CNH Industrial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CNH Industrial Bundle

Unlock the strategic blueprint behind CNH Industrial's success with our comprehensive Business Model Canvas. This detailed analysis dissects how they deliver value through innovative machinery and services, targeting key customer segments like agriculture and construction. Discover their unique revenue streams and cost structures that drive their global operations.

Ready to gain a competitive edge? Download the full CNH Industrial Business Model Canvas to explore their vital partnerships, core resources, and customer relationships that fuel their market leadership. This actionable insight is perfect for strategists and business leaders seeking to emulate proven success.

Partnerships

CNH Industrial's extensive dealer network is fundamental to its business model, acting as the primary channel for sales and after-sales service. The company is actively fostering these relationships through a 'New Deal' initiative, which involves substantial investments aimed at strengthening partnerships and driving mutual growth. This strategic focus ensures CNH Industrial remains close to its customers, facilitating efficient service and maintenance operations.

To underscore this commitment, CNH Industrial has committed to investing approximately 100 basis points of its annual margin over the next five years. This investment is specifically earmarked for dealers identified as growth-oriented, reinforcing the collaborative approach to expanding market reach and enhancing customer satisfaction.

CNH Industrial strategically partners with technology and digital solution providers to embed cutting-edge capabilities into its machinery. A prime example is its collaboration with Starlink, which brings global satellite connectivity to CNH equipment, significantly boosting real-time communication and precision farming, especially in areas with limited terrestrial networks.

These alliances are crucial for enhancing operational efficiency and data-driven decision-making for CNH customers. The company's venture arm, CNH Industrial Ventures, actively scouts and invests in innovative digital and technology startups, ensuring CNH remains at the forefront of advancements in the agriculture and construction sectors.

CNH Industrial cultivates strategic partnerships with component and raw material suppliers, essential for its global manufacturing operations. These relationships are built on long-term agreements designed to ensure a consistent flow of high-quality inputs, thereby bolstering supply chain resilience and driving cost efficiencies. For instance, in 2024, CNH Industrial continued its focus on optimizing its supplier base to achieve the best total value, a critical factor in managing its significant procurement expenditures.

Financial Service Partners

CNH Industrial cultivates key partnerships with financial institutions to bolster its dealer network and provide essential financing for its customers. These collaborations are critical for offering retail note and lease options on both new and used agricultural and construction equipment.

These financial service partnerships are designed to simplify the acquisition of capital goods for customers, thereby driving sales volume. For instance, in 2024, CNH Industrial's financial services segment played a significant role in facilitating equipment purchases, contributing to overall revenue growth.

- Dealer Support: Financial partners provide dealers with the necessary tools and credit lines to extend financing to end-users.

- Customer Accessibility: Offering flexible financing options makes CNH Industrial's machinery more attainable for a broader customer base.

- Sales Enablement: By bridging the gap between customer needs and purchasing power, these partnerships directly boost equipment sales.

Research and Development Collaborations

CNH Industrial actively pursues research and development collaborations, notably with digital and technology startups. These partnerships are crucial for driving innovation in key areas such as automation, autonomous operations, and the development of alternative fuel solutions for their agricultural and construction equipment.

This strategy of engaging with external innovators allows CNH Industrial to accelerate its organic growth. By integrating cutting-edge technologies developed by these partners, the company can more efficiently bring advanced features and capabilities to its product lines, staying ahead of market trends.

These collaborations are fundamental to CNH Industrial's commitment to advancing precision technology. For instance, in 2024, they continued to invest in and partner with firms focused on AI-driven agricultural management and advanced sensor technologies, aiming to enhance crop yield and operational efficiency for their customers.

- Focus on Automation and Autonomy: Partnerships with tech startups help integrate advanced automation and autonomous driving features into tractors and construction machinery.

- Alternative Fuels Development: Collaborations are key to exploring and implementing sustainable power sources, including electric and hydrogen technologies, for future vehicle platforms.

- Accelerated Innovation: Working with agile startups allows CNH Industrial to rapidly test and deploy new technologies, speeding up product development cycles.

- Precision Technology Advancement: These R&D efforts are vital for enhancing precision farming and construction techniques, leveraging data analytics and IoT for improved performance.

CNH Industrial's key partnerships are multifaceted, encompassing its extensive dealer network, technology providers, component suppliers, and financial institutions. These alliances are critical for sales, service, innovation, and customer financing, directly impacting market reach and operational efficiency.

The company's dealer network, supported by initiatives like the 'New Deal' and a 100 basis point margin investment over five years, forms the backbone of customer interaction. Strategic collaborations with tech firms like Starlink integrate advanced connectivity, while R&D partnerships with startups accelerate innovation in automation and alternative fuels.

Furthermore, strong relationships with component suppliers ensure supply chain resilience, and financial partnerships facilitate customer equipment acquisition, driving sales volumes. These collaborations are vital for CNH Industrial's growth and its ability to deliver advanced, accessible machinery.

| Partner Type | Purpose | 2024 Focus/Data Point |

|---|---|---|

| Dealer Network | Sales, After-sales Service, Customer Financing | 'New Deal' initiative investment; ~100 bps margin investment over 5 years for growth dealers. |

| Technology Providers (e.g., Starlink) | Connectivity, Precision Farming, Digital Solutions | Integration of global satellite connectivity for enhanced real-time communication. |

| Component & Raw Material Suppliers | Supply Chain Resilience, Cost Efficiency | Optimizing supplier base for best total value in procurement. |

| Financial Institutions | Customer Financing (Retail Note, Lease) | Facilitating equipment purchases, contributing to revenue growth. |

| R&D Startups | Innovation (Automation, Alternative Fuels, Precision Tech) | Investment in AI-driven agriculture and advanced sensor technologies. |

What is included in the product

This Business Model Canvas provides a strategic overview of CNH Industrial's operations, detailing its customer segments, value propositions, and revenue streams across its agricultural and construction equipment sectors.

It offers a comprehensive, pre-written business model tailored to CNH Industrial's strategy, designed for informed decision-making and presentations to stakeholders.

