CommVault Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CommVault Bundle

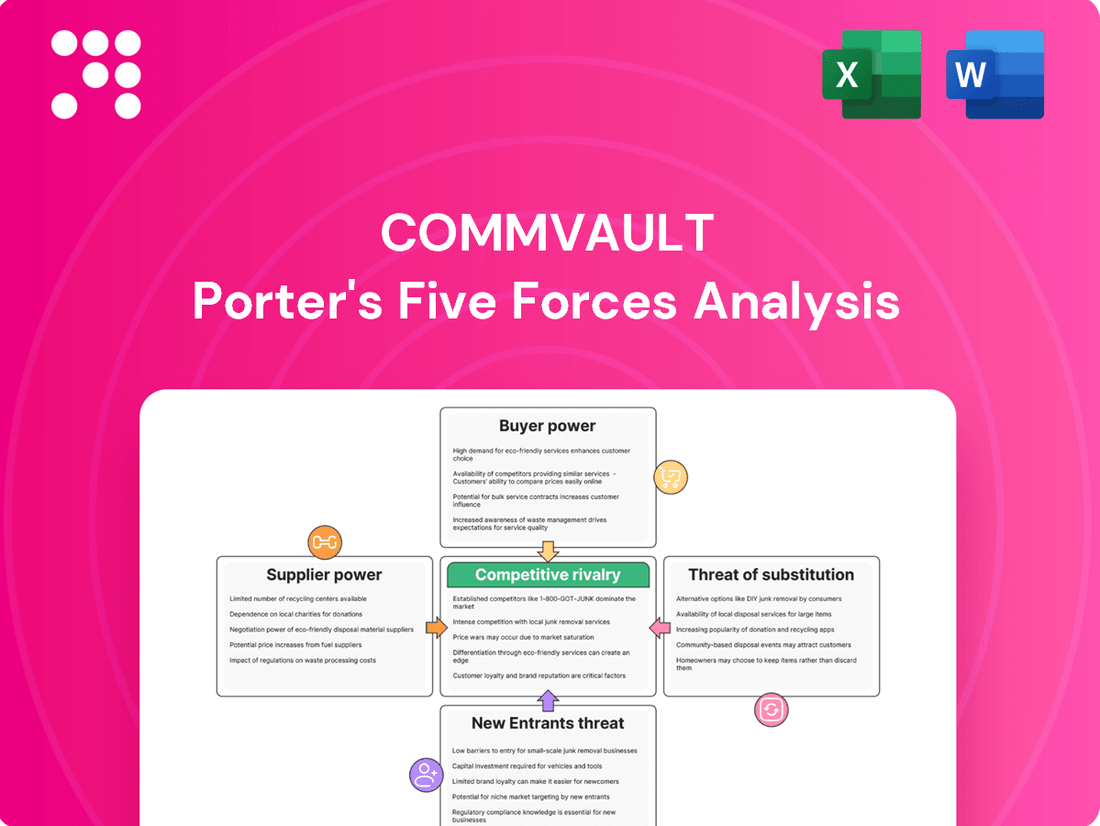

Our CommVault Porter's Five Forces Analysis highlights the intense competitive rivalry and the significant threat of substitutes in the data protection market. It also details the moderate bargaining power of buyers and suppliers, and the low threat of new entrants. This snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore CommVault’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

CommVault's reliance on specialized software and hardware components, including those from cloud service providers, can give certain suppliers a degree of bargaining power. If these critical technologies are proprietary and difficult to substitute, suppliers can exert moderate influence.

CommVault's increasing reliance on major cloud infrastructure providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud significantly impacts its bargaining power of suppliers. As of late 2024, these hyperscalers continue to dominate the cloud infrastructure market, with AWS holding approximately 31% of the global cloud infrastructure market share, followed by Azure at around 24% and Google Cloud at about 11%. This concentration means CommVault, like many SaaS companies, faces a situation where a few dominant players can exert considerable influence over pricing and contract terms.

