Dongfeng Motor Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dongfeng Motor Group Bundle

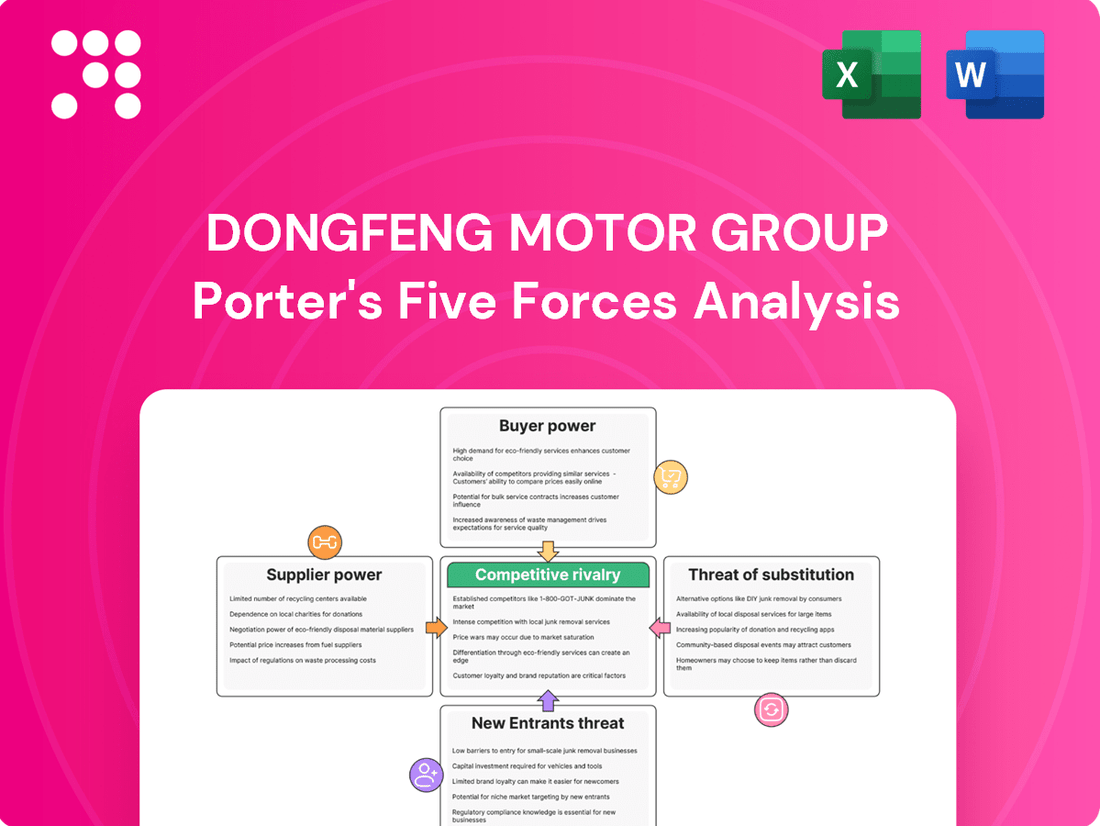

Dongfeng Motor Group faces significant competitive pressures, with intense rivalry among established players and the looming threat of new entrants in the rapidly evolving automotive market. Bargaining power of buyers, driven by price sensitivity and brand loyalty, also plays a crucial role in shaping their strategies.

The complete report reveals the real forces shaping Dongfeng Motor Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Dongfeng Motor Group's reliance on a concentrated supplier base for critical components like batteries for New Energy Vehicles (NEVs) and advanced semiconductors poses a significant risk. In 2024, the global semiconductor shortage continued to impact automotive production, with lead times for certain chips extending to over a year, directly affecting manufacturers like Dongfeng.

A limited number of specialized suppliers for these high-tech components grants them considerable leverage. This can translate into higher input costs for Dongfeng, squeezing profit margins, or even lead to production delays if these key suppliers face their own operational challenges. For instance, battery cell manufacturers, particularly those producing advanced chemistries, are experiencing robust demand, strengthening their negotiating position.

The costs and complexities involved in switching suppliers significantly impact Dongfeng Motor Group's bargaining power. If transitioning to a new supplier requires substantial investment in retooling manufacturing lines, redesigning components, or undergoing lengthy requalification procedures, current suppliers gain leverage. This is especially true for specialized or proprietary parts where alternatives are scarce or require extensive integration efforts.

