant Cash Cow. This segment, encompassing vehicle financing and after-sales support, thrives in a mature market where demand is consistent and predictable, generating steady, reliable revenue streams. In 2023, Dongfeng's financial services segment reported consistent profitability, contributing significantly to the group's overall financial stability.

| Segment | BCG Status | Key Characteristics | 2024 Data/Observation |

|---|---|---|---|

| Traditional ICE Passenger Vehicles (Wholly-Owned Brands) | Cash Cow | High market share, consistent sales volume, mature market | 55% of total sales in 2024 |

| Auto Parts & Components | Cash Cow | Integral to supply chain, reliable profit margins, consistent cash flow | Bedrock of operations, ensuring steady supply |

| Military Vehicles | Cash Cow | Long-term contracts, low market volatility, stable revenue | Consistent and reliable revenue stream |

| Financial & Automotive Services | Cash Cow | Mature market, predictable demand, steady income | Consistent profitability reported in 2023 |

Delivered as Shown

Dongfeng Motor Group BCG Matrix

The Dongfeng Motor Group BCG Matrix you are currently previewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, featuring all strategic insights and detailed market positioning, is ready for your immediate use in business planning and decision-making.

Dogs

Dongfeng Honda's internal combustion engine (ICE) vehicle sales have seen a sharp downturn, with a 30.9% drop in 2024, bringing sales below the one million unit mark for the first time in almost a decade. This significant decline reflects Honda's strategic shift away from ICE production in China, signaling a shrinking presence in a segment facing diminishing demand.

These traditional ICE models within Dongfeng Honda's portfolio are increasingly being categorized as 'Dogs' in the BCG matrix. This classification stems from their current market position, characterized by low growth and declining sales, suggesting they are resource-intensive without offering strong future growth prospects.

Traditional Dongfeng Peugeot Citroën (DPCA) passenger car models are currently positioned as Dogs in the BCG Matrix. In June 2025, these models experienced significant year-on-year sales declines, contributing to a 9.24% overall drop in DPCA's total sales. This underperformance is largely attributed to their low market share and the waning demand for older internal combustion engine (ICE) vehicles within the highly competitive Chinese automotive market.

Certain Dongfeng Forthing internal combustion engine (ICE) models are experiencing a downturn. For instance, the Forthing T5 EVO and Future Youting models saw notable year-on-year sales drops in November 2024.

This decline reflects a broader market trend favoring new energy vehicles (NEVs). As a result, these traditional ICE models are losing ground and could be considered question marks in the BCG matrix, potentially needing strategic reassessment or even divestment.

Older Generation Dongfeng Aeolus ICE Models

Older generation Dongfeng Aeolus internal combustion engine (ICE) models are likely positioned as Dogs within the Dongfeng Motor Group's BCG Matrix. As the automotive market rapidly shifts towards electrification, these ICE models probably face declining market share and limited growth prospects.

The overall trend in the automotive industry, especially in China, shows a significant push towards new energy vehicles (NEVs). For instance, by the end of 2023, China's NEV sales had surpassed 9.49 million units, marking a substantial year-on-year increase. This market dynamic puts pressure on traditional ICE offerings, including older Aeolus models, which may struggle to compete against newer, more technologically advanced, and environmentally friendly alternatives.

- Low Market Share: Older ICE models often have a diminished presence in a market increasingly dominated by NEVs.

- Limited Growth Potential: The rapid electrification trend suggests that the growth trajectory for traditional ICE vehicles is slowing down considerably.

- Competitive Disadvantage: Without significant updates, these models may lack the features, efficiency, or environmental credentials that consumers now expect.

- Portfolio Drag: These models could represent a drain on resources without generating substantial returns, impacting overall portfolio performance.

Divested Joint Ventures

Divested Joint Ventures represent Dongfeng Motor Group's strategic exits from underperforming collaborations. The dissolution of Dongfeng Renault, the bankruptcy of Dongfeng Yulon, and the withdrawal of Dongfeng Yueda Kia are clear examples of these divestments. These ventures struggled to achieve sustainable market share or profitability, underscoring the risks in the automotive sector.

These exits highlight a strategic pruning of the portfolio, focusing resources on more promising areas. For instance, Dongfeng Renault ceased operations in 2020, and Dongfeng Yulon declared bankruptcy in 2020. Dongfeng Yueda Kia also underwent significant restructuring and ownership changes, indicating a shift away from these specific partnerships.

- Dongfeng Renault Dissolution: Ended in 2020, marking a significant exit from the passenger vehicle market through this particular JV.