While CommVault's strategy of supporting multi-cloud environments helps mitigate complete dependence on any single provider, substantial usage of a particular cloud's services for core operations can still grant that provider leverage. This leverage can manifest in negotiations for infrastructure costs, service level agreements, or even the availability of specific integration capabilities that CommVault relies upon for its data protection and management solutions.

The data management and cybersecurity sectors are hungry for highly specialized talent. Think software engineers with deep knowledge of cloud infrastructure, and cybersecurity experts who can defend against evolving threats. This demand means that individuals with these skills are in short supply.

This scarcity directly translates to increased bargaining power for these skilled professionals. When there are fewer qualified candidates than available roles, these individuals can command higher salaries and better benefits, directly impacting CommVault's operational costs and its ability to attract and retain top-tier talent crucial for innovation.

Limited Forward Integration Threat

Suppliers of generic hardware or standard software components typically face significant hurdles if they consider forward integration into CommVault's specialized enterprise data protection market. The intricate nature of data protection solutions, coupled with the deep-rooted customer relationships CommVault has cultivated, makes it a challenging environment for new entrants without specialized expertise.

For instance, a generic hardware provider would need to invest heavily in developing sophisticated software capabilities, understanding complex regulatory compliance, and building a sales and support infrastructure tailored to enterprise IT needs. This barrier is substantial, as evidenced by the continued dominance of specialized players in the data protection software sector, where market share is often driven by feature sets and service rather than just underlying hardware.

- Limited Threat of Forward Integration: Generic hardware or standard software suppliers are unlikely to integrate forward into CommVault's specialized data protection market due to the complexity and established customer relationships.

- High Barriers to Entry: The specialized nature of enterprise data protection requires significant investment in software development, regulatory understanding, and customer support, deterring less specialized suppliers.

- Focus on Core Competencies: Most suppliers of generic components focus on their core manufacturing or software development strengths, rather than venturing into the highly competitive and technically demanding data protection arena.

Strategic Partnerships Mitigating Risk

CommVault’s approach to mitigating supplier bargaining power heavily relies on forging strategic partnerships. By collaborating with key technology vendors and cloud service providers, CommVault diversifies its supply chain, diminishing the leverage any single supplier holds. This strategy is crucial for maintaining flexibility and cost-effectiveness in a rapidly evolving tech landscape.

- Diversified Technology Access: Partnerships ensure CommVault has access to a broad spectrum of cutting-edge technologies, preventing over-reliance on a limited set of providers.

- Enhanced Market Reach: Collaborations with cloud providers, for instance, expand CommVault's service delivery capabilities and customer access.

- Reduced Dependency: By cultivating multiple supplier relationships and strategic alliances, CommVault actively works to avoid situations where a single supplier can dictate terms or pricing.

CommVault's reliance on specialized software and hardware components, including those from cloud service providers, can give certain suppliers a degree of bargaining power. If these critical technologies are proprietary and difficult to substitute, suppliers can exert moderate influence.

CommVault's increasing reliance on major cloud infrastructure providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud significantly impacts its bargaining power of suppliers. As of late 2024, these hyperscalers continue to dominate the cloud infrastructure market, with AWS holding approximately 31% of the global cloud infrastructure market share, followed by Azure at around 24% and Google Cloud at about 11%. This concentration means CommVault, like many SaaS companies, faces a situation where a few dominant players can exert considerable influence over pricing and contract terms.

While CommVault's strategy of supporting multi-cloud environments helps mitigate complete dependence on any single provider, substantial usage of a particular cloud's services for core operations can still grant that provider leverage. This leverage can manifest in negotiations for infrastructure costs, service level agreements, or even the availability of specific integration capabilities that CommVault relies upon for its data protection and management solutions.

The data management and cybersecurity sectors are hungry for highly specialized talent. Think software engineers with deep knowledge of cloud infrastructure, and cybersecurity experts who can defend against evolving threats. This demand means that individuals with these skills are in short supply.

