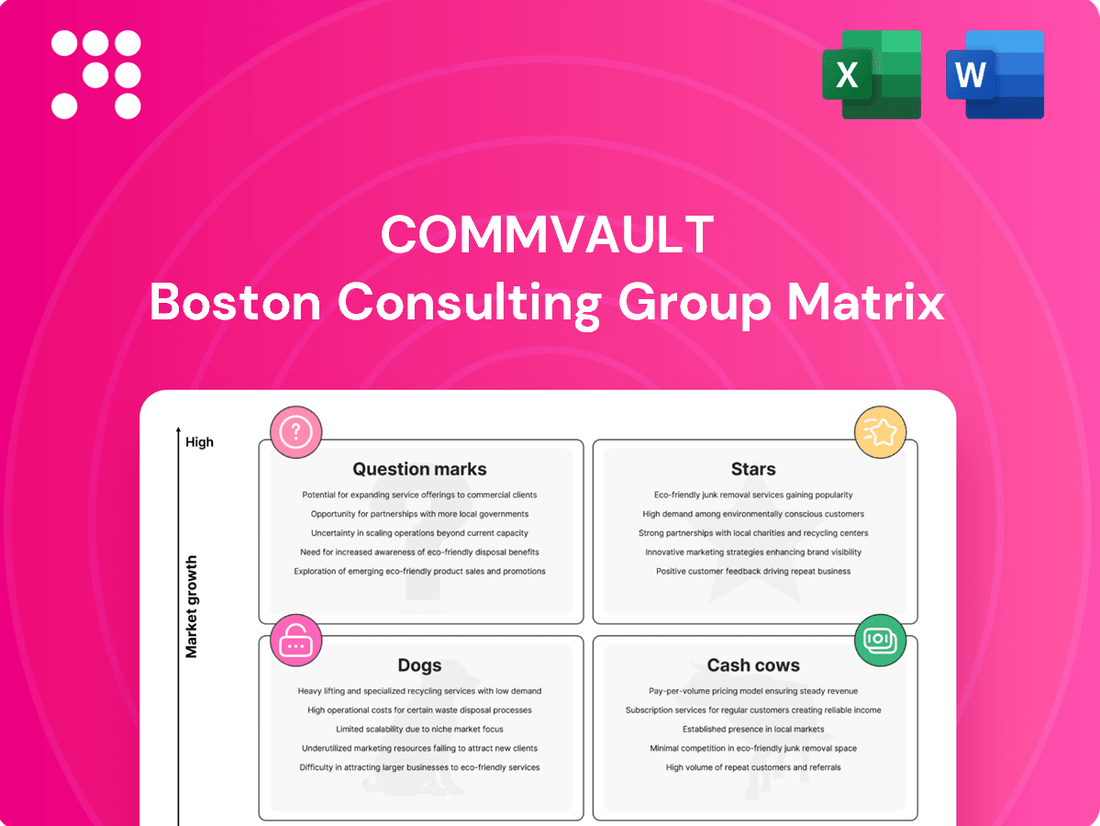

CommVault Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CommVault Bundle

This glimpse into CommVault's BCG Matrix highlights its strategic product positioning. Understanding which offerings are Stars, Cash Cows, Dogs, or Question Marks is crucial for effective resource allocation and future growth. Purchase the full BCG Matrix for a comprehensive analysis and actionable strategies to optimize your data protection portfolio.

Stars

The Commvault Cloud Platform stands out in the expanding cyber resilience market, especially for hybrid cloud setups. Its consistent recognition as a Leader in Gartner's Magic Quadrant for Enterprise Backup and Recovery Software Solutions, including in 2024 and 2025, underscores its strong market presence and execution capabilities.

This platform provides a unified solution for data protection, disaster recovery, and governance across diverse environments. It leverages advanced security and AI to tackle cyber threats and streamline data management, a key factor in its market leadership.

Commvault's subscription revenue saw a substantial 45% increase in Q4 FY2025, largely driven by the demand for its cloud-based solutions like the Commvault Cloud Platform, demonstrating its significant financial impact.

