China Southern Airlines PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Southern Airlines Bundle

Navigate the complex external forces impacting China Southern Airlines with our comprehensive PESTLE analysis. Discover how political shifts, economic fluctuations, and technological advancements are shaping the airline's strategic landscape. Unlock actionable intelligence to refine your market approach and gain a competitive edge.

Gain a crucial understanding of the political, economic, social, technological, legal, and environmental factors influencing China Southern Airlines. Our expertly crafted PESTLE analysis provides the deep-dive insights you need to make informed decisions. Download the full version now and equip yourself with the knowledge to anticipate market changes and capitalize on opportunities.

Political factors

China Southern Airlines operates as a state-owned enterprise, with China Southern Air Holding Company Limited (CSAH) holding a controlling stake. This government ownership grants Beijing considerable influence over the airline's strategic planning, operational choices, and capital investments, shaping its trajectory within the global aviation market.

The Chinese government's involvement extends to providing financial support, with aid packages historically playing a crucial role in bolstering the airline's financial stability during challenging periods. For instance, during the COVID-19 pandemic, state-backed airlines, including China Southern, received significant financial assistance to navigate the severe downturn in air travel.

China's government actively shapes the aviation landscape through its policies. These include stringent regulations on civil aviation safety, significant investments in infrastructure development, and evolving rules for low-altitude airspace management, all of which directly influence China Southern Airlines' operations and strategic planning.

Recent legislative efforts, such as draft amendments to the Civil Aviation Law, underscore the government's commitment to improving safety standards and fostering the growth of general aviation. These proposed changes also aim to bolster passenger rights, creating a more regulated and consumer-focused environment for airlines like China Southern.

Geopolitical tensions and evolving trade relations between China and key international partners significantly impact China Southern Airlines' operations. Fluctuations in these relationships can directly affect the viability of international flight routes, influencing passenger demand and the efficiency of vital supply chains for aircraft components.

For instance, the ongoing uncertainty surrounding Boeing 737 MAX delivery schedules, partly influenced by international trade dynamics, has compelled China Southern Airlines to make strategic adjustments to its fleet expansion plans. This directly impacts its capacity and long-term growth trajectory.

Visa Policies and Tourism Initiatives

Government decisions regarding visa policies and tourism promotion are crucial for China Southern Airlines. Initiatives to simplify visa processes and boost both inbound and outbound travel directly impact passenger numbers.

China's efforts to encourage tourism, such as expanding visa-free transit policies and targeted marketing, are anticipated to significantly increase inbound travel. For instance, in 2023, China saw a notable rebound in international arrivals, with the government actively working to further this trend through 2024 and 2025.

- Visa-Free Policies: Expanded visa-free transit options for numerous countries can attract more international passengers connecting through China.

- Tourism Stimulus: Government-led campaigns promoting China as a travel destination are expected to drive a surge in inbound tourism.

- Outbound Travel Support: Policies facilitating Chinese citizens' outbound travel also benefit airlines like China Southern by increasing demand for international routes.

National Strategic Alignment

China Southern Airlines' strategic direction is closely tied to national development plans, fostering alignment with government priorities. This includes supporting China's ambition to develop its own aviation manufacturing sector, such as the COMAC C919 aircraft. The airline's integration with these national strategies can unlock significant advantages, including potential government subsidies and favorable regulatory treatment, bolstering its competitive position.

This national strategic alignment translates into tangible benefits. For instance, China Southern Airlines is a key player in supporting regional economic development through its extensive route network. By prioritizing domestically produced aircraft, the airline directly contributes to the growth of China's aerospace industry, which saw the C919 begin commercial passenger flights with China Eastern Airlines in May 2023, marking a significant milestone.

- National Strategy Integration: China Southern Airlines actively participates in national initiatives, such as those aimed at boosting domestic air travel and supporting the burgeoning Chinese aerospace manufacturing industry.

- Government Support & Preferential Policies: This alignment often results in favorable government policies, including potential financial incentives and regulatory advantages, especially concerning the use and promotion of domestically built aircraft like the C919.

- Regional Development Contribution: The airline's operational footprint is designed to complement national goals for regional economic growth and connectivity, further solidifying its strategic importance.

Government policies heavily influence China Southern Airlines, given its state-owned nature. Beijing's strategic directives shape fleet expansion, route planning, and operational priorities, often aligning with national economic and developmental goals. For example, the government's push to develop domestic aircraft manufacturing, like the COMAC C919, directly impacts fleet choices and future orders.

