China Southern Airlines Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Southern Airlines Bundle

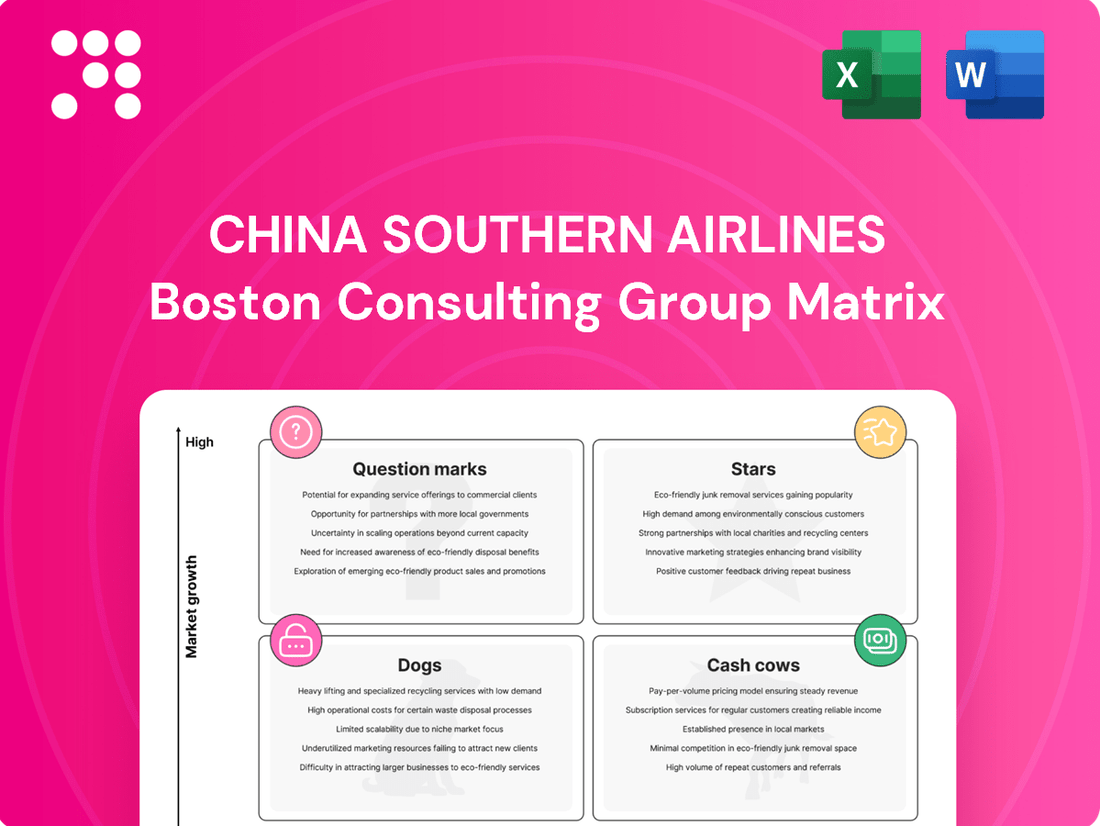

China Southern Airlines' strategic positioning is laid bare in its BCG Matrix, revealing which routes are soaring as Stars, which are reliably generating Cash Cows, and which may be underperforming Dogs. Understanding these dynamics is crucial for navigating the competitive aviation landscape.

This preview offers a glimpse into the airline's portfolio, but for a comprehensive understanding of their market share and growth potential across all segments, you need the full picture. Purchase the complete BCG Matrix to unlock actionable insights and make informed strategic decisions.

Don't just guess where China Southern Airlines is investing; know it. The full BCG Matrix provides the detailed quadrant placements and strategic recommendations you need to confidently plan your next move in the airline industry.

Stars

China Southern Airlines commands a substantial 15% of the domestic market, solidifying its position as China's busiest airline. In July 2025, it offered 12.1 million seats, a testament to its vast operational scale. This robust domestic footprint is a cornerstone of its revenue generation and operational resilience.

The airline has capitalized on the strong rebound in domestic travel, with passenger numbers experiencing significant growth. For instance, March 2024 saw an 18% increase in domestic passengers compared to the previous year, and a 13% rise when measured against 2019 figures. This surge underscores the airline's ability to leverage the recovering and expanding Chinese travel market.

