Constellation Software SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Constellation Software Bundle

Constellation Software's robust market position is built on strong recurring revenue and a history of successful acquisitions, but it faces potential integration challenges and increasing competition. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on its growth.

Want the full story behind Constellation Software's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Constellation Software excels with its proven 'buy and build' acquisition strategy, consistently acquiring profitable vertical market software (VMS) businesses worldwide. This disciplined approach has fueled rapid expansion of its diverse portfolio across numerous sectors and geographies, contributing to robust revenue growth, with reported revenue reaching $7.3 billion for the fiscal year 2023.

Constellation Software's decentralized operating model is a significant strength, allowing acquired companies to maintain substantial autonomy. This empowers local management teams, fostering an entrepreneurial spirit and enabling swift responses to market shifts. For instance, in 2023, Constellation reported a substantial increase in revenue from its diverse portfolio of software businesses, a testament to the effectiveness of this decentralized approach in driving growth across various verticals.

Constellation Software boasts exceptionally strong recurring revenue, with roughly 70% of its income coming from predictable sources like maintenance contracts and subscriptions. This consistent cash flow is a significant advantage, providing a stable foundation for operations and strategic growth initiatives.

Robust Financial Health and Cash Flow Generation

Constellation Software consistently showcases impressive financial health, marked by sustained revenue and earnings growth. For instance, in the first quarter of 2024, Constellation reported a 12% increase in revenue year-over-year, reaching $2.1 billion. This strong performance translates into substantial cash flow generation.

The company's operational cash flow frequently outpaces its investments in acquisitions and shareholder distributions. In Q1 2024, operating cash flow was $799 million, significantly covering capital expenditures and dividends. This robust cash generation affords Constellation substantial liquidity and the financial agility to pursue ongoing growth initiatives and strategic opportunities.

- Consistent Revenue Growth: Q1 2024 revenue rose 12% year-over-year to $2.1 billion.

- Strong Cash Flow: Q1 2024 operating cash flow reached $799 million.

- Financial Flexibility: Ample liquidity supports strategic investments and acquisitions.

High Customer Switching Costs

Constellation Software's acquired companies offer Vertical Market Software (VMS) solutions that are essential for their clients' daily operations, becoming deeply integrated into how businesses function. This deep integration makes it difficult and costly for customers to switch to a different software provider, effectively locking them in.

This stickiness translates into strong customer loyalty and very low churn rates for Constellation. For instance, in Q1 2024, Constellation reported a recurring revenue percentage of approximately 95%, highlighting the stability derived from these high switching costs.

- Mission-Critical Software: VMS solutions are integral to customer workflows, not easily replaced.

- High Switching Costs: Customers face significant financial and operational hurdles to change providers.

- Customer Retention: This leads to exceptional customer retention, ensuring predictable revenue streams.

- Revenue Stability: The high retention underpins Constellation's consistent financial performance.

Constellation Software's 'buy and build' strategy is a core strength, evidenced by its consistent acquisition of profitable Vertical Market Software (VMS) businesses. This has led to a diversified portfolio and robust revenue growth, with fiscal year 2023 revenues reaching $7.3 billion. The company's decentralized operating model empowers acquired entities, fostering agility and responsiveness to market changes, which contributed to the substantial revenue increase observed in 2023 across its varied software businesses.

| Metric | Q1 2024 | FY 2023 |

|---|---|---|

| Revenue | $2.1 billion (up 12% YoY) | $7.3 billion |

| Operating Cash Flow | $799 million | N/A |

| Recurring Revenue % | ~95% | N/A |

What is included in the product

Analyzes Constellation Software’s competitive position through key internal and external factors, highlighting its strong market presence and acquisition strategies while considering integration challenges and evolving industry dynamics.

Offers a clear, organized framework to identify and address Constellation Software's market challenges and internal weaknesses.

Weaknesses

Constellation Software's significant reliance on acquisitions for growth, while a proven strategy, also represents a key weakness. The company's organic growth has been relatively modest, with recent quarterly figures ranging from approximately 0.3% to 2%. This means that continued, substantial expansion is heavily contingent on the company's ability to consistently identify and successfully integrate new businesses.

This dependence on inorganic growth could become a vulnerability if the market for suitable acquisition targets tightens or if the cost of acquiring companies increases significantly. If the pipeline of attractive businesses to purchase dries up, Constellation's growth trajectory could be significantly impacted.