Metallic, Commvault's Software-as-a-Service data protection solution, is a star performer in the company's portfolio. Its cloud-native approach directly tackles the growing need for flexible and efficient backup and recovery. This offering is a significant growth engine for Commvault.

The impressive growth of Metallic is evident in its financial performance. In fiscal year 2025, the SaaS Annual Recurring Revenue (ARR) surged by 68% year-over-year, reaching $281 million. This clearly positions Metallic as a key driver of Commvault's subscription revenue and customer acquisition.

Metallic's success is rooted in its ability to meet enterprise demands for simplified, cost-effective, and secure cloud data protection. It effectively broadens Commvault's market presence beyond its traditional on-premises strengths, making it a strategic cornerstone for the company's future expansion and market penetration.

Commvault's focus on cyber resilience, a critical need in today's threat landscape, positions it well within the BCG matrix. Their solutions offer rapid recovery from cyberattacks, a key differentiator for businesses facing increasing digital threats.

The company integrates advanced security and AI to help organizations anticipate, mitigate, and recover from cyber incidents. This proactive and reactive approach is vital for maintaining business continuity and protecting sensitive data.

Commvault's commitment to innovation in cyber resilience is evident in features like Active Directory Forest Recovery and Cloud Rewind, directly addressing customer pain points. This strategic alignment with market demands fuels its growth potential.

Cloud-Native Database Protection (e.g., Clumio Backtrack)

Commvault's strategic acquisition of Clumio, including its Backtrack technology for Amazon DynamoDB and S3, significantly bolsters its position in the high-growth cloud-native database protection market. This move directly addresses the increasing demand for rapid, granular data recovery essential for modern cloud applications.

The cloud data management sector is experiencing substantial growth, with businesses increasingly relying on cloud-native databases for critical operations. Commvault's investment in these advanced protection solutions, like Clumio Backtrack, positions it to capture a larger share of this expanding market.

- Market Growth: The global cloud database market was projected to reach over $60 billion by 2025, indicating a strong demand for robust data protection solutions.

- Key Features: Clumio Backtrack offers automated, immutable backups and fast, granular recovery for cloud data, crucial for ransomware resilience and compliance.

- Commvault's Strategy: The acquisition signals Commvault's commitment to expanding its high-growth cloud-native offerings, aiming for leadership in this critical segment.

- Customer Benefit: Businesses can achieve efficient and cost-effective data management for their cloud-native workloads, ensuring business continuity and data integrity.

AI-Powered Data Security and Governance (Satori Cyber Acquisition)

Commvault's planned acquisition of Satori Cyber is a significant step to bolster its data security and governance capabilities, particularly for AI workloads. This move directly addresses the increasing need to protect sensitive data within cloud-native environments and the burgeoning field of Large Language Models (LLMs). By integrating Satori Cyber's technology, Commvault aims to provide customers with advanced tools for data discovery, classification, and protection, thereby navigating the complex compliance and security landscapes shaped by AI adoption. This strategic acquisition positions Commvault to capture a larger share of a market experiencing rapid expansion and heightened demand for robust AI-specific data protection solutions.

The acquisition is particularly timely given the projected growth in AI spending. For instance, global spending on AI is anticipated to reach hundreds of billions of dollars in the coming years, with a significant portion allocated to AI security and data governance. Commvault's move taps into this trend by offering solutions that manage the unique data security challenges presented by AI, such as data privacy in LLMs and the secure training of AI models. This strategic alignment is expected to enhance Commvault's competitive standing in the data management sector.

- Strategic Focus on AI Data Security: Commvault's intent to acquire Satori Cyber highlights a clear strategic pivot towards securing data used in AI applications, including LLMs.

- Enhanced Cloud-Native Data Protection: The acquisition aims to improve Commvault's ability to identify, classify, and protect sensitive data within modern cloud environments.

- Addressing Emerging AI Compliance Needs: By integrating Satori Cyber, Commvault is positioning itself to meet the evolving security and regulatory requirements associated with widespread AI adoption.