The uniqueness of inputs is a key driver of supplier bargaining power for Dongfeng Motor Group. When suppliers provide highly specialized or patented components, particularly crucial for the performance and differentiation of Dongfeng's vehicles, their leverage grows significantly. This is especially relevant in the fast-paced new energy vehicle (NEV) sector, where advanced battery technology or unique powertrain systems can be critical differentiators.

Threat of Forward Integration

The threat of forward integration by suppliers represents a significant concern for Dongfeng Motor Group. If a supplier, particularly one providing critical or high-value components, were to establish its own automotive manufacturing operations, it could dramatically shift bargaining power. This would allow them to capture more of the value chain, potentially dictating terms or even becoming a direct competitor.

While less common for suppliers of mass-produced, standardized parts, the possibility exists for specialized component providers. For instance, a firm excelling in advanced battery technology for electric vehicles might explore assembling entire EV units if the market conditions and capital investment become favorable. This scenario would directly challenge Dongfeng’s established position.

Consider the automotive industry's ongoing shift towards electrification and autonomous driving. Suppliers specializing in these cutting-edge technologies, which require substantial R&D investment and proprietary know-how, might find forward integration a more viable strategy. For example, a 2024 report highlighted a 15% increase in M&A activity among EV component suppliers, indicating a consolidation and potential for larger players to vertically integrate.

- Supplier Capability: Assess the technical expertise and capital resources of key suppliers to gauge their potential for forward integration.

- Market Dynamics: Monitor industry trends, particularly in new technologies like EVs and autonomous systems, where specialized suppliers may have a stronger incentive to integrate forward.

- Competitive Landscape: Analyze if any suppliers are already exhibiting characteristics or making investments that suggest a move towards manufacturing their own vehicles.

Importance of Supplier to Dongfeng

Dongfeng Motor Group's substantial size means it is a significant customer for many of its suppliers. This scale grants Dongfeng considerable leverage, as suppliers are likely reliant on its business. For instance, if a supplier's revenue heavily depends on Dongfeng, they may be incentivized to offer competitive pricing and favorable terms to retain this crucial relationship.

The bargaining power of suppliers for Dongfeng is influenced by the overall importance of Dongfeng as a customer to them. If Dongfeng accounts for a large percentage of a supplier's total sales, that supplier will likely be more amenable to negotiating better terms and conditions. Dongfeng's sheer scale as an automaker suggests it is a major client for a wide array of component manufacturers.

- Supplier Dependence: Dongfeng's large order volumes make it a critical revenue source for many suppliers, potentially weakening supplier bargaining power.

- Economies of Scale: Suppliers serving Dongfeng likely benefit from economies of scale, which can reduce their per-unit costs and give them less room to absorb further price concessions.

- Component Specialization: The degree to which suppliers offer specialized or unique components can influence their bargaining power; highly specialized parts may give suppliers more leverage.

Dongfeng Motor Group faces significant supplier bargaining power, particularly for critical components like batteries and semiconductors. The global semiconductor shortage in 2024, with lead times exceeding a year for some chips, directly impacted automotive production, including Dongfeng's. This scarcity, coupled with the specialized nature of these inputs, grants suppliers substantial leverage, potentially leading to higher costs and production disruptions.

The cost and complexity of switching suppliers are key factors amplifying supplier power. When transitioning to new suppliers for specialized parts requires significant investment in retooling or lengthy requalification, existing suppliers gain leverage. This is particularly true in the NEV sector, where advanced battery technology or unique powertrain systems are essential differentiators.

Suppliers of unique or proprietary components hold considerable sway over Dongfeng. When these specialized parts are crucial for vehicle performance and market differentiation, suppliers can dictate terms. The automotive industry's shift towards electrification and autonomous driving in 2024, with a reported 15% increase in M&A among EV component suppliers, signals consolidation and potential for forward integration by these specialized firms.

| Factor | Impact on Dongfeng | Example/Data (2024) |

|---|---|---|

| Concentrated Supplier Base | Increased leverage for suppliers | Semiconductor lead times > 1 year |

| Uniqueness of Inputs | Higher supplier power for specialized components | Advanced battery technology for NEVs |

| Switching Costs | Reinforces existing supplier relationships | Retooling, requalification for new parts |

| Forward Integration Threat | Potential for suppliers to become competitors | Increased M&A in EV component sector (15% rise) |

What is included in the product

This analysis unpacks the competitive intensity faced by Dongfeng Motor Group, detailing the power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players in the automotive sector.