Regulatory frameworks, including safety standards and air traffic management, are set by the Civil Aviation Administration of China (CAAC). These regulations, continually updated to enhance safety and efficiency, directly govern China Southern's operations. Recent amendments to the Civil Aviation Law in 2024, focusing on passenger rights and safety, exemplify this evolving regulatory landscape.

Geopolitical factors and international trade relations also play a significant role. Trade disputes or shifts in diplomatic ties can affect international route approvals, aircraft part sourcing, and overall passenger demand on global routes. The ongoing integration of China's aviation sector with global standards, while also promoting domestic capabilities, presents a complex political environment.

Government support, particularly during economic downturns, remains a critical political factor. State-backed financial assistance and preferential policies, such as those offered during the COVID-19 pandemic, have been instrumental in maintaining stability. This support is expected to continue, especially as the airline integrates more domestically produced aircraft into its operations.

What is included in the product

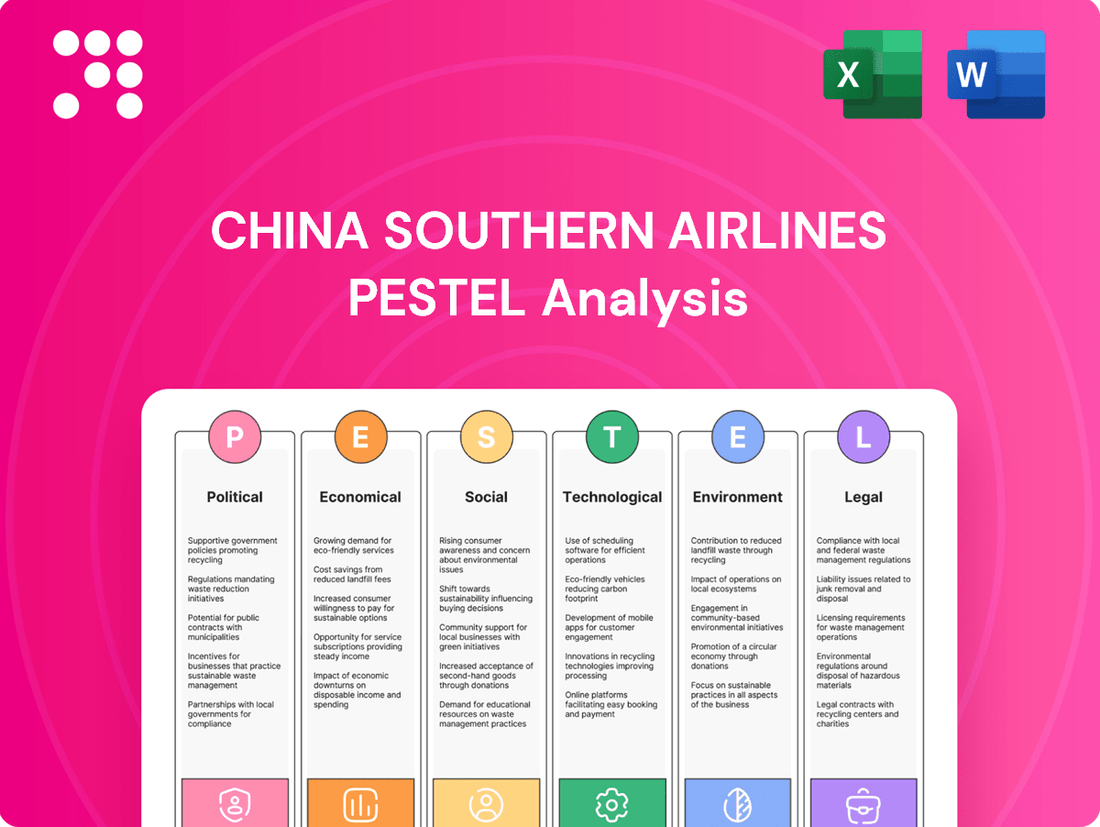

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing China Southern Airlines, providing a comprehensive overview of the external forces shaping its operations and strategic decisions.

This PESTLE analysis for China Southern Airlines offers a concise, easily digestible summary, acting as a pain point reliever by providing quick insights into external factors for streamlined decision-making.

Economic factors

China Southern Airlines has seen a robust rebound in its domestic market, a crucial element in its financial resurgence. Passenger volumes on domestic routes surged, with reports indicating a substantial increase in the first half of 2024 compared to the previous year.

