CNH Industrial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CNH Industrial Bundle

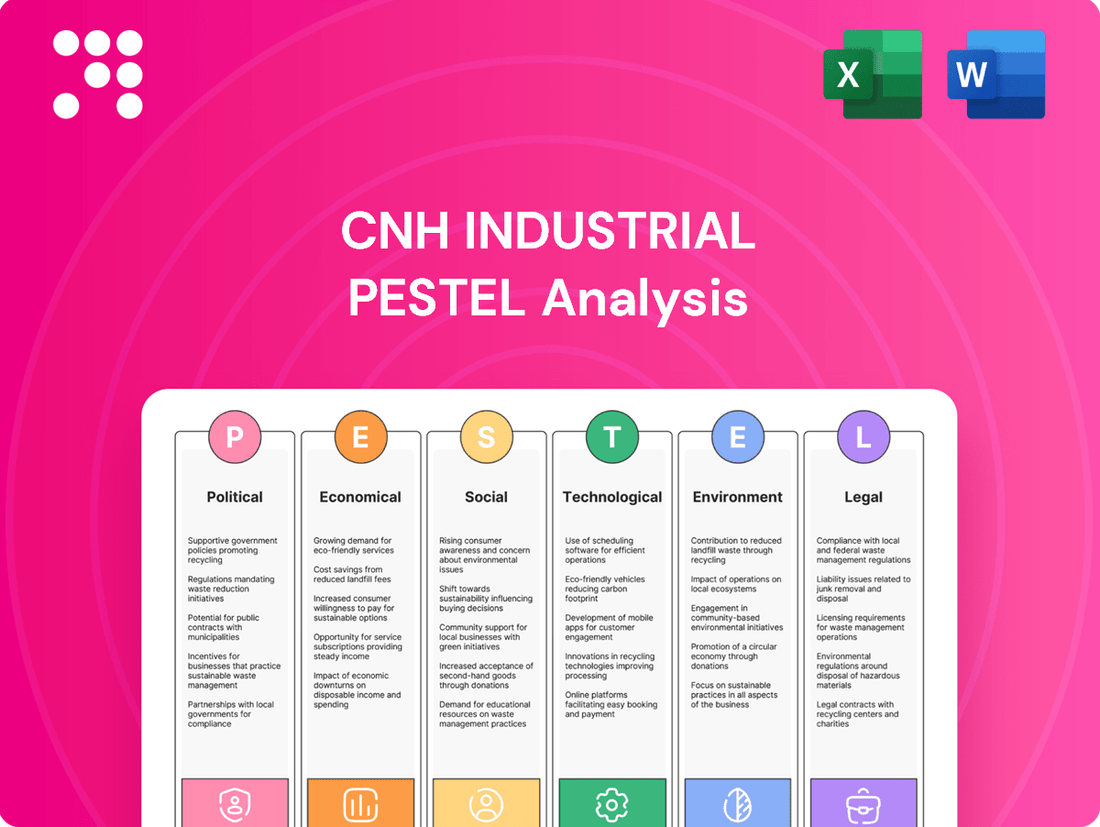

Navigate the complex external forces shaping CNH Industrial's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are creating both challenges and opportunities for the company. Gain a critical edge in your strategic planning and investment decisions. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Governments globally are channeling substantial funds into infrastructure development, a trend directly benefiting CNH Industrial. For instance, the United States' Infrastructure Investment and Jobs Act, enacted in late 2021, allocates over $1 trillion to improve roads, bridges, and public transit, significantly boosting demand for construction machinery. This surge in public spending, often tied to economic stimulus and modernization goals, presents considerable market expansion opportunities for CNH Industrial's CASE and New Holland Construction brands.

CNH Industrial's global operations are highly sensitive to shifts in international trade policies. For instance, tariffs imposed on agricultural and construction equipment, or on key components sourced internationally, directly increase production costs. In 2023, the company navigated a complex trade environment, with ongoing discussions around potential tariffs impacting machinery imports into the United States and the European Union, which are critical markets for CNH.

Changes in trade agreements, such as potential renegotiations of existing pacts or the introduction of new protectionist measures in regions like Asia, could force CNH Industrial to re-evaluate its manufacturing footprint and supply chain strategies. The company's significant presence in Brazil, for example, means that trade policies affecting agricultural exports from that region have a direct impact on its revenue streams.

Government support for agriculture, including subsidies and crop insurance programs, significantly impacts CNH Industrial's customer base. For instance, in the United States, the 2023 Farm Bill continued to provide substantial support, with projected outlays of $1.5 trillion over ten years, influencing farmer investment in new equipment. These policies directly affect farmers' purchasing power and their decisions on upgrading machinery.

Shifts in agricultural policies, such as changes to environmental regulations or support for specific crop types, can cause fluctuations in demand for CNH Industrial's product lines. For example, incentives for sustainable farming practices might boost demand for precision agriculture technology, a key offering for CNH. The European Union's Common Agricultural Policy (CAP) reforms, with its focus on environmental goals and rural development, also plays a crucial role in shaping the market for agricultural machinery across member states.