Understand the competitive landscape of Dongfeng Motor Group's Porter's Five Forces with easily digestible charts and summaries, simplifying complex strategic analysis.

Quickly identify and address key competitive pressures impacting Dongfeng Motor Group by visualizing the intensity of each force, enabling targeted strategic responses.

Customers Bargaining Power

The price sensitivity of buyers in China's automotive sector is a significant factor for Dongfeng Motor. Intense competition, particularly in the electric vehicle (EV) market, has led to widespread price wars, forcing manufacturers to offer more competitive pricing. Consumers are actively seeking the best value, directly impacting Dongfeng's pricing power and profitability.

The automotive market is flooded with choices. Consumers can pick from a vast selection of domestic and international brands, and the surge in new energy vehicles (NEVs) further expands these options. For instance, in 2024, the Chinese NEV market alone saw sales exceeding 6 million units, offering buyers a clear alternative to traditional internal combustion engine vehicles.

Buyer Information Availability significantly strengthens the bargaining power of customers for Dongfeng Motor Group. The widespread availability of detailed vehicle specifications, pricing comparisons, and independent customer reviews online means buyers are far more informed than ever before. This accessibility directly reduces the information gap between Dongfeng and its potential customers, giving buyers a stronger hand when negotiating prices and features.

Buyer Volume and Concentration

While individual car buyers are generally fragmented, large fleet buyers, such as rental companies or government agencies, can wield considerable bargaining power. This is particularly true for Dongfeng Motor Group when dealing with bulk purchases for commercial or public sector fleets.

For instance, in 2024, the Chinese government's procurement policies for new energy vehicles (NEVs) significantly influenced pricing and feature sets for manufacturers like Dongfeng. Large orders from these entities can dictate terms, pushing for lower per-unit costs and customized specifications.

- Buyer Volume: Large fleet orders, especially from government or commercial entities, represent substantial purchase volumes for Dongfeng.

- Concentration: A few major fleet buyers can represent a significant portion of Dongfeng's sales in certain segments, increasing their leverage.

- Impact on Pricing: High buyer concentration can lead to price concessions for Dongfeng, impacting profit margins on these large deals.

- Sector Specificity: Dongfeng's exposure to commercial vehicle sales and potential military contracts makes it more susceptible to the bargaining power of concentrated buyers in these sectors.

Product Differentiation

The degree to which Dongfeng Motor's vehicles are differentiated from competitors significantly impacts customer bargaining power. If Dongfeng can successfully offer unique technology, distinctive design, or strong brand appeal, customers are likely to be less sensitive to price, thereby reducing their bargaining leverage.

However, the competitive landscape in China, particularly in certain automotive segments, is characterized by increasing homogeneity. This means that many vehicles offer similar features and performance, which can empower customers to demand lower prices or switch to alternatives more readily. For instance, in 2024, the passenger vehicle market saw intense competition, with many brands offering comparable SUV and sedan models, putting pressure on manufacturers like Dongfeng to differentiate effectively.

- Product Differentiation: Dongfeng's ability to stand out through unique features, design, or brand reputation directly counters customer bargaining power.

- Market Homogeneity: The increasing similarity of vehicles in the Chinese market, a trend observed through 2024, amplifies customer options and their ability to negotiate.

- Price Sensitivity: Strong differentiation reduces customer price sensitivity, while a lack of it increases it, giving customers more sway.

The bargaining power of customers for Dongfeng Motor Group is substantial, driven by high price sensitivity and a vast array of choices in the Chinese automotive market. With over 6 million NEV sales in China in 2024 alone, consumers have ample alternatives, intensifying competition and limiting Dongfeng's pricing flexibility. This environment, marked by increasing product homogeneity, empowers buyers to demand better value and makes switching brands easier.

| Factor | Impact on Dongfeng | 2024 Data/Observation |

|---|---|---|

| Price Sensitivity | High, limiting pricing power | Intense price wars in the EV segment |

| Availability of Substitutes | High, due to market saturation | Over 6 million NEV sales in China in 2024 |

| Buyer Information | Empowers buyers with knowledge | Widespread online reviews and price comparisons |

| Fleet Buyer Power | Significant for bulk orders | Government NEV procurement policies influence terms |

Full Version Awaits

Dongfeng Motor Group Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Dongfeng Motor Group, offering a deep dive into the competitive landscape. You're looking at the actual document, which meticulously details the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the automotive sector. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for immediate use.