This domestic recovery continues to be the primary engine for China Southern's passenger traffic and revenue generation. For instance, in Q1 2024, the airline reported a significant year-on-year growth in domestic passenger carriage, underscoring the market's importance.

Global economic uncertainties continue to cast a shadow over the aviation sector, directly impacting China Southern Airlines. Fluctuations in global growth forecasts and geopolitical tensions can dampen travel demand, a critical factor for airline revenue. For instance, the International Monetary Fund (IMF) has revised its global growth projections multiple times in the past year, reflecting persistent headwinds.

Fuel prices, a significant operational expense for airlines, remain a key vulnerability. Jet fuel costs are intrinsically linked to crude oil prices, which have experienced considerable volatility. In early 2024, Brent crude oil prices hovered around $80-$90 per barrel, a level that significantly increases operating costs for carriers like China Southern. Higher fuel expenses directly translate to reduced profit margins, potentially forcing airlines to implement surcharges or cut capacity.

The interplay of these factors creates a challenging environment. For China Southern Airlines, managing these economic uncertainties and fuel price volatility is paramount. The airline's ability to adapt its pricing strategies, optimize fuel hedging, and control operational costs will be crucial for maintaining profitability in the face of these external pressures.

China Southern Airlines is navigating a complex market where passenger traffic is booming, yet profitability per passenger is under pressure. Despite record passenger numbers, the average economy class fare and revenue per passenger-kilometer have seen a decline. This suggests a crowded market where intense competition is driving down prices, making it challenging to translate high passenger volumes into commensurate revenue growth.

Cargo Business Performance

The air cargo sector has experienced robust growth, marked by increasing volumes and elevated pricing in international freight. This surge is significantly fueled by the booming cross-border e-commerce market, presenting a crucial revenue avenue for China Southern Airlines, particularly as its passenger segment navigates challenges.

In 2024, the International Air Transport Association (IATA) projected a 4.5% increase in global air cargo volumes compared to 2023, reaching 61.7 million tonnes. This positive trend directly benefits airlines like China Southern, whose cargo operations are vital for diversifying income streams.

- E-commerce Driven Demand: Cross-border e-commerce continues to be a primary driver for air cargo, boosting demand for fast and reliable shipping.

- Revenue Diversification: The strong performance of the cargo business offers China Southern Airlines a stable revenue source, mitigating risks associated with passenger travel fluctuations.

- Capacity Utilization: Increased cargo demand allows for better utilization of aircraft belly capacity, enhancing overall operational efficiency.

Cost Control and Operational Efficiency

China Southern Airlines is actively pursuing cost control and operational efficiency to bolster its financial health. The airline has implemented various cost-cutting initiatives, including optimizing its fleet and concentrating on routes that generate higher profits.

A key aspect of this strategy involves restructuring the fleet by phasing out older, less fuel-efficient aircraft. This move is designed to significantly improve operational cost-effectiveness and reduce maintenance expenses. For instance, by the end of 2023, China Southern Airlines was reportedly operating a fleet of over 900 aircraft, with ongoing efforts to modernize and streamline this inventory.

- Fleet Modernization: Phasing out older aircraft reduces fuel consumption and maintenance costs.

- Route Optimization: Focusing on profitable routes enhances revenue generation and resource allocation.

- Operational Efficiency: Streamlining ground operations and cabin services contributes to overall cost savings.

- Digital Transformation: Investing in technology for better passenger experience and internal process management also aids efficiency.

The domestic Chinese economy's strength is a primary driver for China Southern Airlines, with passenger numbers showing a significant rebound in early 2024. However, global economic uncertainties, including fluctuating growth forecasts and geopolitical tensions, continue to pose risks by potentially dampening international travel demand. Rising fuel prices, directly linked to volatile crude oil markets, remain a major operational cost challenge, impacting profitability. For instance, Brent crude oil prices in early 2024 hovered around $80-$90 per barrel, increasing operational expenses.

Despite record passenger volumes, intense market competition has pressured average fares and revenue per passenger-kilometer, making it harder to translate traffic growth into proportional revenue increases. Conversely, the air cargo sector is experiencing robust growth, driven by cross-border e-commerce, offering a vital revenue diversification opportunity for China Southern. IATA projected a 4.5% increase in global air cargo volumes for 2024, reaching 61.7 million tonnes.