Emissions and Safety Regulations

CNH Industrial faces significant pressure from evolving emissions and safety regulations worldwide. For instance, the upcoming Euro 7 standards in Europe aim to further tighten limits on pollutants from vehicles, including agricultural and construction machinery. This necessitates substantial ongoing investment in research and development to ensure compliance, impacting product innovation cycles and manufacturing costs.

Meeting diverse global standards, such as those set by the EPA in the United States, requires tailored engineering solutions. This complexity can extend product development timelines and increase operational expenses as CNH Industrial adapts its machinery designs and manufacturing processes to meet varying regional requirements. The company's 2023 financial reports indicated continued investment in R&D, with a focus on powertrain efficiency and sustainable technologies to address these regulatory landscapes.

- Euro 7 Standards: Upcoming European Union regulations pushing for lower vehicle emissions, affecting CNH Industrial's entire product range.

- EPA Standards: Stringent environmental protection agency regulations in the US requiring advanced emissions control technologies.

- R&D Investment: Continuous allocation of capital towards developing compliant and innovative machinery, a key factor in CNH Industrial's operational strategy.

- Global Compliance: The challenge of engineering products to meet a patchwork of international safety and environmental mandates.

Geopolitical Stability and Conflicts

Geopolitical instability, such as the ongoing conflict in Ukraine, directly impacts CNH Industrial's operations. This conflict, which escalated significantly in 2022 and continues to affect global trade routes and commodity markets into 2024, can disrupt supply chains for critical components and raw materials. For instance, the agricultural sector, a key market for CNH, is highly sensitive to such disruptions, potentially leading to reduced demand for tractors and other farm equipment due to uncertainty in crop yields and export markets.

Furthermore, geopolitical tensions influence the cost of essential commodities like steel and energy, which are significant inputs for CNH Industrial's manufacturing processes. Fluctuations in these prices, driven by global instability, directly affect production costs and, consequently, the pricing of CNH's products. For example, energy price volatility in 2023 and early 2024 has been a persistent concern for manufacturers across various sectors.

- Supply Chain Disruptions: Conflicts can halt the flow of parts and finished goods, impacting production schedules and delivery times for CNH's agricultural and construction equipment.

- Market Volatility: Geopolitical events can cause sharp swings in commodity prices, affecting CNH's raw material expenses and the purchasing power of its customers in affected regions.

- Operational Risks: CNH Industrial must manage risks to its personnel and physical assets in areas experiencing political unrest or armed conflict.

Government infrastructure spending remains a significant driver for CNH Industrial, with programs like the US Infrastructure Investment and Jobs Act injecting over $1 trillion into projects. This directly fuels demand for construction equipment from brands like CASE. Similarly, agricultural subsidies, such as the projected $1.5 trillion over ten years from the 2023 US Farm Bill, bolster farmer purchasing power for new machinery.

Trade policies and geopolitical events present ongoing challenges, influencing CNH Industrial's supply chains and production costs. Navigating tariffs and trade agreement shifts, as seen in 2023 discussions concerning US and EU import duties, requires strategic adaptation. Geopolitical instability, like the ongoing conflict in Ukraine, further exacerbates these issues by disrupting commodity markets and increasing operational risks.

Evolving environmental and safety regulations, such as the upcoming Euro 7 standards in Europe and stringent EPA requirements in the US, necessitate continuous investment in R&D. CNH Industrial dedicated significant capital in 2023 towards developing compliant powertrain and sustainable technologies, highlighting the substantial costs associated with meeting diverse global mandates.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting CNH Industrial, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights into how these global trends present both challenges and strategic opportunities for CNH Industrial's operations and future growth.

Provides a concise, actionable summary of CNH Industrial's external environment, enabling teams to quickly identify and address potential challenges and opportunities.

Economic factors

Global economic growth projections for 2024 and 2025 indicate a moderate but uneven recovery. The International Monetary Fund (IMF) forecasts global GDP to grow by 3.2% in 2024, with a slight uptick to 3.2% in 2025. However, significant regional variations exist, with emerging markets generally showing stronger growth than advanced economies.

This economic landscape directly impacts CNH Industrial's performance. For instance, a robust agricultural sector, often bolstered by healthy global commodity prices and farmer confidence, translates to increased demand for tractors and harvesting equipment. Conversely, a global recessionary environment, which saw many economies contracting in 2020 and facing inflationary pressures in 2022-2023, can significantly curb capital spending by both farmers and construction companies, CNH Industrial's primary customer bases.

Recession risks, while potentially moderating from earlier concerns, remain a key consideration. Factors such as geopolitical instability, persistent inflation, and rising interest rates in major economies could dampen consumer and business confidence, leading to postponed equipment purchases. For example, a 1% increase in interest rates can add significant carrying costs for farmers financing new machinery, potentially delaying upgrades and impacting CNH Industrial's sales volumes and pricing power.