- Dongfeng Yulon Bankruptcy: The venture faced financial collapse and bankruptcy proceedings in 2020, illustrating severe underperformance.

- Dongfeng Yueda Kia Restructuring: While not a complete exit, significant changes and reduced stakes reflect a strategic re-evaluation of this JV's future.

Certain traditional internal combustion engine (ICE) models within Dongfeng Motor Group's various joint ventures and brands are now classified as Dogs. This is due to their low market share and declining sales, especially in the face of China's rapidly growing new energy vehicle (NEV) market. For example, Dongfeng Honda's ICE sales dropped 30.9% in 2024, and DPCA saw a 9.24% overall sales decline in June 2025, largely due to these older ICE models.

These 'Dog' products, such as older Dongfeng Aeolus ICE models and specific Dongfeng Forthing ICE variants, represent resource drains with minimal future growth potential. Their underperformance is exacerbated by a competitive disadvantage against newer, more appealing NEVs and a general market shift away from traditional ICE technology.

The strategic divestment from ventures like Dongfeng Renault and the restructuring of Dongfeng Yueda Kia further underscore Dongfeng Motor Group's move away from underperforming ICE-centric businesses. These actions align with a broader industry trend, prioritizing electrification and higher-growth segments.

The table below illustrates the declining sales of some ICE models, highlighting their 'Dog' status.

| Brand/Model Segment | 2024 Sales Trend (YoY) | Market Position | BCG Matrix Category |

| Dongfeng Honda (ICE) | -30.9% | Low Market Share, Declining | Dog |

| DPCA Passenger Cars (ICE) | -9.24% (Overall June 2025) | Low Market Share, Declining | Dog |

| Dongfeng Forthing (Specific ICE Models) | Notable YoY drops (e.g., T5 EVO, Future Youting Nov 2024) | Low Market Share, Declining | Dog |

| Dongfeng Aeolus (Older ICE) | Declining Market Share | Low Market Share, Declining | Dog |

Question Marks

New energy vehicle (NEV) models like the 2025 Dongfeng Aeolus L7 PHEV and the range of Dongfeng Forthing NEVs are positioned in a rapidly expanding market segment. Despite this high-growth environment, these specific models currently represent a smaller portion of the overall NEV market share.

Significant investment in marketing, brand building, and ongoing research and development will be crucial for these vehicles to capture a larger market presence and potentially achieve leadership positions. Their trajectory remains uncertain, placing them in the 'question mark' category of the BCG matrix.

Dongfeng Motor Group's significant investment of CNY 100 billion in R&D for intelligent technologies like electronic architectures, automotive-grade chips, and autonomous driving places these initiatives squarely in the Stars category of the BCG matrix. These areas represent high-growth potential but also demand substantial capital expenditure with uncertain near-term profitability, characteristic of a Star. This strategic allocation aims to position Dongfeng as a leader in the evolving automotive landscape.

Dongfeng Honda's new NEV factory, a significant investment aimed at capturing a larger share of China's burgeoning electric vehicle market, has begun production. This strategic move by the joint venture is designed to bolster its new energy vehicle (NEV) offerings and compete more effectively.

However, these new NEV models from Dongfeng Honda are entering a highly competitive landscape characterized by established domestic players who already command substantial market share. Initial market penetration for these new ventures is expected to be low, presenting a challenge for rapid growth and profitability.

In 2023, China's NEV sales surpassed 9 million units, a testament to the segment's explosive growth. Dongfeng Honda's new models will need to achieve substantial sales volume quickly to overcome the initial low market share and intense competition, a common characteristic of 'question mark' business units in the BCG matrix.

High-End Electric Off-Road Concepts Beyond M-Hero

Dongfeng Motor Group is strategically positioning itself in the burgeoning high-end electric off-road segment. While the M-Hero brand is making strides, the company is exploring other concepts to capture this high-growth market. These ventures, though currently in nascent stages or possessing minimal market share, represent significant potential for future expansion.

These emerging high-end electric off-road concepts are classified as question marks in the BCG matrix. They operate in a market with substantial growth prospects, demanding considerable investment in research, development, and marketing to achieve market penetration and establish a strong brand presence. Success hinges on innovative product design, robust performance capabilities, and effective market positioning against established and emerging competitors.

- Emerging Electric Off-Road Concepts: Dongfeng is evaluating additional premium electric off-road models beyond M-Hero, aiming to diversify its offerings in this niche.