- Market Expansion in a Growing Segment: This move is designed to expand Commvault's market presence in the critical and rapidly growing sector of AI-driven data security and governance.

Metallic, Commvault's SaaS data protection solution, is a clear star in their portfolio. Its cloud-native design directly addresses the growing demand for flexible and efficient backup and recovery, making it a significant growth engine for the company.

The impressive growth of Metallic is evident in its financial performance. In fiscal year 2025, the SaaS Annual Recurring Revenue (ARR) surged by 68% year-over-year, reaching $281 million. This clearly positions Metallic as a key driver of Commvault's subscription revenue and customer acquisition.

Metallic's success is rooted in its ability to meet enterprise demands for simplified, cost-effective, and secure cloud data protection. It effectively broadens Commvault's market presence beyond its traditional on-premises strengths, making it a strategic cornerstone for the company's future expansion and market penetration.

What is included in the product

This BCG Matrix analysis provides tailored insights into CommVault's product portfolio, categorizing each into Stars, Cash Cows, Question Marks, and Dogs to guide strategic decisions.

Simplify complex data management strategy by clearly visualizing CommVault's offerings in a BCG matrix, easing decision-making.

Cash Cows

Commvault's traditional on-premises backup and recovery software represents a significant Cash Cow. The company boasts a robust market share and a deeply entrenched customer base in this mature segment. While the growth rate for purely on-premises solutions has moderated, these offerings continue to be a reliable source of substantial and consistent cash flow for Commvault.

The mature nature of these on-premises solutions means they require less intensive ongoing investment in marketing and development compared to newer, emerging technologies. This allows Commvault to effectively harvest the profits generated by these established products, reinforcing their Cash Cow status. For instance, in 2024, the on-premises data protection market, while experiencing slower growth than cloud alternatives, still represented a substantial portion of overall IT infrastructure spending, with many enterprises maintaining significant on-premises investments.

Commvault's Customer Support and Maintenance Services are a classic Cash Cow. The company's substantial enterprise customer base generates a consistent, high-margin revenue through essential support and maintenance agreements. This predictable cash flow is a direct result of organizations depending on Commvault's robust data management platforms.

These services require minimal new investment due to the mature nature of the market segment. This allows Commvault to consistently generate profits from this established revenue stream, reinforcing its position as a reliable Cash Cow.

Commvault's legacy perpetual license revenue, while a diminishing segment, continues to be a source of stable, high-margin cash. For the fiscal year ending March 31, 2024, Commvault reported total revenue of $764.5 million, with a portion of this still stemming from these older licensing models. These sales require minimal ongoing investment, effectively acting as a cash cow that supports the company's transition to its subscription-first strategy.

Hybrid Cloud Data Management Solutions

Commvault's hybrid cloud data management solutions are firmly positioned as Cash Cows. These offerings effectively bridge on-premises infrastructure with various cloud environments, a critical need for many enterprises. This mature segment benefits from Commvault's established market presence, ensuring a steady stream of revenue.

The demand for managing data across both traditional data centers and cloud platforms remains robust, making these solutions a consistent generator of cash for Commvault. While the growth rate might not match emerging technologies, the sheer volume of businesses operating in hybrid setups provides a stable and predictable income source.

- Market Position: Commvault holds a significant share in the hybrid cloud data management space.

- Revenue Stability: Solutions catering to the large enterprise segment operating in mixed environments provide consistent cash flow.

- Growth Trajectory: While hybrid adoption continues, it represents a more established market compared to pure cloud-native solutions, supporting steady cash generation.

- Financial Performance: In fiscal year 2024, Commvault reported strong performance in its subscription-based revenue, a key indicator for its Cash Cow segments.

Data Archiving and Compliance Solutions

Commvault's data archiving and compliance solutions represent a significant Cash Cow for the company. These offerings are designed for businesses facing rigorous regulatory mandates and the need for long-term data preservation, a market segment that exhibits consistent demand.

