CommVault SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CommVault Bundle

Commvault's robust platform and strong customer base represent significant strengths, but market competition and evolving cloud strategies present key challenges. Understanding these dynamics is crucial for any investor or strategist looking to leverage their position.

Want the full story behind Commvault's competitive advantages, potential threats, and future opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Commvault's strong focus on cyber resilience is a significant strength, positioning them as a leader in protecting against evolving threats like ransomware. Their platform is recognized as a gold standard for data recovery, ensuring businesses can quickly restore operations after an attack.

The company's comprehensive approach covers data security and governance across various environments, providing a robust defense. This dedication to safeguarding data is crucial in today's landscape, where cyberattacks are increasingly sophisticated and damaging.

Commvault's transition to a subscription and SaaS model is proving highly effective. The company reported a substantial 45% surge in subscription revenue for the fourth quarter of fiscal year 2025, and for the full fiscal year 2025, this growth reached an impressive 37%.

This strong performance is further underscored by the rapid expansion of its SaaS Annual Recurring Revenue (ARR). In the fourth quarter of fiscal year 2025, SaaS ARR experienced a remarkable increase of approximately 70%, signaling a successful and accelerating shift towards a predictable, recurring revenue stream.

Commvault's unified hybrid and multi-cloud data management platform is a significant strength, allowing businesses to protect and manage data seamlessly across diverse environments. This single-pane-of-glass approach simplifies complex IT infrastructures and enhances operational efficiency.

This unified strategy is particularly valuable as organizations increasingly adopt hybrid and multi-cloud architectures. In 2024, a significant majority of enterprises are expected to operate in hybrid cloud environments, making Commvault's integrated solution highly relevant.

Consistent Recognition as an Industry Leader by Analysts

Commvault's consistent positioning as a Leader by industry analysts is a significant strength. For instance, their 13th consecutive placement in the 2024 Gartner Magic Quadrant for Enterprise Backup and Recovery Software Solutions highlights their sustained market leadership and robust product offerings.

This external validation is further bolstered by their recognition in the Forrester Wave for Data Resilience in Q4 2024. Such consistent accolades from reputable third-party evaluators underscore Commvault's strong market standing and advanced technological capabilities in the data protection and resilience space.

- Industry Recognition: Commvault has been named a Leader in the 2024 Gartner Magic Quadrant for Enterprise Backup and Recovery Software Solutions for the 13th consecutive year.

- Analyst Validation: They were also recognized in the Forrester Wave for Data Resilience in Q4 2024.

- Market Position: These consistent recognitions affirm Commvault's strong market position and product leadership.

Strategic Acquisitions and Partnerships for Enhanced Capabilities

Commvault's strategic acquisitions, such as Appranix and Clumio, have significantly bolstered its capabilities in cloud-native data protection and automated recovery. These moves, completed in recent years, directly address the growing complexity of hybrid cloud environments.

Furthermore, Commvault's robust ecosystem of partnerships with major cloud providers like AWS and Google Cloud, alongside technology giants such as HPE and Kyndryl, amplifies its market reach. These collaborations are crucial for delivering integrated solutions and expanding its customer base in the evolving data management landscape.

- Acquisitions: Appranix (cloud-native data protection) and Clumio (SaaS data protection) integration.

- Cloud Partnerships: Deepened ties with AWS, Azure, and Google Cloud for enhanced service delivery.

- Technology Alliances: Collaborations with HPE and Kyndryl to broaden solution reach and integration.

Commvault's dedication to cyber resilience is a key strength, with its platform widely regarded for effective data recovery against sophisticated threats like ransomware. This focus ensures business continuity.

The company's successful shift to a subscription and SaaS model is evident in its financial performance. For Q4 FY2025, subscription revenue grew 45%, and full-year FY2025 subscription revenue saw a 37% increase, demonstrating strong customer adoption and predictable revenue streams.

Commvault's unified hybrid and multi-cloud data management platform simplifies IT operations for businesses adopting complex cloud architectures. This integrated approach is highly valued in the current market, where hybrid cloud adoption is widespread.

Commvault's consistent recognition as an industry leader, including its 13th consecutive year in the Gartner Magic Quadrant for Enterprise Backup and Recovery Software Solutions (2024) and inclusion in the Forrester Wave for Data Resilience (Q4 2024), validates its market leadership and advanced technology.

