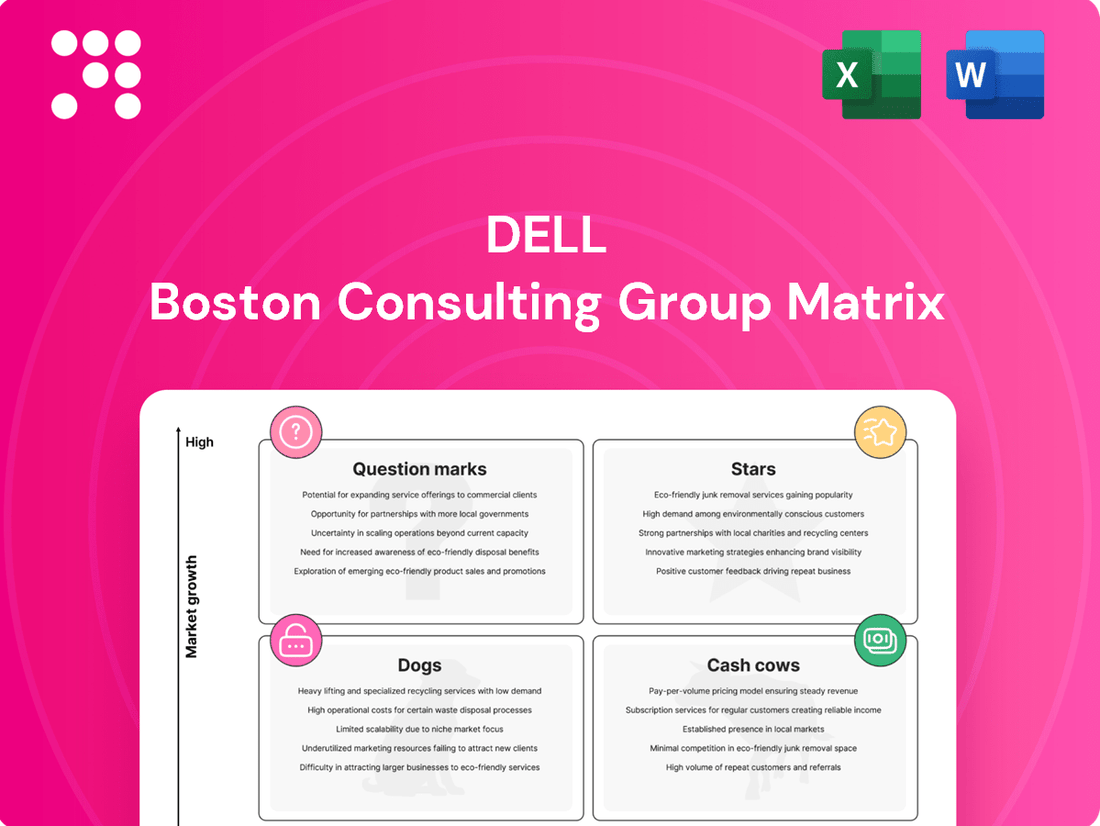

Dell Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dell Bundle

Curious about Dell's product portfolio performance? Our preview offers a glimpse into how their offerings might fit into the BCG Matrix – identifying potential Stars, Cash Cows, Dogs, or Question Marks.

To truly unlock strategic advantage, dive into the full BCG Matrix report. It provides a comprehensive, data-driven analysis of each product's market share and growth rate, equipping you with the insights needed to make informed decisions about resource allocation and future investments.

Don't miss out on the complete picture; purchase the full version today for actionable strategies and a clear roadmap to optimizing Dell's product success.

Stars

Dell's AI-optimized servers are a clear star in its portfolio, with Q1 2025 orders already exceeding $12 billion. This surge is fueled by a massive enterprise demand for advanced AI infrastructure.

The company anticipates shipping $15 billion worth of AI servers in fiscal year 2026, highlighting its dominant position in this rapidly expanding market. This segment represents a significant growth engine for Dell, promising substantial future revenue and market share gains.

