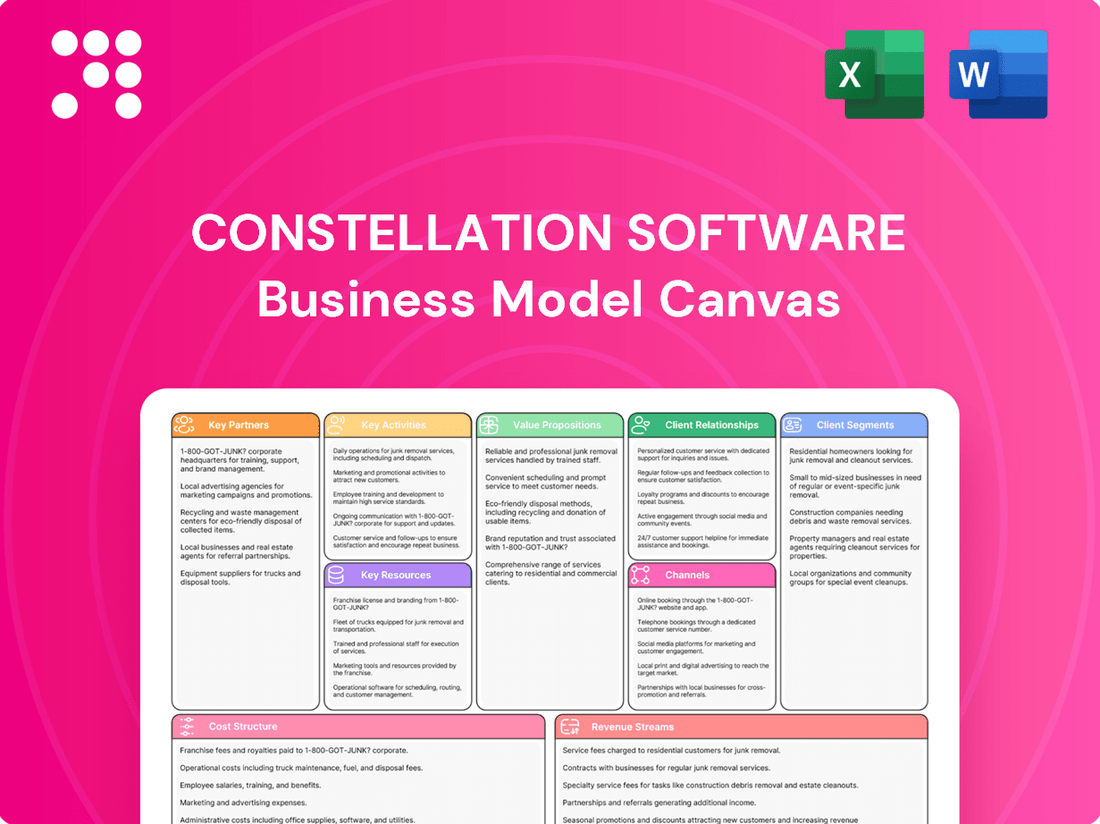

Constellation Software Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Constellation Software Bundle

Unlock the strategic framework behind Constellation Software's remarkable growth. This detailed Business Model Canvas breaks down their approach to customer relationships, revenue streams, and key resources, offering a clear blueprint for success. Discover the core elements that drive their industry dominance and gain actionable insights for your own ventures.

Partnerships

Constellation Software's core partners are the owners of vertical market software (VMS) companies who are ready to sell their businesses. These sellers are typically looking for a reliable, long-term owner who will continue to grow their software and support its customer base.

Constellation provides this by often allowing the existing management teams of acquired VMS companies to remain in their roles. This approach offers a sense of continuity and stability, which is highly appealing to founders who want to ensure their company's legacy and the well-being of their employees.

In 2024, Constellation continued its strategy of acquiring VMS businesses, demonstrating the ongoing appeal of its partnership model. For instance, their acquisition of companies like Aptean in prior years highlights their commitment to integrating and nurturing these businesses.

Constellation Software's aggressive acquisition strategy is heavily supported by its relationships with financial institutions and lenders. These partnerships are crucial for securing the debt financing needed to fund its continuous global M&A activities.

In 2024, Constellation Software's ability to manage significant debt levels, a direct result of its growth-focused acquisition approach, underscores the strength and reliability of these financial relationships. This access to capital allows them to execute their strategy effectively.

Constellation Software actively participates in industry associations and professional networks. These connections are crucial for gathering market intelligence and understanding trends within the specialized software sectors where its business units operate. For instance, engagement with associations in healthcare IT or public sector software provides direct insights into regulatory changes and customer demands.

These partnerships also serve as a pipeline for potential acquisitions, allowing Constellation to identify and vet companies that align with its growth strategy. In 2024, Constellation continued its acquisitive growth, with a significant portion of its expansion driven by identifying and integrating software companies operating within specific industry verticals. This network access is vital for discovering these opportunities.

Furthermore, maintaining a visible presence in these industry communities enhances Constellation's reputation and credibility. It facilitates the identification of niche market opportunities and strengthens relationships with peers and potential partners. This strategic engagement helps ensure the company remains attuned to the evolving needs of its diverse customer base across various software markets.

Technology and Platform Providers

Constellation Software, while championing autonomy in its acquired companies, strategically partners with technology and platform providers across its vast ecosystem. These collaborations are crucial for enhancing the capabilities of the software solutions developed by its many subsidiaries.

These partnerships can manifest in several ways, often involving the adoption of specific cloud infrastructure, development tools, or specialized technologies. For instance, a subsidiary might integrate a new AI platform to improve its analytics software, or leverage a particular cloud provider for scalable hosting solutions. These integrations are not mandated but are often adopted based on the strategic needs and opportunities identified by the individual operating companies.

Such collaborations are vital for driving innovation and operational efficiency. By leveraging external technological advancements, Constellation’s companies can accelerate product development, improve user experiences, and maintain a competitive edge in their respective markets. For example, in 2024, many of Constellation's software verticals are exploring partnerships with leading cloud providers to optimize data management and deployment, aiming for enhanced scalability and cost-effectiveness.

- Cloud Infrastructure: Partnerships with providers like Microsoft Azure, Amazon Web Services (AWS), and Google Cloud Platform are common for hosting and scaling acquired software solutions.

- Development Tools & Platforms: Collaborations may involve utilizing specific Integrated Development Environments (IDEs), CI/CD pipelines, or low-code/no-code platforms to streamline software development.

- Specialized Technology Integration: Subsidiaries might partner with providers of niche technologies, such as AI/ML platforms, cybersecurity solutions, or data analytics engines, to embed advanced features into their offerings.