This scarcity directly translates to increased bargaining power for these skilled professionals. When there are fewer qualified candidates than available roles, these individuals can command higher salaries and better benefits, directly impacting CommVault's operational costs and its ability to attract and retain top-tier talent crucial for innovation.

Suppliers of generic hardware or standard software components typically face significant hurdles if they consider forward integration into CommVault's specialized enterprise data protection market. The intricate nature of data protection solutions, coupled with the deep-rooted customer relationships CommVault has cultivated, makes it a challenging environment for new entrants without specialized expertise.

For instance, a generic hardware provider would need to invest heavily in developing sophisticated software capabilities, understanding complex regulatory compliance, and building a sales and support infrastructure tailored to enterprise IT needs. This barrier is substantial, as evidenced by the continued dominance of specialized players in the data protection software sector, where market share is often driven by feature sets and service rather than just underlying hardware.

- Limited Threat of Forward Integration: Generic hardware or standard software suppliers are unlikely to integrate forward into CommVault's specialized data protection market due to the complexity and established customer relationships.

- High Barriers to Entry: The specialized nature of enterprise data protection requires significant investment in software development, regulatory understanding, and customer support, deterring less specialized suppliers.

- Focus on Core Competencies: Most suppliers of generic components focus on their core manufacturing or software development strengths, rather than venturing into the highly competitive and technically demanding data protection arena.

CommVault’s approach to mitigating supplier bargaining power heavily relies on forging strategic partnerships. By collaborating with key technology vendors and cloud service providers, CommVault diversifies its supply chain, diminishing the leverage any single supplier holds. This strategy is crucial for maintaining flexibility and cost-effectiveness in a rapidly evolving tech landscape.

- Diversified Technology Access: Partnerships ensure CommVault has access to a broad spectrum of cutting-edge technologies, preventing over-reliance on a limited set of providers.

- Enhanced Market Reach: Collaborations with cloud providers, for instance, expand CommVault's service delivery capabilities and customer access.

- Reduced Dependency: By cultivating multiple supplier relationships and strategic alliances, CommVault actively works to avoid situations where a single supplier can dictate terms or pricing.

| Supplier Type | Bargaining Power Factor | Impact on CommVault | Mitigation Strategy |

|---|---|---|---|

| Cloud Infrastructure Providers (e.g., AWS, Azure, GCP) | Market concentration, proprietary technology | Moderate to High leverage on pricing and terms | Multi-cloud strategy, strategic partnerships |

| Specialized Software/Hardware Component Vendors | Proprietary technology, high switching costs | Moderate leverage on pricing and features | Supplier diversification, long-term contracts |

| Skilled Talent (e.g., Cloud Engineers, Cybersecurity Experts) | High demand, low supply | Increased labor costs, retention challenges | Competitive compensation, talent development programs |

What is included in the product

This analysis unpacks the competitive forces impacting CommVault, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the data protection and management market.

Instantly visualize competitive pressures with a dynamic Porter's Five Forces analysis, allowing for rapid identification of threats and opportunities.

Customers Bargaining Power

CommVault's extensive reach, serving over 12,000 subscription customers, significantly dilutes the bargaining power of any single client. This broad and diverse enterprise base means that no individual customer represents a substantial portion of CommVault's revenue. Consequently, individual customers have limited leverage to demand preferential terms or pricing.

Customers who have integrated Commvault's comprehensive data management platform into their complex hybrid and multi-cloud infrastructures face substantial switching costs. These costs include the significant effort and expense involved in migrating large volumes of data, reconfiguring intricate IT systems, and retraining personnel on new solutions. For instance, a typical enterprise might have petabytes of data managed by Commvault, making a transition a multi-year, multi-million dollar undertaking.

Data protection and cyber resilience are absolutely vital for businesses today, particularly with the escalating threat of cyberattacks. This essential nature of the service means customers are often less concerned with price and more focused on ensuring the solution is robust and offers complete protection. This inherent criticality of data protection significantly strengthens CommVault's bargaining power with its customers.