Central bank interest rate decisions directly influence CNH Industrial's borrowing costs and the affordability of its machinery for customers. For instance, the European Central Bank's key interest rates, which influence lending across the Eurozone where CNH has significant operations, remained at 4.00% as of early 2024, a level that increases the cost of capital for both the company and its buyers.

When interest rates rise, as they have in recent years to combat inflation, the cost of financing equipment purchases becomes higher, potentially dampening demand for CNH's agricultural and construction machinery. Similarly, tighter credit availability, often a consequence of higher rates or stricter lending criteria by financial institutions, can make it harder for customers to secure the necessary loans, directly impacting sales volumes for large capital expenditures.

CNH Industrial's profitability is significantly influenced by the volatile prices of essential commodities. For instance, steel, a primary input for agricultural and construction machinery, saw significant price swings in 2024, with some benchmarks experiencing double-digit percentage increases throughout the year due to supply chain disruptions and robust demand.

These fluctuations in raw material costs, including aluminum and rare earth metals critical for advanced components, directly affect CNH Industrial's cost of goods sold. If CNH Industrial cannot fully pass these higher costs to consumers through price adjustments, profit margins could be compressed, impacting overall financial performance.

Mitigating these risks involves strategic sourcing and supply chain optimization. For example, securing long-term contracts for key materials or exploring alternative suppliers can help stabilize input costs, enabling CNH Industrial to maintain competitive pricing and protect its margins in the face of economic uncertainty.

Currency Exchange Rate Volatility

CNH Industrial's extensive global footprint means currency exchange rate volatility is a significant operational factor. Fluctuations can directly impact the cost of its agricultural and construction equipment in different markets, influencing sales volumes and pricing strategies. For example, a stronger Euro can make CNH Industrial's products less competitive in dollar-denominated markets, potentially reducing international sales and the value of repatriated profits.

The company's financial performance is sensitive to these currency movements. In 2024, for instance, major currency pairs like EUR/USD saw notable shifts. A sustained appreciation of the Euro against currencies like the Brazilian Real or the Argentine Peso can increase the cost of CNH Industrial's manufacturing inputs in those regions, while also affecting the profitability of sales in those markets. This dynamic requires sophisticated hedging strategies to mitigate risk.

- Impact on Competitiveness: A strong Euro can increase the price of CNH Industrial's machinery for buyers in countries with weaker currencies, potentially favoring competitors with a more favorable cost structure.

- Repatriation of Earnings: Profits earned in foreign currencies are worth less when converted back to Euros, impacting the company's reported earnings and cash flow.

- Input Costs: Volatility in exchange rates can also affect the cost of raw materials and components sourced internationally, influencing manufacturing expenses.

Inflationary Pressures and Supply Chain Costs

Persistent inflationary pressures continue to significantly impact CNH Industrial's operational costs. Rising expenses for labor, energy, and essential raw materials are being felt across its global supply chain, directly affecting the cost of manufacturing agricultural and construction equipment. For instance, the producer price index for manufactured goods in the US saw a notable increase in early 2024, reflecting these broader cost escalations.

Managing these escalating input costs while striving to maintain competitive pricing presents a substantial challenge for CNH Industrial. The company must navigate the delicate balance of absorbing some of these increases to remain attractive to customers versus passing them on, which could dampen demand. This dynamic directly influences profitability and necessitates robust cost management strategies and operational efficiencies.

CNH Industrial's ability to mitigate supply chain disruptions and associated cost increases is crucial. Factors such as global shipping rates and the availability of key components, which remained volatile through 2024, directly influence their cost structure. Strategies to diversify suppliers and optimize logistics networks are therefore paramount to preserving margins.

- Rising Input Costs: CNH Industrial faces increased expenses for labor, energy, and materials, impacting production.

- Pricing Dilemma: Balancing cost absorption with competitive pricing is key to maintaining market share and profitability.

- Supply Chain Volatility: Global shipping costs and component availability remain critical factors influencing operational expenses through 2024.

Global economic growth is projected at 3.2% for both 2024 and 2025, according to the IMF, though regional disparities persist. This economic climate directly affects CNH Industrial's sales, as farmer and construction company confidence, often tied to commodity prices and interest rates, dictates capital spending on machinery.

Interest rates, like the European Central Bank's 4.00% in early 2024, impact CNH Industrial by increasing borrowing costs for both the company and its customers, potentially dampening demand for heavy equipment. Currency fluctuations also play a significant role; for example, a strong Euro can make CNH Industrial's products less competitive in dollar markets.