- API Integrations: Facilitating seamless data exchange and interoperability between different software solutions, both within and outside the Constellation portfolio, through API partnerships.

M&A Brokers and Advisors

Constellation Software relies heavily on M&A brokers and advisors to fuel its growth. These professionals act as crucial gatekeepers, identifying and pre-screening potential acquisition targets within niche software markets. Their deep industry knowledge and established networks streamline the initial stages of Constellation's aggressive acquisition strategy.

In 2023, Constellation Software continued its robust acquisition pace, completing numerous deals. While specific figures for the exact number of deals facilitated by brokers are not publicly disclosed, the company's consistent deal flow underscores the importance of these intermediaries. For instance, in the first half of 2024, Constellation announced several acquisitions, demonstrating ongoing reliance on external sourcing channels.

- Deal Sourcing: M&A brokers provide access to a pipeline of potential acquisition candidates that Constellation might not otherwise discover.

- Vetting and Qualification: Advisors perform initial due diligence, saving Constellation time and resources by filtering out unsuitable targets.

- Transaction Facilitation: These partners are instrumental in navigating the complexities of deal structuring, negotiation, and closing.

Constellation Software's key partnerships are primarily with the owners of vertical market software (VMS) businesses seeking to sell. These sellers are often founders or management teams looking for a stable, growth-oriented buyer who will preserve their company's legacy and customer relationships. Constellation facilitates this by frequently retaining existing management, providing continuity that appeals to these sellers.

Financial institutions and lenders are critical partners, providing the substantial debt financing necessary to fuel Constellation's ongoing global acquisition strategy. In 2024, Constellation's ability to manage its debt load reflects the strength and reliability of these relationships, ensuring consistent access to capital for M&A activities.

Industry associations and professional networks are vital for market intelligence and identifying potential acquisition targets. These partnerships allow Constellation to stay abreast of trends and regulatory changes within specialized software sectors, such as healthcare IT or public sector software, informing both strategic direction and deal sourcing.

M&A brokers and advisors play a crucial role by sourcing and pre-screening potential acquisition targets, streamlining Constellation's aggressive growth strategy. Their expertise in niche software markets and deal facilitation is instrumental in identifying and executing new acquisitions, as evidenced by Constellation's continued deal flow throughout 2024.

What is included in the product

A detailed Business Model Canvas outlining Constellation Software's strategy for acquiring, managing, and growing vertical market software businesses.

It covers key elements like customer segments, value propositions, revenue streams, and cost structure, reflecting their proven acquisition and operational model.

Constellation Software's Business Model Canvas acts as a pain point reliever by providing a clear, structured framework to visualize and understand their complex acquisition and integration strategy.

This allows stakeholders to quickly grasp how the company manages diverse software businesses, addressing the pain point of complexity and opacity in their operations.

Activities

Constellation Software's primary activity revolves around acquiring vertical market software (VMS) businesses worldwide. This strategic focus means constantly identifying, vetting, negotiating with, and integrating new companies into their existing framework.

The company actively manages a vast pipeline of potential acquisition targets, employing a rigorous due diligence process and a structured evaluation system. This systematic approach ensures they can efficiently identify and secure valuable VMS assets.

In 2023, Constellation Software continued its aggressive acquisition strategy, notably completing 35 acquisitions. This included significant deals that expanded their reach and capabilities within various software verticals, demonstrating their ongoing commitment to growth through M&A.

Post-acquisition, Constellation Software actively manages and integrates its acquired entities, a core activity that leverages their existing strengths. This isn't about wholesale restructuring; rather, it's about providing strategic guidance and fostering operational efficiencies. In 2023, Constellation's acquisition strategy continued to be a significant driver of growth, with the company completing numerous deals across various vertical markets.

The company's approach emphasizes preserving the autonomy of acquired businesses, a key differentiator. This decentralized model allows for continued innovation and helps retain valuable talent within these newly integrated firms. Constellation focuses on sharing best practices and optimizing processes, acting as a supportive partner rather than a controlling entity.

This management style is crucial for maintaining the unique value propositions of each acquired software company. By allowing them to operate with a degree of independence, Constellation fosters an environment where specialized expertise can thrive, contributing to the overall resilience and growth of its diverse portfolio.

Constellation Software's subsidiaries are deeply involved in the continuous development and upkeep of their specialized Vertical Market Software (VMS). This ensures their mission-critical solutions stay relevant, secure, and high-performing for their diverse customer base.

This ongoing product enhancement is a cornerstone of their strategy for customer loyalty and securing predictable, recurring revenue streams. For example, in 2023, Constellation's software segment continued to see robust performance, reflecting the value customers place on these essential, updated systems.

Talent Retention and Development

Constellation Software's core strength lies in its ability to retain and develop the talent within the companies it acquires. This is a critical activity for maintaining the value and operational efficiency of its diverse portfolio.

The company’s strategy actively focuses on keeping existing management teams in place, fostering an entrepreneurial spirit that encourages innovation and autonomy. This hands-off yet supportive approach is key to preserving institutional knowledge and strong customer relationships.

By empowering these teams, Constellation ensures operational continuity and allows acquired businesses to continue thriving under their established leadership. For instance, in 2023, Constellation reported that its decentralized structure, which relies heavily on the expertise of acquired company management, contributed to consistent revenue growth across its segments.

- Focus on Retaining Acquired Management: Constellation’s model prioritizes keeping experienced leadership teams post-acquisition.

- Fostering Entrepreneurial Culture: The company encourages autonomy and innovation within its subsidiaries.

- Preserving Institutional Knowledge: Retaining existing talent ensures the continuity of valuable operational expertise and customer insights.

- Driving Operational Continuity: This strategy minimizes disruption and maintains the acquired businesses’ performance trajectory.

Capital Allocation and Portfolio Optimization

Constellation Software's capital allocation strategy is central to its business model, focusing on reinvesting free cash flow into its diverse portfolio of Vertical Market Software (VMS) businesses. This active management aims to drive both growth and profitability across its many acquired companies.

The company consistently targets a high hurdle rate for its investments, ensuring that capital is deployed into opportunities expected to yield significant returns. This disciplined approach underpins its long-term value creation strategy.

- Strategic Reinvestment: Constellation Software actively deploys excess cash flow to fuel further acquisitions, expanding its reach and capabilities within the VMS sector.

- Portfolio Optimization: The company continuously works to enhance the performance and profitability of its existing network of businesses through strategic capital deployment.

- High Hurdle Rate: Investments are rigorously evaluated against a high hurdle rate, ensuring capital is allocated to projects with the highest potential for generating superior returns.

- Acquisition Focus: A significant portion of capital is directed towards acquiring new VMS businesses that align with Constellation's growth objectives and diversification strategy.

