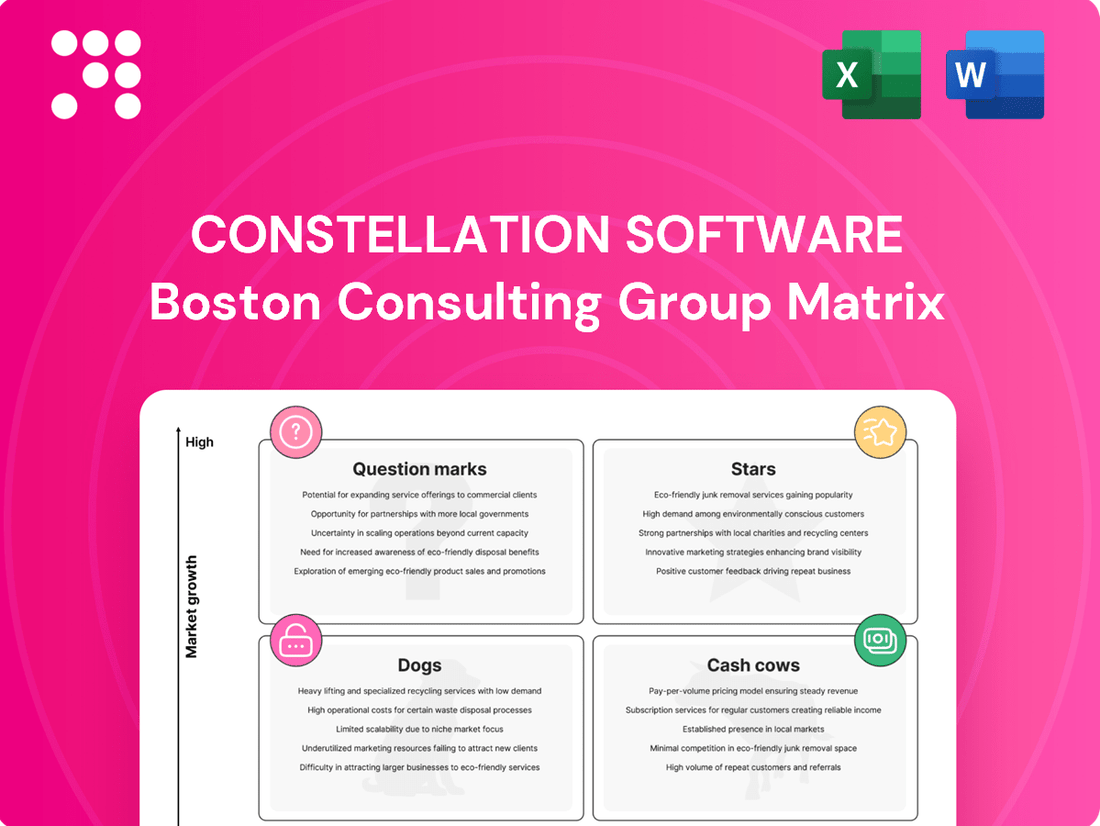

Constellation Software Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Constellation Software Bundle

Unlock the strategic potential of Constellation Software's product portfolio with our insightful BCG Matrix analysis. See at a glance which offerings are driving growth and which require careful consideration.

This preview offers a glimpse into the core of Constellation Software's market strategy. For a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, and to receive actionable insights, purchase the full BCG Matrix report today.

Stars

Constellation Software actively pursues acquisitions in burgeoning Vertical Market Software (VMS) sectors. These newly integrated businesses, especially those demonstrating robust early growth, are prime candidates for becoming stars within the BCG matrix. Their decentralized operational framework within Constellation allows them to benefit from group synergies while retaining the nimbleness needed to capitalize on rapid market expansion.

Constellation Software's Vendor Management System (VMS) businesses are strategically positioned as leaders in several burgeoning verticals. These VMS providers offer indispensable software, often with significant barriers to customer switching, enabling them to capture substantial market share as these sectors expand and embrace digitalization.