Dell's high-performance computing (HPC) solutions, a significant driver of its business, are thriving due to robust demand, particularly from AI-driven initiatives. These advanced systems are essential for tackling demanding computational challenges across research, science, and sophisticated enterprise operations. The HPC market's consistent expansion solidifies Dell's strong market position and growth trajectory in this segment.

Dell's APEX portfolio offers IT infrastructure as a service, a key growth area as businesses shift how they consume technology. This approach provides much-needed flexibility and scalability, making it attractive for companies aiming to update their IT operations.

The as-a-service model is experiencing significant growth across the industry, and Dell is making substantial investments to secure a strong position within this expanding market. While precise market share figures for APEX specifically can be elusive, the overall trend indicates a highly favorable environment for such offerings.

Commercial AI PCs

Dell currently leads the commercial AI PC market, a segment expected to see substantial expansion. This growth is fueled by the upcoming end-of-support for Windows 10, driving a significant PC refresh cycle. Dell's strategic placement of AI processors and features within its commercial offerings positions it to capture a considerable portion of this evolving demand.

The anticipated surge in AI PC adoption, particularly in 2025 and 2026, presents a prime opportunity for Dell. Industry analysts project that the commercial PC refresh cycle, spurred by AI capabilities and OS transitions, could see millions of units upgraded.

- Market Leadership: Dell holds the top spot in commercial AI PC market share.

- Growth Drivers: Windows 10 end-of-life and AI PC refresh cycles are key catalysts.

- Projected Expansion: Significant growth is expected in 2025 and 2026 for AI-capable PCs.

- Dell's Strategy: Early integration of AI processors and features positions Dell for success.

Edge Computing Solutions

Dell is aggressively expanding its AI capabilities at the edge, a move that firmly places its edge computing solutions in the star category of the BCG matrix. Innovations like Dell NativeEdge are designed to streamline the process of deploying and managing artificial intelligence models across numerous distributed locations, making complex edge AI more accessible.

The global edge computing market is experiencing explosive growth, with projections indicating a significant surge in value. For instance, the market was valued at approximately $15.5 billion in 2023 and is anticipated to reach over $100 billion by 2028, growing at a compound annual growth rate (CAGR) of around 43.3%. This rapid expansion underscores the strategic importance Dell places on this segment, aiming to support the increasing demand for real-time data processing and novel workloads at the network's periphery.

- Market Growth: The edge computing market is a high-growth area, expected to expand significantly in the coming years.

- Dell's Investment: Dell is making substantial investments in its edge solutions to capitalize on this burgeoning market.

- Key Technology: Dell NativeEdge simplifies AI model deployment and management in distributed edge environments.

- Strategic Importance: Edge solutions are positioned as a key star due to their role in supporting real-time data processing and new workloads.

Dell's AI-optimized servers are a clear star, with Q1 2025 orders exceeding $12 billion, driven by enterprise demand for AI infrastructure. The company anticipates shipping $15 billion worth of AI servers in fiscal year 2026, solidifying its dominant position. This segment is a significant growth engine for Dell, promising substantial future revenue and market share gains.

Dell's edge computing solutions, bolstered by innovations like Dell NativeEdge, are also stars. The global edge computing market is projected to grow from approximately $15.5 billion in 2023 to over $100 billion by 2028, a CAGR of around 43.3%. This rapid expansion highlights the strategic importance of Dell's edge offerings in supporting real-time data processing.

| Product Category | BCG Matrix Classification | Key Growth Drivers | Fiscal Year 2025/2026 Projections |

|---|---|---|---|

| AI-Optimized Servers | Star | Enterprise AI infrastructure demand | Q1 2025 orders > $12 billion; FY2026 shipments projected at $15 billion |

| Edge Computing Solutions | Star | Real-time data processing, AI at the edge | Market expected to exceed $100 billion by 2028 (from $15.5 billion in 2023) |

| Commercial AI PCs | Star | Windows 10 EOL, AI PC refresh cycle | Significant expansion anticipated in 2025-2026 |

What is included in the product

Dell's BCG Matrix offers a strategic overview of its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

The Dell BCG Matrix provides a clear visual of product performance, alleviating the pain of uncertainty in resource allocation.