The complexity inherent in compliance and data retention creates a substantial barrier to entry for new players, solidifying Commvault's position. This mature segment is known for its healthy profit margins and its consistent generation of predictable cash flow, which is crucial for funding other business initiatives.

- Stable Demand: Businesses across various regulated industries, such as finance and healthcare, continuously require robust archiving and compliance solutions.

- High Profitability: The specialized nature and regulatory compliance aspects of these solutions allow for strong profit margins.

- Reliable Cash Flow: These mature offerings provide a steady stream of revenue, acting as a dependable financial backbone for Commvault.

- Market Leadership: Commvault's established presence and comprehensive suite of tools in this area contribute to its strong market share.

Commvault's established on-premises backup and recovery software, along with its customer support and maintenance services, are prime examples of Cash Cows. These mature segments benefit from a large, loyal customer base and require minimal new investment, generating consistent and high-margin profits. For the fiscal year ending March 31, 2024, Commvault reported total revenue of $764.5 million, with these established offerings contributing significantly to this figure.

| Segment | Market Maturity | Cash Flow Generation | Investment Needs |

| On-Premises Backup & Recovery | Mature | High, Consistent | Low |

| Customer Support & Maintenance | Mature | High, Predictable | Very Low |

| Hybrid Cloud Data Management | Mature | Steady | Moderate |

| Data Archiving & Compliance | Mature | High, Stable | Low |

Delivered as Shown

CommVault BCG Matrix

The CommVault BCG Matrix preview you are currently viewing is the identical, fully realized document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no limitations; you're seeing the complete, professionally formatted strategic analysis ready for immediate application. Once acquired, this comprehensive report will be yours to download and utilize without any further modifications or hidden content, empowering your strategic decision-making process directly. Rest assured, the quality and completeness of this preview directly translate to the final product you will possess, ensuring transparency and immediate value for your business planning needs.

Dogs

Unsupported or End-of-Life Product Versions in Commvault's portfolio, like the discontinued support for certain older versions of PostgreSQL and EnterpriseDB Version 9.x, represent the Dogs category. These products have low market share and little growth potential.

The shift from Virtual Server Agent (VSA) V1 to VSA V2 exemplifies this, where older versions cease to receive updates and new features. Such products often incur maintenance costs without generating significant new revenue, making them prime candidates for divestment or discontinuation.

Commvault's portfolio may include highly niche on-premises connectors with minimal adoption. These specialized integrations, often built for specific, less common enterprise applications or databases, contribute little to the company's revenue or market presence. For instance, connectors for legacy systems that are no longer widely used represent a segment that has seen very low uptake.

The challenge with these low-adoption connectors lies in resource allocation. Commvault, like many software companies, must balance the cost of maintaining and updating these specialized components against the minimal return they generate. In 2024, companies are increasingly scrutinizing such offerings, prioritizing those with broader market appeal and higher revenue potential.

Underperforming Regional or Vertical Market Initiatives represent areas where Commvault's strategic efforts haven't translated into desired market penetration or revenue growth. These could be specific geographic regions where adoption is slow, or niche industry verticals where the company's solutions face intense competition or a lack of perceived value. For instance, if a particular vertical market initiative, like a specialized data protection solution for the healthcare sector, failed to capture even 5% of its target market by the end of 2024, it would fall into this category.

Such initiatives, despite initial resource allocation, demonstrate a weak competitive advantage or operate in stagnant markets, leading to low return on investment. For example, if a regional push into Southeast Asia saw less than a 2% year-over-year revenue increase in 2024, despite significant marketing spend, it signals an underperformance. Continued funding in these areas diverts capital from more promising opportunities, suggesting a need for strategic review, potential divestment, or a significant scaling back of operations to reallocate resources effectively.

Direct Hardware Sales (Discontinued)

Commvault's historical direct hardware sales segment, now discontinued, would be classified as a 'Dog' in the BCG Matrix. This is because the company strategically shifted to a pure software vendor model, moving away from the low-margin, capital-intensive hardware business. This transition signifies that direct hardware sales no longer contribute to revenue and were a drain on growth and profitability.