Rivalry Among Competitors

The Chinese automotive market is a crowded arena, featuring a substantial number of both domestic manufacturers and global automotive giants. This includes established brands alongside a growing wave of new energy vehicle (NEV) startups, creating a highly diverse competitive environment.

Dongfeng Motor Group faces intense pressure from this multifaceted competition. In 2023, China's auto sales surpassed 30 million units, a testament to the market's sheer size and the fierce battle for market share among numerous players.

The Chinese automotive market, while experiencing robust growth, particularly in the New Energy Vehicle (NEV) sector, faces intensifying competitive rivalry. In 2023, China's auto sales reached 30.09 million units, a 12% increase year-on-year, with NEVs accounting for 9.495 million units, up 37.7% from 2022. This rapid expansion, coupled with significant investments in new model development and production capacity by numerous players, creates a dynamic environment where oversupply is a growing concern in certain segments.

The automotive industry, and particularly the Chinese market where Dongfeng Motor operates, is characterized by an intense pace of technological innovation, especially in electrification and autonomous driving. Rivals are aggressively launching new models packed with advanced features, forcing Dongfeng to prioritize its own product differentiation and innovation efforts to remain competitive.

In 2023, China's new energy vehicle (NEV) sales surged by 37.9% year-on-year, reaching 9.495 million units, highlighting the rapid shift in consumer preference. This trend underscores the critical need for Dongfeng Motor to continuously innovate its product portfolio, integrating cutting-edge smart technologies and powertrain advancements to capture market share against agile competitors.

Exit Barriers

Dongfeng Motor Group faces intensified competitive rivalry due to significant exit barriers within the automotive industry. These barriers, including substantial investments in manufacturing plants and specialized equipment, make it difficult and costly for companies to leave the market, even when facing financial difficulties. This often results in a prolonged presence of less profitable entities, intensifying price wars and impacting overall industry profitability.

The high capital intensity of automotive manufacturing, for instance, means that exiting the market would involve significant losses on the sale of specialized assets. In 2024, the global automotive sector continued to grapple with overcapacity in certain segments, a situation exacerbated by companies being unable to divest their fixed assets easily. This forces them to continue production, leading to aggressive pricing strategies to maintain market share.

- High Capital Investment: The automotive sector requires enormous upfront investment in factories, machinery, and research and development, creating a substantial barrier to exit.

- Specialized Workforce: A highly skilled and specialized labor force in areas like engineering and manufacturing is difficult to redeploy or retrain, making workforce reductions costly upon exit.

- Long-Term Commitments: Companies often have long-term contracts with suppliers and distributors, creating further entanglement and expense if they attempt to cease operations.

- Brand and Reputation: The significant effort and investment required to build a brand in the automotive industry mean that companies are reluctant to abandon their market presence, even in challenging times.

Strategic Alliances and Joint Ventures

Strategic alliances and joint ventures are a significant factor in the automotive industry, particularly in China, impacting competitive rivalry. These collaborations allow companies to combine strengths, share development costs, and access new markets, thereby intensifying competition. For instance, by mid-2024, the Chinese automotive market continued to see numerous joint ventures and strategic partnerships forming, both domestically and with foreign automakers, aiming to accelerate the transition to electric vehicles and smart technologies.

Dongfeng Motor Group actively participates in these collaborations. As of early 2024, Dongfeng maintained significant joint ventures with international players like Stellantis and Nissan. These partnerships enable Dongfeng to leverage advanced technologies and global manufacturing expertise, but also mean facing intensified competition from these very partners in certain market segments. The success of these ventures often hinges on effective integration and shared strategic vision, directly influencing the competitive landscape.

- Increased Market Penetration: Joint ventures allow companies to pool resources and expertise, enabling faster market entry and expansion, which directly escalates competitive pressures.

- Technology Sharing: Alliances facilitate the sharing of critical technologies, such as EV platforms and autonomous driving systems, leading to a more rapid pace of innovation and heightened competition based on technological advancement.