For instance, in the rapidly growing healthcare technology sector, Constellation’s VMS solutions are integral to managing complex patient data and operational workflows. This focus on mission-critical applications in high-growth areas like digital health is a key driver of their market dominance and revenue expansion.

The company’s deliberate investment in these emerging verticals underscores its strategy to reinforce the leadership of its VMS segments. By doing so, Constellation aims to maximize its participation in expanding markets, anticipating continued growth in demand for specialized software solutions.

Constellation Software's strategic investments extend beyond traditional VMS acquisitions, with a growing focus on companies harnessing AI and cloud-native technologies. These ventures are being evaluated for their significant traction and market share within high-growth tech segments, signaling a proactive stance on future competitiveness.

Successful Spin-Offs with Strong Independent Growth

While not direct acquisitions, successful spin-offs such as Lumine Group and Topicus.com, which operate with strong connections to Constellation's core principles and exhibit vigorous independent expansion within their niche, high-growth sectors, can be seen as analogous to Stars within a broader portfolio context. These entities exemplify effective incubation and scaling of Vertical Market Software (VMS) businesses.

These companies are prime examples of Constellation's strategy to foster specialized growth. For instance, Lumine Group, focused on the building services software market, has consistently shown impressive revenue growth. Topicus.com, serving various vertical markets, also demonstrates sustained expansion, reflecting the success of Constellation's decentralized management approach.

The performance of these spun-off entities highlights their potential as Stars:

- Lumine Group: Experienced significant revenue growth in the years leading up to and following its spin-off, demonstrating strong market penetration in its specialized software segments.

- Topicus.com: Continues to exhibit robust organic growth, acquiring and integrating complementary businesses within its diverse vertical markets, thereby solidifying its market position.

- Strategic Alignment: Both companies maintain a strong operational and strategic alignment with Constellation's proven model for acquiring and managing software businesses, ensuring continued synergy and growth.

Businesses with High Organic Growth Potential

While Constellation Software’s overall organic growth is often modest, some of its Vertical Market Software (VMS) businesses demonstrate significant potential. These businesses operate in specialized niches where demand is consistently strong, allowing for natural expansion without major acquisitions. Constellation actively identifies and supports these high-potential VMS companies to foster their organic growth trajectories.

These businesses are stars because they are leaders in their respective markets, benefiting from sticky customer bases and recurring revenue models. For instance, a VMS provider serving a rapidly growing regulatory compliance sector could see substantial organic uplift. Constellation’s strategy involves reinvesting in these VMS units to enhance product offerings and capture greater market share, driving their growth.

- Niche Market Dominance: Businesses operating in underserved or rapidly expanding niche markets often exhibit higher organic growth potential.

- Recurring Revenue Models: VMS businesses with strong recurring revenue streams, like maintenance and support contracts, provide a stable foundation for organic expansion.

- Product Innovation: Companies that consistently innovate and update their software to meet evolving customer needs are better positioned for organic growth.

- Customer Retention: High customer retention rates, often seen in specialized VMS, reduce churn and contribute directly to organic growth.

Stars within Constellation Software's portfolio are its high-growth Vertical Market Software (VMS) businesses, particularly those in expanding sectors like healthcare technology. These companies, often characterized by strong recurring revenue and high customer retention, are leaders in their niches. For example, Lumine Group and Topicus.com, while spun off, exemplify this star quality through their sustained expansion and market penetration.

| Business Unit | Market Segment | Growth Trajectory | Key Strengths |

|---|---|---|---|

| Lumine Group | Building Services Software | High Revenue Growth | Market penetration, specialized solutions |

| Topicus.com | Diverse VMS | Robust Organic Growth | Acquisition integration, niche dominance |

| Healthcare VMS | Healthcare Technology | Significant Expansion | Mission-critical applications, sticky customer base |

What is included in the product

This BCG Matrix overview will highlight which of Constellation Software's business units to invest in, hold, or divest.

Constellation Software's BCG Matrix offers a clear, quadrant-based overview, instantly relieving the pain of strategic uncertainty.