China Southern Airlines is actively implementing cost control measures, including fleet modernization by phasing out older, less fuel-efficient aircraft to improve operational cost-effectiveness. By the end of 2023, the airline operated over 900 aircraft, with ongoing efforts to streamline its fleet. Route optimization and digital transformation are also key strategies to enhance efficiency and manage costs effectively.

| Economic Factor | Impact on China Southern Airlines | 2024/2025 Data/Trend |

|---|---|---|

| Domestic Economic Growth | Increased passenger demand and revenue | Robust rebound in domestic passenger volumes in H1 2024. |

| Global Economic Uncertainty | Reduced international travel demand, potential revenue loss | IMF revisions to global growth forecasts reflect persistent headwinds. |

| Fuel Prices (Jet Fuel) | Increased operational costs, reduced profit margins | Brent crude oil prices around $80-$90/barrel in early 2024. |

| Inflation/Consumer Spending | Impacts disposable income for travel, fare sensitivity | Consumer spending patterns are closely monitored for travel demand elasticity. |

| Interest Rates | Affects cost of capital for fleet expansion/financing | Central bank policies on interest rates influence borrowing costs. |

What You See Is What You Get

China Southern Airlines PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for China Southern Airlines delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic decisions. Understand the critical external forces shaping the airline's future.

Sociological factors

Chinese travelers are increasingly prioritizing unique and personalized experiences over mass tourism. This shift is evident in the growing popularity of smaller, more intimate group tours and the rise of self-guided adventures, with a significant portion of younger travelers actively seeking customized itineraries. For instance, a 2024 survey indicated that over 60% of Chinese millennials and Gen Z expressed a preference for bespoke travel arrangements.

Furthermore, there's a noticeable trend towards exploring destinations during off-peak seasons to avoid crowds and often secure better value. This desire for a more authentic and less congested travel experience is a key driver for many. Concurrently, sustainable travel options are gaining traction, especially among younger demographics who are more environmentally conscious, with reports from 2025 showing a 15% increase in bookings for eco-friendly tour packages.

The demographic landscape of Chinese travelers is evolving significantly. Younger generations, particularly those born after 1990 and 2000, now represent a substantial and growing segment of outbound tourism. This shift is fueled by their increasing financial independence and a pronounced appetite for exploration and novel experiences.

The growing popularity of 'bleisure' travel, blending business and leisure, is a significant sociological shift. Younger generations, in particular, are embracing flexible work arrangements, leading them to combine business trips with personal travel or work remotely from vacation spots. This trend is projected to boost demand for longer stays and potentially alter travel patterns.

For instance, a 2024 survey indicated that over 60% of business travelers in Asia Pacific expressed interest in extending their trips for leisure. This growing segment of travelers may seek enhanced amenities and services catering to both work and relaxation, presenting opportunities for airlines like China Southern to adapt their offerings.

Digital Accessibility and Marketing

Consumers in China increasingly expect seamless digital experiences and tailored services from travel providers. This shift is driven by widespread internet access and a growing digital native population.

Travel companies are heavily investing in digital marketing, with social media platforms playing a crucial role. For instance, by mid-2024, China's social commerce market was projected to reach over $3.9 trillion, highlighting the immense potential for platforms like WeChat, Douyin, and Xiaohongshu to drive bookings and customer engagement.

- Rising Digital Expectations: Chinese consumers anticipate intuitive online booking processes and personalized travel recommendations.

- Social Media Dominance: Platforms like WeChat and Douyin are essential for marketing, customer service, and direct sales, with many users discovering and booking travel through these channels.

- Personalization is Key: Data analytics are used to offer customized travel packages and promotions, enhancing customer loyalty and revenue.

- Mobile-First Approach: The majority of online travel bookings in China occur via mobile devices, necessitating mobile-optimized digital platforms.

Health and Safety Concerns

Public perception of health and safety significantly impacts travel choices, especially following events like the COVID-19 pandemic. For China Southern Airlines, maintaining and clearly communicating robust safety protocols is paramount to rebuilding and sustaining passenger trust. This includes everything from enhanced cabin cleaning to air filtration systems, all of which directly influence booking decisions.

The lingering effects of the pandemic mean that travelers are more attuned than ever to an airline's commitment to health. For instance, in 2024, passenger surveys consistently show that visible safety measures are a key factor in choosing an airline. China Southern Airlines' investment in advanced air purification technology, exceeding industry standards, aims to directly address these heightened concerns and differentiate itself in a competitive market.