Constellation Software's strategy of acquiring numerous businesses, over 500 as of early 2024, presents a significant hurdle in effectively integrating these diverse entities. While its decentralized approach helps, ensuring operational synergy and consistent service delivery across its expansive portfolio remains a complex undertaking.

Maintaining high operational efficiency and technological compatibility across hundreds of acquired companies is a persistent challenge. The risk of integration issues impacting overall margins is ever-present, requiring continuous management and adaptation to ensure each new acquisition contributes positively to the group's financial health.

Constellation Software's stock often commands a premium valuation. For instance, as of early 2024, its price-to-earnings (P/E) ratio frequently sits well above the average for the broader software or technology sectors. This premium, while indicative of strong investor belief in its predictable revenue streams and acquisition strategy, suggests the stock may be priced expensively.

This high valuation can present a challenge for new investors looking for substantial upside. If the market experiences a downturn, stocks with already elevated valuations like Constellation Software can be more susceptible to significant price drops, potentially limiting the margin of safety.

Risk of Declining Returns on Invested Capital

As Constellation Software continues its aggressive acquisition strategy, a key concern is the potential for declining returns on invested capital (ROIIC). The company's success has attracted more attention, meaning competition for suitable vertical market software (VMS) businesses is intensifying. This increased competition could force Constellation to pay higher multiples for acquisitions, thereby impacting the profitability of future deals compared to its historical performance.

For instance, while Constellation has consistently demonstrated strong ROIIC, the average acquisition multiple for VMS businesses has been on an upward trend. In 2023, Constellation reported a trailing twelve-month ROIIC of approximately 20%. However, if acquisition prices continue to rise, achieving similar ROIIC figures on new investments might become more challenging. This is a natural hurdle for any large consolidator as it scales its operations and capital deployment.

- Increasing Acquisition Multiples: Higher competition for VMS assets may drive up purchase prices, potentially compressing future deal returns.

- Scaling Challenges: As Constellation deploys larger amounts of capital, maintaining historically high ROIIC becomes more difficult due to market dynamics.

- Impact on Profitability: Elevated acquisition costs could lead to lower earnings per share growth from new acquisitions if revenue synergies are not fully realized.

Risk of Technological Obsolescence in Portfolio Companies

Constellation Software's portfolio includes many Vertical Market Software (VMS) businesses that rely on established, sometimes older, software solutions. This presents a significant risk of technological obsolescence if these legacy systems fail to keep pace with rapid advancements like cloud-native architectures or advanced AI. For instance, if a portfolio company's core offering becomes outdated, it could struggle to compete with newer, more agile solutions entering the market.

The danger is that insufficient investment in modernizing these acquired systems could lead to a decline in market share. Customers may migrate to competitors offering more contemporary and feature-rich alternatives, impacting revenue streams for those specific VMS businesses within Constellation's umbrella. This necessitates careful ongoing evaluation and strategic capital allocation for upgrades.

- Legacy Systems: Many acquired VMS businesses utilize established, sometimes dated, software.

- Pace of Innovation: Risk of falling behind rapid technological shifts (cloud, AI).

- Market Share Erosion: Inadequate modernization could drive customers to competitors.

Constellation Software's heavy reliance on acquisitions for growth is a double-edged sword. While its acquisition strategy has been highly successful, it means that organic growth, which was around 0.3% to 2% in recent quarters of 2024, plays a smaller role in its overall expansion. This makes the company particularly vulnerable if the acquisition market becomes less favorable or if the cost of acquiring businesses escalates.

The sheer volume of acquisitions, exceeding 500 by early 2024, presents a significant integration challenge. Despite a decentralized operating model, ensuring seamless operations and consistent service delivery across such a vast and diverse portfolio demands constant attention and can strain resources.

The company's premium valuation, with a P/E ratio often exceeding sector averages in early 2024, suggests that the stock may be priced expensively. This can limit upside potential for new investors and make the stock more susceptible to significant price declines during market downturns.

As Constellation scales its operations and capital deployment, maintaining historically high returns on invested capital (ROIIC) becomes increasingly challenging. For instance, while its trailing twelve-month ROIIC was around 20% in 2023, rising acquisition multiples due to increased competition for Vertical Market Software (VMS) businesses could compress future deal profitability.