China Southern Airlines is aggressively pursuing international route expansion, a key indicator for its Stars in the BCG Matrix. In 2024, the airline launched 17 new long-haul international routes, demonstrating a strong commitment to global market penetration. This expansion is crucial for capturing growth in emerging travel markets and diversifying revenue, reflecting a confident stance on the recovery of international travel.

By October 2024, China Southern aims to have 85% of its pre-pandemic route network back online. This strategic move includes adding new destinations like Amsterdam, London, Doha, Riyadh, and Tehran. For instance, the Beijing Daxing to Amsterdam route will see increased frequency to six weekly flights starting in January 2025, and new seasonal services to Melbourne and Sydney were introduced from Beijing Daxing in December 2024.

China Southern Airlines' cargo operations are experiencing a strong upward trajectory. Cargo and mail revenue surged by 22.39% from RMB 15,275 million in 2023 to RMB 18,695 million in 2024.

This impressive expansion is largely fueled by heightened demand for international cargo, significantly amplified by the booming cross-border e-commerce sector. These operations represent a vital and growing component of the airline's overall traffic revenue, indicating a healthy market position.

Fleet Modernization and Efficiency

China Southern Airlines is strategically upgrading its fleet to improve efficiency and reduce operational costs. This involves introducing newer, more fuel-efficient aircraft while retiring older models. This proactive approach is crucial for maintaining competitiveness in the aviation industry.

The airline's commitment to modernization is evident in its recent fleet activities. In December 2024 alone, China Southern integrated eight new aircraft into its operations, simultaneously retiring ten older planes. By June 2025, the airline's commercial fleet stood at a substantial 943 aircraft, further bolstered by the addition of four new planes.

This fleet renewal program specifically targets the phasing out of less efficient models like the Boeing 787-8 and Airbus A319. The objective is clear: to significantly enhance operational cost-effectiveness and improve fuel consumption. This ensures China Southern maintains a modern and capable fleet ready to meet future market demands.

- Fleet Modernization: Actively adding new aircraft and retiring older, less efficient models.

- December 2024 Activity: Added eight new aircraft and phased out ten older planes.

- June 2025 Fleet Size: Maintained 943 commercial aircraft, with an additional four new aircraft.

- Efficiency Goals: Aims to boost operational cost-effectiveness and enhance fuel efficiency by retiring models like the Boeing 787-8 and Airbus A319.

Strategic Hub Development at Beijing Daxing

China Southern Airlines is strategically developing its operations at Beijing Daxing International Airport (PKX), aiming to establish it as a key international-to-international connecting hub. This initiative involves significant investment in new routes and infrastructure at Daxing, a move designed to leverage the airport's expanding passenger capacity and improve the airline's global reach.

The airline's commitment to Daxing is evident in its aggressive route expansion. By the end of 2024, China Southern had already launched 13 new direct international and regional routes from Beijing Daxing, significantly increasing its connectivity. This expansion is crucial for capturing traffic flows and solidifying its position in the competitive global aviation market.

- Strategic Hub Focus: China Southern Airlines is prioritizing Beijing Daxing (PKX) for its international-to-international connecting hub ambitions.

- Route Expansion: The airline launched 13 new direct international and regional routes from Beijing Daxing by the end of 2024.

- Capacity Utilization: This strategy aims to capitalize on Daxing's growing passenger throughput, which handled over 32 million passengers in 2023.

- Global Connectivity: The development enhances China Southern's global network and competitive positioning.

China Southern Airlines' international expansion and strong cargo performance position its international routes as Stars in the BCG Matrix. The launch of 17 new long-haul international routes in 2024, coupled with a 22.39% surge in cargo revenue to RMB 18,695 million in 2024, highlights significant growth potential in high-demand markets.

What is included in the product

China Southern's BCG Matrix likely analyzes its diverse fleet and routes, identifying Stars in high-growth markets and Cash Cows in established routes.

This framework would highlight which segments to invest in, hold, or divest to optimize its aviation portfolio.

A clear China Southern Airlines BCG Matrix overview, placing each business unit in a quadrant, simplifies strategic decision-making.

Cash Cows

Guangzhou Hub Operations represent a classic Cash Cow for China Southern Airlines. This hub, centered at Guangzhou Baiyun International Airport, holds a dominant market share within a mature, low-growth region. The sheer volume of passengers and cargo handled here ensures a consistent and substantial generation of cash flow, underpinning the airline's financial stability.