The airline's approach to safety is not just operational; it's a critical component of its brand image. Effective communication about these measures, through various channels, is essential for reassuring passengers. This focus on safety is crucial for driving demand, particularly in the leisure travel segment, which often exhibits higher sensitivity to health risks.

Key health and safety considerations for China Southern Airlines include:

- Enhanced cabin sanitation protocols: Implementing rigorous cleaning schedules for all aircraft surfaces.

- Advanced air filtration systems: Utilizing HEPA filters to ensure high-quality cabin air.

- Clear communication of safety measures: Informing passengers about implemented protocols before and during flights.

- Employee health monitoring: Ensuring crew members adhere to health guidelines to minimize transmission risks.

Chinese travelers are increasingly prioritizing personalized and unique experiences, with younger demographics actively seeking customized itineraries. A 2024 survey revealed over 60% of Chinese millennials and Gen Z prefer bespoke travel arrangements, signaling a move away from mass tourism.

The rise of 'bleisure' travel, blending business and leisure, is also reshaping travel patterns. By mid-2024, over 60% of Asia Pacific business travelers expressed interest in extending trips for leisure, indicating a growing demand for flexible travel options and enhanced amenities.

Digital engagement is paramount, with social media platforms like WeChat and Douyin driving discovery and bookings. The Chinese social commerce market was projected to exceed $3.9 trillion by mid-2024, underscoring the importance of a mobile-first, data-driven approach for travel providers.

Health and safety remain critical, with visible sanitation protocols and advanced air filtration systems influencing passenger trust and airline choice. Post-pandemic, travelers are more sensitive to safety measures, making clear communication of these efforts essential for China Southern Airlines.

Technological factors

China Southern Airlines is making significant strides in fleet modernization, integrating advanced aircraft like the Airbus A350-900 and Boeing 787-9 Dreamliner into its operations. This strategic move is driven by the pursuit of enhanced fuel efficiency and technological superiority. For instance, the A350-900 offers a 25% reduction in fuel burn compared to previous generation aircraft.

These new additions not only elevate the passenger experience through improved comfort but also contribute to a reduced environmental footprint. The airline's commitment to a younger, more advanced fleet directly translates to lower operating costs and a competitive edge in an increasingly sustainability-conscious market.

China Southern Airlines is heavily invested in digital transformation, leveraging advanced systems to streamline operations. The 'Horus' aircraft health monitoring system, for instance, provides real-time data to proactively identify and address potential maintenance issues, aiming to reduce downtime and enhance safety. This digital push is crucial for maintaining a competitive edge in the rapidly evolving aviation sector.

Furthermore, the 'Tianji' operation control system is central to their strategy, enabling more efficient flight scheduling, resource allocation, and disruption management. By integrating these sophisticated digital tools, China Southern Airlines seeks to optimize its entire operational ecosystem, leading to improved punctuality and customer satisfaction. This focus on technology is a key enabler for their growth and efficiency targets through 2025.

China Southern Airlines is actively leveraging big data, notably with its proprietary aviation fuel management system, 'Fuel eCloud.' This system is designed to significantly boost energy efficiency, a critical factor in reducing operational costs and environmental impact. In 2023, the airline reported substantial savings through optimized fuel management, though specific figures remain proprietary.

The wider aviation sector is also embracing artificial intelligence, including generative AI, to revolutionize customer experience. This includes AI-powered trip planning tools and the delivery of highly personalized services, aiming to increase passenger satisfaction and loyalty. By 2025, it's projected that AI integration in customer service could lead to a 15% increase in ancillary revenue for airlines that effectively implement these technologies.

Aircraft Maintenance and Manufacturing Advancements

China Southern Airlines' operational efficiency and cost structure are significantly influenced by advancements in aircraft maintenance and manufacturing. The development of core technologies for large aircraft and sophisticated engine systems directly impacts the airline's ability to maintain its fleet, reduce downtime, and manage repair expenses. For instance, the ongoing progress in composite materials and advanced diagnostics can lead to lighter, more fuel-efficient aircraft, lowering maintenance needs and fuel consumption.

The airline's engagement in aircraft maintenance services itself is a key area where technological progress offers opportunities. Innovations in predictive maintenance, utilizing AI and big data analytics, allow for proactive identification of potential issues before they escalate, thereby minimizing unscheduled maintenance and associated costs. This shift from reactive to proactive maintenance is crucial for optimizing fleet availability and operational reliability.