Subscription Model and Retention

CommVault's subscription model significantly bolsters its position against customer bargaining power. The company's impressive net dollar retention rate of 127% as of June 2024 demonstrates that customers are not only renewing their subscriptions but also expanding their usage and services. This high retention indicates strong customer satisfaction and loyalty, making it more difficult for customers to exert downward price pressure or switch to competitors without significant disruption.

- Strong Subscription Revenue: CommVault's success in recurring revenue streams locks customers into its ecosystem.

- High Net Dollar Retention: A 127% net dollar retention rate as of June 2024 signifies customer expansion and loyalty.

- Reduced Switching Propensity: Increased spending by existing customers suggests satisfaction and a higher cost of switching.

- Customer Lock-in Effect: Deep integration of CommVault's solutions into customer IT infrastructure limits their ability to easily change providers.

Customer Demand for Integrated Security

Customers are increasingly seeking unified solutions for data security and cyber resilience. This trend signifies a shift in their expectations, moving beyond siloed products to comprehensive, integrated platforms. CommVault's strategic focus on these areas directly addresses this evolving customer demand.

CommVault's commitment to innovation, including its acquisition of Satori Cyber for AI and data security in 2023, demonstrates its proactive approach to meeting these integrated security needs. This strengthens their market position and customer relationships.

- Customer Demand: A growing preference for comprehensive, end-to-end data protection and cyber resilience solutions.

- CommVault's Response: Investments in AI and data security, exemplified by the Satori Cyber acquisition, directly address this demand.

- Impact on Bargaining Power: By aligning with customer needs, CommVault can foster loyalty and reduce the customers' leverage to negotiate unfavorable terms.

The bargaining power of CommVault's customers is generally low, primarily due to the company's broad customer base and the significant switching costs associated with its comprehensive data management solutions. The essential nature of data protection further limits customer leverage, as businesses prioritize reliability and security over price. CommVault's subscription model and high customer retention rates, with a net dollar retention of 127% as of June 2024, reinforce this position by fostering loyalty and increasing the difficulty for customers to switch providers.

| Factor | Impact on Customer Bargaining Power | CommVault's Position |

|---|---|---|

| Customer Base Size | Low (each customer is a small part of total revenue) | Over 12,000 subscription customers |

| Switching Costs | Low (high costs for data migration, system reconfiguration, and retraining) | Significant integration into hybrid/multi-cloud environments |

| Service Essentiality | Low (data protection is critical, prioritizing reliability) | Vital for cyber resilience and business continuity |

| Subscription Model & Retention | Low (high retention indicates satisfaction and reduces price sensitivity) | 127% net dollar retention (June 2024), fostering loyalty |

Preview the Actual Deliverable

CommVault Porter's Five Forces Analysis

This preview showcases the comprehensive CommVault Porter's Five Forces Analysis, detailing the competitive landscape within the data protection and management industry. The document you see here is the exact, professionally formatted analysis you will receive instantly upon purchase, providing actionable insights without any placeholders or alterations.

Rivalry Among Competitors

The data protection and management landscape is incredibly crowded, with giants like Veeam, Cohesity, Dell Technologies, Veritas, Rubrik, and IBM all vying for market share. These established companies offer a wide array of similar, robust solutions. This intense rivalry often boils down to a battle of features, raw performance, and, crucially, pricing strategies, making it challenging for any single player to dominate.

Competitors are heavily investing in cyber resilience, cloud-native data protection, and AI, directly challenging CommVault's core strategies. This shared focus means that companies like Rubrik and Veeam are not just offering similar services but are actively innovating in these same high-growth areas, leading to a more intense battle for market share.

For instance, the data protection market, where CommVault operates, saw significant growth in 2024, with analysts projecting continued expansion driven by ransomware threats and cloud adoption. Companies that can effectively demonstrate superior AI-powered threat detection and recovery capabilities are poised to gain a competitive edge, making this a critical battleground.