CNH Industrial's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex operations, enabling rapid identification of inefficiencies and strategic alignment.

Activities

CNH Industrial's central operations revolve around the intricate design and robust manufacturing of specialized capital goods. This core activity spans a wide array of agricultural machinery, from tractors and harvesters to sophisticated implements, alongside a comprehensive suite of construction equipment like excavators.

The company demonstrates a commitment to innovation through its ongoing product line rejuvenation. Notably, CNH Industrial introduced new generation combines in 2024, signaling its dedication to staying at the forefront of agricultural technology. Furthermore, a complete overhaul of its tractor offerings is slated to commence in 2026, underscoring a forward-looking strategy for product development.

CNH Industrial dedicates substantial resources to Research and Development, aiming for technological leadership in precision agriculture, automation, and autonomous systems. This commitment is crucial for staying competitive and meeting evolving customer needs.

By 2030, CNH plans to integrate advanced Artificial Intelligence into its entire product range and develop 90% of its precision technology in-house. This strategic move signifies a deep focus on proprietary innovation, encompassing areas like agronomic sensors and smart implements.

CNH Industrial orchestrates its sales and distribution via an extensive global network of dealers, complemented by direct sales initiatives. This strategy is designed to optimize market reach and customer engagement, adapting to diverse regional needs.

A key aspect of their go-to-market approach in 2024 involves a new dual-brand dealer strategy, aimed at strengthening farmer relationships and expanding market penetration. This initiative reflects a commitment to enhancing brand visibility and customer service at the local level.

Furthermore, CNH Industrial actively manages dealer inventory, a crucial activity particularly during periods of softer demand. This proactive inventory management helps ensure product availability while mitigating risks associated with excess stock, a practice vital for maintaining financial health and operational efficiency.

Provision of Financial Services

CNH Industrial actively provides a comprehensive suite of financial services to bolster its global dealer network and directly support its end customers. This crucial activity is designed to streamline and encourage the purchase of agricultural and construction equipment by offering flexible retail note and lease financing options for both new and pre-owned machinery.

These financial offerings are more than just an ancillary service; they represent a substantial and integral part of CNH Industrial's overarching business strategy. In 2024, CNH Industrial reported that its financial services segment played a vital role in driving sales and enhancing customer accessibility to its product lines.

- Global Reach: Financial services are offered across key markets worldwide, supporting diverse customer needs.

- Product Support: Facilitates the acquisition of both new and used agricultural and construction equipment.

- Financing Options: Provides retail note and lease financing solutions tailored to customer requirements.

- Revenue Contribution: Financial services are a significant contributor to the company's overall financial performance and sales volume.

Aftermarket Support and Services

A cornerstone of CNH Industrial's strategy involves robust aftermarket support, encompassing parts availability, maintenance services, and sophisticated repair capabilities. This ensures customers can keep their machinery operational with minimal disruption.

CNH is actively enhancing its customer service by integrating digital platforms and leveraging AI for predictive and scheduled maintenance. This proactive approach aims to minimize downtime and maximize equipment efficiency for users.

The company's commitment is to achieve 100% uptime for its customers. They are striving for a 'fix right the first time' guarantee, underscoring their dedication to quality and customer satisfaction in their service offerings.

- Parts Availability: Ensuring timely access to genuine CNH parts is crucial for minimizing repair times and keeping equipment running.

- Maintenance Services: Offering scheduled maintenance programs and on-demand repair services helps customers maintain their fleet's peak performance.

- Advanced Service Capabilities: Investment in technician training and diagnostic tools allows for complex repairs and the implementation of new technologies.

- Digital and AI Integration: Utilizing integrated platforms and AI for predictive maintenance aims to anticipate issues before they cause breakdowns, improving overall reliability.

CNH Industrial's key activities center on the design, manufacturing, and sale of agricultural and construction equipment. They also provide vital financial services to support these sales and offer comprehensive aftermarket support to ensure customer satisfaction and equipment longevity. Innovation through R&D, particularly in precision agriculture and AI, is a significant ongoing effort.