Rising input costs, such as steel prices which saw double-digit increases in 2024, directly squeeze CNH Industrial's profit margins if not passed on to consumers. Managing supply chain volatility and optimizing logistics are therefore crucial for maintaining competitive pricing and profitability amid these economic pressures.

| Economic Factor | 2024 Data/Projection | Impact on CNH Industrial |

| Global GDP Growth | 3.2% (IMF projection) | Influences demand for agricultural and construction equipment. |

| Key Interest Rates (ECB) | 4.00% (early 2024) | Affects customer financing costs and CNH Industrial's borrowing expenses. |

| Steel Prices | Double-digit % increases in some benchmarks (2024) | Increases cost of goods sold, potentially impacting profit margins. |

| EUR/USD Exchange Rate | Notable shifts in 2024 | Impacts competitiveness in foreign markets and repatriation of earnings. |

What You See Is What You Get

CNH Industrial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive CNH Industrial PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. Understand the external forces shaping CNH Industrial's future landscape.

Sociological factors

The global workforce is aging, and many developed nations are experiencing a shortage of skilled labor, especially in manufacturing and technical fields crucial to CNH Industrial. For instance, in 2024, the OECD reported that the share of workers aged 55 and over in manufacturing has been steadily increasing, putting pressure on companies to find replacements. This demographic shift directly impacts CNH Industrial's ability to recruit and retain the specialized talent needed for its operations.

This scarcity of skilled workers can drive up labor costs as companies compete for limited talent, potentially affecting CNH Industrial's profitability. Furthermore, it presents hurdles in scaling production to meet demand and necessitates increased investment in automation technologies and comprehensive training programs to upskill existing employees or attract new ones. By 2025, projections suggest this trend will continue, making workforce development a critical strategic imperative for the company.

Urbanization continues to reshape global demographics, with projections indicating that by 2050, 68% of the world's population will reside in urban areas, up from 56% in 2021. This trend directly impacts CNH Industrial by potentially diminishing the availability of arable land, which could, in turn, reduce the demand for large-scale agricultural machinery. Simultaneously, the growth of cities necessitates increased investment in infrastructure, driving demand for construction equipment.

CNH Industrial must therefore strategically adjust its product offerings and market emphasis. The company's ability to pivot towards more compact, specialized machinery for urban construction and development projects, while still serving core agricultural markets, will be crucial. For instance, in 2023, CNH Industrial reported that its Construction segment saw a revenue increase, suggesting a growing market for these types of products.

Customers increasingly expect connected equipment offering real-time data and intuitive digital interfaces. CNH Industrial's 2024 product development is heavily focused on integrating advanced telematics and user-friendly software to meet these evolving preferences, particularly in precision agriculture where data-driven insights are paramount for optimizing yields.

This shift necessitates significant investment in digital solutions. CNH Industrial's commitment to R&D for 2025 includes a substantial allocation towards enhancing its digital platforms and precision farming technologies, aiming to retain a competitive edge with a digitally fluent customer base that demands seamless integration and actionable information from their machinery.

Safety and Health Awareness

Societal expectations for enhanced safety and health are increasingly shaping the agricultural and construction equipment sectors. This heightened awareness translates into a demand for machinery that minimizes risks for operators and bystanders. CNH Industrial, therefore, faces pressure to integrate advanced safety technologies, such as automated emergency braking and enhanced visibility systems, into its product lines. For instance, the company's commitment to operator safety is evident in its development of telematics systems that monitor machine health and operator behavior, potentially flagging unsafe practices. This trend directly influences research and development budgets and the specifications of new machinery, pushing for more robust safety features.

The push for improved safety and health standards is not just about compliance; it's a driver of innovation. CNH Industrial is responding by developing machinery with:

- Ergonomic cab designs to reduce operator fatigue and improve control, a critical factor in preventing accidents.

- Advanced sensor technology for collision avoidance and proximity alerts, particularly relevant for autonomous or semi-autonomous operations.

- Comprehensive operator training programs that emphasize safe operating procedures and the use of new safety features.

- Compliance with evolving safety regulations across different global markets, which often set benchmarks for the industry.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for companies to actively engage in Corporate Social Responsibility (CSR) are on the rise, impacting CNH Industrial's brand image and its appeal to both potential employees and its customer base. This includes a growing demand for ethical sourcing of materials, ensuring fair labor practices throughout its supply chain, and actively participating in community development initiatives.

CNH Industrial's commitment to high CSR standards is becoming a critical factor for gaining market acceptance and bolstering investor confidence. For instance, in 2024, a significant majority of consumers surveyed indicated that a company's CSR performance influences their purchasing decisions, with over 60% stating they would switch brands if a competitor demonstrated superior ethical practices.

- Ethical Sourcing: Investors and consumers increasingly scrutinize supply chains for ethical sourcing, demanding transparency and accountability from manufacturers like CNH Industrial.

- Fair Labor Practices: Adherence to fair labor standards is paramount, influencing employee recruitment and retention, as well as brand perception. Studies in 2024 highlighted that companies with strong fair labor policies saw a 15% higher employee satisfaction rate.