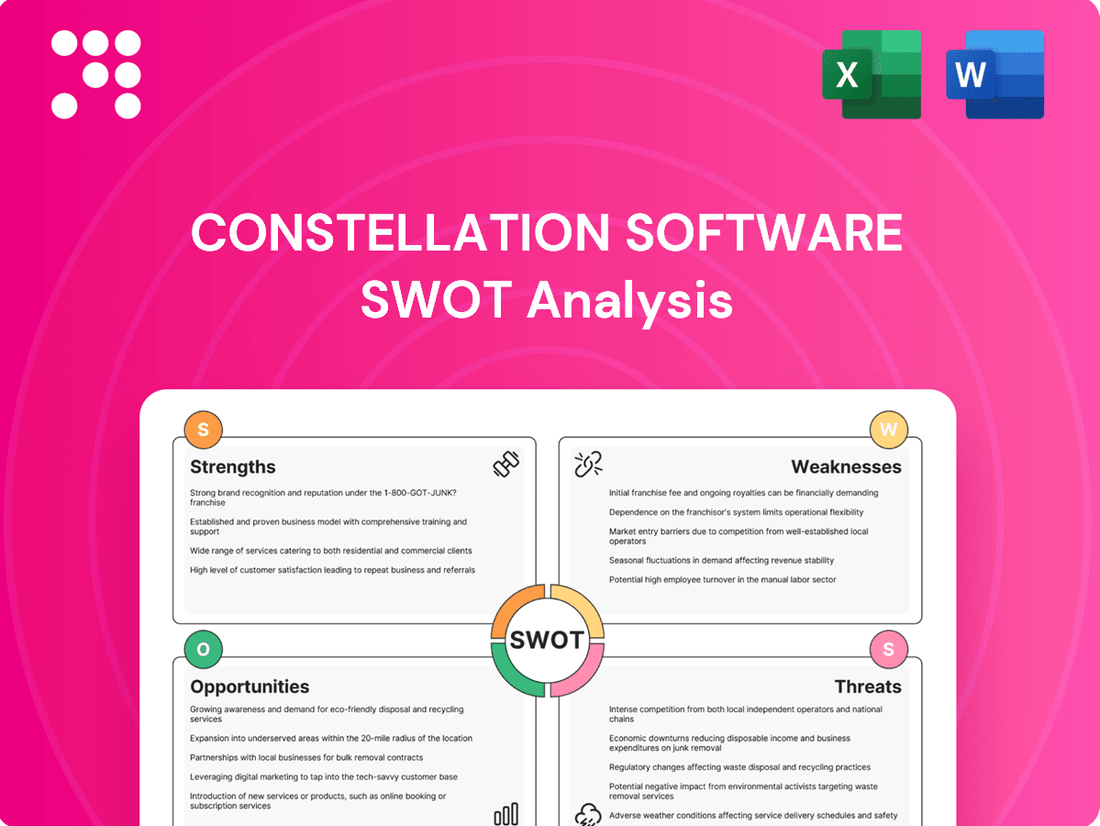

Preview the Actual Deliverable

Constellation Software SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're getting a direct look at the comprehensive breakdown of Constellation Software's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a complete strategic overview for Constellation Software.

Opportunities

Constellation Software has a substantial opportunity to broaden its reach by entering new vertical markets that are currently underserved. Its established strategy of acquiring Vertical Market Software (VMS) businesses can be applied to identify and integrate companies in emerging sectors or untapped geographic locations. This strategic expansion is key to diversifying revenue and strengthening its market footprint, offering a significant runway for future growth through acquisitions.

In 2023, Constellation Software's acquisition activity continued, with the company completing 32 acquisitions. This demonstrates its ongoing commitment and capability to execute its expansion strategy. The company's focus on acquiring stable, cash-generative VMS businesses in diverse markets positions it well to capitalize on opportunities in new verticals and geographies, further solidifying its global presence and revenue diversification.

Constellation Software's extensive portfolio of over 500 vertical market software (VMS) businesses presents a significant opportunity for internal growth through cross-selling and upselling. By strategically identifying complementary products and services within its existing customer base, the company can unlock new revenue streams.

For instance, a customer using a specific VMS for healthcare management might also benefit from a complementary financial management solution from another Constellation subsidiary. This approach capitalizes on established trust and reduces the need for costly new customer acquisition, directly boosting profitability.