Cash Cows

Traditional enterprise servers represent a cornerstone of Dell's business, a segment where the company maintains a commanding 19.3% global market share as of 2025. This strong position is built on a foundation of long-standing customer relationships and a reputation for reliability.

While the explosive growth is currently seen in AI-specific hardware, traditional servers continue to be a vital and consistent revenue stream for Dell. Their widespread adoption across various industries ensures a steady demand, making them a predictable source of income.

The significant cash flow generated by this mature market segment is a direct result of Dell's established infrastructure and brand loyalty. These servers, though not at the cutting edge of AI development, are essential for the day-to-day operations of countless businesses worldwide.

Traditional enterprise storage solutions represent a significant cash cow for Dell. In 2023, Dell held the top spot as the leading storage array maker, commanding a substantial 26% market share. This dominance continued into 2025, with Dell maintaining its number one ranking in key areas like external RAID enterprise storage.

While the overall growth of the storage market might be more modest compared to sectors like servers, Dell's entrenched market position and loyal customer base guarantee a consistent and reliable cash flow. The company is actively working to enhance the profitability of its storage intellectual property, further solidifying its cash-generating capabilities in this mature segment.

Dell's mainstream commercial client PCs, encompassing laptops and desktops, are firmly positioned as Cash Cows. The company secured a solid 15.1% share of the global PC market in Q1 2025, ranking as the third-largest vendor. This segment benefits from consistent demand, even as the broader PC market experiences modest growth.

The mature nature of the PC market, coupled with Dell's strong brand and extensive distribution network, translates into dependable and significant cash flow generation. These products are high-volume sellers, providing a stable revenue stream that fuels other areas of Dell's business.

Basic IT Services and Support

Dell's basic IT services and support, encompassing maintenance, deployment, and professional services, represent a significant cash cow. These offerings tap into Dell's extensive installed base, generating consistent, recurring revenue streams. The stability of demand for these essential services, even in a mature market, underpins their cash cow status.

These services are crucial for customer retention, fostering loyalty around Dell's hardware and software ecosystem. While not experiencing rapid expansion, the sheer volume of Dell devices in operation globally ensures a predictable and substantial cash flow from these support functions. For instance, in 2024, Dell Technologies reported substantial revenue from its Infrastructure Solutions Group, which includes support services, highlighting the ongoing financial contribution of these offerings.

- Recurring Revenue: Services like ProSupport and Premium Support provide predictable income.

- High Customer Retention: Bundled support encourages continued engagement with Dell products.

- Stable Demand: Essential IT maintenance and deployment are always needed by businesses.

- Mature Market Contribution: These services leverage Dell's large existing customer base for consistent cash generation.

Networking Hardware (Core Enterprise)

Dell's networking hardware, especially for core enterprise infrastructure, is a well-established area where the company holds a strong position. Even though the market for traditional networking gear might not be growing at a breakneck pace, Dell's ability to offer combined solutions with their servers and storage guarantees consistent demand. This segment is crucial for Dell's revenue stability and cash generation, leveraging their deep existing customer ties.

- Market Position: Dell is a significant player in the enterprise networking hardware market, focusing on core infrastructure.

- Demand Drivers: Stable demand is driven by Dell's integrated solutions that bundle networking with servers and storage.

- Financial Contribution: This segment acts as a cash cow, providing consistent revenue and cash flow for Dell.

- Customer Base: Dell benefits from its established enterprise customer relationships, ensuring continued sales.

Dell's traditional enterprise servers are a prime example of a cash cow. With a global market share of 19.3% in 2025, these servers generate consistent revenue due to their widespread adoption and Dell's strong customer relationships.