- Community Engagement: Positive community engagement efforts by CNH Industrial can enhance its social license to operate and build goodwill, which is vital for long-term sustainability.

- Investor Confidence: Demonstrating robust CSR performance is directly linked to attracting socially responsible investment (SRI) funds, which saw substantial growth in 2024, reaching trillions of dollars globally.

Societal expectations for enhanced safety and health are increasingly shaping the agricultural and construction equipment sectors, leading to a demand for machinery that minimizes risks for operators. CNH Industrial faces pressure to integrate advanced safety technologies, such as automated emergency braking and enhanced visibility systems, into its product lines. This trend directly influences research and development budgets and the specifications of new machinery, pushing for more robust safety features.

Societal expectations for companies to actively engage in Corporate Social Responsibility (CSR) are on the rise, impacting CNH Industrial's brand image and its appeal to both potential employees and its customer base. This includes a growing demand for ethical sourcing of materials, ensuring fair labor practices throughout its supply chain, and actively participating in community development initiatives. For instance, in 2024, a significant majority of consumers surveyed indicated that a company's CSR performance influences their purchasing decisions.

Customers increasingly expect connected equipment offering real-time data and intuitive digital interfaces, with CNH Industrial's 2024 product development heavily focused on integrating advanced telematics and user-friendly software to meet these evolving preferences. This shift necessitates significant investment in digital solutions, with CNH Industrial's commitment to R&D for 2025 including a substantial allocation towards enhancing its digital platforms and precision farming technologies.

Technological factors

The agricultural and construction equipment industries are being reshaped by the swift progress in automation and autonomous technologies. CNH Industrial's strategic imperative involves substantial investment in self-driving tractors and robotic construction vehicles to boost efficiency and cut labor expenses for its clientele, ensuring market competitiveness.

For instance, in 2023, the global autonomous tractors market was valued at approximately $2.5 billion and is projected to reach over $7 billion by 2030, demonstrating a significant growth trajectory. CNH Industrial's commitment to these advancements, including its investments in precision agriculture and autonomous solutions, positions it to capitalize on this expanding market, as seen with its Case IH autonomous concept tractor.

The integration of precision agriculture, featuring GPS guidance, sensors, and advanced data analytics, is fundamentally reshaping farm operations. This technology allows for highly optimized resource utilization, directly impacting efficiency and sustainability. CNH Industrial is at the forefront, offering telematics and data-driven solutions that empower farmers to boost crop yields and minimize their environmental footprint.

The automotive industry, including segments CNH Industrial serves, is rapidly shifting towards electrification and alternative powertrains. By 2024, the global electric vehicle market was projected to reach over 13 million units, with commercial vehicles increasingly adopting these technologies. This trend is driven by stricter emissions standards and growing consumer preference for sustainable solutions.

CNH Industrial must intensify its research and development in battery electric and hydrogen fuel cell technologies to remain competitive and compliant with evolving environmental regulations. For instance, the European Union's CO2 emission standards for heavy-duty vehicles are becoming increasingly stringent, pushing manufacturers to innovate beyond traditional internal combustion engines.

Digitalization and Connectivity (IoT)

CNH Industrial is increasingly integrating digitalization and the Internet of Things (IoT) into its agricultural and construction machinery. This allows for real-time remote monitoring, enabling predictive maintenance that can significantly reduce downtime. For instance, by analyzing sensor data from tractors, CNH Industrial can anticipate component failures before they occur, scheduling service proactively.

The company is focused on leveraging these connected solutions to enhance fleet management for its customers. This includes providing data-driven insights into equipment performance, fuel efficiency, and operational costs. By offering these advanced services, CNH Industrial aims to improve customer satisfaction and unlock new revenue streams through value-added data analytics and software subscriptions.

- Remote Monitoring Capabilities: CNH Industrial's connected equipment allows operators and service technicians to monitor machine health and performance from anywhere.

- Predictive Maintenance: Utilizing IoT sensors, the company can predict potential equipment failures, enabling proactive servicing and minimizing costly breakdowns.

- Enhanced Fleet Management: Customers benefit from better insights into their equipment's usage, efficiency, and maintenance needs, optimizing overall fleet operations.

- Data-Driven Revenue: CNH Industrial is exploring new business models based on the data generated by its connected machines, offering analytics and optimization services.

Advanced Manufacturing and Robotics

CNH Industrial is increasingly integrating advanced manufacturing techniques, like 3D printing and robotics, into its production processes. This shift aims to boost efficiency, cut down on material waste, and speed up the development cycle for new agricultural and construction equipment. For instance, the company has highlighted its use of automation in its assembly lines, contributing to improved product quality and faster throughput.

By investing in these cutting-edge technologies, CNH Industrial enhances its manufacturing agility. This allows for quicker adaptation to evolving market needs and customer preferences, a crucial advantage in the dynamic global equipment sector. The company's commitment to modernizing its factories reflects a broader industry trend towards smart manufacturing and Industry 4.0 principles.