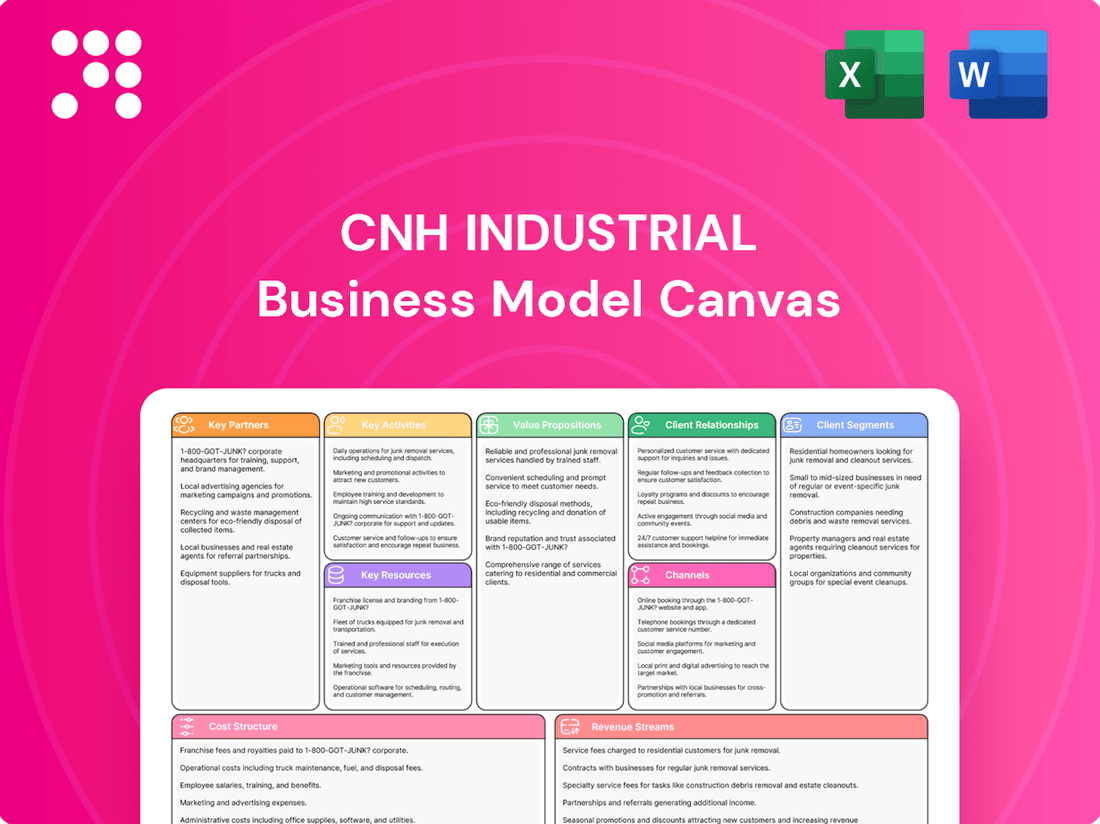

Delivered as Displayed

Business Model Canvas

The CNH Industrial Business Model Canvas preview you're viewing is the exact document you'll receive upon purchase. This isn't a sample or mockup; it's a direct snapshot of the comprehensive analysis you'll gain. You'll get full access to this professionally structured and detailed canvas, ready for your strategic planning.

Resources

CNH Industrial holds a robust portfolio of intellectual property, particularly in cutting-edge agricultural technologies. This includes their advancements in precision farming, artificial intelligence applications, and autonomous operational capabilities, which are crucial for modern agriculture.

Key brands such as Raven and Hemisphere are instrumental in driving CNH Industrial's technological prowess, contributing significantly to their market position in advanced solutions. These acquisitions bolster the company's ability to offer integrated and sophisticated technology packages to customers.

A strategic commitment to in-house development is evident in their goal to create 90% of their precision technology internally by 2030. This focus on proprietary development ensures greater control over innovation and a stronger, more defensible technology base.

CNH Industrial leverages a vast global manufacturing and supply chain network, spanning five continents, to produce and distribute its agricultural and construction equipment. This extensive infrastructure is a cornerstone of its business model, enabling efficient operations worldwide.

In 2023, CNH Industrial reported net sales of €24.3 billion, underscoring the scale of its global reach and production capabilities. The company's commitment to supply chain resilience is demonstrated through strategic sourcing programs designed to optimize material costs and enhance overall efficiency.

CNH Industrial's strong brand portfolio is a cornerstone of its business model, featuring globally recognized names like Case IH, New Holland, and CASE, alongside regional powerhouses such as STEYR. These brands possess substantial market equity and cater to diverse customer needs across agriculture and construction sectors.

The company is actively investing in enhancing the distinct identities of these brands, aiming to foster deeper connections and engagement with farmers. This strategic focus is crucial for driving future growth and maintaining market leadership.

For instance, CNH Industrial reported net sales of $22.1 billion in 2023, with its Agriculture segment contributing significantly, underscoring the market's reliance on its established brands.

Human Capital and Expertise

CNH Industrial's extensive global workforce, numbering over 35,000 employees, is a foundational asset. This diverse team brings critical expertise across design, engineering, manufacturing, sales, and after-sales service, directly fueling the company's innovation and operational efficiency.

The company's strategic focus on cultivating and retaining talent is paramount. This commitment to human capital development is not just about maintaining current capabilities but is intrinsically linked to CNH Industrial's long-term growth and competitive positioning.

- Global Workforce: Over 35,000 employees worldwide contribute diverse skills.

- Core Expertise: Essential knowledge in design, engineering, manufacturing, sales, and service.

- Innovation Driver: Human capital is key to developing new technologies and improving processes.

- Strategic Importance: Talent engagement and development are integral to the company's strategic plans.

Financial Capital and Access to Funding

CNH Industrial relies on substantial financial capital, including cash and cash equivalents, to fuel its operations. As of December 31, 2023, the company reported cash and cash equivalents totaling $6.6 billion, providing a solid foundation for its activities.

Access to diverse funding mechanisms is paramount for CNH Industrial. This includes credit facilities, debt issuance, and equity markets, enabling the company to secure the necessary resources for its strategic objectives. In 2023, CNH Industrial successfully issued €500 million in sustainability-linked notes, demonstrating its ability to tap into capital markets.

- Financial Capital: CNH Industrial maintained a strong liquidity position with $6.6 billion in cash and cash equivalents as of year-end 2023.

- Funding Mechanisms: The company utilizes various funding sources, including credit lines and debt issuance, to support its operations and investments.

- R&D and CapEx: Financial capital underpins significant investments in research and development and capital expenditures, crucial for product innovation and manufacturing efficiency. In 2023, R&D expenses were $1.1 billion.

- Financial Services: A portion of this capital is allocated to its financial services division, offering financing solutions to customers, thereby facilitating sales and customer relationships.

CNH Industrial's intellectual property is a significant resource, particularly in advanced agricultural technologies like precision farming and autonomous systems. Acquisitions such as Raven and Hemisphere bolster this technological edge, with a strategic aim to develop 90% of their precision technology in-house by 2030.

Value Propositions

CNH Industrial enhances customer productivity and operational efficiency through advanced equipment and integrated technology. For instance, their new generation of combines offers a 15% lower total cost of ownership, directly impacting efficiency.

Automation and autonomous features are key to optimizing field operations and maximizing yields. These technologies empower farmers to work smarter, not just harder, leading to tangible gains in output.

CNH Industrial is committed to delivering cutting-edge technology, integrating advanced solutions like AI and precision farming tools. This 'Iron + Tech' approach ensures customers receive the most sophisticated equipment available, enhancing operational efficiency and user experience.

The company's investment in innovation is evident in its growing Precision Tech segment. For 2024, CNH Industrial anticipates Precision Tech sales to nearly double as a percentage of total agriculture net sales, underscoring the increasing market demand for these advanced capabilities.