Constellation Software's key activities center on a relentless pursuit of acquiring vertical market software (VMS) businesses globally. This involves a continuous cycle of identifying, evaluating, negotiating, and integrating new companies. The company actively manages a robust pipeline of potential acquisition targets, employing rigorous due diligence and a structured evaluation process to ensure efficient identification and acquisition of valuable VMS assets.

Post-acquisition, a critical activity is the active management and integration of these acquired entities, a process that leverages Constellation's existing strengths without drastic restructuring. This approach focuses on providing strategic guidance and fostering operational efficiencies. In 2023, Constellation completed 35 acquisitions, underscoring its ongoing commitment to growth through mergers and acquisitions.

Furthermore, Constellation's subsidiaries are deeply engaged in the ongoing development and maintenance of their specialized VMS offerings. This ensures their mission-critical solutions remain current, secure, and high-performing for their customer base, a crucial element for customer loyalty and predictable recurring revenue. The company's strategy also heavily emphasizes retaining and developing talent within acquired companies, preserving institutional knowledge and strong customer relationships.

Capital allocation is another core activity, with Constellation consistently reinvesting free cash flow into its VMS portfolio to drive growth and profitability. The company maintains a high hurdle rate for investments, ensuring capital is deployed into opportunities with the highest potential for superior returns. For example, in 2023, Constellation's diversified portfolio continued to demonstrate resilience and growth, supported by strategic capital deployment and effective management of acquired businesses.

| Key Activity | Description | 2023 Impact/Focus |

|---|---|---|

| Acquisition of VMS Businesses | Identifying, vetting, negotiating, and integrating vertical market software companies worldwide. | Completed 35 acquisitions, expanding market reach and capabilities. |

| Portfolio Management & Integration | Providing strategic guidance and fostering operational efficiencies within acquired entities, preserving autonomy. | Focus on maintaining unique value propositions and fostering innovation within subsidiaries. |

| Product Development & Maintenance | Continuous enhancement and upkeep of specialized VMS offerings by subsidiaries. | Ensuring solutions remain relevant, secure, and high-performing to drive customer loyalty and recurring revenue. |

| Talent Retention & Development | Retaining and developing experienced management and employees within acquired companies. | Empowering teams to ensure operational continuity and leverage existing expertise, contributing to consistent revenue growth. |

| Capital Allocation | Reinvesting free cash flow into the VMS portfolio and targeting high hurdle rates for investments. | Disciplined deployment of capital to drive growth and profitability across the diverse portfolio. |

Full Version Awaits

Business Model Canvas

The Constellation Software Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered to you, ensuring complete transparency and no surprises. Once your order is complete, you'll gain full access to this ready-to-use Business Model Canvas, allowing you to immediately begin refining your strategy.

Resources

Constellation Software's access to substantial and consistent acquisition capital is a cornerstone of its business model, fueling its relentless buy-and-build strategy. This financial firepower allows the company to identify and execute a high volume of strategic acquisitions, a key driver of its growth.

The company's robust balance sheet, characterized by strong cash reserves and consistent operational cash flow, is critical. As of the first quarter of 2024, Constellation reported over CAD 1.5 billion in cash and cash equivalents, demonstrating its capacity to fund multiple acquisitions and manage its leverage effectively.

Constellation Software's extensive portfolio of Vertical Market Software (VMS) companies is a cornerstone of its business model. This ever-growing collection of acquired businesses offers a vast array of mission-critical software solutions tailored to specific industries. As of the first quarter of 2024, Constellation Software had acquired over 300 VMS companies, demonstrating significant market reach and stability.

This diverse portfolio is a key resource because it generates a wide range of recurring revenue streams. By serving numerous verticals, from healthcare to public sector and utilities, Constellation mitigates risk and ensures consistent financial performance. The sheer number and variety of these businesses provide a robust foundation for continued growth and operational resilience.

Constellation Software's decentralized management expertise is a core resource, allowing them to effectively acquire and integrate vertical market software (VMS) companies. This structure, combined with a well-honed M&A playbook, facilitates scalable growth by empowering local management teams.

This decentralized approach, supported by experienced leadership at both the corporate and business unit levels, is a significant intangible asset. It enables Constellation to maintain operational efficiency and foster innovation across its diverse portfolio of VMS businesses.

In 2024, Constellation Software continued to demonstrate the strength of this model, with its acquisition strategy remaining a key driver of its financial performance. The company's ability to identify, execute, and manage acquisitions efficiently underpins its sustained growth trajectory.

Proprietary M&A Database and Deal Sourcing Network

Constellation Software's proprietary M&A database and extensive deal sourcing network are critical assets. This allows them to systematically identify and assess thousands of potential acquisition targets each year, ensuring a consistent flow of opportunities to fuel their growth. For instance, in 2023, Constellation completed 34 acquisitions, demonstrating the effectiveness of their sourcing capabilities.

This robust infrastructure is fundamental to their business model. It enables proactive engagement with the market, rather than reactive responses to inbound opportunities. The sheer volume of targets evaluated means they can be highly selective, focusing on acquisitions that align with their strategic objectives and financial criteria.

- Proprietary M&A Database: An internal repository of potential acquisition targets, meticulously categorized and analyzed.

- Deal Sourcing Network: A broad network of industry contacts, intermediaries, and advisors that continuously feeds potential acquisition opportunities.

- Annual Evaluation Capacity: The ability to evaluate thousands of potential acquisitions annually, ensuring a wide funnel of prospects.

- Strategic Growth Engine: This systematic approach provides a predictable pipeline of acquisition candidates, underpinning Constellation's long-term growth strategy.

Skilled Software Development and Support Teams

Constellation Software leverages a vast network of skilled software development and support teams across its numerous subsidiaries. These dedicated professionals are the backbone of the company, responsible for the continuous innovation, maintenance, and improvement of highly specialized vertical market software. Their expertise ensures that Constellation's acquired businesses remain at the forefront of their respective industries, delivering exceptional value and support to a global customer base.

These teams are crucial for maintaining the high quality and technical sophistication of the software products Constellation offers. By fostering deep domain knowledge within these development groups, the company ensures that its solutions are not only functional but also perfectly tailored to the unique needs of each vertical market it serves. This focus on specialized expertise drives customer loyalty and reinforces Constellation's position as a leader in its chosen sectors.

For instance, as of late 2023 and looking into 2024, Constellation's decentralized model allows these skilled teams to operate with autonomy, fostering agility and rapid response to market changes. This structure is a key driver of the company's sustained growth and its ability to integrate and enhance acquired software businesses effectively. The emphasis on specialized talent ensures ongoing product relevance and customer satisfaction.