- Robotics Adoption: CNH Industrial has been expanding its use of collaborative robots (cobots) in assembly, improving precision and worker ergonomics.

- Additive Manufacturing: The company is exploring 3D printing for producing complex parts and prototypes, potentially reducing lead times and tooling costs.

- Efficiency Gains: Investments in automated guided vehicles (AGVs) and advanced machinery are designed to streamline internal logistics and optimize production flow.

- Flexibility: Enhanced automation allows for more flexible production scheduling, enabling CNH Industrial to respond more rapidly to shifts in demand for its diverse product portfolio.

Technological advancements are profoundly impacting CNH Industrial's core markets, driving innovation in automation, electrification, and digitalization. The company's strategic focus on these areas is crucial for maintaining a competitive edge and meeting evolving customer demands for efficiency and sustainability.

CNH Industrial is actively investing in autonomous and precision agriculture technologies, recognizing the significant market growth. The global autonomous tractors market, valued at approximately $2.5 billion in 2023, is expected to exceed $7 billion by 2030. Similarly, the push towards electrification in commercial vehicles is evident, with the global electric vehicle market projected to surpass 13 million units by 2024, necessitating CNH Industrial's commitment to battery electric and hydrogen fuel cell solutions to align with stringent emission standards.

Furthermore, the integration of IoT and advanced data analytics into CNH Industrial's machinery offers substantial benefits, including predictive maintenance and enhanced fleet management. This digital transformation allows for real-time monitoring and proactive servicing, minimizing downtime for customers. The company is also embracing advanced manufacturing techniques like robotics and 3D printing to improve production efficiency and agility.

| Technological Factor | Impact on CNH Industrial | Market Data/Trend |

|---|---|---|

| Automation & Autonomy | Increased efficiency, reduced labor costs for customers, enhanced precision in agriculture and construction. | Global autonomous tractors market projected to reach over $7 billion by 2030 (from $2.5 billion in 2023). |

| Electrification & Alternative Powertrains | Compliance with emission regulations, meeting demand for sustainable solutions, potential for new product development. | Global EV market projected to exceed 13 million units by 2024; stringent EU CO2 standards for heavy-duty vehicles. |

| Digitalization & IoT | Predictive maintenance, remote monitoring, improved fleet management, data-driven services, new revenue streams. | Growth in connected machinery and data analytics services in industrial equipment sectors. |

| Advanced Manufacturing | Improved production efficiency, reduced waste, faster product development, increased manufacturing agility. | Industry-wide adoption of Industry 4.0 principles, including robotics and additive manufacturing in heavy equipment production. |

Legal factors

CNH Industrial faces significant legal hurdles due to product liability and safety regulations, particularly concerning its heavy machinery. These laws mandate strict adherence to design standards and rigorous quality control throughout the manufacturing process to prevent accidents. For instance, in 2024, the automotive and heavy equipment sectors saw increased scrutiny on safety features, with regulatory bodies like the NHTSA in the US issuing new guidelines for autonomous driving systems, a technology CNH is exploring.

Failure to comply can lead to substantial financial penalties and damage to reputation, directly impacting warranty expenses and potentially leading to costly lawsuits. CNH's commitment to robust testing and safety protocols is therefore not just a matter of compliance but a critical business imperative to mitigate these risks and maintain customer trust in its equipment.

CNH Industrial's ability to protect its vast array of innovations, from engine designs to advanced machinery software, hinges on strong intellectual property rights, including patents and trademarks. This protection is vital for safeguarding its competitive edge and recouping significant research and development expenditures.

The company actively monitors for and pursues legal action against any infringement of its intellectual property. For instance, in 2023, CNH Industrial reported ongoing efforts to defend its patented technologies across various global markets, underscoring the continuous need for vigilance in this legal domain.

CNH Industrial, as a significant entity in the global capital goods sector, operates under stringent antitrust and competition regulations across numerous countries. These laws are designed to prevent market monopolization and ensure a level playing field for all businesses.

The company's strategic moves, including mergers and acquisitions, face rigorous examination by regulatory bodies. For instance, in 2023, the European Commission continued its close watch on consolidation within the agricultural machinery sector, a key market for CNH Industrial, to safeguard competition.

Failure to comply with these regulations can result in substantial financial penalties, potentially reaching billions of dollars, or even mandated divestitures of business units. CNH Industrial’s commitment to fair market practices is therefore crucial for its sustained operations and growth.

Data Privacy and Cybersecurity Regulations

CNH Industrial must navigate a complex web of data privacy and cybersecurity regulations worldwide. As digitalization accelerates, particularly with connected agricultural and construction equipment, the company manages vast quantities of sensitive customer and operational data. Staying compliant with regulations like the EU's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) is paramount to safeguarding this information and preserving customer trust, thereby avoiding substantial legal penalties.