Strategic acquisitions like Appranix and Clumio, along with strong partnerships with major cloud providers (AWS, Google Cloud) and technology firms (HPE, Kyndryl), enhance Commvault's capabilities and market reach, particularly in cloud-native data protection.

| Metric | FY2025 (Full Year) | Q4 FY2025 |

|---|---|---|

| Subscription Revenue Growth | 37% | 45% |

| SaaS ARR Growth | N/A | ~70% |

What is included in the product

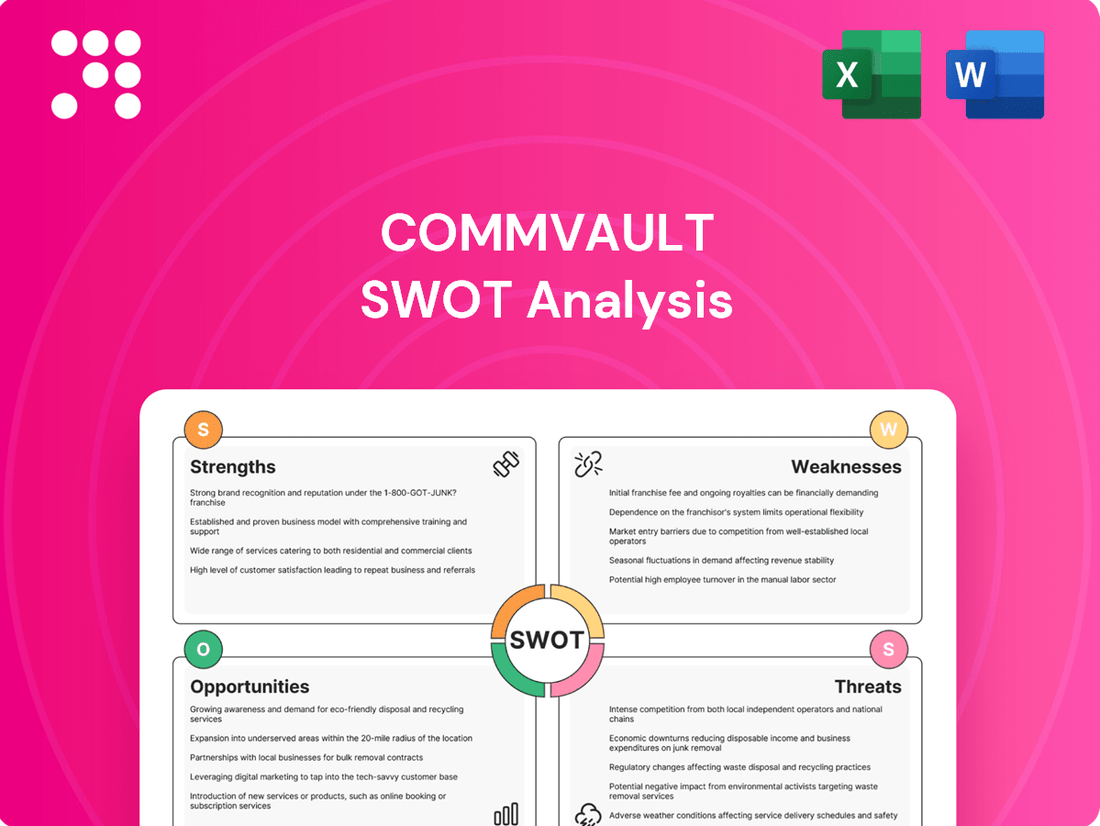

Analyzes CommVault’s competitive position through key internal and external factors, detailing its strengths in comprehensive data protection and opportunities in cloud adoption, while acknowledging weaknesses in market perception and threats from evolving competitive landscapes.

Simplifies complex data protection challenges by highlighting Commvault's strengths and mitigating weaknesses for strategic advantage.

Weaknesses

CommVault's transition to a Software-as-a-Service (SaaS) model, while beneficial for recurring revenue, introduces potential margin pressure. This is due to the substantial ongoing investments required for developing, integrating, and supporting these cloud-based offerings.

The company's own financial outlook reflects this challenge, as evidenced by their lowered Free Cash Flow guidance for Fiscal Year 2025. This adjustment signals that the costs associated with scaling their SaaS solutions are impacting short-term profitability.

Commvault experiences elevated customer acquisition costs, with a notable CAC payback period of 88.7 months in Q4 FY2024. This indicates a substantial outlay for sales and marketing efforts to onboard new clients in a highly competitive landscape. Such prolonged payback periods can strain cash flow and potentially affect the company's profitability margins.