Competitive rivalry in the data protection and management sector is intense, largely fueled by a relentless pursuit of innovation and product differentiation. Companies like CommVault are constantly pushing the envelope, releasing new features specifically designed to address critical customer needs such as enhanced ransomware recovery capabilities, seamless cloud integration, and robust data governance solutions. This continuous development cycle ensures that staying ahead requires significant investment in research and development.

CommVault's position in the market is a testament to its successful innovation strategy. The company has consistently earned recognition as a leader in reports from prominent industry analysts. For instance, in 2024, Gartner's Magic Quadrant for Enterprise Information Archiving, CommVault was again positioned as a Leader, underscoring its ability to execute and its completeness of vision. This consistent acknowledgment validates CommVault's strong competitive standing, driven by its ongoing commitment to delivering cutting-edge solutions that meet evolving market demands.

Strategic Partnerships and Acquisitions

Competitive rivalry in the data protection and management space is intensified by strategic partnerships and acquisitions. Competitors are consolidating their offerings and expanding their market reach through these maneuvers. A prime example is Cohesity’s acquisition of Veritas, a move that significantly reshapes the competitive landscape by combining two major players. This trend underscores the industry's drive for scale and comprehensive solutions.

CommVault actively participates in this consolidation strategy, leveraging acquisitions and partnerships to bolster its competitive standing and broaden its ecosystem. These actions are crucial for staying ahead in a market where integrated solutions and extensive partner networks are increasingly valued. By strategically aligning with other entities, CommVault aims to enhance its product portfolio and extend its global presence.

- Cohesity's acquisition of Veritas in late 2023 aimed to create a larger entity with a more comprehensive data management portfolio, impacting market share dynamics.

- CommVault has historically pursued partnerships, such as its collaboration with Microsoft Azure, to offer integrated cloud data protection solutions.

- The ongoing M&A activity suggests a market trend towards fewer, larger players capable of offering end-to-end data management services.

- These strategic moves aim to capture greater market share and provide customers with more unified and advanced data protection capabilities.

High Fixed Costs and R&D Investment

Developing and maintaining advanced enterprise data management platforms, like those offered by Commvault, demands significant, ongoing investment in research and development. This high R&D expenditure, coupled with substantial fixed costs associated with infrastructure and talent, creates a powerful incentive for companies to scale rapidly. Achieving a larger market share is crucial to amortize these costs and remain competitive, thereby intensifying rivalry among established players and potential entrants.

The need for scale to offset high fixed costs and R&D spending directly fuels competitive intensity. Companies are driven to capture more market share to achieve economies of scale, which can lead to aggressive pricing strategies and increased marketing efforts. This dynamic is evident in the data management sector, where players constantly innovate to differentiate their offerings and attract new customers.

- High R&D Spend: Companies in this space often allocate a significant portion of their revenue to R&D, with figures sometimes reaching 15-20% or more for leading innovators.

- Economies of Scale: Larger players can spread their fixed costs over a broader customer base, leading to lower per-unit costs and potentially more competitive pricing.

- Market Share Drive: The pursuit of market share is a constant battle, pushing companies to invest heavily in sales, marketing, and product development to gain an edge.

- Barriers to Entry: The substantial capital required for R&D and infrastructure acts as a significant barrier for new companies looking to enter the enterprise data management market.

The competitive rivalry within the data protection and management sector is exceptionally fierce. This intensity stems from a market populated by numerous well-established players, each offering comparable, robust solutions. Consequently, differentiation often hinges on feature sets, performance benchmarks, and aggressive pricing, making it difficult for any single entity to achieve sustained market dominance.

Key competitors are heavily investing in areas like cyber resilience, cloud-native data protection, and AI, directly mirroring CommVault's strategic focus. This shared commitment to innovation in high-growth segments intensifies the battle for market share, as companies like Rubrik and Veeam actively vie for customer attention with similar advancements.