CNH Industrial boasts a comprehensive product portfolio, spanning agricultural and construction equipment, trucks, commercial vehicles, buses, and specialized vehicles. This extensive offering ensures customers can source tailored solutions, whether for intricate farming operations or large-scale construction endeavors.

In 2024, CNH Industrial continued its commitment to innovation, with significant investments in refreshing and expanding its product lines. For instance, the agricultural segment saw the introduction of new precision farming technologies designed to enhance efficiency and sustainability for farmers.

Reliable Support and Uptime

CNH Industrial prioritizes keeping customer equipment running smoothly, aiming for maximum uptime and unwavering reliability. They achieve this through advanced customer service, incorporating predictive maintenance and connected digital tools. This commitment to resolving issues correctly the first time directly translates to less downtime and uninterrupted operations for their clients.

A significant part of this value proposition involves substantial investment in enhancing the service capabilities of their dealer network. This ensures that customers have access to skilled technicians and readily available parts, reinforcing the promise of dependable support.

- Maximizing Equipment Uptime: CNH Industrial’s strategy focuses on minimizing operational interruptions for its customers.

- Predictive Maintenance & Digital Platforms: The company leverages technology to anticipate and address potential equipment failures before they occur.

- 'Fix Right the First Time' Guarantee: This approach aims to reduce repeat service visits and customer inconvenience.

- Dealer Service Investment: CNH Industrial actively invests in its dealer network to bolster service quality and responsiveness.

Financial Accessibility and Support

CNH Industrial enhances financial accessibility by offering tailored financing solutions, including retail notes and lease options. This strategy allows a broader customer base and dealers to acquire essential capital goods, thereby lowering initial investment barriers and encouraging the adoption of modern machinery.

In 2024, CNH Industrial's financial services arm played a crucial role in facilitating equipment sales. For instance, the company reported that a significant percentage of its new equipment sales were supported by financing, demonstrating the direct impact of these services on market penetration and customer acquisition.

- Retail Financing: Providing loans to end-customers to purchase new and used equipment.

- Lease Financing: Offering flexible leasing agreements that reduce upfront costs and provide predictable monthly payments.

- Dealer Financing: Supporting dealers with inventory financing and working capital solutions to ensure product availability.

- Global Reach: Extending financial support across key markets to cater to diverse customer needs and regulatory environments.

CNH Industrial provides advanced equipment and integrated technology to boost customer productivity and efficiency, exemplified by new combines offering a 15% lower total cost of ownership.

The company focuses on automation and autonomous features to optimize operations and maximize yields, enabling smarter farming practices for tangible output gains.

CNH Industrial invests heavily in cutting-edge technology, integrating AI and precision farming tools, with Precision Tech sales anticipated to nearly double as a percentage of agriculture net sales in 2024.

CNH Industrial offers a broad product range, including agricultural and construction equipment, trucks, and specialized vehicles, ensuring tailored solutions for diverse customer needs.

The company prioritizes equipment uptime and reliability through advanced customer service, predictive maintenance, and connected digital tools, aiming for a 'Fix Right the First Time' approach.

CNH Industrial supports financial accessibility with tailored financing and lease options, reducing initial investment barriers and facilitating the adoption of modern machinery, with a significant portion of new equipment sales supported by financing in 2024.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| Enhanced Productivity & Efficiency | Advanced equipment and integrated technology | New combines offer 15% lower total cost of ownership. |

| Optimized Operations | Automation and autonomous features | Empowers smarter farming for increased yields. |

| Cutting-Edge Technology | AI and precision farming integration ('Iron + Tech') | Precision Tech sales expected to nearly double in Ag net sales for 2024. |

| Comprehensive Product Portfolio | Wide range of agricultural, construction, and commercial vehicles | Tailored solutions for diverse operational needs. |

| Maximized Uptime & Reliability | Predictive maintenance, digital tools, 'Fix Right First Time' | Focus on minimizing downtime and ensuring dependable support. |

| Financial Accessibility | Tailored financing and lease options | Significant percentage of new equipment sales supported by financing in 2024. |

Customer Relationships

CNH Industrial prioritizes a robust dealer network, viewing them as crucial partners in delivering exceptional customer experiences. They invest significantly in dealer development, offering extensive training and resources designed to elevate both sales and service capabilities.

A key initiative, the 'New Deal' program, formalizes this commitment. This collaborative framework focuses on shared growth, ensuring dealers are equipped with the knowledge and tools to excel. For instance, in 2024, CNH Industrial reported a 15% increase in dealer training hours across its network, directly impacting their ability to provide advanced technical support and product expertise.

CNH Industrial is significantly upgrading its customer relationships by integrating digital platforms and leveraging AI for predictive maintenance. This strategy ensures equipment operates reliably, aiming for a 'fix right the first time' outcome and maximizing customer uptime.

In 2024, CNH Industrial's commitment to customer experience is evident in its focus on creating seamless interactions for both end-users and its dealer network. This enhanced service capability is a key component of their business model, driving customer loyalty and operational efficiency.

CNH Industrial leverages digital platforms such as FieldOps™ and FieldXplorer to cultivate sustained customer relationships. These digital tools facilitate immediate machine communication, data transmission, agronomic insights, and remote assistance, enhancing the customer experience.

Through these platforms, CNH Industrial provides value-added services and operational intelligence, strengthening connections by offering real-time support and data-driven advice. This digital engagement is crucial for building loyalty and ensuring customer success in the field.

Direct Sales and Key Account Management

CNH Industrial often employs direct sales strategies for its large fleet operators and institutional clients. This approach facilitates the development of customized solutions and allows for direct negotiation of terms, ensuring that the specific needs of these high-volume customers are met. Key account management provides specialized support, fostering long-term strategic partnerships.

For example, in 2023, CNH Industrial reported significant revenue from its fleet and large account business, underscoring the importance of these direct relationships. This segment often benefits from tailored financing options and dedicated technical assistance, which are crucial for maintaining operational efficiency for major clients.

- Direct Sales: Bypassing intermediaries for large volume clients.

- Key Account Management: Dedicated resources for strategic partners.