In 2024, China Southern Airlines continued to leverage its Guangzhou hub's strengths. The airline reported carrying over 160 million passengers across its network in the first three quarters of 2024, with a significant portion originating from or transiting through Guangzhou. This robust performance highlights the hub's enduring importance and its role in generating reliable profits.

China Southern Airlines' aircraft maintenance, repair, and overhaul (MRO) services are a strong contender for a cash cow. These operations likely generate consistent revenue due to the sheer size of the airline's fleet and its established expertise.

With a focus on efficiency and potentially serving external clients, the MRO segment benefits from a mature market where demand for maintenance is steady. China Southern's investment in innovation, such as its civil aviation maintenance engineering technology research center, further solidifies its position in this segment, ensuring continued profitability with minimal incremental investment.

China Southern Airlines' catering services are a classic cash cow. This segment generates substantial and steady income due to the sheer volume of passengers served on its extensive flight network.

With established infrastructure and efficient operations, the catering division enjoys high profitability. For instance, China Southern reported carrying 150.08 million passengers in 2023, directly translating to a massive customer base for its catering services.

While the growth potential in airline catering might be moderate, its consistent revenue generation and strong market position make it a vital contributor to the airline's overall financial health, allowing it to fund other ventures.

Ground Handling Services

Ground handling services at China Southern Airlines function as a classic cash cow within their business portfolio. These essential operations, which include everything from baggage handling to aircraft maintenance on the ground, are critical for every flight, ensuring a steady and predictable revenue stream.

The consistent demand for these services makes them a reliable source of cash generation. For instance, China Southern reported that other operating revenue, largely driven by ground service income, saw a significant increase of 7.01% in 2024. This highlights the robust and growing nature of this segment.

Strategic investments in supporting infrastructure for ground handling can further enhance operational efficiency. This not only solidifies the cash-generating capabilities of this mature business area but also has the potential to boost overall cash flow.

- Stable Revenue: Ground handling is essential for all flights, guaranteeing consistent demand.

- Growth in 2024: Ground service income contributed to a 7.01% rise in other operating revenue.

- Efficiency Gains: Investments in infrastructure can improve operations and cash flow.

Established Domestic Routes

China Southern's established domestic routes function as significant cash cows. These routes, connecting major Chinese cities, boast high market share and steady demand, minimizing the need for extensive marketing spend. Their maturity means they consistently generate substantial revenue for the airline, even amidst competitive pricing.

The robust recovery of China's domestic air travel market in 2023 and continuing into 2024 has directly bolstered the performance of these established routes. For instance, China Southern reported a net profit attributable to shareholders of 7.06 billion yuan (approximately $980 million USD) for the first half of 2024, a substantial turnaround from a net loss in the same period of 2023, largely driven by domestic demand.

- High Market Share: Key domestic corridors demonstrate a dominant presence for China Southern.

- Consistent Demand: Mature city pairs exhibit reliable passenger traffic year-round.

- Revenue Generation: These routes are primary contributors to the airline's overall financial health.

- Reduced Investment Needs: Established routes require less capital for promotion and market development.

China Southern Airlines' cargo operations represent a significant cash cow. These services benefit from established logistics networks and consistent demand from businesses reliant on efficient freight transport. The airline's extensive network allows for broad reach, ensuring a steady flow of revenue.

In 2024, the air cargo sector continued to demonstrate resilience. China Southern's cargo volume, while subject to global economic fluctuations, remained a reliable contributor to its financial performance, leveraging its existing infrastructure to maximize returns with minimal new investment.

The airline's loyalty program, Sky Pearl Club, also functions as a cash cow. It fosters customer retention and encourages repeat business, generating steady revenue through membership fees and ancillary services.