Similarly, Dell's leadership in enterprise storage, holding a 26% market share in 2023 and maintaining its top position in key areas through 2025, solidifies this segment as a cash cow. Despite slower market growth, Dell's dominance ensures reliable cash flow.

Mainstream commercial client PCs also function as cash cows for Dell. Securing a 15.1% share of the global PC market in Q1 2025, Dell's high-volume sales in this mature segment provide a stable revenue stream.

Dell's basic IT services and support, including maintenance and deployment, are significant cash cows. These services leverage Dell's vast installed base, generating predictable, recurring revenue and contributing substantially to the Infrastructure Solutions Group's revenue in 2024.

| Dell Product Segment | Market Position (2025 Data) | Cash Cow Characteristics | 2024/2025 Financial Insight |

|---|---|---|---|

| Traditional Enterprise Servers | 19.3% Global Market Share | Mature market, consistent demand, strong customer loyalty | Significant revenue contributor |

| Enterprise Storage | #1 Global Vendor (26% share in 2023) | Dominant market position, predictable cash flow | Continued #1 ranking in key storage areas |

| Mainstream Commercial PCs | #3 Global Vendor (15.1% share in Q1 2025) | High-volume sales, stable revenue stream | Dependable cash generation |

| Basic IT Services & Support | Leverages large installed base | Recurring revenue, high customer retention | Substantial contribution to Infrastructure Solutions Group revenue |

Full Transparency, Always

Dell BCG Matrix

The Dell BCG Matrix analysis you are previewing is the exact, fully completed document you will receive upon purchase. This comprehensive report, ready for immediate strategic application, includes all data, charts, and insights without any watermarks or placeholder content. You can be confident that the professional-grade analysis and clear presentation you see now is precisely what you will download to inform your business decisions.

Dogs

Legacy consumer desktop PCs represent a challenging segment for Dell. The consumer PC market has seen persistent difficulties, with Dell's consumer revenue in its Client Solutions Group experiencing a notable downturn. Specifically, this revenue declined by 15% year-over-year in Q1 2025 and further dropped by 19% in Q1 2026.

These older, less differentiated consumer desktop models, particularly those lacking advanced AI capabilities, are positioned within a market characterized by low growth and intense competition, where Dell holds a relatively small market share. Continued resource allocation to these products is likely to yield diminishing returns, suggesting they may be candidates for divestment or reduced operational support.

Niche, outdated peripherals, like basic monitors or standard keyboards, often find themselves in a tough spot. They face fierce competition and struggle to stand out. This commoditization means low profit margins and very little room for growth. For instance, the global market for PC peripherals, while large, sees a significant portion of its value driven by gaming and productivity-focused, higher-end devices, leaving basic models with diminishing appeal.

Dell has a history of acquiring and developing a wide array of software. Products that haven't evolved with cloud-first or AI-driven advancements, or those experiencing user base decline and poor integration, fall into the 'dog' category of the BCG matrix. For instance, older customer relationship management (CRM) tools that lack modern analytics capabilities and have limited mobile access would be prime examples, generating minimal new revenue while still incurring maintenance costs.

Older Generations of Virtual Desktop Infrastructure (VDI) Solutions

Older generations of Dell's Virtual Desktop Infrastructure (VDI) solutions, if not actively evolving to support hybrid work or cloud-native strategies, could be categorized as dogs in the BCG matrix. These legacy offerings might face declining demand and limited growth potential as the market shifts towards more flexible and integrated 'as-a-service' models.

For instance, if Dell maintains VDI solutions that are solely on-premises and lack robust remote access capabilities or fail to integrate with modern cloud platforms, their market share could erode. The global VDI market, while growing, is increasingly favoring solutions that offer scalability and cost-efficiency through cloud integration, a segment where older, less adaptable technologies might fall behind.