The data protection market experienced substantial growth in 2024, with projections indicating continued expansion driven by the persistent threat of ransomware and increasing cloud adoption. Companies demonstrating superior AI-powered threat detection and recovery capabilities are expected to gain a significant competitive advantage in this critical arena.

Strategic partnerships and acquisitions further escalate competitive rivalry in data protection and management. Competitors are consolidating their offerings and expanding their reach through these maneuvers, as seen with Cohesity’s acquisition of Veritas, which significantly reshaped market dynamics by merging two major players. This trend highlights the industry's drive for scale and comprehensive solutions.

| Company | Key Focus Areas | 2024 Market Standing Indicator |

|---|---|---|

| CommVault | Data protection, ransomware recovery, cloud integration | Leader in Gartner Magic Quadrant for Enterprise Information Archiving (2024) |

| Veeam | Cloud data protection, backup, disaster recovery | Strong market presence, significant growth in cloud-native solutions |

| Rubrik | Cyber resilience, ransomware recovery, cloud data management | Rapid growth, focus on AI-driven security and data management |

| Cohesity | Data management, security, AI-powered analytics | Expanding portfolio post-Veritas acquisition, focus on integrated solutions |

SSubstitutes Threaten

Native cloud provider tools, such as Amazon Web Services' S3 Versioning and DynamoDB recovery features, present a significant threat of substitution for Commvault. These integrated solutions offer a streamlined approach to data protection for cloud-native workloads, potentially negating the need for third-party backup and recovery services for some organizations.

For businesses heavily invested in a single cloud ecosystem, these native tools can be more cost-effective and easier to manage than specialized third-party offerings. For instance, AWS offers tiered storage options and robust data lifecycle management within S3, which can fulfill basic backup requirements for many cloud-based applications.

For organizations with very specific or limited data protection requirements, open-source backup solutions and specialized niche tools present a viable alternative to comprehensive platforms like CommVault. These alternatives can be significantly more cost-effective, appealing to budget-conscious departments or smaller businesses with straightforward needs.

While these substitutes may not match CommVault's extensive feature set or robust enterprise-level support, their lower price point makes them attractive. For instance, many open-source projects offer core backup functionality without the licensing fees associated with commercial software, making them a compelling option for those prioritizing cost savings over advanced capabilities.

In smaller or less complex IT environments, organizations might still rely on manual backup processes or basic custom scripts for data management. These rudimentary methods can act as substitutes for sophisticated backup solutions, particularly if the perceived cost or complexity of commercial offerings appears prohibitive. For instance, a 2024 survey indicated that approximately 15% of small businesses with fewer than 50 employees still utilize manual backup methods, highlighting the persistence of these less robust alternatives.

Point Solutions for Specific Data Types

The threat of substitutes for Commvault's integrated data protection platform arises from the growing availability of specialized, point solutions. Businesses might choose to adopt multiple, single-purpose tools for specific data types, such as dedicated cloud backup services or specialized ransomware recovery software, rather than a comprehensive suite.

This unbundled approach can be appealing if these point solutions offer superior functionality or a lower entry cost for a particular niche. For example, a company heavily invested in Microsoft 365 might find a highly integrated M365 backup tool a sufficient substitute for a portion of Commvault's offering, potentially reducing their reliance on a single vendor.

- Market Trend: The market for data protection is increasingly fragmented, with specialized vendors gaining traction.

- Customer Behavior: Some organizations prioritize best-of-breed solutions for critical data sets over a single, unified platform.

- Cost Factor: Point solutions can sometimes offer a more granular and potentially lower cost of entry for specific data protection needs.

- Integration Challenges: While point solutions address specific needs, managing multiple tools can introduce integration complexities and increase operational overhead.