The program's established user base and ongoing engagement strategies ensure consistent income. China Southern's focus on enhancing member benefits in 2024 aimed to further solidify this revenue stream, capitalizing on its mature market presence.

| Business Segment | BCG Category | Rationale | 2024 Data/Insight |

| Guangzhou Hub Operations | Cash Cow | Dominant market share in a mature, low-growth region, generating consistent cash flow. | Carried over 160 million passengers network-wide in Q1-Q3 2024. |

| Aircraft Maintenance, Repair, and Overhaul (MRO) | Cash Cow | Steady revenue from large fleet and established expertise in a mature market. | Focus on innovation in MRO engineering technology. |

| Catering Services | Cash Cow | Substantial and steady income from a large passenger base on extensive routes. | Served 150.08 million passengers in 2023. |

| Ground Handling Services | Cash Cow | Essential operations with consistent demand, providing a reliable revenue stream. | Contributed to a 7.01% increase in other operating revenue in 2024. |

| Domestic Routes | Cash Cow | High market share and steady demand on key city pairs, requiring less marketing spend. | Net profit of 7.06 billion yuan in H1 2024 driven by domestic demand. |

| Cargo Operations | Cash Cow | Established logistics, consistent demand, and broad network reach ensure steady revenue. | Resilient performance in the air cargo sector in 2024. |

| Loyalty Program (Sky Pearl Club) | Cash Cow | Fosters customer retention and repeat business, generating consistent income. | Ongoing enhancements to member benefits in 2024. |

What You See Is What You Get

China Southern Airlines BCG Matrix

The preview you see is the exact China Southern Airlines BCG Matrix report you will receive after purchase, offering a complete and unwatermarked strategic analysis. This comprehensive document is ready for immediate use, providing actionable insights into China Southern Airlines' business units. You'll gain access to the fully formatted, professionally designed matrix, enabling you to effectively strategize and present findings. No demo content or alterations will be present; it's the final, polished report for your business planning needs.

Dogs

Certain regional routes within China Southern Airlines' network may be classified as dogs in the BCG matrix. These routes typically exhibit low passenger demand and face fierce competition, often resulting in minimal profit or outright losses. For instance, routes with consistently low load factors, perhaps below 60% on average throughout 2024, would be prime candidates for this classification.

These underperforming routes tie up valuable resources, such as aircraft and crew, without generating substantial returns for the airline. China Southern Airlines actively monitors key performance indicators, including passenger numbers and revenue per available seat kilometer (RASK), to identify these less profitable segments. A route consistently failing to meet its operating costs throughout the year would be a clear indicator of its dog status.

Older, less fuel-efficient aircraft sub-fleets that incur higher maintenance expenses but haven't been fully retired can be classified as dogs in China Southern Airlines' BCG Matrix. Despite ongoing fleet modernization efforts, any remaining older aircraft that don't generate substantial profits would fall into this category.

China Southern has been progressively retiring older aircraft, including some of its Boeing 787-8 and Airbus A319 models, to boost operational efficiency. For instance, by the end of 2023, the airline continued its fleet renewal program, aiming to phase out older, less economical models.

Certain China Southern Airlines routes are facing significant geopolitical headwinds, potentially classifying them as 'dogs' in the BCG Matrix. These routes, particularly those connecting to North America, have experienced substantial demand reduction due to ongoing geopolitical tensions. For instance, flights between China and the United States remained critically low in late 2024, operating at less than 30% of their pre-pandemic capacity.

These routes, once profitable, have seen a sharp decline in traffic and a slow recovery post-pandemic. This has led to the underutilization of the airline's wide-body aircraft dedicated to these long-haul services. The financial strain from these underperforming routes, characterized by reduced capacity and persistently weak demand, makes them a drag on the company's overall performance.

Specific Unprofitable Cargo Lanes

While China Southern Airlines' cargo operations are generally considered a Star, certain specific cargo lanes can be classified as Dogs. These are routes where demand is low and operational costs are high, making them unprofitable. For example, routes with minimal freight volume might not cover the expenses associated with operating the aircraft, fuel, and handling.

These underperforming lanes contribute little to overall profitability and can even incur losses. The airline's cargo capacity saw a decrease of 8.62% in December 2024, which could be partly attributed to the scaling back or discontinuation of such less viable routes.

- Unprofitable Routes: Specific, low-demand cargo lanes with high operating expenses.

- Negative Contribution: These lanes often result in minimal or negative profit contributions.

- Capacity Adjustments: A 8.62% decrease in cargo capacity in December 2024 may reflect the phasing out of such underperforming routes.

Legacy IT Systems and Manual Processes

Legacy IT systems and manual processes within China Southern Airlines, especially those not yet fully integrated into its digital transformation initiatives, represent the 'dogs' in a BCG Matrix analysis of operational efficiency. These systems often require significant maintenance and consume resources without contributing substantially to the airline's competitive edge or future growth. For instance, reliance on older booking or passenger management systems can lead to slower processing times and increased error rates compared to modern, integrated platforms.