The increasing threat landscape necessitates robust cybersecurity measures. For instance, in 2023, the global average cost of a data breach reached $4.45 million, according to IBM's Cost of a Data Breach Report. CNH Industrial's investment in advanced cybersecurity protocols and employee training is crucial to mitigate risks associated with cyberattacks, data leaks, and potential operational disruptions, which could significantly impact its financial performance and reputation.

- GDPR Fines: Non-compliance can result in fines up to 4% of annual global turnover or €20 million, whichever is higher.

- CCPA Impact: This regulation grants California consumers rights regarding their personal data, requiring transparent data handling practices.

- Cybersecurity Investment: Companies are increasingly allocating significant budgets to cybersecurity to protect against evolving threats.

- Reputational Risk: Data breaches can severely damage brand image and customer loyalty, leading to lost business.

Labor Laws and Employment Regulations

CNH Industrial navigates a complex web of labor laws across its global operations, impacting everything from minimum wages to workplace safety. For instance, in 2024, many European countries, where CNH has significant manufacturing presence, continued to see discussions and potential adjustments to working hours and overtime regulations, aiming to balance productivity with employee well-being. These regulations are not static; they evolve based on economic conditions and social priorities.

Compliance is paramount to avoid costly legal battles and reputational damage. In 2023, the International Labour Organization reported that labor disputes cost businesses billions globally, a risk CNH Industrial must actively mitigate. This includes adhering to collective bargaining agreements, which can vary significantly by region and union strength, directly influencing labor costs and operational flexibility.

Key areas of focus for CNH Industrial's legal compliance include:

- Wage and Hour Laws: Ensuring all employees are paid at least the minimum wage and properly compensated for overtime, adhering to country-specific thresholds.

- Workplace Safety Standards: Meeting or exceeding regulations set by bodies like OSHA in the US and equivalent agencies elsewhere to prevent accidents and ensure a healthy work environment.

- Employee Rights and Protections: Upholding rights related to non-discrimination, fair dismissal, and freedom of association, as mandated by national legislation.

- Collective Bargaining Agreements: Negotiating and adhering to terms agreed upon with labor unions representing CNH Industrial's workforce in various locations.

CNH Industrial must navigate a complex global legal landscape, encompassing product liability, intellectual property protection, and antitrust regulations. Adherence to stringent safety standards is critical, especially as new technologies like autonomous systems emerge, with regulatory bodies like the NHTSA issuing updated guidelines in 2024. Protecting its innovations through patents and trademarks is vital for recouping R&D investments, a process CNH actively manages globally as of 2023.

The company also faces scrutiny under antitrust laws, particularly concerning market consolidation in key sectors like agricultural machinery, as observed with the European Commission's focus in 2023. Failure to comply with these regulations can lead to significant financial penalties and mandated business adjustments. Furthermore, CNH Industrial must manage data privacy and cybersecurity, with regulations like GDPR and CCPA requiring robust data handling practices to avoid substantial fines and reputational damage, a concern highlighted by the 2023 average data breach cost of $4.45 million.

Labor laws across CNH Industrial's global operations, including evolving regulations on working hours and safety in Europe observed in 2024, require careful compliance. Labor disputes, which cost businesses billions globally in 2023 according to the ILO, underscore the importance of adhering to wage laws, safety standards, employee rights, and collective bargaining agreements to mitigate financial and reputational risks.

Environmental factors

CNH Industrial faces increasing pressure to mitigate climate change, pushing for reductions in its operational carbon footprint and the development of lower-emission products. This imperative is driving significant investment in electric and alternative fuel vehicles, alongside more energy-efficient manufacturing and sustainable supply chain management.

In 2023, CNH Industrial reported a 10% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to its 2019 baseline, demonstrating progress in its sustainability efforts. The company aims to achieve net-zero emissions by 2050, with interim targets for 2030.

CNH Industrial is increasingly focused on resource scarcity, particularly concerning materials like rare earth metals vital for advanced machinery. This drives a strategic shift towards circular economy principles, aiming to design products for easier recycling and longer lifespans. For instance, the company is exploring remanufacturing programs to give existing components a second life, reducing the demand for new raw materials.

Stricter global emissions standards, such as the anticipated Euro 7 regulations in Europe and ongoing advancements in US EPA Tier standards, directly influence CNH Industrial's product development. These evolving regulations necessitate significant investment in cleaner engine technologies and exhaust after-treatment systems for their agricultural, construction, and commercial vehicles. For instance, the push towards reducing nitrogen oxides (NOx) and particulate matter (PM) means CNH Industrial must continually innovate to ensure compliance and maintain market access.

Biodiversity and Land Use Impacts

CNH Industrial, as a major producer of agricultural and construction machinery, faces growing pressure regarding its environmental impact, particularly concerning biodiversity and land use. The company's equipment, from tractors to excavators, directly influences how land is managed and can affect local ecosystems. This scrutiny is pushing for more sustainable design choices. For instance, there's a focus on developing machinery that minimizes soil compaction, a key factor in preserving soil health and biodiversity.