Managed Services without Dedicated Software

Managed services that bundle data protection without requiring clients to directly purchase or manage specific software present a significant threat. Organizations can offload the complexity of data management to third-party providers who leverage their own integrated solutions. This approach bypasses the need for individual software licenses and the associated maintenance overhead, making it an attractive alternative for businesses seeking streamlined operations.

These providers often utilize a mix of best-of-breed technologies or proprietary platforms, effectively acting as a substitute for CommVault’s direct software offering. For example, a growing number of businesses in 2024 are opting for comprehensive cloud-based backup and disaster recovery solutions from managed service providers, reducing their reliance on on-premises software deployments. This trend is driven by a desire for predictable costs and the expertise of specialized providers.

- Managed Services Bypass Direct Software Purchase: Organizations can outsource data protection entirely, avoiding the need to buy and manage CommVault software.

- Provider-Specific Solutions as Substitutes: MSPs often use proprietary or aggregated technologies, directly competing with dedicated software vendors.

- Growing Adoption of Bundled Services: In 2024, many companies are shifting towards managed IT services that include data protection as a component, reducing the perceived need for standalone software.

Native cloud provider tools and open-source solutions represent significant substitutes for Commvault. For instance, AWS S3 Versioning offers basic data protection, and many smaller businesses in 2024 still rely on manual backups, with around 15% of companies under 50 employees using these methods. These alternatives often come with lower or no licensing fees, appealing to cost-conscious users despite lacking Commvault's comprehensive features.

Specialized, point solutions also act as substitutes, allowing organizations to address specific data protection needs without a full suite. A company heavily invested in Microsoft 365, for example, might opt for a dedicated M365 backup tool, reducing dependence on a broader platform like Commvault. This fragmented approach is growing, with some customers preferring best-of-breed tools for critical data.

Managed services present another threat, as they bundle data protection, allowing clients to outsource management and bypass direct software purchases. In 2024, many businesses are choosing these services, which often use proprietary or aggregated technologies, to simplify operations and benefit from predictable costs and specialized expertise, thereby reducing the perceived need for standalone software.

Entrants Threaten

The enterprise data management and protection market demands significant upfront capital for research and development. Building a robust, scalable, and secure platform requires substantial investment, making it difficult for newcomers to compete with established vendors like CommVault. For instance, in 2024, many leading data management companies reported R&D expenditures in the hundreds of millions of dollars, highlighting the financial barrier to entry.

The threat of new entrants for Commvault is significantly mitigated by the sheer complexity and depth of integration required in the data protection and management space. Commvault’s offerings are designed to seamlessly connect with a vast array of on-premises hardware, cloud platforms like AWS and Azure, and a multitude of applications and databases. This intricate web of compatibility is not easily replicated.

New players would face a substantial hurdle in developing comparable integration capabilities, a process that demands considerable time, financial investment, and technical expertise. Furthermore, building a robust partner ecosystem, crucial for widespread adoption and support, represents another significant barrier to entry. For instance, as of early 2024, Commvault reported strong growth in its Metallic SaaS platform, underscoring the value of its established cloud integrations and partner network.

The threat of new entrants in data protection is significantly mitigated by the critical importance of brand reputation and customer trust. CommVault has cultivated this trust over decades, a factor new competitors find incredibly difficult to replicate quickly.

In a field as sensitive as data protection, where the integrity and security of information are paramount, established players like CommVault benefit immensely from their proven track record. Newcomers face a steep uphill battle in convincing potential clients to entrust them with their most valuable data assets.

Regulatory Compliance and Security Standards

The data storage and management industry is heavily regulated, with new entrants needing to comply with a complex web of data privacy laws like GDPR and CCPA, alongside industry-specific mandates. For instance, in 2024, companies handling sensitive customer data must demonstrate robust security protocols, often requiring significant investment in compliance infrastructure and personnel. Meeting these rigorous security standards, such as ISO 27001 or SOC 2, is a substantial hurdle, demanding advanced technical capabilities and ongoing audits that can deter smaller or less-resourced competitors.

