Dell SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dell Bundle

Dell's impressive brand loyalty and strong direct-to-consumer model are significant strengths, but competitive pricing pressures and reliance on PC sales present notable challenges. Discover the complete picture behind Dell's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Dell Technologies commands exceptional global brand recognition, consistently holding a position among the top three PC vendors worldwide. This robust reputation, cultivated through years of delivering quality and fostering customer loyalty, offers a substantial competitive edge and a foundation for ongoing expansion. Dell's expansive reach extends across more than 170 countries, firmly establishing its presence in diverse international markets.

Dell's strength lies in its extensive and diverse product and service offerings, moving well beyond its PC origins. This includes servers, storage, networking gear, software, and a rapidly expanding services division, effectively positioning Dell as a full-spectrum IT solutions provider for a wide range of clients, from individuals to major corporations and government entities.

This broad portfolio significantly mitigates risk and bolsters market stability by reducing reliance on any single product category. Dell's strategic evolution into an end-to-end IT solutions provider, notably through its Infrastructure Solutions Group (ISG), strengthens its overall value proposition and market competitiveness.

Dell is demonstrating strong leadership in the AI-optimized server market, a significant growth area. The company reported substantial order backlogs and increasing shipments in fiscal year 2025, directly fueled by enterprise demand for AI solutions. This positions Dell to benefit from the ongoing AI revolution.

Dell's strategic partnerships with industry leaders like NVIDIA and AMD are crucial. These collaborations allow Dell to offer comprehensive AI infrastructure, making them a preferred provider for businesses looking to implement on-premises AI. This focus is a primary driver of their revenue growth for the foreseeable future.

Efficient Supply Chain and Direct Sales Model

Dell's direct-to-consumer sales model is a significant strength, fostering direct customer relationships and providing unparalleled control over its supply chain. This approach contributes to impressive cost efficiencies and enhances operational agility, allowing Dell to respond swiftly to market changes.

The company’s vertically integrated business model is key to maintaining lower costs and facilitating the quick rollout of new technologies, including advanced AI solutions. This integration ensures Dell can offer competitive pricing and rapid innovation.

Dell's robust supply chain and distribution network are fundamental to its success, enabling efficient operations even in volatile market environments. This infrastructure is crucial for delivering products and services reliably to a global customer base.

- Direct Sales Advantage Dell's direct sales model bypasses traditional retail markups, leading to cost savings passed on to consumers and higher margins for the company.

- Supply Chain Control This direct approach grants Dell greater visibility and control over inventory, production, and delivery, minimizing lead times and stockouts.

- Operational Agility The streamlined supply chain allows Dell to adapt quickly to demand fluctuations and introduce new products, such as AI-powered PCs, with greater speed.

- Cost Efficiency By managing its own sales channels and supply chain, Dell achieves significant cost efficiencies, contributing to its competitive pricing strategy.

Commitment to Innovation and R&D Investment

Dell's dedication to innovation is a significant strength, consistently demonstrated through substantial investments in research and development. This focus fuels the company's ability to introduce groundbreaking products and services. For instance, at CES 2025, Dell unveiled advancements in AI-powered PCs, highlighting their commitment to future computing trends.

The company's strategic investment in R&D is evident in its expanding Dell APEX portfolio, which offers flexible cloud solutions. Furthermore, Dell's advancements in data protection, showcased at Dell Technologies World 2025, underscore its proactive approach to emerging technological needs. These efforts ensure Dell remains competitive and relevant in a rapidly evolving tech landscape.

- Significant R&D Investment: Dell consistently allocates substantial resources to research and development, fostering a culture of continuous improvement and technological advancement.

- AI-Powered PC Innovations: Demonstrations at CES 2025 highlighted Dell's progress in integrating AI capabilities into personal computers, anticipating future market demands.

- Dell APEX Expansion: The growth of Dell APEX showcases a commitment to providing flexible and scalable cloud infrastructure solutions, meeting diverse customer needs.

- Advanced Data Protection: Innovations in data security and protection, presented at Dell Technologies World 2025, reinforce Dell's position as a trusted provider of robust IT solutions.

Dell's robust global brand recognition, consistently ranking among the top three PC vendors, provides a significant competitive advantage and a foundation for growth. Its expansive reach across over 170 countries solidifies its international market presence.

The company's comprehensive portfolio, extending beyond PCs to servers, storage, networking, software, and services, positions Dell as a full-spectrum IT solutions provider. This diversification reduces reliance on any single product category, enhancing market stability.