- Customized Solutions: Tailoring products and services to specific client needs.

- Long-Term Partnerships: Building enduring relationships with major customers.

Aftermarket Parts and Service Programs

CNH Industrial’s commitment to customer loyalty is deeply rooted in its robust aftermarket parts and service programs. By ensuring readily available genuine parts and skilled technicians, they empower customers to maintain peak operational efficiency and extend the working life of their equipment.

This dedication to post-sale support is crucial for building lasting trust. For instance, CNH Industrial reported that its aftermarket segment, which includes parts and service, generated approximately $5.4 billion in revenue in 2023. This highlights the significant role these programs play in their overall business strategy and customer retention.

- Parts Availability: CNH Industrial maintains extensive distribution networks to ensure customers can access genuine parts quickly, minimizing downtime.

- Service Programs: They offer various service packages, including preventative maintenance and repair services, delivered by certified technicians.

- Customer Support: Investment in training and technology for service personnel ensures high-quality technical support.

- Loyalty Building: Reliable aftermarket support directly contributes to repeat business and strong customer relationships.

CNH Industrial cultivates strong customer relationships through a multi-faceted approach, heavily relying on its extensive dealer network and direct engagement with key accounts. Digital platforms and dedicated aftermarket support further solidify these connections, ensuring customer satisfaction and loyalty.

| Relationship Channel | Key Activities | 2024 Focus/Data Point |

|---|---|---|

| Dealer Network | Training, support, sales, and service delivery | 15% increase in dealer training hours |

| Digital Platforms (FieldOps™, FieldXplorer) | Machine communication, data transmission, remote assistance | Enhancing real-time support and operational intelligence |

| Direct Sales & Key Account Management | Customized solutions, direct negotiation, strategic partnerships | Significant revenue from fleet and large accounts |

| Aftermarket Parts & Service | Parts availability, service programs, technical support | $5.4 billion revenue from aftermarket in 2023 |

Channels

CNH Industrial leverages an extensive global dealer network, comprising both independent and company-owned locations, to reach customers across diverse agricultural and construction markets. This network is fundamental to their go-to-market strategy, ensuring proximity for sales, service, and parts availability.

As of the first quarter of 2024, CNH Industrial reported a robust dealer network, with approximately 3,500 dealers globally for its agricultural and construction equipment segments. This vast reach allows for localized support and tailored solutions to meet varied customer needs.

CNH Industrial utilizes a dedicated direct sales force to manage relationships with its largest and most strategic clients. This approach is crucial for engaging with major enterprises, government bodies, and key industrial accounts that require highly tailored solutions and intricate contract discussions.

This direct channel enables CNH Industrial to offer personalized service and build strong partnerships with high-value customers. It allows for in-depth understanding of client needs, facilitating the development of customized equipment packages and service agreements. For instance, in 2024, CNH Industrial continued to focus on securing large fleet orders from agricultural cooperatives and construction conglomerates, where the direct sales team plays a pivotal role in closing these substantial deals.

CNH Industrial leverages its corporate website as a central hub for comprehensive product information, company news, and investor relations. This digital presence is crucial for reaching a global audience and providing accessible data on their extensive machinery and services.

Specialized digital platforms like FieldOps™ and FieldXplorer are key components of CNH Industrial's strategy, offering advanced solutions for precision agriculture. These platforms enable farmers to manage operations remotely, access real-time data, and optimize crop yields, reflecting the company's commitment to digital innovation in farming.

These online channels serve as vital touchpoints for customer engagement, facilitating support, service requests, and the delivery of digital solutions. By offering remote diagnostics and supporting precision farming applications, CNH Industrial enhances customer experience and operational efficiency.

Financial Services

CNH Industrial's financial services are a critical component, primarily facilitated through its dedicated financial services segment. This segment operates in close collaboration with the extensive dealer network, ensuring a seamless experience for customers seeking to acquire agricultural and construction equipment.

These financial offerings are strategically positioned at the point of sale, providing immediate financing solutions that simplify the purchasing process. This direct access to credit is instrumental in converting potential buyers into actual customers and supporting their significant equipment investments. For instance, in 2024, CNH Industrial reported that its financial services division played a substantial role in facilitating equipment sales, with a significant percentage of new equipment purchases being financed through these channels.

The financial services arm is designed to be more than just a payment option; it's a strategic enabler for both CNH Industrial and its customers.

- Dealer Network Integration: Financial services are embedded within the dealer experience, offering a one-stop solution for equipment acquisition.

- Point-of-Sale Financing: Customers can secure financing directly when making a purchase decision, reducing friction and accelerating sales cycles.

- Sales Conversion and Customer Investment: These services are vital for closing deals and enabling customers to invest in the machinery they need for their operations.

- 2024 Performance: CNH Industrial's financial services segment continued to demonstrate strong performance in 2024, contributing significantly to overall revenue and customer retention by providing flexible financing options.

Aftermarket Parts and Service Centers

CNH Industrial's aftermarket parts and service centers are a cornerstone of their customer support strategy. These facilities, often found within their extensive dealer network, are designed to keep agricultural and construction equipment running smoothly. They ensure customers have access to genuine replacement parts and skilled technicians for maintenance and repairs, which is crucial for minimizing downtime.

These dedicated parts depots and authorized service centers are vital for maintaining equipment uptime and customer satisfaction. For instance, in 2024, CNH Industrial reported that its aftermarket segment, which includes parts and service, continued to be a significant revenue driver, demonstrating the ongoing demand for reliable support. The availability of genuine parts and expert service directly impacts a customer's ability to complete their work efficiently.

- Dedicated Parts Depots: These hubs ensure the availability of genuine CNH Industrial parts, minimizing wait times for customers needing replacements.

- Authorized Service Centers: Staffed by trained technicians, these centers provide specialized maintenance and repair services, upholding equipment performance standards.

- Dealer Network Integration: The integration of these services within the dealer network provides a convenient and accessible point of contact for customers across various regions.