- Technological Advancements in Aircraft Manufacturing: The introduction of new generation aircraft, such as the COMAC C919, which China Southern Airlines is expected to operate, brings updated maintenance requirements and potential for improved operational performance and cost savings compared to older models.

- Engine Technology Improvements: Developments in engine efficiency and durability, like those seen in the latest turbofan engines, directly reduce fuel burn and maintenance intervals, impacting China Southern's operating costs and environmental footprint.

- Digitalization of Maintenance: The adoption of digital tools for maintenance planning, execution, and record-keeping enhances efficiency, reduces errors, and provides better data for cost analysis and future planning.

Autonomous Flight and IoT Exploration

China Southern Airlines, like the broader aviation sector, is observing the burgeoning integration of autonomous flight technologies and the Internet of Things (IoT). These advancements are poised to significantly refine operational efficiencies and passenger experiences. For instance, by 2025, the global aviation IoT market is projected to reach over $10 billion, indicating substantial investment and development in this area.

The exploration of autonomous flight, while still in its nascent stages for commercial passenger transport, holds the potential to revolutionize flight management and safety protocols. IoT integration, conversely, is already making inroads by enabling real-time data collection from aircraft components, leading to predictive maintenance and optimized flight paths. This connectivity allows for more proactive issue resolution, reducing downtime and enhancing service reliability.

- Autonomous Flight Potential: While full autonomy in passenger flights remains a long-term goal, advancements in AI and sensor technology are paving the way for increased automation in flight management systems, potentially leading to reduced pilot workload and enhanced safety.

- IoT for Operational Efficiency: The implementation of IoT devices across China Southern's fleet can provide real-time data on aircraft health, fuel consumption, and passenger cabin conditions. This data enables predictive maintenance, optimizing schedules and reducing operational costs.

- Enhanced Connectivity and Services: IoT will facilitate improved in-flight connectivity for passengers and enable more seamless integration between ground operations and aircraft, leading to better passenger service and more efficient turnaround times.

China Southern Airlines is embracing cutting-edge technology to enhance its fleet and operations. The airline is integrating advanced aircraft like the Airbus A350-900, which boasts a 25% improvement in fuel efficiency over older models. This focus on modernization directly translates to lower operating costs and a reduced environmental impact.

The airline is also heavily invested in digital transformation, utilizing systems like 'Horus' for real-time aircraft health monitoring and 'Tianji' for optimizing flight scheduling and resource allocation. These digital tools are crucial for maintaining a competitive edge through improved punctuality and customer satisfaction, with a strong focus on growth and efficiency targets through 2025.

Furthermore, China Southern Airlines leverages big data through its 'Fuel eCloud' system to boost energy efficiency, a key factor in cost reduction. The aviation industry's wider adoption of AI, including generative AI, is expected to revolutionize customer experience, potentially increasing ancillary revenue by 15% by 2025 for airlines effectively implementing these technologies.

Advancements in aircraft maintenance and manufacturing, including the use of composite materials and AI-driven predictive maintenance, are critical for China Southern. These innovations help reduce downtime and repair expenses, optimizing fleet availability and operational reliability. The airline is also exploring the potential of autonomous flight technologies and IoT for enhanced operational efficiency and passenger services, with the global aviation IoT market projected to exceed $10 billion by 2025.

Legal factors

China's Civil Aviation Law is in the process of being revised. These updates aim to tackle new issues in the industry, such as improving safety standards, encouraging the growth of general aviation, and bolstering passenger rights. These changes are set to directly influence how China Southern Airlines operates.

The amendments are expected to introduce stricter safety regulations, potentially increasing compliance costs for airlines like China Southern. For instance, a focus on enhanced pilot training and aircraft maintenance protocols could necessitate additional investment. Furthermore, the strengthening of passenger rights might lead to revised compensation policies for flight delays or cancellations, impacting operational expenses.

The Civil Aviation Administration of China (CAAC) is the primary body overseeing China Southern Airlines, setting ambitious targets for the sector. For instance, the CAAC aims for significant growth in transportation turnover, passenger trips, and cargo volume, with projections indicating continued expansion in the coming years. China Southern Airlines, like all carriers, must meticulously adhere to these CAAC regulations and evolving safety and service standards to maintain its operational license and reputation.

China Southern Airlines' commitment to robust corporate governance is evident in its establishment of a Remuneration and Assessment Committee. This committee is tasked with the crucial role of evaluating and determining compensation for directors and senior management, ensuring objective and fair decision-making processes. This structure is designed to align executive incentives with the company's strategic goals and shareholder interests, a key requirement in today's regulatory landscape.