Commvault's heavy reliance on a few key distribution partners presents a notable weakness. For instance, Arrow Electronics alone represented a substantial 36% of Commvault's total revenue in fiscal year 2024.

This concentration means that any disruption to these critical relationships, or a downturn in the performance of these partners, could significantly impact Commvault's financial results and market reach.

Competition in a Dynamic Market

CommVault operates in a fiercely competitive data management and protection landscape. Many vendors offer comparable solutions, creating significant pricing pressure. For instance, Gartner's Magic Quadrant for Data Center Backup and Recovery Solutions consistently features a broad range of competitors, highlighting the crowded nature of this space. This intense rivalry necessitates ongoing, substantial investment in research and development to differentiate offerings and secure market share.

The need for continuous innovation to stay ahead in this dynamic market presents a considerable financial challenge for CommVault. Companies must constantly update their platforms to address evolving threats, cloud integration, and new data types. This commitment to innovation, while crucial for long-term viability, directly impacts profitability and requires careful resource allocation, especially when facing established giants and agile startups alike.

Key competitive pressures include:

- Established Competitors: Major players like Dell EMC, IBM, and Veritas have deep market penetration and extensive customer bases.

- Emerging Technologies: The rise of cloud-native backup solutions and software-defined storage presents new challenges and necessitates adaptation.

- Pricing Sensitivity: Intense competition often leads to price wars, impacting CommVault's revenue margins.

Complexity of Hybrid IT Environments

While Commvault provides robust solutions for hybrid and multi-cloud setups, the sheer complexity of managing data across these varied infrastructures can still be a hurdle for many organizations. This complexity means that achieving truly seamless integration and simplified data management across all platforms requires ongoing customer effort and vendor support.

The challenge isn't just about the technology itself, but also about how customers adapt and implement it. For instance, a 2024 industry survey indicated that over 60% of IT leaders find data management across hybrid environments to be a significant operational challenge, highlighting the need for intuitive and highly automated solutions.

- Integration Hurdles: Ensuring interoperability and consistent data protection policies across on-premises, private cloud, and multiple public cloud providers (like AWS, Azure, and GCP) remains a complex task.

- Management Overhead: Customers often face increased administrative burden to configure, monitor, and troubleshoot data protection across diverse and potentially disparate systems.

- Skill Gaps: The specialized knowledge required to effectively manage data in these intricate hybrid environments can be a limiting factor for some organizations, impacting their ability to fully leverage Commvault's capabilities.

Commvault's shift to a SaaS model, while strategic for recurring revenue, is currently impacting profitability due to significant upfront investment in development and support, as reflected in their lowered Free Cash Flow guidance for FY2025.

The company faces a prolonged customer acquisition payback period, averaging 88.7 months in Q4 FY2024, indicating high sales and marketing costs that strain short-term cash flow and margins.

A substantial 36% of Commvault's FY2024 revenue came from Arrow Electronics, highlighting a critical dependency on a few key distribution partners, which poses a risk to financial stability and market reach.

Intense competition in the data management space, with numerous vendors offering comparable solutions, leads to pricing pressures and necessitates substantial R&D spending to maintain differentiation and market share.

What You See Is What You Get

CommVault SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The increasing frequency and sophistication of cyberattacks, particularly ransomware, are significantly boosting the market for cyber resilience solutions. This trend directly benefits companies like Commvault, which are well-positioned to capitalize on this growing need for data protection and rapid recovery capabilities.

In 2024, the global cybersecurity market is projected to reach over $200 billion, with data security and resilience being key growth drivers. Commvault’s established expertise in backup, recovery, and disaster recovery solutions places it in a prime position to address this escalating demand, offering a crucial advantage in a rapidly evolving threat landscape.

The banking and healthcare sectors are experiencing a significant surge in demand for robust data protection and stringent compliance solutions. These industries, heavily regulated, require advanced capabilities to safeguard sensitive customer information and meet evolving legal mandates.

Commvault's comprehensive platform, already equipped with strong compliance features, is well-positioned to capitalize on this trend. By tailoring its offerings to the specific needs of these sectors, Commvault can significantly expand its market share. For instance, the financial services industry globally is projected to spend over $10 billion annually on data security and compliance by 2025, highlighting the immense opportunity.