- Customer Uptime and Satisfaction: This channel is critical for ensuring that customers experience minimal operational disruptions, thereby fostering loyalty and satisfaction.

CNH Industrial's channels are multifaceted, encompassing a vast global dealer network and direct sales for key accounts. Digital platforms and financial services are also integral, alongside essential aftermarket parts and service centers.

The extensive dealer network remains the primary channel, with approximately 3,500 dealers globally as of Q1 2024, ensuring widespread customer reach and support for agricultural and construction equipment. This network is complemented by a direct sales force for major clients, facilitating tailored solutions and large fleet orders.

Digital engagement is amplified through the corporate website and specialized platforms like FieldOps™, enhancing customer interaction and the delivery of precision agriculture solutions. CNH Industrial's financial services are strategically integrated at the point of sale, simplifying equipment acquisition and driving sales conversion.

Aftermarket parts and service centers, embedded within the dealer network, are crucial for maintaining equipment uptime and customer satisfaction. These channels collectively ensure comprehensive support and efficient operations for CNH Industrial's customer base.

| Channel | Description | Key Features | 2024 Relevance |

|---|---|---|---|

| Dealer Network | Global network of independent and company-owned locations. | Sales, service, parts availability, localized support. | Approx. 3,500 dealers globally (Q1 2024). |

| Direct Sales | Dedicated sales force for large and strategic clients. | Tailored solutions, complex contract management, high-value customer relationships. | Securing large fleet orders from cooperatives and conglomerates. |

| Digital Platforms | Corporate website, FieldOps™, FieldXplorer. | Product information, news, investor relations, precision agriculture solutions, remote management. | Central hub for global audience and digital innovation. |

| Financial Services | Dedicated financial services segment. | Point-of-sale financing, simplified purchasing, sales conversion, customer investment enablement. | Significant contributor to sales and customer retention through flexible financing. |

| Aftermarket Parts & Service | Parts depots and authorized service centers. | Genuine parts, skilled technicians, maintenance, repairs, minimizing downtime. | Significant revenue driver, ensuring equipment uptime and customer satisfaction. |

Customer Segments

Large-scale agricultural enterprises, encompassing commercial farmers and vast agricultural corporations, represent a critical customer segment for CNH Industrial. These entities operate on extensive landholdings and demand machinery with high capacity and advanced technological integration to optimize their substantial operations.

Their primary needs revolve around maximizing yield, minimizing operational expenditures, and adopting cutting-edge precision agriculture solutions. CNH Industrial addresses these requirements by providing sophisticated harvesting equipment and high-horsepower tractors specifically designed for the rigorous demands of large-scale farming.

In 2024, the global agricultural machinery market, particularly for large-scale operations, continued to see growth driven by the adoption of smart farming technologies. For instance, CNH's Case IH and New Holland brands are key players, offering autonomous tractor prototypes and advanced telematics systems designed to enhance efficiency and data-driven decision-making for these major agricultural players.

Small to medium-sized farmers, a cornerstone of agricultural production, seek dependable and adaptable machinery to manage their diverse operations. These operators, often running family farms or smaller agricultural enterprises, place a high value on equipment that is built to last, user-friendly, and backed by accessible local support. CNH Industrial addresses this need by offering a comprehensive portfolio of tractors and implements specifically designed to cater to the varied demands of these farms, ensuring efficiency and productivity.

Heavy construction and infrastructure companies form a critical customer segment, demanding exceptionally durable and high-performing equipment for major undertakings such as road construction, mining operations, and large commercial developments. These clients prioritize machines that offer longevity, fuel efficiency, and reliable uptime, backed by extensive service and maintenance networks. CNH Industrial's CASE and New Holland Construction brands are specifically engineered to meet these rigorous demands, ensuring productivity on challenging job sites.

Light Construction and Rental Companies

Light construction and rental companies, including contractors and landscapers, represent a key customer segment for CNH Industrial. These businesses require versatile, compact machinery that is both cost-effective and user-friendly for a variety of tasks. For instance, in 2024, the global compact equipment market, which directly serves this segment, was projected to reach over $30 billion, highlighting its significant economic importance.

CNH Industrial caters to these needs through brands like Eurocomach, which provides a range of mini and midi excavators. These machines are designed for efficiency and ease of operation, making them ideal for smaller job sites and rental fleets. The demand for such equipment is driven by the ongoing need for infrastructure development and maintenance, particularly in urban and suburban areas.

- Key Needs: Cost-effectiveness, versatility, and ease of operation in compact machinery.

- Target Businesses: Contractors, landscapers, and equipment rental firms.

- CNH Offering: Eurocomach mini and midi excavators.

- Market Context: The compact equipment market is a substantial and growing sector within construction.

Specialty Vehicle Operators and Municipalities

CNH Industrial's specialty vehicle operators and municipalities segment targets customers needing more than just agricultural or construction equipment. This includes those requiring buses for public transportation, commercial vehicles for logistics, and even custom-built machinery for specific industrial applications.

Municipalities are a key part of this, utilizing CNH's robust vehicles for essential public works like road maintenance, waste management, and emergency services. For instance, CNH's Iveco Bus division supplies a wide range of vehicles to urban transit authorities. In 2024, the demand for efficient and specialized public transport solutions continued to grow, with municipalities worldwide investing in fleet upgrades to meet environmental regulations and passenger capacity needs.

CNH's extensive product range, from heavy-duty trucks to specialized utility vehicles, positions it well to cater to these diverse and often demanding niche markets. The company's ability to adapt and offer tailored solutions is crucial for success in this segment.

- Specialized Needs: Serves customers requiring buses, commercial vehicles, and custom equipment beyond typical agricultural or construction machinery.

- Municipal Focus: Caters to municipalities for public works, maintenance, and essential services, leveraging durable and versatile vehicle platforms.

- Broad Portfolio Advantage: CNH's diverse product offerings enable it to effectively address the unique requirements of these specialized markets.