Key aspects of these skilled teams include:

- Deep Vertical Market Expertise: Developers and support staff possess specialized knowledge relevant to each specific industry served.

- Product Development and Enhancement: Teams are responsible for building new features and improving existing functionalities.

- Customer Support Excellence: Providing timely and effective technical assistance to ensure high customer satisfaction.

- Acquisition Integration: Facilitating the smooth integration and ongoing support of newly acquired software companies.

Constellation Software's access to substantial and consistent acquisition capital is a cornerstone of its business model, fueling its relentless buy-and-build strategy. This financial firepower allows the company to identify and execute a high volume of strategic acquisitions, a key driver of its growth. The company's robust balance sheet, characterized by strong cash reserves and consistent operational cash flow, is critical. As of the first quarter of 2024, Constellation reported over CAD 1.5 billion in cash and cash equivalents, demonstrating its capacity to fund multiple acquisitions and manage its leverage effectively.

Constellation Software's extensive portfolio of Vertical Market Software (VMS) companies is a cornerstone of its business model. This ever-growing collection of acquired businesses offers a vast array of mission-critical software solutions tailored to specific industries. As of the first quarter of 2024, Constellation Software had acquired over 300 VMS companies, demonstrating significant market reach and stability.

Constellation Software's decentralized management expertise is a core resource, allowing them to effectively acquire and integrate vertical market software (VMS) companies. This structure, combined with a well-honed M&A playbook, facilitates scalable growth by empowering local management teams. In 2024, Constellation Software continued to demonstrate the strength of this model, with its acquisition strategy remaining a key driver of its financial performance.

Constellation Software's proprietary M&A database and extensive deal sourcing network are critical assets. This allows them to systematically identify and assess thousands of potential acquisition targets each year, ensuring a consistent flow of opportunities to fuel their growth. For instance, in 2023, Constellation completed 34 acquisitions, demonstrating the effectiveness of their sourcing capabilities.

Constellation Software leverages a vast network of skilled software development and support teams across its numerous subsidiaries. These dedicated professionals are the backbone of the company, responsible for the continuous innovation, maintenance, and improvement of highly specialized vertical market software. Their expertise ensures that Constellation's acquired businesses remain at the forefront of their respective industries.

These skilled teams possess deep vertical market expertise, are responsible for product development and enhancement, provide customer support excellence, and facilitate acquisition integration.

| Key Resource | Description | 2024 Relevance/Data |

| Acquisition Capital | Substantial and consistent capital for acquiring VMS companies. | Over CAD 1.5 billion in cash and cash equivalents (Q1 2024). |

| VMS Portfolio | Diverse collection of mission-critical software solutions across various industries. | Over 300 VMS companies acquired (Q1 2024). |

| Decentralized Management | Expertise in acquiring and integrating VMS companies with empowered local teams. | Continues to be a key driver of financial performance in 2024. |

| M&A Database & Network | Proprietary system and broad network for identifying acquisition targets. | Evaluates thousands of targets annually; 34 acquisitions completed in 2023. |

| Skilled Development & Support Teams | Specialized teams driving innovation, maintenance, and customer support. | Focus on deep vertical market expertise and product enhancement. |

Value Propositions

Constellation Software offers acquired VMS business owners a distinct advantage: a permanent, stable home for their company, a stark contrast to the common private equity practice of rapid resale. This model prioritizes the long-term health and continuity of the business, its employees, and its customer base.

This approach often allows existing management teams to continue leading their companies with significant autonomy, preserving the unique culture and operational strategies that made the business successful. For instance, Constellation's decentralized model means acquired companies typically operate independently, maintaining their brand and management structure.

The benefit for acquired owners is substantial peace of mind, knowing their legacy business is not subject to the pressures of short-term financial engineering. This stability fosters a sense of security, ensuring the business can continue to thrive and evolve without the looming threat of an imminent sale or drastic operational changes.

Customers of Constellation's Vertical Market Software (VMS) businesses benefit from mission-critical, reliable solutions designed for their specific industries. These aren't just off-the-shelf programs; they are deeply integrated tools that manage essential operations.

Constellation’s commitment to long-term stability means continuous support, maintenance, and upgrades, ensuring these vital systems remain effective. This dedication fosters exceptional customer loyalty, as businesses become highly reliant on the software's consistent performance and evolution.

Constellation Software offers shareholders a robust growth trajectory fueled by its strategic acquisition model and a significant base of recurring revenue. This approach ensures a predictable income stream, making it an attractive proposition for long-term investment.

The company's diversified revenue streams, stemming from its vast portfolio of software businesses across various industries, act as a powerful risk mitigator. This diversification, coupled with a strong focus on generating free cash flow, has historically translated into impressive shareholder returns, with the company consistently demonstrating its ability to deliver value.

For Employees of Acquired Businesses: Stability and Growth Opportunities

Employees of acquired VMS companies often find a stable environment with clear paths for professional advancement. Constellation Software's decentralized approach typically preserves existing teams and company cultures, offering a sense of security that differs from more disruptive acquisition models.

This preservation fosters a loyal workforce, encouraging continued dedication and productivity. For instance, Constellation's strategy often involves empowering local management, allowing for a smoother transition and retaining valuable institutional knowledge.

The company’s growth strategy, which prioritizes acquiring and nurturing vertical market software businesses, directly translates into expanded opportunities for employees. This can include cross-functional training, exposure to different business units, and career progression within a larger, diversified portfolio.

Constellation Software’s commitment to retaining and developing talent within its acquired entities is a key component of its value proposition. By providing stability and growth, they ensure that the expertise of acquired teams remains a driving force for future success.

- Job Security: Acquired employees benefit from Constellation’s proven track record of integrating businesses without significant layoffs, often retaining existing staff and management structures.

- Career Development: Opportunities arise through exposure to a broad portfolio of software businesses, facilitating skill enhancement and career advancement within the Constellation ecosystem.

- Cultural Preservation: Constellation’s decentralized model respects and often maintains the unique culture of acquired companies, creating a more comfortable and productive work environment.

- Growth Opportunities: Employees can leverage the resources and scale of a large, global software company to pursue new challenges and contribute to a wider range of innovative projects.

For Vertical Markets: Specialized Industry Expertise and Innovation

Constellation Software nurtures vertical markets by acquiring and developing software companies with deep industry knowledge. These specialized businesses provide tailored solutions, enhancing operational efficiency and compliance for their respective sectors.

This focus on niche expertise allows Constellation's acquired companies to innovate effectively, addressing unique challenges. For instance, their healthcare software providers are crucial for managing patient data and regulatory adherence. In 2023, Constellation reported total revenue of CAD $7.2 billion, a testament to the value derived from these specialized software solutions across diverse markets.