- Cost Efficiencies: By sharing R&D and production costs, partners can offer more competitive pricing, further intensifying rivalry among all players in the market.

- Global Reach: International joint ventures provide access to new geographic markets, meaning companies must compete on a broader, global scale, not just within their home territories.

The competitive rivalry within the Chinese automotive market, where Dongfeng Motor Group operates, is exceptionally fierce. This intensity is driven by a large number of domestic and international players, all vying for market share, particularly in the rapidly expanding New Energy Vehicle (NEV) segment. In 2023, China's auto sales surpassed 30 million units, with NEVs alone accounting for over 9.4 million units, showcasing the vastness and dynamism of this competitive landscape.

Dongfeng Motor faces significant pressure from rivals who are aggressively innovating and launching new models, often equipped with advanced smart technologies and powertrain advancements. This rapid pace of technological change, especially in electrification and autonomous driving, necessitates continuous product differentiation and innovation from Dongfeng to maintain its competitive edge.

The presence of high exit barriers, such as substantial investments in manufacturing facilities and specialized equipment, contributes to the sustained rivalry. Companies find it difficult to leave the market, leading to continued production and often aggressive pricing strategies to retain market share, even in challenging economic conditions.

Strategic alliances and joint ventures, prevalent in the Chinese market, further intensify competition by enabling companies to share costs, access technology, and expand market reach. Dongfeng's own joint ventures, for instance, provide access to global expertise but also place it in direct competition with its partners in certain segments.

| Key Competitors | Market Share (Approx. 2023) | Key Strengths |

| BYD | ~18% (NEV Market) | Vertical integration, strong battery technology, wide NEV range |

| SAIC Motor | ~12% (Overall Market) | Strong domestic presence, extensive JV portfolio (VW, GM) |

| Geely Auto | ~7% (Overall Market) | Brand diversification (Volvo, Polestar), rapid NEV development |

| Changan Automobile | ~6.5% (Overall Market) | Growing NEV portfolio, focus on smart technology |

| Tesla | ~6% (NEV Market) | Brand recognition, advanced EV technology, charging infrastructure |

SSubstitutes Threaten

The rising accessibility and convenience of public transportation systems, particularly in major urban centers, pose a direct substitute for private car ownership. This trend is amplified by the rapid expansion of ride-sharing platforms, offering flexible and often cost-effective alternatives for mobility.

In 2024, cities like London saw continued growth in their integrated public transport usage, with over 3 billion journeys recorded annually across its various networks. Similarly, ride-sharing services, such as Uber and Lyft, reported significant increases in ride volume, indicating a growing preference among consumers for these on-demand transportation solutions over personal vehicle use, impacting potential demand for Dongfeng Motor's offerings.

The rise of alternative mobility solutions presents a significant threat to traditional automotive manufacturers like Dongfeng Motor Group. Services like e-bike sharing, electric scooter rentals, and car subscription models offer convenient and often more affordable transportation, especially in urban environments. For instance, the global micro-mobility market was valued at approximately USD 40 billion in 2023 and is projected to grow substantially, indicating a shift in consumer preferences away from outright car ownership for shorter trips.

These substitutes appeal particularly to younger generations and those prioritizing flexibility and cost-effectiveness over long-term vehicle investment. As these alternatives become more integrated into urban infrastructure and consumer habits, they directly compete for the same transportation needs that Dongfeng's vehicles aim to fulfill. This trend could dampen demand for new car sales, especially in segments catering to urban commuting and second-car ownership.

Rapid technological advancements, particularly in autonomous driving and advanced driver-assistance systems (ADAS), pose a significant threat to traditional private vehicle ownership for companies like Dongfeng Motor Group. If public transport or ride-sharing services integrate these technologies to offer superior convenience and safety, it could diminish the appeal of owning a personal car. For instance, by 2025, the global autonomous vehicle market is projected to reach over $200 billion, indicating a strong shift towards alternative mobility solutions.

Shift in Consumer Preferences

A significant shift in consumer preferences away from traditional personal car ownership represents a growing threat of substitutes for Dongfeng Motor Group. This trend is driven by increasing environmental awareness, evolving urban planning, and changing lifestyle choices, all favoring more sustainable and integrated transportation options.

For instance, the rise of ride-sharing services and the increasing adoption of public transportation, especially in densely populated urban areas, directly compete with the need for individual vehicle ownership. By 2024, the global mobility-as-a-service (MaaS) market is projected to reach substantial figures, indicating a strong consumer pull towards alternatives.