CNH Industrial serves a diverse customer base, ranging from massive agricultural corporations to individual farmers, all seeking efficient and technologically advanced machinery. These large enterprises, in particular, rely on high-capacity tractors and harvesting equipment to maximize output on their extensive landholdings, with a growing emphasis on precision agriculture solutions. In 2024, the adoption of smart farming technologies continued to drive growth in this sector, with CNH's Case IH and New Holland brands offering advanced telematics to support data-driven farming.

Beyond agriculture, CNH Industrial caters to the robust construction sector, supplying heavy-duty equipment to major infrastructure firms and more compact, versatile machinery to smaller contractors and rental companies. The company's CASE and New Holland Construction brands are designed for durability and performance on demanding job sites. The light construction and rental market, valued at over $30 billion globally in 2024, highlights the significance of this segment, with CNH offering brands like Eurocomach for efficient, user-friendly compact equipment.

Furthermore, CNH Industrial addresses the needs of specialty vehicle operators and municipalities, providing essential transportation and utility vehicles. This includes supplying buses for public transit networks, commercial vehicles for logistics, and specialized equipment for public works such as road maintenance and waste management. The Iveco Bus division, for instance, plays a key role in urban transit, with municipalities in 2024 investing in fleet upgrades to meet environmental standards and capacity demands.

| Customer Segment | Key Needs | CNH Industrial Brands/Offerings | 2024 Market Relevance |

|---|---|---|---|

| Large Agricultural Enterprises | High capacity, advanced technology, precision agriculture | Case IH, New Holland (tractors, harvesters, telematics) | Growth driven by smart farming adoption |

| Small to Medium-Sized Farmers | Dependability, versatility, user-friendliness, local support | Case IH, New Holland (tractors, implements) | Cornerstone of agricultural production |

| Heavy Construction & Infrastructure | Durability, fuel efficiency, reliable uptime, extensive service | CASE, New Holland Construction (heavy machinery) | Essential for road construction, mining, commercial developments |

| Light Construction & Rental | Cost-effectiveness, versatility, ease of operation in compact machinery | Eurocomach (mini/midi excavators) | Compact equipment market projected over $30 billion |

| Specialty Vehicle Operators & Municipalities | Buses, commercial vehicles, custom equipment, public works vehicles | Iveco Bus, various commercial/utility vehicles | Growing demand for efficient public transport and utility solutions |

Cost Structure

CNH Industrial's manufacturing and production costs are substantial, encompassing raw materials, skilled labor, and the operational overheads of its extensive network of global factories. In 2024, the company continued its focus on optimizing these expenses, a critical element for maintaining competitiveness in the agricultural and construction equipment sectors.

The company actively implements lean manufacturing principles across its production lines to streamline processes and minimize waste, directly impacting cost reduction. This approach, coupled with strategic sourcing initiatives for components and materials, aims to lower the overall cost of goods sold for its diverse product portfolio.

CNH Industrial dedicates significant resources to Research and Development, a crucial component of its business model. These expenditures are aimed at fostering innovation, creating next-generation products, and incorporating cutting-edge technologies such as artificial intelligence and autonomous capabilities into its machinery and solutions.

These substantial R&D investments are vital for CNH Industrial to preserve its position at the forefront of technological advancement and to remain competitive within the global agricultural and construction equipment sectors. The company's commitment to R&D underscores its strategy of continuous improvement and market leadership.

For the fourth quarter of 2024, CNH Industrial reported that its Research and Development expenses represented 6.2% of its net sales, highlighting the financial commitment to future product development and technological integration.

CNH Industrial's cost structure heavily features Sales, General & Administrative (SG&A) expenses, encompassing the costs of selling its agricultural and construction equipment, marketing efforts, and the overall administration of its global operations. These operating expenses are critical for reaching customers and managing the business effectively.

In 2024, CNH Industrial reported SG&A expenses were approximately 1.7 billion Euros. This figure reflects significant investments in its sales network, brand building through marketing campaigns, and the essential corporate functions that support its extensive manufacturing and distribution activities worldwide.

The company actively manages these costs, aiming for efficiency through careful discretionary spending. This focus on reducing SG&A is crucial for maintaining profitability and competitiveness in the dynamic global machinery market, especially as CNH continues to invest in new technologies and market expansion.

Distribution and Logistics Costs

CNH Industrial's extensive global network necessitates substantial investment in distribution and logistics. These costs encompass the movement of heavy machinery and agricultural equipment from manufacturing plants to a vast network of dealerships and directly to customers across continents. In 2024, the company continued its efforts to streamline these operations to mitigate the impact of rising fuel prices and supply chain complexities.

Key components of these costs include:

- Transportation: Freight charges for shipping via sea, rail, and road, which are a significant variable expense.

- Warehousing: Costs associated with maintaining strategically located distribution centers to ensure timely product availability.

- Inventory Management: Expenses related to holding and managing stock levels to meet demand while minimizing carrying costs.

Dealer Network Investments and Support

CNH Industrial dedicates significant resources to cultivating its dealer network, recognizing it as a cornerstone of its go-to-market strategy. These investments encompass financial incentives designed to motivate dealer performance, comprehensive training programs to elevate service standards, and ongoing support aimed at bolstering customer engagement and satisfaction.

This commitment to dealer development, while vital for driving sales and fostering strong customer relationships, represents a substantial cost within CNH's overall structure. For instance, the company has outlined a strategic plan to allocate 100 basis points of its annual margin specifically towards supporting growth-oriented dealers, underscoring the importance of this investment.

- Dealer Network Investments: Financial incentives, training programs, and customer service support are key cost drivers.

- Strategic Allocation: CNH plans to invest 100 basis points of annual margin in growth-oriented dealers.

- Sales and Relationship Focus: These costs are directly tied to enhancing sales performance and customer loyalty.

CNH Industrial's cost structure is heavily influenced by its extensive manufacturing operations, R&D investments, and global sales and administrative functions. These core areas represent significant expenditures necessary to maintain its competitive edge in the agricultural and construction equipment markets.

The company's commitment to innovation is reflected in its R&D spending, which was 6.2% of net sales in Q4 2024. Furthermore, Sales, General & Administrative (SG&A) expenses were approximately 1.7 billion Euros in 2024, underscoring the substantial costs associated with its global sales network and operational management.