These operational inefficiencies directly impact customer experience and internal workflows. Manual data entry and reconciliation, common in legacy systems, are prone to human error and are time-consuming. China Southern's ongoing digital transformation aims to address these issues by consolidating information management and creating a more seamless operational flow, moving away from fragmented and isolated IT environments. This strategic shift is crucial for improving overall productivity and competitiveness in the aviation industry.

- Resource Drain: Legacy systems often incur high maintenance costs and require specialized, often scarce, technical expertise, diverting funds and talent from more strategic initiatives.

- Operational Bottlenecks: Manual processes and outdated IT infrastructure can create significant delays in critical operations like baggage handling, flight scheduling, and customer service, impacting on-time performance.

- Limited Scalability: These systems typically lack the flexibility to adapt to growing passenger volumes or new service offerings, hindering the airline's ability to scale efficiently.

- Competitive Disadvantage: Competitors leveraging advanced digital platforms can offer faster booking, personalized services, and more efficient operations, putting airlines reliant on legacy systems at a disadvantage.

Certain less-trafficked regional routes, particularly those with consistently low load factors below 60% throughout 2024, are likely classified as dogs within China Southern Airlines' BCG matrix. These routes consume resources without generating sufficient returns, impacting overall profitability.

Older, less fuel-efficient aircraft sub-fleets, such as remaining Boeing 787-8 or Airbus A319 models not yet fully retired, also fall into the dog category. These aircraft incur higher maintenance costs and lower operational efficiency, especially when compared to the airline's newer fleet. By the end of 2023, China Southern continued its fleet modernization, aiming to phase out such uneconomical models.

Geopolitical tensions have also impacted certain long-haul routes, particularly to North America, leading to demand reduction and underutilization of wide-body aircraft. Flights between China and the United States in late 2024 operated at less than 30% of pre-pandemic capacity, highlighting these routes as potential dogs due to persistently weak demand and reduced capacity.

Legacy IT systems and manual processes that haven't been integrated into the airline's digital transformation efforts represent operational dogs. These systems, like older booking platforms, lead to slower processing and increased errors, creating bottlenecks in baggage handling and customer service, and hindering scalability and competitiveness.

| BCG Category | Examples for China Southern Airlines | Key Characteristics | Impact on Airline |

|---|---|---|---|

| Dogs | Low-demand regional routes | Low passenger numbers, high competition, consistently low load factors (<60% in 2024) | Resource drain, minimal profit, potential losses |

| Dogs | Older aircraft sub-fleets | Lower fuel efficiency, higher maintenance costs (e.g., remaining B787-8, A319) | Increased operational expenses, reduced efficiency |

| Dogs | Geopolitically impacted long-haul routes | Significantly reduced demand (e.g., US routes <30% pre-pandemic capacity in late 2024) | Underutilization of assets, financial strain |

| Dogs | Legacy IT systems and manual processes | Slow processing, higher error rates, lack of integration | Operational bottlenecks, competitive disadvantage |

Question Marks

China Southern Airlines' new international long-haul routes, including Beijing Daxing to Melbourne, Sydney, Tehran, and Riyadh, are prime examples of question marks in its BCG Matrix. These routes tap into markets exhibiting strong growth potential, a key characteristic for question mark products.

Despite the promising market growth, China Southern currently holds a low market share on these new routes, reflecting their nascent stage of development. For instance, the Beijing-Melbourne route, launched in late 2023, is still building passenger traffic and brand recognition in a competitive landscape.

These question mark initiatives demand substantial investment in marketing, advertising, and network development to capture market share and achieve profitability. The airline must strategically allocate resources to build awareness and encourage adoption, aiming to transition these routes into stars.

China Southern Airlines' expansion in premium economy and business class presents a classic question mark scenario within its BCG Matrix. While the airline is actively enhancing these premium cabins, the competitive landscape is fierce, demanding significant capital for fleet upgrades and service improvements to capture market share from established players.

The airline's strategic push into these higher-yield segments faces headwinds. In 2024, the proportion of high-value passengers, including business and premium travelers, declined. This dip occurred even as overall passenger numbers saw an increase, highlighting the challenge in attracting and retaining these crucial customer segments amidst intense competition and potentially shifting travel patterns.