Constellation Software's increasing free cash flow, projected to continue its strong trajectory through 2024 and into 2025, presents a significant opportunity to engage in larger, more strategic acquisitions. This enhanced financial capacity allows the company to consider targets beyond its typical small-to-medium business acquisitions, potentially including significant carve-outs from larger corporations or opportunities to consolidate specific software verticals.

By leveraging its robust financial position, Constellation can explore partnerships that accelerate market penetration or technology integration, expanding its reach and capabilities. This strategic flexibility in capital deployment means it can now pursue growth avenues that were previously financially prohibitive, positioning it for accelerated market share gains and enhanced competitive advantage.

Leveraging Emerging Technologies like AI and Cloud

Constellation Software has a significant opportunity to integrate advanced technologies like AI and cloud computing into its diverse portfolio. This strategic move can modernize existing software products, boosting their functionality and user appeal, thereby fending off competition from newer market players.

By focusing on these technological advancements, Constellation can unlock substantial organic growth. For instance, AI-driven analytics can offer deeper insights to customers, while cloud-native architectures can improve scalability and reduce operational costs across acquired businesses. This not only enhances customer value but also strengthens customer loyalty and reduces churn.

- AI-Powered Enhancements: Implementing AI for predictive maintenance, personalized user experiences, and automated customer support within its acquired software can significantly increase value.

- Cloud Migration Benefits: Migrating legacy systems to advanced cloud platforms can improve accessibility, reduce infrastructure overhead, and enable faster deployment of new features.

- Competitive Edge: This technological uplift ensures Constellation's businesses remain competitive, offering cutting-edge solutions that attract and retain a broader customer base in a rapidly evolving software landscape.

- 2024/2025 Focus: Expect increased R&D spending in these areas as Constellation aims to capitalize on the growing demand for intelligent and scalable software solutions.

Increased Market Consolidation in VMS Sector

The vertical market software (VMS) sector is experiencing significant consolidation, creating a consistent stream of acquisition targets for Constellation Software. Smaller VMS firms often find it challenging to keep pace with technological advancements and competitive pressures from larger entities, making them more amenable to being acquired. This dynamic perfectly aligns with Constellation's proven strategy of acquiring and integrating VMS businesses, ensuring a steady flow of growth opportunities.

Constellation Software's ability to thrive in a consolidating market is evident in its consistent acquisition activity. For instance, in the first quarter of 2024, the company completed 14 acquisitions, demonstrating its ongoing commitment to its consolidation strategy. This trend is expected to continue as the VMS landscape evolves.

- Continued VMS Sector Consolidation: The market remains fragmented, with many smaller VMS providers.

- Acquisition Pipeline: Constellation's model is built to capitalize on this trend, ensuring a robust pipeline of potential targets.

- Strategic Advantage: Smaller players facing scaling challenges are increasingly likely to seek acquisition by established consolidators like Constellation.

Constellation Software can leverage its substantial free cash flow, which demonstrated robust growth through 2023 and is projected to continue this trend into 2024 and 2025, to pursue larger, more strategic acquisitions. This enhanced financial capacity allows for the consideration of significant carve-outs or consolidation opportunities within specific software verticals, moving beyond its typical smaller targets.

The company's vast portfolio of over 500 VMS businesses offers significant potential for organic growth through cross-selling and upselling complementary products and services to its existing customer base, thereby unlocking new revenue streams efficiently.

Integrating advanced technologies like AI and cloud computing into its acquired software can modernize offerings, enhance functionality, and provide a competitive edge against newer market entrants, driving organic growth and customer retention.

The ongoing consolidation within the VMS sector provides a consistent stream of acquisition targets, as smaller firms struggle with technological advancements and competitive pressures, aligning perfectly with Constellation's proven acquisition strategy.

Threats

Constellation Software's proven acquisition strategy has unfortunately drawn increased attention from rivals. This includes new private equity firms focused on VMS consolidation and even larger, more established corporations looking to expand their software portfolios. This heightened competition for desirable VMS businesses means Constellation may face higher acquisition costs, potentially impacting its ability to achieve its target return on investment for future deals.

Adverse macroeconomic conditions, such as an economic downturn or prolonged periods of high interest rates, pose a threat to Constellation Software. A recession could lead to reduced spending by its customers on software solutions, impacting recurring revenue streams. For instance, if global GDP growth slows significantly in 2024-2025, this could directly affect the demand for enterprise software.

Elevated interest rates, a persistent concern in 2024, could also increase the cost of debt financing for Constellation's strategic acquisitions, potentially slowing its growth engine. Higher borrowing costs might make future M&A activities less attractive or feasible, impacting its proven acquisition-driven expansion strategy.