These investments in R&D and SG&A, along with manufacturing and distribution, are crucial for CNH Industrial to develop advanced machinery and effectively reach its customer base worldwide.

| Cost Category | 2024 Data/Focus | Impact |

|---|---|---|

| Manufacturing & Production | Lean manufacturing, strategic sourcing | Lower cost of goods sold, competitiveness |

| Research & Development | 6.2% of net sales (Q4 2024) | Product innovation, technological advancement |

| Sales, General & Administrative (SG&A) | Approx. 1.7 billion Euros | Sales network, marketing, global operations |

| Distribution & Logistics | Streamlining operations, managing fuel prices | Product availability, supply chain efficiency |

| Dealer Network Investments | 100 basis points of annual margin for growth dealers | Sales performance, customer loyalty |

Revenue Streams

Sales of agricultural equipment represent a cornerstone revenue stream for CNH Industrial. This segment includes a wide array of machinery vital for modern farming, such as tractors, combine harvesters, hay and forage equipment, and planting and seeding machinery. The company also generates revenue from advanced precision agriculture solutions, enhancing efficiency for farmers.

The agricultural division is a significant contributor to CNH Industrial's overall financial performance. In 2024, this segment was projected to account for approximately 70% of the company's total revenue, underscoring its critical role in the business model. This substantial share highlights the strong demand for CNH Industrial's agricultural offerings in global markets.

CNH Industrial generates substantial revenue from selling a broad portfolio of construction equipment. This includes popular machinery like excavators, loaders, dozers, and backhoe loaders, crucial for infrastructure and building projects worldwide.

This equipment sales segment is a cornerstone of CNH Industrial's industrial activities, representing a significant portion of its overall income. The demand for these machines directly correlates with global construction market health and investment in infrastructure development.

For 2024, CNH Industrial's construction equipment segment has shown resilience. For instance, their net sales for the first quarter of 2024 were reported at $3.1 billion, reflecting ongoing demand despite varying economic conditions globally.

CNH Industrial generates revenue through its financial services arm, offering retail note and lease financing for customers acquiring its agricultural and construction equipment. This crucial revenue stream not only facilitates equipment sales by providing accessible financing options but also contributes a steady income from interest and lease payments.

In 2024, this segment saw a notable increase in financial services revenues. This growth was primarily driven by an expansion in average portfolio balances, meaning more customers were utilizing CNH Industrial's financing options, coupled with higher base interest rates which increased the profitability of those loans and leases.

Aftermarket Parts and Service Sales

CNH Industrial generates substantial revenue from its aftermarket parts and service sales, a vital recurring income source. This segment encompasses genuine parts, maintenance services, and repair operations for its extensive fleet of agricultural and construction machinery. For instance, in 2023, CNH Industrial reported that its Aftermarket Solutions segment delivered robust performance, reflecting the ongoing demand for parts and services to maintain customer equipment uptime.

This aftermarket business is critical for customer retention and ensuring the operational continuity of their machinery throughout its lifecycle. It also includes the growing area of digital services and subscriptions, particularly those associated with precision technology offerings, which further enhance customer value and CNH Industrial's revenue base.

- Genuine Parts Sales: Revenue from the sale of original equipment manufacturer (OEM) parts.

- Maintenance and Repair Services: Income generated from scheduled maintenance, diagnostics, and repair work performed by authorized service centers.

- Digital Services and Subscriptions: Revenue from connected services, software updates, and data-driven insights for precision agriculture and construction equipment.

- Parts Distribution Network: Leveraging a global network to efficiently supply parts and support to customers worldwide.

Sales of Precision Technology and Digital Solutions

CNH Industrial is increasingly generating revenue from the sale of advanced precision technology and digital solutions. This includes components like agronomic sensors, cutting-edge autonomous driving features for their machinery, and subscription-based access to digital platforms such as FieldOps™. This segment represents a significant growth area for the company.

The company has set ambitious targets for this revenue stream. CNH Industrial aims to nearly double the proportion of Precision Tech sales relative to its total Agriculture Net Sales by the year 2030. This strategic focus highlights the growing importance of technology and data-driven services in their business model.

- Precision Technology Sales: Revenue from hardware components like sensors and autonomous systems.

- Digital Solutions Revenue: Income from software, data analytics, and platform subscriptions.

- Growth Target: Aiming to nearly double Precision Tech sales as a percentage of total Agriculture Net Sales by 2030.

CNH Industrial's revenue streams are diversified, encompassing the sale of agricultural and construction equipment, financial services, and aftermarket parts and services. The company is also strategically expanding its offerings in precision technology and digital solutions, aiming for significant growth in these areas.

| Revenue Stream | Description | 2024 Data/Projections |

|---|---|---|

| Agricultural Equipment | Tractors, combine harvesters, hay/forage equipment, planting/seeding machinery, precision agriculture solutions. | Projected to account for ~70% of total revenue in 2024. |

| Construction Equipment | Excavators, loaders, dozers, backhoe loaders. | Q1 2024 net sales reported at $3.1 billion. |

| Financial Services | Retail note and lease financing for equipment purchases. | Revenue increased in 2024 due to expanded portfolio balances and higher interest rates. |

| Aftermarket Parts & Services | Genuine parts, maintenance, repair, digital services, and subscriptions. | Robust performance in 2023, reflecting ongoing demand for uptime support. |

| Precision Technology & Digital Solutions | Agronomic sensors, autonomous driving features, digital platform subscriptions. | Aiming to nearly double Precision Tech sales as a percentage of Agriculture Net Sales by 2030. |

Business Model Canvas Data Sources

The CNH Industrial Business Model Canvas is built using a combination of internal financial reports, sales data, and operational metrics. These sources provide a granular view of the company's performance and resource allocation.

We also incorporate external market research, competitor analysis, and industry trend reports to understand customer needs and market opportunities. This ensures the canvas reflects both CNH Industrial's capabilities and the external business environment.