International Aviation Agreements and Treaties

China Southern Airlines, as a global carrier, navigates a complex web of international aviation agreements and treaties. These pacts, like the Chicago Convention, dictate crucial operational aspects such as traffic rights, which directly shape the airline's ability to fly specific international routes. For instance, the bilateral air service agreements between China and other nations determine the number of flights and destinations China Southern can serve.

These international frameworks also set stringent safety and environmental standards. Compliance with International Civil Aviation Organization (ICAO) standards is paramount, influencing everything from aircraft maintenance protocols to noise pollution regulations. As of early 2024, the global aviation industry continues to grapple with evolving environmental mandates, pushing airlines like China Southern to invest in more fuel-efficient fleets and sustainable aviation fuels, impacting operational costs and strategic planning.

- International Air Service Agreements: These define market access, route authorities, and capacity limits between China and partner countries, directly impacting China Southern's network expansion.

- ICAO Standards: Adherence to ICAO's safety and security recommendations is non-negotiable for international operations, influencing operational procedures and training.

- Environmental Treaties: Global agreements on emissions reduction, such as those under the UNFCCC, are increasingly influencing fleet modernization and operational efficiency strategies for airlines like China Southern.

Data Privacy and Consumer Protection Laws

China Southern Airlines, like all major carriers, navigates a complex web of data privacy and consumer protection laws. As digital interactions and personalized services become more prevalent, the airline must meticulously manage customer data in compliance with regulations. This is particularly important given the increasing volume of personal information handled through bookings, loyalty programs, and in-flight services.

These legal frameworks are essential for maintaining consumer trust and ensuring fair practices. For instance, China's Personal Information Protection Law (PIPL), effective from November 1, 2021, imposes strict requirements on how companies collect, process, and store personal data. Violations can lead to significant fines, impacting the airline's financial performance and reputation.

- Data Handling Compliance: Adherence to PIPL and similar international regulations is paramount for China Southern Airlines' digital operations.

- Consumer Rights Protection: Ensuring transparent data usage and providing clear recourse for consumers is a legal necessity.

- Cross-border Data Transfer: Regulations governing the transfer of passenger data across international borders add another layer of complexity to compliance efforts.

- Regulatory Scrutiny: Increased government oversight on data practices means proactive compliance is key to avoiding penalties.

China's evolving aviation laws, including revisions to the Civil Aviation Law, directly impact China Southern Airlines' operational framework. Stricter safety mandates and enhanced passenger rights, as seen in the push for better compensation policies for delays, are key considerations. The Civil Aviation Administration of China (CAAC) sets growth targets, such as increasing passenger trips by an estimated 10% annually in the coming years, which China Southern must align with.

International agreements, like bilateral air service agreements, dictate route authorities and capacity, influencing China Southern's global network. Compliance with International Civil Aviation Organization (ICAO) standards is critical for safety and environmental regulations, pushing for investments in newer, more fuel-efficient aircraft. For instance, the global aviation industry is increasingly focused on reducing emissions, a trend that will shape fleet modernization strategies through 2025.

Data privacy laws, such as China's Personal Information Protection Law (PIPL), mandate stringent handling of customer data. As of early 2024, PIPL's enforcement means significant penalties for non-compliance, affecting airlines that process large volumes of personal information for bookings and loyalty programs. This necessitates robust data governance to maintain consumer trust and avoid financial repercussions.

Environmental factors

China Southern Airlines is actively addressing environmental concerns by developing a carbon peaking action plan, aligning with China's ambitious 'dual carbon' objectives of peaking emissions by 2030 and achieving carbon neutrality by 2060. This strategic move reflects a growing global emphasis on sustainability within the aviation sector.

Key initiatives include the implementation of digital fuel-saving practices, which aim to optimize flight routes and reduce overall fuel consumption. Additionally, the airline is exploring carbon offset services as a means to mitigate its environmental footprint, demonstrating a commitment to responsible operations.

China Southern Airlines is actively pursuing enhanced fuel efficiency, a critical environmental factor. This involves rigorous fuel management, integrating advanced aircraft like the Airbus A350, and implementing digital solutions for optimized fuel consumption. For instance, in 2023, the airline reported a significant reduction in fuel burn per flight hour through these initiatives.