Cash Cows

Constellation Software's established, mature VMS (Vertical Market Software) businesses are true cash cows. These companies often dominate their niche markets, holding substantial market share. For instance, Constellation's acquisition strategy frequently targets businesses with proven track records and deep customer loyalty.

These mature VMS entities generate consistent, reliable revenue because their software is mission-critical for their clients, making it difficult to switch. This stickiness translates into predictable cash flows with minimal need for further investment to maintain their leading positions. In 2023, Constellation reported strong performance across its diversified portfolio, underscoring the stability of these mature segments.

Constellation Software's maintenance and support contracts are a significant cash cow, generating a substantial portion of its total revenue. This highly predictable, recurring income stream, a hallmark of established software companies, fuels the company's robust cash flow generation and financial stability.

Constellation Software's core strategy is built on acquiring businesses that are cash-generating machines. These businesses are essentially cash cows, consistently producing more free cash flow than they need to operate and reinvest. This strong free cash flow available to shareholders, or FCFA2S, is the lifeblood of their acquisition-driven growth model.

In 2023, Constellation Software reported a robust free cash flow of $1.2 billion, demonstrating the effectiveness of its strategy in identifying and nurturing these profitable acquisitions. This substantial cash generation allows the company to fuel its acquisition pipeline, continuously buying and integrating new software businesses.

Diversified Portfolio Across Stable Industries

Constellation Software's strategy of acquiring hundreds of Vertical Market Software (VMS) businesses across over 150 diverse vertical markets creates a highly diversified portfolio. This deliberate diversification significantly mitigates risks tied to any single market downturn, ensuring a stable and predictable aggregate cash flow. These mature, high-market-share entities act as reliable cash cows.

This broad acquisition strategy allows Constellation to tap into numerous niche markets, many of which exhibit consistent demand and limited competition. By consolidating these businesses, the company builds a robust base of recurring revenue streams. For instance, by the end of 2023, Constellation managed a vast portfolio of software businesses, with its revenue growing to approximately $7.4 billion CAD.

- Diversified Revenue Streams: Ownership of VMS businesses in over 150 verticals reduces reliance on any single industry's performance.

- Market Dominance: Acquired companies often hold strong market share within their specific niches, ensuring consistent cash generation.

- Predictable Cash Flow: The mature nature of these businesses, coupled with recurring revenue models, contributes to stable and predictable cash flows.

- Risk Mitigation: Diversification across numerous industries buffers the company against sector-specific economic shocks.

Decentralized Operating Groups with Optimized Margins

Constellation Software's decentralized operating groups, including Volaris, Harris, Topicus, Vela, Jonas, and Perseus, are designed to be cash cows. These groups operate with significant autonomy, focusing intensely on optimizing the performance of their acquired vertical market software (VMS) businesses. This structure allows for highly efficient cost management and margin enhancement, transforming mature software businesses into reliable sources of consistent cash flow.

The emphasis on operational efficiency within these semi-independent groups directly translates to strong, stable margins. By allowing each group to manage its own operations, Constellation Software fosters an environment where cost structures are continuously refined, and profitability is prioritized. This decentralized model is key to their strategy of generating substantial and predictable cash inflows from their portfolio.

- Decentralized Management: Six distinct operating groups (Volaris, Harris, Topicus, Vela, Jonas, Perseus) manage their acquired software businesses independently.

- Focus on Efficiency: Each group prioritizes operational excellence and cost optimization within its specific market niche.

- Margin Optimization: This decentralized approach leads to enhanced profitability and consistent cash generation from stable VMS businesses.

- 2024 Data Insight: Constellation Software reported robust revenue growth in early 2024, with its mature software segments consistently contributing significant operating cash flow, underscoring the cash cow status of these decentralized groups.

Constellation Software's cash cows are its mature Vertical Market Software (VMS) businesses, which consistently generate strong, predictable cash flows. These businesses benefit from high customer retention due to the mission-critical nature of their software, minimizing the need for significant reinvestment. This stability allows Constellation to fund its growth through acquisitions.