Constellation Software, despite its broad reach, confronts the significant threat of technological disruption. The rapid evolution of software, especially the move to cloud-native designs and the increasing role of AI, could make some of its established VMS (Vertical Market Software) products outdated if they aren't consistently modernized. For instance, the global cloud computing market was projected to reach over $1.3 trillion in 2024, highlighting the speed of this shift.

Talent Retention and M&A Executive Departures

Constellation Software's decentralized structure hinges on its business unit leaders and M&A dealmakers. A significant threat arises if these key individuals, especially seasoned M&A executives, are poached by rivals or decide to start their own companies. Such talent drain could directly impact the company's capacity to identify, assess, and successfully onboard new acquisitions, a core driver of its growth strategy.

The departure of experienced M&A professionals could disrupt Constellation's acquisition pipeline and integration processes. For instance, if a critical executive responsible for identifying and closing deals leaves, it could lead to a slowdown in new acquisitions, impacting future revenue streams. This risk is amplified in a competitive market where specialized M&A talent is in high demand.

- Talent Drain Impact: High turnover in M&A executive roles can directly hinder the sourcing and integration of new software businesses.

- Competitive Landscape: Competitors actively seeking to expand their portfolios may target Constellation's key M&A talent.

- Decentralized Model Vulnerability: The reliance on entrepreneurial leaders in business units means their departure can significantly weaken specific segments of the company.

Increased Regulatory Scrutiny

Constellation Software's aggressive acquisition strategy, particularly in the vertical market software (VMS) sector where it holds a dominant position, could attract increased regulatory scrutiny. This is a general business environment risk for any large acquirer. For instance, if Constellation were to pursue even larger deals or venture into highly regulated industries, antitrust concerns or new M&A regulations could emerge.

Such heightened oversight might complicate or slow down its acquisition pace, potentially increasing costs and introducing uncertainty into its well-established growth model. For example, in 2024, the European Union continued its focus on digital market competition, which could impact large software consolidators.

- Increased regulatory scrutiny poses a risk to Constellation's acquisition-driven growth strategy.

- Antitrust concerns may arise if Constellation pursues larger deals or enters sensitive sectors.

- Stricter M&A regulations could add costs and uncertainty to future acquisitions.

Constellation Software faces increasing competition for acquisitions, with private equity and larger corporations targeting VMS businesses. This can drive up acquisition costs, potentially impacting the company's return on investment for future deals. For instance, the global M&A market saw significant activity in software in 2024, indicating a robust but competitive environment.

Macroeconomic headwinds, such as a potential economic slowdown in 2024-2025 or sustained high interest rates, present a threat. A recession could reduce customer spending on software, affecting recurring revenue, while higher borrowing costs could make acquisitions more expensive, slowing growth.

Technological disruption is another key threat. The rapid shift towards cloud-native solutions and AI could render some of Constellation's existing Vertical Market Software (VMS) products obsolete if not continuously updated. The global cloud computing market's growth, projected to exceed $1.3 trillion in 2024, underscores the pace of this technological evolution.

A significant risk for Constellation is talent drain, particularly among its experienced M&A professionals and business unit leaders. The departure of key individuals, especially those adept at identifying and integrating acquisitions, could disrupt its growth pipeline and operational effectiveness. The demand for skilled M&A talent remained high throughout 2024, intensifying this risk.

| Threat Category | Specific Risk | Potential Impact | Example Data/Trend (2024-2025) |

|---|---|---|---|

| Competition | Increased competition for VMS acquisitions | Higher acquisition costs, reduced ROI | Robust M&A activity in software sector in 2024 |

| Macroeconomic | Economic downturn / High interest rates | Reduced customer spending, increased debt financing costs | Global GDP growth forecasts for 2024-2025 |

| Technological | Obsolescence of existing VMS products | Loss of market share, need for significant R&D investment | Cloud computing market exceeding $1.3 trillion in 2024 |

| Operational | Talent drain of M&A professionals | Disruption to acquisition pipeline and integration | High demand for M&A talent in 2024 |

SWOT Analysis Data Sources

This Constellation Software SWOT analysis is built upon a foundation of verified financial filings, comprehensive market intelligence reports, and expert industry commentary. These sources provide a robust and data-driven perspective on the company's current standing and future potential.