- Industry-Specific Solutions: Deep understanding of unique workflows and regulatory needs within verticals like government, utilities, and healthcare.

- Efficiency Gains: Specialized software drives significant operational improvements and cost savings for clients.

- Innovation Catalyst: Constellation's investment fuels innovation within niche software providers, leading to advanced industry solutions.

- Market Leadership: By consolidating and growing specialized players, Constellation strengthens the competitive landscape within each vertical.

Constellation Software's value proposition centers on providing a stable, long-term home for acquired Vertical Market Software (VMS) businesses, contrasting with typical private equity models. This stability preserves company culture and allows existing management to operate with autonomy, ensuring business continuity and customer satisfaction.

Customers receive mission-critical, reliable software solutions tailored to their industries, backed by continuous support and upgrades, fostering strong loyalty. Shareholders benefit from a robust growth trajectory driven by strategic acquisitions and recurring revenue streams, with diversified income sources mitigating risk and delivering consistent value.

Employees find job security and career development opportunities within a decentralized structure that respects company culture, while nurtured verticals benefit from industry-specific innovation and market leadership.

| Value Proposition | Target Audience | Key Benefit | Supporting Fact (2023/2024 Data) |

| Permanent, Stable Home for Acquired Businesses | Acquired Business Owners | Peace of mind, legacy preservation, no short-term financial pressures. | Constellation's decentralized model preserves unique cultures and management structures. |

| Mission-Critical, Reliable Software Solutions | Customers | Operational efficiency, compliance, continuous support, and evolution. | Total revenue of CAD $7.2 billion in 2023 highlights the value of specialized VMS. |

| Robust Growth & Predictable Revenue | Shareholders | Attractive long-term investment, risk mitigation through diversification. | Consistent ability to deliver value and impressive shareholder returns. |

| Job Security & Career Development | Employees | Stable work environment, professional advancement, cultural preservation. | Decentralized approach retains staff and empowers local management. |

| Industry-Specific Innovation & Market Leadership | Vertical Markets | Enhanced efficiency, cost savings, advanced solutions, stronger competitive landscape. | Focus on niche expertise fuels innovation in sectors like healthcare and government. |

Customer Relationships

Constellation's Vertical Market Software (VMS) businesses cultivate long-term, deeply embedded customer relationships. This is primarily because their software is mission-critical, meaning businesses rely on it for essential operations. For instance, their software for municipal governments manages everything from property taxes to public works, making it indispensable.

The high switching costs associated with these specialized solutions foster significant customer loyalty and create predictable, recurring revenue streams. Customers often invest heavily in integrating Constellation's software into their existing workflows, making a change prohibitively expensive and complex. This embedded nature ensures a stable foundation for Constellation's growth.

Constellation Software's business model emphasizes dedicated local support, meaning each acquired Vertical Market Software (VMS) company retains its existing customer support and professional services teams. This strategy ensures that clients receive personalized, industry-specific assistance, fostering strong relationships and a deep understanding of their unique needs within their respective verticals. For instance, in 2023, Constellation reported that its decentralized support model contributed to high customer retention rates across its diverse portfolio of VMS businesses.

Constellation Software cultivates strong customer relationships through dedicated account managers and product specialists within each vertical market software (VMS) business unit. This direct approach ensures that customer feedback is a vital input for ongoing product development and service enhancements. For instance, in 2024, the company continued to leverage these relationships to drive incremental revenue, with many VMS units reporting a significant portion of their growth stemming from existing customer bases through up-selling and cross-selling initiatives.

Community and User Group Participation

Constellation Software actively cultivates vibrant communities and user groups. These platforms serve as crucial hubs for customers to exchange best practices, offer direct feedback, and engage in collaborative problem-solving.

This active participation by users significantly strengthens customer loyalty and provides Constellation with invaluable, real-time insights into evolving market demands and product development needs. For instance, in 2024, feedback from user groups directly influenced the roadmap for several key software updates, enhancing their utility.

- Community Engagement: Fosters a sense of belonging and shared learning among users.

- Feedback Loop: Provides direct channels for customers to influence product development.

- Best Practice Sharing: Elevates the collective knowledge and efficiency of the user base.

- Market Insight: Delivers crucial data on customer pain points and desired features.

Contractual Maintenance and Support Agreements

Constellation Software's customer relationships are heavily anchored by contractual maintenance and support agreements. These aren't just service add-ons; they form the backbone of ongoing engagement, ensuring customers stay current with software. For example, in 2023, recurring revenue, largely driven by these contracts, represented a substantial portion of Constellation's overall income, highlighting their critical role in predictable cash flow.

These agreements are designed to provide continuous value, encompassing essential software updates, crucial technical assistance, and access to new functionalities. This ensures that clients, whether in the public or private sector, benefit from an evolving product suite. The stability offered by these contracts is a key factor in Constellation's resilient financial performance, contributing to a predictable revenue stream year after year.

- Recurring Revenue Stability: Maintenance and support contracts are a primary driver of Constellation's predictable, recurring revenue, a hallmark of its business model.

- Customer Retention: These agreements foster strong customer loyalty by ensuring ongoing value through updates and technical support, minimizing churn.

- Value Proposition: They guarantee customers access to the latest software versions and expert assistance, keeping their solutions optimized and current.

- Financial Predictability: The contractual nature of these relationships provides Constellation with a clear and reliable revenue forecast, aiding strategic planning and investment.

Constellation Software's customer relationships are built on deep integration and mission-critical software, fostering long-term loyalty and predictable recurring revenue. Their decentralized support model, where acquired companies maintain local teams, ensures personalized service, a strategy that contributed to high customer retention in 2023.

Dedicated account managers and product specialists within each business unit drive product development through direct customer feedback. In 2024, a significant portion of growth came from existing customers via up-selling and cross-selling, underscoring the strength of these relationships.

| Metric | 2023 Data | 2024 Focus |

|---|---|---|

| Customer Retention | High (reported by VMS units) | Continued emphasis on personalized support and feedback integration. |

| Revenue Source | Substantial recurring revenue from maintenance/support contracts. | Leveraging existing customer bases for incremental revenue growth. |

| Product Development Influence | User group feedback directly influenced key updates. | Ongoing integration of customer insights into product roadmaps. |

Channels

Direct sales and account management teams within each acquired VMS business unit serve as the primary conduit to end-customers. These embedded teams leverage their specialized industry expertise and existing customer relationships for precise sales efforts and robust relationship nurturing.

This decentralized approach is particularly potent in reaching and serving niche markets, fostering strong customer loyalty and understanding. For instance, in 2023, Constellation Software reported that its VMS segment, which heavily relies on these direct sales channels, continued to show robust growth, contributing significantly to the company's overall revenue of CAD 7.7 billion.