- Growing adoption of ride-sharing: Services like Didi Chuxing and Uber continue to gain traction, offering convenient and often cost-effective alternatives to car ownership, particularly in major Chinese cities where Dongfeng operates.

- Increased investment in public transport: Governments worldwide, including China, are investing heavily in expanding and modernizing public transit networks, making them more appealing and efficient for commuters.

- Demand for micro-mobility: Electric scooters and bikes are becoming popular for short urban commutes, further reducing reliance on cars for shorter distances.

- Environmental concerns: A growing segment of consumers is actively seeking eco-friendly transportation solutions, which may lead them to prioritize shared electric vehicles or public transit over purchasing a new gasoline-powered car.

Cost-Effectiveness of Substitutes

The relative cost-effectiveness of alternatives to owning a Dongfeng vehicle directly influences the threat of substitutes. If public transportation and ride-sharing services offer a more compelling value proposition in terms of affordability and convenience, it can significantly reduce consumer demand for Dongfeng's products.

For instance, in 2024, the average cost of a monthly public transport pass in major Chinese cities remained substantially lower than the combined expenses of car ownership, including fuel, insurance, and maintenance. Ride-sharing services further intensified this by offering flexible, pay-as-you-go options that appeal to users who prioritize cost control and infrequent travel.

- Cost Comparison: Public transport monthly passes in top-tier Chinese cities averaged around ¥200-¥300 in 2024, a fraction of the estimated ¥1,500-¥2,500 monthly cost of owning a compact car.

- Ride-Sharing Adoption: Ride-sharing platforms like Didi Chuxing saw continued strong user engagement in 2024, with many urban dwellers opting for these services for short to medium-distance travel, bypassing the need for personal vehicle ownership.

- Fuel Price Volatility: Fluctuations in gasoline prices throughout 2024 also played a role, making the predictable costs of public transport or ride-sharing more attractive compared to the variable expenses of internal combustion engine vehicles.

The increasing availability and affordability of public transportation, coupled with the convenience of ride-sharing services, directly challenges the necessity of personal vehicle ownership for many consumers. These alternatives are particularly appealing in urban settings where traffic congestion and parking costs are significant deterrents to owning a car.

In 2024, the global micro-mobility market, encompassing e-scooters and e-bikes, continued its robust expansion, with projections indicating a market value exceeding USD 60 billion. This growth highlights a clear consumer shift towards flexible, cost-effective, and often environmentally friendly short-distance travel options, directly impacting the demand for traditional vehicles like those produced by Dongfeng.

| Alternative Mobility Solution | 2024 Market Data/Trend | Impact on Dongfeng Motor Group |

|---|---|---|

| Public Transportation Usage | Over 3 billion journeys in London alone; significant investment in network expansion in China. | Reduces demand for personal urban commuting vehicles. |

| Ride-Sharing Services (e.g., Didi, Uber) | Continued strong user engagement in urban areas; flexible, pay-as-you-go models. | Offers a direct substitute for car ownership, especially for occasional users. |

| Micro-Mobility (E-scooters, E-bikes) | Global market projected to exceed USD 60 billion by 2024; popular for short urban trips. | Captures demand for short-distance travel, reducing the need for a car for such journeys. |

Entrants Threaten

The automotive sector, particularly with the burgeoning electric vehicle (EV) and advanced manufacturing trends, presents a formidable hurdle for new players due to immense capital demands. Establishing state-of-the-art R&D centers, constructing modern production plants, and building robust distribution and charging infrastructure necessitate billions of dollars in investment.

For instance, setting up a new EV manufacturing facility can easily cost upwards of $1 billion, a figure that excludes the substantial ongoing expenditures for research and development of battery technology and autonomous driving systems. Dongfeng Motor Group, like its established peers, has already made significant investments in these areas, creating a high barrier to entry.

Established players like Dongfeng Motor Group leverage significant economies of scale in production, procurement, and research and development. This allows them to achieve lower per-unit costs, making it difficult for new entrants to compete on price. For instance, Dongfeng's extensive manufacturing network and bulk purchasing power in 2024 enable substantial cost advantages.