The global landscape for data privacy and governance is rapidly evolving, with new regulations like DORA (Digital Operational Resilience Act) becoming increasingly stringent. This creates a significant market opportunity for companies like Commvault, as businesses worldwide are compelled to invest in robust data management and protection solutions to avoid hefty penalties and maintain customer trust.

Commvault's comprehensive suite of offerings, including advanced data discovery, security, and compliance management tools, directly addresses these growing regulatory needs. For instance, their Metallic platform provides integrated data protection and compliance capabilities, enabling organizations to navigate complex requirements efficiently. This positions Commvault favorably to capitalize on the heightened demand for solutions that ensure data integrity and regulatory adherence.

Potential for Cross-selling and Upselling within Existing Customer Base

Commvault's substantial customer base, exceeding 100,000 organizations, presents a prime opportunity for revenue growth through cross-selling and upselling. The company can leverage this existing loyalty to introduce its newer, cloud-centric solutions. For instance, as of early 2024, Commvault has been actively promoting its enhanced SaaS data protection capabilities and its specialized Cleanroom Recovery offering, designed to safeguard against ransomware attacks.

This strategy capitalizes on the trust already established with its clients, making them more receptive to adopting additional services. By showcasing the value proposition of these advanced solutions, Commvault can deepen customer relationships and increase the average revenue per user. The focus on cyber resilience, a critical concern for businesses in 2024 and beyond, positions these upsell opportunities as highly relevant and timely.

- Leverage existing customer relationships for increased revenue.

- Promote cloud-first and cyber resilience solutions like Cleanroom Recovery.

- Capitalize on the growing market demand for advanced data protection.

- Enhance customer lifetime value by expanding service adoption.

Leveraging AI and Machine Learning for Enhanced Offerings

The growing integration of AI and machine learning offers a significant avenue for Commvault to refine its data protection and recovery services. By leveraging these advanced technologies, Commvault can develop more sophisticated and automated solutions. For instance, in 2024, the company continued to invest in AI-driven features that promise more intelligent threat detection and faster, more reliable recovery processes, aiming to reduce downtime and enhance data security for its clients.

Commvault's strategic use of AI and machine learning can lead to several key improvements:

- Predictive Threat Analysis: AI algorithms can identify potential security threats before they impact data, allowing for proactive defense mechanisms.

- Automated Recovery Processes: Machine learning can optimize recovery operations, ensuring faster restoration of data and applications after an incident.

- Enhanced Efficiency: Automation powered by AI can reduce manual intervention, leading to more streamlined and cost-effective data management.

- Intelligent Data Insights: AI can analyze vast datasets to provide actionable insights, helping businesses better understand and manage their data.

The escalating global demand for robust cybersecurity solutions, driven by increasingly sophisticated cyber threats, presents a significant opportunity for Commvault. As businesses prioritize data resilience and rapid recovery, Commvault's established expertise in backup, disaster recovery, and ransomware protection positions it to capture a larger market share. The projected growth of the cybersecurity market, expected to exceed $200 billion in 2024, underscores this favorable market dynamic.

Commvault is well-positioned to capitalize on the stringent data protection and compliance requirements within heavily regulated sectors like banking and healthcare. These industries are investing heavily in safeguarding sensitive information, with the financial services sector alone anticipated to spend over $10 billion annually on data security and compliance by 2025. Commvault’s comprehensive platform, featuring advanced compliance tools, directly addresses these critical needs.

The evolving global data privacy landscape, marked by new regulations such as DORA, creates a substantial market opportunity for Commvault. Businesses are compelled to invest in advanced data management and protection to ensure compliance and avoid penalties. Commvault's Metallic platform, offering integrated data protection and compliance, enables organizations to navigate these complex requirements efficiently.

Commvault's extensive customer base of over 100,000 organizations offers a prime opportunity for upselling and cross-selling its cloud-centric and cyber resilience solutions, such as its Cleanroom Recovery offering. By leveraging existing customer trust, Commvault can drive revenue growth and enhance customer lifetime value. The company's continued investment in AI and machine learning also promises to deliver more intelligent and automated data protection services, further strengthening its competitive edge in 2024 and beyond.

Threats

Commvault navigates a fiercely competitive data management sector, facing pressure from both long-standing giants and agile newcomers. Major tech firms such as Microsoft, with its extensive cloud offerings, and Oracle, a dominant force in enterprise databases, represent significant competitive threats, often leveraging their broader ecosystems to their advantage.