Constellation's VMS companies actively participate in industry-specific conferences and trade shows. These events serve as vital platforms for showcasing specialized software solutions to targeted audiences. For instance, a company focused on the legal sector might exhibit at a legal tech conference, demonstrating case management software to potential law firm clients.

These gatherings are instrumental in lead generation and direct customer engagement. By presenting product demonstrations and engaging in face-to-face discussions, VMS companies can effectively highlight their software's unique value propositions. In 2024, many such events saw robust attendance, indicating continued industry interest in specialized software solutions.

Brand awareness within niche markets is significantly boosted through these channels. Establishing a presence at key industry events helps position Constellation's VMS businesses as thought leaders and reliable solution providers. This direct exposure is crucial for differentiating their offerings in competitive vertical markets.

Constellation Software heavily relies on referral networks and word-of-mouth due to the specialized nature of its acquired software. Satisfied customers within these niche markets often become powerful advocates, recommending solutions to their peers. This organic growth channel is incredibly cost-effective, as the trust built through reliable software and dedicated support naturally drives new business.

Online Presence and Digital Marketing (for VMS products)

Each VMS business under Constellation Software actively cultivates its online presence through dedicated websites, detailed product pages, and strategic digital marketing campaigns. These platforms are crucial for educating prospective clients, driving inbound leads, and offering comprehensive product details and demonstrations. Content is meticulously crafted to resonate with the specific needs and language of each vertical market, ensuring maximum relevance and impact.

In 2024, digital marketing spend for B2B software solutions, including VMS products, continued to rise. Companies are increasingly leveraging search engine optimization (SEO), pay-per-click (PPC) advertising, and content marketing to reach their target audiences. For instance, a significant portion of B2B software lead generation now originates from online channels, with many VMS providers reporting that over 60% of their inbound leads come from digital efforts.

- Website Optimization: VMS providers focus on user-friendly websites that clearly articulate value propositions and facilitate easy navigation to product information and demo requests.

- Content Marketing: Creation of blog posts, whitepapers, case studies, and webinars tailored to industry-specific challenges and solutions drives engagement and establishes thought leadership.

- Targeted Advertising: Utilizing platforms like Google Ads and LinkedIn to reach decision-makers within specific industries with relevant VMS solutions.

- Lead Generation Tools: Implementing forms, chatbots, and gated content to capture visitor information and nurture potential customers through the sales funnel.

M&A Sourcing (for company acquisitions)

Constellation Software's M&A sourcing functions as a crucial, albeit indirect, channel for growth, focusing on identifying and acquiring vertical market software (VMS) businesses. This network is vital for maintaining a steady stream of acquisition opportunities, ensuring the company's continuous expansion and market consolidation strategy.

The sourcing process involves a multi-pronged approach, actively engaging with company owners for direct deals, leveraging the expertise of M&A brokers, partnering with investment banks, and utilizing proprietary databases to uncover potential targets. This diversified strategy is key to Constellation's success in identifying suitable acquisition candidates.

- Direct Outreach: Constellation actively contacts founders and owners of VMS companies, often approaching them directly to initiate acquisition discussions.

- M&A Brokers and Investment Banks: The company works with intermediaries who specialize in facilitating company sales, tapping into their deal flow and advisory services.

- Proprietary Databases: Constellation maintains and utilizes internal databases of potential acquisition targets, often built over years of market observation and networking.

- Industry Networking: Building relationships within the VMS industry allows for informal deal sourcing and early access to potential opportunities.

Constellation Software's channel strategy for its Vertical Market Software (VMS) segment is characterized by a blend of direct sales, industry engagement, digital marketing, and strategic acquisitions.

The direct sales model, managed by dedicated teams within each acquired business, ensures deep customer understanding and tailored solutions, a key factor in the VMS segment's consistent growth. For instance, in 2023, this segment was a significant revenue driver for Constellation, contributing to its overall CAD 7.7 billion in revenue.

Digital channels are increasingly vital, with many VMS providers reporting over 60% of inbound leads originating online in 2024, driven by optimized websites, targeted advertising, and valuable content marketing.

The company also leverages industry conferences and referral networks, capitalizing on satisfied customers and niche market presence to foster organic growth and brand awareness.

| Channel | Description | Key Activities | 2024 Focus/Trend |

|---|---|---|---|

| Direct Sales | Embedded sales teams within acquired VMS businesses. | Industry expertise, customer relationship management, tailored sales. | Continued emphasis on niche market penetration and customer retention. |

| Industry Events | Participation in trade shows and conferences. | Product demonstrations, lead generation, brand visibility. | Robust attendance in 2024 indicates strong industry interest in specialized software. |

| Digital Marketing | Online presence via websites, SEO, PPC, content marketing. | Lead capture, customer education, product showcasing. | Increasing reliance, with over 60% of inbound leads from digital efforts reported by many VMS providers. |

| Referral Networks | Word-of-mouth and customer advocacy. | Leveraging satisfied customers for organic growth. | Cost-effective channel driven by software reliability and support. |

| M&A Sourcing | Acquisition of new VMS businesses. | Direct outreach, M&A brokers, investment banks, databases. | Crucial for expansion and market consolidation strategy. |

Customer Segments

Constellation Software actively seeks to acquire small to medium-sized vertical market software (VMS) businesses. These companies are often characterized by their profitability and a dominant presence within their specialized industry segments, making them attractive targets that might be overlooked by larger investment groups.

The core appeal of these VMS businesses lies in their provision of mission-critical software solutions. This often translates into a strong foundation of recurring revenue, a key metric for stable and predictable financial performance, which is highly valued by Constellation.

For instance, in 2024, the VMS sector continued to demonstrate resilience, with many niche software providers reporting consistent revenue growth, often in the high single digits to low double digits. This sustained performance underscores the strategic advantage of acquiring businesses with established, indispensable software offerings.

Constellation Software's subsidiaries serve end-customers across a wide spectrum of industries. These include vital sectors like healthcare, where specialized software manages patient records and billing, and education, supporting administrative and learning platforms. The public sector also relies heavily on their solutions for everything from tax collection to public safety.

The company's strategy deliberately embraces this broad diversification across numerous vertical markets. This approach allows Constellation to capture market share in distinct industries, each with its own set of specialized software requirements. For instance, in 2023, Constellation reported revenues of CAD 8.7 billion, demonstrating the scale of its operations across these varied segments.

Each vertical market presents unique challenges and demands that are met by tailored software solutions. This specialization is key to Constellation's success, enabling them to provide deep value to customers in areas such as utilities, finance, and construction, among many others. This wide reach ensures resilience and broad market penetration.