- Stagnant Demand: Legacy VDI solutions may see a decrease in new customer adoption as businesses prioritize cloud-first or hybrid-ready infrastructure.

- Low Growth Prospects: Without significant innovation or integration into broader service platforms, these older VDI offerings are unlikely to capture new market share.

- Market Shift: The VDI market is increasingly driven by cloud-native and hybrid work enablement, leaving less adaptable solutions at a disadvantage.

Non-Strategic, Low-Margin Niche Hardware

Dell's extensive hardware offerings may contain specialized components or legacy product lines that have become largely commoditized, leading to very low profit margins. These items typically exhibit limited growth potential and hold negligible strategic value for Dell's future focus on areas like artificial intelligence, edge computing, or as-a-service models.

Keeping these low-margin niche hardware products in the portfolio can divert valuable resources. For instance, in 2024, the IT hardware market, while growing, sees intense competition in commoditized segments, making profitability challenging. Dell’s strategy likely involves optimizing resource allocation towards higher-growth, higher-margin areas.

- Low Growth Prospects: These products often cater to shrinking or stagnant markets.

- Thin Margins: Intense competition drives down prices, eroding profitability.

- Resource Drain: Maintaining older product lines can consume R&D and support resources.

- Strategic Misalignment: They do not align with Dell's forward-looking strategies in AI or cloud services.

Products in the Dogs quadrant of the BCG matrix represent business units or product lines with low market share in a low-growth industry. For Dell, this often includes legacy hardware or software that has been superseded by newer technologies or has seen declining demand. These offerings typically generate minimal profits, if any, and may even incur losses due to ongoing maintenance and support costs.

The challenge with these products is their inability to contribute significantly to growth or market leadership. Dell’s strategic focus is on innovation and high-growth areas, making it essential to identify and manage these underperforming assets. Resource allocation away from these 'dogs' allows for greater investment in more promising ventures.

For instance, older generations of specialized server components or niche enterprise software that have not been updated to support modern cloud or AI architectures would likely fall into this category. These products may still have a small, dedicated customer base but lack the scalability and future potential to warrant significant ongoing investment.

Dell's approach to managing 'dogs' often involves a strategic decision to either phase them out, divest them, or reduce support to minimize losses. This allows the company to concentrate its resources on areas with higher growth potential, such as AI-powered solutions or advanced cloud services, thereby optimizing its overall portfolio performance.

Question Marks

Dell is strategically expanding its AI Factory by developing integrated software platforms designed to support diverse AI workloads. This move aims to complement its strong AI server hardware, creating a more comprehensive AI ecosystem for customers.

While Dell's AI server hardware is a market leader, the newer AI-driven software and services are still in the early stages of market penetration. These emerging offerings are positioned within a rapidly expanding market, necessitating substantial investment to gain wider adoption and establish a stronger competitive foothold.

The market for AI software and services is experiencing explosive growth, with projections indicating continued strong expansion through 2024 and beyond. For instance, the global AI market was valued at approximately $200 billion in 2023 and is expected to reach over $1.8 trillion by 2030, demonstrating the immense potential for Dell's developing AI software and services.

Dell's involvement in emerging immersive technologies like Augmented Reality (AR) and Virtual Reality (VR) for enterprise is exploratory rather than a core business. While these sectors show significant growth potential, with the global AR/VR market projected to reach $332.7 billion by 2028, Dell's current market share in these niche areas is likely minimal.

The substantial investment needed to develop and scale AR/VR solutions means Dell is carefully assessing these opportunities. The company's strategy likely involves strategic partnerships and pilot programs to gauge market viability before committing significant resources to establish a strong market presence.

Dell's specialized IoT gateway solutions for niche verticals, like advanced manufacturing or precision agriculture, often fall into the question mark category of the BCG matrix. While these markets are experiencing significant growth, with the global industrial IoT market projected to reach $115.8 billion by 2024, Dell's penetration in these highly specific segments might be relatively low.