- High Growth Potential: The global market for luxury electric SUVs and off-road vehicles is experiencing rapid expansion, driven by consumer demand for sustainability and advanced capabilities. For instance, the global electric SUV market size was valued at approximately USD 250 billion in 2023 and is projected to grow significantly.

- Significant Investment Required: Developing these advanced off-road vehicles necessitates substantial capital outlay for battery technology, powertrain development, and specialized chassis engineering.

- Market Introduction Challenges: Successfully launching these concepts will depend on overcoming consumer perception, building brand loyalty in a competitive landscape, and ensuring competitive pricing and features.

Hydrogen Fuel Cell Commercial Vehicles

The market for hydrogen fuel cell heavy trucks is still in its early stages, with very low sales volumes recorded in 2024. Despite this, it holds significant potential for future growth as a clean energy solution for commercial vehicles.

Dongfeng Motor Group is actively investing in this sector, developing advanced systems like Mach Power and Dongfeng Hydrogen Boat. These initiatives require substantial research and development alongside considerable infrastructure investment to ensure their long-term success and market adoption.

Key considerations for Dongfeng's fuel cell commercial vehicles include:

- Nascent Market: Low 2024 sales volumes highlight the early stage of fuel cell adoption in heavy trucking.

- High Growth Potential: Fuel cell technology offers a promising path towards zero-emission commercial transport.

- Significant R&D Investment: Dongfeng's Mach Power and Hydrogen Boat systems necessitate ongoing research to refine performance and efficiency.

- Infrastructure Dependency: Widespread adoption hinges on the development of hydrogen refueling infrastructure, a major hurdle requiring substantial investment.

New energy vehicle (NEV) models like the 2025 Dongfeng Aeolus L7 PHEV and the range of Dongfeng Forthing NEVs are positioned in a rapidly expanding market segment. Despite this high-growth environment, these specific models currently represent a smaller portion of the overall NEV market share.

Significant investment in marketing, brand building, and ongoing research and development will be crucial for these vehicles to capture a larger market presence and potentially achieve leadership positions. Their trajectory remains uncertain, placing them in the 'question mark' category of the BCG matrix.

Dongfeng Honda's new NEV factory, a significant investment aimed at capturing a larger share of China's burgeoning electric vehicle market, has begun production. However, these new NEV models from Dongfeng Honda are entering a highly competitive landscape characterized by established domestic players who already command substantial market share. Initial market penetration for these new ventures is expected to be low, presenting a challenge for rapid growth and profitability. In 2023, China's NEV sales surpassed 9 million units, a testament to the segment's explosive growth. Dongfeng Honda's new models will need to achieve substantial sales volume quickly to overcome the initial low market share and intense competition, a common characteristic of 'question mark' business units in the BCG matrix.

Dongfeng Motor Group is strategically positioning itself in the burgeoning high-end electric off-road segment. While the M-Hero brand is making strides, the company is exploring other concepts to capture this high-growth market. These ventures, though currently in nascent stages or possessing minimal market share, represent significant potential for future expansion. The global market for luxury electric SUVs and off-road vehicles is experiencing rapid expansion, with the global electric SUV market size valued at approximately USD 250 billion in 2023. Developing these advanced off-road vehicles necessitates substantial capital outlay for battery technology, powertrain development, and specialized chassis engineering. Successfully launching these concepts will depend on overcoming consumer perception, building brand loyalty in a competitive landscape, and ensuring competitive pricing and features.

The market for hydrogen fuel cell heavy trucks is still in its early stages, with very low sales volumes recorded in 2024. Despite this, it holds significant potential for future growth as a clean energy solution for commercial vehicles. Dongfeng Motor Group is actively investing in this sector, developing advanced systems like Mach Power and Dongfeng Hydrogen Boat. These initiatives require substantial research and development alongside considerable infrastructure investment to ensure their long-term success and market adoption. Key considerations for Dongfeng's fuel cell commercial vehicles include low 2024 sales volumes highlighting the early stage of fuel cell adoption, high growth potential towards zero-emission commercial transport, significant R&D investment in Mach Power and Hydrogen Boat systems, and dependency on the development of hydrogen refueling infrastructure.

| Business Unit | Market Growth | Relative Market Share | BCG Classification |

| Dongfeng Aeolus L7 PHEV & Forthing NEVs | High | Low | Question Mark |

| Dongfeng Honda NEVs | High | Low | Question Mark |

| Emerging Electric Off-Road Concepts | High | Low | Question Mark |

| Hydrogen Fuel Cell Heavy Trucks | High | Low | Question Mark |

BCG Matrix Data Sources

Our Dongfeng Motor Group BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.