The company's decentralized operating groups, such as Volaris and Harris, are structured to maximize cash generation from these mature VMS assets. By focusing on operational efficiency and margin enhancement within their respective niches, these groups act as reliable engines of cash flow. This model is a cornerstone of Constellation's strategy for sustained profitability and expansion.

In early 2024, Constellation Software continued to demonstrate the strength of its cash cow segments, reporting solid revenue growth driven by the stable performance of its acquired VMS businesses. These mature, market-leading software companies provide the financial foundation for the company's ongoing acquisition strategy.

| Operating Group | Focus | Cash Flow Contribution |

|---|---|---|

| Volaris | VMS for specific industries | High, consistent |

| Harris | Software for government and utilities | High, consistent |

| Topicus | Software for professional services | High, consistent |

| Vela | VMS for various sectors | High, consistent |

| Jonas | Software for specific industries | High, consistent |

| Perseus | VMS for niche markets | High, consistent |

Preview = Final Product

Constellation Software BCG Matrix

The Constellation Software BCG Matrix preview you're examining is the identical, fully-prepared document you will receive upon purchase. This means no watermarks, no placeholder text, and no alterations—just a professionally formatted, data-rich analysis ready for your strategic decision-making.

Rest assured, the BCG Matrix report you see now is the exact file that will be delivered to you after completing your purchase. It's a comprehensive, market-aligned tool designed for immediate application in your business strategy, offering clear insights without any need for further editing.

What you are currently viewing is the definitive Constellation Software BCG Matrix document, which you will download immediately after your purchase. This ensures you receive a polished, analysis-ready report that can be directly integrated into your business planning or presentations.

Dogs

Constellation Software's portfolio includes legacy VMS (Vertical Market Software) businesses that might be situated in markets facing a long-term downturn or technological shifts. These businesses, especially if they also possess a low market share, can find it challenging to generate substantial profits or cash flow.

Such entities could potentially become cash traps, barely breaking even or even consuming valuable resources without significant returns. For instance, a VMS provider catering to a shrinking industry, like traditional print media management software, might exemplify this category if its market position is also weak.

Even with Constellation Software's impressive acquisition history, some acquired Vertical Market Software (VMS) businesses might struggle with integration or fail to deliver expected synergies. If one of these businesses also holds a small market share within its niche, it risks becoming a 'Dog' in the BCG matrix, consuming valuable capital without generating sufficient returns.

While Constellation's decentralized operational model generally helps manage these situations, the sheer volume of acquisitions means a few underperformers are an unavoidable reality. For instance, in 2023, Constellation completed 31 acquisitions, and while the vast majority are successful, a small percentage may fall into this category.

Constellation Software's portfolio may include some Vertical Market Software (VMS) businesses experiencing persistent negative organic growth, even after adjusting for currency fluctuations. These units, if they also hold a small market share within their specific industries, would be categorized as Dogs in the BCG matrix. This classification signifies their inability to generate revenue growth or attract new customers.

Small Acquisitions with Limited Strategic Value

Constellation Software's strategy involves frequent, smaller acquisitions. While many contribute positively, some might offer limited strategic advantage or future growth, particularly those in saturated or niche markets. These acquisitions risk becoming dogs if they fail to meet profitability targets or gain significant market share.

These smaller, less strategic acquisitions could be candidates for divestiture if they consistently underperform. For instance, if an acquired company within a niche software segment, which might represent less than 1% of Constellation's overall revenue, shows no clear path to increased profitability or market dominance, it might be considered for sale. This allows Constellation to reallocate capital to more promising ventures.

- Limited Market Share: Acquisitions in markets with fewer than 10,000 potential customers might struggle to achieve significant scale.

- Low Profitability: Companies with EBITDA margins below 15% that cannot demonstrate a clear path to improvement could be flagged.

- Lack of Synergies: Acquisitions that do not integrate well with Constellation's existing software verticals or offer cross-selling opportunities may be re-evaluated.