These established competitors, alongside cloud-native solutions and specialized backup providers, constantly challenge Commvault's market position and ability to command premium pricing. For instance, the increasing adoption of integrated data protection within major cloud platforms like Microsoft Azure and Amazon Web Services presents a direct challenge to standalone data management solutions.

Potential economic slowdowns pose a significant threat, as uncertainty often leads businesses to curb IT expenditures. This directly impacts companies like Commvault, whose revenue is tied to organizations investing in data protection and management solutions. For instance, a projected global GDP growth slowdown in 2024-2025 could translate into delayed or reduced upgrades for data infrastructure.

The data management and cybersecurity sectors are in constant flux, demanding relentless innovation from companies like Commvault. This rapid pace of technological change, including advancements in AI-driven data protection and cloud-native solutions, means Commvault must consistently invest in R&D to stay competitive and address evolving cyber threats. For instance, the global data management market is projected to reach over $100 billion by 2027, highlighting the immense pressure to innovate within this growing space.

Foreign Exchange Fluctuations

As a global player, Commvault's financial performance is susceptible to the ebb and flow of foreign exchange rates. When currencies unfavorable move against the US dollar, it can directly diminish the value of revenues and profits earned from its international operations. For instance, if the Euro weakens against the dollar, sales generated in Europe will translate to fewer dollars when reported in Commvault's financial statements.

These currency shifts can introduce volatility into the company's reported earnings, making it harder for investors to predict future performance. Commvault, like many multinational corporations, actively manages its currency exposure through various hedging strategies, but significant adverse movements can still impact its bottom line. In 2023, for example, many technology companies reported impacts from a strengthening US dollar, which generally reduces the value of overseas earnings when repatriated.

- Currency Volatility: Fluctuations in exchange rates can significantly impact the reported financial results of global companies like Commvault.

- Revenue Erosion: Unfavorable currency movements can directly reduce the dollar value of revenues generated in foreign markets.

- Profitability Squeeze: Beyond revenue, exchange rate shifts can also negatively affect the profitability of international subsidiaries.

- Hedging Challenges: While Commvault likely employs hedging strategies, these may not fully mitigate the impact of substantial currency swings.

Emergence of New Cyber and Attack Vectors

The cybersecurity landscape is in constant flux, with threats like advanced ransomware and entirely new attack methods emerging regularly. For instance, the global cost of ransomware attacks is projected to reach $265 billion annually by 2031, a significant increase from previous years, highlighting the escalating nature of this threat.

Commvault faces the challenge of continuously evolving its data protection and management solutions to counter these sophisticated and novel attack vectors. This necessitates ongoing, substantial investment in research and development, as well as maintaining a high level of specialized expertise to stay ahead of malicious actors.

- Evolving Threat Landscape: Cybercriminals are developing increasingly sophisticated ransomware and novel attack methods.

- Continuous Adaptation Required: Commvault must consistently update its offerings to effectively combat these emerging threats.

- Investment in R&D: Addressing new attack vectors demands sustained financial commitment to research and development.

- Expertise is Crucial: Maintaining a skilled workforce with up-to-date knowledge is vital for developing effective defenses.

Commvault operates in a highly competitive market, challenged by major tech companies like Microsoft and Oracle, as well as cloud-native providers. The increasing integration of data protection within cloud platforms like Azure and AWS directly impacts Commvault's standalone solutions. Economic downturns also pose a threat, as businesses tend to cut IT spending during uncertain periods, potentially delaying or reducing investments in data management infrastructure, a trend that could be amplified by projected global GDP slowdowns in 2024-2025.

The rapid pace of technological change, including AI-driven data protection and evolving cyber threats, requires continuous and significant investment in research and development for Commvault to remain competitive. For instance, the global data management market is expected to exceed $100 billion by 2027, underscoring the intense pressure to innovate. Furthermore, currency volatility can impact Commvault's reported earnings, as unfavorable exchange rate movements can diminish the value of international revenues, a challenge many multinational tech firms faced in 2023 with a strengthening US dollar.

Cybersecurity threats are escalating, with ransomware attacks projected to cost $265 billion annually by 2031. Commvault must constantly adapt its offerings to counter these sophisticated and novel attack vectors, demanding substantial R&D investment and specialized expertise.

SWOT Analysis Data Sources

This CommVault SWOT analysis is meticulously constructed using a blend of authoritative data, encompassing recent financial filings, comprehensive market research reports, and expert industry analyses to provide a robust and insightful evaluation.