Organizations requiring mission-critical, specialized software are typically government entities, utilities, and niche industry players. These customers rely on deeply integrated solutions for essential functions like public safety dispatch, utility billing, or specialized legal practice management.

The software is often indispensable, forming the backbone of daily operations and regulatory compliance, leading to significant switching costs. For instance, a municipal government's property tax assessment software, used for decades, would be incredibly complex and costly to replace.

Constellation Software's 2023 annual report highlights its success in serving these segments, with revenue from vertical market software continuing to be a strong driver. The company's strategy of acquiring and managing these specialized software businesses ensures continued revenue streams due to the inherent stickiness of their customer base.

Long-Term Software Users Seeking Stability

Constellation Software's customer segment includes businesses that prioritize stability and long-term partnerships over the constant churn of software upgrades or platform changes. These organizations are often deeply reliant on their existing software infrastructure and seek a vendor that offers continuity and dependable support for mission-critical operations.

The company's acquisition strategy, often described as a 'buy and hold forever' approach, directly addresses this need. By integrating acquired companies and maintaining their software solutions, Constellation provides a sense of security and predictability to its user base. This model resonates with customers who are wary of the disruption and cost associated with frequent software migrations, valuing instead the enduring support for their established systems.

For instance, many of Constellation's acquired software businesses serve niche markets with specialized needs, where switching vendors can be prohibitively expensive and complex. In 2023, Constellation reported revenue of CAD $7.3 billion, a testament to the sustained demand for its stable software offerings across diverse industries.

- Long-Term Partnership: Customers seek vendors committed to ongoing support and development, avoiding costly and disruptive migrations.

- Stability Over Innovation: Preference for reliable, proven software solutions that ensure operational continuity.

- Niche Market Focus: Many users operate in specialized sectors where software customization and long-term vendor relationships are paramount.

- 'Buy and Hold' Appeal: Constellation's acquisition model provides assurance of continued support for acquired software assets.

Companies Seeking Operational Efficiency and Compliance

Many companies turn to Constellation's Vertical Market Software (VMS) to streamline their operations and meet strict regulatory demands. These businesses often operate in specialized industries where off-the-shelf software just doesn't cut it. Constellation's tailored solutions are designed to automate complex workflows, reduce manual errors, and ensure adherence to sector-specific compliance standards, ultimately boosting efficiency.

For instance, Constellation's acquisition of Tyler Technologies' New World public safety software in 2024 highlights this focus. This VMS helps law enforcement and emergency services agencies manage dispatch, records, and field operations, directly improving their operational efficiency and compliance with public safety regulations. These specialized solutions are key to delivering significant value to these niche markets.

Constellation's strategy directly addresses the needs of these segments through:

- Automation of core business processes

- Ensuring adherence to industry-specific regulations

- Providing specialized software for niche markets

- Improving overall operational effectiveness

Constellation Software's customer base primarily consists of organizations requiring highly specialized, mission-critical software solutions. These customers are often found in niche vertical markets, including government, utilities, healthcare, and education, where off-the-shelf software is insufficient for their unique operational needs.

These clients prioritize stability, long-term support, and deep integration with their existing workflows, valuing continuity over frequent technological shifts. For example, in 2023, Constellation's revenue from vertical market software reached CAD $7.3 billion, underscoring the sustained demand from these loyal customer segments.

The company's acquisition strategy targets businesses with established customer relationships, often characterized by high switching costs and a reliance on dependable software for essential functions. This approach ensures a stable revenue base, as seen in the consistent performance of its acquired software portfolios throughout 2024.

| Customer Segment | Key Characteristics | Value Proposition | 2023 Revenue Contribution (VMS) |

| Government Agencies | Mission-critical operations, regulatory compliance, long-term IT needs | Specialized software for public services, tax, safety | Significant portion of CAD $7.3 billion |

| Utilities | Essential services, complex billing, operational efficiency | Software for billing, customer management, asset tracking | Significant portion of CAD $7.3 billion |

| Healthcare Providers | Patient data management, regulatory adherence, specialized workflows | Software for practice management, billing, electronic health records | Significant portion of CAD $7.3 billion |

| Niche Industry Players | Unique business processes, specialized software requirements | Tailored solutions for finance, legal, construction, etc. | Significant portion of CAD $7.3 billion |

Cost Structure

Constellation Software's primary expenditure stems from its aggressive acquisition strategy. This involves significant cash outlays and deferred payments for acquiring Vertical Market Software (VMS) businesses, alongside essential transaction costs like due diligence, legal, and advisory services.

In 2023, Constellation Software spent approximately $1.1 billion on acquisitions, a substantial increase from prior years, reflecting its ongoing commitment to expanding its portfolio. This capital deployment underscores M&A as the most significant component of their cost structure.

A significant portion of Constellation Software's cost structure is tied to the operating expenses of its numerous acquired businesses. These ongoing costs encompass essential elements like employee salaries and benefits for software development, sales, and customer support teams, alongside expenditures for office spaces, utilities, and general administrative functions.

The decentralized operational approach means these costs are distributed across Constellation's vast portfolio of acquired companies, rather than being heavily concentrated in a single headquarters. For instance, in 2023, Constellation reported total selling, general, and administrative expenses of $1.5 billion, reflecting these distributed operational costs.

Constellation Software allocates substantial resources to ongoing research and development across its various Vertical Market Software (VMS) businesses. These investments are vital for creating new functionalities, enhancing existing product suites, and ensuring technological relevance in rapidly changing markets.

A significant portion of this cost is dedicated to maintaining and updating software for its customer base, a necessary expense for ensuring product longevity and customer satisfaction. For instance, in 2023, Constellation Software reported R&D expenses of approximately $238 million, reflecting its commitment to innovation and product support.

Interest Expenses on Debt

Constellation Software's acquisition-driven growth model necessitates significant financing, resulting in substantial interest expenses on its debt. This cost is a key element within its operational expenditures, directly impacting profitability.

Despite a robust net debt to EBITDA ratio, which indicates a manageable leverage position, the actual cash outflow for servicing this debt remains a considerable financial commitment. For instance, in the first quarter of 2024, Constellation reported interest expenses of approximately $67.7 million.

- Debt Servicing Costs: Interest expenses represent a direct cost of capital for Constellation's ongoing acquisitions and operations.

- Financial Health Indicator: While debt is essential for its strategy, the interest expense is a key metric for evaluating financial efficiency.

- Q1 2024 Impact: The $67.7 million in interest paid in Q1 2024 highlights the ongoing financial commitment associated with its debt portfolio.

Corporate Overhead and Central Services

Constellation Software manages its corporate overhead and central services efficiently, despite its decentralized operational structure. These costs are essential for overseeing the vast portfolio, facilitating mergers and acquisitions, and maintaining core administrative functions across the group.