Dell is a leader in the AI-optimized server market, with substantial order backlogs and increasing shipments in fiscal year 2025 driven by enterprise AI demand. Strategic partnerships with NVIDIA and AMD further enhance its ability to offer integrated AI infrastructure solutions, a key revenue driver.

Dell's direct-to-consumer sales model fosters strong customer relationships and supply chain control, leading to cost efficiencies and agility. This integrated approach allows for competitive pricing and rapid innovation, as seen with AI-powered PCs unveiled at CES 2025.

Dell's commitment to innovation is backed by significant R&D investment, evident in its expanding APEX cloud solutions and advancements in data protection showcased at Dell Technologies World 2025.

What is included in the product

Delivers a strategic overview of Dell’s internal and external business factors, identifying its strengths, weaknesses, opportunities, and threats.

Dell's SWOT analysis offers a clear framework to identify and address critical market challenges, transforming potential weaknesses into actionable strategies.

Weaknesses

Dell's significant reliance on the Client Solutions Group (CSG), encompassing its PC business, remains a notable weakness. Despite efforts at diversification, CSG still represents a substantial chunk of Dell's overall revenue. This dependence makes the company vulnerable to the inherent volatility and recent declines observed in the PC market, which experienced a downturn in fiscal year 2023, with shipments falling by 15% globally.

While analysts anticipate a market recovery, Dell's heavy exposure to PC sales exposes it to the risks of market saturation and the cyclical nature of consumer demand. The consumer segment, specifically, has shown reduced purchasing power, further highlighting this vulnerability.

Dell's strategic acquisitions, notably the $67 billion purchase of EMC Corporation in 2016, have significantly increased its debt burden. As of the first quarter of 2024, Dell reported total debt of approximately $37.8 billion. This substantial leverage can constrain financial maneuverability, particularly in a rising interest rate environment, potentially hindering future growth initiatives or share repurchases.

The technology sector is a battlefield, with giants like HP, Lenovo, Apple, and Microsoft constantly challenging Dell across every product category. This fierce rivalry puts a squeeze on profits and makes it tough for Dell to stand out when many products are quite similar. Staying ahead means Dell must constantly innovate and operate with maximum efficiency.

Potential for Supply Chain Bottlenecks

Dell's otherwise streamlined supply chain isn't immune to global disruptions, especially concerning vital components like advanced GPUs crucial for the booming AI server market. These bottlenecks can directly hinder Dell's ability to capitalize on growth opportunities, leading to delayed shipments and affecting operational consistency.

The company's reliance on a complex global network means it's exposed to potential shortages and price fluctuations for key semiconductors and other advanced materials. For instance, the ongoing global chip shortage, while easing in some sectors, continues to present challenges for high-demand components, impacting production schedules. Increased geopolitical instability and economic uncertainty further amplify these supply chain vulnerabilities, potentially delaying product launches and impacting revenue forecasts.

- Vulnerability to Component Shortages: Dell faces risks from shortages of critical components, such as advanced GPUs, which are essential for its AI server offerings.

- Impact on Growth Realization: Supply chain disruptions can limit Dell's capacity to meet surging demand for AI infrastructure, thereby capping its growth potential.

- Operational and Financial Risks: Delays in product shipments and increased costs due to supply chain issues can negatively affect Dell's financial performance and operational stability.

- Exacerbating Factors: Geopolitical tensions and global economic volatility are identified as factors that could worsen these supply chain risks for Dell.

Lower Profit Margins in Hardware Sales

Dell operates in the computer hardware sector, an industry known for its thin profit margins. This makes it challenging for the company to boost profitability solely through hardware sales. For instance, in fiscal year 2024, while Dell saw revenue growth, the gross margin for its Infrastructure Solutions Group (ISG) was around 21%, and for its Client Solutions Group (CSG) it hovered near 23%, illustrating the competitive pressure on hardware pricing.

This inherent margin limitation means Dell must actively pursue higher-margin areas to improve its overall financial performance. The company's strategic shift towards services, software, and solutions is a direct response to this weakness. These areas typically offer better profitability compared to the commoditized nature of hardware. This pivot is essential for Dell to build a more resilient and profitable business model in the long term.

- Thin Margins: The hardware industry, a cornerstone of Dell's business, typically yields lower profit margins compared to services and software.

- Differentiation Challenge: Relying solely on hardware makes it difficult for Dell to significantly increase profitability or stand out from competitors.

- Strategic Imperative: Dell's focus on expanding its higher-margin services and solutions portfolio is critical to offset the inherent profitability constraints of hardware sales.