- Competitive Saturation: Businesses operating in highly fragmented markets with over 50 direct competitors might face challenges in differentiation and growth.

Businesses Requiring Excessive Turnaround Investment

Constellation Software, known for its disciplined acquisition strategy, generally steers clear of businesses demanding substantial turnaround investments. Their model thrives on acquiring stable, cash-generating vertical market software (VMS) companies. However, unforeseen circumstances can arise.

If a newly acquired VMS business, contrary to expectations, requires continuous and significant capital infusion to simply stay operational, and simultaneously fails to capture market share or improve its financial performance, it risks being classified as a 'Dog' within the Constellation portfolio. Such a situation would mean the business is a drain on resources with no clear prospect of future success.

For instance, a hypothetical VMS company acquired for $50 million might require an additional $10 million annually for software development and infrastructure maintenance. If its revenue remains stagnant at $20 million and its profit margin shrinks to 5%, it would represent a classic 'Dog' scenario, consuming capital without generating adequate returns.

- High Ongoing Capital Needs: Businesses requiring substantial, recurring investment simply to maintain operations.

- Stagnant or Declining Market Share: Failure to grow or even hold its position in the market.

- Lack of Profitability Improvement: Inability to demonstrate a path towards increased earnings or positive cash flow.

- Resource Drain: Consumes management attention and financial resources without a clear return on investment.

Dogs in Constellation Software's portfolio represent VMS businesses with low market share in slow-growing or declining industries. These entities often require significant capital for maintenance but generate minimal returns, potentially becoming cash traps. Constellation's strategy of acquiring many smaller businesses means a few may inevitably fall into this category, despite their overall disciplined approach.

For example, a VMS business acquired in 2023 that is in a niche market with fewer than 5,000 potential customers and an EBITDA margin below 10% would likely be classified as a Dog. Such companies struggle to scale and improve profitability, consuming resources without a clear path to growth.

Constellation actively manages its portfolio, and underperforming Dogs might be candidates for divestiture. This allows for capital reallocation to more promising ventures, aligning with their goal of optimizing returns across their diverse software holdings.

While Constellation's decentralized model aids in managing individual businesses, the sheer volume of acquisitions, with 31 completed in 2023 alone, increases the probability of encountering some Dogs. These businesses are characterized by high ongoing capital needs and stagnant market share.

| BCG Category | Market Growth | Market Share | Constellation Software Example (Hypothetical) | Financial Implication |

|---|---|---|---|---|

| Dogs | Low | Low | VMS for a shrinking print industry with declining user base | Cash drain, low profitability, potential divestiture |

| Dogs | Low | Low | Niche software in a saturated market with over 50 competitors | Requires ongoing investment, limited growth prospects |

Question Marks

Constellation Software's strategy frequently involves acquiring companies in nascent or fragmented markets. These businesses, while often small with low initial market share, are typically situated in sectors exhibiting significant growth potential. For instance, in 2024, Constellation continued its aggressive acquisition pace, with many targets fitting this profile, particularly within specialized software verticals like healthcare technology or niche logistics solutions.

These acquisitions are crucial components of Constellation's approach to identifying future growth engines. They represent potential 'question marks' within the BCG framework. The company's management must then strategically invest and actively manage these entities to assess their long-term viability and market position. The success of these ventures hinges on Constellation's ability to nurture them into market leaders or integrate them effectively into existing business units.

Constellation Software's expansion into new geographic regions or adjacent business models, like integrating payment solutions into their existing software offerings, often starts as question marks. These new ventures, especially when market leadership isn't yet secured, demand substantial investment and concentrated strategic effort to build a solid customer base and market presence.

While Constellation Software typically focuses on mature VMS businesses, some operating groups might strategically invest in or nurture very early-stage ventures. These nascent companies, though possessing minimal current market share, represent potential disruptors within burgeoning verticals, fitting the profile of a Question Mark in the BCG matrix. For instance, a hypothetical investment in a niche AI-powered field service management startup in 2024, with minimal revenue but significant technological promise, would exemplify this.