The company's strategic pivot away from hardware sales is a clear indicator of its focus on higher-margin software solutions. For instance, in fiscal year 2024, Commvault reported a significant increase in its recurring revenue, highlighting the success of its software-centric strategy. This move allowed them to concentrate resources on innovation and customer support within their core software offerings.

The discontinuation of direct hardware sales means this segment represents a low market share and low growth. Commvault's focus has shifted to areas like Metallic, their SaaS backup and recovery solution, which has seen substantial adoption and revenue growth. This strategic realignment exemplifies a business divesting from underperforming or non-core assets to reinvest in more promising ventures.

- Discontinued Business Segment: Direct hardware sales are no longer offered by Commvault.

- BCG Matrix Classification: This segment falls under the 'Dog' category due to its lack of revenue generation and strategic obsolescence.

- Strategic Shift: Commvault transitioned to a pure software vendor, emphasizing higher-margin, scalable solutions.

- Financial Implication: The move away from hardware was driven by a recognition of its drag on overall profitability and growth potential.

Perpetual License Sales (Declining Trend)

Perpetual license sales at Commvault, while still contributing some revenue, are on a clear downward trajectory. This decline is a direct result of Commvault's strategic pivot towards subscription-based offerings and its increasing emphasis on Annual Recurring Revenue (ARR). The company's investment and promotional efforts are now heavily concentrated on its subscription models, naturally diminishing the focus on perpetual licenses.

This segment, therefore, falls into the 'Dog' category within the BCG Matrix, indicating low market share and low growth prospects. As Commvault's cloud-first and subscription strategies continue to mature and gain traction, the contribution from perpetual licenses is expected to shrink further.

- Declining Revenue Stream: Perpetual license sales are a shrinking portion of Commvault's overall revenue as the company transitions to subscription models.

- Low Growth Potential: With Commvault prioritizing subscription growth and ARR, perpetual licenses are unlikely to see significant future expansion.

- Strategic Shift: The company's strategic focus and resource allocation are directed away from promoting and developing perpetual license offerings.

- Market Trend Alignment: This trend aligns with broader industry shifts towards consumption-based and subscription software models.

Products like older, unsupported Commvault software versions, or highly specialized connectors for niche legacy systems, are considered 'Dogs'. These offerings have minimal market share and very little potential for growth, often representing a drain on resources. For example, if a specific integration for a database with less than 1% market penetration in 2024 is maintained, it fits this category.

These 'Dogs' often incur maintenance costs without generating significant new revenue. Commvault's strategic shift away from direct hardware sales, a low-margin business, also placed it in this category as resources were reallocated to higher-growth software areas. The company's focus on subscription models, like Metallic, further emphasizes this move away from legacy, low-growth segments.

Commvault's perpetual license sales are also a 'Dog' as the company prioritizes subscription-based ARR. This segment is on a downward trajectory, with minimal future expansion expected. By 2024, the industry trend strongly favors consumption-based models, making perpetual licenses a declining, low-growth area for Commvault.

Underperforming regional or vertical market initiatives, where strategic efforts fail to yield significant market penetration or revenue growth, also fall into the 'Dog' category. If a specific regional push saw less than a 2% year-over-year revenue increase in 2024 despite marketing spend, it signals an underperformance and a need for strategic review.

Question Marks

Commvault is actively developing AI-specific data protection features, including tools to monitor data utilized within large language models (LLMs) and assess associated risks. This positions them within the burgeoning AI security market, a sector experiencing rapid growth.

While Commvault's market share and revenue contribution from these nascent AI security features are currently small, the company is making strategic investments to capture leadership in this expanding space. Success will depend on widespread enterprise adoption and seamless integration into existing AI strategies.

Commvault's acquisition of Satori Cyber significantly bolsters its position in the burgeoning cloud-native data governance market. This move grants them capabilities like agentless controls and granular visibility into structured and AI training data, crucial for modern data management.