These regulatory and security demands create a significant barrier to entry for new players. Navigating the intricate legal frameworks and implementing the necessary technical safeguards to ensure data integrity and client confidentiality requires substantial capital and expertise. For example, achieving compliance in the financial services sector, where data breach penalties can reach millions, necessitates advanced encryption and access control mechanisms that are costly to develop and maintain. This environment favors established companies with existing compliance frameworks and resources.

- High Compliance Costs: New entrants face substantial upfront and ongoing expenses to meet data privacy (e.g., GDPR, CCPA) and industry-specific regulations.

- Technical Security Demands: Achieving certifications like ISO 27001 or SOC 2 requires significant investment in advanced security infrastructure and expertise.

- Legal and Regulatory Expertise: Understanding and adhering to evolving global data protection laws necessitates specialized legal and compliance teams.

- Risk of Penalties: Non-compliance can lead to severe financial penalties and reputational damage, acting as a strong deterrent for new market entrants.

Economies of Scale and Network Effects

Established players like CommVault leverage significant economies of scale, reducing per-unit costs in areas like research and development, sales operations, and customer support. This cost advantage makes it difficult for newcomers to match pricing and service levels. For instance, in 2024, CommVault's substantial R&D investments, reported in the hundreds of millions, allow for continuous product innovation that smaller firms struggle to replicate.

Furthermore, CommVault benefits from powerful network effects. A large and loyal customer base, coupled with an extensive partner ecosystem, creates a self-reinforcing cycle of value. As more customers adopt CommVault's solutions, the platform becomes more attractive due to increased interoperability and a wider range of integrated services, presenting a formidable barrier to entry for new competitors.

- Economies of Scale: CommVault's established size allows for cost efficiencies in R&D, sales, and support, creating a price advantage.

- Network Effects: A large customer and partner base enhances the value of CommVault's offerings, making it harder for new entrants to attract users.

- Customer Lock-in: Existing infrastructure and integration with CommVault solutions can lead to customer inertia, further deterring new market entrants.

- Brand Reputation: Years of operation and successful deployments build trust and a strong brand, which new companies must work hard to establish.

The threat of new entrants for Commvault is generally low due to the substantial capital investment required for research and development in enterprise data management. Companies like Commvault invest hundreds of millions annually in R&D, a significant barrier for startups.

The complexity of integrating with diverse IT environments and building a trusted brand also deters new players. Commvault's established partner ecosystem and its Metallic SaaS platform's growth in 2024 highlight the advantage of existing networks.

High compliance costs, stringent security demands like ISO 27001, and the need for legal expertise in data privacy regulations (GDPR, CCPA) create further formidable barriers. These factors demand significant resources and time, which new entrants often lack.

Economies of scale and network effects further solidify Commvault's position. Its large customer base and integrated solutions foster customer loyalty, making it challenging for newcomers to gain traction and compete on price or service.

| Barrier to Entry | Description | Example/Data (2024) |

|---|---|---|

| Capital Requirements | High R&D and infrastructure costs | Leading data management firms reported R&D in hundreds of millions. |

| Technical Complexity | Intricate integration with diverse systems | Commvault's extensive compatibility with cloud and on-premise solutions. |

| Brand Reputation & Trust | Building credibility in data security | Commvault's decades of operation and proven track record. |

| Regulatory Compliance | Adherence to data privacy laws | Meeting GDPR, CCPA, ISO 27001, SOC 2 standards. |

| Economies of Scale | Cost advantages from size | Reduced per-unit costs in R&D, sales, and support. |

| Network Effects | Value increases with user base | Growing customer and partner ecosystem for Commvault. |

Porter's Five Forces Analysis Data Sources

Our CommVault Porter's Five Forces analysis is built upon a foundation of diverse and reliable data sources, including CommVault's own SEC filings, annual reports, and investor presentations. We supplement this with industry-specific market research reports from firms like Gartner and IDC, as well as competitor financial statements and public announcements.