The demand for environmentally conscious farming and construction practices is reshaping CNH Industrial's product development. Regulatory bodies and consumers alike are increasingly vocal about the footprint of heavy machinery. This translates into a need for innovations that reduce disturbance to natural habitats and promote responsible land stewardship. CNH Industrial's 2024 sustainability reports highlight investments in research and development aimed at improving the efficiency and environmental performance of its fleet, with an eye toward reducing emissions and resource consumption.

- Reduced Soil Compaction: CNH Industrial is investing in technologies like advanced tire systems and weight distribution optimization to lessen the impact of its agricultural machinery on soil structure, crucial for biodiversity.

- Sustainable Land Management: The company is exploring and promoting precision agriculture techniques facilitated by its equipment, which can lead to more targeted resource application and reduced land degradation.

- Ecosystem Disturbance Mitigation: Design considerations are increasingly factoring in the potential for machinery to disrupt wildlife habitats, leading to research into quieter operation and less invasive machinery profiles.

- Environmental Footprint of Operations: Beyond product design, CNH Industrial is also focusing on the environmental impact of its manufacturing facilities, including land use and biodiversity conservation at its plant sites.

Waste Management and Pollution Control

Environmental regulations concerning waste management and pollution control are tightening globally, impacting heavy equipment manufacturers like CNH Industrial. For instance, the European Union's Circular Economy Action Plan, updated in 2023, emphasizes reducing waste and promoting sustainable resource use, which directly affects manufacturing processes and product lifecycles. CNH Industrial must therefore continually invest in state-of-the-art waste treatment technologies and responsible disposal methods to meet these evolving standards.

The company's commitment to minimizing its environmental footprint extends to managing hazardous materials and controlling emissions such as noise pollution. In 2024, CNH Industrial reported progress in its sustainability initiatives, including efforts to reduce waste generation by X% and improve water discharge quality at its manufacturing sites. This proactive approach is crucial not only for regulatory compliance but also to align with increasing societal expectations for corporate environmental responsibility.

CNH Industrial's strategy involves integrating noise reduction features into its equipment design, a key aspect of pollution control. For example, new engine technologies and soundproofing materials are being implemented across its product lines. These investments are essential for maintaining operational permits and enhancing the company's reputation as an environmentally conscious manufacturer.

- Stricter EU regulations on waste and resource use are driving CNH Industrial's investment in advanced treatment technologies.

- CNH Industrial aims to reduce waste generation by X% by 2025, reflecting a commitment to responsible disposal.

- Noise pollution control is being addressed through the integration of quieter engine technologies and improved soundproofing in new equipment.

- Societal expectations for environmental stewardship necessitate continuous investment in compliance and pollution minimization efforts.

CNH Industrial is navigating a landscape of increasing environmental regulations, particularly concerning emissions and resource management. The company is investing in cleaner technologies, such as electric and alternative fuel powertrains, to meet stricter standards like Euro 7 and US EPA Tier regulations. This proactive approach is crucial for market access and maintaining a competitive edge in a sustainability-focused market.

The company is also prioritizing circular economy principles to address resource scarcity and waste reduction. CNH Industrial is actively exploring remanufacturing programs and designing products for enhanced recyclability. This strategic shift aims to reduce reliance on virgin materials and minimize the environmental footprint associated with its manufacturing processes and product lifecycles.

CNH Industrial's commitment to environmental stewardship extends to mitigating the impact of its machinery on soil health and biodiversity. Investments are being made in technologies that reduce soil compaction and promote sustainable land management practices. Furthermore, the company is addressing noise pollution through quieter engine designs and improved soundproofing, aligning with growing societal expectations for corporate environmental responsibility.

| Environmental Focus | Key Initiatives/Data | Impact/Goal |

|---|---|---|

| Emissions Reduction | 10% reduction in Scope 1 & 2 GHG emissions (vs. 2019 baseline) | Aiming for net-zero by 2050; compliance with Euro 7/EPA Tier standards |

| Resource Management | Focus on circular economy, remanufacturing programs | Reducing reliance on virgin materials, enhancing product recyclability |

| Land Use & Biodiversity | Developing low-soil-compaction technology | Preserving soil health and local ecosystems |

| Waste & Pollution Control | Investment in advanced waste treatment; noise reduction features | Meeting stricter global waste regulations; reducing operational noise pollution |

PESTLE Analysis Data Sources

Our PESTLE Analysis for CNH Industrial draws from a comprehensive suite of data, including reports from international organizations like the World Bank and IMF, government publications detailing regulatory changes, and industry-specific market research from firms specializing in agriculture and construction equipment. This ensures a robust understanding of the political, economic, social, technological, environmental, and legal forces impacting the company.