Dell's substantial debt, largely stemming from its 2016 acquisition of EMC, presents a significant financial weakness. As of Q1 FY2025, Dell's total debt stood at approximately $37.8 billion. This considerable leverage can limit its financial flexibility, making it harder to invest in new ventures or respond to market shifts, especially in a climate of potentially rising interest rates.

The company faces intense competition from established players like HP, Lenovo, and Apple, as well as emerging threats. This rivalry, particularly in the PC market, often leads to price wars and thinner profit margins, making it challenging for Dell to differentiate its offerings and maintain strong profitability. For instance, the global PC market saw a decline in shipments in 2023, impacting revenues across the sector.

Dell's heavy reliance on the PC market, its Client Solutions Group, remains a key vulnerability. While this segment is crucial for revenue, it's also subject to the cyclical nature and volatility of the personal computer industry. Any significant downturn in PC demand, as experienced in 2023 with a global shipment drop of around 15%, directly impacts Dell's overall financial performance.

Preview the Actual Deliverable

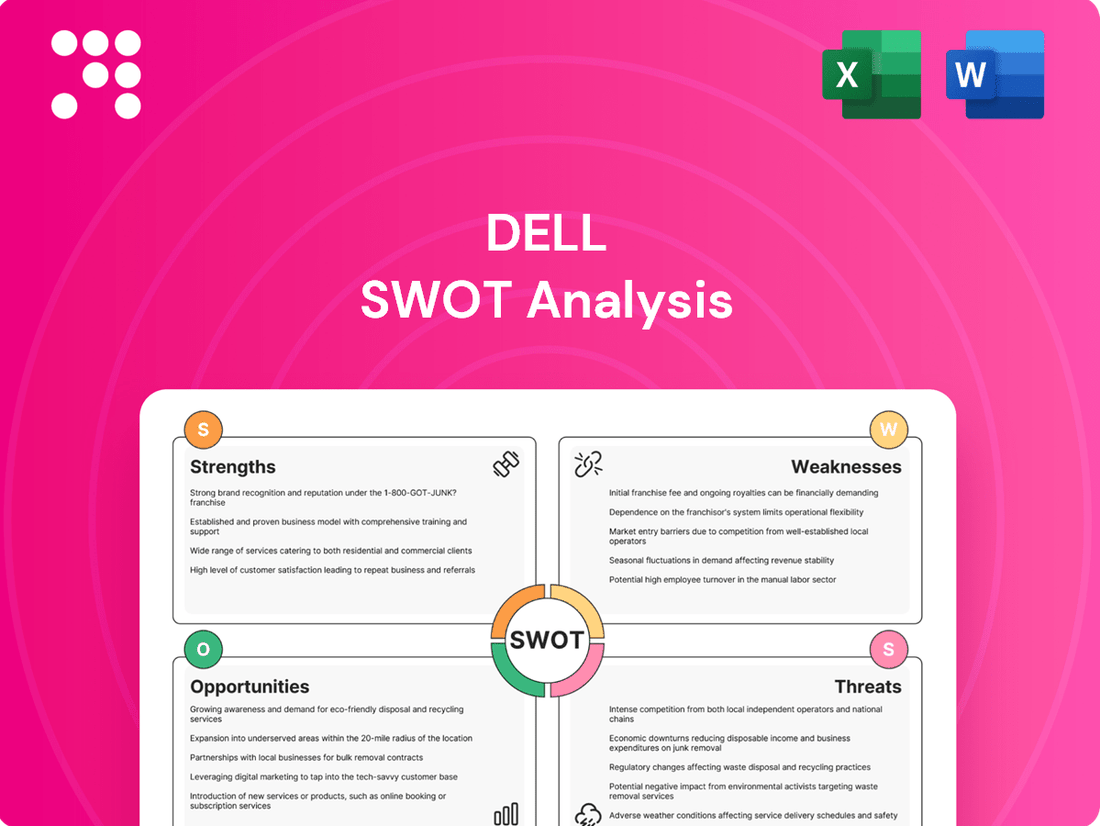

Dell SWOT Analysis

This is the actual Dell SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can see the clear breakdown of Dell's Strengths, Weaknesses, Opportunities, and Threats, giving you a comprehensive overview. This preview is exactly what you'll download, ensuring you get the full, detailed report.

Opportunities

The escalating demand for AI and machine learning solutions, especially AI-optimized servers, offers a substantial avenue for growth. Enterprises are increasingly opting to host generative AI workloads on-premises, driving this demand.