The cloud-native data governance sector is experiencing rapid expansion, fueled by escalating data complexity and stringent regulatory requirements in cloud environments. This high-growth potential makes it an attractive area for investment.

As a relatively new entrant in this advanced space, Commvault's market share for these specific capabilities is currently modest. Achieving substantial growth and market leadership will necessitate significant investment and flawless execution to elevate this offering from a Question Mark to a Star in their portfolio.

Commvault's strategic expansion into new geographic markets, particularly those with high growth potential in data protection and cyber resilience but currently low market share, represents a Stars or Question Marks category in the BCG matrix. These ventures demand substantial initial investment in sales infrastructure, marketing campaigns, and product localization, making their immediate profitability uncertain.

For instance, while specific new market entries weren't detailed, Commvault's global roadshow, SHIFT 2024, signals a commitment to broadening its international presence. Success in these nascent regions hinges on Commvault's ability to effectively penetrate and capture market share, transforming these investments into future Stars.

Targeted Solutions for Specific, Rapidly Growing Cloud Platforms (Beyond AWS/Azure)

Commvault's strategy should include developing specialized data protection solutions for rapidly growing, niche cloud platforms beyond AWS and Azure. These emerging markets, such as specialized PaaS or serverless environments, represent significant future revenue potential, even with a low initial market share. Capturing leadership in these areas will require substantial investment.

For instance, the global serverless computing market was projected to reach $25.7 billion by 2024, showcasing the rapid growth in this sector. Similarly, specific PaaS solutions catering to industries like FinTech or IoT are experiencing accelerated adoption. Commvault could target these by offering tailored backup and recovery for platforms like Google Cloud's App Engine or specialized container orchestration services.

- Targeted Data Protection: Develop specialized solutions for emerging cloud platforms like Google Cloud's App Engine, Kubernetes-as-a-Service, or specific IoT cloud platforms.

- Market Opportunity: Capitalize on the rapid growth of niche cloud markets, such as the projected $25.7 billion serverless market in 2024, where specialized data protection is often underserved.

- Strategic Investment: Allocate resources to build and market these solutions, aiming to establish a leadership position and capture significant revenue in these expanding segments.

Advanced Cyber Recovery Services (e.g., Recovery Range)

Commvault's advanced cyber recovery services, exemplified by its Recovery Range, represent a strategic move into a high-growth market focused on proactive cyber resilience. These offerings provide crucial hands-on training and simulations designed to prepare organizations for sophisticated cyber threats.

While these innovative services address a critical and expanding need, their market penetration and revenue impact are likely in the nascent stages compared to Commvault's established backup and recovery solutions. The market for cyber resilience is projected to grow significantly, with some reports indicating a compound annual growth rate exceeding 15% in the coming years.

- Market Opportunity: The global cybersecurity market is substantial, with cyber recovery and resilience solutions becoming increasingly vital as ransomware and other attacks escalate.

- Investment Required: Scaling these advanced services necessitates considerable investment in technology development, expert personnel, and robust marketing efforts to drive adoption.

- Early Stage Adoption: While demand is high, the adoption curve for specialized cyber recovery training and simulation services is often longer, requiring education and trust-building within the market.

- Future Potential: Commvault's commitment to these services positions them to capture a significant share of the evolving cyber resilience market, assuming successful execution and market penetration strategies are implemented.

Commvault's focus on emerging AI data protection and cloud-native data governance places them in high-growth sectors with currently modest market share. These initiatives, like the acquisition of Satori Cyber, require substantial investment to mature from Question Marks into potential Stars.

The company's expansion into new geographic markets and specialized cloud platforms also represents Question Mark opportunities, demanding significant upfront capital for market penetration and product adaptation.

Commvault's advanced cyber recovery services, while addressing a critical need with strong market growth projections, are in their early adoption phase, necessitating continued investment to build market share.

These ventures highlight Commvault's strategic pivot towards future-oriented technologies and markets, where success hinges on effective execution and capturing nascent demand.

BCG Matrix Data Sources

Our CommVault BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.