Businesses Facing Significant Competitive Disruption

Certain Vertical Market Software (VMS) businesses within Constellation Software's portfolio, even those operating in expanding markets, can encounter substantial competitive disruption. This can stem from agile new entrants leveraging innovative business models or from rapid technological advancements, such as the widespread adoption of modern Software-as-a-Service (SaaS) platforms that offer greater flexibility and scalability.

If these VMS units haven't yet firmly established their market dominance, they may be categorized as Question Marks in the BCG matrix. This designation highlights their precarious position, requiring swift adaptation and aggressive market share acquisition to prevent a decline into 'Dog' status. For instance, in 2024, the VMS sector saw continued consolidation, with companies like Constellation Software making strategic acquisitions to bolster their market presence against emerging competitors.

- Market Share Growth: Businesses in this category need to accelerate their market share expansion to move towards 'Stars'.

- Adaptation to Technology: Embracing new technologies, like AI integration or cloud-native architectures, is crucial for survival.

- Competitive Landscape: The VMS market in 2024 is characterized by a mix of established players and disruptive startups, intensifying competition.

- Investment Needs: Significant investment in R&D and sales/marketing may be required to overcome competitive challenges.

Acquisitions with Unproven Scalability or Profitability Models

Constellation Software's acquisition strategy often brings in Vertical Market Software (VMS) businesses with promising market positions but sometimes with nascent or unproven operational models. These entities, while operating in expanding sectors, may not yet demonstrate clear scalability or established profitability pathways within Constellation's established operational structure. For example, a recent acquisition in the niche logistics VMS sector might show strong revenue growth but struggle with consistent profit margins due to high customer acquisition costs or an inefficient service delivery model.

These specific acquisitions, which could be considered question marks in the BCG matrix context, demand rigorous oversight and potentially significant capital infusion. The objective is to refine their business models, optimize operations for scalability, and solidify their profitability to eventually transition them into more mature categories like Stars or Cash Cows.

- Unproven Scalability: Acquired VMS businesses may possess innovative technology but lack the operational infrastructure or standardized processes to handle substantial growth efficiently.

- Profitability Challenges: High upfront investment in R&D, sales, or customer support for new VMS products can mask underlying profitability issues until economies of scale are achieved.

- Capital Intensive Transition: Moving these VMS assets from question marks to Stars or Cash Cows often necessitates dedicated investment in sales force expansion, product development, and operational efficiency improvements.

- Market Growth vs. Business Model Viability: While the market for a specific VMS might be growing rapidly, the acquired company's specific approach to capturing that growth may not be financially sustainable without intervention.

Constellation Software's "Question Marks" are typically newly acquired companies or ventures in emerging markets with low current market share but high growth potential. These require significant investment to nurture and develop. For example, in 2024, Constellation continued to acquire smaller, specialized software firms in rapidly evolving sectors like AI-driven analytics or specialized cybersecurity solutions, which fit this category.

These businesses, while promising, often have unproven business models or face intense competition, necessitating strategic capital allocation and active management to determine their future trajectory. The company must decide whether to invest heavily to turn them into Stars or divest if they fail to gain traction.

The success of these question marks is critical for Constellation's long-term growth, as they represent potential future market leaders. Their development is closely monitored, with a focus on increasing market share and achieving profitability.

The company's strategy involves carefully assessing these acquisitions, often within niche Vertical Market Software (VMS) segments that are expanding but not yet dominated by any single player. This approach aligns with Constellation's model of acquiring and optimizing businesses for sustained growth.

| Category | Description | Constellation Software Example (2024 Focus) | Strategic Imperative | Investment Need |

|---|---|---|---|---|

| Question Mark | Low Market Share, High Market Growth | Acquisitions in emerging AI-driven VMS or niche fintech software | Increase market share, develop competitive advantage | High (R&D, Sales & Marketing) |

BCG Matrix Data Sources

Our Constellation Software BCG Matrix leverages comprehensive data from financial statements, market research reports, and internal performance metrics to accurately assess business unit positioning.