Dell's robust AI infrastructure portfolio, coupled with its 'AI Factory' strategy, strategically positions the company to leverage this burgeoning market. This approach spans from cloud service providers to enterprise and edge computing environments, demonstrating broad applicability.

This expansion into AI solutions presents an opportunity for Dell to enhance its revenue streams. Beyond server hardware sales, the company can generate higher-margin income through associated services, further solidifying its market presence.

Dell can capitalize on the booming cloud computing and data center market. The company's Infrastructure Solutions Group is well-positioned to meet the increasing demand for hybrid cloud and robust data management. Dell APEX, for instance, offers flexible consumption models that align with the evolving needs of businesses undergoing digital transformation.

Emerging markets offer substantial avenues for expansion, with technology adoption rates accelerating. Dell can leverage this by increasing its footprint in regions such as Southeast Asia and Latin America, where digital infrastructure is rapidly developing. For instance, IDC reported that IT spending in emerging markets was projected to grow by over 6% in 2024, presenting a clear opportunity for Dell's diversified product and service portfolio.

The ongoing global digital transformation is a major tailwind, driving demand for comprehensive IT solutions. Industries worldwide are investing heavily in cloud, AI, and data analytics, areas where Dell provides integrated hardware, software, and services. Dell's own reports indicate a significant increase in demand for its hybrid cloud solutions, reflecting this trend and highlighting the opportunity to provide end-to-end support for businesses undergoing modernization.

Leveraging Cybersecurity and Data Protection Needs

The escalating sophistication of cyber threats in 2024 and beyond creates a significant opportunity for Dell to bolster its cybersecurity and data protection solutions. Organizations worldwide are prioritizing these areas, with spending on cybersecurity expected to reach $232 billion in 2025, according to industry forecasts. Dell's established expertise in secure infrastructure, including advanced cyber vaults and Zero Trust principles, positions it well to capitalize on this growing demand.

Dell's strategic investments in secure infrastructure are directly addressing the critical needs of businesses navigating an increasingly complex threat landscape. For instance, their cyber vault technology offers immutable storage, protecting sensitive data from ransomware attacks that continue to plague enterprises. This focus on resilience and proactive threat detection, including AI-driven anomaly detection, is crucial for maintaining business continuity and trust.

- Expanding Managed Security Services: Dell can grow its managed security services portfolio, offering end-to-end protection for clients.

- Integrating AI for Threat Intelligence: Further embedding AI and machine learning into its security offerings can provide more sophisticated threat prediction and response capabilities.

- Partnerships for Extended Security Ecosystems: Collaborating with other cybersecurity leaders can create comprehensive solutions that address a wider range of threats.

- Focus on Data Sovereignty and Compliance: As data privacy regulations tighten globally, Dell can emphasize solutions that ensure data sovereignty and compliance, a key concern for businesses in 2025.

Innovation in AI PCs and Edge Computing

The rise of AI PCs presents a significant opportunity for Dell to boost its Client Solutions Group. By integrating enterprise-grade Neural Processing Units (NPUs) into its new AI-powered PCs, Dell can cater to the growing demand for more intelligent and responsive personal computing experiences.

Furthermore, the expansion of edge computing offers Dell a chance to broaden its market reach. The company's solutions designed for AI at the edge directly address evolving industry needs, positioning Dell to capitalize on the trend of processing data closer to its source for faster, more efficient operations.

- AI PC Market Growth: Analysts project the AI PC market to reach substantial figures, with some estimates suggesting over 250 million AI PCs could ship by 2027, indicating a robust growth trajectory.

- Dell's AI PC Strategy: Dell has actively launched AI-ready laptops and desktops, featuring Intel Core Ultra processors with integrated NPUs, designed to accelerate AI tasks for professionals.

- Edge Computing Investment: Dell continues to invest in its edge solutions portfolio, aiming to provide robust hardware and software for distributed AI deployments across various industries.

Dell's strategic focus on AI infrastructure, particularly AI-optimized servers and its 'AI Factory' approach, positions it to capitalize on the escalating demand for generative AI workloads hosted on-premises. This expansion into AI solutions offers a pathway to higher-margin revenue through associated services beyond hardware sales.

Threats

Dell faces significant pressure from tech titans like Hewlett Packard Enterprise, IBM, Lenovo, Apple, and Microsoft, all of whom are aggressively expanding their offerings. These rivals are not only competing in traditional hardware but also increasingly in integrated solutions and services, directly challenging Dell's established market positions.

The relentless innovation from these tech giants, particularly in areas like AI-driven hardware and cloud-native solutions, poses a constant threat to Dell's market share and its ability to maintain pricing power. For instance, in the PC market, Lenovo consistently holds a strong global market share, often exceeding 23% in recent quarters of 2024, indicating the intense competitive landscape Dell navigates.