Key components of this cost structure include executive compensation, investor relations activities, and shared services that provide essential support to the individual business units. These central functions are designed to be lean, ensuring that operational costs remain proportionate to the company's significant scale of operations.

- Executive Salaries and Benefits: Covering leadership roles that guide the overall strategy and performance of the conglomerate.

- Investor Relations: Costs associated with communicating with shareholders and the financial community.

- Mergers & Acquisitions (M&A) Teams: Expenses related to identifying, evaluating, and integrating acquired businesses.

- Central Administrative Functions: Including legal, finance, and IT support that benefit all operating segments.

In 2023, Constellation Software reported general and administrative expenses of approximately $368 million, representing a modest percentage of its total revenue, underscoring the company's commitment to cost-effective central management.

Constellation Software's cost structure is heavily influenced by its acquisition strategy, operational expenses of acquired businesses, R&D, and debt servicing. In 2023, the company spent approximately $1.1 billion on acquisitions and reported $1.5 billion in selling, general, and administrative expenses, reflecting the scale of its decentralized operations. Research and development costs amounted to roughly $238 million in 2023, while interest expenses were $67.7 million in Q1 2024, underscoring the financial commitments tied to its growth model.

| Cost Category | 2023 (Approximate) | Q1 2024 (Approximate) |

|---|---|---|

| Acquisitions | $1.1 billion | N/A |

| Selling, General & Administrative (SG&A) | $1.5 billion | N/A |

| Research & Development (R&D) | $238 million | N/A |

| Interest Expense | N/A | $67.7 million |

Revenue Streams

Recurring software maintenance and support fees represent Constellation Software's primary and most dependable revenue source. Customers pay these fees for ongoing support and updates to their essential software systems, creating a predictable and profitable income stream.

These long-term contracts are a cornerstone of Constellation's strategy, fostering customer loyalty and generating high-margin revenue. This consistent revenue base is a defining characteristic of their business model, providing stability even in fluctuating market conditions.

For instance, in 2023, Constellation reported that its recurring revenue, largely from these maintenance and support agreements, constituted a significant portion of its overall income, underscoring its importance. This sticky revenue allows for continued investment in product development and acquisitions.

Constellation Software generates revenue through initial software licensing fees when new customers implement their solutions. This also includes ongoing license sales for adding more users or new functionalities to existing systems.

While not as steady as recurring maintenance, these licensing fees are a significant contributor to Constellation's overall revenue, particularly when they secure new clients. For instance, in 2023, Constellation reported total revenue of C$7.75 billion, with software revenue forming a substantial portion of this growth.

Constellation's VMS businesses frequently offer professional services like software implementation, customization, consulting, and training. These services are crucial for the effective deployment and user adoption of their niche software solutions. In 2023, Constellation reported that its software and services segment generated approximately CAD 7.1 billion in revenue, with professional services playing a significant role in this total.

Subscription Fees for Cloud-Based Solutions

Constellation Software is increasingly seeing its revenue generated from subscription fees for cloud-based solutions, often referred to as Software-as-a-Service (SaaS). This shift provides a highly predictable and scalable income stream, perfectly fitting how businesses consume software today.

Many of Constellation's Vertical Market Software (VMS) businesses are either moving towards or have already fully adopted SaaS models. This approach to revenue generation is a significant trend in the software industry.

- Predictable Revenue: Subscription models offer recurring income, making financial forecasting more reliable.

- Scalability: Cloud-based solutions can easily scale to accommodate more users or data without significant upfront infrastructure costs for the customer.

- Customer Retention: SaaS models often foster stronger customer relationships through ongoing service and support.

- Market Alignment: This revenue stream aligns with modern software consumption trends, enhancing market competitiveness.

Hardware Sales and Other Ancillary Services

Constellation Software also generates income through hardware sales and other related services. While not their primary focus, these offerings complement their software solutions and provide customers with a more integrated experience. For instance, some Vertical Market Software (VMS) businesses within Constellation's portfolio might sell specialized hardware necessary for their software to function optimally, or offer installation and setup services.

These ancillary revenue streams, though typically smaller in proportion to software licensing and maintenance fees, are crucial for diversifying Constellation's income. They contribute to a more robust financial model by capturing additional value from the customer relationship and offering a more complete package. This strategy helps solidify customer loyalty and can open doors for further software upselling.

For example, in 2023, Constellation Software's reporting indicated that while software and maintenance were the dominant revenue drivers, hardware and other services represented a consistent, albeit smaller, portion of their overall financial performance, contributing to their resilient business model.

- Hardware Sales: Revenue generated from the sale of physical components or devices required for software operation.

- Ancillary Services: Income from related services such as installation, customization, training, or support beyond standard maintenance.

- Revenue Diversification: These streams reduce reliance on software subscriptions alone, creating a more stable financial base.

- Customer Value Proposition: Offering hardware and related services provides a more comprehensive, end-to-end solution for clients.

Constellation Software's revenue streams are diverse, with recurring software maintenance and support fees forming the bedrock of its income. These long-term contracts ensure a predictable and high-margin revenue base, fostering customer loyalty. For instance, in 2023, recurring revenue was a substantial part of Constellation's total C$7.75 billion in revenue, demonstrating its critical role in the company's stability and growth.

Initial software licensing fees and ongoing license sales for additional users or functionalities also contribute significantly, especially with new client acquisitions. Professional services, including implementation, customization, and training, are vital for the successful deployment of their niche software, with the software and services segment generating approximately CAD 7.1 billion in 2023.

The company is also increasingly leveraging subscription fees for cloud-based Software-as-a-Service (SaaS) solutions, a trend that offers predictable and scalable income, aligning with modern software consumption patterns. While hardware sales and other ancillary services represent a smaller portion of revenue, they complement software offerings and diversify income streams, contributing to a robust financial model.

| Revenue Stream | Description | 2023 Significance (Approx.) |

|---|---|---|

| Maintenance & Support Fees | Ongoing fees for software updates and technical assistance | Largest and most predictable component |

| Software Licensing | Initial and expansion fees for software use | Significant contributor, especially with new clients |

| Professional Services | Implementation, customization, training, consulting | Integral to software adoption; part of CAD 7.1B segment |

| SaaS Subscriptions | Recurring fees for cloud-based software access | Growing segment, reflecting market trends |

| Hardware & Other Services | Sales of related hardware and ancillary services | Diversifying revenue, complementing software |

Business Model Canvas Data Sources

The Constellation Software Business Model Canvas is built using a combination of internal financial reports, investor relations disclosures, and detailed market research. These sources provide a comprehensive view of revenue streams, cost structures, and customer segments.