China Southern Airlines' early-stage digital transformation initiatives, like its 'Human + AI Robot' customer service platform and 'Green Flight' products, are positioned as question marks in its BCG matrix. These ventures are tapping into a rapidly expanding technological landscape, yet their current market penetration and customer adoption levels are still developing.

Significant capital is being funneled into these areas to foster growth and prove their long-term value proposition. The airline's 2024 Digital Transformation Action Plan underscores this commitment, detailing strategic investments aimed at enhancing operational efficiency and customer experience through technological innovation.

Strategic Partnerships and Alliances

China Southern's strategic partnerships, like its recent alliances with Qatar Airways and Kenya Airways, are currently positioned as question marks within its BCG Matrix. These collaborations are designed to significantly boost global connectivity, aiming to provide seamless travel to over 170 destinations worldwide.

- Expanding Market Reach: These partnerships are crucial for China Southern to tap into and grow its presence in key international markets, particularly in Africa and the Middle East, which are experiencing robust travel demand.

- Uncertainty of Success: While the intent is clear – to enhance global reach and offer better transit options – the ultimate success of these alliances in terms of market share gains and profitability remains to be fully determined.

- Connectivity Enhancement: The goal of offering seamless connections across a vast network aims to attract more international passengers, thereby strengthening China Southern's competitive position against other global carriers.

Domestically Produced Aircraft (C919/C909 Integration)

China Southern's integration of domestically produced aircraft, such as the COMAC C919 and the anticipated C909, positions these assets as potential question marks within its BCG matrix. This classification stems from the aircrafts' nascent market presence and evolving operational track record, despite their alignment with China's strategic aviation goals.

The airline received its inaugural C919 aircraft by the close of 2024, marking a significant step in adopting these new domestic models. While this move could yield long-term cost advantages and bolster national aerospace capabilities, the immediate market acceptance and proven operational efficiency of these aircraft in a highly competitive global aviation landscape remain uncertain factors.

- Market Uncertainty: The C919 and C909 are relatively new entrants, and their long-term demand and operational reliability are still being established.

- Strategic Alignment vs. Operational Risk: While supporting national manufacturing, China Southern faces the risk of lower-than-expected performance or passenger demand for these aircraft compared to established international models.

- Fleet Integration Costs: Initial costs associated with training, maintenance, and potential operational adjustments for new aircraft types can be substantial.

- Competitive Landscape: The success of these aircraft will be measured against established competitors like Boeing and Airbus, which have proven track records and extensive support networks.

China Southern Airlines' new international routes, digital initiatives, strategic partnerships, and adoption of domestically produced aircraft all represent question marks in its BCG Matrix. These ventures are in early stages with high growth potential but currently low market share.

Significant investment is required to nurture these question marks, aiming to convert them into stars by capturing market share and achieving profitability. The success of these initiatives, such as the C919 integration and new international routes, hinges on market acceptance and operational efficiency.

For instance, the airline's 2024 Digital Transformation Action Plan highlights substantial investment in technology, while the introduction of the C919 by the close of 2024 signifies a commitment to new domestic aircraft, both facing market uncertainties.

The airline's strategic partnerships, like those with Qatar Airways and Kenya Airways, aim to boost global connectivity, but their ultimate impact on market share and profitability remains to be seen.

| Initiative | BCG Category | Market Share | Growth Potential | Investment Needs | Key Considerations |

|---|---|---|---|---|---|

| New International Routes (e.g., Beijing-Melbourne) | Question Mark | Low | High | High (Marketing, Network Dev.) | Building brand recognition, competitive landscape |

| Premium Economy/Business Class Expansion | Question Mark | Low to Medium | High | High (Fleet Upgrades, Service) | Intense competition, attracting high-yield passengers |

| Digital Transformation (AI Robots, Green Flight) | Question Mark | Developing | High | High (Tech Investment) | Customer adoption, proving value proposition |

| Strategic Partnerships (Qatar Airways, Kenya Airways) | Question Mark | N/A (Collaborative) | High | Moderate (Integration Costs) | Global connectivity, seamless travel, market reach |

| Domestic Aircraft Integration (C919, C909) | Question Mark | Low | Medium to High | High (Training, Maintenance) | Market acceptance, operational reliability, cost advantages |

BCG Matrix Data Sources

Our China Southern Airlines BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.