The relentless pace of technological change presents a significant threat to Dell. Products and solutions can become outdated very quickly, forcing the company to invest heavily and consistently in research and development just to stay in the game. For example, the rapid evolution of AI hardware and the shift towards disaggregated infrastructure demand constant adaptation.

Dell's ability to keep pace with emerging technologies, such as advancements in generative AI and novel computing architectures, is crucial. Failure to adapt swiftly could allow more nimble competitors to gain a significant advantage, potentially leaving Dell behind in key market segments. This necessitates agile product development cycles and strategic foresight.

Global economic uncertainties, including potential recessions and persistent inflationary pressures, pose a significant threat to Dell. For instance, in early 2024, global GDP growth forecasts were revised downwards by institutions like the IMF due to these very concerns, directly impacting discretionary IT spending by both businesses and consumers. This cautious spending environment can lead to extended refresh cycles for hardware and reduced demand for new services, directly affecting Dell's revenue streams.

Supply Chain Risks and Geopolitical Factors

Dell's supply chain, while robust, still faces significant threats from geopolitical instability and evolving trade policies. For instance, the ongoing global semiconductor shortage, exacerbated by geopolitical tensions, continued to impact PC and server manufacturing throughout 2024, potentially affecting Dell's production volumes and delivery timelines.

Changes in trade agreements or the imposition of new tariffs, particularly concerning key manufacturing hubs like China, could directly increase Dell's cost of goods sold and necessitate costly adjustments to its sourcing strategies.

Furthermore, disruptions to the availability of critical components or raw materials, whether due to natural disasters or political unrest in supplier regions, pose a persistent risk. For example, in late 2024, reports indicated potential disruptions in rare earth mineral supply chains, essential for electronic components, which could ripple through Dell's manufacturing operations.

- Geopolitical Tensions: Ongoing global conflicts and trade disputes create uncertainty, potentially impacting international trade routes and component sourcing.

- Tariff Impacts: New or increased tariffs on imported goods or components could raise Dell's operational costs and affect pricing strategies.

- Component Shortages: Persistent shortages of key components, such as advanced semiconductors, can lead to production delays and limit product availability.

- Regional Manufacturing Risks: Reliance on specific manufacturing regions makes Dell vulnerable to localized disruptions like natural disasters or political instability.

Declining Profitability of Traditional Hardware

The ongoing commoditization of traditional PC and server hardware continues to squeeze profit margins for companies like Dell. This trend makes it increasingly difficult to achieve substantial profitability from these foundational product lines.

While the demand for AI servers presents a significant growth opportunity, the broader market reality of shrinking hardware profit margins underscores the critical need for Dell to successfully transition towards higher-value services and software offerings to offset these pressures.

- Margin Pressure: Dell's traditional PC and server hardware segments face persistent margin erosion due to intense market competition and commoditization.

- AI Server Opportunity: The burgeoning AI server market offers a counter-balance, but it requires significant investment and faces its own competitive dynamics.

- Strategic Pivot: A successful shift to services and software is essential for Dell to maintain overall profitability and drive future growth amidst hardware commoditization.

Dell's core hardware business faces intense competition, with rivals like Lenovo consistently capturing significant global market share, often above 23% in the PC segment during 2024. This aggressive competition, coupled with rapid technological advancements, particularly in AI and cloud solutions, constantly challenges Dell's market position and pricing power.

Economic uncertainties, including potential recessions and inflation, directly impact IT spending, leading to longer hardware refresh cycles and reduced demand for Dell's products and services. For instance, the IMF revised global GDP growth forecasts downwards in early 2024 due to these concerns, highlighting the volatile market conditions.

Supply chain vulnerabilities, exacerbated by geopolitical tensions and trade policies, pose a significant risk. Persistent semiconductor shortages continued to affect manufacturing throughout 2024, and potential disruptions in critical component supplies, such as rare earth minerals, could further impact Dell's operations.

The commoditization of traditional PC and server hardware continues to put pressure on profit margins. This necessitates a strategic pivot towards higher-value services and software to maintain profitability, a transition that is both critical and challenging in the face of evolving market demands.

SWOT Analysis Data Sources

This Dell SWOT analysis is built upon a foundation of diverse and credible data sources, including Dell's official financial reports, comprehensive market research from leading industry analysts, and insights from technology sector experts. These sources provide a robust understanding of Dell's internal capabilities and external market positioning.