These solutions require substantial investment to develop tailored features and build market share against established niche players. For instance, a gateway designed for autonomous mining operations needs robust environmental hardening and specific communication protocols that differ greatly from a smart city deployment.

The strategy here involves careful analysis of which niche verticals offer the greatest potential for future market leadership. Dell must decide whether to invest heavily to increase market share in these promising but currently small segments, or to divest if the investment required outweighs the potential return.

Advanced Sustainability-Focused Hardware Innovations

Dell is aggressively pursuing sustainability in its hardware, exemplified by its Latitude AI Series which features modular designs and a greater incorporation of recycled materials. This strategic pivot aligns with growing market demand for environmentally conscious technology. For instance, Dell announced in early 2024 that its Latitude 7440 laptop incorporates 30% recycled plastics and aims for 50% recycled content in its packaging by 2030.

While the trend towards sustainability presents a high-growth opportunity, the market's willingness to adopt and pay a premium for these specific eco-innovations is still developing. Consumer and enterprise purchasing decisions often balance environmental benefits with performance, cost, and perceived longevity. In 2023, the global market for sustainable electronics was valued at approximately $50 billion, but the segment for hardware with advanced sustainable features is still nascent.

- Modular Design: Enables easier repair and upgrades, extending product lifecycles and reducing e-waste.

- Recycled Materials: Increased use of post-consumer recycled (PCR) plastics and metals in components like chassis and internal parts.

- Energy Efficiency: Innovations in power management and component design to reduce energy consumption during operation.

- Circular Economy Focus: Initiatives for product take-back programs and material reclamation to create a closed-loop system.

Quantum Computing Initiatives (Research & Early Development)

Dell's involvement in quantum computing initiatives positions these efforts squarely in the question mark category of the BCG matrix. This emerging technology, while holding immense long-term growth potential, currently lacks a substantial commercial market. Significant, speculative investment is necessary for Dell to explore breakthroughs in this area, much like other tech leaders such as IBM and Google, who have also committed billions to quantum research.

The quantum computing sector is characterized by its nascent stage and high risk, a hallmark of question marks. Companies are investing heavily in research and development, aiming to overcome complex technical hurdles. For instance, in 2024, global investment in quantum computing R&D was projected to exceed $10 billion, reflecting the sector's speculative nature and the drive to unlock its future capabilities.

- High Growth Potential: Quantum computing promises to revolutionize fields like drug discovery, materials science, and cryptography, offering transformative solutions.

- Low Current Market Share: The commercial market for quantum computing is still in its infancy, with limited widespread adoption and revenue generation.

- Substantial Investment Required: Significant capital is needed for research, talent acquisition, and the development of quantum hardware and software.

- Speculative Nature: The timeline for widespread commercial viability and the ultimate market dominance of specific quantum approaches remain uncertain.

Question Marks represent areas where Dell is investing in emerging technologies with high growth potential but currently low market share. These are often new product categories or nascent markets where Dell is building a presence, requiring significant investment to capture future market leadership. The key challenge is to determine which of these question marks have the potential to become stars or cash cows, and which might not gain traction.

Dell's AI software and services, alongside its ventures into AR/VR and quantum computing, fit this description. These areas are characterized by substantial R&D expenditure and the need to cultivate market demand. For example, the global AI market is projected for significant growth, but Dell's specific software offerings are still establishing their footing.

The company must carefully evaluate the investment required against the potential returns for each question mark. Strategic decisions involve either increasing investment to drive market share and convert them into stars, or divesting if the path to profitability appears too uncertain or costly. This is a critical phase for Dell to shape its future product portfolio.

Dell's exploration into quantum computing exemplifies a classic question mark. The sector boasts immense long-term potential, with global R&D investment projected to exceed $10 billion in 2024, yet its commercial market is still in its infancy. Dell's commitment here requires substantial, speculative investment to navigate complex technical challenges and foster market adoption.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and competitor performance to ensure reliable, high-impact insights.