Building strong brand loyalty in the competitive Chinese automotive market is a significant hurdle for new entrants. Dongfeng Motor Group, like other established players, has invested heavily in marketing and product development to cultivate trust and preference among consumers. This loyalty acts as a barrier, as customers often perceive costs, whether financial or psychological, associated with switching to an unfamiliar brand. For instance, in 2024, the Chinese passenger vehicle market saw a continued emphasis on brand reputation, with consumers often prioritizing established names and proven reliability over novelty, making it challenging for newcomers to capture significant market share.

Access to Distribution Channels

Securing access to established distribution channels presents a significant hurdle for new automotive players. Dongfeng Motor, like other major manufacturers, benefits from a vast and intricate network of dealerships and service centers built over years. For instance, in 2023, Dongfeng Motor continued to expand its sales network, aiming to reach more consumers across diverse regions in China.

New entrants must invest heavily to replicate this reach, often facing resistance from existing channel partners who are loyal to established brands. This can manifest as difficulty in securing prime dealership locations or obtaining favorable terms.

- Distribution Network Investment: Building a comparable network requires substantial capital outlay for infrastructure and logistics.

- Dealership Agreements: Incumbents often have exclusive or preferential agreements with dealerships, limiting options for newcomers.

- After-Sales Service Infrastructure: Establishing a reliable after-sales service network, crucial for customer retention, is a complex and costly undertaking for any new entrant.

Government Policy and Regulations

Government policies and regulations significantly influence the threat of new entrants in the automotive sector. Policies favoring state-owned enterprises, such as Dongfeng Motor Group, can erect substantial barriers. For instance, preferential treatment in licensing, access to capital, or government contracts can give established players an inherent advantage.

Furthermore, regulations promoting specific technologies, like New Energy Vehicles (NEVs), can also shape market entry. While these initiatives aim to foster innovation, they often require significant upfront investment in research, development, and manufacturing capabilities, which can be prohibitive for new, smaller companies. China's NEV mandates and subsidies, for example, have historically benefited larger, established manufacturers with the scale to comply and invest.

- Government Support for State-Owned Enterprises: Policies can grant SOEs like Dongfeng preferential access to financing, land, and permits, making it harder for private firms to compete.

- NEV Mandates and Subsidies: Strict emissions standards and generous subsidies for electric vehicles necessitate substantial R&D and production investment, favoring incumbents.

- Local Content Requirements: Regulations requiring a certain percentage of components to be sourced domestically can disadvantage foreign entrants or those without established local supply chains.

- Safety and Environmental Standards: Increasingly stringent safety and environmental regulations require significant capital expenditure for compliance, acting as a barrier to new entrants lacking these resources.

The threat of new entrants in the automotive sector, particularly for a company like Dongfeng Motor Group, is significantly mitigated by the immense capital requirements for establishing production facilities and developing advanced technologies. For instance, in 2024, the automotive industry continues to demand billions in investment for R&D, particularly in areas like electric vehicles and autonomous driving, creating a substantial barrier.

Established players benefit from economies of scale, which lower per-unit costs, making it difficult for newcomers to compete on price. Dongfeng's extensive manufacturing footprint and procurement power in 2024 provide a distinct cost advantage.

Brand loyalty and extensive distribution networks, cultivated over years by companies like Dongfeng, also present a formidable challenge for new entrants. In 2024, consumer preference in China often leans towards established brands with proven reliability, making market penetration difficult for unfamiliar names.

Government policies, including support for state-owned enterprises and mandates for new energy vehicles, can further solidify the position of incumbents like Dongfeng, while increasing the investment hurdle for new players.

| Factor | Impact on New Entrants | Dongfeng Motor Group's Advantage |

|---|---|---|

| Capital Investment | Extremely High (Billions for R&D, Manufacturing) | Established infrastructure and ongoing R&D investment create a high barrier. |

| Economies of Scale | Difficult to Achieve | Large-scale production and procurement in 2024 lead to lower per-unit costs. |

| Brand Loyalty & Distribution | Challenging to Build | Years of marketing and an extensive dealership network in China, reinforced in 2024. |

| Government Policy | Can be Disadvantageous | Potential preferential treatment and scale to meet NEV mandates. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Dongfeng Motor Group leverages data from the company's official annual reports, investor presentations, and publicly available financial statements. We supplement this with industry-specific market research reports from reputable firms and relevant government automotive industry data to provide a comprehensive competitive landscape.