The airline's commitment extends to pioneering 'Green Flight' services. These innovative approaches, such as offering on-demand dining options, aim to minimize waste and reduce the overall environmental impact of their operations. This focus aligns with global trends and regulatory pressures towards sustainable aviation practices.

The global aviation sector is committed to achieving net-zero carbon emissions by 2050, with Sustainable Aviation Fuel (SAF) being a cornerstone of this strategy. This presents both a challenge and a significant opportunity for airlines like China Southern.

While precise SAF adoption targets for China Southern Airlines are not publicly detailed, the airline operates within a global ecosystem increasingly prioritizing decarbonization. For instance, the International Air Transport Association (IATA) projects that SAF could account for 65% of the mitigation needed to reach net-zero by 2050, highlighting the critical role of SAF in the industry's future.

The increasing demand for SAF, driven by regulatory pressures and corporate sustainability goals, is likely to influence China Southern's operational and investment decisions. This shift could involve securing SAF supply chains and potentially investing in SAF production technologies to meet future mandates and customer expectations.

Noise Pollution Management

China Southern Airlines, like other major carriers, faces increasing scrutiny over noise pollution, especially near its major hubs such as Guangzhou Baiyun International Airport. The airline is actively investing in fleet modernization to address this. For instance, their acquisition of new generation aircraft, like the Airbus A350 and Boeing 787, significantly reduces noise footprints compared to older models. These newer planes are designed with advanced engine technology and aerodynamic features contributing to quieter operations.

Managing noise pollution is crucial for maintaining good community relations and complying with evolving environmental regulations. China Southern's commitment to this is reflected in their operational strategies and aircraft procurement. By 2024, the airline aimed to have a substantial portion of its fleet composed of these more fuel-efficient and quieter aircraft, a trend expected to continue through 2025.

- Fleet Modernization: Continued integration of quieter aircraft like the Airbus A350 and Boeing 787.

- Operational Adjustments: Implementing flight path optimizations and altitude changes to minimize noise impact on residential areas.

- Regulatory Compliance: Adhering to increasingly strict international and domestic noise regulations around airports.

- Community Engagement: Proactive communication with communities affected by airport noise.

Waste Management and Recycling

Environmental regulations in China increasingly mandate robust waste management and recycling protocols for all industries, including aviation. This directly impacts China Southern Airlines' catering and ground handling operations, requiring diligent sorting and disposal of waste generated during flights and at airports. The airline's commitment to sustainability is therefore intrinsically linked to its ability to implement and adhere to these evolving environmental standards.

China Southern Airlines' proactive approach to waste management is crucial for compliance and enhancing its environmental credentials. For instance, by 2023, airlines globally were reporting significant progress in reducing single-use plastics onboard. China Southern Airlines' specific initiatives in this area, such as implementing advanced recycling programs for cabin waste and optimizing catering supplies to minimize food waste, are key performance indicators.

- Onboard Waste Reduction: Implementing programs to reduce single-use plastics and improve recycling rates for cabin waste.

- Catering Efficiency: Optimizing food supply chains and preparation to minimize food waste, a significant component of airline operational waste.

- Ground Operations: Ensuring responsible waste management practices at airport facilities, including the recycling of materials from aircraft maintenance and ground support equipment.

- Regulatory Compliance: Adhering to China's increasingly stringent environmental protection laws concerning waste disposal and recycling.

China Southern Airlines is actively working towards China's ambitious carbon goals, aiming for emissions peaking by 2030 and carbon neutrality by 2060. This involves optimizing fuel efficiency through advanced aircraft like the Airbus A350 and digital solutions, with reported reductions in fuel burn per flight hour in 2023.

The airline is also embracing 'Green Flight' initiatives, focusing on waste reduction and exploring carbon offset services. The global push for Sustainable Aviation Fuel (SAF) presents both challenges and opportunities, with IATA projecting SAF to be crucial for net-zero by 2050.

Noise pollution is another key environmental factor, addressed through fleet modernization with quieter aircraft like the Boeing 787, alongside operational adjustments and community engagement to comply with regulations.

Stringent waste management regulations are also impacting China Southern, necessitating improved recycling protocols for catering and ground operations, with efforts to reduce single-use plastics and food waste being key performance indicators.

PESTLE Analysis Data Sources

Our China Southern Airlines PESTLE Analysis is grounded in data from official Chinese government bodies, international aviation organizations, and reputable economic forecasting firms. We incorporate reports on trade policies, environmental regulations, technological advancements, and socio-economic trends to ensure comprehensive insights.